The Evolution and Challenges of Bitcoin Scaling from the Perspective of Asset Issuance

TechFlow Selected TechFlow Selected

The Evolution and Challenges of Bitcoin Scaling from the Perspective of Asset Issuance

This article will examine the new normal that Ordinals has brought to the BTC ecosystem, analyze the current challenges facing Bitcoin's scaling in terms of asset issuance, and finally predict that RGB and Taproot Assets—combining asset issuance with practical applications—have the potential to lead the next narrative.

Author: Xuanrui丨0xDragon888

Infinitas丨AC Capital Co-published

Guidance: Hong Shuning

(TL;DR)

-

The Ordinals ecosystem booms: unlocking new possibilities for asset issuance on Bitcoin

-

Ordinals brings a new normal: competition for block space and UTXO bloat

-

The evolution and challenges of BTC scaling from the perspective of asset issuance

-

Scaling solutions combining asset issuance with real-world applications have enormous growth potential

1. The Rise of Ordinals: Unlocking New Possibilities for Bitcoin Asset Issuance

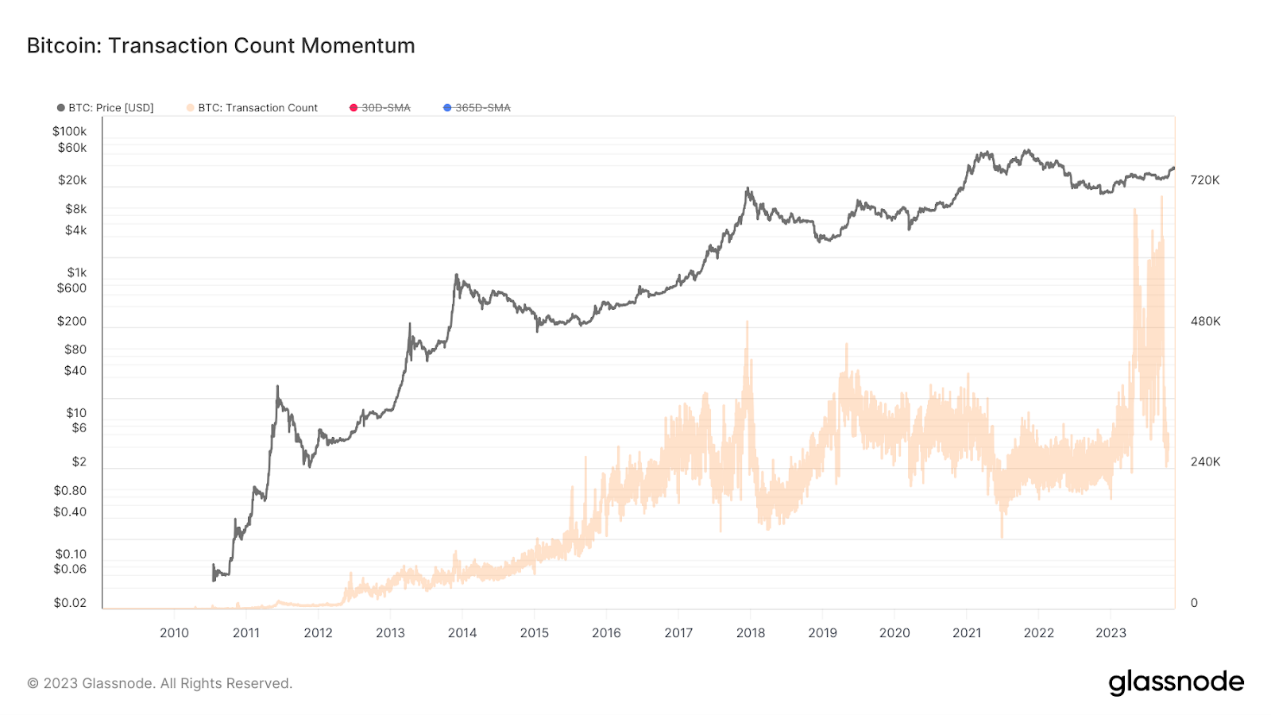

As digital gold or currency, the Bitcoin community has become conservative since its hard fork in 2017 and lacked new narratives in recent years. In early 2023, the Ordinals protocol began to shift Bitcoin's fate, followed by an explosion of users in the Ordinals ecosystem. For the first time in six years, Bitcoin’s on-chain transaction fees surpassed those of Ethereum, reigniting the crypto industry’s imagination around the Bitcoin blockchain.

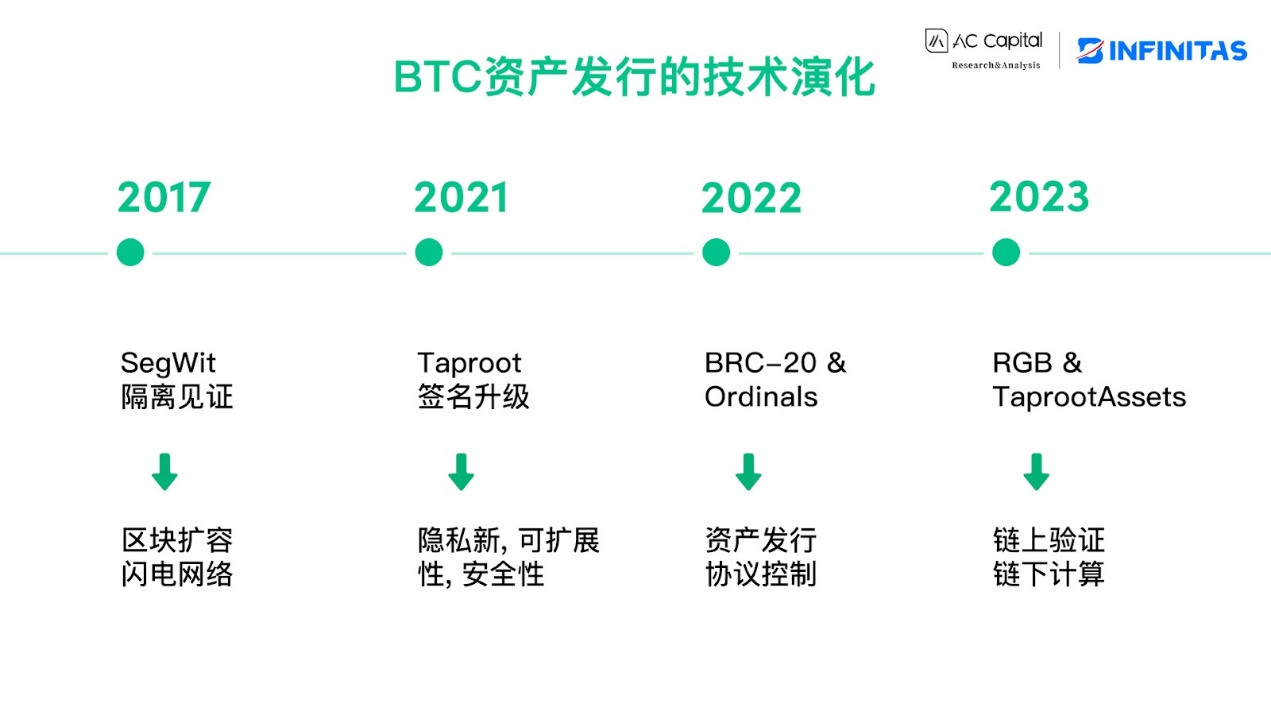

Before the emergence of the Ordinals protocol, Bitcoin underwent several major technical upgrades. In 2017, the SegWit (Segregated Witness) upgrade activated, expanding block size to 4 MB and increasing transaction throughput. Soon after, developers introduced the Lightning Network, bringing Bitcoin Layer 2 into public awareness. The Taproot upgrade in 2021 further enhanced Bitcoin’s security, efficiency, privacy, and programmability.

Despite these technical improvements, no solution had addressed real user pain points until the arrival of Ordinals, which opened the door to practical use cases on Bitcoin. In December 2022, Casey launched the Ordinals protocol—an extension protocol for the Bitcoin network that allows data inscription on individual satoshis (sats). The protocol assigns unique identifiers to each satoshi and enables annotations, thereby extending Bitcoin’s functionality.

Inspired by Ordinals, Domo created BRC-20, an experimental token standard on Bitcoin, on March 8, 2023. BRC-20 uses JSON data within ordinals and inscriptions to deploy token contracts, mint tokens, and transfer them—utilizing satoshis to store and manage various token-related information.

Bitcoin previously supported methods for creating and issuing assets, such as Colored Coins in 2012 and Counterparty in 2014, but none successfully addressed user needs. The adoption of fair launches combined with protocol-controlled assets under BRC-20 sparked genuine demand, fueling explosive growth and opening up entirely new possibilities for asset issuance on Bitcoin.

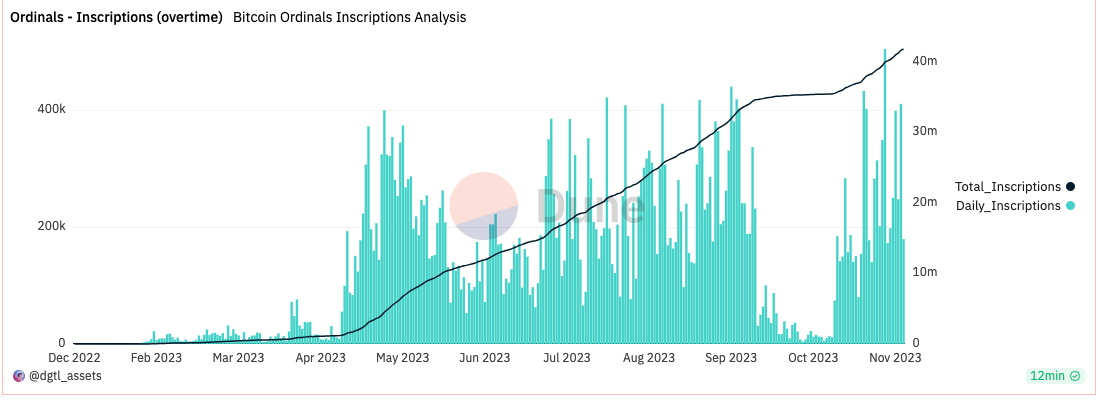

To date, the Ordinals ecosystem has generated over 41 million inscriptions—digital artifacts etched onto the world’s oldest and most secure distributed ledger, including images, text, audio, and even applications. Text-based inscriptions (BRC-20) dominate in volume, and the Ordinals ecosystem has already spawned innovative offshoot protocols such as BRC-20, ATOM, PIPE, and RUNES. The surge in popularity of Ordinals has brought new traffic to the BTC ecosystem—and planted the seeds for future developments.

2. Ordinals Bring a New On-Chain Normal: Competition for Block Space and UTXO Bloat

The frenzy around Ordinals is reflected in users’ willingness to pay high transaction fees. Since text inscriptions are small in data size, BRC-20 users are often willing to pay premium fees. Miners fill blocks with record numbers of transactions, causing excessive BRC-20 activity to consume bandwidth, delay transaction confirmations, and drive up fees.

In 2022, miners earned a total of 5,374 BTC from transaction fees. Since the launch of Ordinals, inscription-related transactions have cumulatively consumed 2,886 BTC. The rise of Ordinals has reduced miners’ reliance on block rewards alone. With transaction fees now making up a significantly larger share of revenue, Ordinals have created a second revenue curve for miners.

Following the rapid growth of inscriptions in the Ordinals ecosystem, the broader Bitcoin community has engaged in heated debates about its impact. Critics argue that prioritizing Ordinals transactions at the expense of financial transactions increases mempool congestion, raises fees, and ultimately hampers peer-to-peer payments.

Casey, the founder of the Ordinals protocol, stated in September that 99.9% of current fungible token protocols on Bitcoin are scams or memes. However, he noted they are unlikely to disappear anytime soon—just like casinos won’t “disappear.” He proposed developing a better asset issuance protocol called Runes, allowing users to continue speculative activities without generating massive UTXOs that burden nodes.

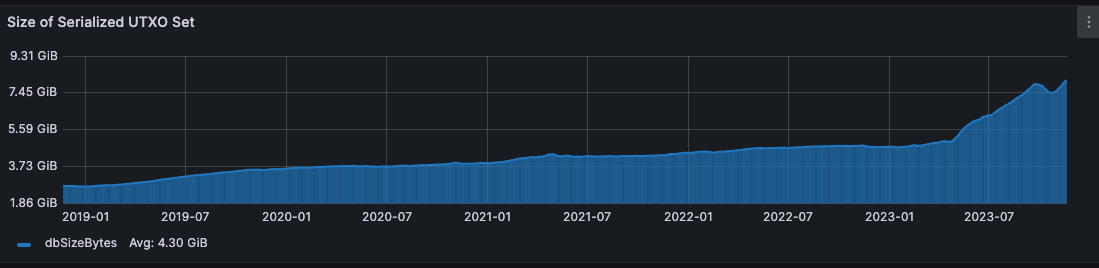

BTCStudy founder Ajian echoed similar concerns, arguing technically that BRC-20 is outdated. Although BRC-20 minting and transfers don’t require UTXO-level associations, the protocol unnecessarily limits the number of tokens per UTXO, potentially leaving many entries permanently in the UTXO set. This leads to UTXO set bloat, increasing the load on full nodes and undermining Bitcoin’s censorship resistance and trustlessness.

Since BRC-20 trading began in April 2023, Bitcoin’s UTXO set has grown from 5 GB to 8.16 GB. The Bitcoin development community continues debating whether to implement technical measures to filter out inscription transactions, as UTXO inflation from inscriptions is eroding the network.

Supporters of the Ordinals ecosystem argue that its popularity brings new traffic and shifts user behavior, requiring the BTC ecosystem to adapt to this new on-chain normal. The next phase of the Ordinals narrative should focus on solving UTXO bloat. Only with improved asset issuance mechanisms can the Bitcoin ecosystem develop richer native applications and achieve sustainable growth.

3. The Evolution and Challenges of BTC Scaling Through the Lens of Asset Issuance

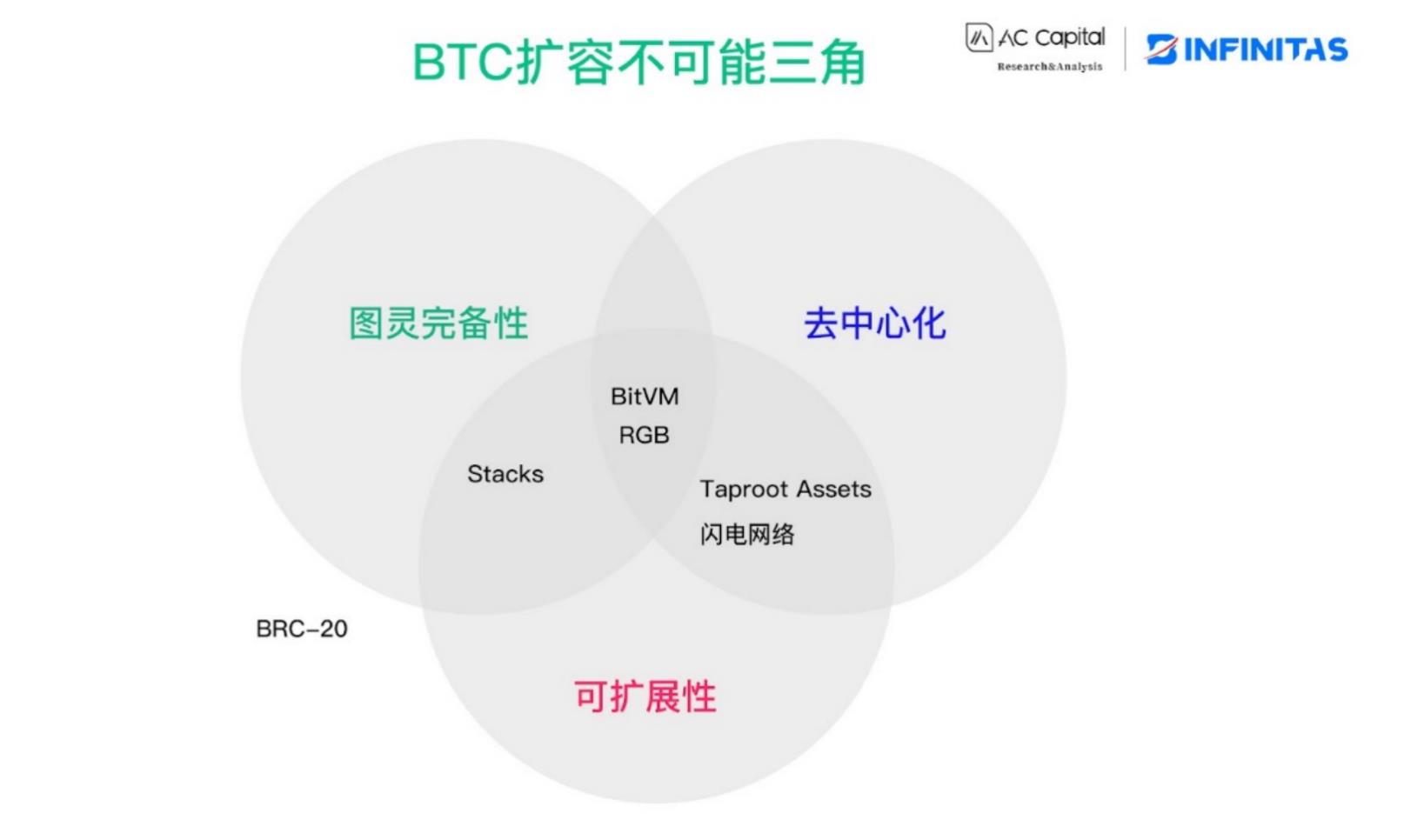

BTC currently lacks not asset issuance protocols, but smart contract capabilities and scalability. Scalability determines the viability and longevity of any given BTC scaling direction. Given the complexity of Layer 1 scaling, the community generally favors building new Layer 2 solutions atop Bitcoin’s Layer 1—preserving compatibility while addressing on-chain congestion.

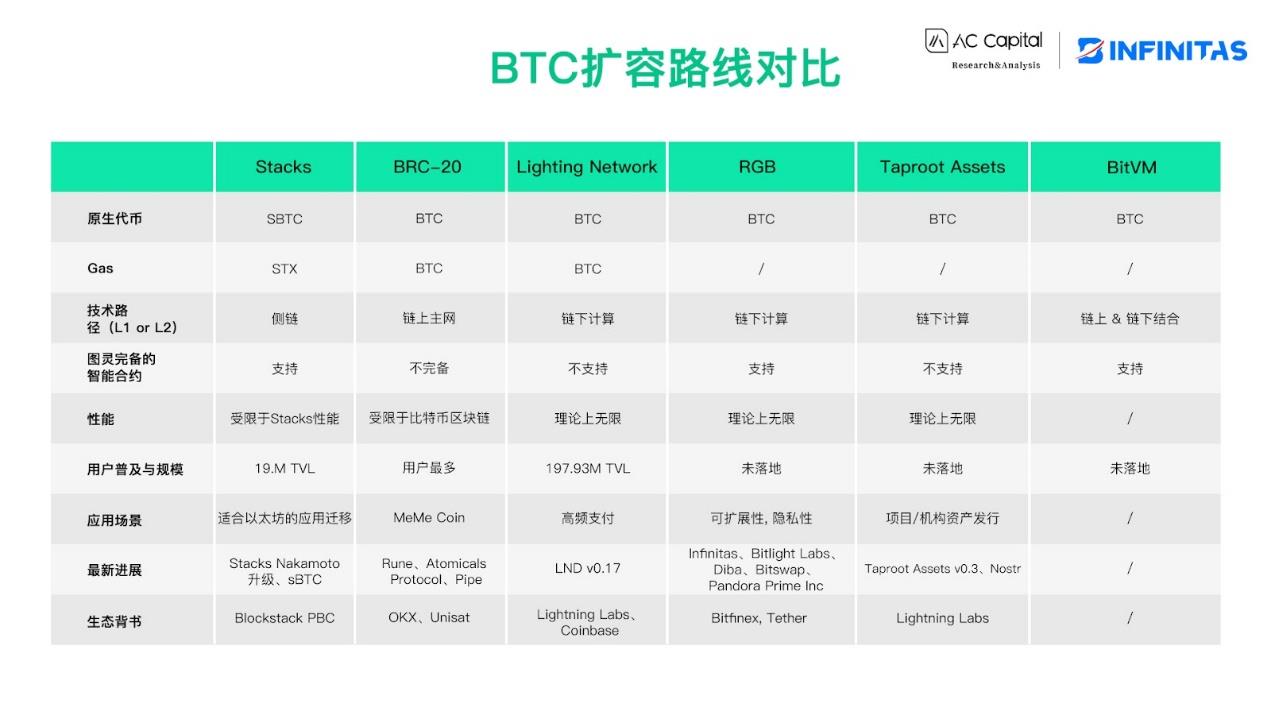

After completing SegWit, the Bitcoin ecosystem focused heavily on developing Lightning Network and sidechains as Layer 2 solutions. Whether it’s Lightning Network, sidechains, or RGB protocol, Bitcoin’s Layer 2 landscape is rapidly evolving. Setting aside consortium chains like Liquid, here we compare BRC-20, Stacks, BitVM, Lightning Network, RGB, and Taproot Assets purely from the perspective of better asset issuance, analyzing their key challenges across three dimensions: Turing completeness, decentralization, and scalability:

-

Stacks (Sidechain): As the leading sidechain, Stacks currently holds 19.3M TVL. It offers advantages such as porting existing Ethereum apps directly. However, sidechains like Stacks and RSK face centralization risks. With the upcoming Nakamoto upgrade in Q4 and the imminent launch of sBTC as a smart contract, progress continues.

-

BRC-20: The flagship of the inscription ecosystem, BRC-20 operates via Bitcoin scripts but lacks Turing completeness. Despite its large user base and simplicity, BRC-20 consumes excessive on-chain space. Its fund security model is overly centralized, and limitations in scalability and non-Turing-complete design constrain further development. Projects like Rune, Arc-20, Pipe, and BRC-20Swap are actively working to address these issues.

-

Lightning Network: The largest and most influential Layer 2 in the Bitcoin ecosystem, increasingly attracting companies. It enables off-chain payments through state channels with final settlement on Bitcoin. However, it cannot issue tokens, supports only high-frequency payments, lacks smart contracts, and is far from Turing complete. While user numbers and use cases remain limited, protocols built on top of it—such as Taproot Assets and RGB—offer greater potential.

-

RGB: Inspired by Peter Todd’s 2016 concepts of single-use seals and client-side validation, RGB introduces smart contract functionality to the Lightning Network. After releasing RGB v0.10 in April 2023, its technical complexity has delayed ecosystem adoption. Yet projects like Infinitas, Bitlight Labs, Diba, Bitswap, and Pandora Prime Inc. are gradually unlocking RGB’s real-world potential. Tether’s CEO has even suggested RGB may be the best option for issuing stablecoins on Bitcoin, with USDT issuance via RGB under consideration.

-

Taproot Assets: Also a client-side asset validation protocol, Taproot Assets released its mainnet alpha v0.3 in October 2023, aiming to transform Bitcoin into a scalable multi-asset network. However, Taproot Assets follows a distribution-based issuance model—assets are issued by projects rather than minted by users. Thus, it better suits institutional or project-led asset issuance. New protocols like Nostr Assets Protocol are now integrating Taproot Assets with the Nostr social protocol.

-

BitVM: Released in October 2023, BitVM adopts a Rollup-like approach—executing complex programs off-chain and submitting critical proofs on-chain. Like RGB, it aims to bring Turing-complete smart contracts to Bitcoin. However, BitVM demands extremely high computational power and remains largely theoretical. Its scalability and commercial feasibility require further exploration.

4. BTC Scaling Solutions Combining Asset Issuance with Real Applications Have Huge Growth Potential

As Bitcoin’s infrastructure matures, various scaling approaches are staking their claims. The next phase of BTC scaling faces two core challenges:

-

From the asset issuance perspective: Is the technical approach suitable for real-world applications? Is it decentralized, Turing-complete, and scalable?

-

From the asset circulation perspective: Can the protocol gain adoption and support from industry infrastructure and users?

From an asset issuance standpoint, BTC still lags behind Ethereum in several areas—notably in the number of well-known projects and user scale. However, as the blockchain network with the highest market cap, BTC Layer 2 solutions that combine asset issuance with compelling applications hold enormous growth potential.

Ordinals have fully unlocked the possibility of asset issuance on Bitcoin. But unlike Ethereum, Bitcoin cannot support on-chain computation at scale. How can the BTC ecosystem achieve efficient asset settlement like Ethereum? Looking at the technical evolution of BTC asset issuance, client-side validation models like RGB and Taproot Assets have the potential to succeed Ordinals inscriptions as the next major narrative.

Moreover, in the coming era of multi-asset Bitcoin, ecosystem growth will require diverse application scenarios. A prerequisite for such diversity is stablecoins, and the Lightning Network is the ideal platform for issuing them. Yet, there aren't enough stablecoins deployed today. Taproot Assets and RGB have strong potential to accelerate development in high-frequency payments, stablecoins, DeFi, and NFTs—expanding into more sectors and user bases, and enriching the Lightning Network’s application landscape.

Conclusion

The Bitcoin ecosystem is experiencing its first wave of momentum driven by Ordinals. Beyond asset issuance, it also needs more sophisticated and sustainable applications to thrive. From the technical evolution of asset issuance, client-side validation paradigms like RGB and Taproot Assets are driving transformative change—minimizing on-chain computation while maximizing on-chain verification, paving the way for more rational asset issuance models on Bitcoin.

If you’re a developer working in the RGB or Taproot Assets space and believe in the mass adoption potential of client-side validation, feel free to reach out to AC Capital and Infinitas. Alternative viewpoints are also welcome in the comments section.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News