Bitdeer Q1 2025 Performance Review and Investment Recommendations

TechFlow Selected TechFlow Selected

Bitdeer Q1 2025 Performance Review and Investment Recommendations

After going through an operational transition period in the fourth quarter of last year and the first quarter of this year, BitDeer will迎来重要时刻.

Author: Cycle Trading

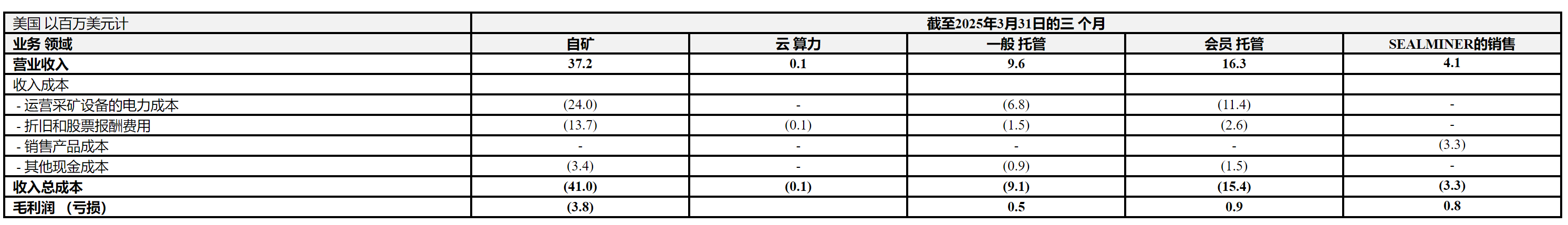

Event: Bitdeer (Btdr.US) released its first-quarter report for the 2025 fiscal year. The company achieved revenue of $70.1 million, down 41.3% year-on-year but up 1.6% quarter-on-quarter. Among this, self-operated business revenue was $37.2 million, down 10.4% year-on-year; gross profit was negative $3.2 million with a gross margin of -4.6%, primarily due to higher electricity prices during Bhutan's dry season, which led to temporary shutdowns of mining facilities there. However, in Q2, as the wet season began, electricity prices have returned to $0.042/kWh. Seal miner sales reached $4.1 million, marking the official start of the company’s miner sales. Adjusted EBITDA was negative $56.1 million, compared to positive $27.3 million in the same period of 2024. Net profit was $410 million, mainly due to the reversal of fair value provisions for convertible notes ($448.7 million) and Tether options ($58.4 million) recorded in Q4 2024.

Commentary:

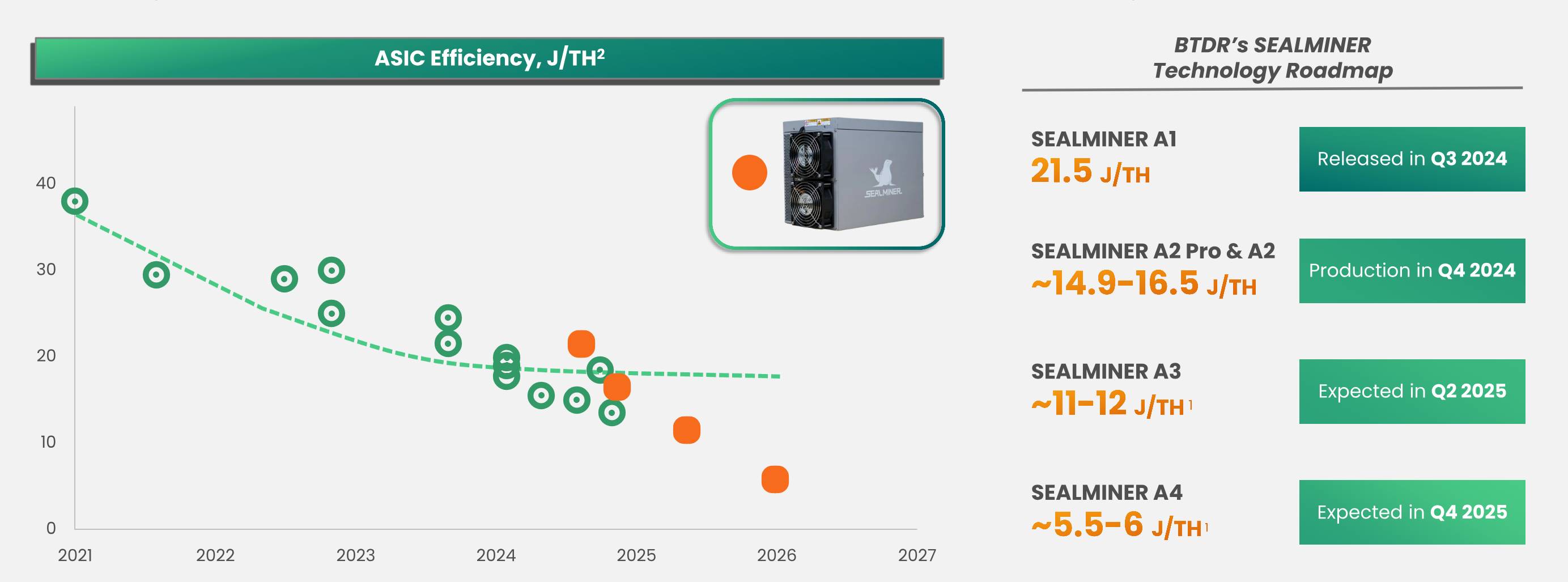

1. Prepayments at Bitdeer rose further to $382 million in Q1 2025 (Q4 2024: $310 million), fully covering the amount required for maximum tape-out capacity currently accessible. The Seal02 miners have entered the shipment phase. Future self-operation and sales schedules will depend on competitors’ pricing strategies—should competition intensify, priority will be given to powering up self-operated mining farms. The Seal03 miner completed tape-out in Q1 and is still in testing, with mass deployment expected to begin in late Q3 or Q4 2025 for both self-operated farms and external sales.

2. Regarding U.S. tariff policies, Bitdeer will complete construction of its North American assembly plant in Q2. Sales in the North American region will then shift to locally assembled units. Although costs will rise by nearly 10%, this increase is negligible compared to current Southeast Asian tariffs. Meanwhile, the Southeast Asian assembly plant will continue serving mining farms outside the U.S.

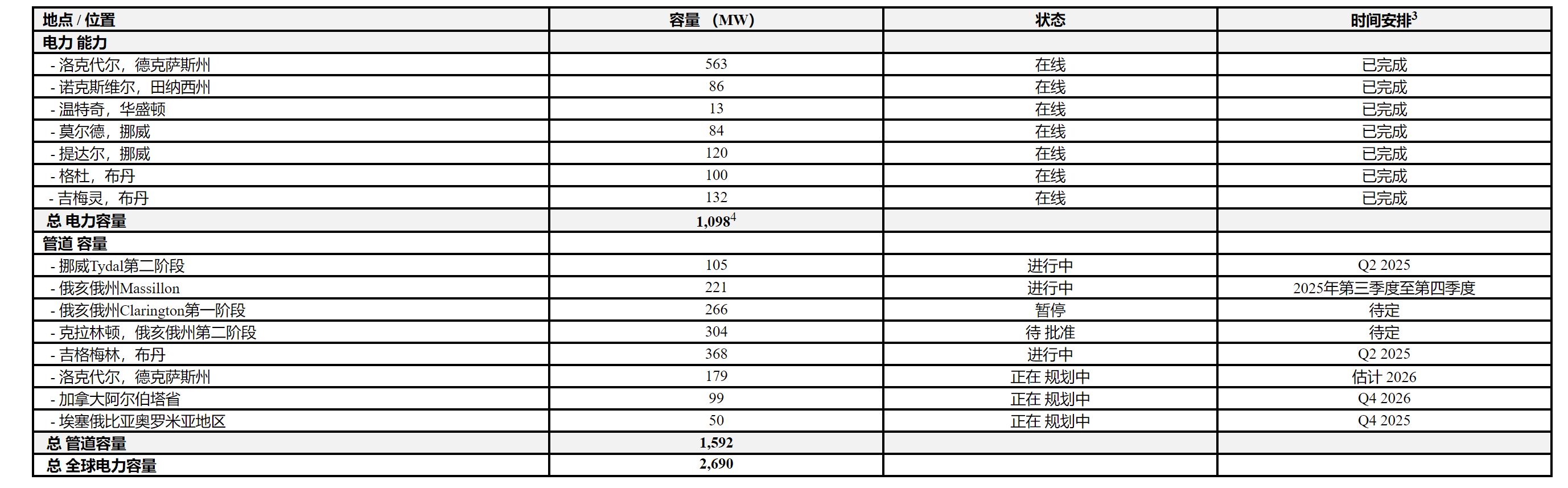

3. Global power infrastructure expansion remains rapid. By the end of Q2, Bitdeer’s total available global power capacity is expected to approach 1.6GW, reaching 1.8GW by year-end.

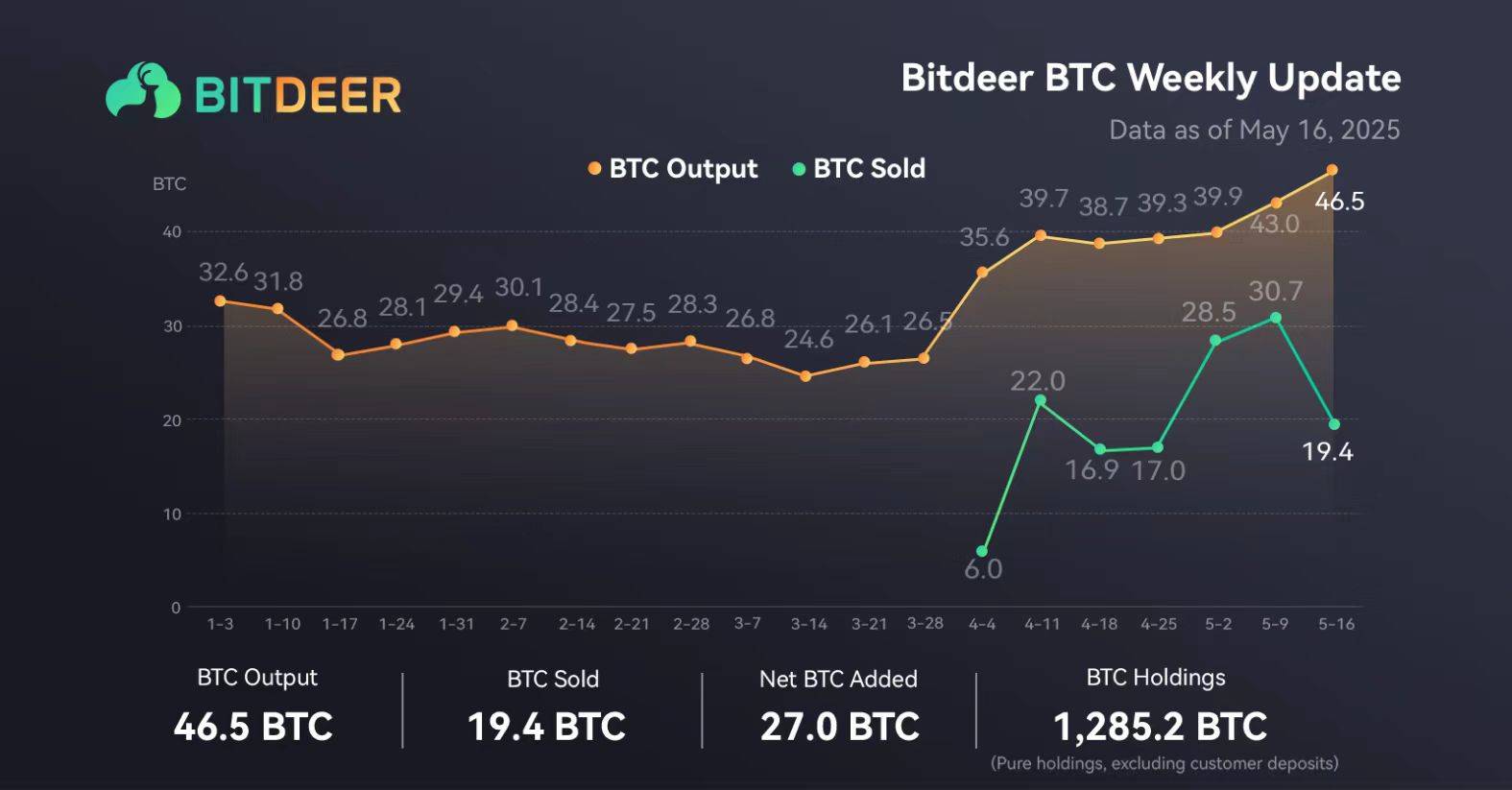

4. As of April, the hashrate of Bitdeer’s self-operated mining farms reached 12.5Eh/s, expected to rise to 40Eh/s by October and exceed 40Eh/s by year-end. The latest Seal01 and Seal02 miners only began operating in self-owned farms in March, yet overall mining costs remain more than 20% lower than peers (including Mara, CLSK, etc.). After full replacement of outdated equipment, cost advantages will become even more pronounced, with monthly output showing exponential growth starting from Q2.

Investment Recommendation: Bitcoin prices have recently resumed an upward trend, potentially breaking the previous all-time high of $109,000 per coin. Since the onset of U.S. trade tensions, the U.S. dollar has weakened, and Bitcoin has begun to exhibit safe-haven characteristics similar to gold. The Federal Reserve has recently adopted an "average inflation" policy, raising expectations for an interest rate cut as early as June and increasing the anticipated number of rate cuts for the year to three (previously one). These factors collectively provide strong support for Bitcoin prices. After navigating an operational transition period in Q4 last year and Q1 this year, Bitdeer is entering a critical phase. The pace of miner development and commissioning of self-operated mining farms will be key highlights over the coming quarters. Q1 2025 likely marked the weakest performance period for the next two years, with an operational turning point now beginning. Bitdeer remains the top choice among North American Bitcoin mining stocks.

Investment Risks: Risk of further Bitcoin price corrections, risk of TSMC tape-outs underperforming expectations, risk of slower-than-expected deployment of company-owned miners.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News