Bitcoin miners, abandoning mining for the cloud

TechFlow Selected TechFlow Selected

Bitcoin miners, abandoning mining for the cloud

Mining companies are starting to leverage existing sites and infrastructure to rent data center space to large technology firms.

Author: Tiger Research

Translation: AididiaoJP, Foresight News

As Bitcoin prices continue to fall, many miners are facing a survival crisis. Amid increasingly fierce competition in core mining operations, how can these companies save themselves? Leasing data center capacity for artificial intelligence (AI) has emerged as a highly watched transformation path.

Key Conclusions

-

Bitcoin mining revenue is unstable, while costs keep rising, making the core business model unsustainable.

-

Mining firms are beginning to leverage existing sites and infrastructure to lease data center space to large technology companies.

-

This transformation alleviates cutthroat competition and helps improve the overall health and stability of the industry.

1. Core Operational Risks Facing Mining Companies

The business model of Bitcoin mining companies is relatively simple, forming a fundamental vulnerability. Their income is almost entirely tied to the highly volatile price of Bitcoin, full of unpredictability; on the cost side, increasing mining difficulty, rising electricity prices, and hardware upgrades show a rigid upward trend.

The problem becomes especially acute when cryptocurrency prices fall: income sharply declines while costs remain high, creating a "squeeze from both ends" dilemma. Additionally, regulatory risks persist—such as New York State's proposed increase in consumption taxes on mining operations. Although this currently affects only limited regions compared to more lenient areas like Texas, it signals potential broader compliance pressures in the future.

All of this forces mining companies to confront one fundamental question: Can a single mining-focused business model be sustained over the long term?

2. Cost Inversion: An Increasingly Fragile Profit Structure

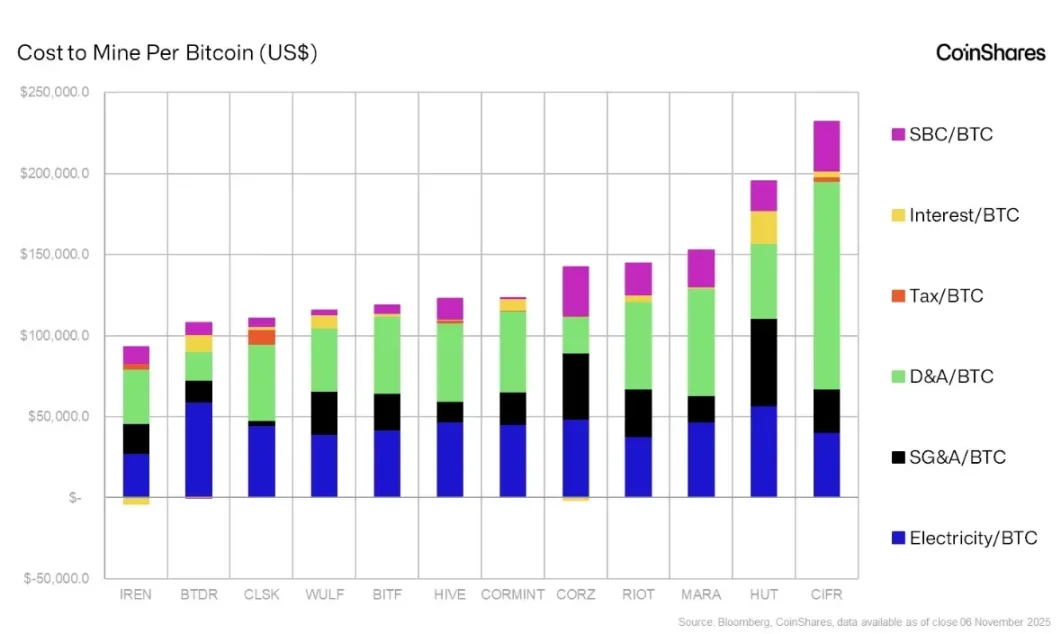

According to CoinShares, the current average cost to mine one Bitcoin has risen to approximately $74,600. When factoring in depreciation and other expenses, total production costs approach $130,000 per Bitcoin.

However, Bitcoin’s current market price is around $91,000. This means that for every Bitcoin produced, mining companies face an accounting loss of about $46,000. Rising mining difficulty and tightening energy policies further deteriorate the cost structure, weakening the industry’s overall profitability foundation.

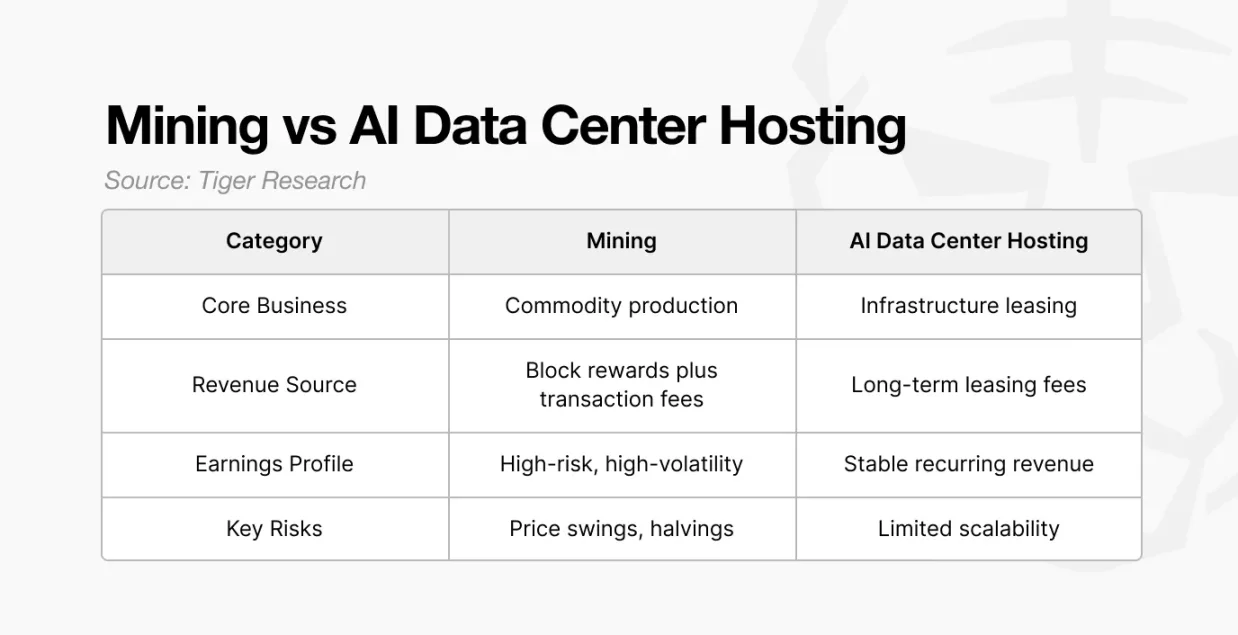

3. The Path to Transformation: Why AI Data Centers?

The AI race has intensified, generating explosive demand from tech giants for data centers. Building new facilities takes time, and market opportunities pass quickly—making leasing ready-made, rapidly adaptable infrastructure an optimal choice.

Existing assets owned by mining companies align well with this need:

-

Computing hardware: Large quantities of high-performance GPUs (such as NVIDIA chips) that can be repurposed for AI computing.

-

Power resources: Access to hundreds of megawatts of grid power already approved—an increasingly scarce resource in today’s energy market.

-

Cooling capabilities: Experience managing heat dissipation from high-power mining rigs can be directly applied to managing AI servers such as H100/H200 models.

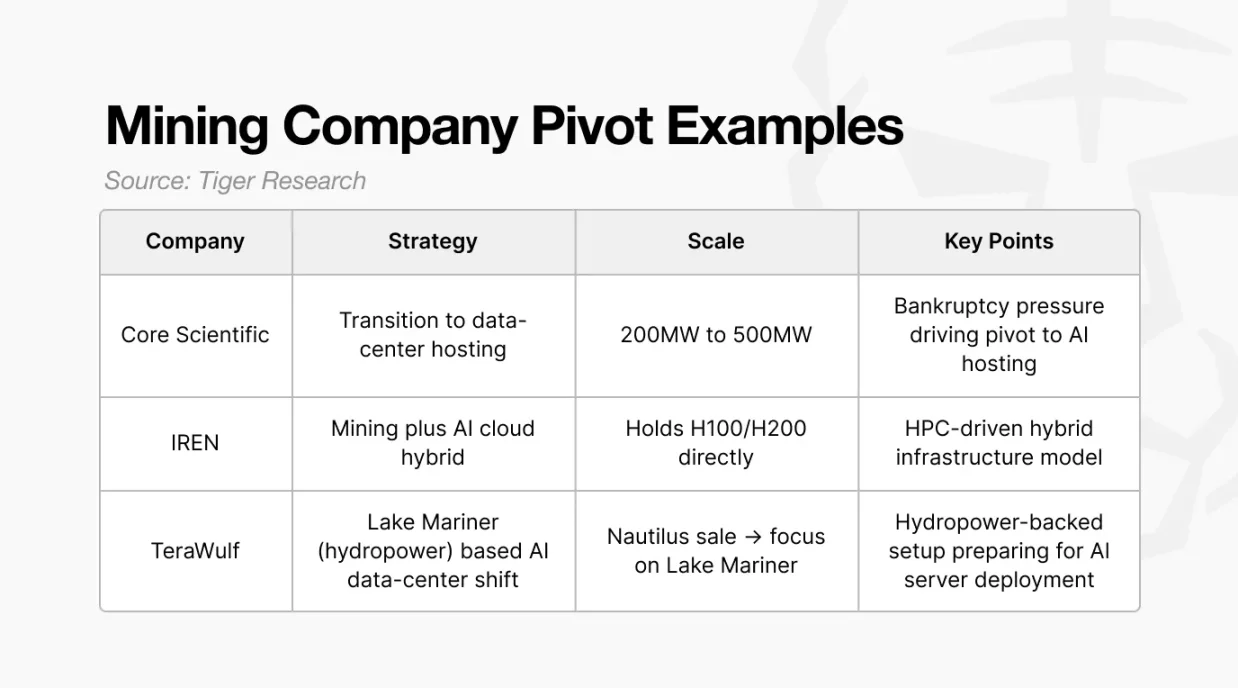

A typical example is Core Scientific, which was once near bankruptcy but successfully turned losses into profits by transforming into an AI data center leasing operation. It now operates about 200 megawatts of capacity and plans to expand to 500 megawatts. IREN, TeraWulf, and others are also exploring similar diversification strategies. This shift is not merely about growth—it is a necessity for survival.

4. Diversified Evolution: More Than Just Data Centers

Transitioning to AI data center leasing is the dominant trend, but not the only option. At its core, this represents a rational reallocation of capital toward higher-efficiency domains. Stable data center revenues provide mining firms with cash flow buffers, allowing them to hold Bitcoin assets strategically without being forced to sell during market downturns.

Meanwhile, some mining companies such as Bitmine and Cathedra Bitcoin are exploring expansion into broader digital asset technology (DAT) business models. These diversified efforts collectively point to one trend: weak standalone miners are being eliminated or transformed, while leading firms evolve into integrated service providers. The entire cryptocurrency mining industry is moving toward a more mature and resilient phase.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News