Huobi Ventures' Latest Research Report: Will the Web3 Social Track Be the Next Bull Market Engine?

TechFlow Selected TechFlow Selected

Huobi Ventures' Latest Research Report: Will the Web3 Social Track Be the Next Bull Market Engine?

This article discusses the current development status of Web3 social, characteristics of products in this sector, analysis of leading projects, as well as the risks and challenges facing the sector.

Author: Juliet Tang, Investment Analyst at Huobi Ventures

Each bull market has its unique engine, and behind every such engine lies a prolonged development process rooted in the previous bear market. From the frenzy of MEMEs to the DeFi Summer—driven by advancements in Web3 technology and infrastructure—the social sector is now emerging with new growth opportunities.

Could Web3 Social Be the Next Bull Market Engine?

As an application-layer sector that demands significant developer creativity, Web3 social encompasses various subcategories including social platforms, identity systems, NFTs, DAOs, and fan economies. The social track is still in its earliest stages. However, with events such as the launch of the Cyber token, Twitter’s rebranding, and creator incentive programs, market interest in the social sector has been steadily rising.

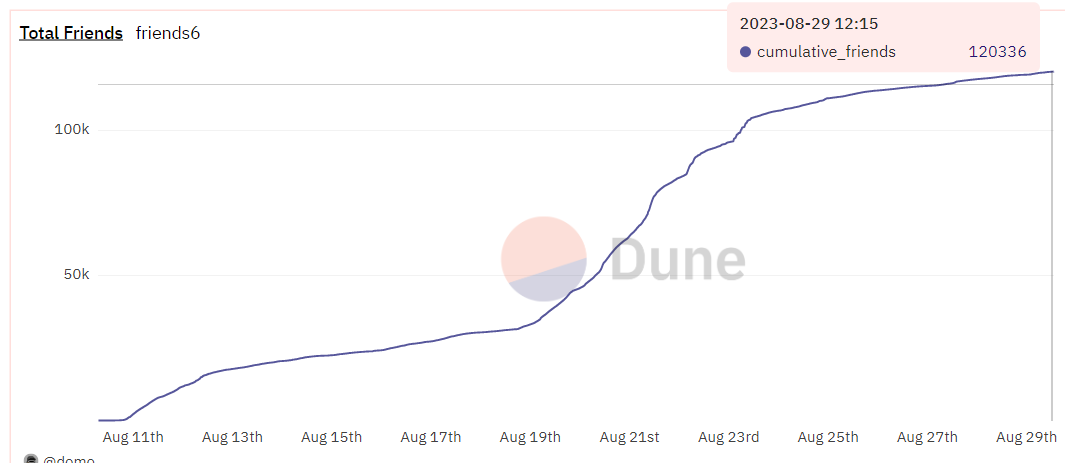

Friend.Tech, a social application built on Coinbase's L2 chain BASE, rapidly gained popularity after launching on August 10. Within less than 20 days of its release, it attracted over 120,000 registered addresses and more than 20,000 active users.

Other tools like CyberConnect and Lens Protocol have also drawn substantial user attention and market interest.

This article explores the current state of Web3 social development, analyzes key product characteristics within the space, examines several leading projects, and evaluates the risks and challenges facing the sector. Overall, we are optimistic about the future of the Web3 social sector, which demonstrates strong investment potential and promising long-term prospects.

This research report is published by Huobi Ventures, the global investment arm of Huobi, integrating investment, incubation, and research to identify the most outstanding and promising projects worldwide.

Why Focus on Social?

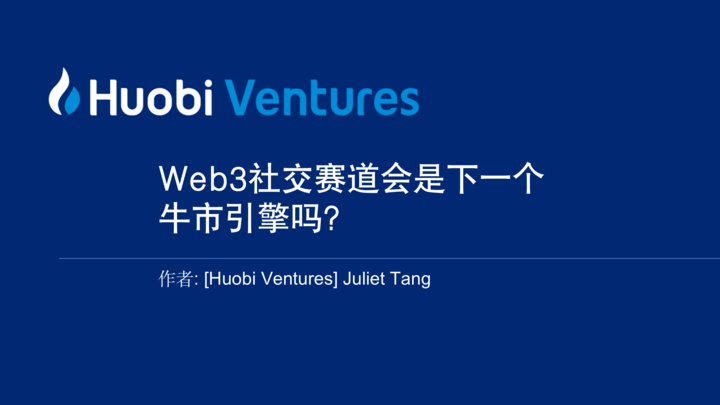

The crypto industry is often seen as an interdisciplinary field combining computer science, finance, cryptography, and mathematics. However, due to its short history, incomplete infrastructure, inconsistent regulatory standards, and non-trivial learning curve, it has yet to achieve widespread global adoption. With the maturation of smart contract platforms like Ethereum, the number of on-chain DApps exploded starting from 2020. As shown below, the cumulative number of DeFi user addresses has surpassed 40 million. DeFi was the first sector to bring users into on-chain interactions, leveraging real-world, convenient use cases to drive the development of the on-chain economy and cultivate a community of dedicated on-chain degens. Starting in 2021, blockchain gaming and NFTs led a new wave of user adoption. Innovative gameplay mechanics, Ponzi-like tokenomics, and diverse value propositions brought massive inflows of new users. Blockchain games attracted many Web2 gamers and low-income individuals from developing countries through play-to-earn incentives, while NFTs drew collectors, artists, and traditional brands due to their identity, collectible, and branding values.

Cumulative On-Chain DeFi User Addresses

Source:

https://dune.com/rchen8/defi-users-over-time

Since 2022, the market has entered a prolonged bear cycle. Previously popular sectors like gaming and NFTs have cooled down, and Ponzi-style economic models collapsed amid insufficient user growth. Web3 user expansion has hit a bottleneck. Despite ongoing innovation across foundational infrastructure, zero-knowledge proofs, payments, identity, and DeFi 2.0, one core challenge remains: too few users. In today’s bear market, many ecosystems and their constituent projects face the dilemma of having completed technical development but lacking genuine user engagement. Excluding bot farms and multi-wallet users, the actual number of active on-chain users may be far from optimistic.

From the supply side, Web3 needs more diverse applications and engaging experiences to attract new users. The social sector shows promise as the next catalyst for broad Web3 adoption. From the demand side, the social sector has already proven its immense potential in traditional internet industries. Massive user bases and commercial value have consistently emerged from this domain—from early platforms like MSN, to Facebook and Instagram, and later TikTok. Each technological iteration in social media has given rise to internet giants and spawned entire ecosystems of upstream and downstream employment. As awareness grows around data ownership, privacy rights, and the commercial value of personal data, increasing voices advocate for users to control their own social information via Web3 and benefit directly from their digital identities and behavioral data. Therefore, exploration of Web3-native social projects represents one of the most promising and commercially viable directions for the foreseeable future.

With the maturation of ecosystems like Cyber Connect and Lens Protocol, the overall social landscape is becoming increasingly robust. The sector appears poised for breakout growth, with recent projects already capturing market attention. For example, Elon Musk, crypto’s most influential figure, acquired Twitter and repeatedly promoted Dogecoin and added Bitcoin to Tesla’s corporate treasury documents—bringing global visibility to the crypto space. While he insists Twitter will never issue a token, speculation continues around social identity, tipping mechanisms, and token-based monetization on the platform. Meanwhile, Lens Protocol raised $15 million in funding, Instagram and other tech giants launched NFT features, and the Cyber token debuted on multiple major exchanges—signaling broader industry momentum.

Characteristics of the Web3 Social Sector

There is currently no unified definition of Web3 social. Broadly speaking, any product involving the publication and exchange of personal information—and useful for user profiling—can be categorized under social. Based on current developments, this includes social-specific blockchains, social graphs, identity protocols, various social applications, and supporting tools.

In the Web2 world, established platforms like Twitter, Instagram, and TikTok already command vast user bases and sophisticated business models. When evaluating Web3 social, we must assess both its necessity and feasibility. Compared to Web2, Web3 social suffers from limited user adoption and remains largely experimental technologically. In summary, this article identifies the following key factors driving Web3 social development:

1. Anonymity and Censorship Resistance

One of the biggest advantages of Web3 social over Web2 is its inherent anonymity and resistance to censorship—a feature already validated as a genuine user need. In Web2, data is controlled by centralized entities; users risk arbitrary content moderation, forced deletions, or edits of their posts. Fundamentally, Web2 social operates under institutional oversight, leaving users unable to fully protect their privacy. In contrast, decentralized Web3 naturally safeguards user privacy and resists centralized control—meeting growing demands for personal security and freedom of expression.

2. User Ownership of Data

Under Web2 social models, user data ownership resides with centralized platforms. These platforms leverage user data to build detailed profiles, analyze behavior patterns, target ads, and maximize monetization. Data itself also holds analytical value. In Web3, returning data ownership to users enables them to capture the commercial value of their own digital footprints. From a user perspective, projects that make it easy to monetize personal data become inherently attractive. This model has precedents in Web2: for instance, Pinduoduo rewards users with cash for watching videos or inviting friends ("cutting prices"), effectively experimenting with traffic monetization. In Web3, numerous initiatives are exploring similar ideas—such as Nostr on Bitcoin’s Lightning Network, Polygon-based Lens, and cross-chain protocol CyberConnect—all aiming to return data sovereignty to users. We believe that thanks to the diversity, volatility, and flexibility of token economics in Web3, novel and engaging monetization mechanisms can emerge—potentially surpassing even the wealth-generation and user-acquisition effects seen during the last blockchain gaming bull run.

3. Simplicity and Usability

A core requirement for any successful social project is rich and free-flowing information within communities—which depends heavily on large-scale user participation. Attracting mass users remains the greatest challenge and opportunity for Web3 social. One major constraint in crypto today is the small user base. Entering the ecosystem requires some technical knowledge, posing a learning barrier. Moreover, most crypto applications remain more complex and less intuitive than their Web2 counterparts. For example, EOA wallets involve complicated seed phrases, risk of phishing attacks, private key theft, and compatibility issues across software versions—all degrading user experience. These friction points keep most Web2 users outside the crypto world. Conversely, solving these usability challenges could unlock massive user flows. A simple, seamless social product could trigger explosive adoption.

4. Composability

In Web2, centralized platforms function as massive data silos. Tech giants controlling these silos wield exclusive access rights and pricing power. Third-party developers must seek permission to access or build atop this data. Furthermore, interoperability issues and competitive tensions between platforms result in fragmented ecosystems where apps rarely interoperate. Users often need to create new accounts and rebuild profiles when switching platforms. Ideal Web3 social products could solve this data silo problem. Initiatives like POAP and ENS represent early attempts at portable identity. In the future, simpler, universal, and permissionless protocols may allow users to easily manage data ownership while seamlessly integrating with multiple services—an area central to DID (Decentralized Identity) research.

Overview of Leading Projects

Social projects can be broadly categorized into three types: social graphs, social applications, and tooling solutions.

Social Graphs

Social graphs serve as foundational infrastructure in Web3 social, providing standardized data sources and APIs for other applications. Key attributes include rich data inputs, high composability, and low entry barriers. From this standpoint, standalone social blockchains or native projects on obscure chains offer limited necessity—they risk isolating themselves from broader ecosystems. Currently, building social identity standards on mature chains is the dominant trend. Projects like Lens Protocol, CyberConnect, and RSS3 lead this category.

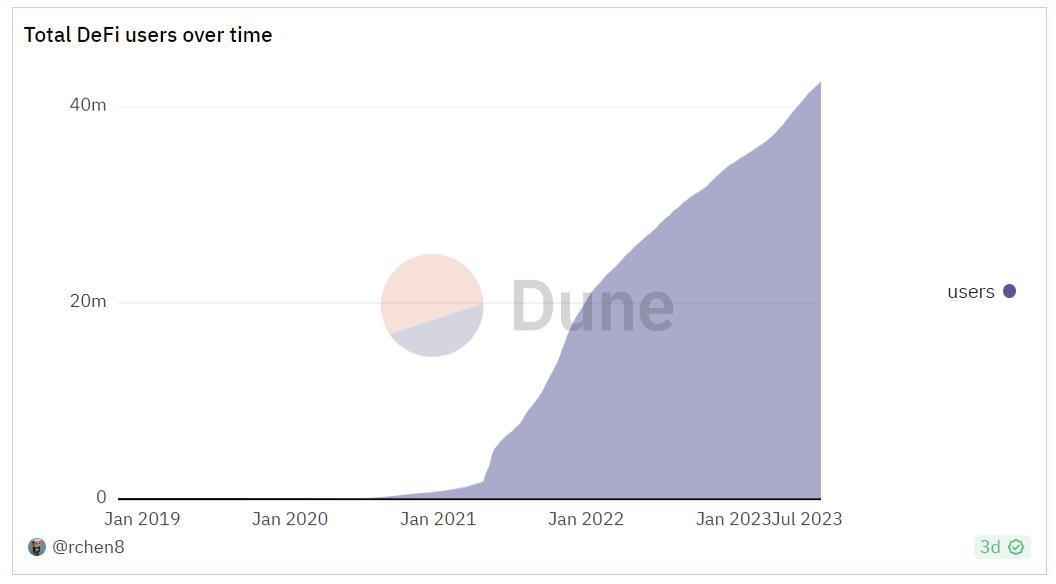

CyberConnect

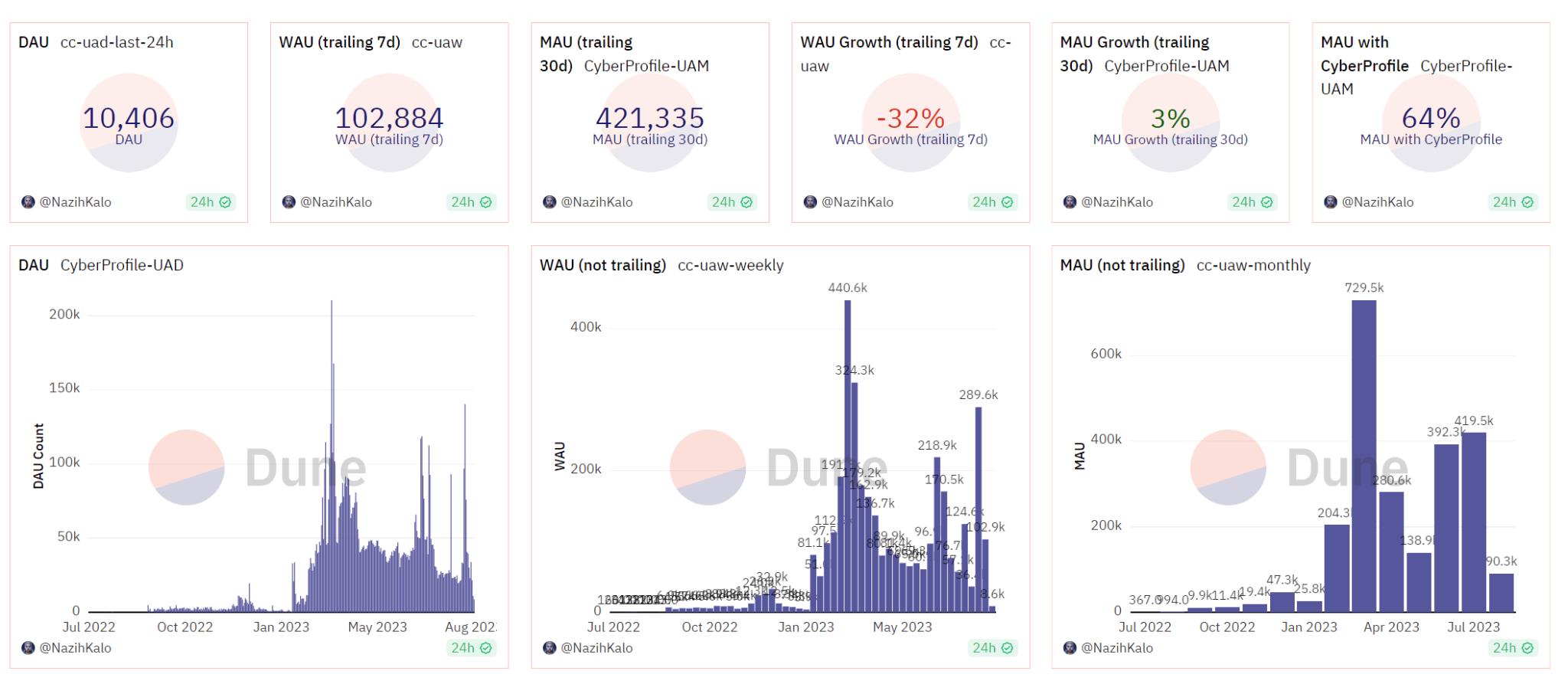

CyberConnect is a multichain social graph that verifies and stores user interaction data. It offers users personal cards, social graphs, and smart contract wallets, while providing standardized API interfaces for DApp developers to enable cross-application data portability. Currently deployed on Polygon, Linea, and Optimism—with plans to expand to Arbitrum—the platform is positioned for further user growth. As shown below, as of August 8, 2023, total account count reached 368k, with 738k recorded operations and over 1.25 million user profiles created.

CyberConnect User Data

Source:

https://dune.com/cyberconnecthq/cyberaccount-cyberconnects-4337-smart-account

Despite the current weak market conditions, CyberConnect maintains a daily active user (DAU) count above 10,000—indicating strong overall traffic.

CyberConnect Traffic Metrics

Source:

https://dune.com/cyberconnecthq/cyberconnect-link3-metrics

Lens Protocol

Developed by the team behind the well-established DeFi lending protocol Aave, Lens Protocol is a social graph built on Polygon. It allows anyone to create self-custodied social profiles and build new social DApps. Users can connect their wallets to mint a social profile NFT and interact with others using it. Developers can build interactive DApps on top of Lens (users log in via Lens, engage across the ecosystem, and all activity is recorded on their Lens profile).

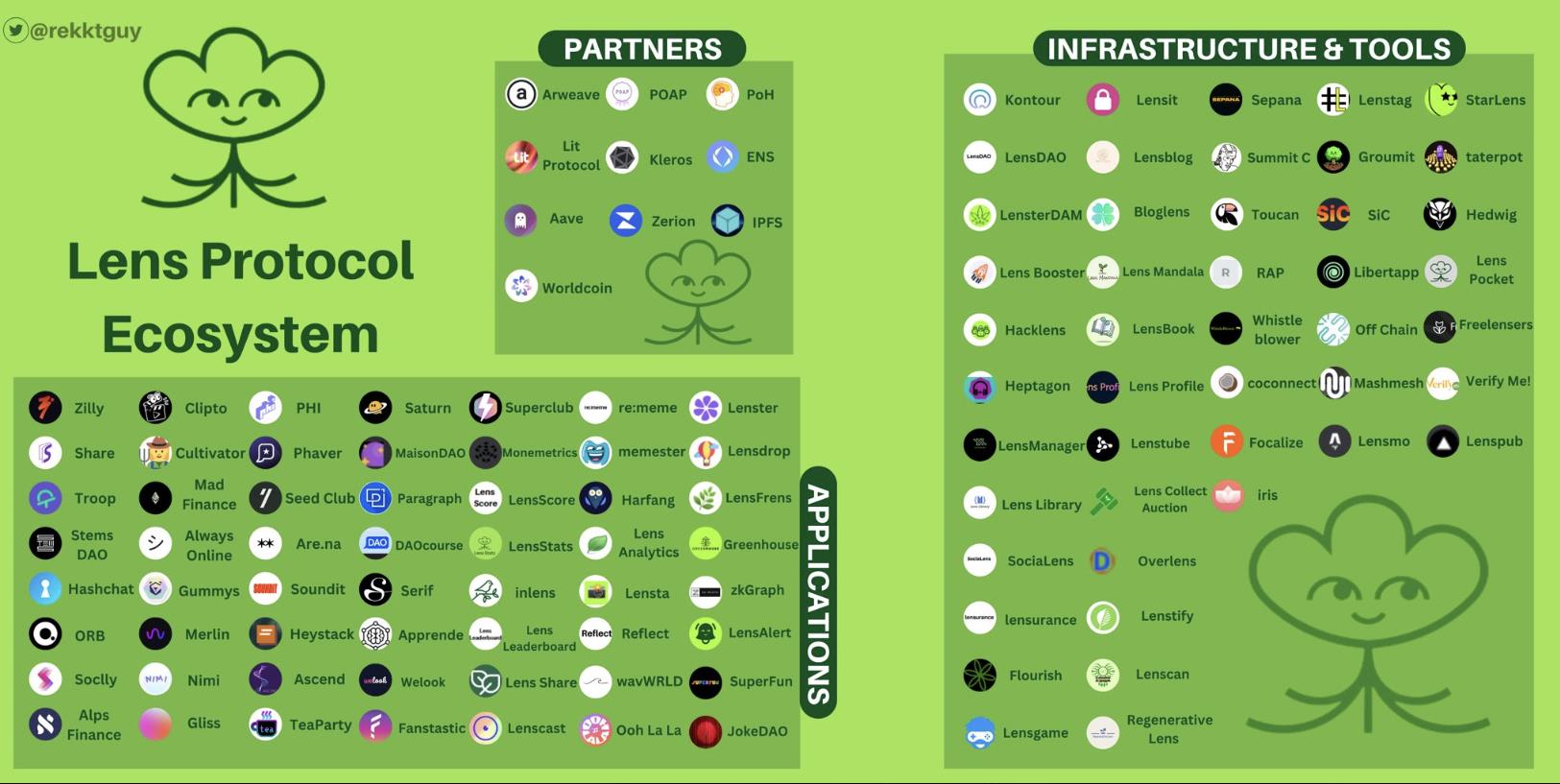

The image below illustrates part of the Lens ecosystem. Over 100 projects have been built on Lens, spanning social networking, play-to-earn, live streaming, DAO tools, ad management, messaging, knowledge monetization, raffles, and more. Although most remain in early development, the breadth and depth of the ecosystem are impressive—even surpassing some layer-1 chains in diversity. Overall, Lens fosters a highly creator-friendly environment.

Partial Lens Protocol Ecosystem Map

Source:

https://twitter.com/rekktguy/status/1582288617229406209?s=20

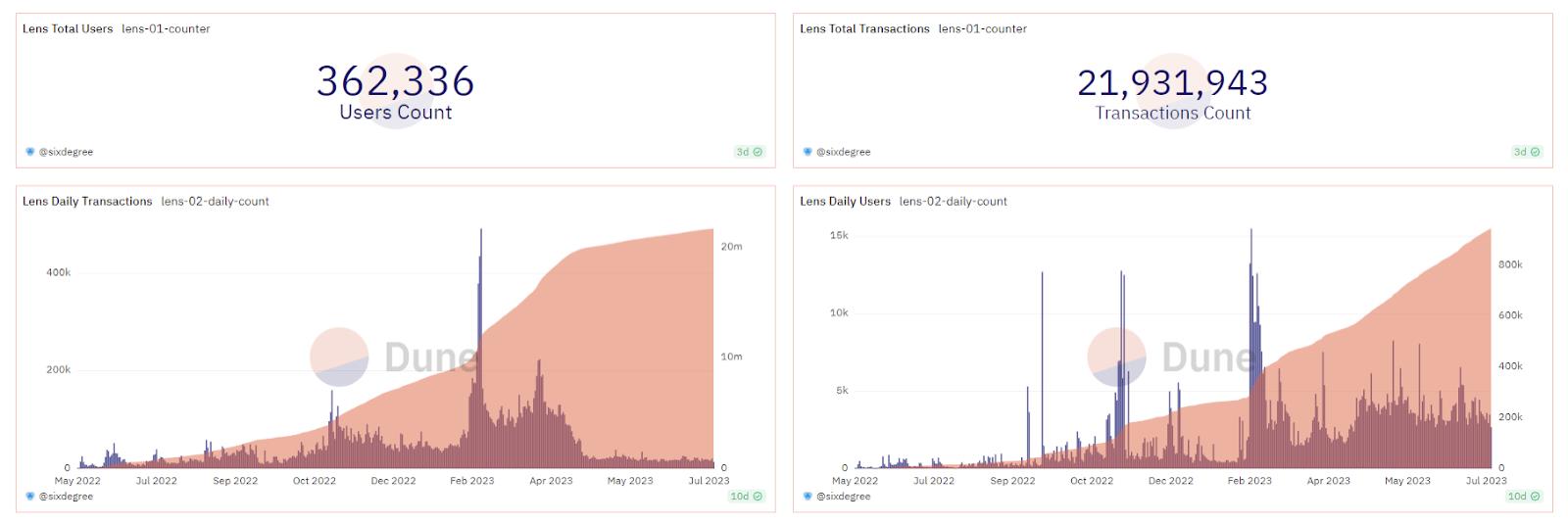

By July 2023, over 110,000 addresses had claimed Profile NFTs. As shown below, Lens has accumulated over 360,000 users and processed 21.93 million transactions. A spike in activity occurred in February 2023, likely driven by retail investors or airdrop farmers. Today, daily on-chain transactions range between 15,000–20,000, with 3,000–5,000 unique wallets interacting daily. Even in a bear market, sustained engagement indicates solid user metrics and growth potential.

Lens Protocol User Statistics

Source:

https://dune.com/sixdegree/lens-protocol-ecosystem-analysis

Overall, social graphs form the foundational infrastructure of the Web3 social stack. Unified, simple, and accessible social graphs reduce user friction, break down barriers between DApps, and accumulate more users and data. Lens Protocol focuses on cultivating its own ecosystem on Polygon, whereas CyberConnect does not operate a content platform. Instead, it supports multiple chains, integrates with various apps, and actively explores Web2-friendly onboarding methods—positioning itself as an open social card system. Both are current leaders in the social space. With continued development and the eventual launch of the Lens token, the social sector may soon enter a breakout phase.

Social Applications

Farcaster

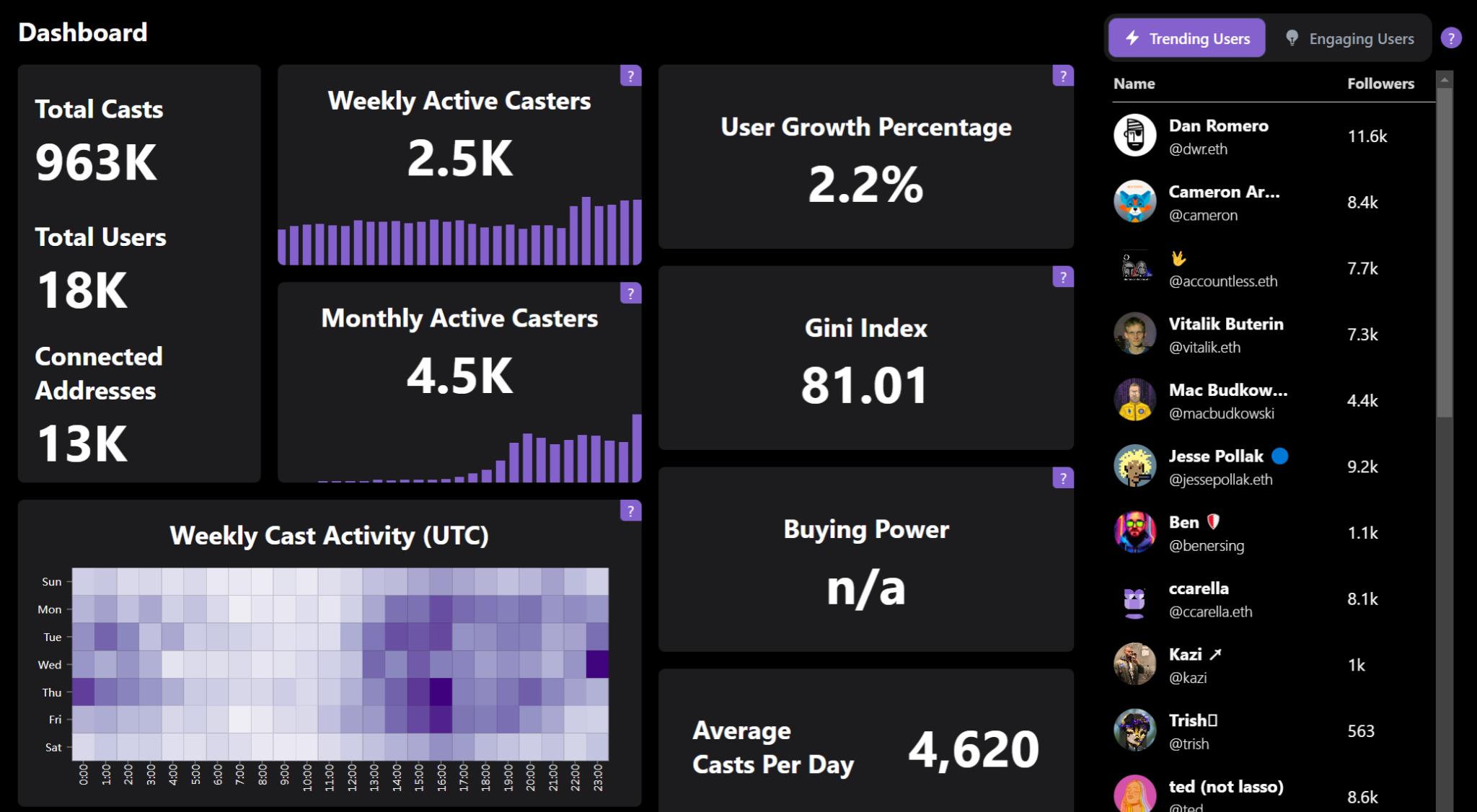

Farcaster is a decentralized social platform founded by Dan Romero, former executive at Coinbase, built on Ethereum as a Twitter alternative. Currently in beta testing, Farcaster generates and stores identity data on-chain while storing other information off-chain in a decentralized database called Hub—enabling fast, low-cost, Web2-like user experiences. Additionally, Farcaster supports self-hosted modes, allowing users to send and receive messages without relying on gateways—ensuring true decentralization. Nearly 20 derivative projects have emerged in its ecosystem, including analytics dashboards, image enhancement tools, trending topics, topic linking, and search engines.

As of August 9, 2023, Farcaster surpassed 13,000 wallet addresses, including notable figures like Vitalik Buterin. Weekly user growth stands at 2.2%, with 2,500 posts published in the past seven days. As a standalone app, its user base and engagement levels are encouraging.

Farcaster User Statistics

Source: https://farcaster.network/

Nostr

Nostr is a decentralized, open-source social transport protocol enabling developers to build DApps. It operates without centralized servers, using a client-relay architecture for message delivery. Compared to Web2, Nostr achieves full decentralization, offering censorship resistance and strong privacy protection. Damus, a decentralized Twitter-like app built on Nostr, provides a familiar interface with added benefits of decentralization, anonymity, and ad-free browsing. Though still in early development, Damus has received public endorsement from Twitter co-founder Jack Dorsey.

As a fully open, anonymous, and censorship-resistant product, Damus holds strong competitive advantages in privacy and security, serving a clear niche. However, attracting broader Web2 audiences may require new product innovations and features.

Friend.Tech

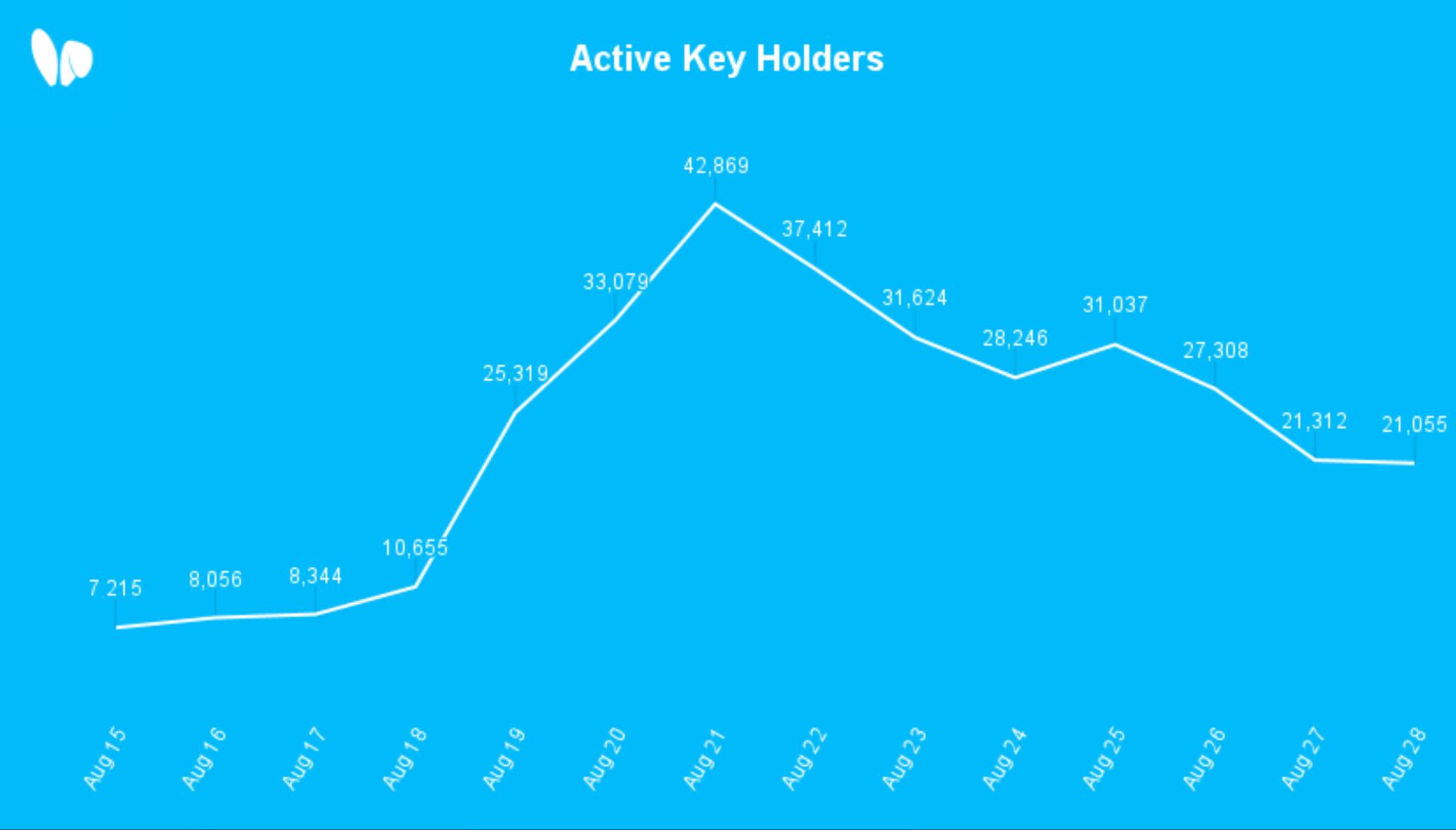

Friend.Tech is a social application funded by Paradigm and deployed on BASE, Coinbase’s L2 chain. Similar to traditional fan token or creator economy models, it allows creators to launch fan communities and issue tokens. Fans join communities by purchasing these tokens. Since launching on August 10, Friend.Tech rapidly gained traction. As shown in the chart, by August 29, 2023—within 20 days—it had attracted over 120,000 registered addresses and more than 20,000 active addresses (users who viewed profiles that day).

Source:

https://dune.com/domo/friendtech

Source:

https://twitter.com/friendtech/status/1696599323637846444/photo/1

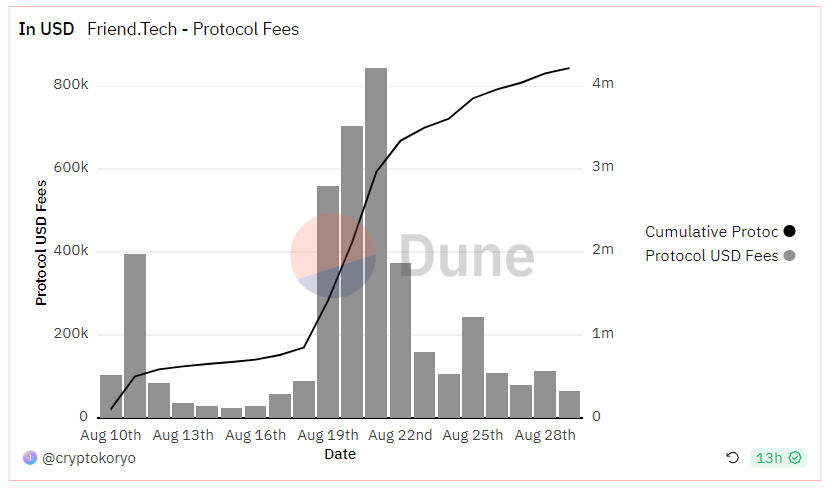

Each trade incurs a 10% fee: 5% goes to the creator, 5% to the protocol. As shown below, as of August 28, 2023, the protocol had generated over $4 million in revenue.

Source:

https://dune.com/cryptokoryo/friendtech

Friend.Tech’s rapid rise sparked renewed market interest in the social sector. What underlying mechanisms enabled such swift and large-scale user acquisition? This article argues that while Friend.Tech doesn’t fundamentally reinvent social or token design, its success follows identifiable strategies:

1. Ponzi-Inspired Fan Token Economics

Currently, fan token designs follow two main models: (1) issuing fungible fan tokens, where holding grants access to a creator’s community, with price determined by market forces, possibly augmented by buybacks, burns, staking, or revenue sharing; or (2) issuing fan NFTs, where ownership unlocks community access, with similar secondary market dynamics and additional perks like future token claims, NFT airdrops, or exclusive rights.

Generally, prior to Friend.Tech, the primary motivation for buying fan tokens stemmed from genuine admiration for creators, with price speculation playing a neutral role. Friend.Tech disrupted this dynamic by combining referral incentives with aggressive tokenomics. The platform announced it would distribute 100 million points over six months—rules undisclosed—but widely assumed to tie into future token airdrops. Combined with a referral program, this fuels user acquisition and encourages purchases across multiple creators to generate trading fees and boost point earnings. This mirrors Blur’s airdrop strategy: long-term point farming + anticipated token rewards drive usage, while extended duration increases user stickiness and ensures market share retention post-airdrop.

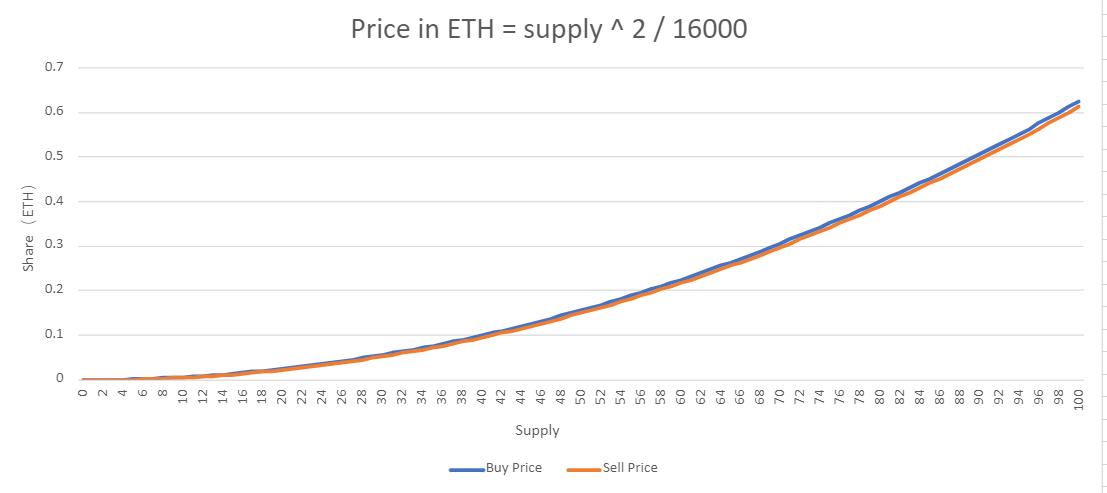

Regarding tokenomics, although official details haven't been released, Laurence Day’s widely cited model suggests Friend.Tech’s token price follows P = supply² / 16,000. Under this pricing curve, price movements become exponentially volatile. Early adopters stand to gain massive returns. This Ponzi-like mechanism drives exponential price surges before equilibrium is reached, drawing in speculative traders. This dynamic played a crucial role in the project’s rapid virality—similar to the XEN meme coin, which leveraged Ponzi-inspired token design and early-bird rewards to ignite market hype.

Source:

2. First-Mover Advantage on BASE

Although Friend.Tech previously existed on other chains, its recent surge coincided with rising attention toward BASE and the broader L2 narrative. Since Arbitrum’s mainnet launch in early 2023, the L2 sector has performed exceptionally well during the bear market. Follow-up ecosystems like Zksync, OP Stack, and BASE ignited waves of excitement. With Starknet, Scroll, and Zksync expected to launch tokens soon—and the upcoming Cancun upgrade—L2 has arguably been the hottest theme in crypto in 2023. BASE benefits further from being backed by Coinbase, a publicly traded exchange. By launching early on BASE, Friend.Tech skillfully capitalized on market momentum and timing.

3. Backing from Top-Tier VC Paradigm

As one of crypto’s most prestigious funds, Paradigm’s involvement significantly boosted credibility. Despite Friend.Tech launching with only a rough beta version, no website, and minimal documentation, the market responded with trust and enthusiasm—largely due to Paradigm’s reputation. Moreover, the similarity between Friend.Tech’s incentive design and Blur’s model suggests possible guidance from Paradigm.

In sum, Friend.Tech employs relatively conventional product mechanics but pushes boundaries in token design, user acquisition, and marketing tactics. In the short term, it may replicate Blur’s growth trajectory. However, whether it can sustain long-term social functionality remains to be seen after full product rollout.

Tooling Projects

Social tooling projects primarily serve supporting roles. Most are designed to empower other projects and DApps—for example, Lenscan (data explorer for Lens), LensDAO (community governance), Alertcaster (notification service for Farcaster), and FarQuest (survey tool). Other general-purpose utilities also fall under this category: DeBank Hi (social promotion module), Utopia (DAO treasury governance), NFT design tools, account managers, wallet organizers, etc.

Overall, the social sector is a playground for developer creativity. Beyond social graphs and tooling, especially in social applications, platforms for socializing, fandom, and media streaming are flourishing. The sector remains in its infancy, but relentless effort from builders and investors will continue to advance progress.

Risks and Challenges

While the crypto social sector attracts growing developer and capital interest, it’s essential to recognize existing risks and challenges. Key issues lie in technology, user growth, and compliance.

Technical Hurdles

Social products reside at the application layer, dependent on underlying infrastructure and technological maturity. As user numbers grow, higher demands arise regarding performance, scalability, data storage, cross-chain communication, transaction costs, and network congestion. Current infrastructure cannot yet support Web2-scale social applications.

User Growth

Beyond anonymity and censorship resistance, why would Web2 users migrate to Web3 social apps? Not everyone prioritizes privacy—many users are satisfied with existing centralized platforms. Beyond privacy-focused users, how do we attract the mainstream? If economic incentives are used, how should token models be structured to avoid circular economies or Ponzi traps? While Web3 social has achieved notable buzz and traffic, much of it remains confined within the crypto-native community. Moving forward, projects must decide whether to fix flaws in existing platforms or invent entirely new functions and needs.

Compliance

Web3 social’s key differentiators from Web2 are threefold: (1) decentralization, censorship resistance, and privacy; (2) user-owned data; and (3) monetization of data ownership. Ironically, these strengths could also become liabilities. Decentralized platforms may attract bad actors involved in illicit activities and draw scrutiny from regulators. As the sector matures and user bases expand, developers must proactively address security risks and potential regulatory inquiries.

Conclusion

The Web3 social sector is in its early developmental stage, relying on progress in foundational technologies such as cross-chain messaging, data storage, reduced transaction costs, and regulatory clarity. Current offerings include social graphs, tools, and applications, with social graphs forming the base layer and applications exhibiting the greatest variety. Numerous developers are experimenting with Web3 social products, and capital is increasingly flowing into the space. Events like the launch of the Cyber token, Twitter’s rebranding, and creator incentive programs reflect rising market interest. While opportunities abound, so do challenges—including immature infrastructure, user growth bottlenecks, and compliance risks. Overall, we view the Web3 social sector as highly promising in terms of development outlook, trends, and market热度. As infrastructure improves, products evolve, capital concentrates, and tokens list, this sector holds strong investment potential and bright long-term prospects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News