Revisiting Cardano: Quietly Building a Competitive L1

TechFlow Selected TechFlow Selected

Revisiting Cardano: Quietly Building a Competitive L1

Cardano today: far from dead, it's highly active, vibrant, and ready to shine in the next bull market.

Author: KODI

Compiled by: TechFlow

Let’s start with a little quiz.

Below are the returns of Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA) during the last bull run—from their respective bottoms on March 19, 2020, to their peaks in 2021. Can you guess which number corresponds to which cryptocurrency?

-

17,469%

-

5,560%

-

1,724%

You might be surprised to learn that among the three, ADA actually delivered the highest return by far.

Yes, that's right: ADA outperformed ETH by more than threefold in the previous cycle—and surpassed BTC by a factor of ten.

For a crypto community that often treats Cardano as a joke, this kind of performance is unexpected.

Still, critics have had a point. For much of the last bull market, Cardano was merely a base L1 blockchain capable only of transferring or staking ADA. There were no other tokens on-chain. And its promised smart contract functionality kept getting indefinitely delayed.

Moreover, compared to other L1s, Cardano has been relatively slow, and the cult-like following around its founder Charles Hoskinson has raised questions about its decentralization.

After a year and a half in this bear market, ADA has fallen 90% from its all-time high, and many have nearly forgotten about Cardano. It seemed like just another L1 destined to fail.

Yet, the winds are beginning to shift. First, it now genuinely has smart contracts. And it's addressing other shortcomings, producing encouraging results in practice.

But will this be enough for ADA to shine again in the next bull market? Let’s find out.

Cardano’s Speed Dilemma

If you want to be a competitive L1 in DeFi, speed matters. Users don’t want to swap tokens and then set a reminder to check 20 minutes later whether their transaction has gone through.

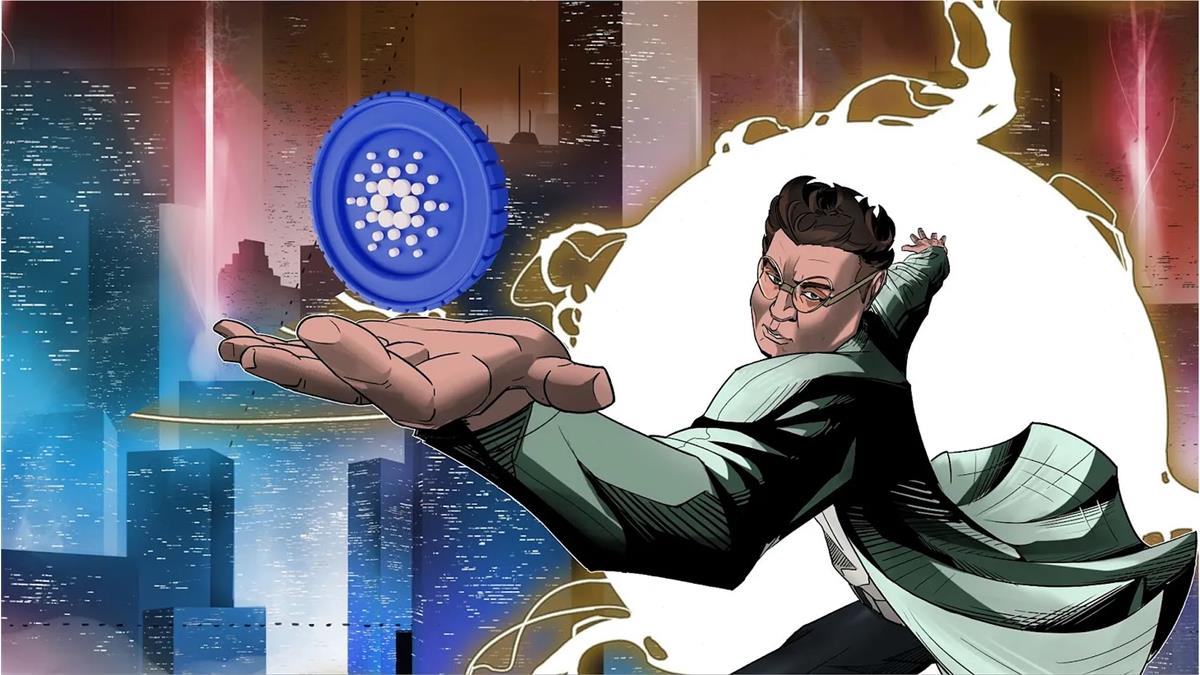

When it comes to blockchain speed, there are several metrics. You’ve probably heard of transactions per second (TPS). Think of it as how many tasks—swaps, NFT mints, transfers—the chain can complete each second.

To get more technical, TPS can be defined as the number of transactions per block divided by the chain’s block time. A pseudo-equation might help visualize it like this:

TPS = (transactions per block) / (block time in seconds).

So, the higher the TPS, the better the performance. Here’s how Cardano compares to other chains:

As you can see, Cardano’s numbers aren’t great.

But here’s the catch: a high TPS doesn’t necessarily mean the chain feels fast or performs quickly.

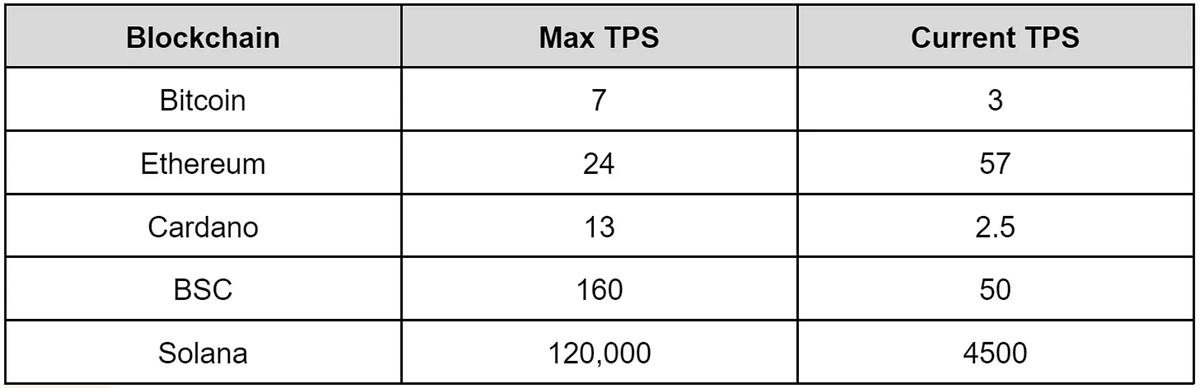

For a transaction to be finalized, the nodes of the blockchain must agree on the truth of the chain. If they don’t, you won’t receive the NFT you just bought, or the tokens someone just sent you.

Or, in some bizarre quirk of this magical technology called blockchain, the entire chain could roll back like a movie, undoing all associated transactions. The time it takes to ensure a transaction is final and irreversible is known as “Time to Finality” (TTF).

Let’s compare Cardano against other L1s once again:

Again, Cardano’s figures are disappointing. Its finality time is similar to Bitcoin’s—a chain without smart contracts. Meanwhile, chains with smart contracts supporting complex applications like DeFi, gaming, and social platforms typically have much lower TTF—often under one minute.

With an actual TPS of around 2–4 and a TTF of up to 60 minutes, Cardano has been a suboptimal choice for DeFi, social apps, or any moderately complex use case.

So it’s no surprise that activity on Cardano stagnated for much of 2022. But the long-awaited solution to Cardano’s speed problem has finally arrived.

Enter Hydra, a solution promising to be the antidote ADA fans have been waiting for: Cardano’s sluggishness.

Hydra is a scalability solution known as a state channel, allowing two or more parties to conduct multiple transactions off-chain without broadcasting every transaction to the entire network—only the initial and final states are recorded on-chain.

Most transactions occur within a Hydra “head,” a private blockchain between users. Each Hydra head can theoretically handle up to 1,000 TPS, with negligible finality time.

I know some of you might be thinking: Does this mean Cardano, by deploying thousands of Hydra heads, can scale to millions of TPS with instant finality?

In reality, each Hydra head still needs to post transactions to the main Cardano chain, so Hydra does not improve the main chain’s TPS or TTF. So while Hydra is a powerful tool, it’s not a silver bullet.

Still, it’s already delivering encouraging results.

Looking Ahead

Hydra launched on May 12 and immediately made an impact.

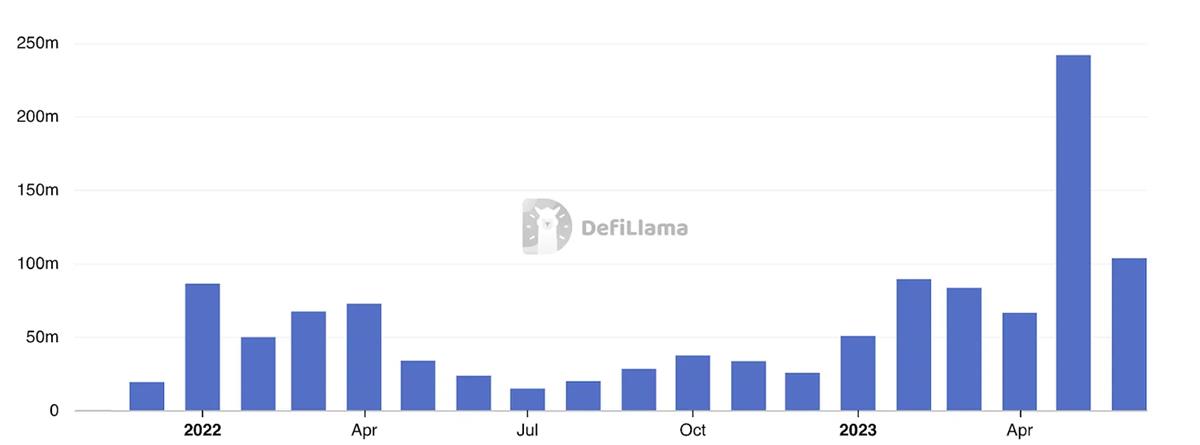

Cardano’s decentralized exchange (DEX) volume, which had hovered around $60–90 million per month, surged to nearly $250 million in May. According to DefiLlama, Minswap—the leading DEX on Cardano—saw weekly volumes 5 to 10 times higher than in previous weeks. Cardano even experienced its own memecoin season.

But this had been building for months. Since the beginning of the year, Cardano’s total value locked (TVL) had been steadily rising, peaking in April before declining. Despite ADA’s price being only one-fifth of its peak, Cardano’s TVL in dollar terms remains over 50% of its all-time high.

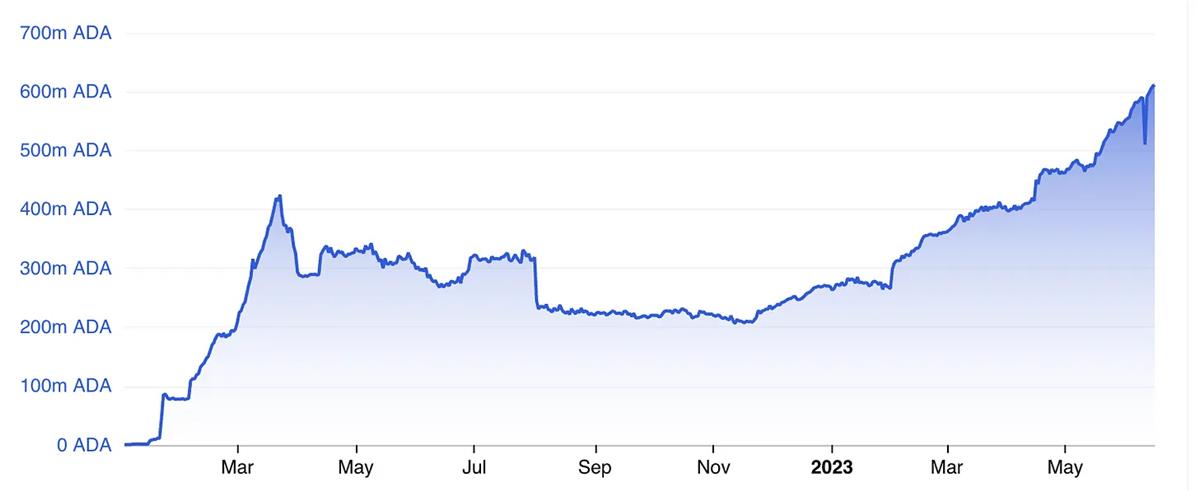

If we measure Cardano’s TVL in ADA, the signs of a DeFi revival become even clearer.

TVL measured in ADA has tripled since the beginning-of-year low.

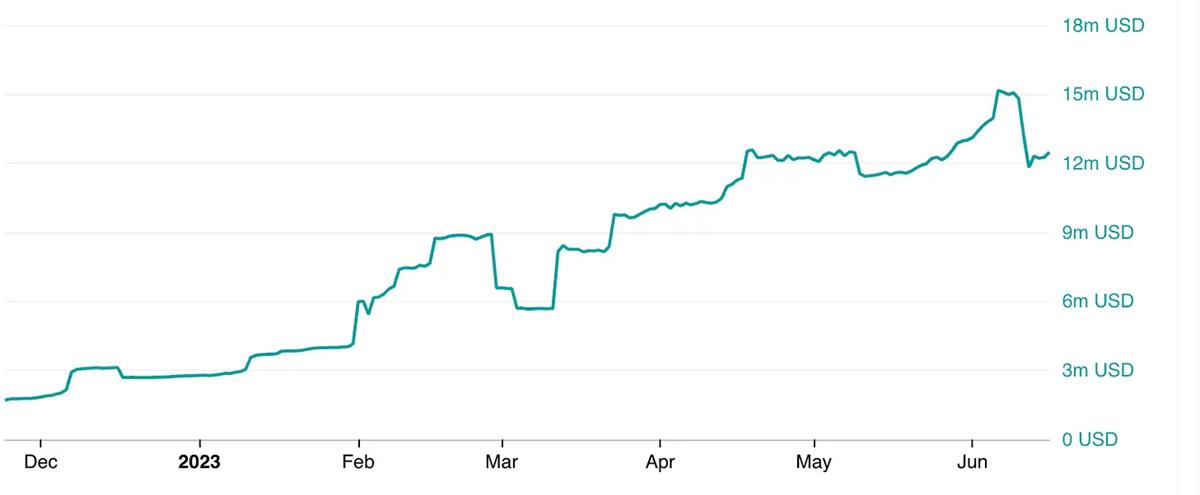

Stablecoins have historically been another weak spot for Cardano. Without stablecoins, it’s hard for a blockchain to sustain a vibrant DeFi ecosystem. Until now, major stablecoins like USDT, USDC, and DAI haven’t established any presence on Cardano.

However, native solutions are starting to change that, led by Indigo’s iUSD.

Since January, stablecoin supply has grown from $3 million to a peak of $15 million, currently sitting at around $12 million. While progress is slow, this marks another significant milestone for Cardano.

So how is Cardano doing in terms of decentralization?

By the People

For better or worse, people love leaders. In past bull runs, some of the biggest gains occurred in ecosystems with strong figureheads: SBF and Solana, Do Kwon and Terra, Daniele Sesta and Frog Nation.

Even Vitalik hasn't escaped this kind of personality cult—he may dislike it, but people still look to him for guidance in the Ethereum ecosystem.

Many of Cardano’s critics resent the outsized role its founder, Charles Hoskinson, plays within the Cardano world. Honestly, I’m not a big fan of Hoskinson either. But you have to admit—he’s a compelling speaker. Here’s what he said after the SEC filed suit against Binance:

“For the industry as a whole, this lawsuit seems like a fantastic opportunity for people to come together and develop rational rules and guidelines—ones that can prevent the U.S. from descending into a dystopia like 1984. I’ll say more later, but for now I want to say we’re going to be okay. Everything’s going to be fine. The future of this industry is bright.”

This man has a large following. Over two million Twitter users saw that post. Charles himself has over a million followers and is undoubtedly the face of Cardano.

Despite Charles Hoskinson’s central role, the chain itself is one of the most decentralized L1s.

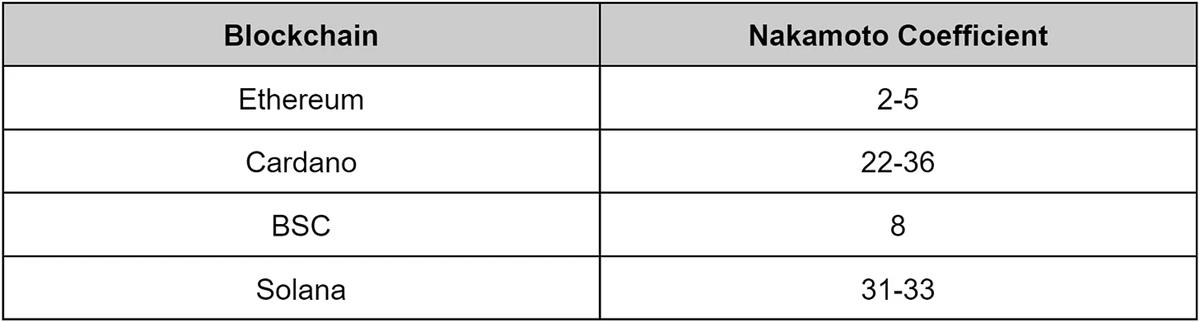

A popular way to measure network decentralization is the Nakamoto coefficient, which indicates the minimum number of entities that would need to collude to compromise the blockchain. For PoS chains like Cardano, Ethereum, or Solana, this threshold is controlling 33.33% of all staked tokens.

The higher the Nakamoto coefficient, the more decentralized the network. Here are the coefficients for some major chains:

Depending on the source, Cardano’s Nakamoto coefficient ranges between 22 and 36, making it one of the most decentralized chains. Among major L1s, only Solana (33) comes close.

Part of this stems from having no minimum token requirement to stake. On Ethereum, validators—nodes that participate in consensus and verify transactions—must stake at least 32 ETH. At current prices, that’s about $50,000.

That’s no small sum, and it’s unaffordable for most people. Most other chains have similar requirements.

Staking derivatives and delegation can help here, but they don’t eliminate the fact that direct staking remains a privilege for the few.

In contrast, Cardano’s staking is egalitarian. With no minimum stake required—just a 2 ADA fee ($0.50)—anyone who wants to stake ADA can do so.

No wonder 60% of ADA is staked. To put that in perspective, Polygon has a staking ratio of 38%, while Ethereum fans are excited that theirs has just crossed 20%.

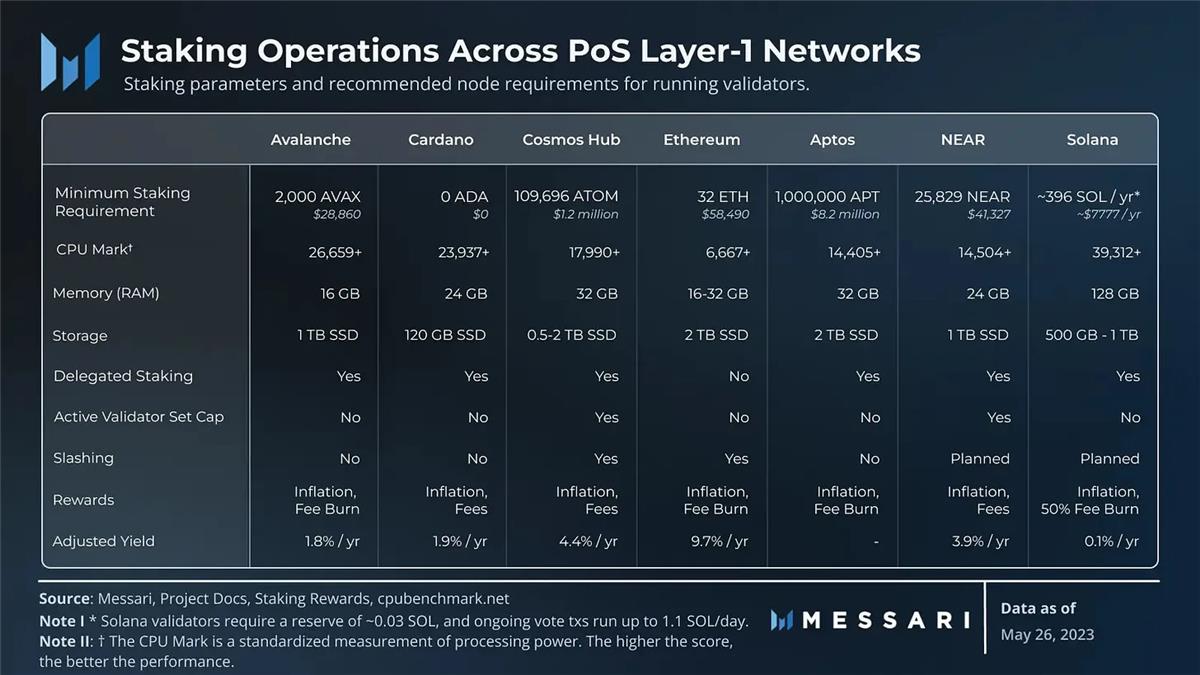

Most importantly, Cardano’s validator hardware requirements are the lowest among major L1s. This table from Messari compares Cardano’s parameters with other L1s.

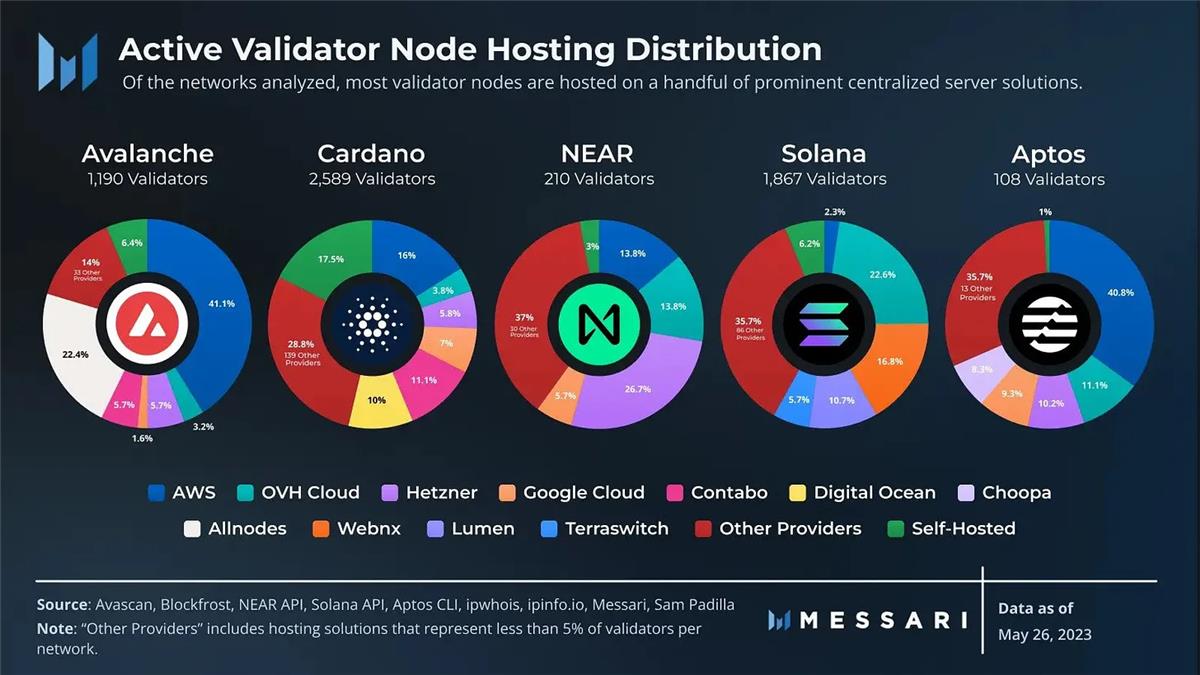

This makes Cardano one of the least dependent blockchains on centralized hosting solutions like Amazon Web Services (AWS), further boosting its decentralization.

Running validators on hosted servers and relying on a few providers may be convenient, but it’s risky—it makes the blockchain dependent on the whims of a handful of companies and governments. The network also becomes more homogenized, so any issues with cloud providers could affect more validators at once.

Over 17% of Cardano validators choose to self-host—better than other L1s like Avalanche and Solana.

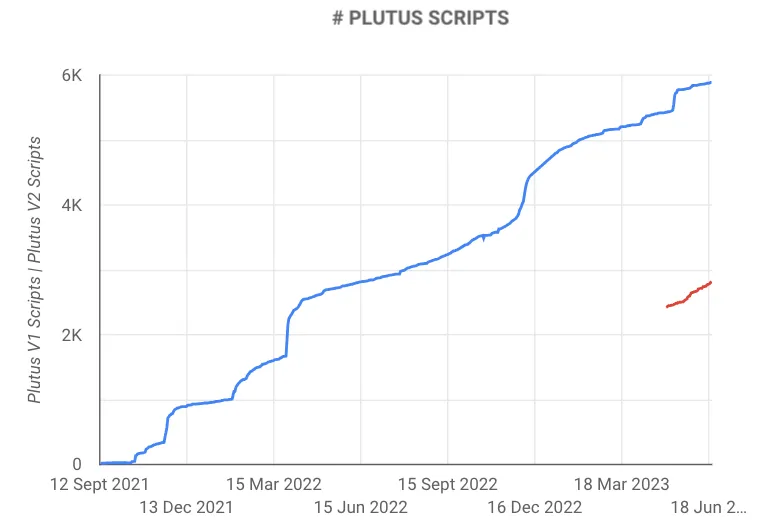

One data point reflecting the resilience and persistence of the Cardano team is the growing number of deployed smart contracts—known as Plutus scripts on Cardano—over time.

So here’s where Cardano stands: it’s not dead. It’s alive, active, and preparing to shine in the next bull market. While I can’t predict how ADA will perform or how much activity Cardano will attract, I believe it’s a project worth paying attention to.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News