Bitdeer Financial Report Analysis: Breaking Free from the Cocoon Amid Market Volatility

TechFlow Selected TechFlow Selected

Bitdeer Financial Report Analysis: Breaking Free from the Cocoon Amid Market Volatility

This article will provide an in-depth analysis of Bitdeer's financial performance over the past two to three years, examine the underlying driving factors, and explore its growth trajectory amid industry competition.

By: Fiona, Chen

Bitdeer was founded in 2018 and went public on Nasdaq via a SPAC merger on April 14, 2023, under the ticker [BTDR]. Headquartered in Singapore, Bitdeer is a leading global digital asset mining service provider. It was co-founded by Wu Jihan, the co-founder of Bitmain and Matrixport, along with renowned investment firms including Sequoia Capital and IDG. The company operates two major platforms—“Bitdeer” and “Mining++”—offering comprehensive mining ecosystem services such as cloud mining and data center hash rate management. Public information indicates that Bitdeer currently operates five proprietary mining data centers in the United States and Norway, serving users across more than 200 countries and regions.

This article provides an in-depth analysis of Bitdeer’s financial performance over the past two to three years and its underlying drivers, exploring its growth trajectory amid industry competition. By examining changes in operational capacity, profit fluctuations, and adjustments in asset-liability structure, we aim to comprehensively understand how Bitdeer has survived and evolved through continuous market turbulence, offering valuable insights for investors and peer companies.

1. Per-Share Metrics

In terms of basic earnings per share (EPS), Bitdeer performed best in 2021. That year, the cryptocurrency market rebounded with rising Bitcoin prices. In January, Wu Jihan, co-founder of Bitmain, announced his resignation from Bitmain and assumed the role of chairman at Bitdeer. Other former Bitmain executives also joined Bitdeer’s leadership team. The influx of experienced professionals helped boost market confidence and contributed to higher EPS. From 2022 to 2023, the company remained in a loss-making state. This was partly due to ongoing turmoil in the crypto market following high-profile collapses such as Terra/UST, LUNA, Three Arrows Capital, FTX, and Genesis, which caused Bitcoin’s price to drop by over 70% at one point. Additionally, Bitcoin's network hash rate continued to rise, pushing mining difficulty to record highs. As a result, shrinking coin prices and increasing mining difficulty further squeezed profitability. In Q1 2024, the company achieved an EPS of USD 0.01—the first positive earnings since 2021.

Regarding book value per share, it stood at USD 7.55 in 2021 and rose slightly to USD 9.07 in 2022. However, it sharply declined to USD 2.97 in 2023, primarily due to the share exchange and consolidation associated with its official listing. As early as November 2021, Bitdeer planned to merge with blank-check company Blue Safari Group Acquisition Corp via a SPAC deal, initially valuing the company at USD 4 billion. After a year and a half, the merger was completed, but the valuation had significantly shrunk—from USD 4 billion down to USD 1.18 billion, a staggering 70.5% decrease. On its listing day, 111 million ordinary shares were issued, leading to equity dilution and reduced market capitalization, both contributing to the decline in book value per share. In Q1 2024, book value per share recovered slightly to USD 3.30, reflecting the company’s return to profitability and increased market value.

Overall, Bitdeer’s financial performance has been closely tied to fluctuations in the cryptocurrency market, management changes, and its listing process. After enduring a bear market, the company’s operating performance has gradually recovered, and its asset scale has resumed an upward trend following post-merger adjustments—highlighting the adaptability and flexibility of Bitdeer’s strategic development in response to market dynamics.

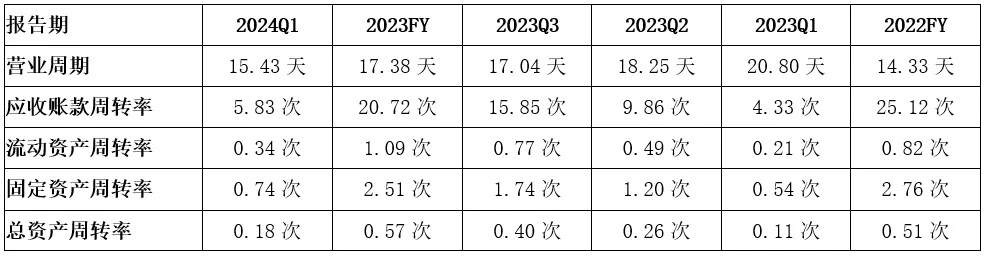

2. Operational Efficiency Analysis

In terms of operational efficiency, Bitdeer’s total asset turnover ratio showed a slight overall increase from 2022 to 2023, with a quarterly upward trend. Despite the global crypto bear market, Bitdeer maintained pressure and continuously improved asset utilization efficiency. The company advanced its vertically integrated technology strategy, successfully tested self-developed chips, and made progress in diversifying and scaling its global mining operations, further reducing costs and enhancing efficiency. By expanding its mining and high-performance computing capabilities, Bitdeer increased its revenue streams and improved asset utilization.

The accounts receivable turnover ratio in 2023 declined compared to 2022, indicating improvements in Bitdeer’s accounts receivable management and collection processes. The company may have reduced receivables buildup through internal enhancements such as stricter customer credit checks or optimized collections strategies. The fixed asset turnover ratio followed a similar upward trend, suggesting that Bitdeer continued making substantial investments in fixed assets during 2023, particularly in mining equipment and technology R&D. In the Bitcoin mining industry, mining machines are the core production tools, directly impacting mining revenue and costs. With rising Bitcoin prices and the halving event approaching, mining costs are set to double—meaning only high-performance miners can maintain profitability.

3. Operating Performance Analysis

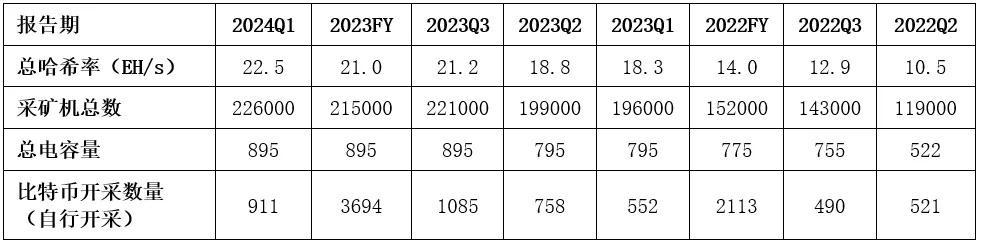

In specific operational metrics, from Q2 2022 to Q1 2024, Bitdeer’s total hash rate and number of mining machines consistently increased. On a quarterly basis, Bitcoin mined volume rose significantly each quarter until Q1 2024, when it saw a slight decline from the previous quarter. On an annual basis, however, total mined volume in 2023 increased by 74.8% compared to 2022—indicating that Bitdeer has continuously enhanced its mining capacity to maintain competitiveness.

Overall, in recent years, Bitdeer has strengthened its mining power and hash rate on the Bitcoin network through measures such as building data centers, expanding equipment capacity, optimizing mining hardware, and broadening partnerships—thereby enhancing its competitive edge in the cryptocurrency mining sector.

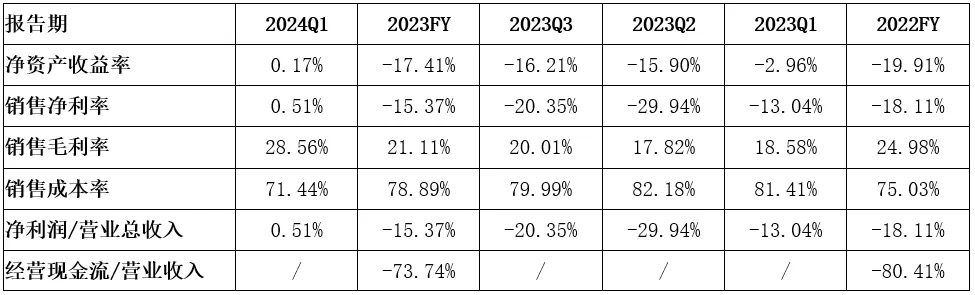

4. Profitability Analysis

In terms of profitability, Bitdeer has shown a clear trend of turning losses into profits.

On return on equity (ROE): For the full year of 2022, Bitdeer’s ROE was -19.91%, meaning net profit relative to shareholders’ equity was negative, reflecting significant losses. In Q1 2023, ROE improved to -2.96%—still negative but a notable improvement from 2022. Starting in Q2 2023, ROE dropped sharply, largely due to high expenses related to the SPAC listing process. For the full year of 2023, ROE was -17.41%. These losses were also tightly linked to the broader downturn in the cryptocurrency market—declining Bitcoin prices and weakened demand led to persistently negative net profit margins. Increased global regulation, tightening monetary policy, economic uncertainty, and high leverage within the crypto industry collectively plunged the sector into a winter period. In Q1 2024, ROE turned positive at 0.17%. Although profits remain modest, achieving positive net income for the first time is undoubtedly a strong positive signal.

Net profit margin followed a similar trend to ROE. It saw a slight increase in Q1 2023 but remained negative, reaching a low of -29.94% in Q2 2023 before gradually recovering. In Q1 2024, it turned positive for the first time at 0.51%.

Gross profit margin: For the full year of 2022, gross margin was 24.98%. It dropped to 18.58% in Q1 2023, then slowly rose, showing a significant improvement by Q1 2024. Bitdeer faced challenges in maintaining gross margins in 2023, driven by changing market conditions, rising costs, and business restructuring.

In summary, from 2022 to Q1 2024, Bitdeer transitioned from sustained losses to profitability. From 2022 through Q2 2023, the company faced significant losses due to the bear market and high listing-related expenses, which reduced revenue while increasing costs. From Q3 to Q4 2023, both profits and EBITDA began showing positive momentum, with narrowing losses. By Q1 2024, the company achieved a turnaround into profitability. Despite ongoing challenges such as crypto market volatility and rising mining difficulty, Bitdeer has worked to improve profitability by increasing self-mined Bitcoin volumes and boosting managed hash rates.

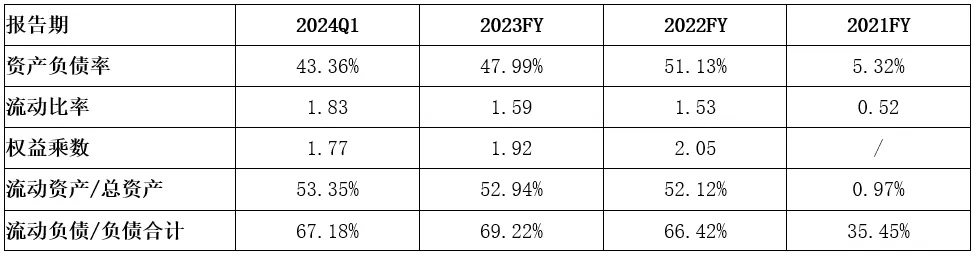

5. Financial Ratio Analysis

Regarding debt-to-asset ratio: The ratio surged from 5.32% in 2021 to 51.13% in 2022. This spike was primarily due to increased borrowing aimed at mitigating cash flow instability caused by Bitcoin price volatility, resulting in higher total liabilities and a sharp rise in current assets. Since shareholders’ equity did not grow at the same pace, the debt-to-asset ratio rose accordingly. From 2022 to Q1 2024, the ratio declined gradually from 51.13% to 43.36%, indicating a relatively more stable financial structure, although the company still maintains a high level of leverage. The current ratio increased significantly from 2021 to 2022 and has continued a slow upward trend thereafter, reflecting steadily improving short-term solvency after going public. The proportion of current assets to total assets shows a similar pattern.

The proportion of current liabilities to total liabilities spiked in 2022 and has since remained at a relatively stable, slightly fluctuating level. Currently, most of the company’s debt is short-term, likely because the volatile nature of the cryptocurrency market makes short-term debt more favorable—it allows quicker responses to market shifts, enabling the company to seize opportunities or relieve short-term funding pressures.

In conclusion, Bitdeer’s financial structure underwent significant changes between 2021 and Q1 2024. The declining debt-to-asset ratio suggests reduced leverage; the rising current ratio reflects stronger short-term repayment ability; the falling equity multiplier indicates lower financial leverage; and the increasing share of current assets points to improved liquidity. However, the high proportion of short-term debt highlights the need for careful management of near-term obligations. These shifts likely reflect deliberate efforts to optimize capital structure and reduce financial risk. Meanwhile, Bitdeer is actively developing AI cloud services and self-developed mining hardware, leveraging its technical expertise and global resources to strengthen its position and capture market opportunities.

Looking ahead, Bitdeer should closely monitor fluctuations in financial indicators, consider diversifying its debt structure, enhance working capital management, establish and refine its risk management system, and continue investing in technology and innovation. The company is advised to explore possibilities for business diversification, reduce reliance on a single market or asset, and ultimately strengthen its overall resilience against risks.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News