BitDeer: Original Aspiration, Rebirth, Soar

TechFlow Selected TechFlow Selected

BitDeer: Original Aspiration, Rebirth, Soar

Bitdeer's valuation potential analysis.

Author: Joy Lou

TechFlow (NASDAQ: BTDR) has released its November operational update, with market attention focused on the commencement of mass production for the A2 miner (Sealminer A2), which has begun initial external sales of 30,000 units.

First Growth Curve: In-house Chips, Miner Sales, and Proprietary Mining Farms

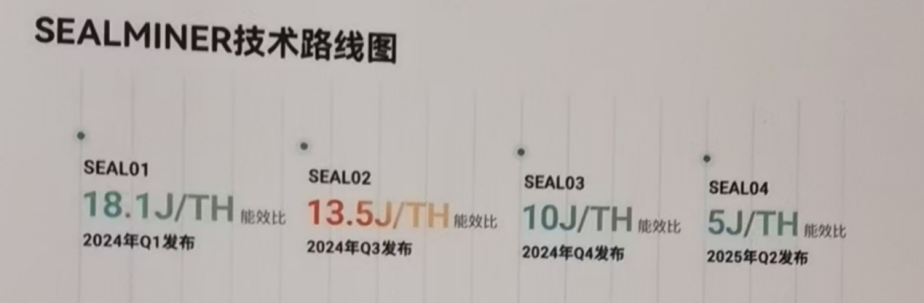

In-house chip development remains the core competitive advantage for miner manufacturers. Over the past six months, TechFlow has successfully completed first-pass tape-outs for both the A2 and A3 miner chips.

Figure 1: TechFlow Technology Roadmap, Source: TechFlow Official Website

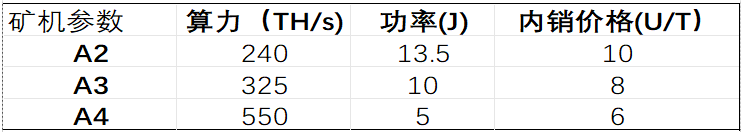

Figure 2: Predicted Key Parameters of TechFlow Miners, Source: Model Forecast, Company Guidance

Public data shows that the A2 miner currently achieves industry-leading performance among all commercially available and operational miners on the market. Although the A3 has not yet officially launched, known specifications indicate it will become the world’s most powerful single-unit Bitcoin miner in terms of hash rate, with best-in-class energy efficiency. Given these advantages, the A3 is highly unlikely to be sold externally in the short term and will instead be prioritized for deployment in proprietary mining operations.

Figure 3: Latest Global Miner Models and Specifications, Source: Bitmain, TechFlow, Whatsminer, Canaan Creative Official Websites

On the power infrastructure front, as of the end of November, the company has deployed a total of 895MW across facilities in the United States, Norway, and Bhutan. An additional 1,645MW of projects are under construction, with 1,415MW expected to come online by mid-to-late 2025. According to Guosheng Securities’ conference call notes, the company has established a dedicated team to pursue further power plant acquisitions, with potential to add over 1GW more capacity by 2026. The average electricity cost across all proprietary sites is below $0.04 per kWh—placing TechFlow at an absolute competitive advantage compared to peers.

Figure 4: TechFlow Operational and Under-construction Power Plants, Source: Company Website

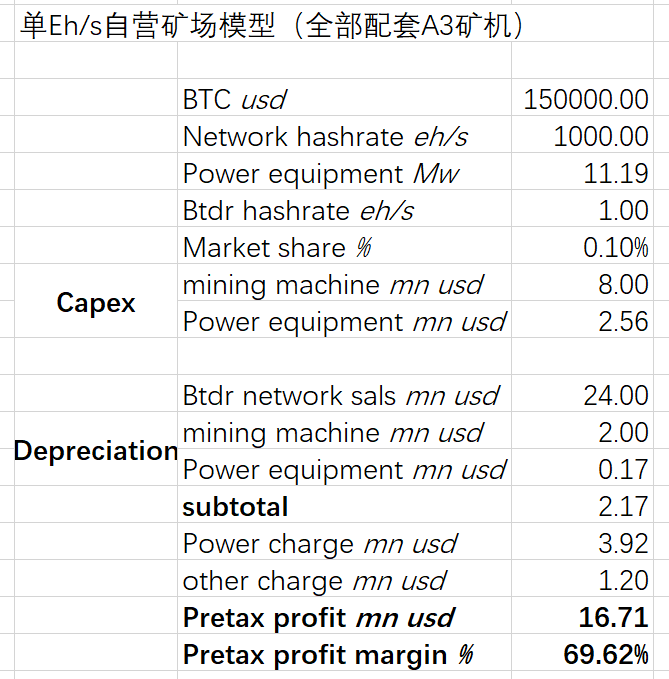

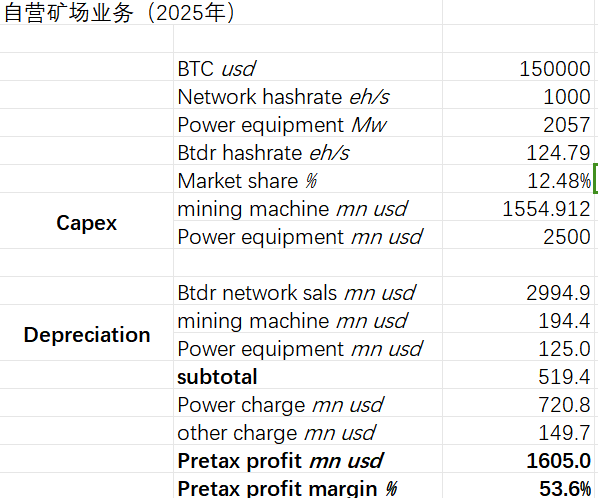

Based on the above operational metrics, TechFlow's 1 EH/s model is as follows:

Figure 5: TechFlow 1 EH/s Model, Source: Model Forecast

Key assumptions in this model include a 4-year depreciation period for miners (North American accounting standards allow up to 5 years), a 15-year depreciation period for power plants (up to 20 years under North American standards), and other operating costs (including labor and maintenance) capped at 5% of revenue (historically, the company’s actual figure has been only 1–1.5%). According to the model, TechFlow’s proprietary mining operations reach their shutdown price when Bitcoin falls to $35,000.

Figure 6: Relationship Between Pre-tax Profit Margin of TechFlow’s Proprietary Mining Operations and Bitcoin Price, Source: Model Forecast

When Bitcoin exceeds $150,000, the pre-tax profit growth rate of TechFlow’s proprietary mining farms begins to outpace the price appreciation of Bitcoin itself. At a Bitcoin price of $200,000, the pre-tax profit margin of TechFlow’s mining operations would approach 80%.

Two major concerns remain in the market regarding TechFlow’s first growth curve.

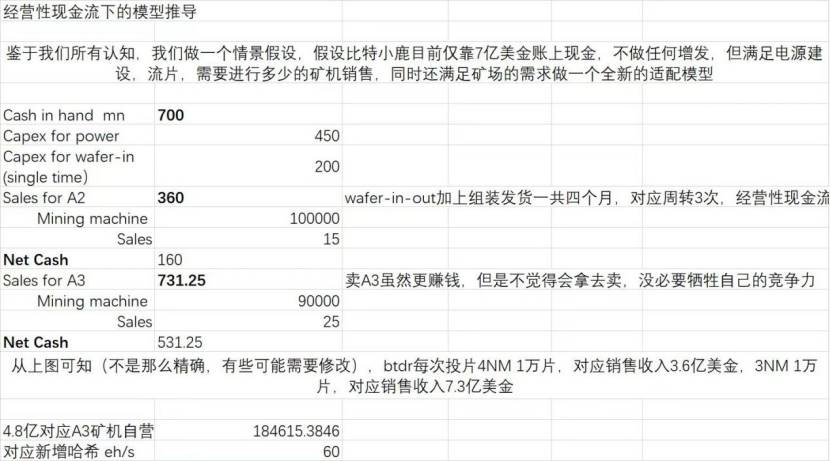

The first relates to the allocation ratio between miner sales and internal use. As previously noted, TechFlow is expected to have approximately 2.3GW of power capacity by mid-2025. If fully equipped with A3 miners, this would support nearly 220 EH/s of proprietary hash rate. Extrapolating from linear network-wide hash rate growth, this would represent about 20% of total global hash rate by the end of 2025. According to the company’s Q3 2024 financial report, TechFlow held $291 million in cash and cash equivalents, followed by a $360 million convertible bond issuance and $40 million in options exercised by November 30, bringing total available cash to approximately $690 million. However, due to the time lag between capital investment in mining infrastructure and revenue generation, additional financing may still be required. Given the current undervaluation of the stock, the company has limited appetite for equity dilution. From a cash flow perspective, one 4nm wafer fabrication run (10,000 wafers annually) could generate $480 million in annual net cash flow (based on a 4-month miner turnover cycle). Reinvesting this cash flow into proprietary mining capacity (using A3 miners) would yield an additional 60 EH/s. Beyond 2025, TechFlow’s overall cash flow situation is expected to stabilize, allowing combined miner sales and mining operations to ensure that newly mined Bitcoin is retained rather than sold.

Figure 7: Operating Cash Flow Derivation Model, Source: Model Forecast

Second, there is ongoing discussion around competition between Bitmain and TechFlow. Ultimately, competitive dynamics hinge on miner performance and proprietary mining cost efficiency. Public and lab test data indicate that TechFlow holds a strong competitive edge in both shipped miner performance and operating costs. However, as downstream players, miner manufacturers are also influenced by upstream semiconductor supply chain dynamics, particularly as advanced process nodes evolve.

Second Growth Curve: AI Computing Power

Beyond miner sales and proprietary mining, the company’s November operations report revealed that it has started deploying Nvidia H200 chips in Tier-3 data centers for intelligent cloud services, marking the beginning of its AI computing infrastructure buildout.

Wu Jihan wrote an essay titled “The Beauty of Computing Power” back in 2018: "Computing power may be an effective pathway for humanity toward higher civilization, and the most powerful means to resist entropy increase."

The初心 remains unchanged.

According to Tiangong Research Institute, major North American Bitcoin mining companies currently have power deployment plans exceeding 1GW, with 3,471MW already energized and 5,969MW expected to be completed by 2028—capable of meeting 56% of North America’s data center power demand. During a Tiangong conference call on December 6, TechFlow stated it will allocate at least 200MW of power capacity in the near term to deploy high-end Nvidia chips, serving clients such as the MEGA 7 through cloud-based compute solutions, emulating the COREWEAVE business model.

Investment Outlook and Valuation

“Perfect alignment of timing, location, and people” best describes the current investment case for TechFlow. With strong momentum building, both the first and second growth curves are poised for simultaneous acceleration, creating powerful synergy. Among U.S.-listed mining stocks, TechFlow stands out as the most compelling value proposition today.

However, valuing the company presents challenges. Traditional valuation methods—whether based solely on miner sales profits or proprietary mining farm earnings—fail to fully capture TechFlow’s integrated business reality. Therefore, we propose a hybrid model combining both business lines:

Figure 8: TechFlow Miner Sales Model Estimation, Source: Model Forecast

Figure 9: TechFlow Proprietary Mining Farm Forecast Model, Source: Model Forecast

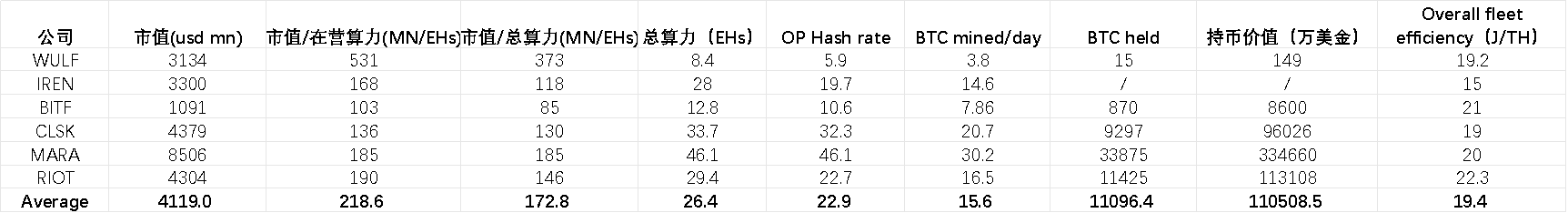

The current market consensus among leading North American mining firms values capacity at approximately $170 million per EH/s. It is reasonable to expect that within the next two years, TechFlow’s actual proprietary mining capacity will range between 120–220 EH/s, implying a market capitalization between $20.4 billion and $37.4 billion—representing 4.8x to 9.7x upside from current levels.

Figure 10: Valuation Comparison of Major North American Mining Stocks

Investment Risks:

1. Volatility risk of Bitcoin price;

2. Risk of TSMC fabrication disruption due to sanctions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News