Weekly Top Reads: Azuki "Collapse," RWA and Pendle War Heating Up, Binance IEO Data Deep Dive | 2023/07/09

TechFlow Selected TechFlow Selected

Weekly Top Reads: Azuki "Collapse," RWA and Pendle War Heating Up, Binance IEO Data Deep Dive | 2023/07/09

Weekly Article Selection

High-quality content is becoming increasingly rare. While there's an overwhelming amount of information every day, much of it is actually low in quality. Even English-language content needs to be demystified.

Starting this week, we will curate a small number of premium articles each week—saving you time and energy while maximizing your insights and reflections. Feel free to read and share.

-

The Azuki "Breakdown" Revelation: Time and Patience Are the Scarcest Resources for Brands - TechFlow

Author: Web3Brand, Twitter: @0xWeb3Brand

Introduction:

Recently, the launch of Azuki's new Beanz collection has been perceived by the community and the public as "half-hearted" and a "rug pull," triggering strong FUD that has driven the project’s floor price steadily downward.

This article reviews the entire timeline of Azuki’s new collection launch and explores whether the move was a deliberate cash grab or simply a misstep. More importantly, looking beyond surface-level events, it reveals the difficulties and challenges of building a brand in the Web3 environment, helping readers better understand Azuki’s future direction.

For fans, consumers, investors, or builders of NFT IP projects, how can one truly “wait until the scenery fades” and walk the long journey with a project? Perhaps this article offers some answers.

Author: Colin Lee, Mint Ventures, Twitter: @Mint_Ventures

Introduction:

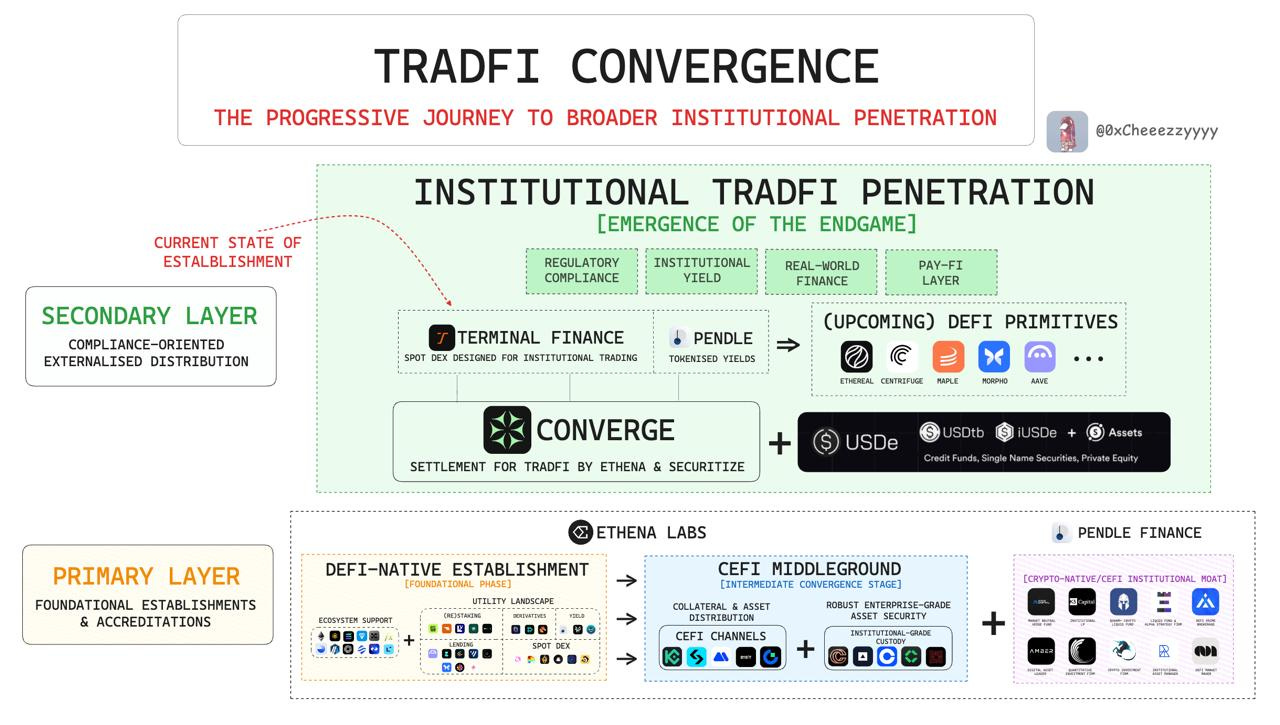

RWA (Real World Assets) has been seen since the beginning of this year as the next potentially hot sector.

When a sector becomes hyped, concepts and prices often lead while real-world examples and risks are overlooked or delayed. Before the RWA narrative fully explodes, issues such as underlying assets, risk management, and off-chain operations must be carefully considered.

This article provides a detailed and concrete explanation of these critical issues, and also looks ahead at potential development paths and regulatory opportunities within RWA. Recommended reading for those researching emerging sectors.

Author: LD Capital, Twitter: @LD_Capital

Introduction:

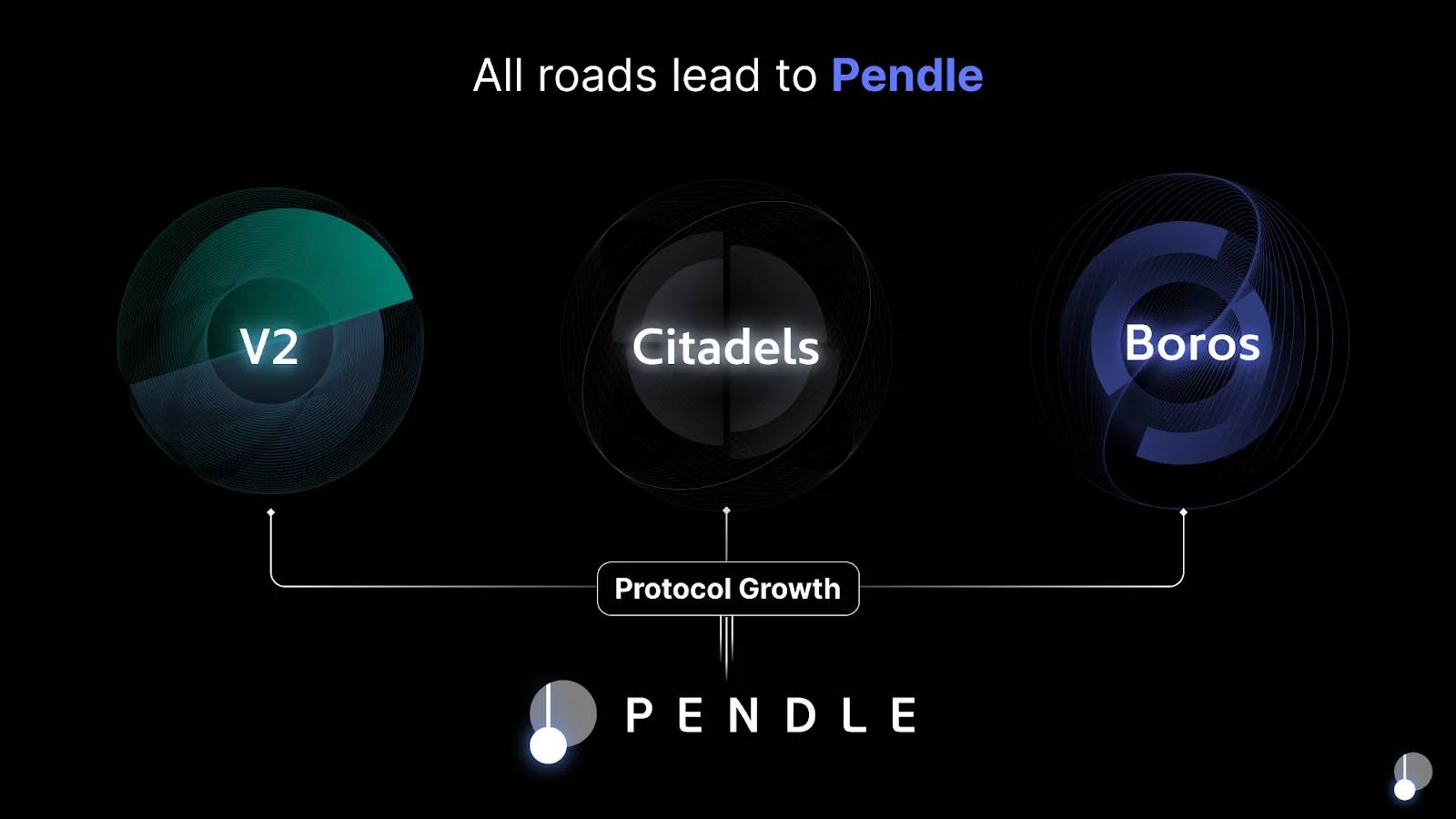

First came the Curve War, now comes the Pendle War.

As a star project in the LSD space, Pendle’s recent listing on Binance has drawn increasing attention to yield-boosting auxiliary protocols within its ecosystem.

Old models like veToken, vote-buying, incentives, and yield don’t mean there are no new opportunities. This article provides a detailed comparison of two leading auxiliary protocols on Pendle—Penpie and Equilibria—including their core business models, operational data, and revenue distribution—and offers outlooks on their future market performance under the veToken model.

If you're searching for new yield opportunities, this article is worth reading.

Further reading: Top 3 Projects to Watch in the Pendle Ecosystem: Penpie, Equilibria, and Stake DAO - TechFlow

Author: CapitalismLab, Twitter: CapitalismLab

Introduction:

Participating in token launches ("sniping") isn't just about "rushing in blindly."

This article outlines the essential research needed before joining a launch, including understanding a project’s valuation logic and key metrics to watch—such as TVL, fee revenue, and market cap—to help form a disciplined approach and avoid the all-too-common "peak at listing" scenario.

Additionally, the article uses historical data to compare past projects on Binance’s Launchpool and Launchpad, clearly illustrating differences in returns and volatility.

While historical data and valuation frameworks shouldn’t be the sole basis for investment decisions, they provide tangible reference points and a methodological foundation for smarter participation.

Author: Tencent Technology

Introduction:

When the West falters, the East shines—can Hong Kong carry the torch?

We often emotionally support Hong Kong’s new pro-crypto policies and initiatives, but when analyzed rationally, how effective have these moves actually been?

A report from Tencent Technology suggests that the crypto craze appears to be cooling in Hong Kong. The article notes high barriers for applying for virtual asset exchange licenses and difficulties in opening corporate bank accounts.

It also highlights structural user issues: Hong Kong’s investment ecosystem favors "smart money" over retail investors. Yet these sophisticated players are precisely the ones who are hard to "farm." As a result, crypto investments may lack a solid foundational base in Hong Kong.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News