Tokenomics 101: How to Create and Accumulate Real Value?

TechFlow Selected TechFlow Selected

Tokenomics 101: How to Create and Accumulate Real Value?

Tokens are a novel invention. They are easy to create, track, exchange, and settle. They are far superior to traditional securities.

Written by: SAM ANDREW

Compiled by: TechFlow

Token value accrual is critical. Valuable tokens secure their blockchain. Validators require economic incentives to participate honestly. They need to be rewarded in tangible value. Without incentives, they will stop validating. A lack of validators jeopardizes blockchain security.

There are now over 2,500 tokens. Token types have expanded beyond L1s. Blockchain tokens are those used to secure the network of a blockchain. Bitcoin (BTC), Ethereum (ETH), SOL, AVAX, and NEAR are examples of native blockchain tokens. Protocols and applications running on blockchains have their own tokens. In crypto, value creation and accrual have become increasingly important. Native blockchain tokens have clear utility and thus value. This is not necessarily true for protocol- or application-related tokens. Moreover, in all token cases, value accrual and distribution have become muddled.

This article outlines four pathways through which tokens gain value, detailing their drawbacks and how they relate to different token types.

Tokens can gain value through four mechanisms:

-

Utility

-

Productive assets

-

Store of value assets

-

Governance rights

Utility

An asset has utility value if it consumes labor or materials in some endeavor. Commodities and money are examples of utility. They are often called consumable or convertible assets. For example, gasoline is consumed when driving a car; euros are used when vacationing in Europe. They are useful and valuable because they provide a means to an end—transportation and vacation in these examples.

Tokens have utility value. Tokens are used as a medium of exchange on blockchains. Users pay with a blockchain’s native token to purchase block space. Validators are paid in the native token to ensure transactions are correctly recorded on-chain.

L1 blockchains require native tokens. Native tokens enable decentralization and coordination among different parties. They prevent blockchains from being subject to central authority. Imagine if Ethereum interactions were priced in U.S. dollars—the decentralized, permissionless model would collapse. A central actor, the U.S. government, would control Ethereum. That entity could censor transactions or reorganize blocks, undermining one of blockchain's core purposes.

Native tokens are essential for designing decentralized, permissionless networks. But this isn't true for all token-based projects. Beyond L1s, there are often no validators to reward. Projects create artificial demand points to give their tokens a semblance of utility. For instance, their native token may be required to interact with their protocol. Token holders are incentivized to "stake"—a misnomer. Such "staking" has nothing to do with validating transactions but rather discourages token sales, artificially inflating the token price.

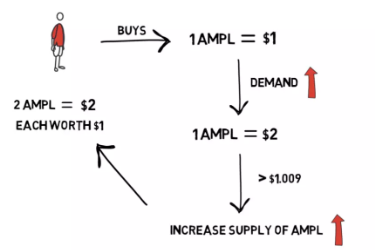

This creates a reflexive model. The more people interact with the protocol, the greater the buying demand and the more tokens get locked up. But once buying demand slows, there’s little to support the token price—and it collapses.

Artificial utility makes sense. Entrepreneurs, developers, and communities behind useful protocols deserve compensation through tokenomics—and they should be rewarded for building useful technology. However, artificially creating token "utility" solely for team compensation results in suboptimal tokenomic models. Balancing token design between developer rewards and long-term sustainability is necessary for the industry’s continued growth.

Token "utility" can also be a disguise. Tokens cannot directly represent equity-like interests in a protocol without risking regulatory scrutiny. Instead, tokens may offer non-essential utility functions and trade as synthetic equity.

The cryptocurrency market hosts many types of tokens. L1 tokens have clear, necessary utility. For other tokens, utility may be ambiguous.

Productive Assets

Productive assets generate returns. Real estate, company stocks, and bonds are productive assets. They’re also known as capital assets. They produce something of value. People buy them based on expectations of future returns or contractual obligations. Bonds contractually obligate issuers to pay disclosed interest rates. Real estate owners earn returns via rental income. Equity holders have claims on corporate cash flows, earning returns either through reinvestment or shareholder distributions.

Tokens exhibit characteristics of productive assets. They produce something valuable that people are willing to pay for. They generate revenue and incur costs. The difference is profit. L1 tokens typically redistribute earned profits by burning tokens—removing them from circulation.

Beyond L1s, profit accrual and distribution remain unclear. This may stem from regulatory uncertainty. If a token distributes profits to holders, it might be classified as a security.

The market is grappling with how token value accumulates. Some argue protocols that don’t charge fees or accrue value are inherently worthless. Others claim fee avoidance helps consolidate market share and sidestep regulatory risks. Reinvesting capital into growth may yield higher returns than distributing it to token holders.

Many Web3 protocols are likened to Amazon. Amazon operated at a loss for decades to solidify dominance, returning capital to shareholders only occasionally through minimal buybacks. This analogy holds partially. Yes, protocols may be reinvesting like Amazon to grow. But Amazon always retained discretion over capital allocation—weighing reinvestment against shareholder returns. For protocols, such alternatives are less clear, at least for now.

The key takeaway for any protocol today is how it creates value, captures that value, and plans to distribute it in the future. Within this framework, the Amazon analogy works. If the market believes a protocol can create and capture value while responsibly managing capital, distribution becomes less urgent. If a protocol fails to capture value or misallocates capital, distribution mechanisms become critical.

Protocol treasuries are increasingly accumulating economic value. How these treasuries manage accrued capital will become a central issue. Will treasuries distribute capital to token holders? If so, how? Will they reinvest? Who decides? How are trade-offs evaluated? Suddenly, code that launched a protocol now requires organizational structures to govern value distribution.

Store of Value Assets

Store of value assets include art, collectibles, and gold. Their value stems from scarcity and social status. People believe they’re valuable—so they become valuable. It’s a memetic effect. Gold didn’t instantly become a store of value; it evolved over centuries. When Da Vinci painted the Mona Lisa, he wasn’t aiming to create a store of value—it became one over time. Satoshi aimed to build a peer-to-peer electronic cash system enabling trustless online payments. The Bitcoin whitepaper never mentions “store of value.”

An asset cannot be designed as a store of value. It’s a label conferred over time due to certain properties and social developments. Thus, “store of value” is largely irrelevant today for crypto assets beyond Bitcoin and Ethereum.

Governance

Governance rights only have economic value if they pertain to economically valuable assets. This economic value can manifest in productive or commodity assets. Just as voting rights on how a company or protocol allocates capital are valuable, so too are votes within OPEC on oil production levels.

In crypto, governance itself has no inherent value. It must be tied to assets with productive or utility value.

Summary

Utility and productive assets are the two most important pathways for crypto assets. A protocol needs a utility component to get someone to buy its token initially, and a productive asset component to get someone to hold it long-term. Bitcoin and Ethereum are unique. Both possess utility and store-of-value attributes. Additionally, Ethereum exhibits productive asset characteristics.

I suspect the value of "utility" (beyond L1 protocols) will diminish over time.

Beyond L1 blockchains, many applications/protocols may not need native tokens. Liquid staking protocols could operate using liquid staking derivatives alongside ETH or stablecoins. Decentralized exchanges could function similarly.

Native tokens are sometimes created primarily as a monetization tool—a quasi-equity that isn’t actually equity. To comply with regulations, it’s wrapped in a veneer of "utility."

Ironically, the "utility" aspect of tokens may undermine value. Protocols distribute tokens to users to drive utility—e.g., requiring tokens to interact with the protocol. Airdrops serve this purpose. But as more tokens are issued, the protocol’s future value gets divided across more tokens, diluting each token’s worth.

Regulatory clarity might eliminate the need for token utility. Protocols could then discard unnecessary and costly issuance and reflexive token models. Users could simply use the native L1 token or stablecoin of the underlying blockchain to interact with protocols. This would greatly improve user experience. Crypto currently demands a different token for nearly every use case. Interacting with each L1 requires its native token. Using an app may require yet another. All must be acquired upfront. Bridging assets across chains introduces hacking risks. It’s a nightmare for users.

Imagine needing a different currency to shop at every store. That would be inefficient chaos. This is the crypto experience.

Globally, there are 180 currencies, but most international trade occurs in USD, CNY, and EUR. The crypto economy will likely follow suit. Most interactions will revolve around a few utility assets. Behind the scenes, many different tokens may facilitate these interactions—but users won’t notice.

If tokens don’t need to hide behind utility, they can transparently serve as quasi-equity for many.

Wait… isn’t that just recreating the securities we already have?

Sort of—but better.

Tokens are a novel invention. They’re easy to create, track, trade, and settle. They vastly outperform traditional securities. Blockchains using tokens are more efficient and transparent than our outdated financial infrastructure.

I believe tokens will represent blockchains, crypto protocols, and off-chain assets mapped on-chain. Beyond L1s, token value will stem primarily from their productive attributes. Most tokens will be viewed as productive assets. Their value will depend on product quality, market demand size, and network effects. Only a few crypto assets will combine utility, productive, and store-of-value properties.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News