The Overnight Windfall of OTC Traders Before ORDI's Price Surge

TechFlow Selected TechFlow Selected

The Overnight Windfall of OTC Traders Before ORDI's Price Surge

It does make money, but it's also genuinely exhausting.

Author: Jaleel, BlockBeats

Editor: Jack, BlockBeats

Over-the-counter (OTC) trading is no stranger to the crypto industry, and especially so in the Bitcoin inscription market. In the early days of the inscriptions market, capital flowed in much faster than information circulated. Leveraging the information asymmetry created by multiple barriers, OTC became the "most profitable business" in this space.

During this wild growth phase, some people got rich overnight, while others lost money and fled. Yet regardless of criticism or praise, OTC traders were undeniably a key component behind the rise of this emerging market—during a time when public trading infrastructure was still blank, they sustained liquidity and public interest within the inscriptions market. Now, as Bitcoin ecosystem infrastructure gradually improves, where should these OTC traders go?

Some ran off with funds, others rose to fame overnight

In the early days of Bitcoin inscription trading, infrastructure lagged significantly. Aside from Unisat in its earliest days, community members had no choice but to rely on OTC traders to exchange inscriptions. But OTC trading ultimately hinges on trust, and in the early market everyone seemed to be gambling. Some bought ORDI at low prices and rode thousand-fold gains, while others ended up empty-handed after their counterparty disappeared.

The former “Top OTC Trader” who stole $6 million worth of ORDI

On the eve of ORDI’s breakout into broader awareness, the first seven-figure BRC-20 scam occurred.

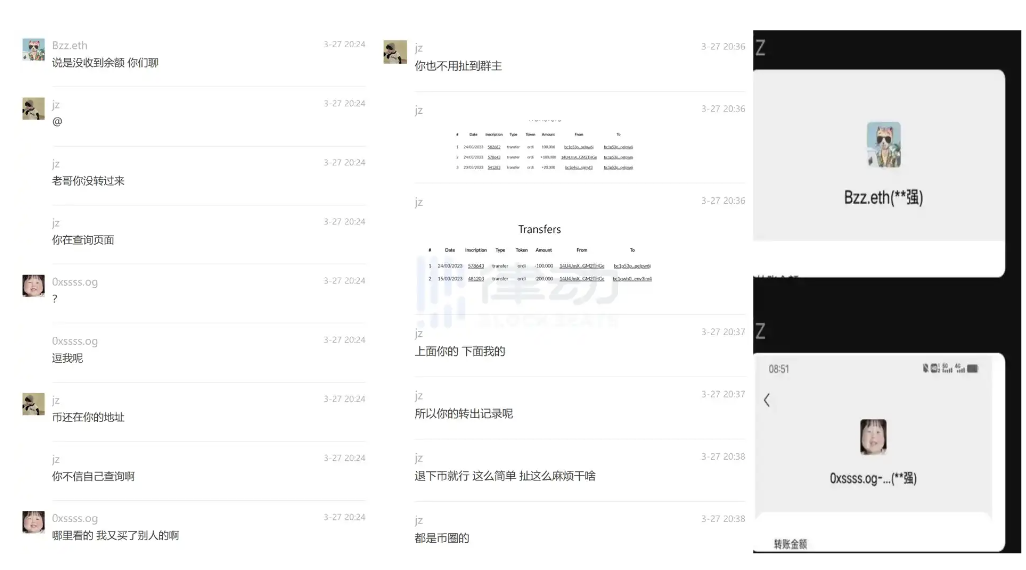

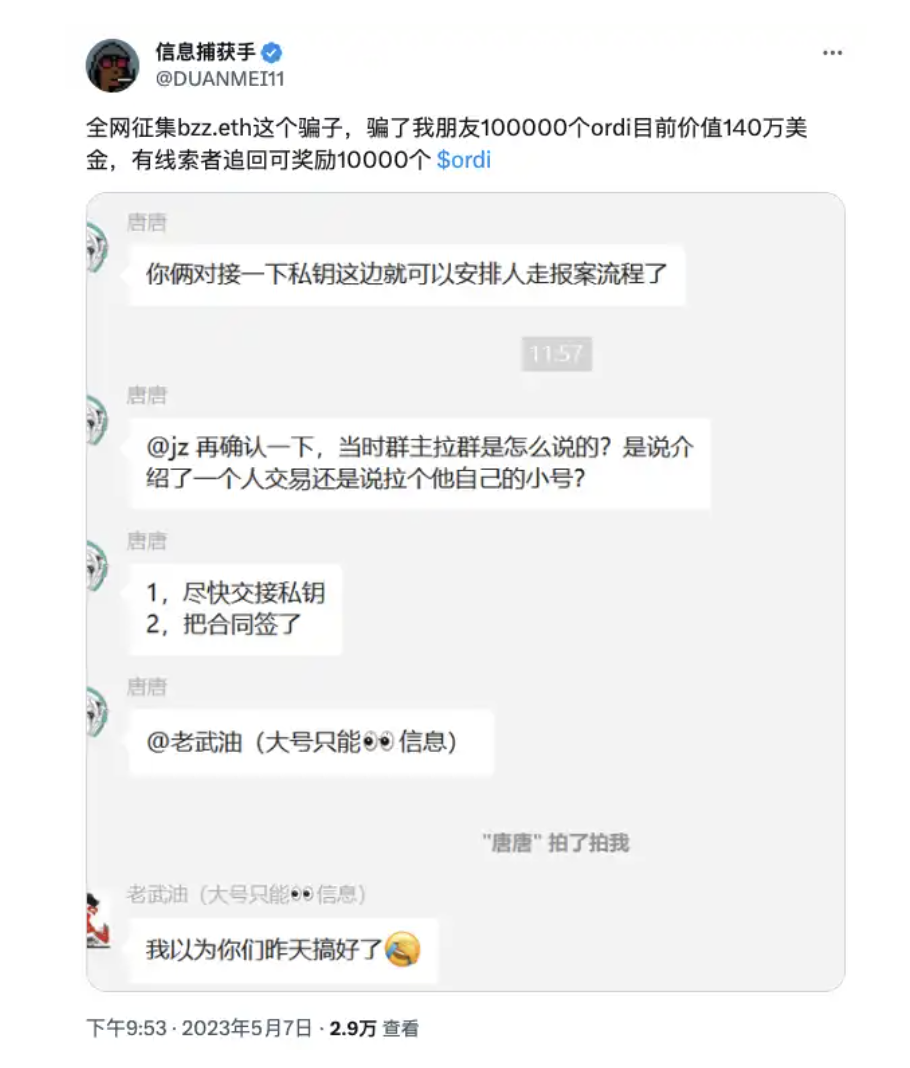

Bzz.eth, once hailed by veteran ORDI players as the top OTC trader, managed several BRC-20 OTC groups as group admin, yet absconded with 100,000 ORDI tokens from victims. At today's price of $60 per ORDI, this heist amounted to $6 million. The community discovered that Bzz.eth used burner accounts to offer high prices for ORDI, then canceled transactions after sellers transferred their tokens, blaming "invalid Transfer inscriptions" and refusing to return funds—thereby seizing the 100,000 ORDI outright.

Process of stealing coins and subsequent discovery that both accounts belonged to the same person

Moreover, many community members accused him of charging excessively high escrow fees and relaying different pricing information between buyers and sellers to pocket the spread. Back in March, BlockBeats had contacted Bzz.eth to learn about the nascent Bitcoin inscription market. At the time, the Bitcoin ecosystem wasn't particularly vibrant. According to Bzz.eth himself, his average transaction size was around $300, with roughly 20 trades per day—an amount not considered large back then—but he was already the first OTC trader most community members encountered.

As events unfolded, Bzz.eth’s WeChat and Twitter account “Baofu Research Institute” were both deleted. Due to investigative difficulties and because victims didn’t bother pursuing him when ORDI prices were low, the situation escalated only after Gate listed ORDI on May 8, causing ORDI’s price to quickly surge to $17.04. As ORDI gained value, losses ballooned and the severity of the incident grew. BlockBeats learned that victims have so far recovered only 10,000 ORDI from Bzz.eth, and Bzz.eth himself has not yet been criminally detained.

A single quote sheet brought fame and fortune

Before Cai Bai, there was no such thing as a quote sheet model in Bitcoin ecosystem OTC trading. At that time, the operation of the Bitcoin inscription market was murky: there were no fixed price lists. When a buyer wanted to purchase an asset, they would inform the group admin, who would then announce a buying price in the group. Transactions relied entirely on negotiation between buyer and seller.

At the time, Cai Bai was just a minor figure in the inscription OTC scene. Seeing a gap in the market, he proposed the idea of using quote sheets to Bzz.eth, hoping Bzz.eth and other OTC traders would adopt it. However, Bzz.eth showed no interest, so Cai Bai designed his own bid-one-to-bid-five and ask-one-to-ask-five quote sheet and started his own OTC business.

Quote sheet template

It turned out the market desperately needed transparent information. After Cai Bai launched his own group, it quickly attracted massive attention. Within less than a week, the group filled up, soon expanding into three or four groups. The quote sheet built tremendous credibility for Cai Bai in early Bitcoin OTC operations, enabling rapid growth and allowing him to hire several assistants. Later, during Atomicals trading, Cai Bai was widely recognized as the deepest OTC provider in the market.

For traders, such quote sheets served as crucial references, especially since the OTC market lacked a clear pricing mechanism and participants often had no firm price expectations. Providing accurate pricing information thus became critically important and significantly improved market transparency.

One month after starting OTC trading, Cai Bai reflected briefly on his journey: “Starting completely from zero, growing into the largest OTC player at the time, achieving daily trading volumes as high as 10 BTC—I’m truly grateful for the trust and support of many friends.”

Capturing spreads, manipulating prices,抢商单—The business of inscription OTC

In reality, most inscription OTC traders are reluctant to publicly share their so-called quote sheets. After all, in such an early-stage market, information asymmetry is precisely what generates high returns. Any increase in transparency means reduced profit margins.

Black box

In the early days of the inscription market, those offering inscription OTC services were known as “escrow agents.” Buyers and sellers sent funds and assets to a middleman escrow agent, who would transfer the assets to each party upon confirmation.

As matchmakers in transactions, OTC traders played an indispensable role—they needed to find a mutually acceptable price point. For example, if a buyer offered $100 and the seller’s asking price was $300, the OTC trader would negotiate compromise, closing the deal at $200.

But early inscription OTC markets were opaque. Escrow agents didn’t even need to create negotiation groups for both parties. This allowed them opportunities to “capture spreads”—secretly pocketing the difference through their own receiving addresses, while both buyer and seller remained unaware. For instance, if a seller listed at $100 and the buyer offered $120, the $20 spread became pure profit for the OTC trader.

Publicly, escrow agents earned revenue via ~4% OTC transaction fees. But in reality, spread-capturing was a major source of income for most. An insider told BlockBeats that under opaque conditions, profits could reach around 50% of transaction volume.

Besides capturing spreads, “posting fake orders” was another common tactic among OTC traders.

Escrow agents would list massive fake sell orders at extremely low prices to trigger panic selling, forcing other sellers to dump assets at lower prices, enabling the agent to accumulate cheaply. If another buyer came looking for a bargain, the agent would claim the order was already filled or canceled, covering their tracks.

“Ultimately, OTC traders hold final interpretive authority,” said one inscription OTC trader. “The greatest power of OTC lies in influencing market trends—due to information asymmetry, they can easily manipulate the market.”

Not just OTC—also market makers

Unlike typical OTC traders, some inscription OTC providers also acted as “market makers.”

Unlike pure OTC, market making sometimes requires deploying proprietary capital to actively absorb supply, stabilize prices and liquidity, and maintain market confidence.

Before doing Bitcoin inscription OTC, Cai Bai had previously provided market-making services for a small altcoin around 2018. “Small altcoins usually require around $200,000 to maintain price stability. By comparison, supporting inscription markets is actually quite easy, especially for tokens with strong holder bases and relatively limited selling pressure.” When ATOM (the Atomicals inscription) dropped to $50 per unit, Cai Bai stabilized the market by purchasing hundreds of ATOMs in bulk. At prevailing prices, his total market-making cost was only around $20,000–$30,000.

While OTC profits mainly come from fees, market makers’ earnings are more influenced by external factors and typically derived from market volatility. In early-stage, illiquid markets like Bitcoin inscriptions, the cost of market making is extremely low, and profit strategies are highly diverse. A classic case is COOK.

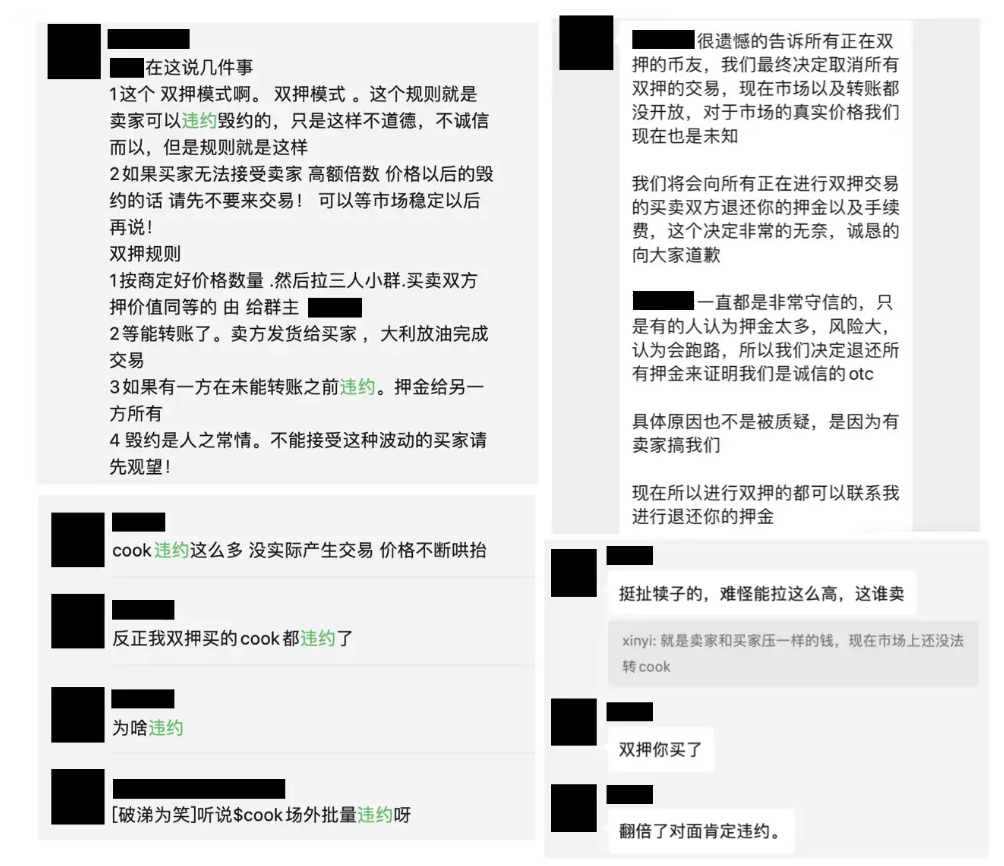

Last December, COOK began minting via the Rune alpha protocol. With no trading platforms or transfer functionality available, OTC traders adopted a dual-deposit model, marking the beginning of a new OTC paradigm in the Bitcoin ecosystem.

The dual-deposit model worked like this: both buyer and seller would stake the agreed-upon amount with the OTC trader. For example, if a buyer offered $80 and the seller accepted, the seller would also deposit $80. Once transfers became possible, the seller would deliver the asset to the buyer, and the OTC trader would release USDT to complete the trade. If either party defaulted before transfer, the deposit went to the non-defaulting party.

At the time, despite high default costs, default rates in the COOK market remained very high. This was primarily because COOK’s price rose too fast—shortly after agreeing on a $50 sale price, COOK surged past $200, making default far more profitable than honoring the deal.

An insider told BlockBeats that during COOK’s rapid price rise, many quotes were artificially inflated. “Many traders used burner accounts to pose as buyers; when sellers defaulted, they collected the penalty. Earnings from penalties far exceeded the 4% transaction fee.”

Figure 1: An OTC trader setting dual-deposit rules; Figure 2: An OTC trader canceling all dual-deposit trades; Figures 3 & 4: Community discussions on COOK defaults

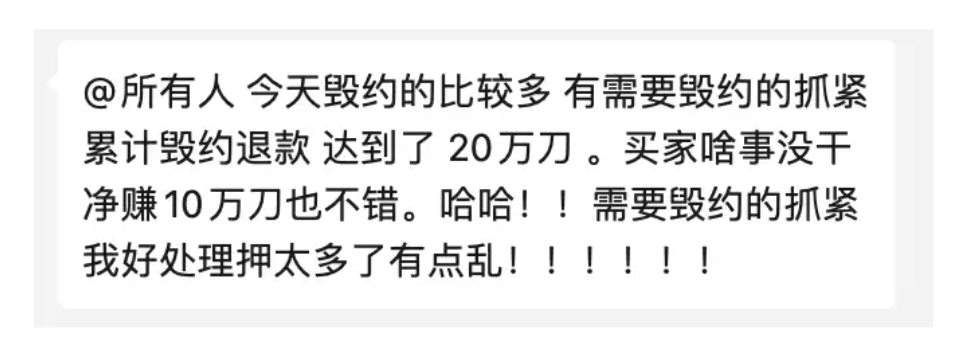

Because COOK couldn’t be transferred, the higher the price climbed, the more buyers were attracted—and the more defaults occurred. During this process, OTC traders amplified COOK’s hype, drawing more participants into trading. Beyond posting fake orders, many traders actively promoted perceived mapping relationships between Rune alpha and Runes protocols to generate bullish sentiment, and not a few openly encouraged others to default.

On December 14, an OTC trader claimed cumulative refunds from broken deals reached $200,000

It’s profitable, but exhausting

Compared to Bzz.eth’s early daily trading volume of several thousand dollars, Cai Bai reached peak daily volumes of around 10 BTC during the May inscription boom. Based on Bitcoin’s price at the time, his daily fee income approached $10,000—equivalent to half a year’s salary for most white-collar workers in China.

A OTC trader specializing in Lightning Network assets told BlockBeats that during hot project phases, daily trading volume was at least $50,000. “With 2% fees on both sides, earning $1,000 per day is no problem.” Another OTC trader, Water, who started with Tap protocol OTC, said that in the first two weeks after Tap launched, weekly trading volume reached around $100,000.

But by last November, the Bitcoin inscription OTC market had gradually become a red ocean. Competition intensified, and newer traders began lowering fees from 4% down to 2% to attract users. While everyone coveted the OTC market, few had Cai Bai’s chance to fill a vacuum—most had to fight fiercely for existing market share.

For Water, this “fighting” meant building trust through active community engagement. He was highly active in both English and Chinese Discord communities for the Trac protocol, earning an officially verified OTC role from Trac’s official Discord. Building on the quote sheet model, Water even registered a dedicated domain for his price board, allowing anyone to view real-time listings. “Reputation is crucial in this kind of trading. No matter how advanced your tech tools are, trust remains the foundational cornerstone,” Water told BlockBeats.

Beyond initial hurdles, OTC traders frequently found themselves embroiled in cutthroat competition. “You earn, but you’re also genuinely exhausted.” This reflects the true sentiment of most OTC traders. WeChat bans, group takedowns, Binance account suspensions, and receiving tainted USDT—all were pains they endured.

Insiders told BlockBeats that “peer reporting” was common in the inscription OTC market. When Cai Bai operated as an ORDI OTC trader, his WeChat account was banned multiple times, making communication difficult. “I went through three WeChat accounts, and eventually could only communicate via single-line contact.”

In Water’s view, doing OTC is tough work for someone with a regular job, and for early coin holders, the earnings aren’t particularly impressive. OTC might generate monthly profits ranging from tens of thousands to a hundred thousand dollars. But if someone accumulated large holdings early via OTC, they could make millions—or even tens of millions—in profits. In a strong bull market, hodling alone could yield tens of millions in short order.

As market size shrinks, where do OTC traders go?

“The water in this pond can only be stirred so much—beyond that, OTC becomes irrelevant.”

In Water’s view, the Bitcoin ecosystem’s OTC market is relatively small, with trading volume and liquidity far below centralized exchanges. He believes real liquidity in the Bitcoin ecosystem won’t emerge until projects list on centralized exchanges—a factor closely tied to overall market capacity.

He told BlockBeats that before projects like ORDI listed on centralized exchanges, daily trading balances might only reach a few million dollars—relatively modest. But once listed, trading volume surges dramatically. After ORDI and SATS launched on exchanges, daily trading volumes reached hundreds of millions of dollars.

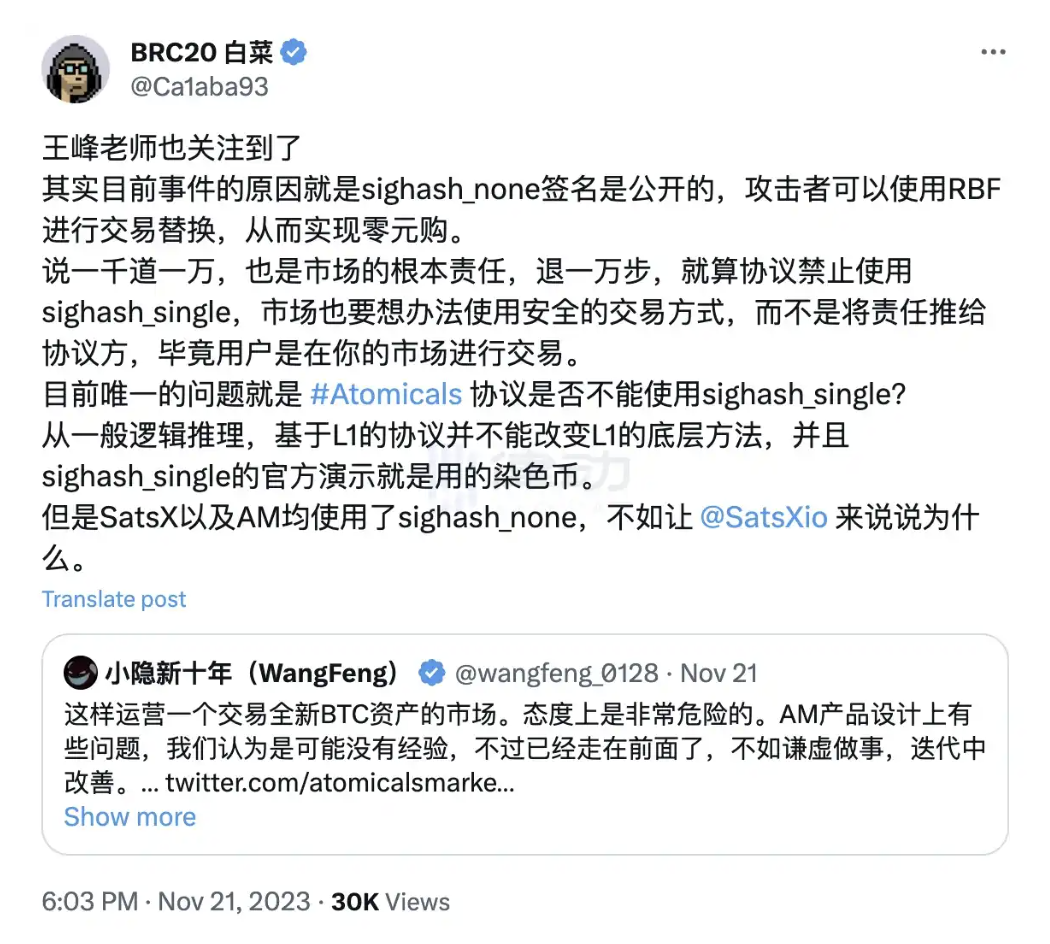

Mid-November saw multiple “zero-dollar purchases” on Atomicals Market. Statistics show all 33,000 Atom affected in the previous two incidents suffered losses. Although substantial evidence pointed to security flaws in AM, and many community users demanded official intervention, AM initially seemed unwilling to take responsibility and even considered shutting down.

To manage the PR fallout and minimize negative impact on the Atomicals community, core community members, OTC traders, and wallet developers representing the community negotiated with Atomicals Market. Fortunately, thanks to mediation by these community figures, the original founder stepped down, leadership changed hands, and the new team completed full compensation after takeover.

This highlights the significant contributions OTC traders have made in advancing the Bitcoin ecosystem and various protocols.

Meanwhile, specialized trading platforms now exist for nearly every Bitcoin ecosystem protocol. With Unisat Market maturing and OKX Web3 Wallet continuing to integrate, the market space for OTC traders continues to shrink. So where have OTC traders gone as market capacity declines?

Today, very few people remain active in Bitcoin ecosystem OTC trading—most have ceased operations. The market has matured to the point where OTC is no longer necessary.

Cai Bai admitted that running a large-scale OTC operation carries policy risks, especially in China’s regulatory environment. Thus, as Atomicals Market matured and redirected real users there, he decided not to continue.

Now, only sporadic OTC activity remains, mostly concentrated in large-volume or whale-level transactions, due to potentially poor market liquidity. When someone wants to buy a large quantity of inscriptions, they may turn to OTC markets to connect directly with sellers for bulk purchases. Small retail trades now rarely use OTC and are mostly handled through centralized markets.

“After stepping away from OTC trading, I returned to my previous routine—researching new projects and making investments,” said Water.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News