The Covert War Between L2 and L1: Who Will Win dApp Yields?

TechFlow Selected TechFlow Selected

The Covert War Between L2 and L1: Who Will Win dApp Yields?

L2 is smarter than L1 because it only requires one sequencer.

Author: 0xtaetaehoho, Chief Security Officer at EclipseFND

Translation: zhouzhou, BlockBeats

Editor's Note: L2s hold an operational cost advantage over L1s because they only need to pay for a single sequencer, whereas L1s must fund security for all validators. L2s have unique advantages in speed and reducing MEV, and can support dApp revenue maximization through innovative economic models. Although L2s cannot compete with L1s in terms of liquidity, their potential in the dApp economy will drive the crypto industry’s transition from infrastructure-focused development to long-term, profit-driven business models.

Below is the original content (slightly edited for readability):

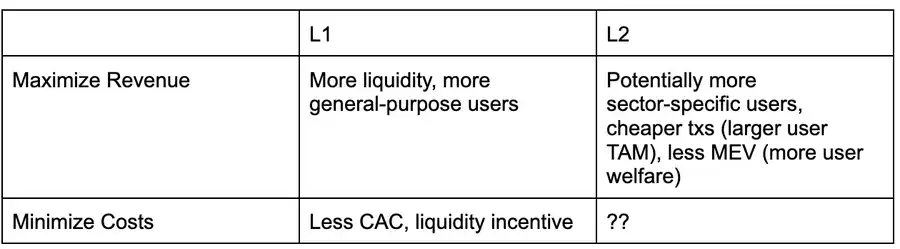

The following is a decision matrix from the dApp perspective, analyzing whether deploying on L1 or L2 is preferable under current conditions—assuming both support similar application types (i.e., neither L1 nor L2 is customized for specific app categories).

Besides relatively lower MEV due to centralized block production, L2s have not yet fully leveraged other structural advantages. For example, although L2s have the potential for lower transaction costs and higher throughput, Solana currently outperforms EVM-based L2s in both performance and cost efficiency.

As Solana continues increasing its throughput and implements MEV taxation mechanisms like ASS and MCP, L2s must explore new ways to help dApps maximize revenue and reduce costs. My current view is that structurally, L2s are better positioned than L1s to rapidly execute strategies that maximize dApp revenues.

One key role of the execution layer in maximizing application revenue lies in how fees/MEV are distributed.

Currently, implementing MEV taxation or fee sharing requires an "honest block proposer"—one willing to follow priority ordering rules or share revenue with applications according to predefined rules. Another approach involves allocating part of the base fee from EIP-1559 to the interacting dApp; Canto CSR and EVMOS appear to use such a mechanism. This at least enables dApps to increase their bidding power for MEV extraction, making them more competitive in the transaction inclusion market.

In the L2 ecosystem, if block proposers are operated by a team (i.e., a single proposer), they are inherently “honest” and can ensure transparency of block-building algorithms via reputation systems or TEE (Trusted Execution Environment) technology. Currently, two L2s have already implemented fee-sharing and priority-ordering block building, while Flashbots Builder can also provide similar functionality to the OP-Stack ecosystem with minimal modifications.

In the SVM (Solana Virtual Machine) ecosystem, infrastructure like Jito can proportionally redistribute MEV to dApps (e.g., based on CUs; Blast uses a similar mechanism).

This means that while L1s are still researching MCP and built-in ASS solutions (Solana may advance here, but there's no revival plan for CSR-like mechanisms in the EVM ecosystem), L2s can deploy these features faster. Since L2s can rely on trusted block producers or TEEs without requiring OCAproof mechanisms, they can adjust dApp MRMC (Margin, Revenue, MEV Competition) models more quickly.

But the advantages of L2s go beyond development speed or fee redistribution—they also face fewer structural constraints.

The survival condition of an L1 ecosystem (i.e., sustaining its validator network) can be described by this equation: Total number of validators × Validator operating cost + Staking capital requirement × Capital cost < TEV (Inflation + Total network fees + MEV tips)

From a single validator’s perspective: Validator operating cost + Staking capital requirement × Capital cost > Inflation rewards + Transaction fees + MEV rewards

In other words, L1s face a hard constraint when attempting to reduce inflation or cut fees (e.g., via sharing with dApps)—validators must remain profitable!

This limitation becomes even more pronounced when validator operating costs are high. For instance, Helius pointed out in its SIMD228-related article that, under the proposed emission curve and 70% staking rate, approximately 3.4% of current validators might exit due to reduced profitability (assuming REV remains as volatile as in 2024).

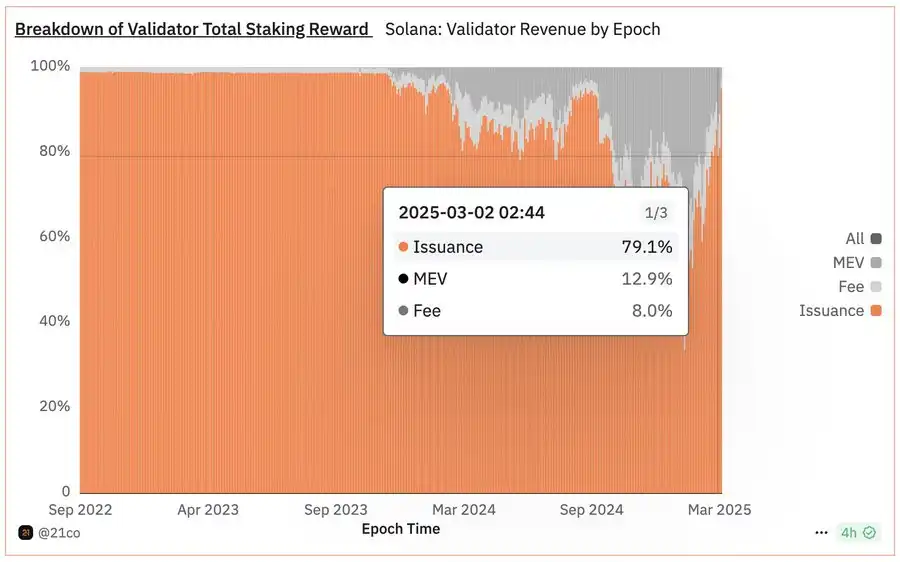

REV (the share of MEV in staking rewards) is extremely volatile: · On the day of the TRUMP event, REV share reached 66% · On November 19, 2024, it was 50% · At the time of writing, REV share stands at just 14.4%

This implies that in L1 ecosystems, efforts to reduce inflation or restructure fee distribution hit a ceiling due to validator profitability pressures. In contrast, L2s are not bound by this constraint and thus enjoy greater freedom in exploring strategies to optimize dApp revenue.

Solana validators currently face high operating costs, which directly limits the "profit pool" available for sharing—especially as inflation declines. If Solana validators must rely on REV to stay profitable, then the total portion allocable to dApps will be strictly constrained.

This creates an interesting trade-off: the higher the validator operating cost, the higher the network’s overall take-rate must be.

From a network-wide perspective, the following formula must hold: Total network operating cost (including capital cost) < Total network REV + Issuance

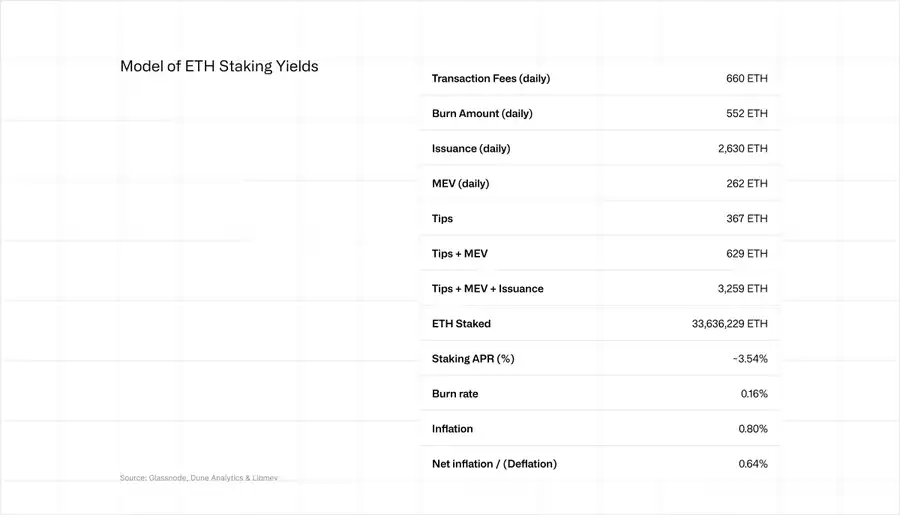

Ethereum faces a similar situation, though less severely. Currently, ETH staking APR ranges between 2.9%-3.6%, with about 20% coming from REV. This also means Ethereum's ability to optimize dApp revenue is similarly constrained by validator profitability requirements.

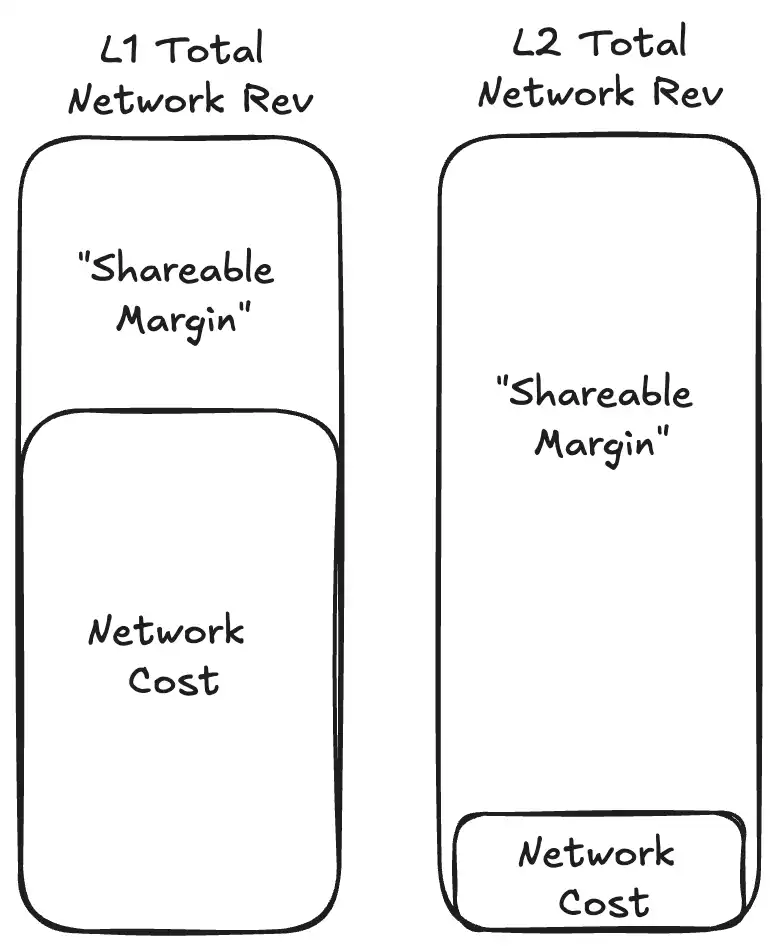

This is precisely where L2s have a natural edge. On an L2, the total network operating cost is merely the cost of running one sequencer, with no capital cost since there is no staking requirement.

Compared to L1s with numerous validators, L2s require minimal profit margins to break even. This means that, at equivalent profit margins, L2s can allocate significantly more value back to the dApp ecosystem, greatly expanding revenue opportunities for dApps.

An L2’s network cost will always be lower than that of a comparably sized L1, because the L2 only periodically “borrows” security from the L1 (occupying a fraction of L1 block space), while the L1 must bear the full security cost of its entire block space.

L1 vs L2: Who Will Dominate the dApp Economy?

By definition, L2s cannot compete with L1s in liquidity, and due to user concentration remaining largely on L1s, L2s have historically struggled to challenge L1s directly on user adoption (though Base is beginning to shift this trend).

Yet so far, few L2s have truly capitalized on their inherent structural advantages stemming from centralized block production.

On the surface, the most discussed benefits of L2s are:

Mitigating adversarial MEV

Improving transaction throughput (some L2s are actively exploring this)

More importantly, however, the next battleground in the L1 vs L2 war will be dApp economic models.

L2 Advantage: Non-OCAproof TFM (Non-strongly-composable TFM)

L1 Advantage: CSR (Contract-Self Revenue) or MCP (Minimum Consensus Protocol) + MEV Tax

This competition is the best thing for the crypto industry

Because it directly leads to:

· Maximizing dApp revenue and minimizing costs, thereby incentivizing developers to build better dApps.

· Shifting crypto incentives away from past infrastructure token premiums (L(x) premium) toward long-term, profit-driven crypto businesses.

· Combined with clearer DeFi regulation, improved token value capture at the protocol layer, and institutional capital inflows, this shift drives the crypto market into an era centered around real business models.

Just as capital flooded into infrastructure over the past few years—driving innovation in applied cryptography, performance engineering, and consensus mechanisms—the current chain-level competition will bring transformative changes to industry incentive structures and attract top talent to the crypto application layer.

Now is truly the starting point for mass-scale crypto adoption!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News