Is There No Way Out in the Face of the Curve Crisis? Response Strategies from the Perspective of DeFi Mining

TechFlow Selected TechFlow Selected

Is There No Way Out in the Face of the Curve Crisis? Response Strategies from the Perspective of DeFi Mining

How to prevent similar potential risks during daily DeFi mining?

Author: Luke (DeFi enthusiast, Head of Cobo Argus Product)

The DeFi world is currently in crisis due to a recent attack on Curve. Since the attack began on July 30, CRV's price has plummeted from 0.74 USDT to below 0.5 USDT, and although it has slightly rebounded today, it remains above 0.6 USDT. While it has now been confirmed that the attack was caused by a bug in an older version of the Ethereum programming language Vyper, the crisis facing Curve is far from over.

Given that Curve’s founder has heavily staked large amounts of CRV as collateral for on-chain loans, any further price decline could trigger massive liquidations, potentially leading to a cascade of bankruptcies—and even the possibility of CRV dropping to zero. As one of the largest protocols in the DeFi space, Curve’s current crisis once again delivers a significant blow to DeFi’s security and credibility, which may have numerous negative implications for DeFi’s future development.

Here, I will examine how participants in DeFi mining can proactively prevent similar risks during daily operations, and discuss practical solutions and tools available—specifically from the perspective of individual DeFi miners.

Background of the Incident

First, let’s briefly review the timeline of events leading up to Curve’s crisis.

On July 30 at 21:34 UTC, the pETH-ETH pool on Curve was attacked, causing pETH’s price to drop to $383. At 22:50, the msETH-ETH pool was attacked. At 23:34, the alETH-ETH pool was attacked.

On July 31 at 00:44, Vyper—the programming language for Ethereum—tweeted that reentrancy locks failed in versions 0.2.15, 0.2.16, and 0.3.0.

At 00:45, Curve announced via Twitter that stablecoin pools using Vyper 0.2.15 (alETH/msETH/pETH) had been compromised due to the reentrancy lock failure, while other pools remained safe.

At 03:08, the CRV-ETH pool was attacked, with CRV’s on-chain price crashing as low as ~0.08.

At 16:41, Curve advised users to remove liquidity from the Tricrypto pool on Arbitrum, noting that although it hadn’t been attacked yet, it might still be at risk.

As a result of the attacks on Curve, numerous abnormal events unfolded across the blockchain: CRV’s price crashed, fears mounted over mich’s leveraged positions being liquidated, prompting users to withdraw liquidity from Aave, and interest rates for USDC and USDT spiked abnormally. The DeFi ecosystem is now entangled in a chain reaction of cascading risks.

Root Cause Analysis

What makes this security incident particularly unique is that it stemmed from a bug at the smart contract language level, which caused reentrancy lock protections in several well-known projects to fail. Fortunately, it was Vyper—not Solidity—that had the issue; otherwise, the entire DeFi ecosystem could have been in grave danger.

DeFi has attracted massive participation thanks to its low friction costs, composability, and higher yields compared to traditional finance. However, wallet security and smart contract security remain persistent threats looming over the sector.

High-profile failures like Euler and Curve—projects once considered battle-tested—have shaken the confidence of many DeFi believers. When a protocol fails, users often lose their entire principal. Beyond smart contract risks, phishing attacks and private key leaks are also constant dangers. Achieving both security and efficiency in DeFi participation remains a major challenge for the industry.

The Cobo team has long been active in the DeFi space and is known for its emphasis on security. Internally, Cobo has developed a comprehensive set of solutions for various DeFi security issues. Now, the team has productized this internal system into Cobo Argus—a solution tailored for DeFi use cases—which quickly reached $100 million in TVL after its new version launched.

Response Strategies

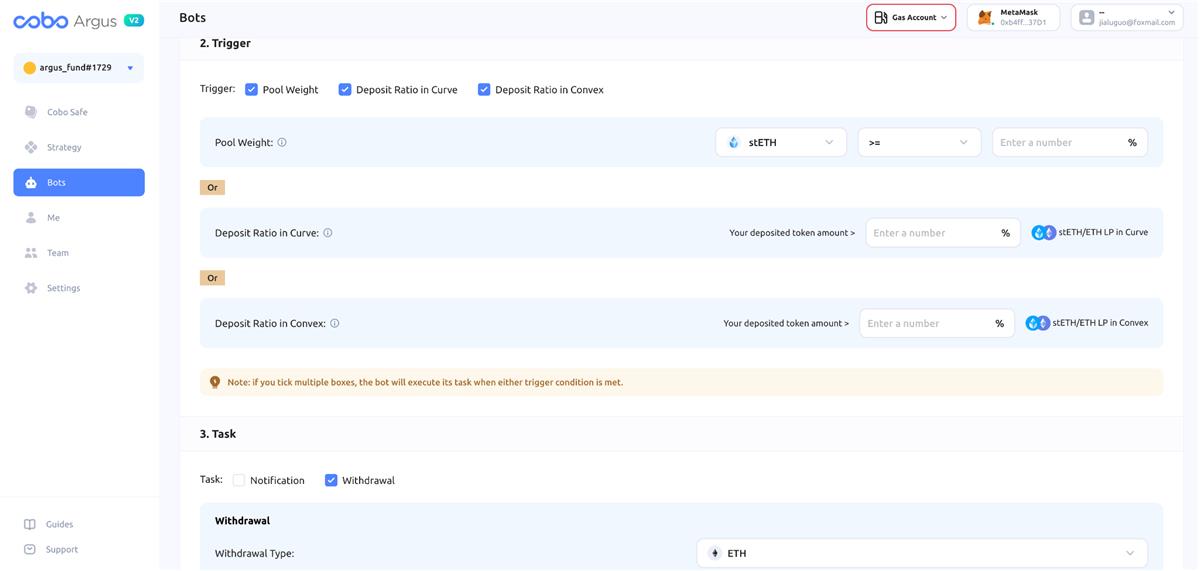

For incidents like the one Curve experienced last night, proactive prevention is nearly impossible. For average DeFi miners, the best they can do is detect problems as early as possible and respond accordingly. In such situations, tools like Cobo Argus can make a critical difference. Cobo Argus offers an “exit bot” feature that monitors on-chain risk indicators and helps users withdraw funds at the first sign of anomalies.

Below is a detailed analysis of how users can leverage the exit bot on Cobo Argus in response to Curve-like scenarios:

When issues arose with the pools on Curve, two clear warning signals emerged:

1. Significant depegging of pegged assets;

2. Sharp decline in TVL due to hacker exploits and large withdrawals.

By using Cobo Argus, users can set up monitoring for these two indicators—tracking the proportion of a specific token within an LP pool, and comparing their principal against the total funds in the LP pool. This enables immediate detection of anomalies and allows the bot to automatically withdraw principal.

Typically, most users only learn about risks in DeFi protocols from warnings posted by white hats on Twitter—often hours after the attack has already occurred, leaving little chance to save their capital.

In contrast, bots that monitor on-chain risk indicators can automatically exit positions at the very first sign of trouble, effectively helping users rescue their assets.

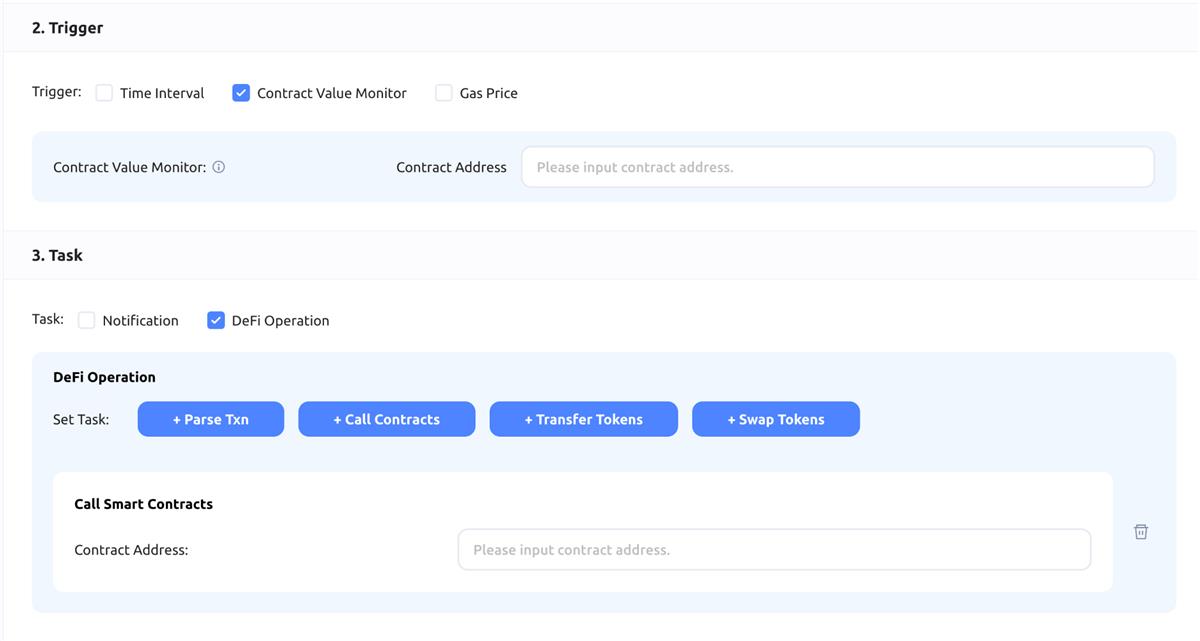

Events such as hacking attacks, token depegs, and lending protocol runs can all be monitored through specific on-chain metrics. Cobo Argus allows users to create custom bots with user-defined monitoring thresholds and trigger conditions for automated contract calls.

Expert users with strong DeFi knowledge can define their own monitoring parameters and bot behaviors, enabling theoretically unlimited application across any DeFi protocol. Recently, within the Cobo Argus community, a user successfully rescued their assets from a lending protocol using a custom bot.

All these features are decentralized and trustless—while Cobo operates the bots, they can only perform actions explicitly authorized by users and cannot exceed those permissions. All authorizations are recorded in an immutable smart contract, with full code and authorization logs transparently stored on-chain for public audit.

As additional context, Cobo Argus’s smart contracts are built on Safe{Wallet}’s Plugin functionality. Safe{Wallet} is the largest, highest-TVL, and widely recognized most secure multi-sig wallet in the Ethereum ecosystem, used by most DeFi protocols to manage their treasuries. Plugins represent Safe{Wallet}’s latest capability, allowing third-party developers to extend Safe{Wallet}’s functionality through custom plugins.

Cobo has maintained close collaboration with the Safe{Wallet} team and developed Cobo Argus early in the lifecycle of Plugin capabilities. Building on Safe{Wallet}, Cobo Argus delivers a suite of DeFi-focused solutions:

-

DeFi Authorization: Allows delegation of specific DeFi protocol operation rights to a single-signature wallet. While using Safe{Wallet} with hardware wallets enhances security, the process is often inefficient and cumbersome, especially unsuitable for frequent DeFi interactions. During protocol failures, such inefficiency can be fatal.

By delegating specific permissions to a designated address, operational efficiency improves without compromising security—because the address can only execute pre-approved actions and cannot transfer principal or perform unauthorized operations.

Through Cobo Argus’s authorization system, users can avoid risks such as phishing-induced mistakes, loss of funds due to hot wallet private key leaks, or insider abuse leading to fund theft.

-

DeFi Bots: Building on the DeFi Authorization feature, Cobo Argus introduces bot automation, enabling users to delegate specific protocol permissions to bots for automated operations—such as auto-claiming rewards, automatic selling and reinvesting, or automatic withdrawal.

Currently, Cobo Argus is used by numerous DeFi asset management teams and individual DeFi whales, significantly improving both operational efficiency and asset protection. Recently, projects such as Solv and izumi have adopted Cobo Argus as their underlying tool for access control and security. Going forward, Cobo will continue innovating to protect ordinary users and builders in the ecosystem, driving industry advancement.

In conclusion, DeFi still holds immense long-term potential. However, participating in DeFi mining always carries inherent risks. We urge everyone to proceed with caution. As the saying goes, “A craftsman must sharpen his tools before he can do his work well.” While staying vigilant and accumulating experience, DeFi miners should also wisely adopt tools to best prepare for various potential risks.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News