What motivates crypto heavyweights to "bail out" Curve?

TechFlow Selected TechFlow Selected

What motivates crypto heavyweights to "bail out" Curve?

It turns out the Ve model's top-heavy effect has led to poor liquidity.

Author: Steven, E2M Researcher

Daily Discussion

Reflection

After Curve was hacked at the end of July last year, various OGs, institutions, and VCs stepped in to help. Wu Jihan, co-founder of Bitmain and Matrixport, posted on social media: "In the upcoming RWA wave, CRV is one of the most important infrastructures. I’ve already bought the dip—this does not constitute financial advice."

Lai Cheng-huang (Machi Big Brother) confirmed via social media that he acquired 3.75 million CRV tokens over-the-counter from Curve’s founder and staked them within the Curve protocol. The next day, addresses linked to Justin Sun transferred 2 million USDT to Egorov’s address and received 5 million CRV in return.

Soon after, projects like Yearn Finance, Stake DAO, and institutions/VCs such as DWF joined the rescue efforts for CRV.

What does it mean for these groups to back Curve? Why save it? This remains deeply puzzling.

Yield has become a cross-sector web3 consideration, no longer confined to specific niches.

CM: Would it matter if Curve’s founder sold his holdings and disengaged from Curve? Not really. Infrastructure-level protocols don’t need continuous development once they reach maturity. Once sufficiently mature, ceasing development doesn’t affect usability. Many market supporters recognize this, which motivates their involvement.

-

Curve has several models allowing veCRV holders to govern autonomously. Existing mechanisms, parameters, and configurations can operate independently, aligning with the original ethos of decentralized applications—control fully devolved to the community.

-

DEX

-

Llama stablecoin algorithm + lending market

-

ve-model

-

Bribery and liquidity system

-

Market performance is another matter. Fundamentally, the current situation is weaker than before. Compared to earlier cycles, there won’t be standout performance, but over extended periods, yield farming will still drive demand. If you believe on-chain ecosystems will remain diverse, Curve still has opportunities—Uniswap can’t solve everything. Curve offers an integrated framework, and its token distribution has become more decentralized. Its long-term prospects look better, assuming future on-chain activity requires incentives.

-

Many buyers are project teams. Yield farming was the core growth engine in the previous cycle. Early-stage projects often rent liquidity instead of bootstrapping natively. Crv solves the problem of token inflation for new projects by allowing them to lease liquidity without inflating their own token supply, enabling tokens to serve other utilities. Tokens retain value even after unlocking. Crv also supports non-stablecoin trading, similar to Uniswap. During peak demand, buying Crv was nearly impossible—priority went to project teams. Projects won’t die easily; they won’t be quickly overtaken by Uniswap in the short term.

1. The Event

Time Point 1

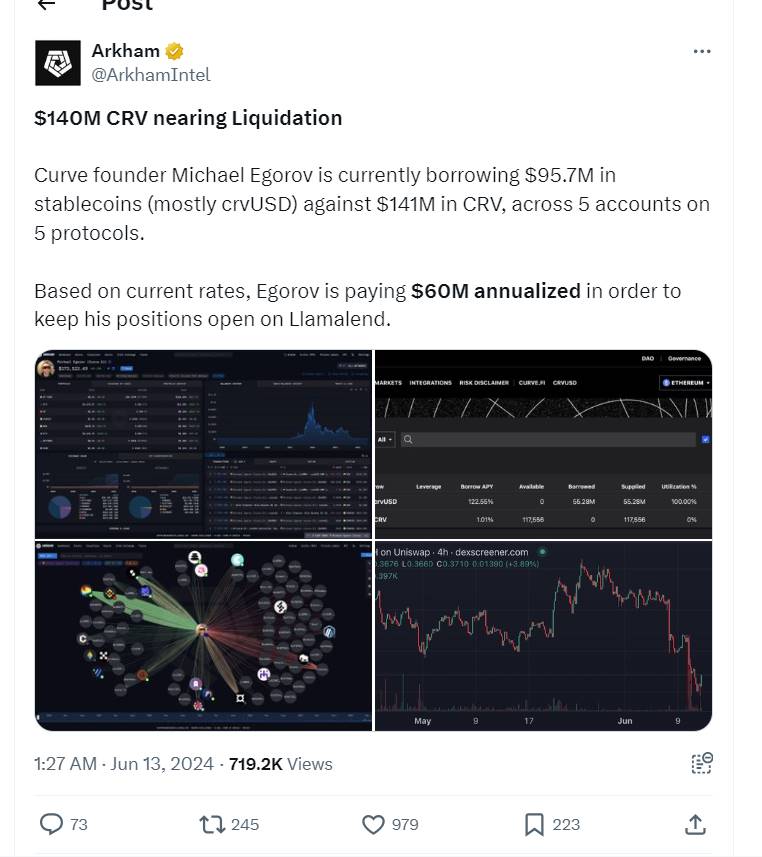

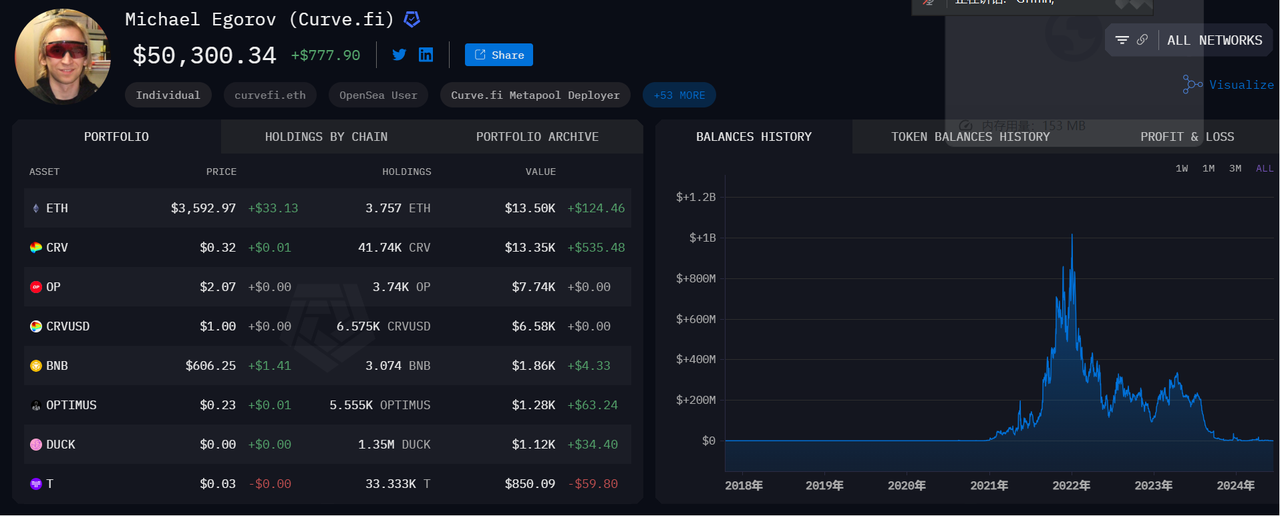

Arkham reported that Michael Egorov, founder of Curve, currently uses 140 million USD worth of CRV as collateral across five accounts in five protocols to borrow 95.7 million USD in stablecoins (primarily crvUSD). Among these, Michael has borrowed 50 million USD in crvUSD on Llamalend, where three of Egorov’s accounts account for over 90% of all crvUSD borrowed on the platform.

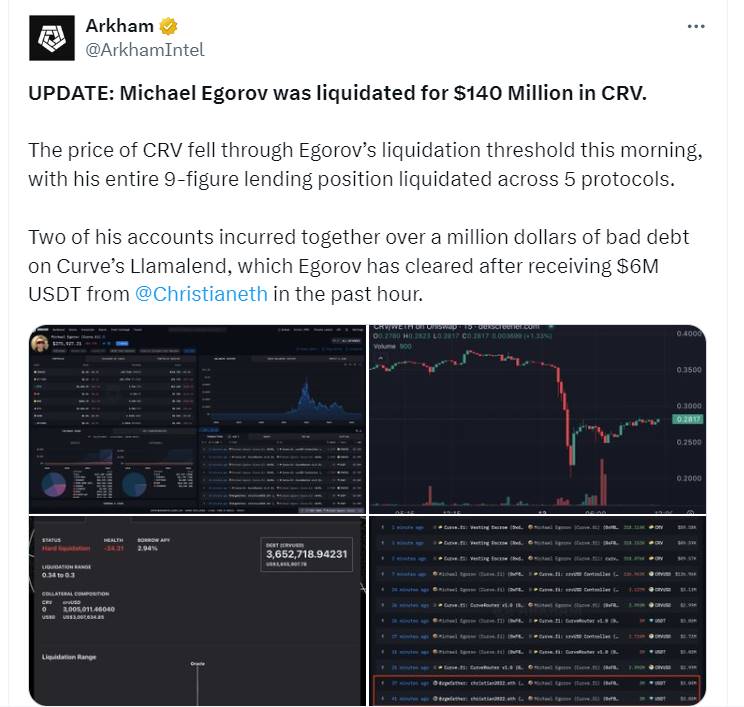

Arkham noted that if CRV’s price drops by about 10%, these positions could begin liquidation. Subsequently, CRV’s decline accelerated, briefly falling below $0.26—a historic low—and multiple addresses linked to Michael gradually fell below their liquidation thresholds.

Time Point 2

Time Point 3 – Current Status

Data source: https://platform.arkhamintelligence.com/explorer/entity/michael-egorov

Investors are facing disaster.

On one hand, falling prices triggered cascading liquidations across other lending platforms. Lenders on Fraxlend suffered millions in liquidations. According to Lookonchain, one user had 10.58 million CRV ($3.3 million) liquidated on Fraxlend.

2. Curve Data Comparison

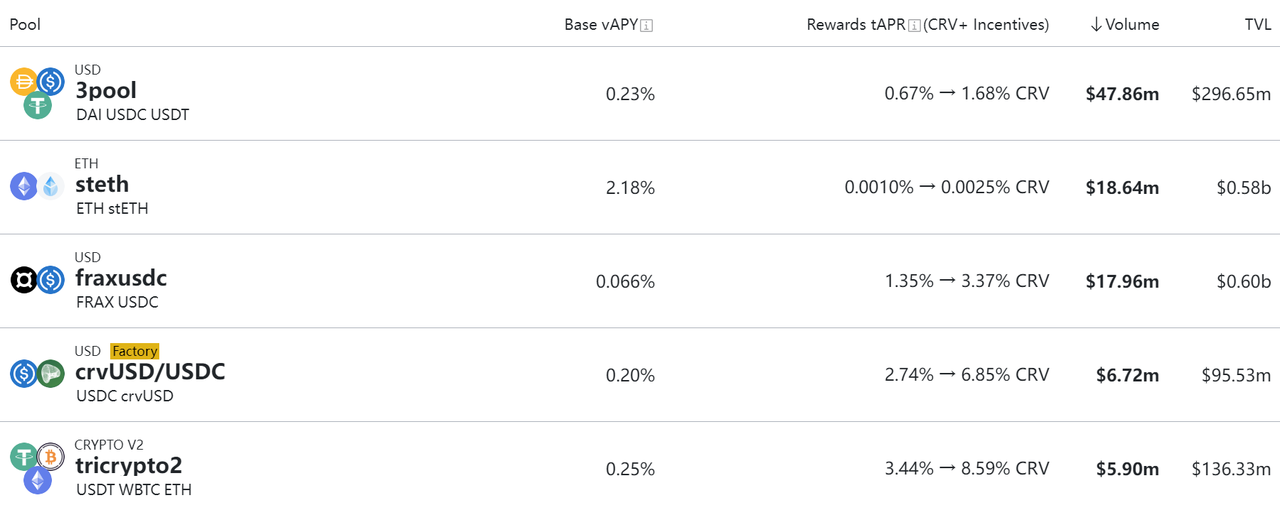

20240616

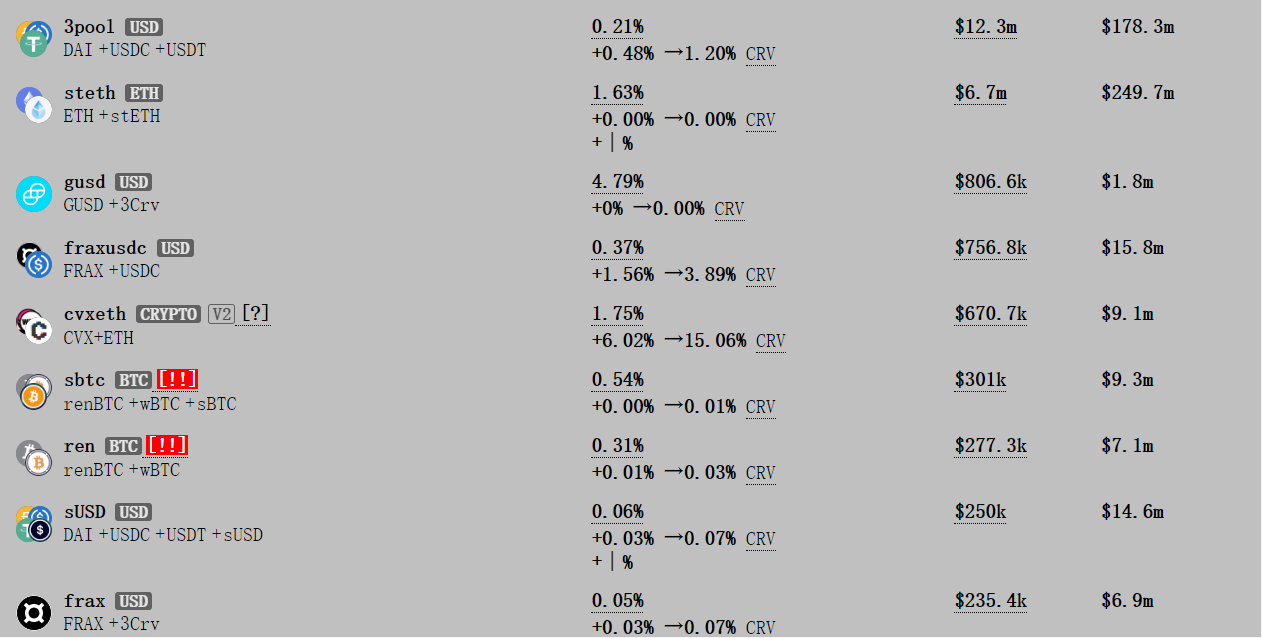

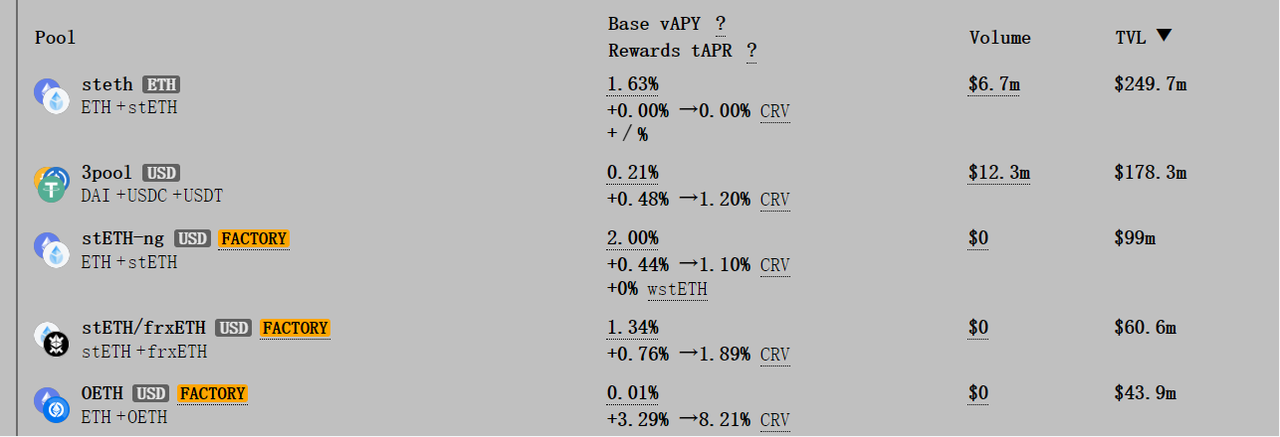

Trading volume: 3pool ($12.3m), steth ($6.7M), fraxUSDC ($756.8M)

TVL comparison (top three from last year): fraxusdc ($15.8m), steth($249.7m), 3pool($178.3m)

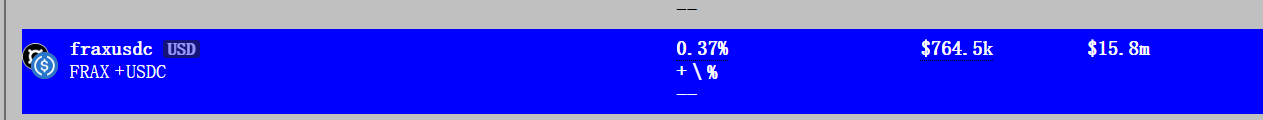

Frax TVL was too low, so a separate snapshot:

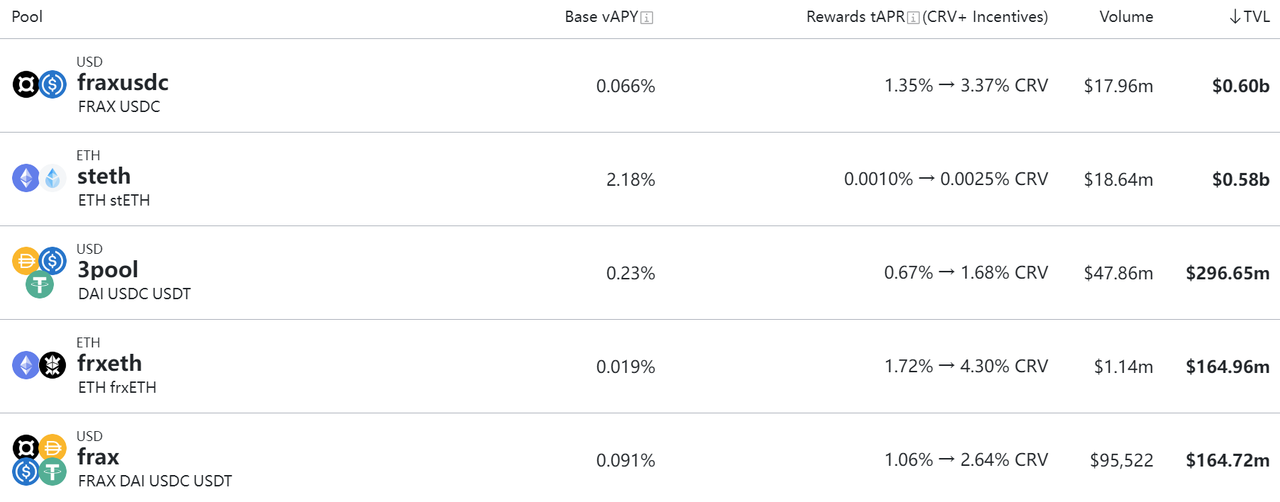

202307——Reference from prior research report

Top 10 pools by TVL: fraxusdc ($0.6b), steth($0.58b), 3pool($296.65m) ranked first three

Top 3 trading volumes: 3pool ($47.86m), steth ($18.64M), fraxUSDC ($17.96M). Despite 3pool’s TVL being only half of the top two, its trading volume exceeded theirs byover 2.5x.

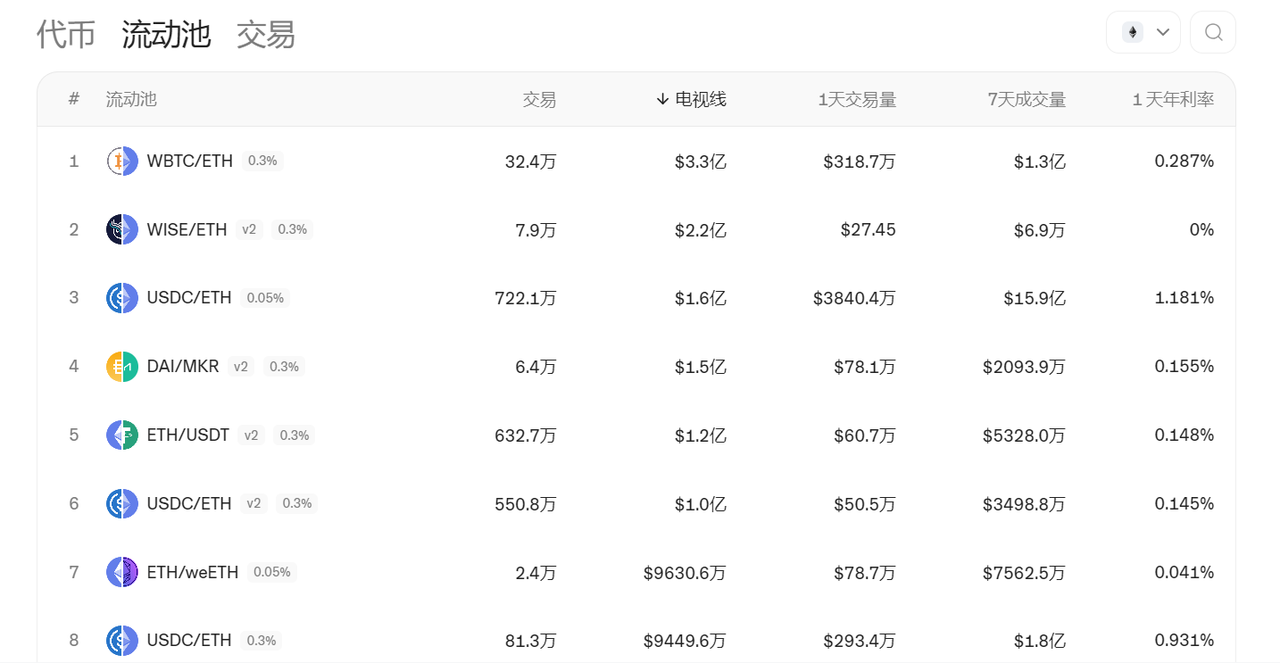

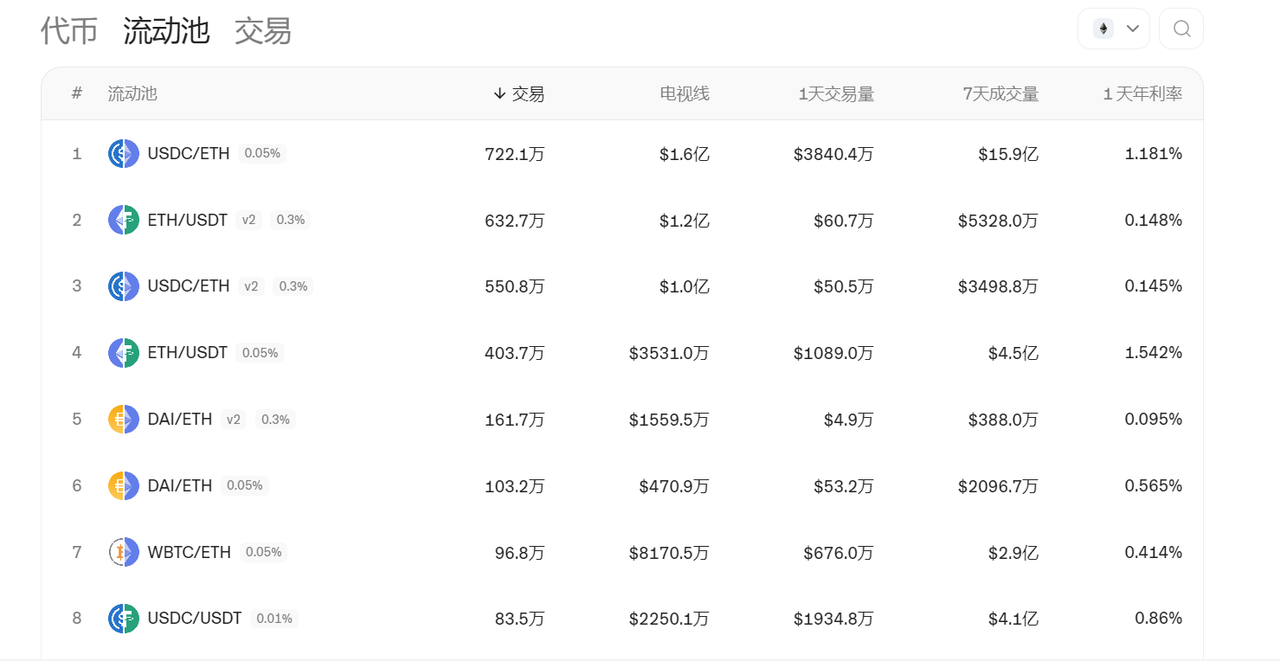

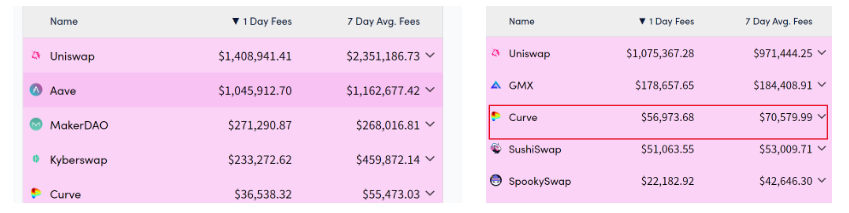

Comparison with Uni

Revenue Comparison

Left: recent data; Right: historical data.

Uniswap sees meme coin trading in bull markets and major assets in bear markets.

3. Issues Highlighted by This Incident

Poor Liquidity Due to Head Concentration in ve-Token Model

The essence of Curve Wars is competing for Curve’s liquidity—winning voting power allows LPs to boost yields in their chosen pools. While higher liquidity benefits projects, different teams purchasing CRV voting rights leads to so-called “wars,” potentially causing market instability and manipulation.

When Curve was first discussed, some believed it might function like a traffic platform—new projects would buy voting power to promote their pools (e.g., Frax). After nearly a year, this hasn’t materialized. With lower returns compared to point systems or Pendle, the model has largely been abandoned.

Liquidations in Lending Markets

Highly volatile assets like CRV, AAVE, or COMP may not be suitable as collateral. In the future, large-scale crypto lending will likely rely on USDT/USDC/DAI combined with BTC and ETH.

Lending risks are complex—price volatility of collateral, coupled with leveraged “Lego-like” stacking, creates bubbles and makes it difficult for Web3 lending to achieve scale.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News