Waterdrip Capital: Explaining BRC-20—A New Narrative or a Bubble Feast?

TechFlow Selected TechFlow Selected

Waterdrip Capital: Explaining BRC-20—A New Narrative or a Bubble Feast?

After the hype fades and market rationality gradually returns, the prices of most BRC-20 tokens may drop significantly.

Authors: August Cao Yihan, Song Hao, Dusko, Deng Xiaojuan, Nora, Tim Hu

Mentor guidance: Jademont, Elaine, Bill @Waterdrip Capital

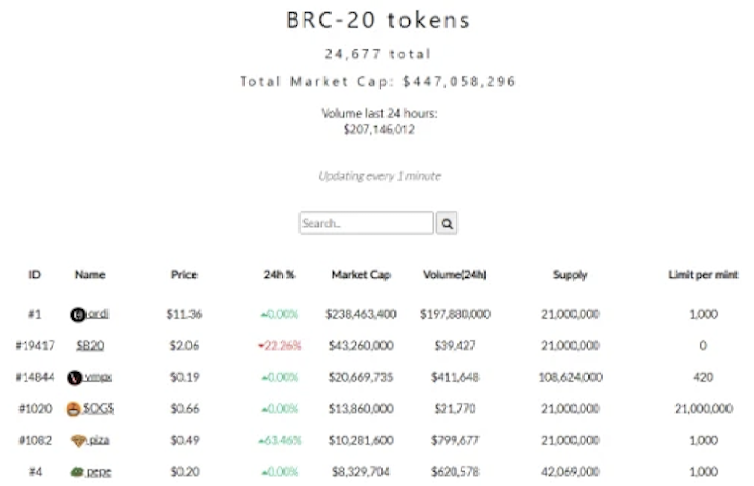

As of May 31 at 17:59, over 24,000 BRC-20 tokens have been deployed with a total market cap exceeding $400 million, where $ordi remains the top-ranked. Undoubtedly, BRC-20 represents a significant recent innovation on the Bitcoin network. However, we believe that as the hype around BRC-20 fades and people stop FOMOing into BRC-20, prices of various BRC-20 tokens will inevitably decline significantly.

What is BRC-20?

BRC-20 is a standard for using inscriptions to mark ledger states. Ordinals is a numbering scheme that allows tracking and trading each individual "sat" (the smallest unit of Bitcoin). Bitcoin is a fungible token—each Bitcoin is identical. BRC-20 assigns sequential numbers to each base unit of Bitcoin—the "sat"—making sats non-fungible. It should be noted that BRC-20 is not an alternative to Bitcoin but rather a protocol built on top of the Bitcoin network.

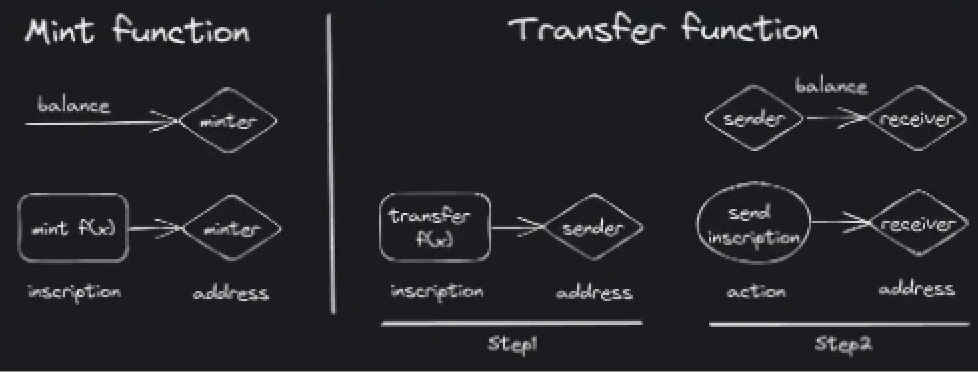

Mint and Transfer functions of BRC-20

Source:https://domo-2.gitbook.io/brc-20-experiment/

BRC-20 achieves the original vision of the crypto industry—anyone can easily issue tokens. Its greatest value lies in being native to Bitcoin; it occupies part of a "sat," making these BRC-20 tokens like avatars of Bitcoin itself. Bitcoin confers value upon them. You could also liken it to issuing currency on RMB—similar to limited-edition RMB notes—where each BRC-20 token is a limited edition of Bitcoin with inherent basic Bitcoin value.

At its core, BRC-20 is essentially an NFT, visually indistinguishable from ERC-20 standard tokens, filling a gap missing in Bitcoin’s ecosystem compared to Ethereum's.

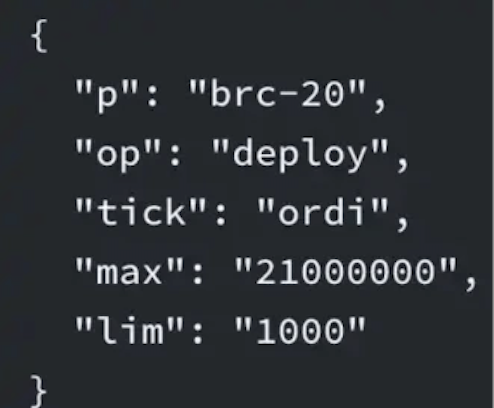

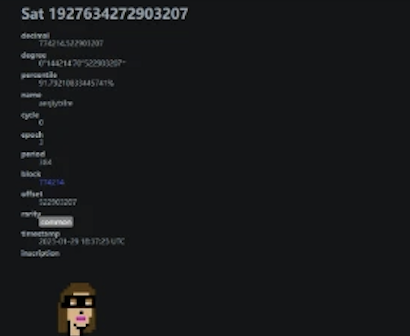

@domodata’s first BRC-20 token “Ordi”

Source:https://domo-2.gitbook.io/brc-20-experiment/

BRC-20 provides three execution standards for issuing tokens on the Bitcoin network: deploy (deployment), mint (minting), and transfer (transferring). Developers following this standard can create and launch BRC-20 tokens.

Users can modify the field after "op" to indicate the operation: "deploy" means token deployment, "mint" indicates token minting, and "transfer" signifies token transfer. The "tick" field specifies which token name is being operated on, allowing users to input the desired token name.

Bitcoin surpasses Ethereum in both market capitalization and total number of users, yet its ecosystem lags behind Ethereum’s—not only due to high mainnet gas fees but also because of the lack of a flexible token issuance mechanism. Since the release of the BRC-20 standard, there may be hope for improving Bitcoin’s ecosystem going forward. Hence, within the crypto community, domo is hailed as “the creator of BRC-20, V God of Bitcoin’s ecosystem.”

Background of BRC-20

Since the launch of the Ordinals protocol, domo has turned his Twitter profile picture into an NFT on BTC.

Domo then analyzed transaction volume in the Ordinals market and found that by March 6 this year, it had already reached $6 million in trading volume and 10,000 unique users—an achievement that took OpenSea 14 months to accomplish. Thus, domo concluded that the Ordinals protocol would definitely endure, revealing the enormous potential of the Ordinals Market.

Twitter user @satsnames introduced the .sats namespace built on Bitcoin at the end of February this year. Its goal is to build a naming ecosystem on Bitcoin, constructed by Bitcoin users and fully based on Bitcoin, with all name states existing directly on Bitcoin—no one holds special privileges. By default, whoever writes a name first owns it, though others might use duplicate names (name collisions). To resolve this, the “first is first” rule was adopted. Since launching this naming system, transactions involving .sats minting have accounted for 45% of all Ordinals minting.

Twitter user @redphonecrypto explained NFTs on Bitcoin, arguing they shouldn’t truly be called NFTs but rather digital artifacts. He refuted the misconception that “Bitcoin inscriptions are just JPGs on Bitcoin, showing no innovation, unprogrammable, and bound to die quickly,” offering several reasons: ① Inscriptions can contain virtually any media modern web browsers can display—including films, games, websites, and JPGs; ② The primary use case is simply publishing text on Bitcoin, enabling easy copy-pasting of content, effectively creating a service similar to “IPFS” in the crypto world; ③ Bitcoin inscriptions function like an immutable timestamped database of transactions, sequentially numbered so the first inscription remains forever the first, tied to an immutable timestamp. Previously, Bitcoin only stored timestamped transactions; now, it can store anything collectively imagined by users.

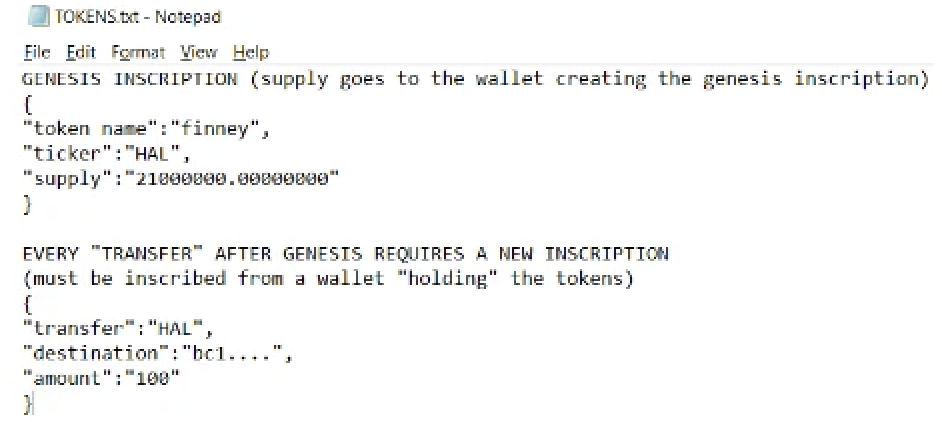

It was also argued that NFTs on Bitcoin outperform those on Ethereum in at least two ways: (1) true scarcity (unlike Ethereum, they cannot be infinitely minted); (2) secured by Bitcoin’s PoW security mechanism; (3) on-chain engraving (instead of linking to IPFS/Arweave/centralized servers). Inspired by the sats file system, @redphonecrypto envisioned someone creating a “BRC-20”-like standard enabling token issuance on Ordinals, proposing his own hypothesis as shown below:

Thus, domo launched the BRC-20 experiment, applying this logic so anyone could deploy, mint, or transfer via Ordinals inscriptions under the “first is first” principle.

Comparison Between BRC-20 and ERC-20

BRC-20 is more like a special type of NFT, where the NFT specifies how many units of a fungible token it represents.

Advantages of BRC-20 over ERC-20:

1. Fairer distribution model. This stems from Bitcoin’s limited programmability. While low programmability is generally seen as a disadvantage compared to Turing-complete chains like Ethereum capable of hosting smart contracts, this very “limitation” ensures BRC-20 tokens cannot be pre-mined, unlike ERC-20 tokens which often include reserved allocations during issuance.

2. Inherent base value. Since BRC-20 relies on “sats,” the minimum value of a BRC-20 token can be considered equivalent to one sat, whereas ERC-20 tokens lack such a floor value.

Disadvantages of BRC-20 vs ERC-20:

1. Low programmability. The absence of native smart contract support on Bitcoin limits DeFi scalability for BRC-20.

2. BTC cannot reject invalid inscriptions. Inscriptions are JSON-formatted data, and Bitcoin nodes do not parse this data.

3. UniSat dominates validation of inscription legitimacy, leading to centralization concerns. UniSat currently dominates the BRC-20 market. Because BRC-20 content consists of JSON data requiring tools for interpretation, UniSat plays the role of interpreter—a clear sign of insufficient decentralization in BRC-20.

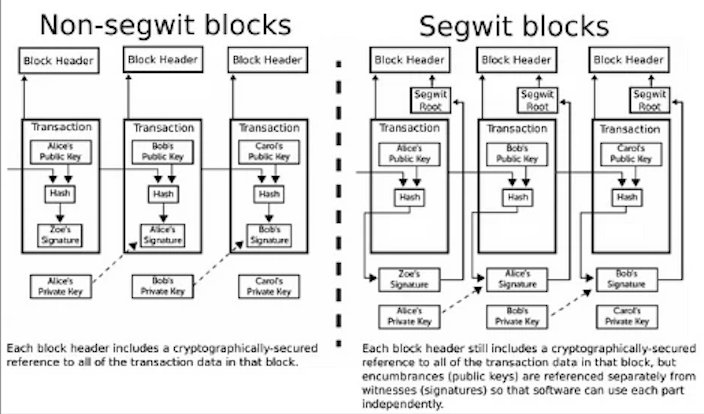

In fact, two technical upgrades to the Bitcoin protocol in 2017 and 2021—Segregated Witness (SegWit) and Taproot—increased block data capacity, enabling the emergence of Ordinals NFTs, although these upgrades were not originally intended for creating Bitcoin NFTs.

SegWit moves script signature (scriptSig) information out of the base block structure into a new data structure. Nodes and miners still verify script signatures in this new structure to ensure transaction validity[4]. SegWit relaxes limits on signature size, effectively increasing Bitcoin’s block capacity.

David A. Harding's diagram comparing old and new transaction serialization

Data source: https://medium.com/@dexx/debunking-three-misconceptions-about-segregated-witness-3bbf55c6f4de

The soft fork Taproot upgrade implemented in 2021 included three BIPs: Schnorr Signatures, Taproot, and Tapscript. Their goals were to enhance privacy and efficiency on the Bitcoin network and address security issues. Schnorr Signature is a digital signature algorithm proposed by Claus Schnorr. It enables aggregation of multiple signatures into one, improving efficiency and privacy. Taproot hides complex transactions under ordinary public keys using Merkle Abstract Syntax Trees, similarly enhancing efficiency and privacy. Tapscript is a new scripting language used to write conditional branching logic within Taproot, optimizing Schnorr signatures and adding new opcodes. The core of this upgrade lies in Schnorr signatures, whose algorithm brings higher performance and better use cases to Bitcoin. Although Bitcoin blocks are capped at 1 MB, additional data can be attached to each transaction, allowing up to 4 MB of data per block[5].

Ultimately, the combination of Ordinal theory + SegWit + Taproot enabled Bitcoin NFTs, giving every sat special meaning.

Bitcoin Punks (Inscription 34400)

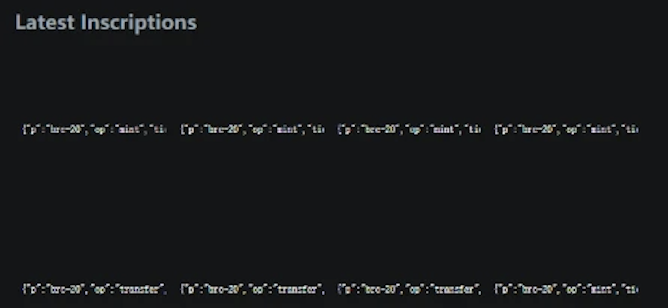

As the potential of Ordinal theory is explored, BRC-20 arrives. At the time of writing, the latest inscriptions are all BRC-20.

Inscriptions at 1:00 on May 6, 2023

Current Status Analysis

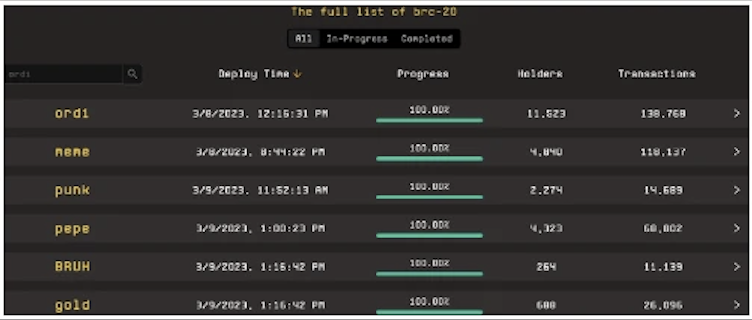

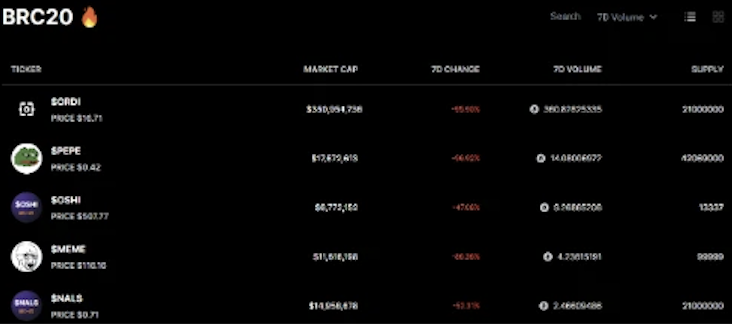

According to the BRC-20 website, market sentiment toward BRC-20 remains extremely high, with over 24,000 BRC-20 tokens deployed and a total market cap exceeding $400 million. Among them, $ordi still ranks first with a market cap of $230 million, accounting for 53% of the total BRC-20 market cap. (Data as of 17:25 on May 31, 2023)

https://BRC-20.io/

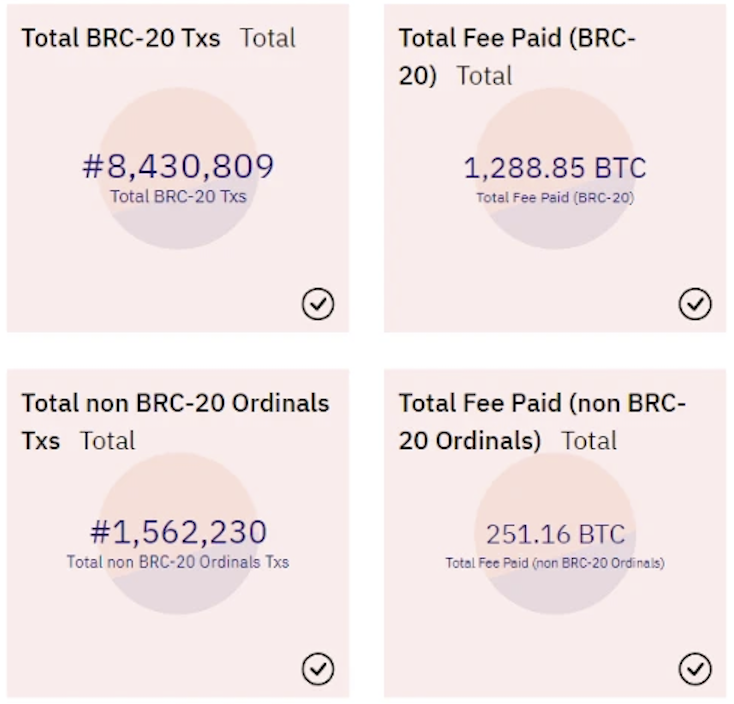

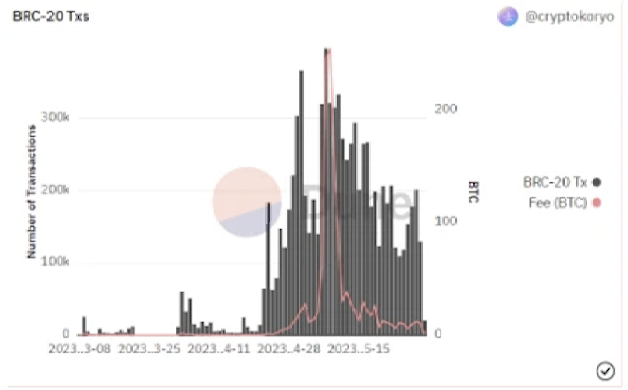

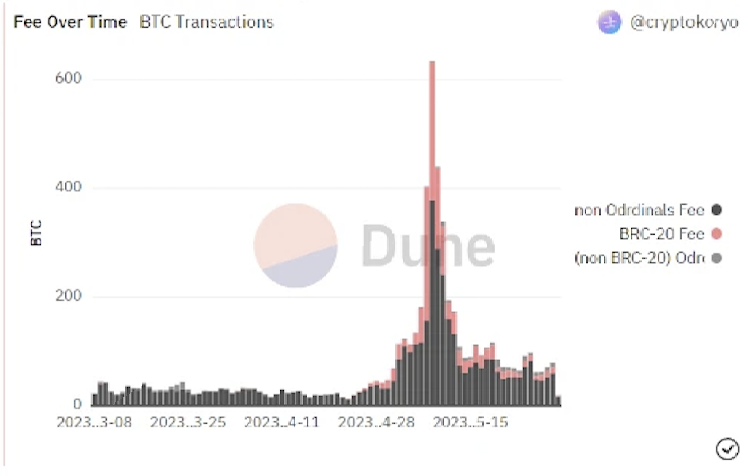

BRC-20 token trading volume remains high, with the BRC-20 market staying active. Currently, the total number of BRC-20 transactions exceeds 8.43 million, with total fees surpassing 1,280 BTC. (Data as of 17:27 on May 31, 2023)

https://dune.com/cryptokoryo/brc20

Daily trading volume consistently exceeds 100,000.

https://dune.com/cryptokoryo/brc20

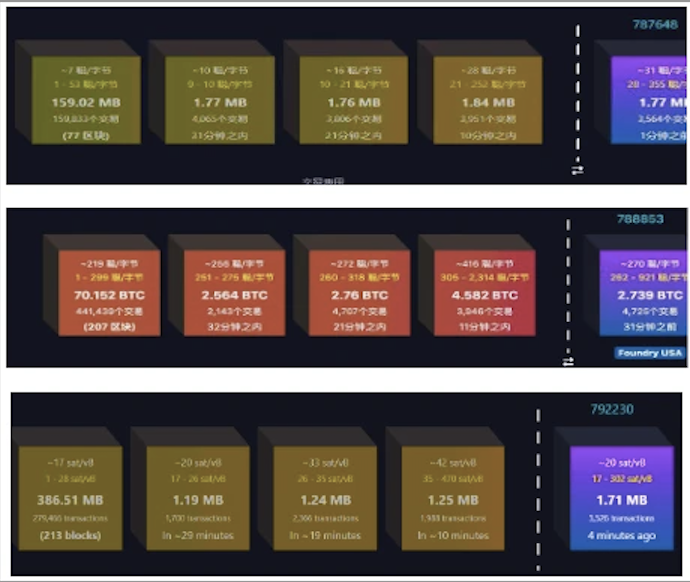

From mempool pool data, in early May—within less than a month—gas fees surged nearly 40-fold from under 10 sats/vb to peaks exceeding 600 sats/vb. Centralized minting and trading platform UniSat saw its user base grow rapidly to hundreds of thousands within weeks, frequently crashing servers due to overwhelming demand. In contrast, when UniSat launched in March, it had only about 50 active users.

The three charts above show mempool transaction fee graphs on April 30, May 8, and May 31, 2023, respectively

Data source: https://mempool.space/

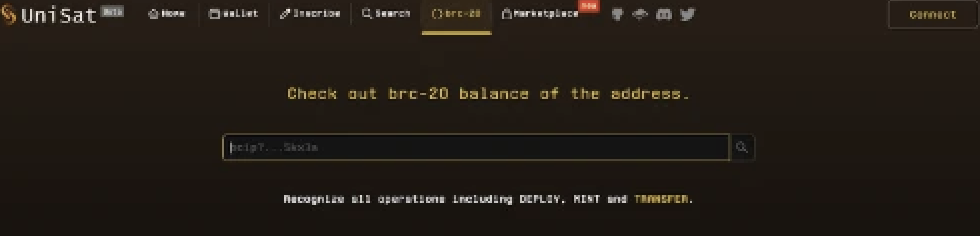

UniSat services

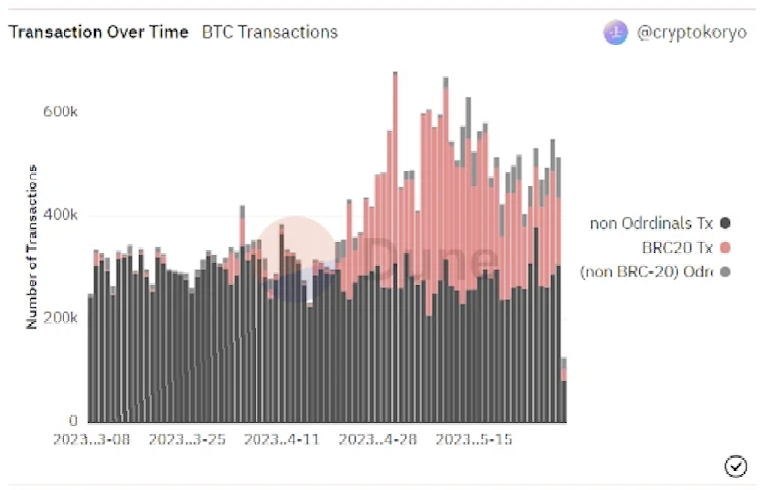

Currently, BRC-20 has directly fueled Bitcoin transactions and continues to maintain strong momentum.

https://dune.com/cryptokoryo/brc20

Heavy transaction volumes have congested the Bitcoin network, causing gas fees to skyrocket, though they’ve recently dropped sharply.

https://dune.com/cryptokoryo/brc20

A growing number of users have entered the BRC-20 market. Top tokens like ordi now have over 11,000 holders, while meme tokens like pepe have over 4,000 holders.

https://unisat.io/brc20

Most participants enter with investment mindsets, expecting price appreciation and dreams of overnight wealth. Price increases often rely on community consensus and fantasies shared by those hoping to get rich quickly. So when BRC-20 tokens list on exchanges, early investors expect more buyers to emerge and take over their holdings. But reality shows otherwise:

1. The number of people entering the BRC-20 market cannot sustain long-term exponential growth.

2. Most traders in the BRC-20 market hold large amounts themselves and prefer launching new projects rather than buying undervalued older ones.

Therefore, when BRC-20 tokens list on exchanges, large holders dump heavily, but few step in to buy. When expectations clash with reality, bubbles burst step by step. This panic triggers more people to sell at lower prices, driving continuous price declines. Many meme coins like bank, vmpx, etc., have already crashed over 90%.

(Figure Eight: VMPX price chart) Data source: https://www.gate.io/zh/trade/VMPX_USDT

Take the VMPX price chart above as an example. Before listing on Gate.io, VMPX steadily rose due to community consensus, reaching $0.80. After news broke about the upcoming listing—but before official launch—prices spiked to $2. Then, large-scale selling began. One hour before listing, prices had already fallen to around $0.30. After listing, the highest price barely reached $0.30, followed by sustained downward volatility, leaving almost nothing.

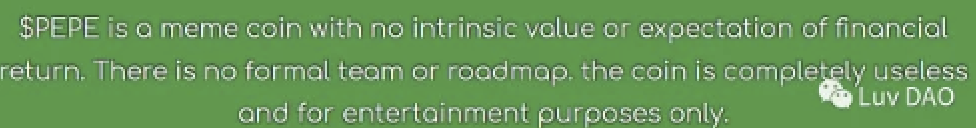

Currently, BRC-20 tokens are merely tokens—we don't yet know where they're headed or what future applications they may have. As most BRC-20 projects are currently speculative "pump-and-dump" schemes with no real value or utility, some original Bitcoin community members oppose BRC-20, believing it only increases network congestion without benefiting Bitcoin. However, others argue that since users must pay sats to purchase any BRC-20 token on-chain, this adds new use cases for the Bitcoin network and attracts a fresh wave of enthusiastic users and developers. They believe this will increase demand for BTC, positively impacting BTC’s price.

As stated on Pepe's official site, Pepe has only entertainment value (https://www.pepe.vip/)

BRC-20 Ecosystem

When discussing BRC-20, UniSat cannot be overlooked. Undeniably, BRC-20 came with built-in narrative power, but UniSat undoubtedly poured fuel on the fire.

What Did UniSat Get Right?

UniSat is primarily a browser extension wallet, designed and operated much like MetaMask. Given MetaMask’s massive user base, users familiar with EVM-compatible chains can easily adapt to Bitcoin blockchain operations. Beyond wallet functionality, UniSat offers inscription browsing, search, and marketplace services, becoming a one-stop solution for all things BRC-20.

UniSat services

With its comprehensive suite of services, UniSat addresses key pain points for BRC-20 users—requiring just one tool to handle minting, selling, searching, and all other BRC-20-related tasks.

Why Did UniSat Fuel the BRC-20 Market Further?

Beyond the aforementioned one-stop services, when UniSat launched its Marketplace feature, access required certain积分(points). Users earned points by using UniSat’s minting tool, forcing users caught in FOMO to quickly mint some new project tokens before purchasing their desired BRC-20 token. This clearly benefits project teams. Moreover, UniSat rewards BRC-20 inscription deployers with 0.2% transaction royalties. Consequently, numerous projects launched simultaneously, further heating up the market. It wasn't until May 11 that, according to its official Twitter, UniSat Marketplace removed access barriers—no longer requiring UniSat积分to use.

What Has UniSat Gained From the BRC-20 Craze?

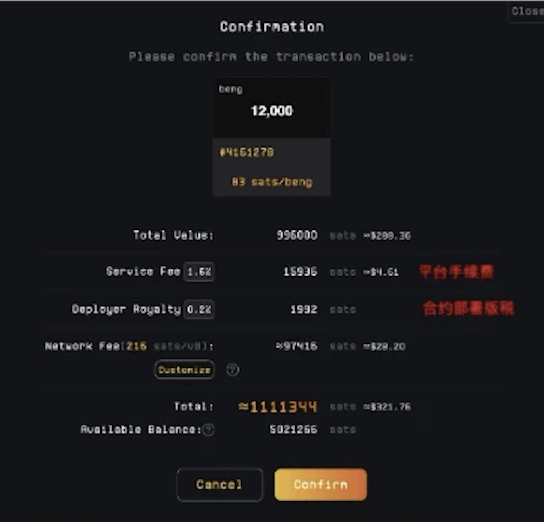

We believe first, UniSat has cultivated strong user habits—when people want to enter the BRC-20 world, UniSat comes to mind immediately, just as MetaMask is the go-to for Ethereum. Second, UniSat has gained real financial returns. Taking the purchase of Beng as an example, users must pay not only the total value of the BRC-20 token and network fees but also a 1.6% platform fee[2].

Purchase confirmation for Beng token (Source:https://twitter.com/punk2898/status/1655220723504541698?s=20)

What Does the UniSat Team Plan to Do in the Future?

According to an interview with Lorenzo from the UniSat team, UniSat has near-term fundraising plans. Regarding products, Lorenzo mentioned only that UniSat will improve cross-platform user experience, securely store users’ inscriptions within the wallet, enhance mobile access, and optimize the minting process.

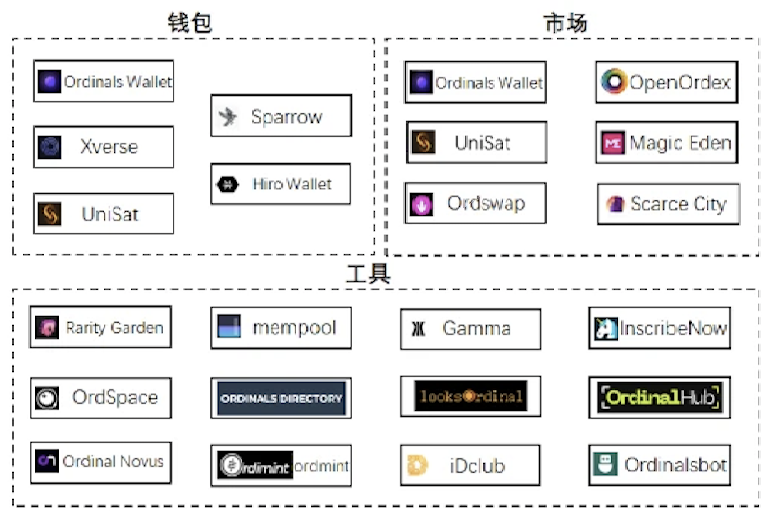

Besides UniSat, many ecosystem projects have emerged around the narratives of Ordinals and BRC-20. We’ll briefly review some of them below.

Ordswap

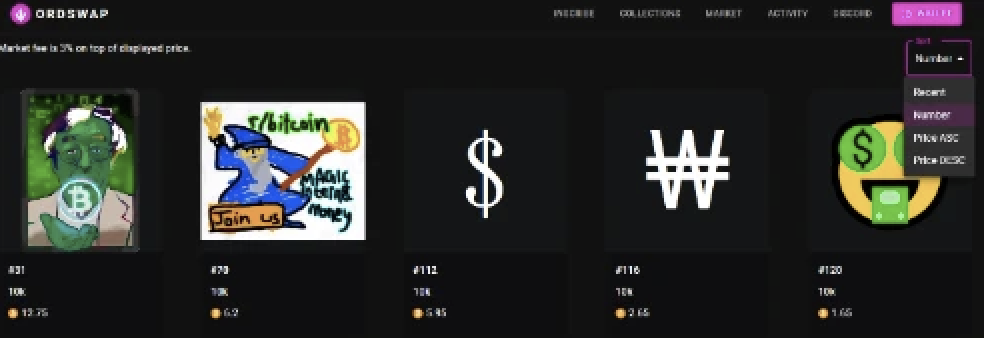

Ordswap also aims to provide an all-in-one tool, allowing users to mint and trade Ordinals inscriptions on its platform. However, Ordswap isn't particularly friendly toward BRC-20 inscriptions—the marketplace isn't optimized specifically for BRC-20, supporting only four sorting methods (Recent, Number, Price ASC, Price DESC). Clearly, BRC-20 enthusiasts won't consider Ordswap their preferred trading venue.

Ordswap market interface

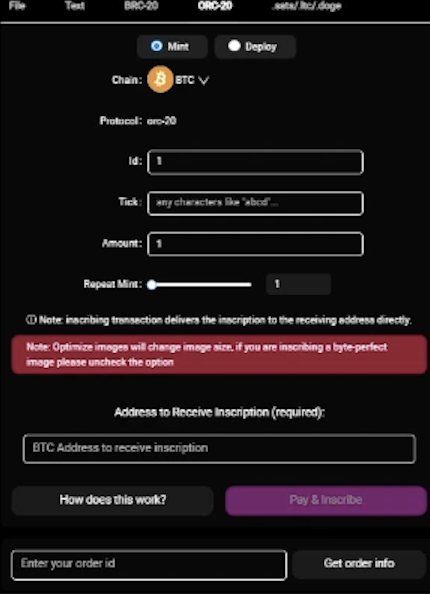

Interestingly, Ordswap provides an interface for inscribing orc-20 (an upgraded protocol compatible with BRC-20), facilitating related operations.

Inscribe orc-20

Ordmint

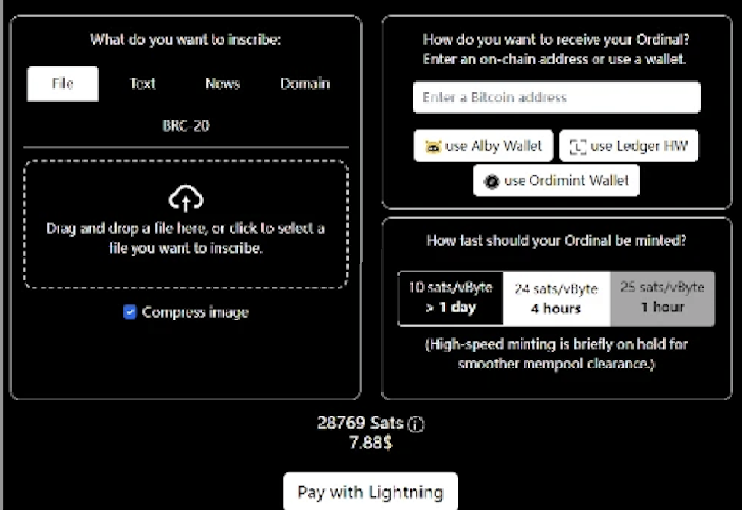

Ordmint is currently mainly a minting tool, supporting payment in BTC via the Lightning Network to mint inscriptions. It includes some search features, though they’re not well-developed. It helps users check whether a .sat domain has already been minted, although other front-end search options added remain unusable as of now.

Ordmint minting function

It currently assists users in checking whether a .sat domain has been minted, although additional search options have been added on the frontend but remain unavailable as of now.

Ordmint search function

Ordinals Wallet

Ordinals Wallet is a web-based wallet and inscription explorer specifically developed for Ordinals, currently offering minting, trading, and other functions highly compatible with BRC-20. The project has already airdropped Pixel Pepes NFTs to early users.

BRC-20 dashboard in Ordinals Wallet

Additionally, here are some other infrastructure components in the broader Ordinals/BRC-20 ecosystem.

DEX for BRC-20

Bitcoin’s scripting language is not Turing-complete, and BRC-20 inscriptions require external tools for parsing. These factors limit Bitcoin’s DeFi extensibility and make BRC-20 assets overly dependent on centralized interpretation tools. Together, these challenges make building a DEX for trading BRC-20 tokens difficult. Most BRC-20 markets like UniSat adopt order-book models relying on manual market makers to facilitate trades.

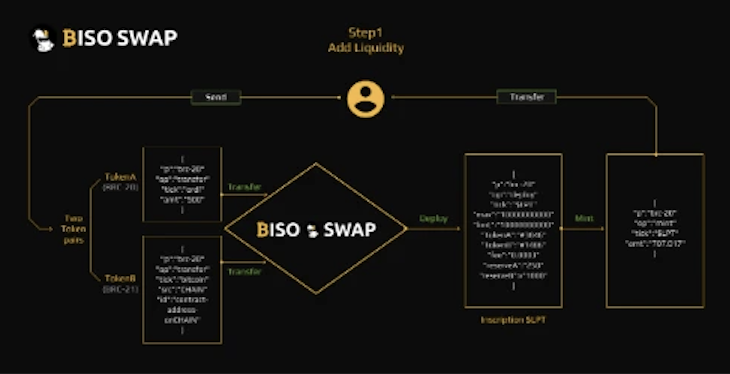

On May 9, BisoSwap announced the deployment of the first AMM DEX in the BRC-20 ecosystem. BisoSwap described workflows for adding liquidity, swapping tokens, and removing liquidity in its official documentation.

According to the liquidity addition workflow, users send BRC-20 and BRC-21 token pairs to BisoSwap, which then deploys LP Token inscriptions on-chain, mints them, and transfers them back to users.

Liquidity addition workflow (Source:https://bisoswap.gitbook.io/bisoswap/workflow-and-architect-a-seamless-3-step-liquidity-solution-for-the-brc-20-ecosystem)

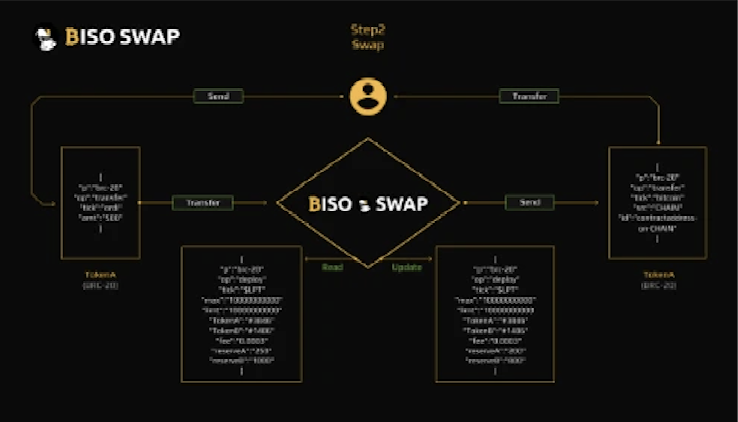

The swap function description states that users send a BRC-20 TokenA transfer inscription to BisoSwap. BisoSwap reads the deployed LP Token “contract,” calculates and updates the latest values of TokenA and TokenB in the pool, then sends a TokenB transfer inscription back to the user, who can redeem locked assets on the target chain as needed.

Token swap workflow (Source:https://bisoswap.gitbook.io/bisoswap/workflow-and-architect-a-seamless-3-step-liquidity-solution-for-the-brc-20-ecosystem)

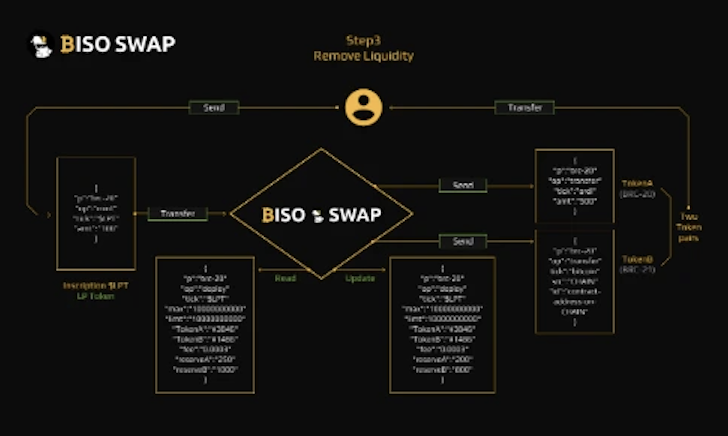

Removing Liquidity Workflow

To remove liquidity, users transfer the mint inscription of the LP Token to BisoSwap. BisoSwap reads the deployed LP Token “contract,” calculates and updates the latest values of TokenA and TokenB in the pool, then sends transfer inscriptions for TokenA and TokenB back to the user.

Liquidity removal workflow (Source:https://bisoswap.gitbook.io/bisoswap/workflow-and-architect-a-seamless-3-step-liquidity-solution-for-the-brc-20-ecosystem)

We observe that although BisoSwap claims to be a DEX, it still heavily depends on tools to parse inscription content. Furthermore, BisoSwap hasn’t actually implemented these three core functions yet, having instead launched a non-core staking feature. We believe that given Bitcoin’s network constraints and BRC-20’s inherent characteristics, implementing a true AMM DEX purely on the Bitcoin network is extremely challenging—efforts may need to shift toward the Lightning Network or Bitcoin sidechains.

Future Outlook

BRC-20 is a major innovation by domo on the Bitcoin network, revitalizing Bitcoin’s ecosystem and narrative, and bringing renewed attention to the long-overlooked Lightning Network. As more people explore BRC-20’s potential, FOMO around BRC-20 grows. BRC-20 is gradually forming an ecosystem. However, most current BRC-20 tokens remain speculative “shitcoins,” many possessing only entertainment value. Once the excitement fades and market rationality returns, the prices of most BRC-20 tokens will inevitably drop significantly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News