Unveiling Fogo: A High-Performance L1 Built by Pure-Blooded Firedancer, Driving Ferraris on a New Highway

TechFlow Selected TechFlow Selected

Unveiling Fogo: A High-Performance L1 Built by Pure-Blooded Firedancer, Driving Ferraris on a New Highway

Fogo is a Layer 1 blockchain designed for institutional-grade finance, aiming to seamlessly bridge traditional finance and the decentralized world.

Written by: TechFlow

Introduction

The crypto market is always a battlefield driven by attention, and the biggest opportunities often lie hidden within emerging trends.

At the start of this year, one trend stands out above all others: institutional investors rushing into the space and the rise of “Made in America” narratives.

By early 2025, institutions already hold around 15% of the total Bitcoin supply. Nearly half of all hedge funds have started allocating to digital assets, while presidential legislation, the launch of U.S.-based Bitcoin ETFs, and the growing momentum behind RWA (real-world asset) tokenization are further accelerating adoption.

As “institutional-grade on-chain finance” becomes an essential need, both narrative and product development demand infrastructure that combines traditional financial performance with decentralized foundations.

In this context, promising new infrastructure projects have become fresh engines for discovering alpha.

Recently, a project called Fogo has caught our attention. Based on publicly available information, it appears to meet all the criteria outlined above.

Here’s a TL;DR version:

-

Fogo is a Layer 1 blockchain specifically designed for institutional finance, aiming to seamlessly bridge traditional finance with the decentralized world.

-

Technical Highlights: Uses Jump Trading’s Firedancer as its sole client, enabling faster TPS and block times. Powered by the Solana Virtual Machine (SVM), it supports easy migration of Solana-based applications.

-

Team Strength: Led by former quantitative analysts from traditional finance and early Solana developers, backed by Douro Labs and Jump Crypto—deeply rooted in the U.S., aligning perfectly with this year’s “Made in America” narrative.

-

Funding Background: Raised $5.5 million in seed funding, and recently secured $8 million at a $100 million token valuation through Cobie’s fundraising platform Echo.

-

Participation Opportunity: Currently running the Flames Program, where users can earn points via various interactions to position themselves favorably for potential future airdrops—an ideal entry point during current market volatility.

In short, for readers less familiar with technical details, you just need to know that Fogo is a new L1 chain offering superior performance, strong backing, and abundant resources.

More importantly, there's the Flames Program mentioned earlier—which is ultimately what most people care about.

Therefore, this article will first provide a complete guide and introduction to participating in Fogo’s Flames Program, followed by a deeper analysis of the Fogo chain itself.

Complete Guide to the Flames Program

Prior to launch, Fogo’s official Twitter account ran a countdown campaign, indicating thorough marketing preparation by the team.

What Is the Flames Program?

The Flames Program is Fogo’s ecosystem incentive initiative, designed to reward active user participation and drive early growth of the Fogo ecosystem.

The name “Flames” continues the Firedancer theme, symbolizing energy and momentum within the ecosystem. According to official information, Flames are a form of points that may be redeemable for Fogo tokens or other ecosystem rewards in the future.

Each week, Fogo distributes **1,000,000 Flames** to participants who contribute to the ecosystem—through engagement with partner projects or activity across official social channels.

Why Participate in the Flames Program?

-

Early Adopter Rewards: As one of Fogo’s earliest initiatives, the Flames Program offers low-barrier access for users to accumulate ecosystem points. History shows that early participants in similar programs often receive outsized returns—such as airdrops or priority benefits.

-

Future Potential: Although Fogo’s token hasn’t been launched yet, Flames—as an ecosystem point system—are likely to increase in value as the ecosystem grows. Participation not only positions users well for potential token airdrops but also enables deeper involvement in building the Fogo ecosystem.

-

Diverse Participation Options: Whether you’re a DeFi user, a social media enthusiast, or new to blockchain, there’s a way for everyone to get involved.

How to Participate in the Flames Program?

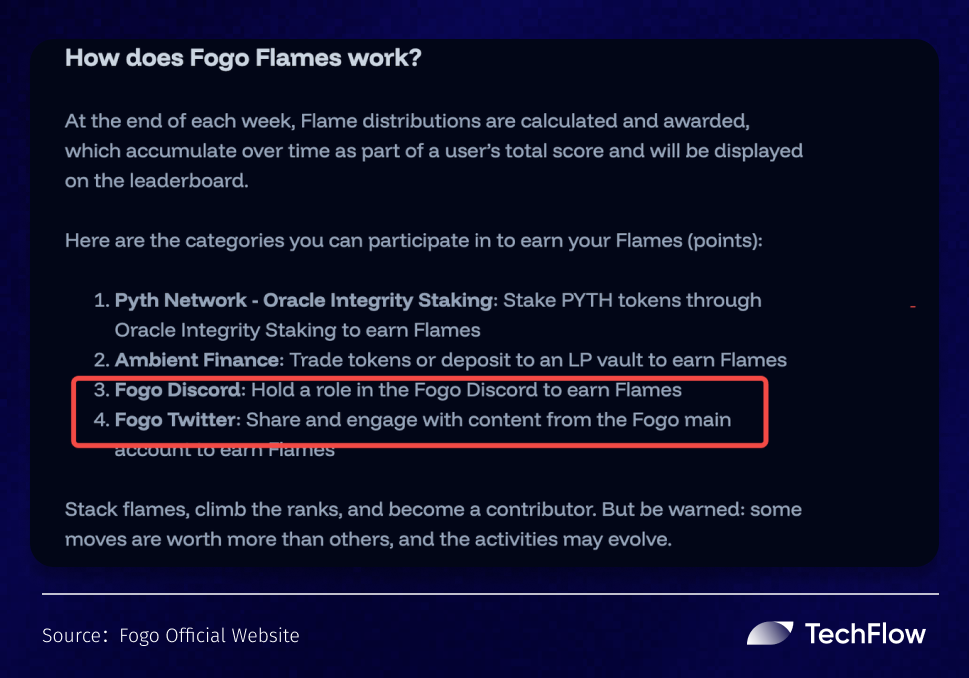

According to official materials, participation currently falls into two main categories: interaction with ecosystem partner projects and activity on official social media channels.

-

Engagement with Ecosystem Partner Projects

-

Pyth Network: Stake PYTH Tokens

Users can stake PYTH tokens through Oracle Integrity Staking (OIS) on Pyth’s staking page (link).

Note: For first-time participants, it’s crucial to select the OIS (Oracle Integrity Staking) mode when entering the staking interface—not the Pyth Governance mode—to avoid ineligible stakes.

If you’ve previously staked under the Governance model, you can still participate in OIS without unlocking or re-staking. Similarly, if your tokens were staked before OIS launched, they remain eligible—no withdrawal required.

-

Ambient Finance: Trade or Provide Liquidity

Ambient (formerly CrocSwap) is a decentralized exchange protocol allowing combined concentrated and constant-product liquidity AMMs across any pair of blockchain assets.

Doug, its founder, is also a co-founder of Fogo—making participation in Ambient a natural fit for earning Fogo points.

You can trade tokens on Ambient Finance or deposit them into liquidity pools (LP Vaults). These actions help earn Flames while familiarizing yourself with key DeFi partners in the Fogo ecosystem.

-

Official Social Media Activity

-

Fogo Discord: Stay active in Fogo’s Discord community—holding certain roles grants Flames points.

-

Fogo Twitter: Earn points by sharing, commenting, liking Fogo tweets, or retweeting Fogo-related content.

Flames Rules and Details

-

Point Accumulation: Flames accumulate over time as your total score. Weekly rewards are calculated and distributed automatically based on contributions.

-

Weighted Points: Different activities carry different point values—for example, staking PYTH earns more than basic social media interaction.

-

Dynamic Adjustments: The team may update rules based on ecosystem development, including adding or refining participation methods.

-

Leaderboard Tracking: Users can check their ranking via the official leaderboard, shown below.

Leveraging Solana’s Firedancer: Putting a Ferrari on a New Highway

If you're curious about Fogo’s technology beyond participation, here’s a simplified breakdown to help you quickly grasp what Fogo is all about.

1. How Can I Quickly Understand Fogo?

Fogo’s official definition: "Fogo is an SVM chain running the Firedancer client, built for large-scale real-time experiences."

This sounds simple, but it reflects ambitious goals in blockchain performance optimization.

To understand Fogo’s significance, we need to clarify two key technical concepts: SVM and Firedancer.

We’ll keep things accessible—even if you’re not technical, understanding what these technologies enable matters most.

-

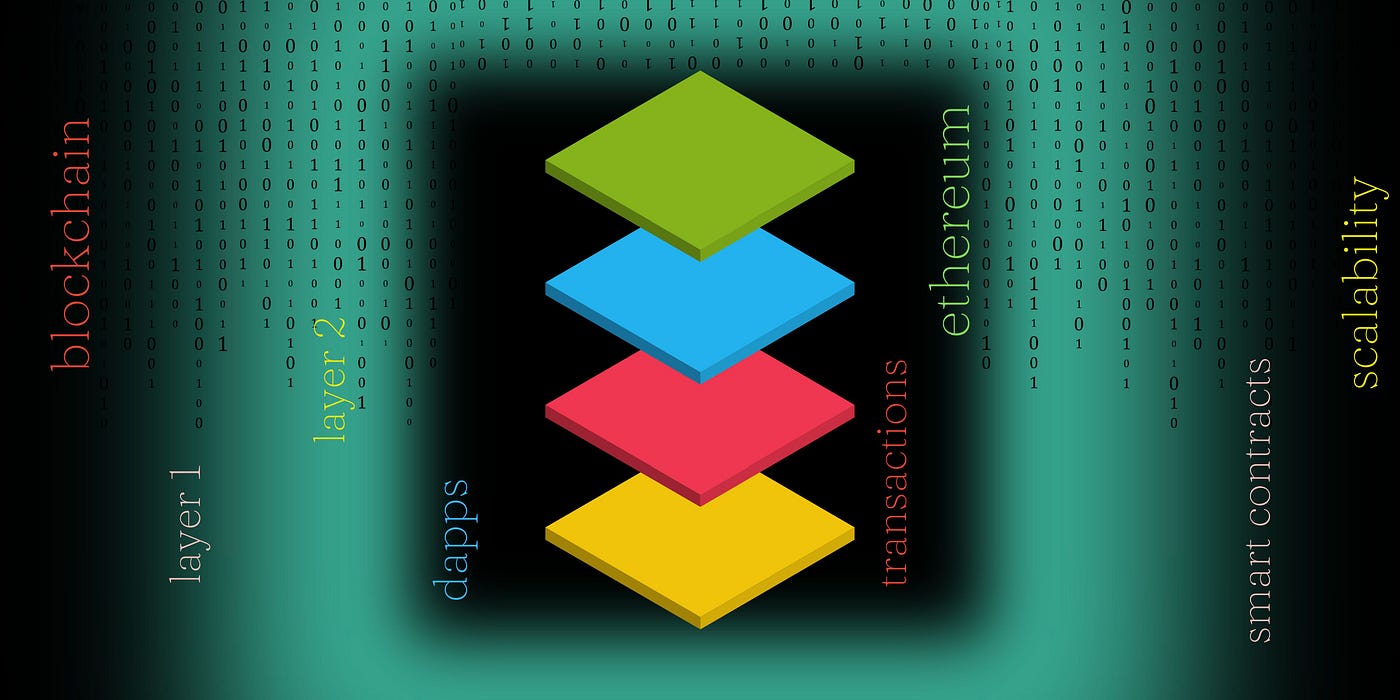

Key Concept 1: SVM

Solana Virtual Machine (SVM) is the core execution environment of the Solana network—essentially its “operating system.” All smart contracts and dApps on Solana run via SVM.

Critical takeaway: By building on SVM, Fogo inherits Solana’s entire tech ecosystem, enabling seamless migration of existing apps to Fogo.

-

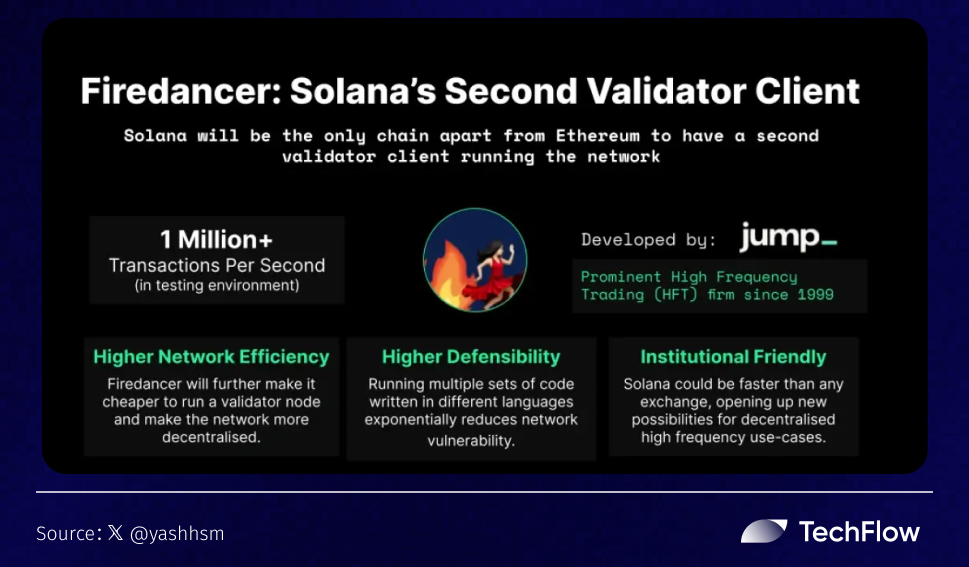

Key Concept 2: Firedancer

Firedancer is a high-performance client developed by Jump Crypto for Solana, designed to make the network faster and more stable.

You may have heard of Solana’s upcoming Firedancer upgrade—it aims to reduce hardware requirements for validators, making node operation easier.

Lower costs, improved speed, and greater resilience make Firedancer a key solution to Solana’s scalability challenges. Its goal is to bring Solana’s performance close to traditional financial systems like NASDAQ, which handles 100,000 transactions per second.

However, as of now, the full Firedancer rollout has not yet been completed on Solana.

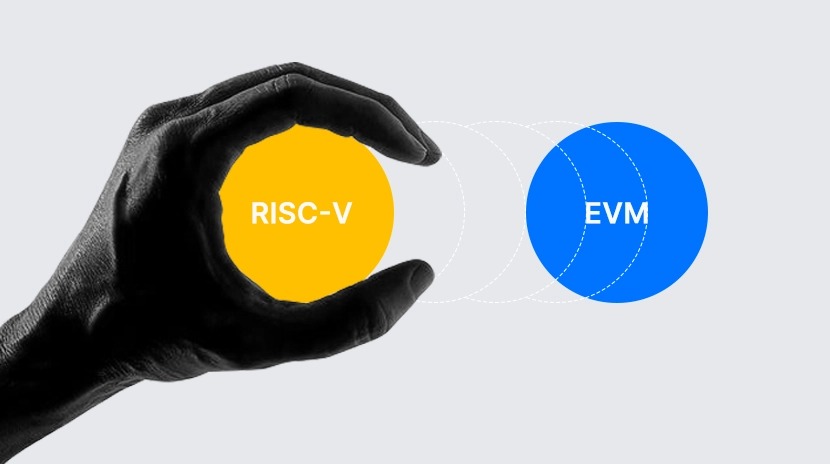

2. Okay, But Why Build a New L1?

If Solana is getting the Firedancer upgrade—and will become faster and better—why create another chain like Fogo?

The issue remains: even with Firedancer, Solana’s multi-client architecture means network speed is limited by the slowest validator—not all nodes can switch to Firedancer immediately.

As Fogo co-founder Doug Colkitt put it: “It’s like owning a Ferrari but driving it in congested New York City traffic.”

Firedancer is the Ferrari, but congestion exists elsewhere on Solana.

So the solution? Build a dedicated highway for the Ferrari.

Instead of letting Firedancer be held back, give it its own stage. Fogo was created to fully unlock Firedancer’s potential—because everyone starts with the same client.

As a standalone L1, Fogo isn’t constrained by multi-client limitations or legacy validator upgrades. By using a unified client and innovative design, it can fully unleash Firedancer’s performance.

Why is a single-client model better?

When blockchains approach the physical limits of hardware and network performance, differences between client implementations create bottlenecks.

Thus, Fogo is “pure-blood” Firedancer from day one—no painful transition needed.

3. Fair Enough. So How Does Fogo Do It?

-

Single Firedancer Client Model

Fogo’s primary innovation is making Firedancer the only standard client, completely eliminating performance bottlenecks caused by Solana’s multi-client setup.

In one sentence:

“Only use the fastest client, so the network always runs at peak performance.”

If you’re unfamiliar with Firedancer, here are the key benefits: parallel transaction processing (greatly increasing throughput), memory optimization (improving hardware efficiency and reducing latency), and low-level hardware optimizations that minimize transaction processing time.

The meme below illustrates how these improvements drastically reduce latency.

-

Dynamic Multi-Region Consensus

Another core innovation is Fogo’s multi-region consensus mechanism.

This dynamically optimizes validator collaboration based on geographic location—achieving ultra-low latency consensus while maintaining global security.

The team calls this “Follow the Sun”. In practice, validator activity shifts according to global trading hours.

This metaphor means that when the sun rises—corresponding to high-traffic periods in a region—consensus activity concentrates there. This ensures validator resources match global transaction rhythms, improving overall network efficiency.

Here’s a simplified explanation:

First, validators are grouped into specific “consensus regions” based on geography, achieving low-latency agreement within each zone.

Second, in case of regional failure, the network automatically switches to global consensus mode, ensuring stability.

Additionally, rotating regions prevents long-term control by any single jurisdiction, enhancing censorship resistance. It also mitigates risks from natural disasters or data center outages.

-

Curated Validator Set

Finally, to ensure high performance and stability, Fogo uses a curated validator set, carefully selecting participants and using economic incentives to maintain efficiency.

What are the selection criteria?

Economic threshold: Validators must meet minimum staking requirements, ensuring sufficient skin in the game.

Hardware capability: Validators must prove access to high-performance hardware and network infrastructure capable of supporting Fogo’s demands.

On the incentive side, validators using high-performance clients (i.e., Firedancer) earn higher rewards. Dynamic block time and size parameters create economic pressure, encouraging optimal performance. Validators failing to meet standards may face penalties or removal.

This design prevents low-performance nodes from dragging down the network. Through self-optimization, validators push the entire network toward higher efficiency and reliability.

Currently, Fogo is on Devnet and即将 transitioning to testnet—meaning broader participation in network interactions will soon be possible.

Public data shows Fogo’s Devnet achieves up to 57,000 TPS with block times under 40ms. Testnet and mainnet performance will require further observation.

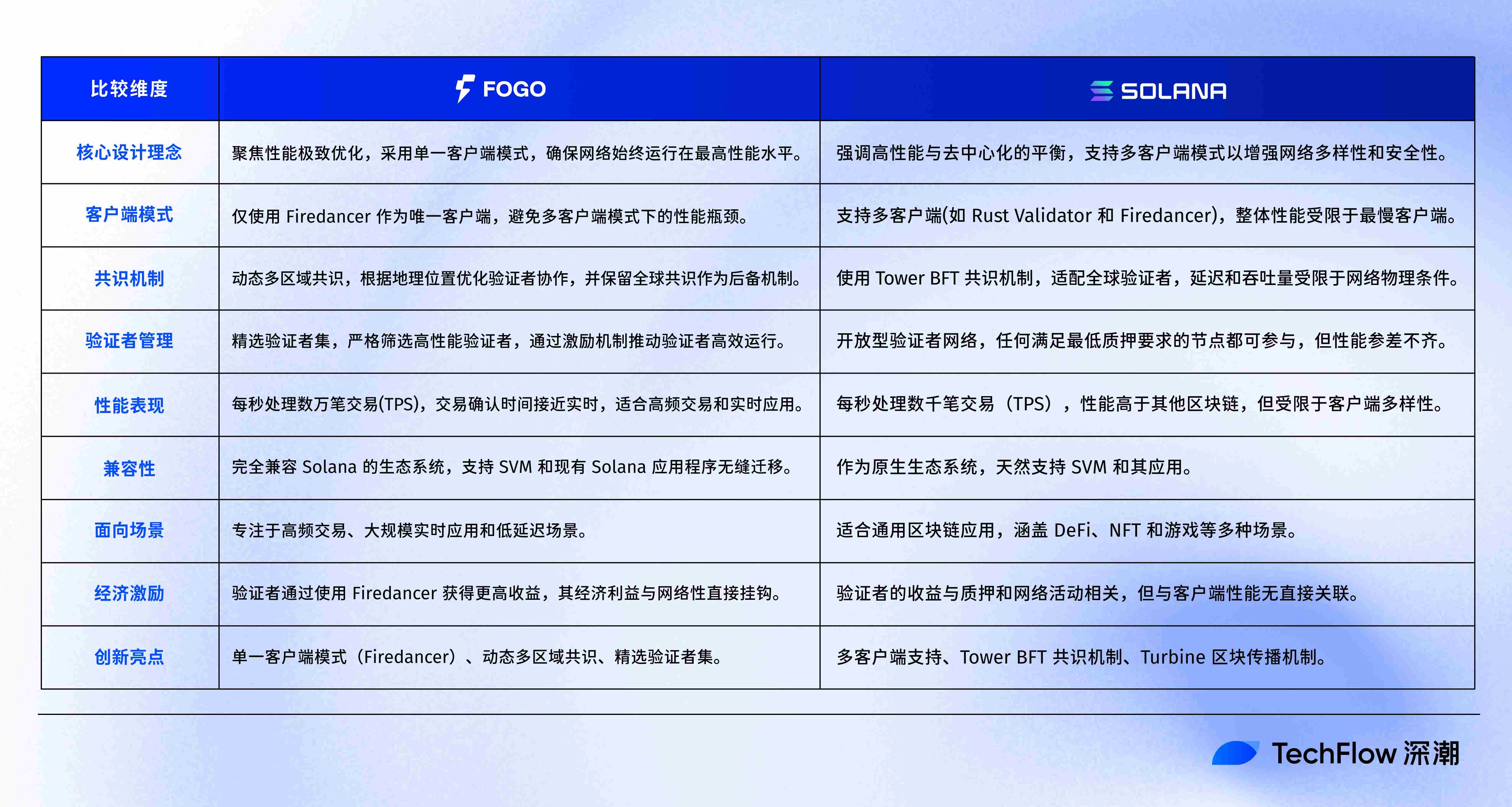

For clarity, here’s a comparison table summarizing the differences and similarities between Fogo and Solana:

From Institutional Narrative Alignment to the Right Team Setup

Clearly, many high-performance L1s exist—why does Fogo stand out?

Are there additional reasons for ordinary users to pay attention?

Perhaps we can analyze Fogo’s potential through three lenses: market trends, team composition, and strategic partnerships.

1. Institutional Adoption Is the Trend—But Requires Low-Latency, High-Performance Infrastructure

Institutional-grade blockchains are a defining trend of 2025, especially in the U.S. The “America narrative”—including pro-crypto policies from figures like Trump—and increasing allocations by legacy financial players (e.g., hedge funds investing in digital assets)—are fueling this wave.

RWA tokenization—such as real estate and bonds—has tripled in market cap over the past 12 months, signaling strong institutional interest in on-chain finance.

Yet existing solutions (like Solana) are limited by global consensus mechanisms, resulting in higher transaction latency—insufficient for institutional needs requiring microsecond-level execution.

For instance, high-frequency trading demands sub-100ms speeds, while traditional blockchains often have block intervals exceeding hundreds of milliseconds.

Fogo leverages Firedancer and multi-region consensus to achieve higher throughput and lower block latency—approaching the performance levels of traditional financial systems like NASDAQ.

Given Fogo’s positioning as an enabler of “on-chain institutional finance,” it naturally fits use cases involving stablecoins (like USDC) and U.S. Treasuries.

2. A Team That Understands Traditional Finance

Trends matter—but only if the right people are executing them.

Fogo’s two co-founders both have deep roots in the U.S. financial ecosystem.

Co-founder Douglas is a DeFi technical expert who previously built trading systems at Goldman Sachs and actively shares insights on X.

Reviewing his past posts, Douglas demonstrates deep knowledge of DeFi products like DEXs and perpetual contracts—and even designed his own DEX called ambient.

The other co-founder, Robert, previously worked at Jump Crypto, bringing direct experience in institutional finance and firsthand insight into Firedancer’s design.

Since Fogo is a new L1 built specifically around the Firedancer client, this expertise is perfectly aligned—effectively transplanting Jump’s engineering excellence directly into Fogo.

Notably, Fogo receives support from Douro Labs—the team behind the Pyth oracle network, which delivers real-time financial data critical for DeFi and institutional applications.

Pyth is closely tied to Jump Crypto—the very team developing Firedancer. This creates a powerful synergy, giving Fogo a competitive edge in both technology and finance.

3. Ecosystem Integration and Convenience for Solana Users

Fogo is built on Solana Virtual Machine (SVM), ensuring compatibility with the Solana ecosystem. Developers can migrate existing applications seamlessly, reducing development costs and learning curves. For Solana users, this is a major advantage—existing SOL assets can be bridged to Fogo via Wormhole, enhancing liquidity.

Integration with Pyth ensures high-quality, real-time data feeds—essential for DeFi and RWA applications. Wormhole enables cross-chain interoperability, allowing assets to flow freely between chains and attracting broader ecosystem participation. For example, users can bridge assets from Solana to Fogo to take advantage of its high-performance environment.

4. Funding and Market Confidence

Fogo’s fundraising trajectory reflects strong investor confidence in its potential.

According to Rootdata, Fogo raised $8 million in a community round via Echo in January 2025 at a $100 million valuation. Earlier, it secured $5.5 million in seed funding led by Distributed Global.

Echo, operated by prominent KOL Cobie, enjoys high credibility in the English-speaking crypto community, helping foster strong investor alignment.

Conclusion

The name “Fogo” means “fire” in Portuguese, symbolizing passion, momentum, and innovation—visually reinforced by its flame logo.

Overall, Fogo’s narrative isn’t just about technical innovation—it’s about building an efficient bridge between traditional finance and crypto, backed by the right team and resources to execute it.

Aligned with the current “Made in America” narrative and branded as the “fastest L1,” Fogo is well-positioned to capture attention in an attention-scarce market.

For regular users, the Flames Program offers an easy entry point. For developers and institutions, Fogo provides a high-performance, highly compatible environment.

In the future of on-chain finance, Fogo may emerge as a significant player. If you’re looking for a project with both technological promise and clear participation opportunities, Fogo deserves your time and attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News