The Path to BRC-20's Popularity Through the Lens of "Narrative Economics"

TechFlow Selected TechFlow Selected

The Path to BRC-20's Popularity Through the Lens of "Narrative Economics"

Understanding Satoshis, Ordinals, BTC-NFTs, and BRC-20: Exploring the unique characteristics of Bitcoin's smallest units and token standards.

Author: chengshutong

Part 1: First Encounter with Ordinals, BTC-NFT, and BRC-20

This section piles up concepts. Although they can be explained in a few sentences, I still want to connect each point from a fundamental perspective. What are sat (satoshi), Ordinals, BTC-NFT, and BRC-20? Understanding them individually may not leave a strong impression—your head might even spin. Below, we’ll thread these scattered concepts together into one coherent narrative.

1. Sat (Satoshi)

Let’s start with a basic concept: the satoshi (sat), the smallest unit of Bitcoin, named after Bitcoin's pseudonymous creator, Satoshi Nakamoto. 1 BTC = 100,000,000 sats. The sat is Bitcoin’s smallest divisible unit and can be used as a denomination for transactions.

Now, we know that the Ordinals protocol is a system that assigns unique numbers to each sat. This numbering relies on the premise that every sat is unique. Each sat has a unique identifier—an unspent transaction output (UTXO)—composed of a transaction ID and an output index. Sats are generated in the order they are mined. Through UTXOs, the Bitcoin network tracks the transaction history and ownership of each sat, ensuring security and reliability, and guaranteeing the uniqueness of each sat.

Thus, we understand that the sat is Bitcoin’s indivisible smallest unit of account, and each sat is unique—doesn’t this already resemble an NFT? In fact, each sat itself can be seen as a special kind of NFT, possessing characteristics such as uniqueness, non-fungibility, and on-chain recordkeeping—features shared by ERC-NFTs.

2. Ordinals = “Numbering System + Annotation System”

Interestingly, the Ordinals protocol builds an additional layer atop this "special NFT." Simply put, Ordinals is a “numbering system + annotation system”—first assigning a number to each sat, then linking different numbers to various content carriers to fill them with data, such as JPG, TXT, MP4, GIF, ZIP, etc., generating corresponding text-format inscriptions, image-format inscriptions, etc. However, storage is limited to a maximum of 4MB.

Doesn’t this process resemble “annotating” a sat? Indeed, the result of this process is called an inscription. However, the Chinese translation remains somewhat obscure; in English, it can be directly understood as “annotation”—assigning derivative meanings to sats. Based on the unique ID of each sat, the Ordinals protocol attaches additional content, enabling sats to be identified, transferred, and imbued with meaning.

3. BTC-NFT vs. ERC-NFT: A Real Difference

The biggest difference from ERC-NFTs is that BTC-NFTs are truly stored on-chain. Blocks can store small, immutable data (≤4MB). By paying certain transaction fees, the stored data is permanently preserved on the blockchain. In contrast, when creating an ETH-NFT, only metadata (such as title, author, timestamp, tags) is typically stored on-chain, not the actual content data.

4. BRC-20 Deployment, Minting, and Transfer

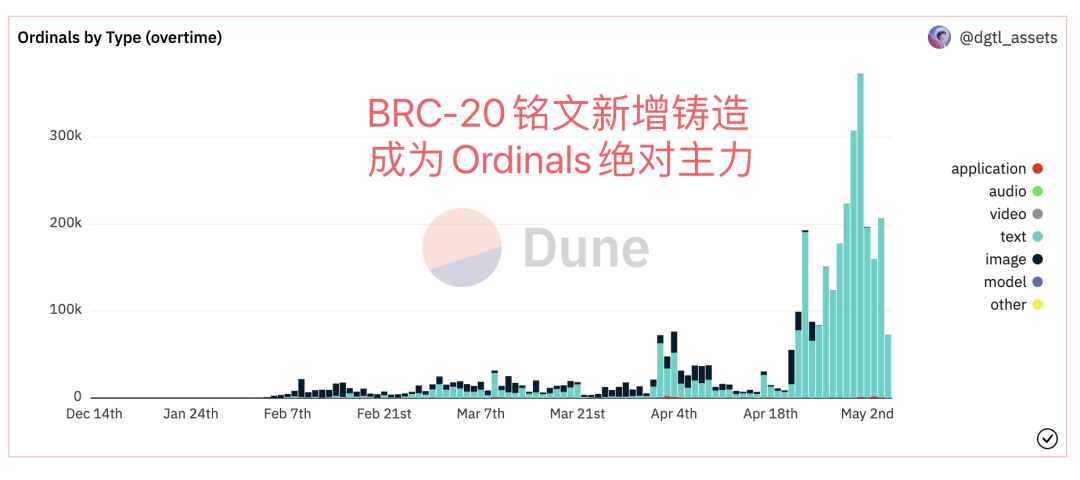

The implementation of the BRC-20 protocol is based on Ordinal inscriptions—specifically, text-type inscriptions. In the BRC-20 protocol, Ordinal inscriptions store token contract information, including the token name, symbol, total supply, decimals, etc. After encoding, this information is stored on the Bitcoin blockchain, enabling token contract deployment and management. By adding text data into Bitcoin transaction records, token minting and transfers are achieved. In essence, deploying, minting, and transferring BRC-20 tokens all involve creating a new inscription (in Text format).

However, BRC-20 tokens cannot interact with smart contracts or perform any automated operations, such as automatic transfers or dividend distributions. This is precisely where BRC-20 differentiates itself from ERC-20—simplicity and higher security are exactly the foundations upon which Bitcoin survives.

#Summary

In summary, the sat is Bitcoin’s smallest unit of account. The Ordinals protocol assigns unique numbers and annotations to each sat, achieving characteristics such as uniqueness, non-fungibility, and on-chain recording.

BTC-NFT refers to non-fungible tokens stored on the Bitcoin blockchain, capable of storing small, immutable data that is permanently preserved on-chain.

The BRC-20 token standard allows users to deploy and manage token contracts via inscriptions on the Bitcoin network, enabling token minting and transfers.

Part 2: The Path to Popularity—A Discussion on “Narrative Economics”

“Narrative Economics,” a book by Robert Shiller, the 2019 Nobel Laureate in Economics, argues that the assumptions of rational actors and perfect information do not apply to all economic scenarios. It primarily explores the role and impact of narratives in economics, introducing the concept of “narrative economics.”

The author believes that narratives significantly influence people’s beliefs, values, and behavioral habits, which in turn affect economic development and operation. The implication of narrative economics for cryptocurrencies is that their success depends not just on technology and functionality, but more crucially on the power and reach of their narrative—the embodiment of particular values and culture, skepticism toward centralized finance and society—which is essential for building consensus. Similarly, I use this book to identify which narratives are more likely to capture market attention, with broader scope and longer duration.

Keywords: simple and easy to understand, novel terms and stories, emotional resonance, widespread controversy, narrative constellations, multidimensional associations, celebrity attention, etc.

1. Controversy Builds Consensus; Biased Attention Leaves Information Bubbles

Controversial narratives often attract more attention, stimulating deeper thinking among industry participants. Stakeholders will thus debate their preferences from multiple angles, indirectly popularizing a concept and increasing the narrative’s reach and influence. Controversy prompts critical thinking about values and biases within narratives. The stronger the opposition, the more cohesive the supporting group becomes—thus, controversy becomes an indispensable part of strengthening consensus.

Cryptocurrencies themselves emerged from controversy. Strong, resilient consensus often begins subtly. Bitcoin has been declared dead or predicted to fail over 300 times due to price volatility, technical issues, regulatory policies, and competitors. Events like Ethereum’s DAO hard fork creating ETC, Parity’s $280 million freeze, network congestion, and gas wars have only strengthened its consensus through controversy. Smooth, uncontested consensus never lasts long—excessive praise inevitably triggers backlash. EOS collapsed after three hype waves dropped to $3; ICP’s ecosystem sank into stagnation.

Uncontested consensus is doomed from the start—this is praise-killing.

Current controversies surrounding BRC-20 mainly include:

First, bloating full nodes with “junk,” compromising Bitcoin’s purity, making blocks bulkier and increasing on-chain storage and transaction costs;

Second, permanent inscription storage on-chain, leading to redundant ledger growth, raising operational costs for full nodes, requiring higher-performance mining equipment, seemingly pushing mining toward centralization;

Third, as previously mentioned, each sat is inherently anNFT, rankable by rarity. With Ordinals, rare sats become identifiable and tradable, losing uniform value, potentially disrupting Bitcoin’s base unit of account;

Fourth, poor scalability and lack of support forsmart contracts, limiting applications to extremely simple games, making it difficult to build a robust ecosystem like Ethereum’s.

Are these concerns valid? Of course—and meaningful. They represent a clash between old and new Bitcoin consensuses. If the new consensus fails to sustain value transmission, it could seriously undermine Bitcoin’s foundation.

Yet for speculative games, controversy holds two key meanings.

First, controversy indicates a narrative’s vitality. As long as it isn’t definitively disproven, bubbles of value persist. As Li Xiaolai once said, “Even a fool’s consensus is still a consensus.” Moreover, if the BRC-20 narrative succeeds, it transforms into a “wise man’s consensus.”

Second, controversy signals early-stage consensus formation. Investment opportunities never arise when everything looks rosy. Market divergence creates cognitive bias—potential buyers emerge amid risk, and high returns come with uncertainty. When certainty arrives, the speculation ends.

2. BRC-20 Is Essentially a Story

Narrative economics emphasizes that stories play a vital role in economics—they evoke emotion, create resonance, and shape beliefs, values, and behaviors. In crypto, a compelling story attracts attention and spreads rapidly. Vivid scenes, interesting characters, and engaging plots help investors emotionally connect, making the narrative memorable. Stories also spread organically via social media, expanding reach and influence.

First, what story does BRC-20 remind us of? Bitcoin’s own origin stories—like the Bitcoin Pizza Event, where a programmer bought two pizzas for 10,000 BTC in 2010, now worth over $400 million, making it the most expensive pizza in Bitcoin history. Then came DeFi, NFTs, memes… tales of overnight wealth—whether lived or missed—make powerful narratives.

Stories serve as vessels for grand narratives—safe harbors for investors holding positions.

Many investors have personally missed these past opportunities. Thus, potential BRC-20/NFT buyers project themselves into those “missed riches” scenarios, grabbing attention instantly. Ordinals combines multiple elements (BTC, NFT, meme, etc.), telling a “wealth-composite” story: I can make up for your regret of missing early BTC, NFT, Doge, or ENS.

In short: Everything you once missed, Ordinals now offers.

Second, from a practical standpoint, Ordinals tells the story of asset issuance on the Bitcoin chain—a story compelling enough to attract seasoned OGs. Many react with surprise: “Bitcoin can do this?” Indeed, ERC/BTC-20 differ fundamentally and won’t replicate identical ecosystems. But even if it’s just memes, who says Ethereum’s meme scene is more authentic? While Bitcoin may lack intrinsic value, it is the origin of crypto narrative and consensus—making memes and classic NFTs on Bitcoin more “legitimately rooted.”

We must not underestimate meme value. As crypto’s origin and cornerstone, the current global crypto market cap is ~$1.2 trillion, with meme sector at ~$18.7 billion (~16%). BRC-20’s market cap is still a mere $140 million.

3. The Spread of Narrative Constellations—Not Isolated Events

In narrative economics, a “narrative constellation” refers to a system of interconnected narratives forming a complete framework, enriching the overall story with multidimensional appeal. Narrative constellations have greater influence than isolated single narratives—reaching wider audiences, lasting longer, and involving more diverse stakeholders.

Let’s examine how the BRC-20/BTC-NFT narrative expanded from Ordinals—can it form a vast narrative constellation? From Ordinals emerged two narratives empowering BTC: NFT and 20. Regarding BTC-NFT, one angle replicates Ethereum’s NFT narrative on Bitcoin, competing for ERC-NFT market share. “Are kings and generals born of noble blood?” Sounds odd saying it with Bitcoin…

On the other hand, BTC-NFT differentiates from ETH-NFT by emphasizing full-node security and permanent on-chain storage—truly inheriting Bitcoin’s security and orthodoxy. As for BRC-20, as previously noted, it tells the story of asset issuance on the BTC chain—essentially, the tokens are just sats. As BTC’s unit of account, sats have a minimum value floor: as long as BTC doesn’t go to zero, BRC-20 won’t either. Utility-wise, sats can act as gas; collectibility effectively locks up BTC supply.

Clearly, BRC-20 asset diversity will keep growing. Currently, only 4-character ticker inscriptions are open, but soon rare 3-digit or 2-letter tickers (ORC is already doing this) will emerge—reminds you of ENS domain speculation logic? Also, projects are reportedly launching NFTs on Litecoin, proving Ordinals’ sustainability. Going further, could we see BRC-20-based DEXs with unique mechanisms, IDO launchpads, or even lending platforms? Wow, an entire industry chain emerges. Thus, BRC-20 is no longer an isolated narrative.

Narrative economics also highlights celebrity effects. As irrational behavior, people often blindly follow celebrities instead of making independent decisions. Social media amplifies this effect. From a stakeholder perspective, can BRC-20 attract widespread attention from crypto influencers—the “masterminds behind the scenes”—to form a narrative constellation?

I’m struck by a quote from Professor 0xTodd: Where do the highest crypto returns come from? The “head” and “tail” of crypto. The head is asset creation—directly issuing assets, like ZK/Arb, Aptos/SUI, or BTC/ETH miners. The tail is asset trading—reallocating assets, like Binance, OKX. The closer you are to these extremes, the higher your excess returns. Thus, the biggest stakeholders (potential influencers) are clear: miners, exchanges, and project teams.

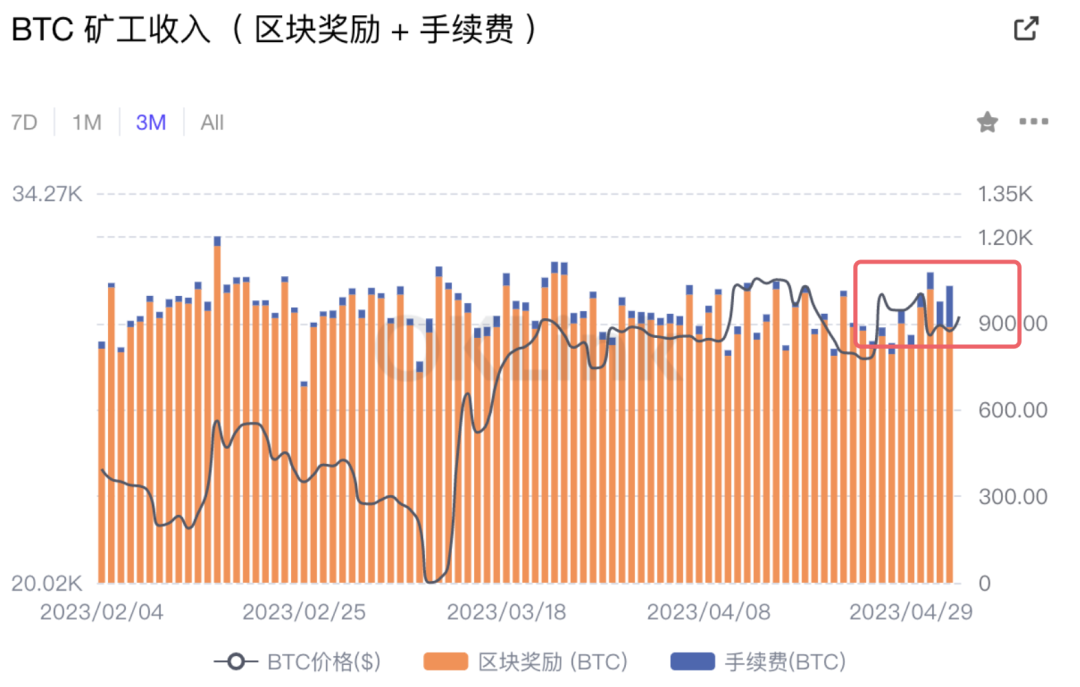

First, Miners: Small Ball Controls Big Ball

Ordinals increase demand for block space, boosting miner revenue and offsetting declining rewards post-halving. Most miners are profit-driven. Recall the 2017–2018 Bitcoin fork frenzy—ostensibly community disagreement, high moral ground reforming Bitcoin—but really about seizing mining dominance and maximizing profits. Hence, most miners actively promote BTC-NFT/BRC-20 and other xRC developments. Gradually, miners shift from relying solely on block rewards to sustaining income via gas fees. This BRC-20 wave is “small ball controlling big ball”—low capital control can maintain high gas fees. Can this boom match the 2017 hard forks? I believe so.

Second, Exchanges: Traffic First

Exchanges list tokens based on two factors: long-term industry value and volume growth. Can BRC-20 generate significant trading volume? Yes. Recall the rise of DAOs—PeopleDAO peaked at $200M daily volume, later spawning valuable DAOs across investment, tools, and communities, bringing long-term industry value. Currently, OKX mobile wallet supports BTC NFTs. Unsurprisingly, OKX will likely be the first to list BRC-20 spot trading. Side note: OKX has the technical capability—unified accounts, Web3 wallet, on-chain analytics—all solid products. Binance has already published educational content on Ordinals; listing is inevitable. Exchanges will push new assets to capture hot-sector volume—it’s coming.

Third, Project Teams: Main Force Behind Asset Creation

An Ordinals hackathon is approaching, attracting developers and professionals—where talent goes, capital follows. YugaLabs’ Twelvefold launched in March, auctioning for up to 7.1159 BTC, with pixel upgrades in late April. More major brands will endorse Ordinals.

In short, BRC-20 has numerous potential stakeholders—not just farmers, NFT enthusiasts, meme coiners, miners, or spot traders—but nearly the entire crypto community. Ten thousand eyes see ten thousand Hamlets. Different stakeholders perceive BRC-20 through different narratives, forming a sustainable narrative constellation.

4. A New Narrative Returning to Origins—Differentiated Competition with ETH

First, ETH-NFTs are, in some sense, “incomplete.”

Inscriptions truly inherit Bitcoin’s security—no need for sidechains or bridges. Inscriptions are permanently on-chain like Bitcoin itself, offering equal security and decentralization.

Second, new narratives layered over Bitcoin’s old ones make things interesting.

As the crypto space evolves, sensitivity to information increases—novelty trumps familiarity. While halvings don’t drastically change marginal supply, combining them with new variables like BTC-NFT, BRC-20, and Lightning Network could breathe new life. In July 2022, I wrote “Is Bitcoin’s Correlation with US Stocks Just Paper Thin?” arguing that “Bitcoin’s various narrative threads constantly evolve—digital gold, speculative asset, commodity, security, safe haven… multidimensional narratives are the best medicine against bear markets.” Today, we see another new narrative Bitcoin can carry—Ordinals.

In fact, crypto merely took a long detour and is now returning to its roots—payments and asset issuance.

Lightning Network launched in 2017 but saw little adoption. Channel count and funds have stalled recently. But Ordinals’ popularity might “accidentally achieve success”—reviving Lightning Network use cases. Massive inscription minting and transfers will inevitably cause block congestion and high gas fees. Technically, sats can transact on Lightning Network—after all, an inscription is just a special Bitcoin transaction. Ordinals acts as asset issuer, Lightning enables low-cost inscription transfers, and Bitcoin mainnet settles batched transactions. This synergy could spark many new innovations—stay tuned.

From this, we see: Can Bitcoin’s ecosystem be compared to Ethereum’s?

Actually, this comparison is flawed—they started differently. Is Alibaba’s Alipay comparable to Microsoft’s Windows? Bitcoin’s endgame isn’t Ethereum’s starting point. They compete differently. Bitcoin is adigital currency, focused on payments and value exchange. Ethereum is asmart contractplatform supporting broader applications. Therefore, Bitcoin will build a distinct ecosystem—not competition, but filling a missing piece of crypto’s original vision.

5. Simplicity: 0.1 Education Cost

Narrative economics notes that simple, clear stories spread easily. People better understand and remember straightforward narratives over complex ones. A resonant narrative often sparks investment decisions and drives deeper value discovery. Top cryptocurrencies all have concise, powerful stories: BTC as inflation-resistant digital gold, ETH as app platform, LINK as off-chain data bridge, UNI enabling CEX-free trading. Despite complex underlying designs, they distill into one sentence: “I’m simple, but powerful.”

Take BRC-20—its name alone implies near-zero education cost.

Seeing BRC evokes ERC; seeing 20 recalls token issuance and the 2017 ICO craze. Practically, both BRC-20 and ERC-20 are token standards for asset issuance and circulation. For users, BRC-20 participation has low barriers—basic Bitcoin wallet and transaction knowledge suffice. For developers, BRC-20 deployment and management are simpler and safer.

Since its inception, “Web3” has been shrouded in mysterious jargon—decentralized, censorship-resistant, immutable—still visibly distant from mainstream adoption.

Mastering algorithms, cryptography, and related tech seems a consensus “baseline” in the space. High cognitive barriers and poor UX hinder broader value discovery. Yet simple, emotionally resonant crypto concepts always break through. Now, BRC-20 radiates simplicity—Ordinal’s minimalist elegance, the clear message: asset issuance on the BTC chain.

Part 3: Implications—The Essence of Crypto

1. Khalil Gibran wrote in “The Prophet”: “We have gone too far, to the point of forgetting why we began.”

Web3 has lost its way. How much crypto spirit remains? Many justify this with regulation, mass traffic, incremental markets—RWA, Hong Kong stablecoins, etc. Even if global participation follows, what’s the point? Blockchain’s essence and初心 boil down to two principles: low-cost trust + maximum freedom. Marx stated commercial credit is essential for capitalist reproduction—low-cost trust accelerates commodity circulation and capital turnover. Early a16z articles argued crypto’s decentralization enables freer interaction among people and resources, breaking unsustainable innovation cycles. Without trustlessness and freedom, so-called “Web3” projects are meaningless. These two words are crypto’s “common sense.” Following value investing can make you money; violating common sense likely won’t.

2. Meme is an experiment; crypto is an experiment. Strong consensus always faces criticism. Trying new opportunities brings unexpected rewards.

Two things frequently occur in crypto: FUD and novelty—both reward investors. Strong phenomena often follow FUD → rising controversy → consensus formation—a natural developmental law. Fresh ideas seem fragile but can grow massive with just a few OGs and media hype. Value discovery in crypto happens faster than ever. Opportunities outside listings level the playing field with institutions. Eventually, people realize meme speculation returns to crypto’s初心—no trust intermediaries + pure freedom. Future crypto alphas lie in early on-chain opportunities—this market rewards pioneers faster. Once listed on major exchanges, value discovery completes in weeks.

3. Don’t get too immersed—your bias isn’t the whole picture.

More importantly, stakeholder interests drive projects behind the scenes. Market participants aren’t just traders—hidden incentives are complex. Yet, each project’s interest distribution reveals a主线: miners, whales, project teams, exchanges—any could be temporary orchestrators. Understand their profit-maximizing logic—and follow.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News