The essence of inscription tokens is SFTs

TechFlow Selected TechFlow Selected

The essence of inscription tokens is SFTs

This article provides a detailed introduction to the nature of inscriptions as a third type of token and their valuation model.

Author: CaptainZ

The Summer of Inscriptions

Previously, people speculated which sector would kick off the bull market—social, gaming, or ZK? Now there’s no doubt: it’s "inscriptions."

However, understanding "inscriptions" remains confusing. Builders, investors, old OGs, and new retail traders all have different perspectives. For a long time, I was misled by a flawed view: "Inscriptions are just a new way to issue assets—basically meme coins going parabolic." It wasn’t until I read articles by Wang Feng and Joslter that I finally grasped the true meaning of inscriptions.

In this article, I’ll explain why "the essence of inscriptions is actually a third type of token—SFT, distinct from both NFTs and FTs," how this leads to a valuation model for ORDI, and finally address several common misconceptions.

What is SFT?

For years, we’ve held fixed ideas about tokens, generally categorizing them into two types: FTs and NFTs.

Fungible Token (FT) refers to tokens that are interchangeable—one unit is identical to another. As the name suggests, any two units of an FT are exactly the same and can be freely exchanged, making them “fungible.”

Since FTs directly correspond to real-world value units like money, common stock, or loyalty points—and support arithmetic operations—they’re intuitive and were among the earliest digital assets. As early as 2015, shortly after Ethereum launched, Vitalik Buterin proposed implementing FTs via smart contracts. Fabian Vogelsteller formalized this with the ERC-20 standard in November 2015. After 2016, ERC-20 became the most widely used and recognized token standard, launching a multi-billion-dollar industry.

Non-Fungible Tokens (NFTs), on the other hand, are the opposite of FTs. While every unit of an FT is identical and interchangeable, each NFT is unique, one-of-a-kind, non-interchangeable, and not suitable for calculation.

While FTs represent abstract quantities, NFTs represent specific digital items—virtual art, domain names, music, in-game assets, etc. To express uniqueness, each NFT has its own unique ID (determined by contract address and serial number) and metadata. The main NFT standard is ERC-721, proposed in January 2018 by William Entriken and others.

For their first three years, NFTs were largely overlooked. Then, in 2021, fueled by the explosion of crypto art, the NFT market took off. In the first five months of 2022 alone, newly issued NFT assets reached $36 billion. Today, NFTs are considered one of the most important infrastructures in Web3 and the metaverse.

SFT stands for Semi-Fungible Token—a new token category standing alongside FT and NFT as the third general-purpose digital asset type. As the name implies, SFTs sit between FTs and NFTs: they can be split and calculated like FTs, yet also carry unique attributes like NFTs.

It's important to note that due to Bitcoin’s lack of smart contract functionality, previous token definitions stemmed from Ethereum’s technical framework—for example, ERC-20 for FTs, ERC-721 for NFTs. So what about SFTs? Meng Yan’s team at Solv Finance introduced ERC-3525 in September 2022, defining the first SFT standard within the Ethereum ecosystem.

Although ERC-3525 has existed in the Ethereum ecosystem for nearly a year, it hasn’t gained much traction. Partly due to the bear market, but more importantly because the SFT tokens issued through Solv partnerships were institutional financial assets—akin to bond markets—and targeted institutional traders, leaving retail investors untouched.

How Are FTs Issued on the BTC Chain?

Before the rise of smart contract platforms, people experimented with issuing FTs and NFTs on the Bitcoin blockchain. The most famous method was Colored Coins.

Colored Coins refer to a set of techniques using the Bitcoin system to record the creation, ownership, and transfer of assets beyond Bitcoin itself. They can track digital assets or even physical assets held by third parties, enabling ownership transactions via colored coins. "Coloring" means attaching specific data to a Bitcoin UTXO to distinguish it from others, thereby introducing heterogeneity among otherwise fungible bitcoins. Through this technique, issued assets inherit many of Bitcoin’s properties—double-spend protection, privacy, security, transparency, and censorship resistance—ensuring transaction reliability.

Notably, the protocols defined by Colored Coins aren't implemented in standard Bitcoin software. Specialized tools are required to recognize and process colored coin transactions. Clearly, colored coins only hold value within communities that recognize the protocol; otherwise, the "color" disappears, reverting the UTXO back to a plain satoshi. On one hand, small communities can leverage Bitcoin’s strengths for asset issuance and circulation. On the other, integrating colored coin protocols into the core Bitcoin software via soft fork is nearly impossible due to lack of broad consensus.

The Mastercoin project conducted an early token sale in 2013 (what we now call an ICO) and successfully raised millions of dollars—considered the first-ever ICO. Mastercoin’s most notable application was Tether (USDT), the most well-known fiat-backed stablecoin, initially issued on the Omni Layer.

Unlike Colored Coins, Mastercoin doesn’t store asset information directly on-chain. Instead, it publishes transaction types on-chain while maintaining a state model database off-chain by scanning Bitcoin blocks. This allows more complex logic than Colored Coins. Since state isn’t stored or validated on-chain, transactions don’t need to be continuous (“permanently colored”). However, to execute Mastercoin’s complex logic, users must trust the off-chain database maintained by nodes or run their own Omni Layer node for verification.

How Are NFTs Issued on the BTC Chain?

The above protocols mainly focused on issuing FTs on Bitcoin. For NFTs, Counterparty is key.

Launched in January 2014, Counterparty initially served as a platform for FT-based financial assets but quickly became home to some of the earliest NFTs—Spells of Genesis, Rare Pepes, and Sarutobi Island. To transfer token ownership on Counterparty, users must make a special Counterparty transaction. Nodes parse the transaction data off-chain and update a ledger/database stored within Counterparty nodes. This is achieved using OP_RETURN, a method allowing arbitrary data to be embedded in Bitcoin transactions—and thus permanently recorded on the Bitcoin blockchain.

Counterparty truly exploded after launching a series of 1,774 frog Pepe NFTs. Collectors stored these NFTs in Counterparty wallets, where OP_RETURN outputs anchored NFT indexes to the Bitcoin blockchain. OP_RETURN limits attached data to 80 bytes—just enough for Counterparty to include an NFT’s description, name, and quantity (though for ordinal inscriptions, the only limit is the Bitcoin block size, which we’ll discuss later).

Beyond OP_RETURN, Bitcoin itself evolved. Technical upgrades like SegWit (2017) and Taproot (2021) paved the way for Ordinals.

The Ordinals protocol was created specifically for NFTs on Bitcoin. Introduced in January 2023 by Casey Rodarmor, who described them as digital art, Ordinals work simply. A satoshi (sat) is Bitcoin’s smallest unit, named after Satoshi Nakamoto. With 100 million sats per BTC, and 21 million BTC total, there will ultimately be 2.1 quadrillion sats. Normally, all sats are identical and interchangeable—hence fungible.

The Ordinals protocol introduces a system to distinguish and track individual sats. When a new Bitcoin block is mined and new BTC awarded, the protocol assigns each sat a unique ordinal number based on mining time—the earlier the sat, the smaller the number.

During transactions, the Ordinals protocol tracks sats using a first-in-first-out approach. These sat numbers are called ordinals because their identification and tracking depend entirely on chronological order of creation and transfer. Once a sat is identified by the Ordinals protocol, users can inscribe arbitrary data onto it, giving it unique characteristics—defined as crypto art. This capability only became feasible after the SegWit (2017) and Taproot (2021) upgrades to Bitcoin Core.

When an Ordinal is inscribed, the inscription is bound to a special type of Taproot script. While this restricts how arbitrary data can be stored on Bitcoin compared to older methods, it enables inscriptions to contain larger amounts of data. Creating and interacting with inscriptions requires running a full Bitcoin node and using a special wallet that supports Ordinals. Ultimately, we arrive at:

Ordinals + Inscriptions = NFTs

Think of the Ordinals theory as a special pair of goggles for viewing the Bitcoin blockchain—allowing users to create, view, and track extra information tied to each sat.

Now comes the final question: How do we issue SFT assets on the BTC chain?

The Essence of Inscription Tokens Is SFT

Bitcoin lacks smart contract functionality, so any asset issuance must use script areas like OP_RETURN or Taproot. There are theoretically two ways to issue SFTs:

Add “uniqueness” to an existing FT;

Add “fungibility” to an existing NFT.

BRC-20 tokens emerged using the second method. As mentioned earlier, users can inscribe arbitrary data onto a sat to give it unique traits. Inscribing text creates a text NFT (similar to Loot on Ethereum); inscribing an image creates an image NFT (like PFPs on Ethereum); inscribing audio creates an audio NFT. What if we inscribe code—specifically, code that issues a fungible token?

BRC-20 leverages the Ordinal protocol to deploy token contracts, mint, and transfer tokens by setting inscriptions as JSON-formatted data. This JSON contains executable code snippets that define token properties such as supply, maximum mint cap, and unique identifier—all executable on the Bitcoin network.

Thus, we see something seemingly strange: when minting an inscription, you get “one piece”—which is 100% an NFT—but this “piece” can be split, distributing fungible tokens individually. This resembles the real-world concept of “wholesale and retail.” No wonder some say “inscriptions are NFTs that can be split.” But something possessing both NFT-like and FT-like properties—that’s precisely the SFT we discussed earlier!

Domo, almost unintentionally, achieved SFT issuance without smart contracts using what appears to be a regressive technical approach—an incredible feat!

How Are SFTs Issued on the ETH Chain?

Earlier, we briefly discussed how non-smart-contract blockchains (like Bitcoin) issue FTs and NFTs. For smart contract platforms like Ethereum, everyone is familiar with ERC-20 for FTs and ERC-721 for NFTs. But how do we issue SFTs on Ethereum? Two standards apply: ERC-1155 and ERC-3525.

ERC-1155 is a multi-token standard. In substance, we prefer calling it a multi-instance NFT standard. It fits a narrow use case: multiple identical copies of the same NFT. Crucially, these instances must be absolutely identical—no differences allowed.

ERC-3525, the semi-fungible token standard, is a general-purpose standard with broad applicability. It recognizes multiple similar but non-identical tokens as belonging to the same class, allowing special operations like transfers between them. Effectively, tokens of the same class can be merged, split, or fragmented—supporting mathematical operations.

The key difference lies in how “sameness” is defined:

ERC-1155 requires objects to be completely identical—even slight differences disqualify them;

ERC-3525 allows similarities with minor variations—core attributes match, while non-critical ones may differ.

For purely meme-oriented SFTs, ERC-1155 suffices. For assets with deeper financial utility, ERC-3525 is more appropriate. Unfortunately, neither 1155 nor 3525 has seen widespread adoption on Ethereum—only a few institutions have issued limited debt-like SFTs.

Why Did Inscriptions Succeed?

“Inscriptions” is a broad term originally meaning “embedding content on-chain.” Historically, inscription-based NFTs weren’t successful and drew little attention. The debate centered on whether issuing NFTs on Bitcoin made sense after fully functional smart contract NFTs (ERC-721) already existed.

Drawing from the concept of fully on-chain games, we can introduce “fully on-chain NFTs.” As widely known, Ethereum’s ERC-721 NFTs store only metadata—the actual content (image or file) is referenced by a URL (if hosted centrally) or a hash (if on decentralized storage). That’s why Musk mocked NFTs, saying, “At least encode the tiny picture onto the blockchain.” Thus, Ethereum NFTs are “off-chain content, on-chain pointer.” If the hosting server vanishes, the NFT becomes useless.

In contrast, inscription-based NFTs are truly fully on-chain—the content resides directly on Bitcoin’s blockchain, with ordered sats pointing to it. This is indeed an advantage, but not compelling enough on its own. Before March, Ordinals NFTs were lukewarm—just a niche market for small images—until BRC-20 arrived.

I believe BRC-20 succeeded for the following reasons:

- BRC-20 implemented SFT issuance on a non-smart-contract blockchain using a crude method. SFT is a new asset class distinct from FT and NFT—this is the fundamental reason for its success (Ordinals NFTs initially failed).

- BRC-20 follows a fair launch model, unlike Ethereum’s VC-centric approach, enabling rapid wealth distribution and FOMO-driven adoption (a stark contrast to Solv Finance).

- ORDI, the flagship SFT token, is an experimental meme coin with no intrinsic valuation—paradoxically increasing imagination and consensus value.

- SFTs combine advantages of both FTs and NFTs, allowing direct use of existing FT and NFT infrastructure. Thus, inscription tokens can trade on NFT marketplaces like OpenSea, centralized exchanges like Binance and OKX, and even DEXs like Uniswap. Initially low liquidity during NFT trading fuels price surges; once listed on centralized exchanges, massive liquidity ensures sustained momentum—best of both worlds.

- It captures overflow capital from the BTC ecosystem. Long restricted to cross-chain moves for DeFi, NFTs, gaming, or social activities, BTC holders now finally have native BTC products to engage with.

ORDI Valuation

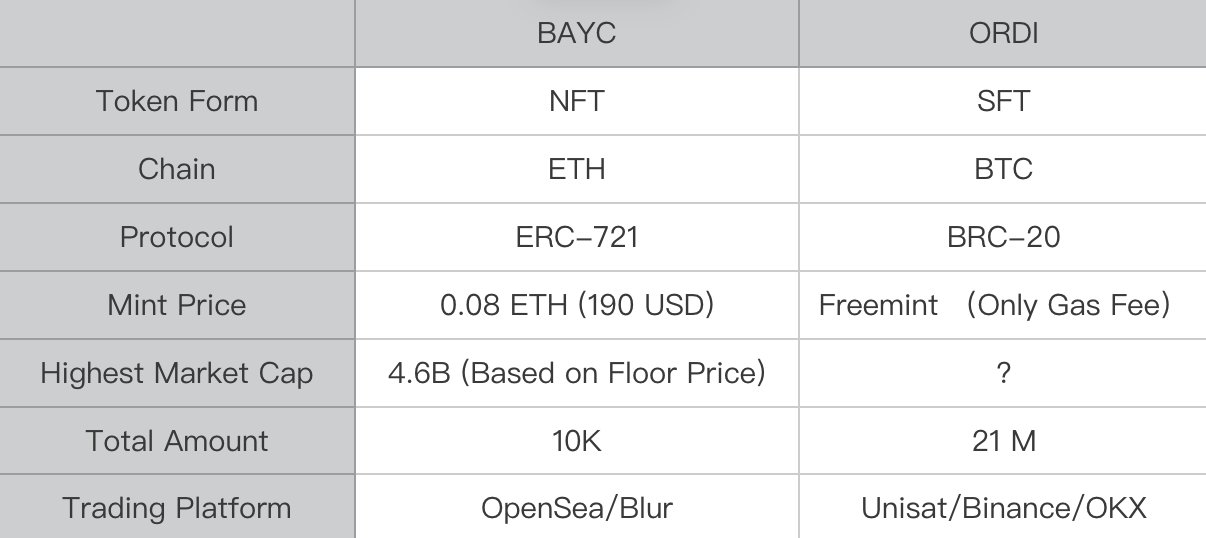

ORDI is the first SFT token in the BTC ecosystem and inherently a meme token—thus lacking intrinsic valuation. In other words, the only limit is your imagination. Still, we can estimate its potential by comparing it to BAYC, the NFT market leader.

BAYC has long led the NFT space—fairly minted at low cost, then rising over a thousandfold, peaking at around $4.6 billion in May 2022.

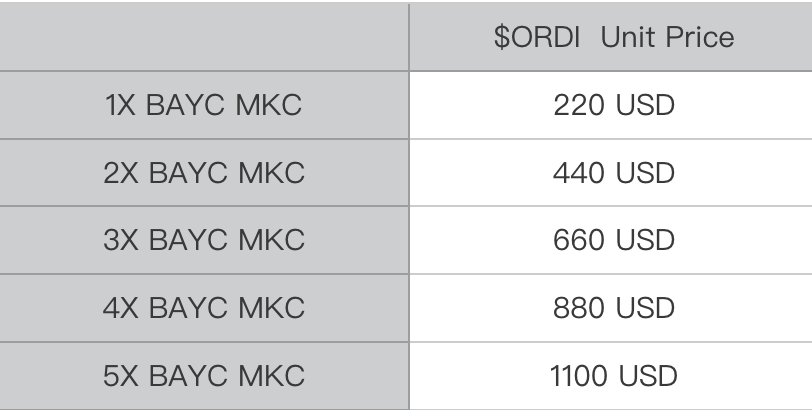

As the first BRC-20 token, ORDI could be minted for minimal gas fees, then rose over a thousandfold, currently stabilizing around $70 (as of December 2023). Assuming ORDI maintains its leadership in the SFT space, its peak bull-market value could at least match BAYC’s—around $220 per token. But since ORDI trades on centralized exchanges—offering far greater liquidity than NFTs like BAYC (many pure traders only use centralized exchanges, not wallets)—its market cap reaching 3–5 times that of BAYC is plausible. Hence, we have the table below:

This comparative valuation method is admittedly rough—take it with a grain of salt. After all, when sentiment kicks in, price is whatever the market says.

Common Misconceptions

Blind men describing an elephant—when a new phenomenon emerges with many novel features, each observer might only see a leg or a trunk, mistaking it for the whole. Over the past six months, I’ve encountered many explanations that misled my own understanding—until I read Wang Feng’s and Joslter’s pieces, finally grasping the essence of inscriptions.

1. Inscriptions Are Just a New Token Distribution Method

This view is completely wrong. “Inscribing” simply means uploading content to blockchain space—a practice that existed years ago, even offered by some mining pools. Early Ordinals NFT inscriptions didn’t gain traction; only when JSON-based fungible tokens were inscribed did it take off. The correct understanding: inscription tokens are a new token type—SFT.

2. Inscriptions Are Just Meme-Driven Pump-and-Dump Schemes

This was my initial belief—partly right, partly wrong. Given the clear 4-year crypto cycle, every sector—including past DeFi and NFT booms—follows a pattern of “narrative → pump → dump.” ORDI is indeed a meme coin. But this view only sees one leg of the elephant, missing the core truth: inscription tokens represent a new token form—SFT. It’s reductive.

3. Inscriptions Are Outdated Technology—a Step Backward

Half right, half wrong. We shouldn’t conflate chains. On BTC (without smart contracts), BRC-20 or similar protocols may be the only viable way to issue SFTs. But on smart contract platforms, using inscription-style methods to issue SFTs is technically regressive—superior standards like ERC-1155 and ERC-3525 exist. At best, it’s speculative hype.

4. Inscriptions Represent BTC Ecosystem’s Counterattack Against ETH

Again, half right, half wrong. Ethereum already has SFT standards, but they haven’t taken off—mainly because only VCs and institutions participated, excluding retail. Retail investors turned to BTC’s fair-launch BRC-20 tokens as a rebellion against VC dominance and Ethereum’s “orthodoxy.” But this “rebellion” is just another leg of the elephant—not the whole animal. Don’t generalize.

5. Inscriptions Are Like Carving Flowers on Gold

Also partly valid. If BTC is digital gold, the analogy fits. But it still misses the essence: inscription tokens are a new asset class—SFT. Another case of partial insight mistaken for full understanding.

From the above discussion, we see that the inscription trend is fundamentally an explosion of SFT—a new token form. For non-smart-contract blockchains, SFT issuance can only happen via BRC-20-like “appendix” methods. For smart contract chains, there are two paths: using VMs and smart contracts, or bypassing VMs via “appendix” methods. In the next article, we’ll explore two evolutionary directions of inscription tokens: recursive inscriptions and smart inscriptions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News