LongHash: 3 Trends in Smart Accounts—Modularization, Specialization, and Multi-chain Integration

TechFlow Selected TechFlow Selected

LongHash: 3 Trends in Smart Accounts—Modularization, Specialization, and Multi-chain Integration

The days of wallets serving merely as signing tools are long gone; now, they are the new battleground for permissionless and composable innovation.

Written by: LongHash Ventures

Translated by: TechFlow

Around 10 years ago, frontend frameworks like React, Angular, and Vue accelerated Web2 adoption by shifting server-side logic to the client side. Decoupling frontends from backends enabled users to interact with applications more seamlessly.

Similarly, as smart accounts bring more logic under direct user control—such as batch transactions and customized gas payments—they are expected to improve cryptocurrency user experience and accelerate Web3 adoption.

To achieve this, we believe two shifts will occur:

-

A shift from externally owned accounts (EOAs) to modular smart accounts;

-

A shift from general-purpose wallets to specialized smart wallets.

Why Modularity?

Developing and maintaining account abstraction (AA) infrastructure such as batched transactions, paymasters, and session keys is no easy task. For example, session keys require secure storage infrastructure. To remain competitive in account features without bearing the burden of infrastructure maintenance, future wallets are more likely to integrate bundlers, paymasters, and session key modules built by specialized infrastructure providers rather than build these capabilities in-house.

Additionally, wallets can integrate modules to extend functionality (e.g., privacy) or provide transaction safeguards (e.g., spending limits). These modules require thorough auditing, so wallets may prefer to integrate battle-tested modules instead of building their own.

Wallets may also integrate external modules to:

-

Incorporate convenient off-the-shelf features (e.g., Safe {Wallet} integrating Redefine’s transaction risk scanner), or;

-

Leverage modules that have already achieved network effects (e.g., a future anti-scam module could maintain maximum scam coverage).

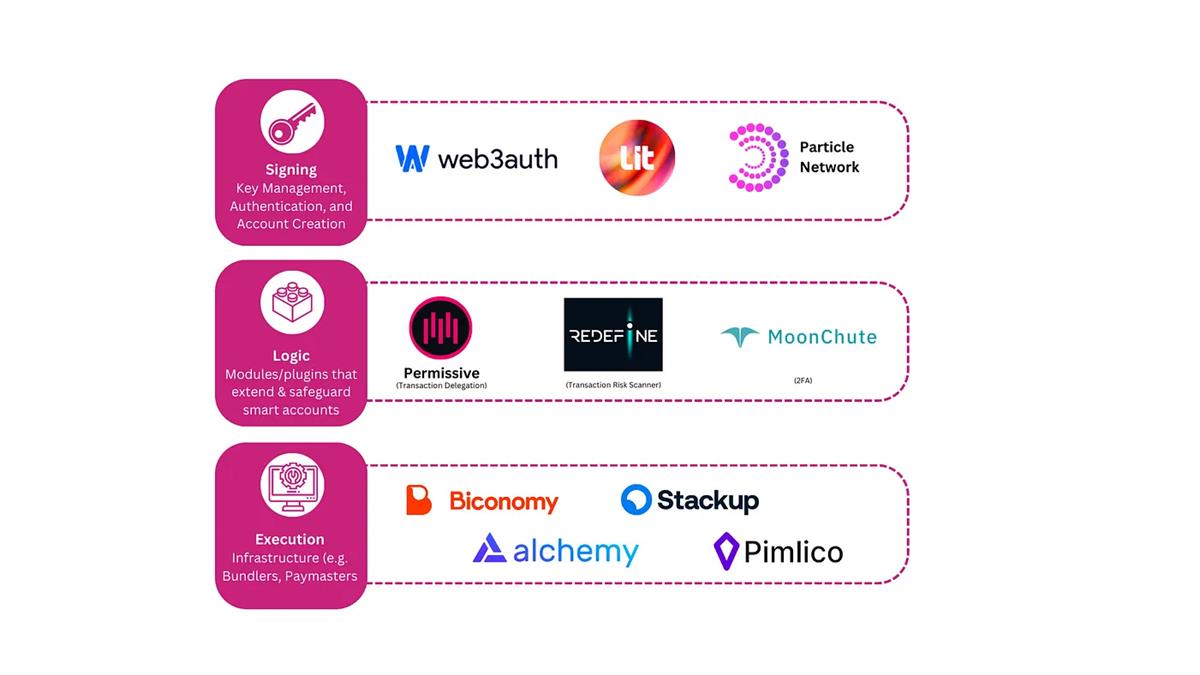

The developer stack for creating their own smart wallet or embedding one into their dApp looks like this:

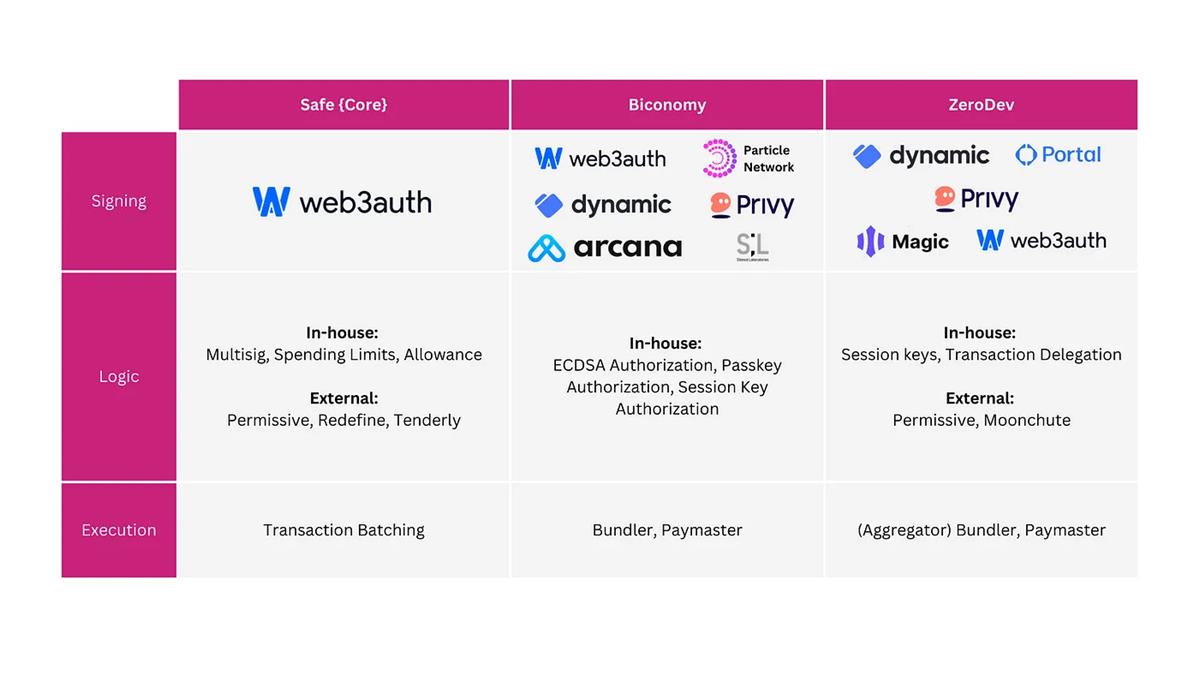

On top of these independent components, three aggregators have emerged—Safe {Core}, Biconomy, and ZeroDev—that bundle together signature methods, logic modules, and execution infrastructure, functioning like a “module app store.”

They simplify the developer experience of building smart accounts by offering integrated, scalable wallet-as-a-service solutions. For instance, ZeroDev abstracts developers away from the complexity of ERC-4337 by aggregating and routing user operations through various bundlers and paymaster infrastructures, while providing multiple optional Web3 onboarding/signature solutions.

While full-stack solutions aggregate existing mature infrastructure, the module market remains relatively immature. As shown in the diagram below, most modules today are still built in-house by the “module app stores” themselves.

One factor modules consider when choosing which ecosystem to join is access to customers. We see early signs of this in modules like Redefine and Tenderly choosing to build on Safe, leveraging its established user base among DeFi-focused institutions.

Beyond customer access, we expect leading ecosystems to be built on factors like perceived security, developer experience, and network effects from a scalable module/plugin ecosystem.

These “module markets” appear to be among the most monetizable areas in smart account infrastructure, as they can build defensible moats around network effects from both modules and users, and generate revenue through revenue sharing, platform fees, MEV capture, and module audits.

Why Specialization?

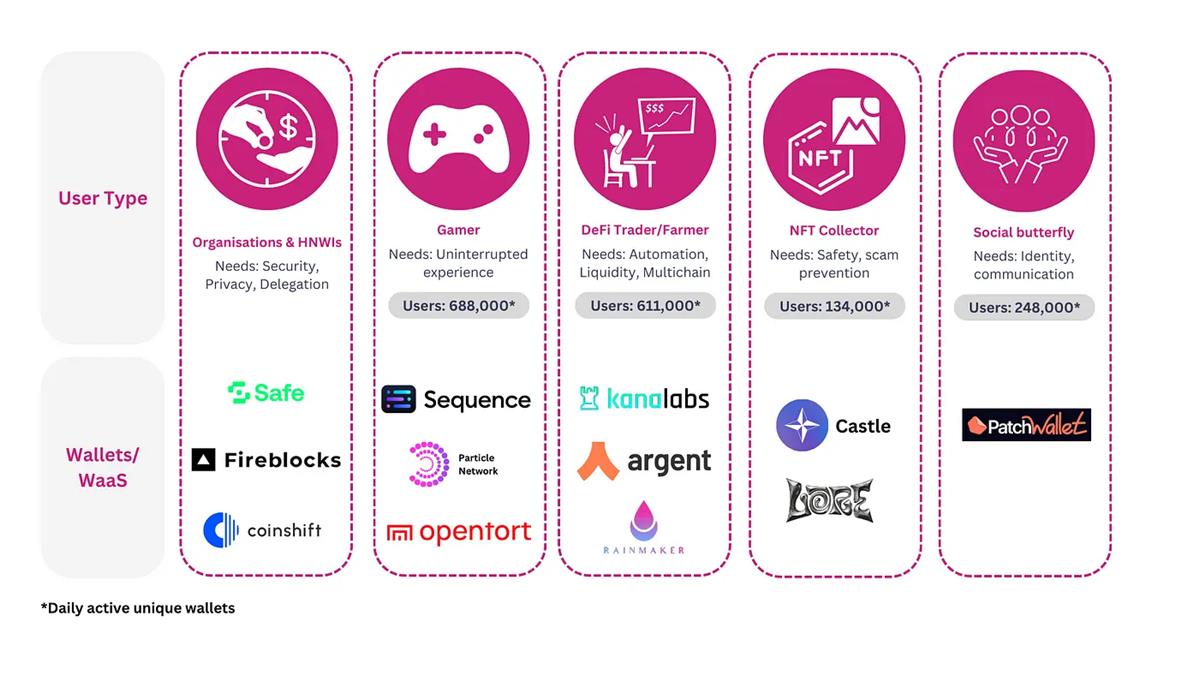

We believe that as Web3 use cases and users become increasingly diverse, general-purpose wallets will fail to meet the needs that customized wallets can fulfill. Safe {Wallet} is a prime example, filling an organizational security need unmet by Metamask. Even Metamask itself is now launching Snaps to enable customization for specific use cases—albeit still within an EOA framework.

Modular smart accounts allow permissionless composition of smart account modules to create specialized wallets. By enabling users to enhance their smart accounts with modules in a permissionless way, users will gain access to wallets better aligned with their specific Web3 needs.

For example, Castle specializes its smart wallet for high-net-worth NFT owners by leveraging Safe’s battle-tested multisig contracts to secure their NFTs, and plans to integrate anti-scam and transaction simulation modules for added security in the future.

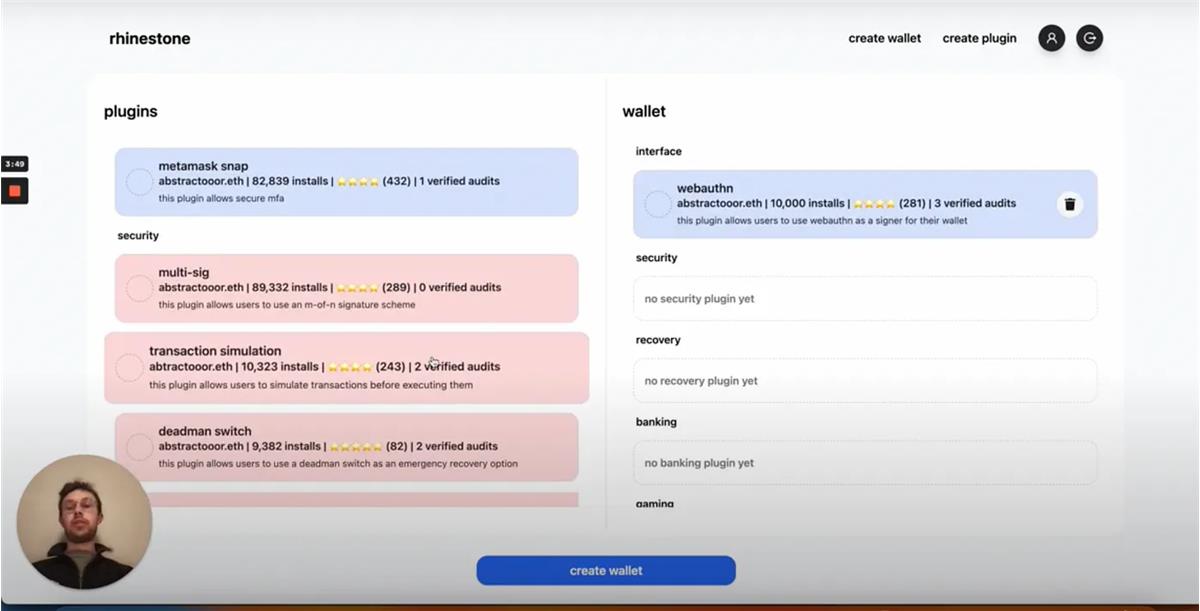

Rhinestone is a new project envisioning a future where users can drag-and-drop smart account modules to create their own custom wallets. This would allow casual mobile gamers, for instance, to log in via Face ID on their safe zone, use session keys, and lend out NFTs within a time-bound window.

As new Web3 domains find product-market fit, we expect specialized wallets to capture market share by aligning more closely with specific user needs. Gamers, DeFi users, and NFT collectors already have smart wallet options available, but competition remains intense with no clear dominant player yet.

The emerging Web3 social space also lacks a mainstream smart wallet. Patch Wallet is a new project that gives anyone with a Twitter account a default smart account (even before registration), bridging Web2 social networks with crypto wallets—but there are currently no other compelling projects in this space.

While gaming and decentralized finance (DeFi) attract the majority of crypto users, Web3 social remains an emerging domain without a standout smart wallet.

We believe smart accounts will be vertically customized in the following ways:

-

Institutions and high-net-worth individuals (HNWIs): It's hard to imagine institutions and HNWIs not using wallets built atop the Safe protocol, which has already gained Lindy effect as a strong moat. Wallets built on this protocol—like their own Safe Multisig {Wallet}—could combine privacy, delegation, and anti-scam modules. A mobile wallet focused on institutions, secured by Safe, that simplifies accessibility and UX, remains an untapped opportunity.

-

Gamers: Game asset interoperability is often limited, and game studios prioritize smooth onboarding for new users. Therefore, we believe embedded wallet-as-a-service solutions that offer seamless, low-cost entry and key management—with features like transaction delegation (e.g., allowing dApps to automatically return lent NFT assets after a lease period) and session keys—will dominate this segment.

-

DeFi traders and miners: Financial participants rarely distinguish between apps, prioritizing liquidity aggregation, automation, and multi-chain coverage. We predict app-like DeFi wallets that aggregate liquidity, curate DeFi strategies, and abstract multi-chain complexity will lead the DeFi-focused smart account market. They could also include MEV-savvy bundlers that auction MEV from user transactions and return it as rebates.

-

NFTs: Given the prevalence of fraud in this space, the next generation of modular smart accounts for NFTs will emphasize security through transaction simulation and anti-scam features, while enhancing NFT discovery via curated and personalized frontends.

-

Social: The key to decentralized social is interoperable identity. Thus, social-focused smart accounts must enable cross-social-network interoperability (rather than being embedded). Mobile wallets could offer better accessibility but would need to provide access to multiple social networks via aggregation, APIs, or mobile browser extensions (similar to Dawn Wallet).

Across verticals, we expect bundled transactions and gas subsidies to become commoditized and standard features of specialized smart wallets.

Heavy on-chain users, institutions/organizations, and high-net-worth individuals may also favor wallets integrated with privacy modules to protect their on-chain footprints. However, for privacy to achieve mainstream adoption, private transactions must be completely frictionless.

Endgame: Multi-chain

Looking ahead, for modular smart accounts to succeed, we need:

-

Interoperability, through standards ensuring modules can be composed together (EIP-6900 is currently in draft);

-

Discoverability, via the aforementioned “module app stores” and registries like Rhinestone;

-

Security, potentially through minimum viable standards that modules must follow to prevent issues like storage collisions.

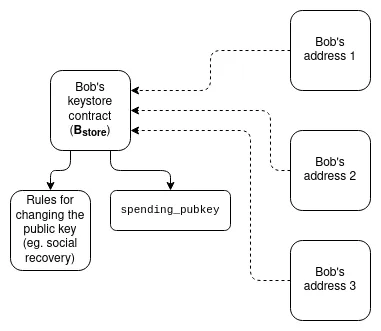

Critically, in the future, as users deploy multiple smart contract accounts across multiple chains, we need to abstract away the multi-chain experience.

For example, if a user needs to sign multiple transactions across multiple chains to change their guardian or add an authorized module, that would be extremely cumbersome. They should only need to sign once, allowing dApps/wallets to execute multiple user operations across chains.

Vitalik has suggested that smart account keys could reside on one chain (e.g., L1 or L2) via a “key storage contract.” Validation logic on accounts across other chains would point to this contract, and spending from accounts on other chains would require submitting a proof (e.g., zk-SNARK) to the contract.

Biconomy is also building a module called “Multichain Session Keys,” enabling dApps to embed smart accounts that execute user operations across multiple chains with a single signature by constructing a Merkle tree. To simplify the experience of transferring funds across different chains to different addresses, Peanut Protocol leverages Axelar to enable cross-chain transfers via URL.

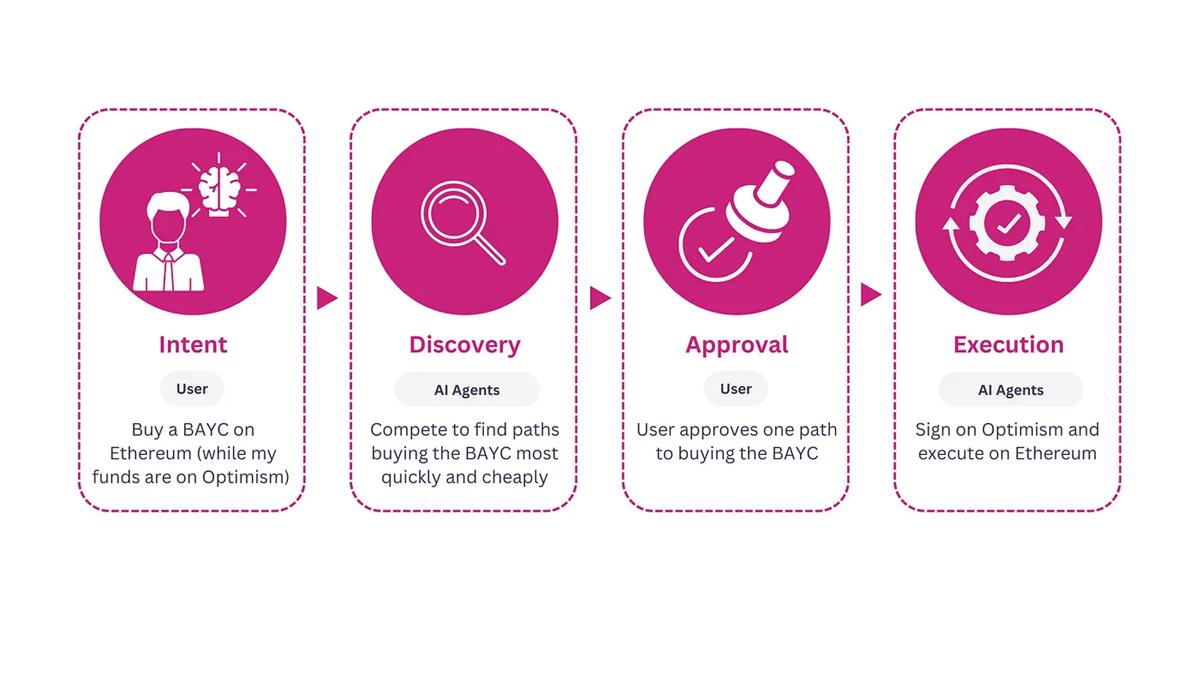

In the more distant future, we expect smart accounts to integrate intents and AI agents.

We envision future smart wallets being able to:

-

Use LLMs to generate user intents;

-

Allow users to delegate transaction execution to the smart wallet within customizable constraints, while remaining self-custodial;

-

Read user intents and prompt for approval;

-

Abstract the cross-chain experience and execute user intents via a decentralized network of AI agents/solvers.

To realize this vision, we need:

-

A gradually decentralized, permissionless network of AI agents/solvers to find the “optimal path” for fulfilling user intents, similar to CoW Protocol’s solvers;

-

Integration into applications across different chains, possibly via AMP (Arbitrary Message Passing) protocols such as Axelar or LayerZero.

The key challenge lies in building an intent-centric, AI-driven protocol that allows users to delegate execution to third-party AI agents while remaining self-custodial, and ensuring the solver network is sufficiently decentralized. If successful, it could become the default way users interact in a multi-chain world.

The first AI-powered cross-chain smart account might be general-purpose, but over time, specialization by vertical is likely. The Banana Wallet team is also integrating Axelar to abstract the multi-chain experience for Safe smart accounts and recently cracked an intent-centric wallet app at ETHcc.

In summary, we expect smart accounts to evolve from monolithic, one-size-fits-all designs to modular, specialized ones. They will abstract multi-chain experiences and integrate intents, becoming the default interface for Web3 users in a multi-chain world.

Driving this transformation will be module builders. While batch transactions and gas subsidies are essential for improving the crypto experience, it will be the innovation of module builders—especially those focused on abstracting multi-chain complexity—that propels the major shift from EOAs to modular smart accounts.

The days of wallets merely serving as signing tools are over. Now, they are the new battleground for permissionless and composable innovation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News