Beginner's Guide: What Is Tokenomics?

TechFlow Selected TechFlow Selected

Beginner's Guide: What Is Tokenomics?

It is crucial to carefully evaluate a project's tokenomics before deciding to participate.

Why should we study tokenomics?

For various Web3 projects, a well-designed token economic model is key to success. Therefore, when developing a project, careful design of the token economy is essential to ensure long-term sustainability.

For ordinary users, thoroughly evaluating a project's tokenomics before deciding to participate is a crucial step—only by fully understanding the project itself can one improve the likelihood of investment success.

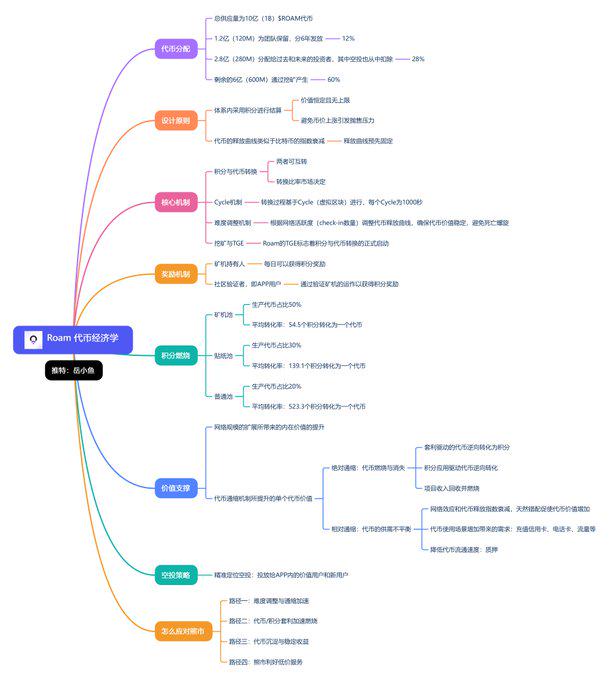

Roam, a leading DePin project previously analyzed, has recently released its tokenomics. We can use this project as a case study to understand how to evaluate the strengths and weaknesses of a token model. @weRoamxyz

(The following mind map summarizes Roam’s tokenomics)

When analyzing a token economic model, four main dimensions should be considered: token supply (supply side), token utility (demand side), token distribution (holder composition), and token governance (long-term ecosystem).

1. Token Supply

The core indicators for assessing token supply are:

(1) Maximum supply: the upper limit of tokens defined in code;

(2) Circulating supply: the number of tokens currently in circulation; (circulating tokens are mainly influenced by two factors: vesting schedules of the development team and investors, and ecosystem incentives)

(3) Current market cap: current price × circulating supply

(4) Fully diluted valuation (FDV): current price × maximum supply (if a new project's price is highly inflated—even reaching an FDV exceeding industry benchmarks like Bitcoin—it may be unsustainable)

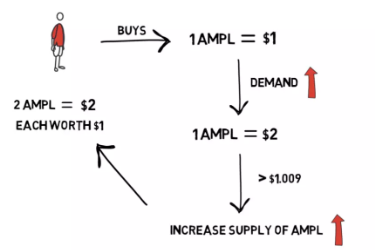

Another important factor affecting token supply is the token burn mechanism: continuously reducing token supply leads to deflation; conversely, increasing supply results in inflation.

Now let’s look at Roam:

Total supply is 1 billion (1B) $ROAM tokens;

120 million (120M) are reserved for the team, distributed over six years, indicating the team’s long-term commitment;

280 million (280M) are allocated to past and future investors, with airdrops deducted from this portion—this constitutes the actual initial circulating supply;

The remaining 600 million (600M) will be mined over time, allowing ongoing participation and avoiding a “pump-and-dump” scenario post-launch.

The project team has also mentioned plans to conduct token buybacks using business revenue.

Overall, Roam follows a deflationary model, which provides strong value support.

2. Token Utility

Token utility reflects the intrinsic value of a token—whether it has real-world use cases and can attract sustained user adoption, i.e., demand-side fundamentals.

Token utility can be categorized into three aspects:

(1) Practicality: Gas fees (e.g., Ether used to pay for computational resources), real-world payments (e.g., Bitcoin, usable for actual transactions)

(2) Value accrual: Staking (security-type tokens that generate yield from protocol earnings), governance (governance tokens allow holders to vote on changes to the protocol)

(3) Meme and narrative: "Meme" refers to internet-born cultural phenomena that spread rapidly—Dogecoin being the quintessential meme coin, gaining popularity not through utility but via viral memes

Looking at Roam, its token is primarily used within the ecosystem—for paying network service fees, redeeming free roaming data, or accessing other features.

Relatively speaking, it has solid value backing and is far from being a useless "air token."

3. Token Distribution

There are two primary methods for launching and distributing tokens:

(1) Fair launch: no pre-allocation occurs before public release—no individual or group receives tokens ahead of the general public. Bitcoin is a classic example;

(2) Pre-mine launch: a certain amount of tokens are minted and allocated to specific groups (such as founders or venture capitalists) before public availability. Ethereum conducted a pre-mine.

Roam clearly did not have a fair launch but instead adopted a pre-allocation model, consistent with typical VC-backed project logic—investors expect returns.

We should also examine the composition of token holders: large institutions and individual investors often behave differently.

Understanding the types of entities holding the tokens allows us to infer potential trading behaviors, which in turn influence token value.

Additionally, we need to assess whether token distribution is equitable: heavy concentration among a few large institutions typically indicates higher risk.

If patient investors and the founding team hold the majority of tokens, their interests are better aligned, increasing the chances of long-term success.

The Web3 industry standard is to allocate at least 50% of tokens to the community, effectively diluting ownership retained by founders and investors.

We must also understand the token lock-up and release schedule—checking whether large volumes of tokens could enter circulation and exert downward pressure on price.

4. Token Governance

How to incentivize participants to ensure long-term sustainable development is a central question in tokenomics.

Many Web3 projects incorporate staking mechanisms into their token models.

Staking can enhance token value in two ways:

First, staking rewards create passive income, meaning the token’s floor value becomes a multiple of future reward value;

Second, locking up tokens reduces tradable supply, which can indirectly support price appreciation.

In Roam’s case, staking is offered to reduce post-launch selling pressure and lower effective circulating supply—now considered a standard feature.

Finally, to summarize:

The tokenomic design of Roam in this case is quite reasonable, adhering to long-termism and sustainability principles.

Only by controlling supply, increasing demand, and supporting these with sound governance mechanisms can a token’s value be sustainably maintained.

We observe that a robust tokenomic model must include three key elements:

(1) A rational staking mechanism: staking aligns user incentives with project value and helps regulate token supply. Curve’s ve-token (vote-escrowed) model has proven particularly effective;

(2) Expanded use cases: this remains the biggest challenge for every project—use case expansion must be driven by organic business growth;

(3) Steadily growing business revenue: while token incentives may attract users initially, Ponzi-like models eventually collapse. The critical factor is whether the underlying business can generate real value;

Tokenomics are extremely important, but everything ultimately depends on the intrinsic value of the business—otherwise, it's just a valueless "air token."

Currently, tokenomic models continue to evolve rapidly. Stay tuned for innovative models emerging in the market.

Nevertheless, despite constant changes, the core analytical framework remains unchanged: token economics can always be evaluated through the four dimensions of supply, demand, distribution, and governance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News