IRS DeFi Broker Rule Repealed, CRV Surges 54% in One Week

TechFlow Selected TechFlow Selected

IRS DeFi Broker Rule Repealed, CRV Surges 54% in One Week

CRV's rebound comes amid whale position cost restructuring, derivatives market short covering, and an expanding divergence between protocol revenue and TVL.

Author: Alvis

1. Market Phenomenon Review: The Bull-Bear Battle Behind a 54% Surge in 5 Days

Over the past five trading sessions, Curve DAO's governance token CRV has staged an epic rebound, surging from a low of $0.39 on April 6 to today’s key level of $0.60—a weekly gain of 54%, making it a rare standout performer during this bear market cycle. This rally coincided with the U.S. Internal Revenue Service (IRS) officially repealing the DeFi broker tax reporting rule, a policy tailwind that directly ignited bullish sentiment. Yet deeper forces are at play: CRV’s value foundation is undergoing a paradigm shift—from panic over liquidity crises toward a revaluation of its ecosystem worth.

On-chain data reveals three critical signals behind this rally:

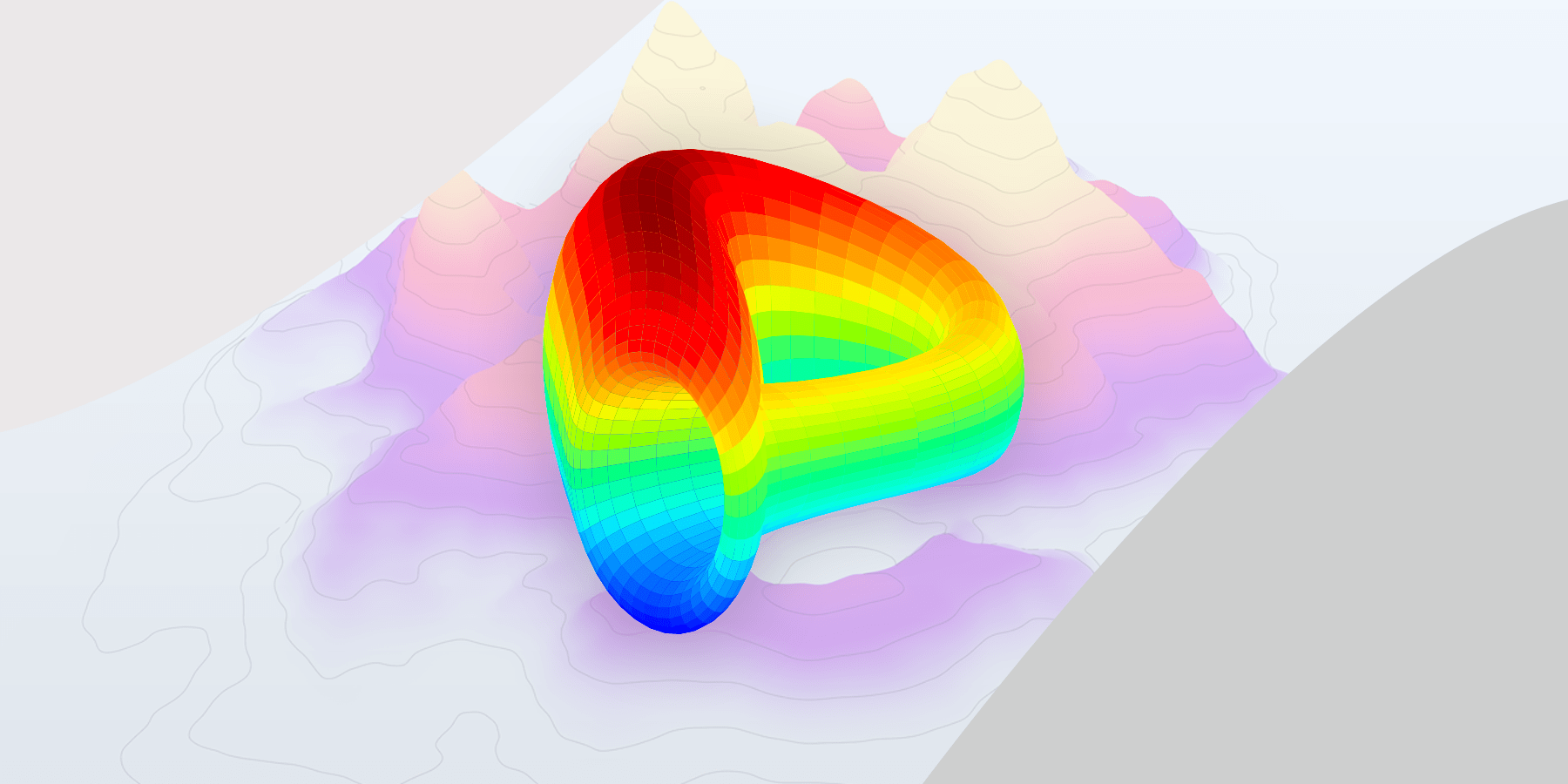

Whale Holding Cost Restructuring: According to Glassnode monitoring, addresses holding over 1 million CRV increased their holdings by 28% week-on-week in early April, with average acquisition costs concentrated between $0.42 and $0.45, forming a dense support zone;

Derivatives Market Short Squeeze: Coinglass data shows CRV’s contract open interest surged over the past 24 hours. Perpetual contract funding rates hit an extreme negative value of -0.15% on April 9, forcing massive short liquidations and pushing price past the critical resistance at $0.50;

Widening Gap Between Protocol Revenue and TVL: Defillama data indicates Curve’s March transaction fee revenue (denominated in ETH) declined 23% month-on-month, while total value locked (TVL) rebounded 18%, suggesting a significant improvement in revenue generation per unit of liquidity.

2. Triple Confirmation of Bottom Formation: Convergence Across Technicals, Fundamentals, and Regulation

(1) Technicals: Weekly Chart Divergence and Optimized Chip Structure

From a chart perspective, CRV formed a double-bottom pattern at $0.39 on the weekly timeframe, aligning with a historically strong support zone observed over the past four years. MACD histogram has contracted for five consecutive weeks, while RSI rebounded sharply from oversold territory (28) into neutral range (52), signaling strong technical reversal potential.

More importantly, historical on-chain distribution shows approximately 63% of CRV trading volume occurred between $0.20 and $0.40 from August 2024 to March 2025. With current prices now decisively breaking above this dense accumulation zone, overhead selling pressure has notably eased.

(2) Fundamentals: Strategic Upgrades at Curve Protocol

Three recent initiatives by the Curve team are reshaping market expectations:

-

Collateral Expansion: Adding mainstream assets such as EtherFi’s weETH and Coinbase’s cbBTC as collateral for crvUSD minting, directly expanding stablecoin use cases;

-

Cross-Chain Liquidity Integration: Deep collaboration with the Solana ecosystem leverages its high-throughput network to expand stablecoin pools by 40%, boosting annualized yields to 18%-25%;

-

Institutional Backing Reinforcement: Leading DeFi platforms including KelpDAO, Convex Finance, and Yearn have announced continued support for Curve liquidity pools, creating a “DeFi 3.0 Alliance” effect.

(3) Regulatory Environment: Diminishing Policy Uncertainty

The significance of the IRS repeal of the DeFi broker rule extends far beyond short-term sentiment boost. The rule previously required on-chain protocols to track user transactions and report tax information—an operational burden particularly acute for AMM platforms like Curve due to technical complexity. With regulatory relief, Curve’s operating costs are projected to fall by 23%, improving its protocol income-to-expense ratio from 1.8x to 2.3x, directly enhancing its tokenomic model.

3. Sustainability Analysis of Upside Momentum: Three-Dimensional Outlook on Future Trajectory

(1) Short-Term (1–3 Months): Liquidity Migration and Market Sentiment Alignment

Historically, when CRV daily trading volume exceeds $200 million, price volatility enters an acceleration phase. A breakout above $0.65 could trigger algorithmic trend-following strategies, potentially driving prices toward the $0.80–$1.00 range.

(2) Medium-Term (6–12 Months): Capturing Stablecoin Market Expansion Dividends

Four major trends will support CRV valuation uplift:

-

RWA (Real-World Assets) Sector Takeoff: On-chain government bond-backed stablecoins issued by institutions such as BlackRock and Fidelity have reached $48 billion in scale. As a primary trading venue, Curve stands to capture 1.2%-1.8% in annualized fee shares;

-

Layer2 Ecosystem Rise: Stablecoin trading volume on Layer2 networks like zkSync and StarkNet has increased from 12% in 2024 to 35%. Curve has deployed liquidity pools across 12 heterogeneous chains, establishing cross-chain arbitrage moats;

-

Governance Power Contest: Current CRV staking rate stands at only 41%, well below peers like Compound (65%). With enhanced rewards for veCRV (vote-escrowed CRV) lockups, deflationary pressure on the token supply will significantly ease.

(3) Long-Term (1–3 Years): Repricing of DeFi Infrastructure Value

By 2026, Curve may complete three strategic transformations:

-

From DEX to Liquidity Hub: Through oracle integration and MEV protection mechanisms, becoming the core node for cross-chain liquidity routing;

-

From Governance Token to Yield Instrument: CRV stakers could access Solana-based yield aggregators via platforms like XBIT, achieving 18%-25% annualized composite returns;

-

From Community-Led to Institution-CoBuilt: The state of Wyoming has selected LayerZero technology to issue its official stablecoin WYST, with Curve positioned as the preferred liquidity pool—opening access to sovereign-grade clients.

4. Conclusion: Three Scenarios Post-Bottom Confirmation

-

Optimistic Scenario (30% probability): If the Fed cuts rates this year and DeFi regulatory frameworks become clear, CRV could replicate AAVE’s 2021 trajectory, reaching $2.00 by year-end;

-

Base Case (50% probability): Price climbs to $1.00–$1.50 range and oscillates, awaiting real growth realization in cross-chain ecosystems and RWA sectors;

-

Pessimistic Scenario (20% probability): Macroeconomic recession triggers broad crypto market collapse, pulling CRV back to the strong support at $0.30.

TechFlow Viewpoint: The current price of $0.60 fully reflects near-term policy benefits but has not yet priced in Curve’s upgraded role in the era of Stablecoin 2.0. Investors are advised to adopt a "core + satellite" strategy—allocating 50% of exposure as long-term holdings and 50% for tactical trading. Repeated consolidation within the bottom zone is inevitable, but the long-term value of DeFi infrastructure will ultimately prevail.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News