From Obscurity to DeFi Rising Star: Pendle's Ascent

TechFlow Selected TechFlow Selected

From Obscurity to DeFi Rising Star: Pendle's Ascent

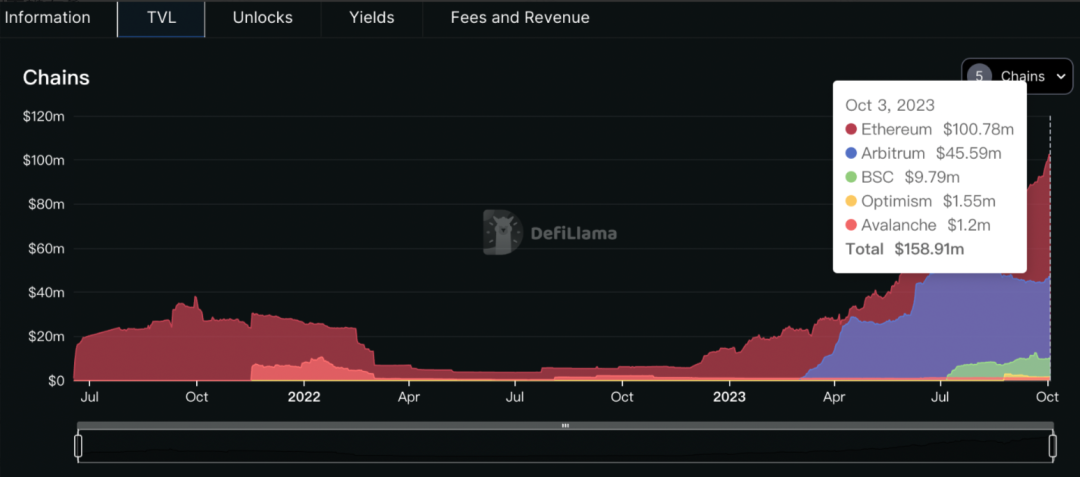

Pendle has accumulated a fairly high TVL, far exceeding previous同类 protocols, and can be considered well past the survival threshold. Hopefully, Pendle will ultimately validate PMF.

Authors: @Luke & @Jane, BuidlerDAO

Author's Note 🖊️

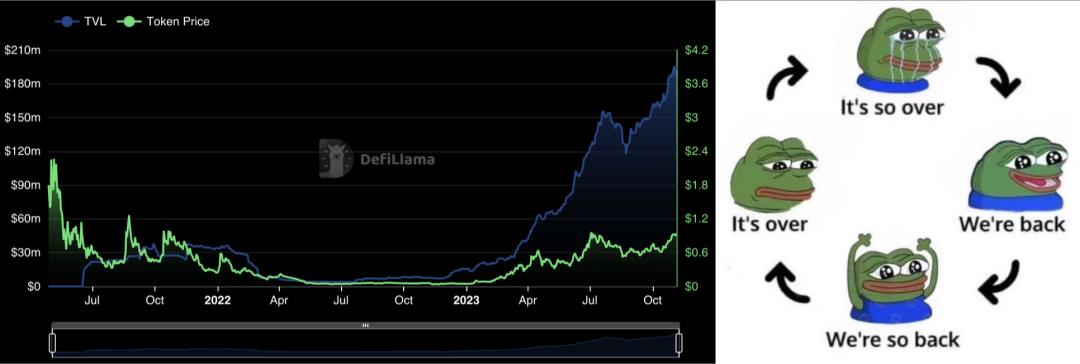

Pendle is a rising star in the recent DeFi market — innovative enough to carve out a new niche within DeFi; maintaining TVL growth throughout the bear market; and successfully launching its token on Binance Launchpad. Upon deeper investigation, we found that Pendle’s journey hasn't been smooth. Two years ago, Pendle v1 launched and experienced rollercoaster swings in both token price and TVL, with the team's Twitter activity going silent for months. Finally, in November 2022, Pendle v2 launched and achieved rapid growth over the next year, transforming into today’s rising star.

We see how Pendle evolved from v1 to v2—going through trials, failures, and significant price drops before becoming a standout success. This sparked our curiosity: What went wrong with v1? What did v2 get right? And how did it manage to stand out amid fierce competition?

We aim to analyze Pendle not from an investment perspective but as a case study of a DeFi startup and founding team, exploring the innovation principles behind crypto-native products—how to build protocols, operate businesses, and maintain true entrepreneurial spirit—to offer insights for builders hoping to contribute meaningfully to the industry.

— Luke & Jane

What is Pendle?

Product Overview

Pendle is a DeFi protocol designed for fixed-income and interest rate swap markets. In traditional finance, interest rate swaps represent a massive market segment where two parties exchange fixed and floating returns on the same principal. For example, under the same USD-denominated yield, Xiao Y gives up fixed returns in exchange for variable yields, while Xiao X gives up variable yields for fixed ones.

Pendle replicates this mechanism on-chain by first splitting yield-bearing assets into two components:

-

Yield-bearing assets (i.e., underlying assets generating yield) are split into YT and PT. For each yield-bearing asset, Pendle separates it into independent YT and PT tokens based on different maturity dates.

-

YT represents the right to future yield. Holding YT continuously accrues floating yield until maturity, so holding YT equates to receiving variable returns. PT represents the residual value of the yield-bearing asset after stripping away the yield rights. It generates no yield during holding but can be redeemed 1:1 for the underlying asset at maturity, thus representing fixed income.

Next, Pendle designs an AMM to enable swapping between these two types of yield (PT and YT):

-

Pendle wraps yield-bearing assets into SY tokens and standardizes three common types of yield-bearing assets (Rebase, Accumulate, Distribute) into a single token format. Then it implements a specialized AMM for trading between SY and PT. Through a mechanism called FlashSwap, YT trades can also occur within this same AMM without requiring a separate secondary market.

-

Different maturities of PT have their own independent PT-SY liquidity pools because they face different duration risks, leading to different prices—and hence different implied yields across maturities.

For token value capture, Pendle follows Curve’s model using a veToken design. Holders of Pendle tokens can stake them to receive vePendle, with longer staking durations yielding more vePendle. vePendle holders earn a share of protocol revenue, vote on weekly liquidity incentives distribution, and boost their LP yields.

Glossary

-

Base Asset: The principal amount of a yield-bearing asset, without inherent yield—e.g., ETH or DAI.

-

Yield-Bearing Assets: Also known as underlying assets, these are base assets invested in other DeFi protocols that generate yield—e.g., stETH relative to ETH, sDAI relative to DAI.

a. Rebase Type: Holding rebase-type tokens automatically changes your token balance—the yield is reflected in changing token quantity. The exchange rate between the yield-bearing token and base asset remains 1:1, e.g., stETH, aTokens.

b. Accumulate Type: Token quantity stays constant, but intrinsic value increases over time, raising the exchange rate between the yield-bearing token and base asset—e.g., wstETH, cTokens.

c. Distribute Type: Token quantity remains unchanged; yield is distributed separately and must be manually claimed by users—e.g., GLP, liquidity mining rewards from LP tokens.

Team Overview

TN, one of Pendle’s co-founders, first encountered crypto in 2014 as a student. After graduation, he joined Kyber Network as part of the funding team, serving as head of business development. After leaving Kyber, he pursued several unsuccessful ventures before starting work on Pendle. The other co-founder and whitepaper author, Vu Gaba Vineb, previously served as tech lead at Digix.

In a May interview, TN revealed the team size is around 20 people, structured as 8+8+4: 8 in growth, 8 in R&D, and 4 in product design.

The Pendle team also maintains high transparency, with many core members publicly doxxing themselves on Twitter—an unusual practice in the largely anonymous DeFi space, which helps build user trust. Publicly identified team members include institutional lead Ken Chia (former APAC head at Abra and ex-J.P. Morgan), growth lead Dan, ecosystem lead Anton Buenavista ("三,三", former senior engineer at Kyber), and engineering lead Long Vuong Hoang (also a Paradigm Fellow).

Funding History

Pendle conducted its seed round and IDO in April 2021, raising $3.7 million with approximately 10% token allocation. Tokens began unlocking three months post-IGO and fully unlocked after one year. Early investors now enjoy roughly 10x returns :)

Following Pendle’s surge in popularity this year, Binxin Venture announced an OTC investment. After the token listing on Binance, Binance Labs also confirmed its investment. Recently (Nov 9), Spartan Group, an early supporter of Pendle, made an additional OTC investment, signaling continued confidence and recognition.

Compared to competitors like Element Finance (which raised $36.4 million including an a16z-backed seed round), Pendle’s initial fundraising appeared modest—but still sufficient to sustain the team through bull and bear cycles.

Users & Use Cases

Pendle serves several key user groups:

-

PT Buyers:

-

PT functions similarly to zero-coupon bonds. Users seeking fixed income can directly purchase PT and wait until maturity to redeem the equivalent underlying asset. The discount of PT relative to the underlying asset at purchase reflects the fixed yield for that term. Ideal for retail users wanting simple, stable financial products, and institutions aiming to reduce risk or build more stable market-neutral strategies.

-

-

PT/YT Traders:

-

The prices of PT and YT reflect implied interest rates under different duration risks. Since markets often disagree on rate expectations, traders can express views and profit by trading PT/YT. Compared to simply holding PT until maturity, trading PT/YT or holding YT carries potential principal loss. While trading PT vs. YT is fundamentally similar, YT trading offers greater leverage—small capital can control tens of times the implied yield of the underlying asset, amplifying exposure.

-

-

Liquidity Providers:

-

Due to PT's characteristics—its price correlates with the underlying asset and fluctuates within a certain negative premium range—impermanent loss (IL) for PT-SY pools is minimal. At maturity, PT price converges exactly with the underlying asset. The Pendle team has shared backtests showing worst-case IL as low as 0.85%. Such low-IL pools are highly attractive to DeFi liquidity providers who measure P&L in token terms, accept variable yields, and are willing to deeply engage with the protocol.

-

-

Liquidity Buyers:

-

These refer to various DeFi protocols needing to attract capital—such as LSD or RWA protocols. Because Pendle builds atop other protocols’ yield-bearing assets and uses a Curve-like tokenomics model, incentivizing liquidity on Pendle becomes a more efficient way for such protocols to draw funds, while also adding fixed-income utility to their own yield-bearing tokens.

-

-

Other DeFi Protocols “Nesting” on Pendle:

-

Thanks to Pendle’s token design and the unique properties of PT and YT, a number of DeFi protocols have emerged building directly on Pendle or integrating Pendle assets to expand their use cases—e.g., StakeDAO, Penpie, Dolomite, Stella, Teller, Archi.

-

Borrowing the Best: Pendle’s Product Design

Abstracting a specific use case into a mathematical problem and selecting the appropriate curve (formula) to solve it lies at the heart of protocol design. Most interest rate swap protocols innovate further upon curves pioneered by Yield Protocol, Balancer, and Notional—and all generally adopt Pendle’s approach of decomposing yield-bearing assets into zero-coupon bonds (PT) and floating yield rights (YT).

Of course, naming conventions and implementations vary slightly across protocols. For clarity, we will uniformly refer to the two tokens as PT and YT below. We’ll compare Pendle against competing protocols in terms of design choices and analyze what makes for strong DeFi product architecture.

Note: Other DeFi products referenced below include Element, Tempus, AP Wine, Sense, Swivel.

Asset Characteristics of PT/YT (Across Protocols)

Fixed-income / interest rate swap assets share four key characteristics:

-

PT price correlates with the underlying asset, fluctuating within a defined negative premium range.

-

There is always a relationship where yield-bearing asset = PT + YT.

-

As maturity approaches, PT price gradually converges toward the underlying asset price with decreasing volatility, ultimately equaling the underlying asset.

-

As maturity nears, YT price volatility decreases until, at maturity, YT loses its ability to accrue further yield and settles at a fixed value. In Pendle’s case, YT price eventually reaches zero.

Key Protocol Components

Different protocols employ distinct designs to accommodate the trading dynamics of these assets, centered around three critical elements:

-

Design of PT and YT tokens

-

Mechanism for trading PT/YT

-

AMM curve design

PT and YT Token Design

Protocols largely agree on PT design: PT is stripped from the yield-bearing asset and redeemable 1:1 for the underlying asset at maturity (e.g., 1 PT-stETH redeems for stETH worth 1 ETH).

Where they differ is in YT design. YT represents the right to floating yield, implemented in two main ways:

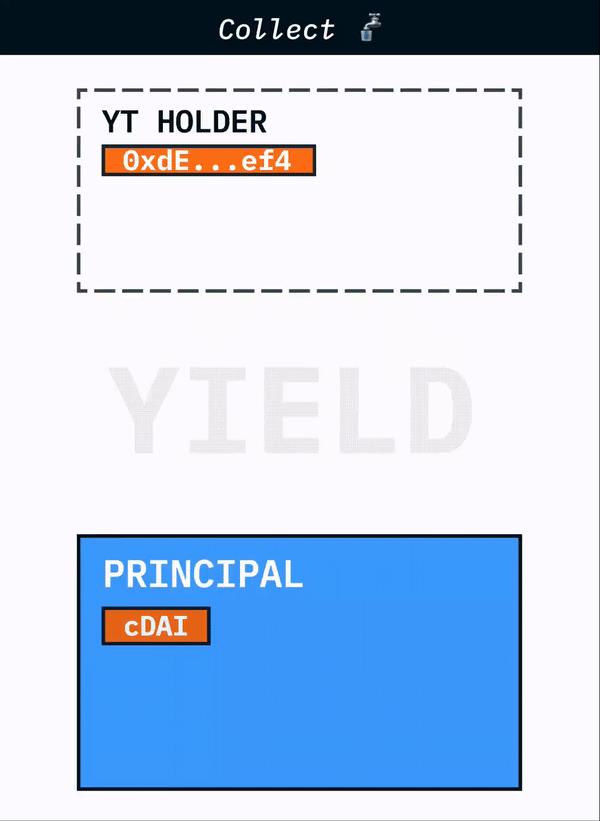

Collect YT:

-

With Collect YT, floating yield from the yield-bearing asset is continuously distributed to YT holders until maturity. After maturity, distributions stop and holding YT becomes worthless.

-

The market price of YT only reflects expectations about future yield. Since no further yield accrues post-maturity, its fair value should be zero.

-

Pendle v1/v2, Swivel, and Sense use this design.

Drag YT:

-

With Drag YT, yield accumulates within the token and can only be withdrawn in full at maturity, similar to PT.

-

Thus, YT value = accumulated past yield + expected future yield. Before maturity, future yield is uncertain, causing price volatility. At maturity, YT value becomes fixed.

-

Element, AP Wine, and Tempus use this design.

-

Comparing both models, Drag YT is more conventional and easier for other protocols to integrate, compatible with standard AMMs.

In contrast, Collect YT is more cleverly designed:

-

From a user standpoint, having realized yield locked inside YT instead of being withdrawable for reinvestment is inefficient. From a pricing perspective, mixing historical payouts with forward-looking expectations complicates valuation.

-

From a protocol design view, if YT naturally settles at a fixed value at maturity, that’s acceptable. But setting final YT value to zero simplifies AMM design—this was precisely the logic behind Pendle v1’s AMM.

Protocols using Drag YT end up with clunkier AMM designs. Since YT settles at a fixed value equal to accrued yield, but that amount varies per asset and pool, there’s no universal figure. This necessitates introducing tracking contracts and dynamically adjusting AMM parameters accordingly.

Mechanisms for Trading PT/YT

Two main approaches exist:

-

Dual Pools:

-

Requires separate liquidity pools for PT and YT. Typically, one token gets a custom AMM while the other uses a generic AMM.

-

This approach is straightforward but clearly flawed: doubling infrastructure overhead, increasing transaction friction, exposing LPs to continuous arbitrage, and doubling incentive costs.

-

Pendle v1, Element, and AP Wine used this model. Tempus technically uses a single pool for PT/YT, but since they can only trade against each other without external pairing, true price discovery isn’t possible—making it effectively dual-pool.

-

-

Single Pool

-

Uses one liquidity pool to serve both PT and YT trading needs. This method is known as FlashSwap, leveraging the identity yield-bearing asset = PT + YT. During swaps, tokens are virtually minted, allowing a two-token pool to facilitate three-token trades.

-

Example: Selling 10 YT into a SY-PT LP pool. First, mint 10 virtual PT, combine with 10 YT to form 10 SY, then swap 9 SY for 10 PT (assuming PT = 0.9 SY), burn the 10 PT, leaving 1 SY as proceeds from selling 10 YT.

-

Compared to dual pools, single-pool design is more elegant and clearly superior—reducing friction and inefficiencies. Pendle v2, Swivel, and Sense all adopted this model.

-

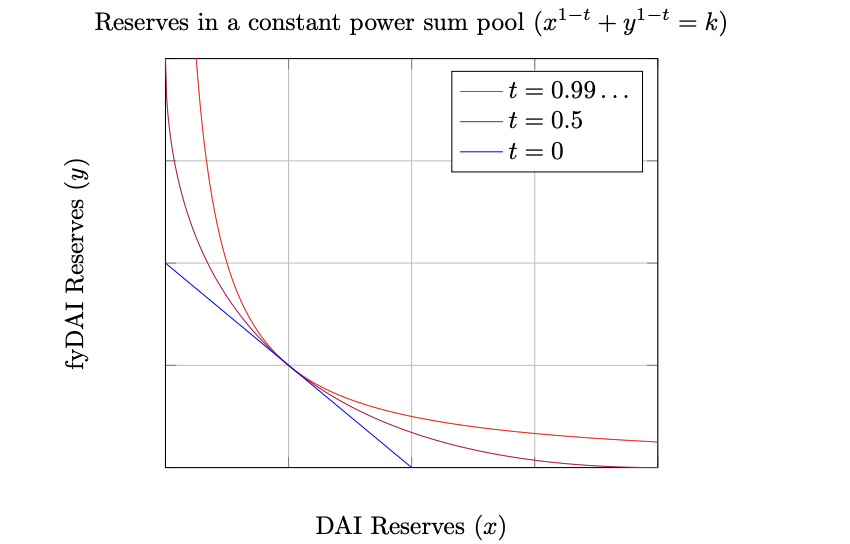

AMM Curve Design

AMM design is paramount. It must align with the unique traits of PT/YT assets, which exhibit three key behaviors:

-

Interest rates fluctuate within bounded ranges: e.g., wstETH floating rate may hover between 3%-5%, GLP yield between 5%-20%. Thus, AMM should concentrate liquidity within these bands.

-

Volatility diminishes as maturity approaches: Duration risk declines over time, so AMM should reflect tightening price bands—i.e., increasing liquidity concentration.

-

Prices converge to fixed values near maturity: PT → underlying asset, YT → 0 or total accrued yield. The AMM must encode this time-dependent convergence.

Most interest rate swap AMMs build upon innovations from Balancer, Yield, and Notional:

Balancer v2:

-

Balancer v2’s curve closely resembles Uniswap’s constant product formula. The key difference: Uniswap v2 supports only two assets at 50/50 weighting, whereas Balancer v2 allows parameter w to adjust weightings (e.g., classic 80/20 pools) and supports ≥2 assets.

-

Pendle v1 and AP Wine innovated upon Balancer v2. In Pendle v1, a dedicated AMM was built for YT and SY. Since Pendle v1 uses Collect YT—which decays to zero at maturity—time parameter t influences weight w. At launch, YT and SY are weighted 50/50; as maturity nears, YT’s w decreases (40/60, 30/70…), until finally 0/100 at maturity—matching the decay-to-zero property.

-

AP Wine applied similar logic to modify Balancer v2, though focused on PT-SY pools, resulting in implementation differences beyond the scope of this article.

Yield Protocol:

-

Yield Protocol is a fixed-rate lending platform that uses AMMs to sell zero-coupon bond-like tokens at a discount to lock in fixed yields—identical in use case to PT tokens. Some rate-swap projects directly reuse Yield Protocol’s AMM for PT trading.

-

Element and Sense follow this path. With Element, a liquidity pool pairs the underlying asset with PT. Initially, it uses x*y constant product; as maturity nears, it transitions to x+y linear invariant, enforcing 1:1 redemption. This satisfies both “PT = underlying at maturity” and “declining volatility near maturity.”

-

Sense mirrors Element with minimal changes. Tempus designs its own AMM for PT/YT, built on Curve code but conceptually aligned with Yield Protocol.

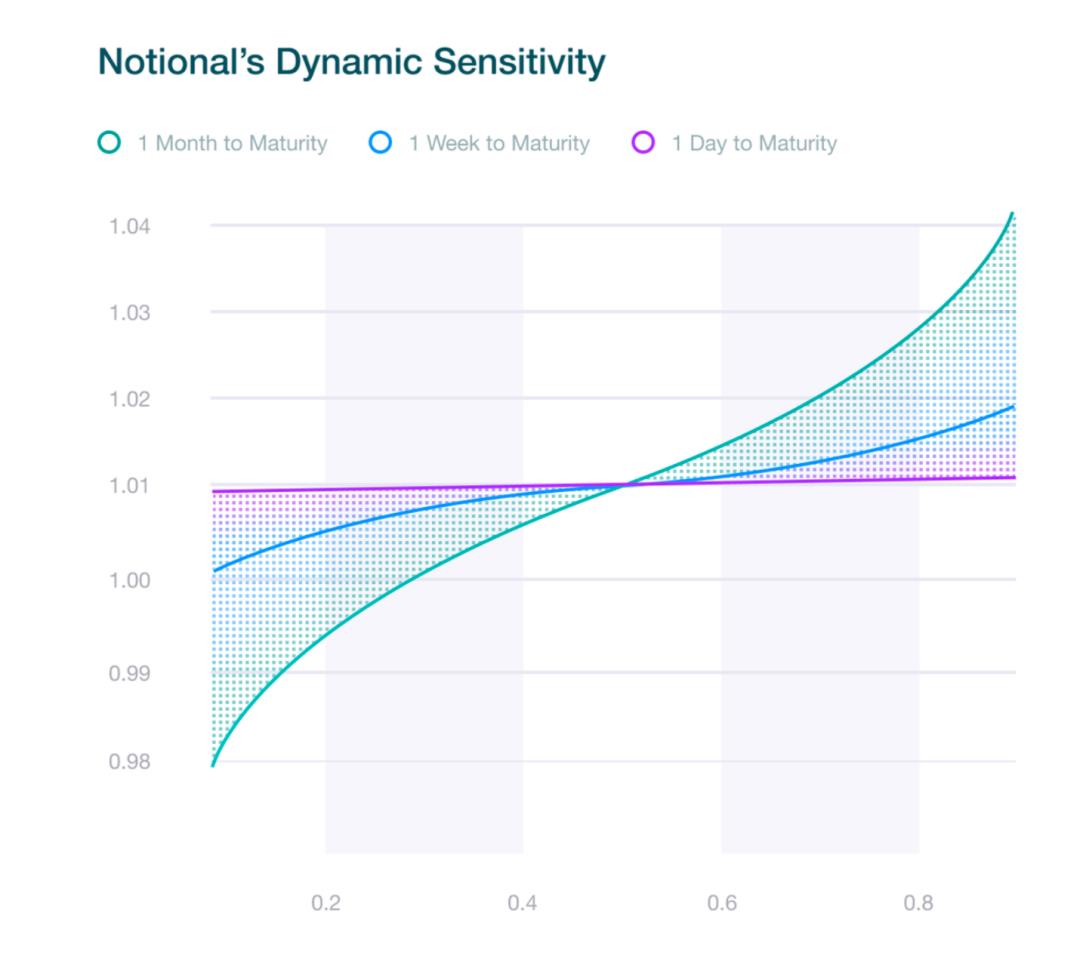

Notional v2:

-

Notional v2 operates in the same space and philosophy as Yield Protocol—a fixed-rate lending protocol using zero-coupon mechanics. However, Notional v2 employs a flatter logistic curve, enabling lower volatility and higher capital efficiency from inception—making it an improved version of Yield Protocol’s curve. See appendix for detailed formulas.

-

Pendle v2 adopts Notional v2’s curve for PT-SY pools, satisfying all three requirements: “PT = underlying at maturity,” “declining volatility near maturity,” and “concentrated liquidity within expected yield bands.” Among the three, Notional v2’s curve stands out as the superior choice.

Swivel took a different path—eschewing AMMs entirely in favor of an orderbook with FlashSwap functionality. This is undoubtedly challenging, as no successful on-chain orderbook protocol currently exists in DeFi.

We include links and explanations of Balancer, Yield, and Notional curves in the appendix. Interested readers are strongly encouraged to read the original whitepapers to grasp subtle technical details omitted due to length constraints.

Summary

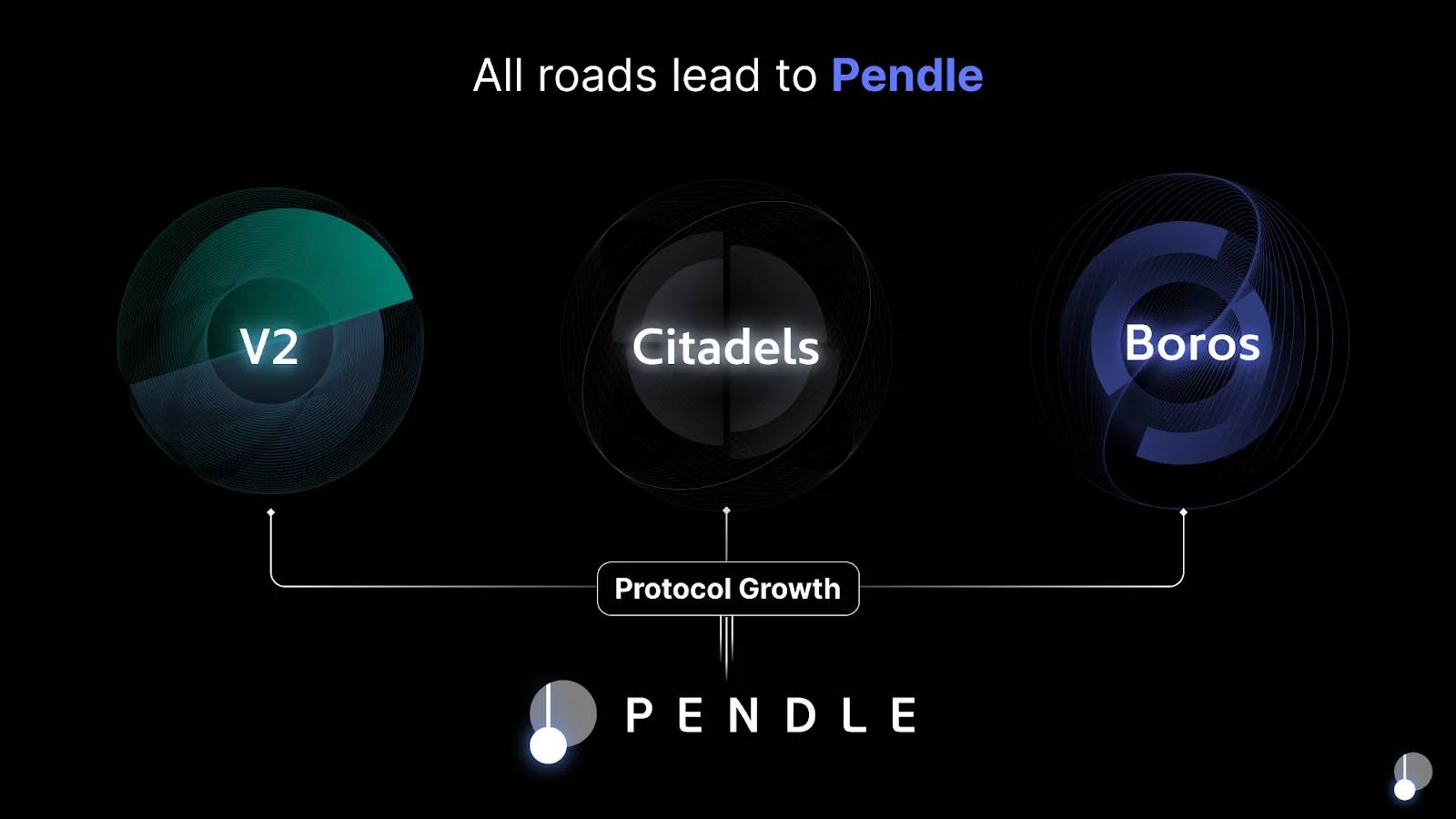

The towering edifice of DeFi wasn’t built overnight nor born from sudden inspiration—it emerged from countless real-money experiments and collective industry learning. The table below lists each protocol’s design and trade-offs chronologically. We see that while Pendle introduced original innovations, v2 also integrated prior breakthroughs, ultimately crafting the most fitting solution for the use case.

*: Adopted by Pendle v2

Beyond those listed, other interesting players in the rate-swap space include Flashstake, IPOR, Voltz, and Revest. These target similar markets but take radically different architectural approaches. This article focuses on comparing protocols sharing the same conceptual foundation to extract generalizable design principles, hence excluding them. Nonetheless, curious readers are encouraged to explore them independently—they may spark new ideas.

Pragmatic Romanticism — Pendle’s Operational Strategy

While Pendle v2’s product improvements over v1 laid the foundation for growth, and the broader rise of yield-bearing assets provided favorable macro tailwinds, Pendle’s operational execution has also been solid and impressive—truly a combination of timing, opportunity, and skillful execution.

Narrative Exploration & Partnership Building

• Embracing Trial and Error to Find the Right Narrative

For a protocol like Pendle, identifying suitable and sizable yield-bearing assets is crucial. Pendle gained mainstream attention primarily through its prominence in the LSD narrative. Hindsight makes this seem inevitable, but historically, Pendle experimented with multiple asset classes—including partnerships with ApeCoin and LooksRare—that failed to deliver lasting results. Its entry into LSD was the outcome of active experimentation combined with positive community feedback.

As TN noted in an interview: "We try many things, but we also accept that not everything will work." This mindset is especially vital during bear markets. Such resilience likely stems from two foundational beliefs: first, that the traditional finance interest rate market is multi-trillion dollar in scale, while DeFi rate trading remains niche—this gap will inevitably close. Second, TN, having entered crypto in 2016 and weathered multiple cycles, witnessed firsthand how unknown protocols like Aave and Compound grew into billion-dollar TVL leaders. He believes fixed-rate markets will similarly mature into a major sector in coming years. With such conviction, focus naturally shifts to practical matters: finding PMF, budget planning, and surviving bear markets.

Pendle continues demonstrating its ability to capture narratives—recently pushing RWA-related pools. As Synthetix’s founder once said: "You have to play the short-term narrative game." In fast-evolving DeFi, identifying which narratives are worth pursuing long-term requires deep expertise. Yet, combining proven success with sound judgment increases Pendle’s odds of consistently capturing compelling stories.

• Learning to Leverage When Small—Providing Differentiated Value Within Existing Ecosystems

Pendle first gained major visibility in the LSD space with the launch of the Aura rETH-WETH pool in January 2023. Through joint promotion with Aura Finance, Rocket Pool, and Balancer, Pendle attracted attention far beyond its organic reach—gaining valuable credibility in the process.

Why were established protocols willing to support Pendle? Beyond ideological alignment, the deeper reason is mutual benefit. By stacking additional APY on top of existing yield-bearing assets, Pendle enables users to participate with minimal opportunity cost. For partner protocols, Pendle’s extra rewards offer an effective tool to attract liquidity. Today, an emerging “Pendle War” ecosystem includes Equilibria, Penpie, and StakeDAO. Given that bribes often yield disproportionately high Pendle rewards, allocating growth budgets to Pendle bribe wars provides leveraged ROI.

Pendle exemplifies how to foster alignment of interests within the DeFi ecosystem.

• Replicating Success—The Unremarkable Path to Sustained Growth

After the success of the Aura rETH-WETH pool, Pendle replicated the model across the LSD ecosystem, launching pools for ankrETH, Stafi-rETH, etc.—essentially cloning the original blueprint. As LSD continues evolving, Pendle’s role is to stay aligned, promptly launching pools for promising new assets. Once a playbook is proven, the focus shifts to solid execution and scaling existing advantages. Ideally, momentum builds until the ecosystem runs itself.

Notably, growth holds a central place within Pendle’s team structure. Of ~20 members, 8 focus on growth—a broad mandate encompassing BD and ecosystem development—highlighting the team’s prioritization.

Expanding Asset Classes & Blockchains

• Ideal Target: GLP – Suitable Properties & Large Scale

For sustained growth, Pendle must either deepen penetration within existing ecosystems (like LSD) or identify new valuable verticals.

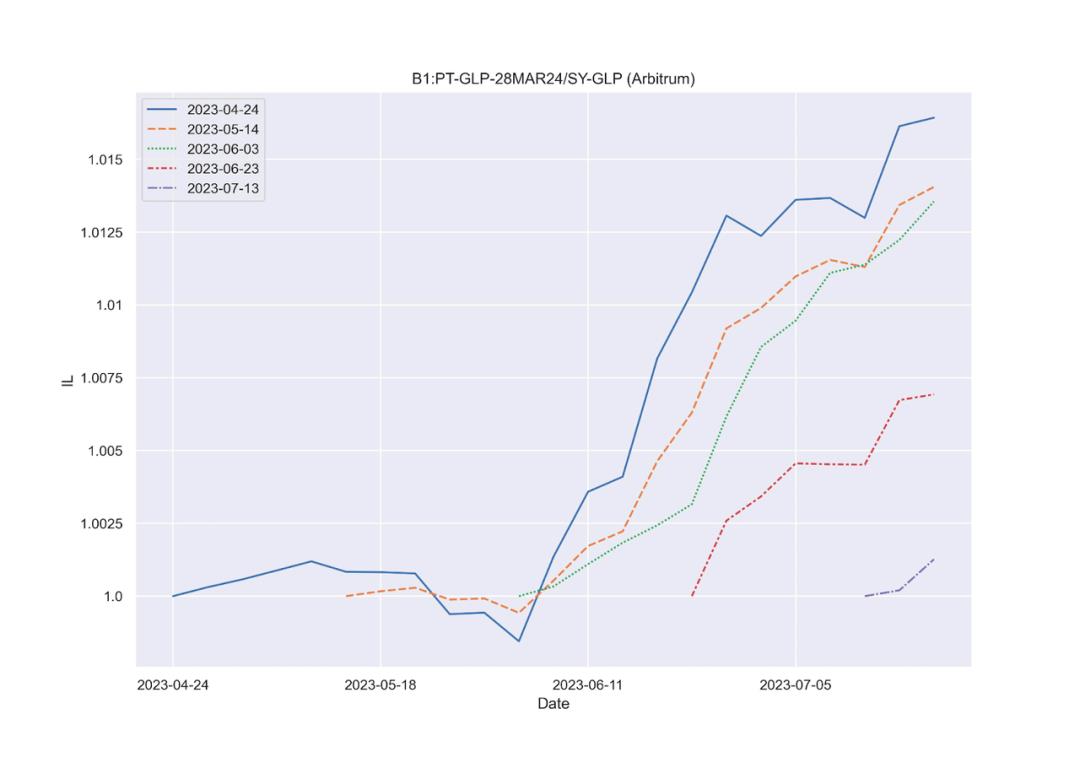

In March 2023, Pendle onboarded GLP (GMX v1’s LP token), entering the Arbitrum ecosystem. GLP is highly popular on Arbitrum—a basket of blue-chip cryptos offering 5%-20% ETH-denominated yields. Even in H1 2023, GLP supply remained robust, peaking above $550M—its yield-bearing nature making it ideal for Pendle.

For Pendle, assets with suitable characteristics, strong momentum, and large scale represent ideal targets. Large size also implies deeper pools and better trading experience. Additionally, GLP’s volatile weekly yield appeals to swing traders, driving speculative activity.

Today, Arbitrum ranks as Pendle’s second-largest chain, contributing nearly 30% of TVL.

• Prioritizing Fertile Ground (Blockchains)

Chain expansion is a key driver of Pendle’s TVL. Beyond Ethereum and Arbitrum, Pendle recently launched on BSC and Optimism. Chain selection criteria require relatively mature yield-bearing ecosystems with substantial scale (> $100M). Due to conversion inefficiencies from native yield assets to Pendle, only sufficiently large chains justify the effort. By this standard, few viable options exist.

TN mentioned in an interview that Polygon might come later—but currently isn’t a priority. Why deprioritize? Likely due to limited bandwidth for operations and marketing. Moreover, Pendle isn’t yet fully permissionless—each new listing requires manual research, contract writing (~1 week effort)—making team capacity a bottleneck. Indeed, Pendle’s deployments on BSC and OP remain underperforming. Hence, careful prioritization ensures efforts focus on highest-impact opportunities—picking the lowest-hanging fruit first.

• Strategic Use of Token Incentives

Token incentives are widely used in DeFi, but opinions differ on when to deploy them. For instance, Kenton, founder of Sense Protocol (a close peer to Pendle), argues that DeFi protocols should avoid token incentives before achieving PMF—otherwise, feedback becomes distorted.

Yet Pendle’s case shows that while incentives may create temporary “artificial prosperity,” they helped attract early users despite suboptimal UX and unclear PMF—enabling earlier product feedback (e.g., which assets suit Pendle’s model). Furthermore, inflated TVL isn’t meaningless: higher TVL means lower slippage, attracting whales and institutions, and stress-testing security. These effects are network-positive for a DeFi protocol. Funding these experiments via token emissions preserves cash reserves—advantageous for early-stage teams with limited funding.

User Growth & Education

Currently, Pendle’s primary goal is boosting trading volume and TVL. Promoting PT usage is the most effective lever: it’s simple to explain, offers superior trading experience, and due to PT-YT linkage, growing PT volume naturally lifts YT

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News