Understanding the Tokenomics of Seven Inspirational Projects from the Previous DeFi Summer

TechFlow Selected TechFlow Selected

Understanding the Tokenomics of Seven Inspirational Projects from the Previous DeFi Summer

Innovation from zero to one is extremely difficult, and this is also true for token economics.

Written by: Ignas

Compiled by: TechFlow

Innovation from zero to one is extremely difficult—and tokenomics is no exception. Yet occasionally, an innovative token emerges that shifts the trajectory of the entire industry.

There were several such examples during the last DeFi bull market.

The innovations from the previous bull run have provided valuable lessons for the next cycle, teaching us how to identify new alpha opportunities. This short article aims to share my personal top 7 tokenomic innovation projects.

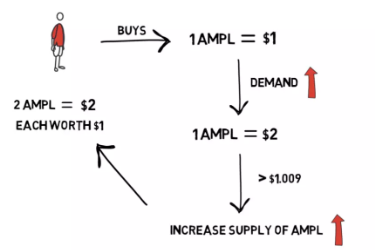

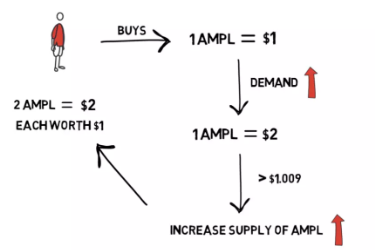

1. Ampleforth

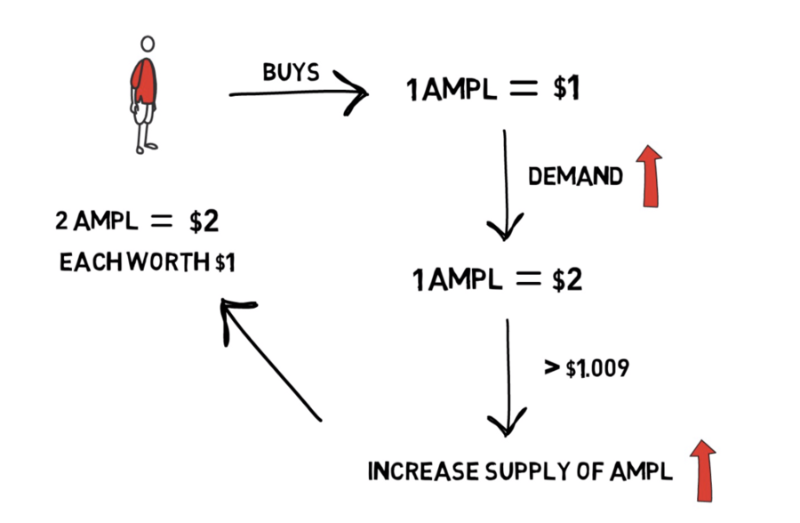

$AMPL features elastic supply—the circulating supply adjusts algorithmically every day. Its target price is defined as the purchasing power of the U.S. dollar in 2019, adjusted for CPI.

If demand for AMPL increases and its price rises above the target, the protocol proportionally "airdrops" new AMPL tokens to your Ethereum address to bring the price back toward the target.

This so-called "rebase" feels like magic: your token balance changes right in your wallet.

2. OlympusDAO

$OHM aims to become the reserve currency of DeFi.

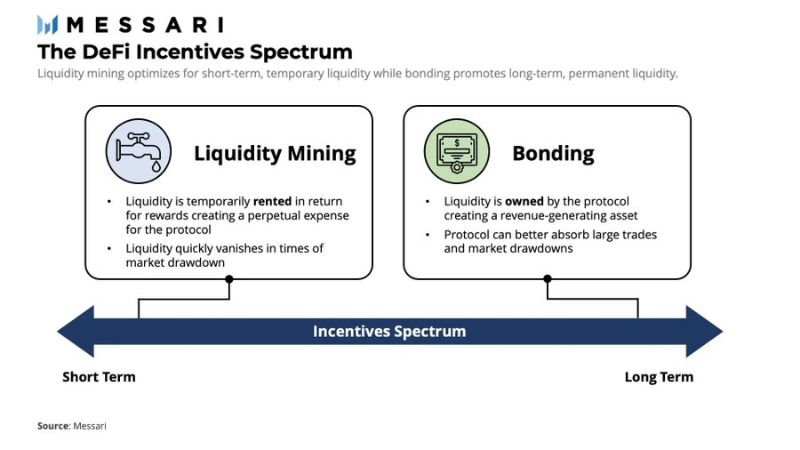

Olympus revolutionized liquidity mining by selling OHM at a discount through "bonds" in exchange for liquidity provider tokens or single-asset tokens. This way, Olympus owns its liquidity instead of renting it.

Protocol-controlled liquidity was a groundbreaking concept in tokenomics, so impactful that it gave rise to the term DeFi 2.0.

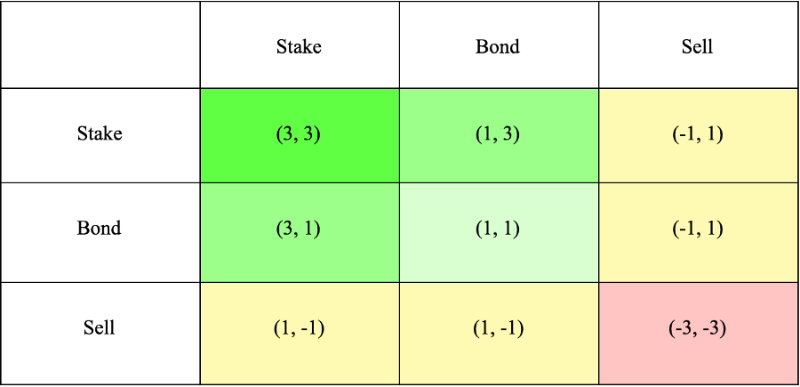

Moreover, Olympus’s bond and re-staking mechanics became a popular (3,3) meme across Crypto Twitter.

OHM’s success spawned dozens of forked tokens, several of which performed quite well.

3. Compound Finance

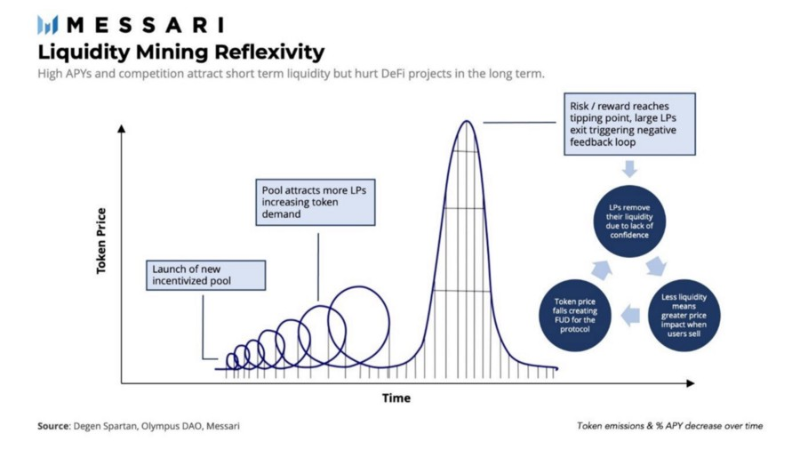

The real innovation of COMP lies in its distribution method: liquidity mining.

Anyone who lends or borrows assets on Compound Finance receives free COMP tokens.

Within a week of launch, Compound's TVL surged from $90 million to $600 million.

COMP quickly became the most traded DeFi token at the time.

Although not the first project to introduce liquidity mining, Compound’s success ignited the DeFi Summer.

It was because of $COMP that yield farming truly began.

4. Curve Finance

ve tokenomics changed the game theory of liquidity mining. The optimal strategy to earn COMP rewards was to frequently harvest and sell COMP for compounding returns. But Curve required CRV stakers to lock their tokens for up to four years to maximize yields.

The result: Curve’s long-term lockups and distribution model bought time for protocol development, adoption, and revenue growth.

The project’s success meant the value proposition of CRV was strong enough that even after token unlocks, CRV would likely not be dumped.

5. Yearn

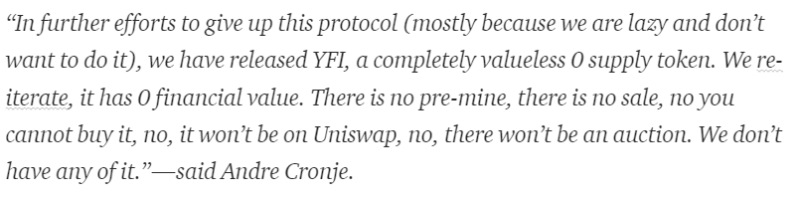

$YFI sparked trends in DeFi around “fair launches” and “governance tokens with no intrinsic value.”

No VC token sale, no team or advisor allocations—all YFI was directly distributed to the community.

The goal was to align incentives between users and developers, encouraging users to actively participate in building the protocol.

However, Andre Cronje later admitted that this method of giving away tokens was a mistake.

6. Nexus Mutual

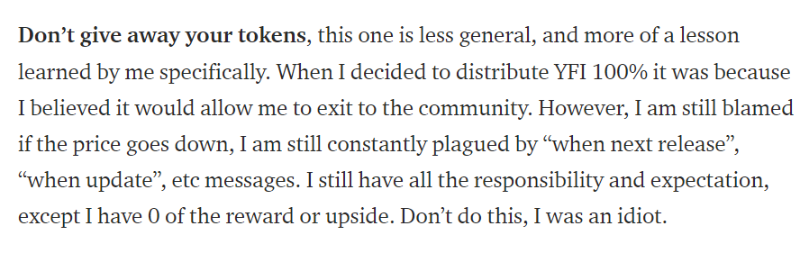

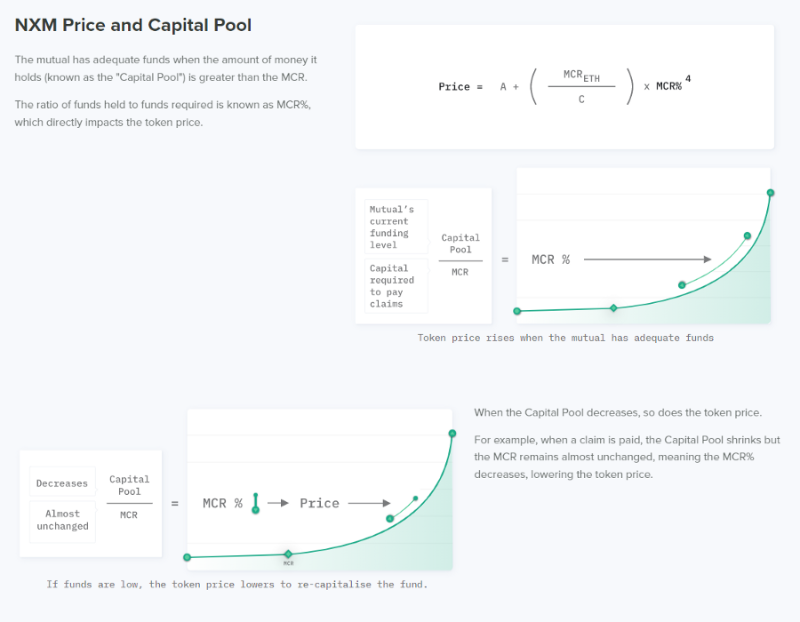

Nexus Mutual is an on-chain insurance protocol where NXM token holders can become members of the protocol.

Members contribute ETH into a pool, sharing risk collectively when paying premiums for coverage.

However, these membership tokens cannot be traded on Uniswap or any other exchange.

All members must pass KYC to purchase—this has been a controversial aspect of the project.

If the regulatory environment for DeFi worsens, more protocols might adopt this KYC-based token model.

7. Synthetix

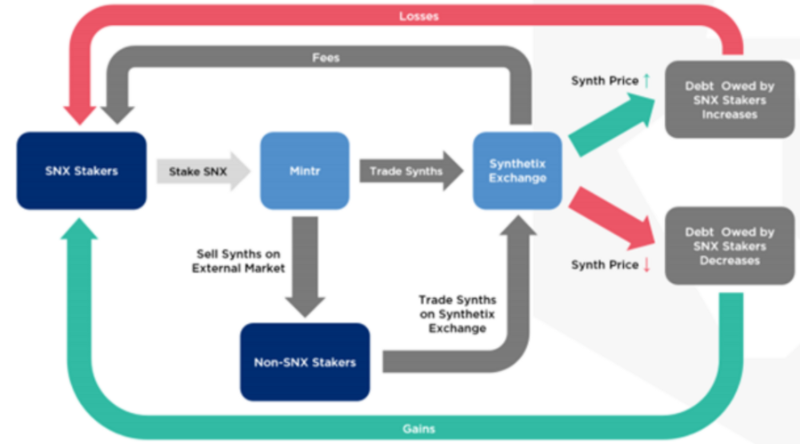

$SNX is used as collateral to mint the synthetic stablecoin sUSD. This innovation successfully pegs sUSD to the U.S. dollar, despite being backed by the highly volatile SNX token.

$SNX holders are incentivized to stake their SNX and mint sUSD, while maintaining a collateralization ratio (C-Ratio) of at least 400%.

Stakers receive additional SNX rewards and protocol fees weekly—but only if their C-Ratio remains at or above 400%.

More importantly, SNX stakers incur a “debt” when they mint sUSD.

When sUSD is used to trade other synthetic assets whose prices fluctuate, this debt also changes.

This means SNX stakers bear the risk of the system’s total debt—known as global debt.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News