What are the reasons behind the BTC surge?

TechFlow Selected TechFlow Selected

What are the reasons behind the BTC surge?

This article will analyze the reasons behind the recent BTC price surge and provide an outlook on its future trend.

Author: veDAO

Bitcoin's price has reached its highest level in 17 months—the highest since May 2022. This surge has caught many off guard, and as the "king of crypto" steadily climbs, a bullish sentiment is spreading across the cryptocurrency market. What are the driving forces behind this rally? And what lies ahead for BTC?

As previously noted in articles by the veDAO Research Institute, despite false news causing Bitcoin’s price to swing dramatically, market sentiment remains positive, suggesting favorable trends ahead. In this article, the veDAO Research Institute will analyze the recent factors fueling BTC's rise and provide insights into its future trajectory.

Reasons Behind BTC's Price Increase

Given the volatility inherent in the crypto market, no single factor can be identified as the sole cause of this rally. Over recent days, BlackRock’s spot BTC ETF briefly appeared on DTCC’s website before being removed and then re-added—an event some believe contributed to the upward momentum. However, several more significant factors are at play:

Approaching Bitcoin Halving

The Bitcoin halving is now less than six months away. The crypto community widely anticipates that this event will trigger the next bull cycle. According to analysts such as Michaël van de Poppe, the optimal time to invest in altcoins is currently—6 to 10 months before the halving—as venture capital firms eagerly seek early exposure.

While investors count down to when their holdings may appreciate, miners face growing anxiety over the upcoming event. Their concern stems from the fact that mining rewards will be cut in half—from 6.25 BTC per block to 3.125 BTC. For investors, however, the halving is valuable because it reduces the rate of new BTC entering circulation. Meanwhile, miners' operating costs continue to rise. Mining infrastructure has become increasingly complex and expensive. Some complain about rising electricity prices, while U.S.-based miners could also face a potential 30% tax, adding further strain. This matters because a large portion of Bitcoin’s hash power—the computational resources required to solve cryptographic algorithms—is concentrated in the United States.

U.S. Banking Crisis and BTC

The U.S. banking crisis in March 2023 turned out to be a blessing for Bitcoin and the broader crypto market. One of the most important reasons was the lack of correlation between cryptocurrencies and the U.S. stock market. Although the banking system stabilized afterward, current market conditions suggest a similar scenario may be unfolding again.

U.S. Banks Hit Again

Wall Street’s four major banks—Citigroup (C), Morgan Stanley (MS), Goldman Sachs (GS), and Bank of America (BAC)—are currently trading at their lowest levels since the earlier banking turmoil. Year-to-date performance shows their share prices are now lower than they were even in March. Citigroup shares have dropped 14% since the start of the year, while Goldman Sachs has declined nearly 13%. Morgan Stanley has fared worse, falling over 16%, and Bank of America leads with a 23% decline.

Negative Correlation Between Cryptocurrency and U.S. Banks

Despite current economic conditions not supporting a bullish outlook for banks or equities, the situation in the crypto market is quite different. Currently, BTC shows a clear negative correlation with both the S&P 500 and Nasdaq indices—at -0.8 and -0.78 respectively.

In March, as banks faced severe stress, BTC prices rose alongside other cryptocurrencies—and coincidentally, BTC is surging again now. This has lifted other altcoins as well, pushing the total crypto market capitalization to $1.244 trillion.

From this perspective, losses suffered by traditional banking institutions are translating into gains for crypto investors, indicating that capital inflows into the sector are not solely driven by domestic U.S. dynamics. However, continued institutional bank losses may not be the only driver behind BTC’s rise.

Behind the Israel-Palestine Conflict: U.S. Treasuries and BTC

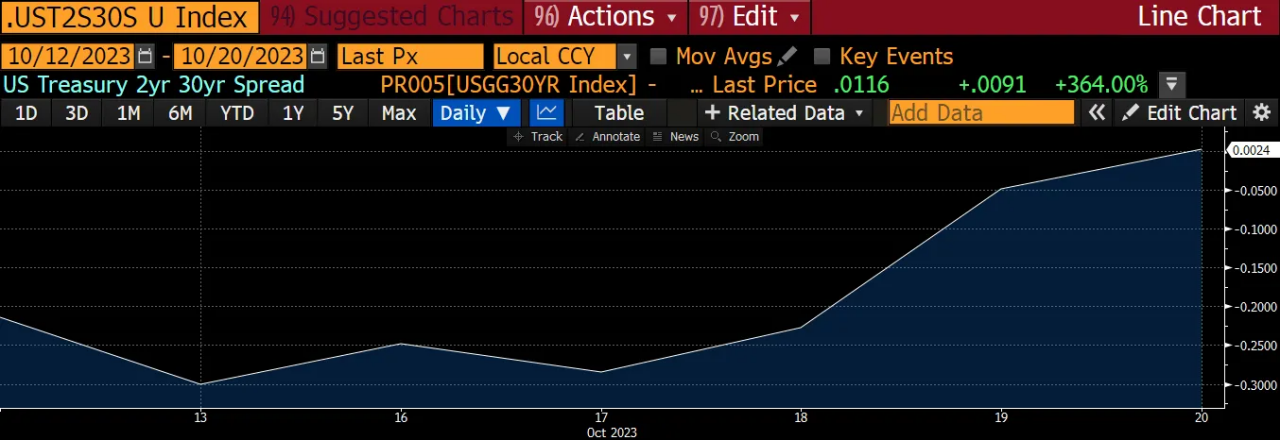

Arthur Hayes, co-founder of BitMEX, recently wrote that the global economy is currently influenced by “global warfare,” which has accelerated the recent sell-off in U.S. Treasuries. As government bonds lose their perceived safety, investors are turning to BTC and gold as alternative assets.

Hayes elaborated on how tensions in the Middle East could impact financial markets, noting that ongoing U.S. military support for Israel may lead to increased selling pressure on U.S. debt. He explained: “If you’re a long-term holder of U.S. Treasuries, your biggest fear is that the U.S. government doesn’t think it spends too much. If U.S. defense spending enters absurd territory, trillions of dollars in borrowing would be needed to fund the war machine, forcing the government to issue more long-term bonds to attract investors—further eroding global confidence in U.S. debt. That’s why bonds are being sold off and yields are rising.”

With the Israel-Palestine conflict and the Federal Reserve pausing rate hikes pushing U.S. Treasury yields to a 16-year high, Hayes believes that as long-term U.S. bonds cease to offer security to investors, alternatives will be sought—and in this context, gold and BTC stand out as top choices. Hayes argues that the rise in BTC and gold isn’t speculative based on ETF approvals, but rather a response to anticipated dollar depreciation and high inflation caused by war. He also cited another reason for the bond selloff: as the Fed’s rate-hiking cycle nears its end and the U.S. economy remains stable, investors lose incentive to hold long-dated bonds, contributing further to the sell-off.

Other Factors That Could Drive BTC Higher

A group of key investors may also be contributing to the rally. Since September 21, whale addresses holding between 100 and 1,000 BTC have been accumulating Bitcoin. Within one month, this cohort increased their holdings by 50,000 BTC—worth $1.7 billion—raising their total from 3.85 million BTC to 3.9 million BTC.

BTC Trend Outlook

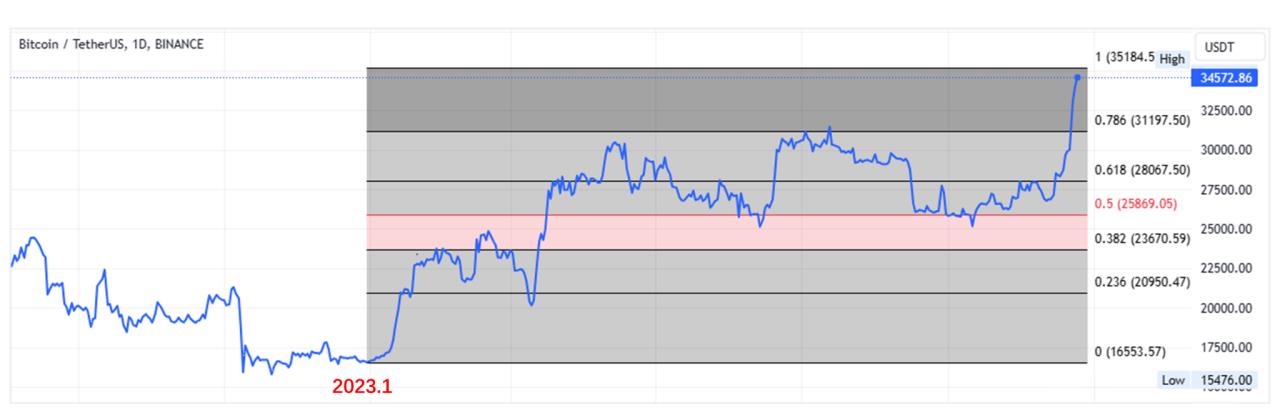

At the time of writing, BTC is priced at $34,572. With strong market momentum, further upside is possible. It remains in the upper range of its recent trading band, as illustrated in the chart above, which evaluates movement from the beginning-of-year low to the current year high of $35,184.

BTC’s price has more than doubled from its December 31 closing price of $16,542. During this rally, it broke through the key Fibonacci retracement level of 61.8% at $28,067, followed by the stronger 78.6% level at $31,197.

Growing buying pressure could push BTC higher, with a bullish target of $35,000. In this scenario, the most logical resistance level would be $35,184—the peak shown on the Fibonacci chart.

However, if profit-taking begins, BTC could enter a downward trend. In such a case, support might emerge around $31,197, or more likely near $28,067. In a worst-case scenario, prices could fall to $25,869.

Conclusion

As BTC continues to climb, market sentiment is clearly improving. The approaching Bitcoin halving, stress within the U.S. banking sector, rising U.S. Treasury yields, and other macroeconomic factors are collectively driving this price increase. While short-term volatility may persist, BTC remains firmly in an upward trajectory from a medium- to long-term perspective. For investors, this remains an opportune moment to position themselves in BTC. As the halving effect unfolds, a new bull cycle may well be on the horizon—one worth watching closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News