Bitget Research Institute Chief Analyst Ryan Lee: BRC-20 sector sees a resurgence—what are the notable assets worth watching?

TechFlow Selected TechFlow Selected

Bitget Research Institute Chief Analyst Ryan Lee: BRC-20 sector sees a resurgence—what are the notable assets worth watching?

This article reviews the three most closely watched assets in the current BRC-20 ecosystem: ORDI, SATS, and RATS.

Author: Ryan Lee, Chief Analyst at Bitget Research

Recently, the BRC20 ecosystem has become extremely hot—not only due to its wealth effect but also because the entire BRC20 ecosystem is continuously improving, with more and more leading exchanges offering support. For example, Binance has listed ORDI, Bitget has launched SATS, and UniSat Wallet has introduced BRC-20 Swap. Today, let's take a look at the three most discussed assets in the current BRC20 ecosystem:

"ORDI"

As the pioneering token of BRC-20, ORDI is undoubtedly the most well-known, highest-trading-volume, and most liquid asset in the ecosystem so far. Every major development or positive news within the BRC20 ecosystem drives up the price of ORDI. Following Binance’s listing of ORDI, its global trading volume reached over $600 million in a single day. Besides massive trading volumes on centralized exchanges (CEXs), ORDI has also accumulated over 13,000 holder addresses on the Bitcoin network.

"SATS"

Symbolically, "SATS" represents the smallest unit of Bitcoin—the "sat," making it highly relatable and easily associated with various developments and positive trends in the Bitcoin ecosystem.

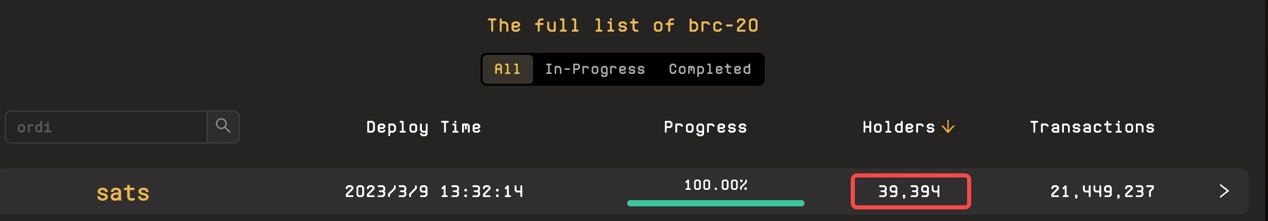

In terms of capital consensus, SATS stands out with its total supply of 210 trillion tokens and a maximum mint amount of 100 million per transaction—meaning it would require 21 million mints to fully mint out. Roughly estimating based on typical BTC network gas fees, fully minting out SATS would cost at least $10–20 million. Such a high cost initially led many to believe that full mint-out was impossible. However, after six months, SATS was indeed 100% minted out—an impressive demonstration of strong capital consensus. Currently, the number of SATS holder addresses has exceeded 39,000.

Regarding utility, Unisat has shown strong confidence in SATS by choosing it as the fee token for their new product, BRC-20 Swap. This adds real-world utility to what was originally just a meme-based BRC-20 token, creating a deflationary consumption mechanism for SATS and further boosting user confidence. This direct integration within the BRC20 ecosystem is far more straightforward and effective than XEN founder Jack’s BRC-20 token "VMPX," which needs to bridge to Ethereum to seek utility opportunities.

"RATS"

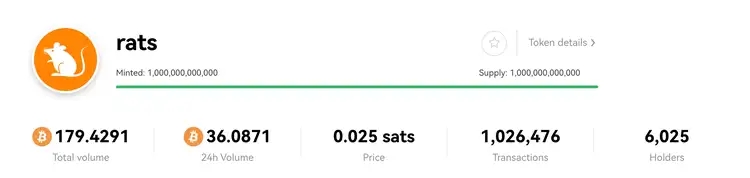

"RATS" gained widespread attention on social media as those who missed out on "SATS" began searching for the next potential opportunity. This logic resembles how investors who missed PEPE’s surge drove the explosive growth of PEPE 2.0.

Generally, markets prefer “chasing new launches rather than old ones,” meaning the BRC20 sector is currently in a phase driven by curiosity and speculative hype. Therefore, while these three assets on BRC20 are extremely popular, they also carry significant risks. Investors should carefully assess their own risk tolerance and proceed with caution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News