Flatcoin Anti-Inflation Stablecoin Sector Overview: Why Did Vitalik Rank It Among the Top 3 Crypto Trends of 2023?

TechFlow Selected TechFlow Selected

Flatcoin Anti-Inflation Stablecoin Sector Overview: Why Did Vitalik Rank It Among the Top 3 Crypto Trends of 2023?

In the field of digital currencies, while traditional stablecoins are designed to peg to specific fiat currencies or assets to maintain their stability, they have also been affected as those fiat currencies experience inflation.

Author: Leo Deng, LK Venture

TL;DR

-

Rise of Inflation-Resistant Stablecoins: Fiat-collateralized digital stablecoins are vulnerable to purchasing power erosion, sparking strong market interest in a new type of stablecoin—“inflation-resistant stablecoins” (Flatcoins)—that maintain real purchasing power during inflation. Designed to track a basket of goods, Flatcoins have drawn attention from industry leaders like Vitalik Buterin and Coinbase CEO Brian Armstrong as a key direction for the future of finance.

-

Definition of Inflation-Resistant Stablecoins: Unlike stablecoins pegged to specific assets or fiat currencies, inflation-resistant stablecoins are designed specifically to preserve purchasing power amid inflation. They serve as effective hedging tools in high-inflation regions such as Latin America and Africa.

-

Design Challenges of Inflation-Resistant Stablecoins: Accurate measurement of inflation is difficult due to regional variations and differing metrics like CPI and PPI; reliable data sources with verification and audit mechanisms are essential; systems must be resilient against manipulation, attacks, and volatility; legal and regulatory differences across jurisdictions pose additional risks; robust economic models are needed to reflect inflation accurately; technically, real-time processing of inflation data, secure smart contracts, and system efficiency are critical; user education and market adoption are also vital to success.

-

Significance in the Crypto Market: These stablecoins protect users' purchasing power in high-inflation environments, offering greater trust than traditional stablecoins; they drive technological innovation, enhance cryptocurrency utility, attract traditional financial participants, support clearer regulation, diversify market offerings, and provide new risk management tools for the global economy.

-

Analysis of Key Projects: Includes Frax Price Index (FPI), a fully crypto-collateralized stablecoin by Frax Finance tied to CPI-U; Reserve Protocol, aiming to build a decentralized stablecoin (RSV) through diversified risk mitigation; SPOT, based on Ampleforth and Buttonwood, bridging speculative crypto and dollar alternatives using zero-liquidation tranching for stability and multi-chain compatibility.

Why Do We Need Inflation-Resistant Stablecoins (Flatcoins)?

Currency reflects economic and national power, evolving throughout history. As dominant powers decline and new ones rise, so too does the prominence of their respective currencies.

The Dutch guilder dominated during its economic peak, and the British pound under the British Empire became a globally trusted currency. Yet neither could maintain supremacy indefinitely.

Recently, Ray Dalio, founder of Bridgewater Associates, suggested that the U.S. dollar’s status as the world’s reserve currency may face challenges. In a 2023 interview, he emphasized that as the dollar's global influence wanes, the international economic and monetary landscape is becoming multipolar, casting uncertainty over the dollar’s future dominance.

Since January 2020, the average American’s purchasing power has declined by 23.90%.

(Source: https://truflation.com/)

From October 10, 2020, to October 10, 2023, Truflation data shows that the average American’s purchasing power dropped by 20.39%. This means those holding only dollar-denominated assets saw their ability to buy goods shrink by one-fifth over three years.

But this inflation trend isn't unique to the U.S. The International Monetary Fund (IMF) projects global inflation at 6.6% in 2023, down from 8.8% in 2022. The World Economic Forum further notes that due to deglobalization, climate change, wage-price spirals, and highly liquid global markets, the world economy faces a prolonged period of high inflation.

Countries like Argentina, Turkey, and Iran, suffering from political instability, sanctions, monetary mismanagement, and economic issues, experienced extreme inflation rates of 76.1%, 51.2%, and 40.0% respectively in 2023.

In the cryptocurrency space, while traditional stablecoins aim to maintain stability by pegging to fiat currencies or assets, they too suffer from inflationary pressures. Since the first stablecoins emerged in 2014, and especially after the DeFi boom in 2017, Tether (USDT) and USD Coin (USDC) have become the third- and fourth-largest cryptocurrencies by market cap. Today, there are around 200 stablecoins with a total market value of $190 billion.

However, these stablecoins, such as USDT and USDC, operate largely under centralized control, exposing holders to counterparty and censorship risks.

More critically, as global inflation persists, the real value of these dollar-pegged stablecoins continues to erode.

Comparison of Dollar Purchasing Power Relative to Initial Issuance

(Source: howmuch.net)

Thus, stablecoins aren’t necessarily “stable”—an apparent contradiction but a real-world dilemma. Amid rising inflation and global economic uncertainty, financial markets, particularly in crypto, are seeking a new type of stablecoin capable of preserving purchasing power even during inflation. Enter the inflation-resistant stablecoin (also known as Flatcoin), now emerging as a focal point in the market.

Flatcoin emerges as a decentralized stablecoin designed to shield assets from inflation. Unlike traditional stablecoins, Flatcoins maintain value by tracking a basket of goods, thus protecting purchasing power. Since its proposal, the concept has attracted significant attention in the crypto industry. The clear goal of Flatcoin is “to maintain stable purchasing power while retaining flexibility to withstand economic uncertainties arising from traditional financial systems.”

At the end of 2022, Ethereum co-founder Vitalik Buterin, in an interview with Bankless, shared his outlook for the 2023 crypto industry, highlighting three unfulfilled “massive” opportunities: mass wallet adoption, inflation-resistant stablecoins, and Ethereum-powered website logins.

Vitalik argued that creating a stablecoin resistant to all conditions—including hyperinflation of the U.S. dollar—would unlock enormous potential for the entire crypto industry. He stressed that providing billions of users with a reliable, inflation-resistant stablecoin would be a crucial complement to traditional financial systems.

Coinbase CEO Brian Armstrong has also repeatedly mentioned Flatcoin in public interviews and discussed it on Twitter, ranking it first among ten key crypto technologies.

Brian believes Flatcoin represents the future evolution of stablecoins. Unlike traditional fiat-pegged stablecoins, Flatcoins offer a new, more stable way to store value by tracking inflation. While Coinbase hasn’t started developing one yet, he expressed strong interest in the potential of this new asset class.

What Are Inflation-Resistant Stablecoins?

An inflation-resistant stablecoin, commonly known as a “Flatcoin” (also referred to as a “value-stable coin” or “purchasing-power-stable coin”), is a type of stablecoin designed to track inflation rates rather than being pegged to a specific currency.

The term “Flatcoin” was first coined in 2021 by Balaji Srinivasan, former CTO of Coinbase. The goal of a Flatcoin is to maintain stable purchasing power, preserving its value even in inflationary environments. By linking to indicators like the Consumer Price Index (CPI), these stablecoins maintain their real value, offering users a more stable and reliable store of value.

Later, blockchain development firm Laguna Labs launched a new cryptocurrency called Nuon, claiming it to be the world’s first over-collateralized and decentralized “Flatcoin.”

Just as decentralized protocols solve the risks of centralized money, over-collateralization protects value during market crashes—so too do inflation-resistant stablecoins offer a long-term solution for preserving value over time.

With inflation rising—such as the U.S. hitting 8.5% in 2022, far above the Federal Reserve’s 2% target—inflation-resistant stablecoins have become increasingly attractive. They typically face no bank deposit restrictions and often offer higher yields, making them compelling options amid inflation.

In Latin America, inflation reached 14.6% in 2022, with forecasts of 9.5% in 2023. In these high-inflation countries, inflation-resistant stablecoins serve as hedges and facilitate cross-border remittances.

How Inflation-Resistant Stablecoins Differ from Other Stablecoins

Stablecoins can be categorized by their backing assets or operational mechanisms. Below are the main types with their characteristics and examples:

1. Commodity-Backed Stablecoins:

Typically backed by hard assets like gold or real estate to maintain value. For example, PAX Gold (PAXG) is a gold-pegged stablecoin where each PAXG represents one troy ounce of gold.

2. Crypto-Backed Stablecoins:

Usually over-collateralized with crypto assets to maintain stability. For instance, DAI, issued by MakerDAO, is pegged to the U.S. dollar but maintains its value through collateralization with Ethereum and other crypto assets.

3. Fiat-Backed Stablecoins:

Typically pegged 1:1 to a fiat currency such as the U.S. dollar, euro, or renminbi. For example, USDT (Tether) and USDC (USD Coin) are both 1:1 pegged to the U.S. dollar.

4. Algorithmic Stablecoins:

Adjust supply algorithmically to maintain value. Ampleforth (AMPL), for example, dynamically adjusts its supply based on market demand.

The primary purpose of inflation-resistant stablecoins (like Flatcoins) is to preserve purchasing power by pegging to inflation indices (e.g., CPI), avoiding the effects of inflation. Other stablecoins typically maintain value by pegging to specific assets or through algorithms.

In design and implementation, inflation-resistant stablecoins require more complex economic models and algorithms to accurately reflect inflation changes and adjust value accordingly. They may also face more complicated regulatory hurdles, particularly concerning the accuracy and impartiality of inflation data.

Design Challenges of Inflation-Resistant Stablecoins

Designing an inflation-resistant stablecoin is a highly challenging task, both technologically and economically. Its goal is to preserve purchasing power during inflation, but several major challenges remain:

1. Accurate Measurement of Inflation:

Inflation rate is a key factor influencing Flatcoin design. Different countries and regions experience different inflation rates, requiring designers to find accurate and reliable ways to measure inflation. Common measures include the Consumer Price Index (CPI), Producer Price Index (PPI), and other inflation indicators. However, these metrics can be influenced by political factors, economic policies, and statistical methods, affecting the accuracy and effectiveness of the stablecoin.

For example, in Volt Protocol, the native stablecoin VOLT is pegged to the CPI. If annual inflation is 7%, the token is pegged at $1.07.

2. Reliability of Data Sources:

The design depends on reliable and accurate data sources. Inaccurate or unreliable data could decouple the stablecoin’s value from actual inflation, undermining its anti-inflation properties. Designers must identify trustworthy data providers and ensure timeliness and accuracy. Robust data validation and auditing mechanisms are also required to guarantee data integrity.

3. System Stability and Security:

All crypto projects, especially stablecoins, must prioritize system stability and security. The design must prevent manipulation, attacks, and other threats. It also requires robust protocols to handle market volatility and unforeseen events, ensuring continuous and stable operation.

For example, on May 10, 2022, the algorithmic stablecoin TerraUSD (UST), running on the Terra blockchain, collapsed and lost its dollar peg. This incident demonstrated how algorithmic stablecoins without sufficient collateral are vulnerable to speculative attacks.

4. Legal and Regulatory Challenges:

Inflation-resistant stablecoins may face varying legal and regulatory environments across jurisdictions, impacting their design, issuance, and trading. Some countries may restrict or ban their use or impose strict compliance requirements. These regulatory hurdles increase complexity and risk.

In late 2019, when stablecoins first emerged, the G7 strongly warned of the serious risks of using them for international settlements, illustrating the impact of regulation. In September 2023, the G20 endorsed Financial Stability Board recommendations on regulating crypto activities and global stablecoin arrangements, signaling more regulations to come.

5. Economic Model Design:

The economic model is foundational to a Flatcoin’s functionality. Designers must create a robust model ensuring the stablecoin’s value accurately reflects inflation. This includes determining issuance, circulation, and burning mechanisms, and how market dynamics adjust value.

6. Technical Complexity:

Implementing an inflation-resistant stablecoin is technically complex, involving multiple algorithms and systems. Challenges include acquiring and processing inflation data in real time, designing secure smart contracts, and ensuring scalability and efficiency. Integration with existing blockchains and crypto ecosystems is also necessary for broad adoption.

7. Market Adoption and User Education:

User understanding and market acceptance are crucial to success. Project teams must educate users about the benefits and usage of Flatcoins and promote widespread adoption.

Significance of Inflation-Resistant Stablecoins in the Digital Asset Market

Exploring inflation-resistant stablecoins holds multifaceted significance for the crypto market, offering users more choices and driving innovation and growth in the industry.

1. Preserving Purchasing Power: By pegging to inflation indices, Flatcoins protect users’ purchasing power, appealing greatly to investors in high-inflation environments. They offer a unique tool for value storage and transactions in the crypto market.

2. Enhancing Market Stability and Trust: Traditional stablecoins like USDT and USDC lose real value as fiat currencies depreciate during inflation. Offering an inflation-resistant alternative increases market stability and trust, reducing inflation-related risks for users and investors.

3. Driving Innovation in Crypto: Designing and implementing Flatcoins involves solving complex technical and economic problems, fostering innovation. Overcoming these challenges can lead to new solutions and technologies, advancing the entire industry.

4. Improving Utility and Adoption: Flatcoins serve as more reliable stores of value and mediums of exchange, enhancing cryptocurrency usability and broader acceptance. They may attract traditional finance players and encourage more merchants to accept crypto payments.

5. Promoting Market Diversification: Flatcoins add diversity to the crypto market, allowing participants to choose stablecoins aligned with their needs and risk preferences. This enriches market complexity and maturity, encouraging wider participation.

6. New Risk Management Tools for the Global Economy: Amid growing economic uncertainty, Flatcoins offer new tools for individuals and businesses to manage financial risks more effectively.

In sum, exploring and developing inflation-resistant stablecoins holds strategic importance for the crypto market. They bring new opportunities but also present challenges requiring collaborative efforts from market participants, developers, and regulators.

Case Studies of Key Projects

1. Frax Price Index

Frax Price Index (FPI) is a stablecoin within the Frax Finance ecosystem and the first stablecoin pegged to a basket of physical consumer goods defined by the U.S. Consumer Price Index for All Urban Consumers (CPI-U). Unlike traditional stablecoins denominated in national currencies, FPI creates an independent unit of account, fully backed by crypto collateral, offering consumers a currency independent of any national fiat.

Key innovations in addressing inflation:

Tied to Consumer Goods: FPI anchors its value to a basket of physical goods defined by the U.S. CPI-U average. This unique linkage ties digital asset value to tangible consumption, aiming to preserve purchasing power and deliver unprecedented price stability in volatile crypto markets.

Inflation Tracking: FPI uses the unadjusted 12-month U.S. government-reported CPI-U inflation rate. This data is submitted on-chain immediately after publication via a dedicated Chainlink oracle. The reported inflation rate adjusts the redemption price of FPI in the system contract. The rate updates every 30 days, aligning with monthly U.S. CPI data releases.

Algorithmic Market Operations (AMOs): FPI employs AMOs similar to FRAX, the main stablecoin in the Frax ecosystem. However, FPI maintains a constant 100% collateral ratio (CR), ensuring protocol balance sheet growth keeps pace with CPI inflation. If AMO returns fall below CPI, the protocol triggers actions—like selling FPIS tokens for FRAX—to restore 100% CR.

Stablecoin as Unit of Account: FPI aims to be the first on-chain stablecoin with a unit of account derived from a goods basket. This vision goes beyond being an inflation hedge—it seeks to create a new standard for measuring transactions, value, and debt. This framework better assesses real value preservation against inflation and links the on-chain economy to real-world asset baskets.

Governance and Revenue Distribution: FPIS tokens serve as governance tokens for the system. They entitle holders to seigniorage revenue, with excess profits transferred from the treasury to FPIS holders. If fiscal revenues are insufficient to support increased FPI backing due to inflation, new FPIS tokens may be minted and sold to strengthen the treasury.

FPI is governed by Frax Price Index Shares (FPIS), launched by Frax Finance in April 2022. FPIS is linked with Frax Share (FXS), forming a joint governance structure supporting FPI’s economics. Through its unique governance and revenue model, FPIS supports the Frax ecosystem and offers FPI users distinct governance and yield opportunities.

FPI adjusts monthly on-chain based on CPI data, increasing the dollar-denominated value of FPI holdings proportionally to reported CPI. For example, if inflation was 9.1% in June 2022, FPIS would grow at that rate over the next 30 days.

2. Reserve Protocol

The Reserve project aims to create a decentralized stablecoin, Reserve Token (RSV), enabling fiat-like transactions. It seeks to reduce risk through diversification and decentralization, creating a stablecoin that avoids both the inflation of traditional fiat (like the dollar) and the volatility of cryptocurrencies like Bitcoin.

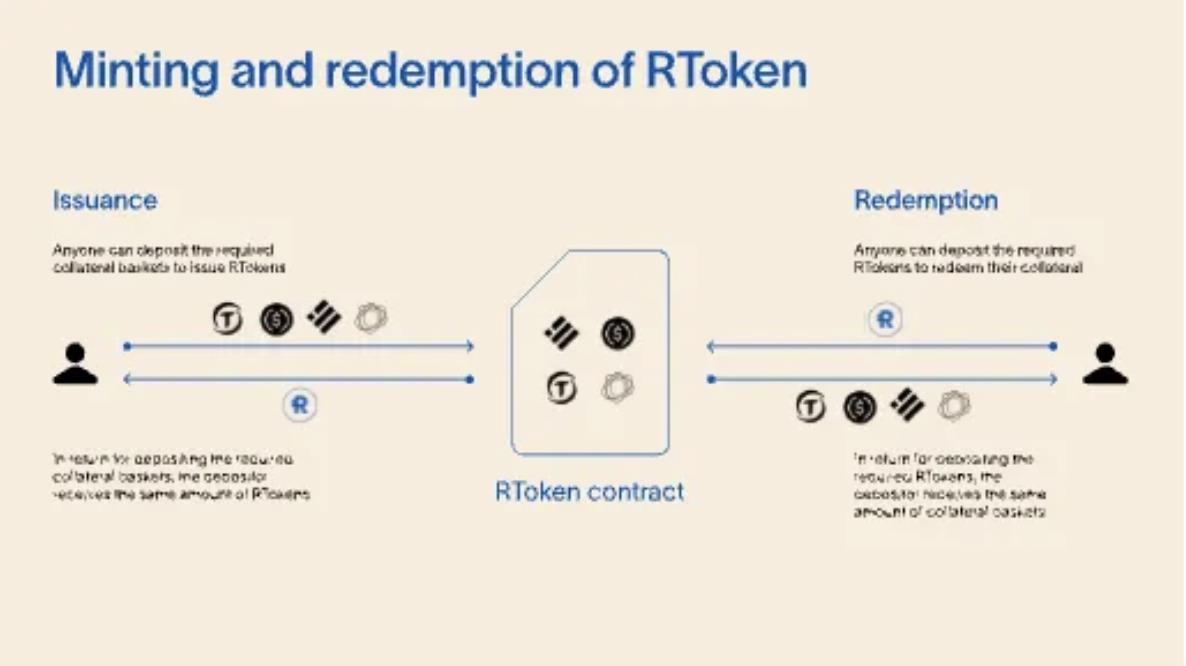

RToken Issuance and Redemption Mechanism

(Source: https://reserve.org/protocol/rtokens/)

Key innovations in addressing inflation:

Two-Token Mechanism: Reserve uses a dual-token system comprising RSV and Reserve Rights Token (RSR). RSV serves as the stablecoin, while RSR and other assets help maintain RSV’s stability, collectively supporting the network’s overall resilience.

Collateralization for Governance: RSV is backed by a basket of assets. This collateral is crucial for maintaining RSV’s peg and its stability under inflationary pressure. When the market value of collateral is insufficient, the protocol uses RSR to restore the peg.

Reserve’s innovation lies in building a mechanism that withstands inflationary pressures while maintaining stable value storage and exchange functions. Through its two-token system, collateral backing, and decentralized architecture, RSV strives to offer a long-term purchasing power preservation solution.

3. SPOT

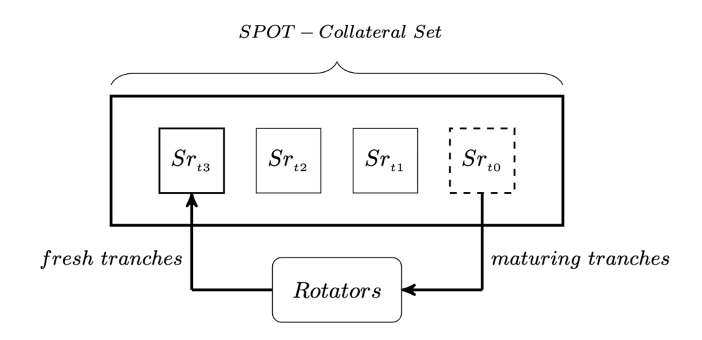

SPOT is an inflation-resistant stablecoin designed to bridge speculative cryptocurrencies and dollar alternatives. Built on Ampleforth and Buttonwood protocols and governed by FORTH tokens, SPOT is a perpetually issued note fully collateralized by AMPL derivatives.

Though possessing many traits of modern stablecoins, SPOT isn’t pegged to a fixed value. Instead, it uses zero-liquidation tranching to provide stability, with prices fluctuating within a range similar to AMPL. Think of SPOT as a derivative that reduces AMPL’s supply volatility.

By launching SPOT, the Ampleforth team aims to deliver the first truly decentralized unit of account for the crypto economy. As a rebasing-resistant, inflation-resistant decentralized stablecoin, SPOT seeks to improve the overall distribution of the evolving digital financial system.

Key innovations in addressing inflation:

ERC-20 Token and Permanent Wrapper: SPOT is an ERC-20 token and a permanent wrapper that abstracts away AMPL’s supply volatility for holders. Its price tracks AMPL (which targets 2019 USD CPI), serving as a haven from volatility and inflation. SPOT is fully backed by AMPL-based derivatives.

SPOT Rotator: Through the SPOT Rotator, staking AMPL supports the SPOT Flatcoin while retaining AMPL’s rebase mechanism (which maintains purchasing power by adjusting wallet balances) and earning AMPL yield. SPOT is a decentralized Flatcoin using tranching instead of liquidation markets to achieve scalable stability.

SPOT Collateral Rotation Mechanism

(Source: docs.spot.cash/spot-documentation)

Multi-Chain Availability: Thanks to its omnichain design, SPOT isn’t limited to a single blockchain. It operates across partner chains—including Ethereum, Polygon (PoS), Arbitrum, Optimism, BNB Chain, and Polygon zkEVM—leveraging unique opportunities on each chain to deliver more reliable assets to users.

Conclusion

Imagine an inflation-resistant stablecoin that preserves its value across centuries, untouched by inflation—that would be an ideal asset. What if you could earn money today and pass it to your descendants, who a century later could purchase the same amount of goods as you can today?

Yet this is beyond the capability of fiat currencies—even strong ones like the U.S. dollar.

In the long run, innovation in the crypto space—especially in stablecoins—should not merely expand existing asset classes, portfolios, and mechanisms, but should create new assets that are stable in the short term, resilient in the long term, and resistant to inflation. In this evolution, inflation-resistant stablecoins will undoubtedly play an increasingly important role.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News