A Brief History of BTC L1 New Protocols, Explained for a 60-Year-Old Grandma

TechFlow Selected TechFlow Selected

A Brief History of BTC L1 New Protocols, Explained for a 60-Year-Old Grandma

Casey believes that creating a good fungible token protocol for Bitcoin could bring significant transaction fee revenue, more developers, and users to Bitcoin.

Author: 0xSea.eth, Host of podcast Sea Talk, Co-founder of NextDAO

Have you recently been confused by the constant emergence of new protocols like Ordinals / BRC-20 / Atomicals / Pipe? Can't figure out how they're related?

Don't worry—I'll help you sort through the timeline and uncover the underlying connections. I’ll keep it simple, avoid complex concepts, and aim for clarity so even complete beginners—or grandmas—can understand. This article does not constitute investment advice (NFA).

Chapter I: Ordinals and BRC-20 — The Wild West of Casey and domo

The Pandora's box of Bitcoin was opened by a man named Casey Rodarmor (@rodarmor).

In December 2022, Casey launched the Ordinals protocol. It assigns a unique serial number to each satoshi (the smallest unit of Bitcoin) and tracks them across transactions. Anyone can attach extra data—text, images, videos, etc.—to these sats via Ordinals, thanks to blockchain’s permissionless nature.

In its early days, Ordinals wasn’t nearly as popular as it is today. Users mostly created NFTs with low trading volume. Casey originally envisioned it as a way to store immutable, eternal artifacts on Bitcoin—the oldest and most consensus-secure chain. For a while, many equated Ordinals directly with “Bitcoin NFTs.”

Everything changed on March 8, 2023, when an anonymous developer known as @domodata introduced BRC-20 based on the Ordinals protocol. The name echoes Ethereum’s ERC-20 token standard—and yes, you can think of BRC-20 simply as a meme coin issuance protocol built atop Ordinals (i.e., Bitcoin).

Issuing meme coins on BTC? Most people initially thought it was absurd—like moving backward. When the first token, $Ordi, launched, tools like Unisat weren’t available yet. You had to run a full Bitcoin node locally, giving tech-savvy developers like @shep_eth an early advantage and allowing them to acquire tokens at very low cost.

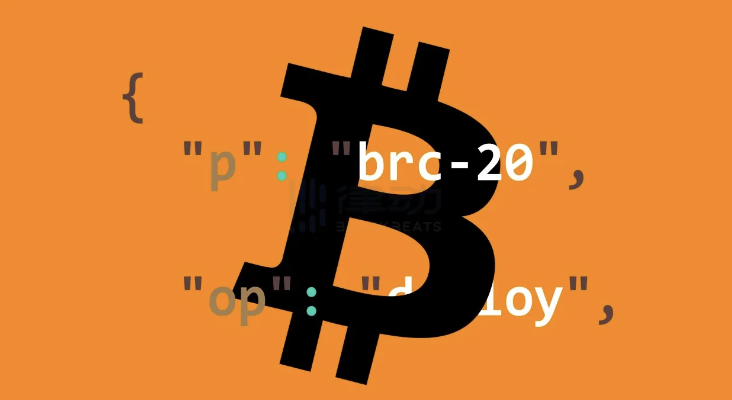

As BRC-20 gained explosive popularity in May–June and again in October–November, BRC-20 transactions came to dominate the Ordinals protocol. This frustrated Casey deeply. He publicly criticized BRC-20 for flooding his creation with junk. Recently, Casey’s team formally requested that Binance remove any mention of “Ordinals” from the $Ordi token description—he doesn’t want Ordinals associated with $Ordi.

Conclusion 1: Casey himself did not receive any $Ordi tokens from its launch. Domo reportedly minted 1,000 (one inscription), but whether other wallets were pre-loaded remains unknown. What either of them truly thinks as Ordi surges higher? Even more uncertain.

Gossip 1: During the Singapore conference in September, someone arranged for Casey and domo to appear at the same event. They reportedly met and exchanged friendly greetings. Looking at their posts on 𝕏, it’s clear they differ greatly in how involved they are with their projects.

Gossip 2: Why did domo wear a mask during public appearances in Singapore? Does anyone know the reason?

Chapter II: A Guy Named Beny — A Tangled Web of Nested Governance

After BRC-20 emerged, an active developer named Beny (who appears to have no personal 𝕏 account) became prominent. This guy is incredibly energetic: he launched LooksOrdinal (a BRC-20 minting tool with no token) around March, deployed $Trac @trac_btc in May, along with the first cursed inscription -crsd capped at 21 million, introduced Tap Protocol @tap_protocol in August as an improved version of BRC-20 for OrdFi, and issued Pipe @PipeBtc in October as an enhanced alternative to Runes.

You might wonder—why is this guy launching so many projects? That question goes straight to Beny. All I can say is he’s extremely energetic and has sharp instincts.

How are these projects connected?

1. $Trac is both a BRC-20 token and the governance token of Tap Protocol.

2. Tap Protocol is a protocol-level upgrade over BRC-20. Tokens $Tap and $-Tap are issued via Tap Protocol and thus fall outside the scope of BRC-20 (though still built on Ordinals).

3. $Tap is the governance token of the Pipe protocol.

4. Pipe protocol builds upon the ideas behind Runes (explained later) and operates entirely outside the Ordinals framework.

Brilliant—a true nesting doll of governance!

Notably, all 21 million $Tap tokens are currently held by Beny with zero circulation. What’s trading now is $-Tap, the first token launched on Tap Protocol. Going forward, the team plans to use $Tap for fundraising and governance, with partial airdrops planned for holders of $Trac, $-Tap, and $Pipe, though exact ratios remain undecided.

If you’re interested in Tap Protocol, here’s my earlier write-up.

As for the other two projects, Looksordinal and -crsd: the former is a pure utility tool without a token; the latter cannot be traded yet because the Ordinals development team hasn’t fully implemented indexing for all negative-number inscriptions.

Conclusion 2: One team launching three interconnected projects with nested incentives—this approach is truly one-of-a-kind in today’s L1 landscape.

Chapter III: Six Months in the Making — The Rise of Newcomer Atomicals

About three months after Ordinals launched, another anonymous developer took notice. After careful study, he identified several shortcomings in Ordinals.

He then went to work. After six to seven months of dedicated development, he unveiled the Atomicals Protocol (@atomicalsxyz) in September. In the early hours of September 21, someone minted the first token on Atomicals, $Atom, which was fully mined within about five hours. Mining $Atom requires CPU power and setting up a local environment—more technically demanding (and geekier) than simply paying gas to grab BRC-20 tokens, making it arguably fairer.

At the technical level, Atomicals differs from Ordinals in several key ways:

1. Atomicals mints and transfers tokens using Bitcoin’s UTXO model, where 1 token = 1 sat. This aligns better with Bitcoin’s core architecture, imposes no additional burden on the network, and scores higher in technical “orthodoxy”—appealing more to BTC Maxi purists.

2. In contrast, Ordinals takes a “hands-off” approach—it doesn’t define a native token standard (hence BRC-20 emerged later). Atomicals, however, launched with the ARC-20 token standard already defined, plus support for various other use cases.

As the community dug deeper into Atomicals, they realized how long it had been under development, how resolute its founder was, and how many features and scenarios were carefully considered. It’s a comprehensive, well-prepared protocol—and it’s gradually earning deep respect from the community.

By the way, @shep_eth commented after watching a few interviews with the anonymous Atomicals founder: “This guy sounds just like young Steve Jobs.” I agree—he speaks rationally and methodically, instantly boosting likability. Years ago, Vitalik proposed improvements to Bitcoin that were rejected, prompting him and others to create Ethereum. The origin story of Atomicals feels surprisingly similar.

For those interested, here’s an interview with the founder.

Conclusion 3: After six months of quiet development, Atomicals is emerging as a strong contender to Ordinals and gaining significant attention. Its ecosystem is still early, but more builders are joining.

Chapter IV: Casey Fights Back — The Coming Storm of Runes

As mentioned earlier, Casey has always disliked BRC-20, seeing it as spamming worthless inscriptions and polluting the purity of Ordinals. Just days after Atomicals launched, on September 26, Casey tweeted that he had a terrifying new idea: creating a fungible token protocol on Bitcoin called Runes (the Rune Protocol).

Like Atomicals (great minds think alike), Runes improves upon BRC-20 by leveraging the UTXO model. Casey believes that establishing a clean, efficient fungible token standard could bring substantial transaction fee revenue, attract more developers, and grow Bitcoin’s user base.

Shortly after Runes documentation was released, Beny spotted the opportunity and quickly launched the Pipe protocol based on Runes’ principles—tying back to Chapter 2.

On Casey’s end, he’s still busy upgrading the Ordinals protocol and fixing occasional bugs, which takes time. The official launch date for Runes remains uncertain—but I believe it will become one of the most watched protocols in the Bitcoin ecosystem.

Conclusion 4: As the creator of today’s hottest protocol (Ordinals), Casey’s launch of Runes will undoubtedly draw massive market attention.

To help clarify the relationships and dependencies among the protocols and closely linked tokens discussed above, I’ve put together a simple mind map (no time for finer details)—hopefully it helps you grasp the competitive and interdependent dynamics.

Finally, there have been far too many new “protocols” on Bitcoin over the past several months. Due to limits in my time and capacity, I couldn’t cover them all—my apologies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News