Curve Liquidity "Wrapping" Battle Overview: Could Yearn Emerge as the Ultimate Winner?

TechFlow Selected TechFlow Selected

Curve Liquidity "Wrapping" Battle Overview: Could Yearn Emerge as the Ultimate Winner?

For holders, locking CRV for 4 years is not a particularly attractive option.

Written by: DeFi Made Here

Translated by: TechFlow

Curve Finance's veToken model allows users to lock $CRV for up to four years and receive protocol fees (paid in stablecoins), while also enabling them to vote on CRV distribution across pools.

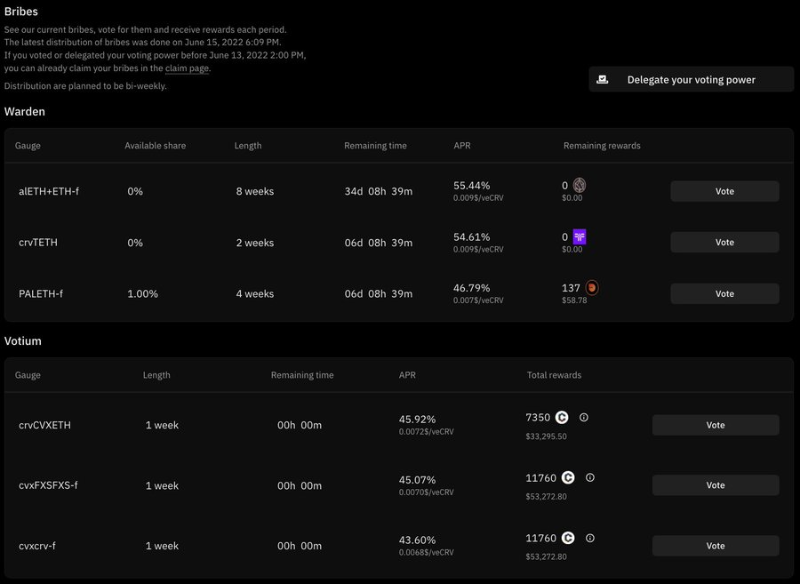

Protocols seeking liquidity can bribe veCRV holders to direct CRV emissions toward their pools. This serves as an additional income stream for veCRV holders beyond protocol fees.

However, locking CRV for four years is not an attractive option for many holders.

What’s the solution?

Choose to wrap your liquidity:

-

cvxCRV from Convex Finance

-

sdCRV from Stake DAO

-

yCRV from Yearn

Liquidity wrapping allows CRV holders to earn fees or bribes without locking for four years, and provides an exit opportunity.

How do they differ?

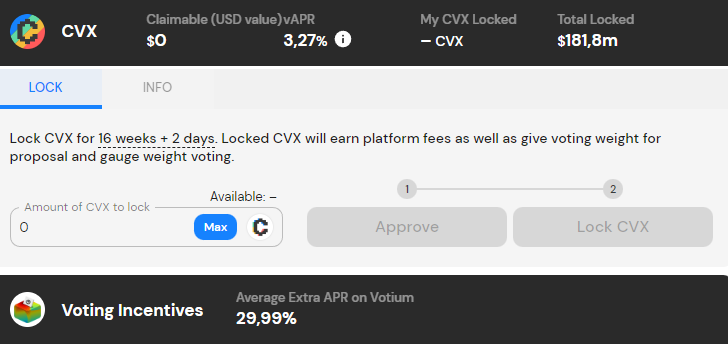

cvxCRV

By staking cvxCRV, you earn fees in 3crv, enhanced CRV rewards from Convex LPs, and 10% of CVX token emissions.

Bribery income (from voting rights) is distributed to CVX locked for voting.

Thus, normal veCRV income (fees + bribes) is split between cvxCRV and CVX.

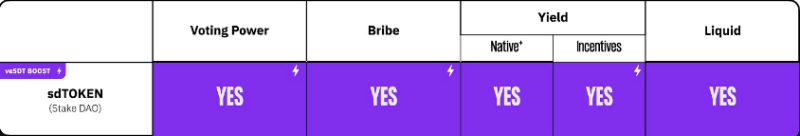

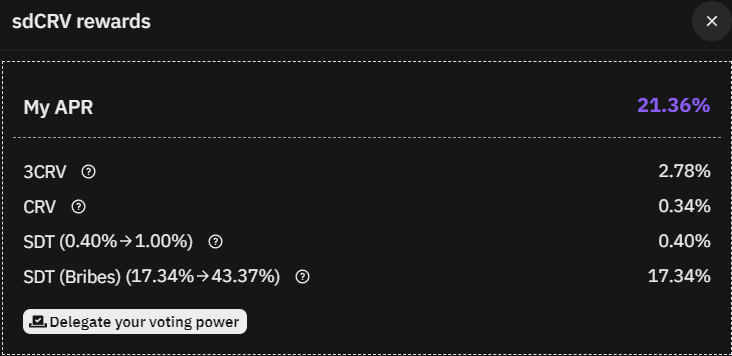

sdCRV

sdCRV distributes 3CRV fees and retains voting rights with the staker.

Voting rights can be delegated to StakeDAO, which aggregates market and OTC bribes for optimal returns.

Alternatively, users can directly access bribes on Stake DAO via Paladin or Votium Protocol.

Because StakeDAO does not split bribes and management fees between sdCRV and its native token, the staking APR is significantly higher.

Stakers receive 3CRV, CRV, and SDT tokens converted from bribe rewards.

However, to achieve the highest APY, users must lock the native token SDT.

With veSDT boosting, sdCRV stakers’ voting power receives a base 0.62x boost, increasing up to 1.56x depending on veSDT balance and total veSDT stakers.

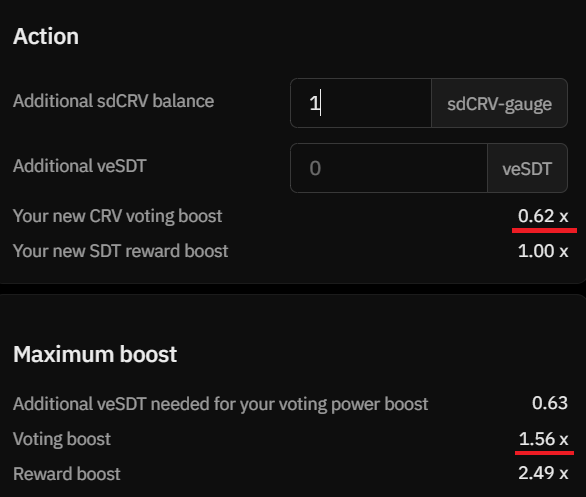

yCRV

Among all wraps, staking yCRV delivers the highest yield.

However, yields will decline over time due to diminishing rewards from the legacy yvBOOST donor contract.

Additionally, one-quarter of all yCRV belongs to the treasury, enhancing returns for all yCRV stakers.

st-yCRV offers a "set-and-forget" user experience, with yield sources from two streams:

• Fees: Earned protocol fees are automatically compounded into more yCRV,

• Bribes: 1 st-yCRV = 1 veCRV voting power is sold on bribe markets to further boost yield.

Unlike sdCRV, st-yCRV holders forfeit their voting rights, so protocols cannot use them for Curve voting.

vl-yCRV holds voting rights and is in final development stages, but it will redirect fees and bribes to support st-yCRV.

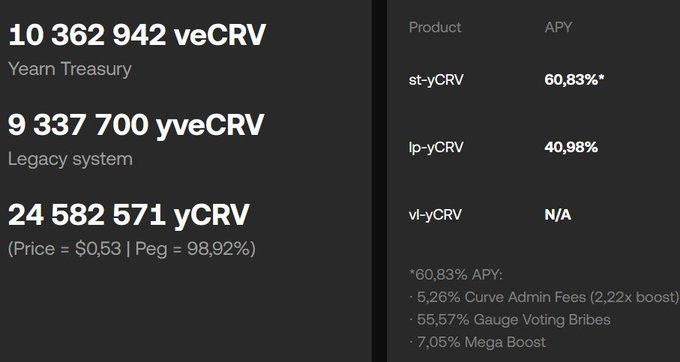

What are the trade-offs among these liquidity wraps?

- Protocol fees

- Voting rights

- Peg protection

Protocol fees are charged for services provided by each protocol (deducted from displayed APR):

• cvxCRV: 0%

• sdCRV: 16%

• yCRV: 10%

Voting Rights:

-

cvxCRV offers no voting rights nor shares bribe income;

-

yCRV offers no voting rights but shares bribe income;

-

sdCRV provides voting rights and bribe income, though both are reduced to support veSDT stakers.

To maintain the peg, all protocols channel CRV to their respective LPs.

When the peg drops below 0.99, StakeDAO uses bribe revenue to buy sdCRV and distribute to stakers (otherwise pays with SDT bought from the market).

What is the best strategy for CRV liquidity wrapping?

First, I must say I don’t own any CRV or its wrapped versions—I’ve been bearish on the CRV token and its lifetime cash flows.

Despite about 50% of CRV being permanently locked, there remains insufficient buying pressure to exceed CRV emissions.

If all CRV were locked, yields would be severely diluted.

As CRV price declines alongside TVL in Curve Finance, bribe value also decreases.

However, with the introduction of crvUSD, I see potential for Curve—it could drive more volume and TVL back to the platform.

But we’ll only know the outcome after actual deployment.

In my view, yCRV is winning the battle for Curve liquidity wrapping, offering the highest returns and the simplest user experience.

Users who hold veSDT might find the sdCRV solution more appealing, as their votes boost liquidity across multiple assets:

- sdCRV

- sdBAL

- sdFXS

- sdYFI

- sdANGLE

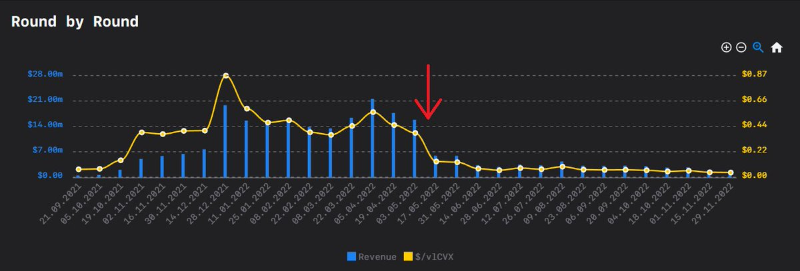

In this context, cvxCRV is clearly the loser. It has the lowest yield, no voting rights or bribe income, weak peg support, etc.

I expect cvxCRV to further depreciate until its yield reaches equilibrium with yCRV.

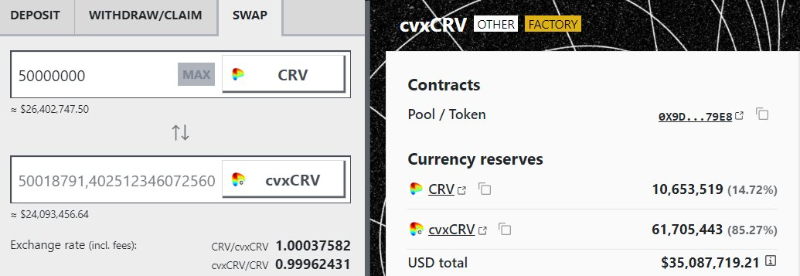

Another issue for Convex is that new cvxCRV minting is unlikely in the foreseeable future—there are already 50 million “cheap” cvxCRV tokens in circulation.

This implies Convex’s total ownership share of veCRV supply will likely continue to decrease.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News