Understanding Convergence: Governance Aggregation and Yield Redistribution Similar to Convex

TechFlow Selected TechFlow Selected

Understanding Convergence: Governance Aggregation and Yield Redistribution Similar to Convex

In this article, crypto analyst DeFi Made Here dives deep into the protocol's mechanism and its token economics.

Author: DeFi Made Here

Translation: TechFlow

DeFi protocols issue hundreds of millions of dollars in native tokens annually (CRV alone reaches approximately $160 million). To capture a portion of these emissions, Convergence Fi has launched a neutral layer similar to Convex that pools governance and redistributes yields back to token holders. In this article, crypto analyst DeFi Made Here dives deep into the protocol's mechanism and tokenomics.

Many high-quality projects require users to lock governance tokens to earn certain rewards. For users, locking is painful because it requires long-term capital immobilization.

To solve these issues, liquid wrappers were created. However, liquid wrappers are often limited to specific assets or lack scalability.

Convergence aims to create a governance black hole, starting with Tokemak and then focusing on the Curve ecosystem. Overall, Convergence will:

• Aggregate protocols and operate meta-governance (i.e., governance over underlying protocols), similar to Convex;

• Run its own governance and directly issue tokens like Curve;

• Issue discounted $CVG bonds to build POL (Protocol Owned Liquidity), similar to Olympus.

Let me explain.

Convergence issues cvgAssets (liquid wrappers), which are paired 1:1 for every deposited asset. For example:

• CRV ➡️ cvgCRV;

• CVX ➡️ cvgCVX;

• FXS ➡️ cvgFXS;

• And so on.

The underlying assets will be permanently staked/locked, and their governance power will be delegated to $CVG (Convergence’s native token) holders. Native yields from the staked/locked assets will be boosted and redirected to cvgAsset holders.

Similar to how users provide liquidity on Curve via Convex to earn enhanced yields, Convergence will allow them to stake their LP tokens across each aggregated protocol. Depending on the design of the underlying protocol, LP holders will receive elevated returns.

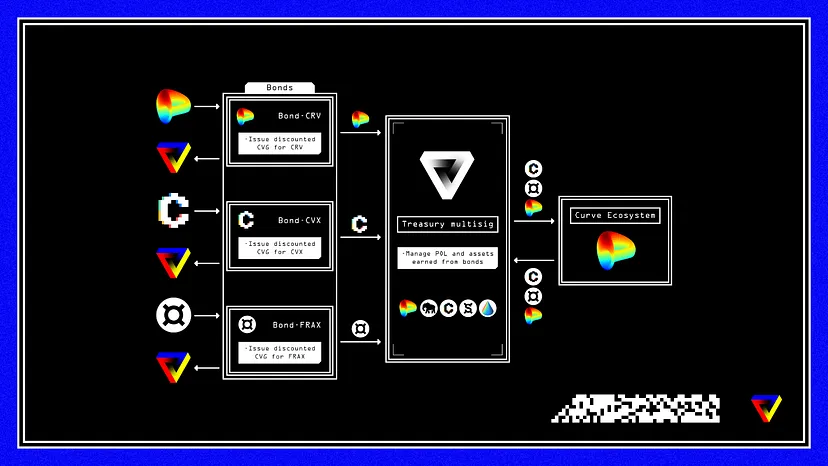

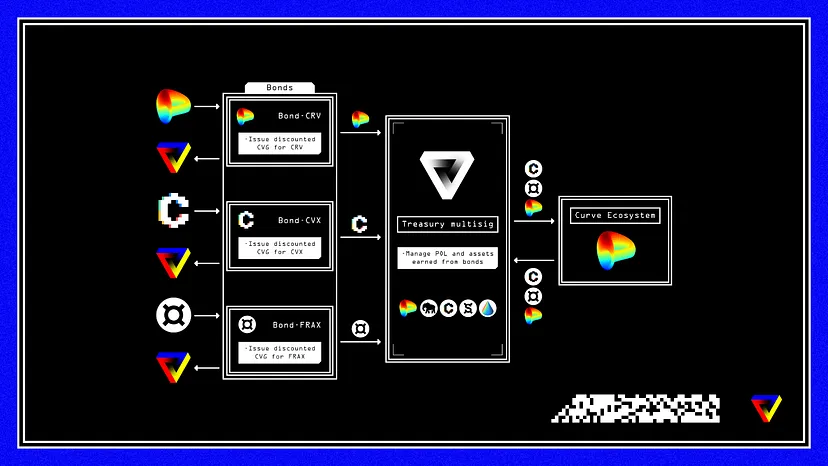

What sets Convergence apart is its approach to POL. Instead of liquidity mining, the protocol issues bonds to accumulate valuable governance power into its treasury. The bond program will span four and a half years, representing 30% of the total supply.

The treasury does not exist to support or redeem any functions. Instead, it generates yield, which is further distributed to $CVG holders every three months in the form of $CRV, $CVX, $FXS, $SDT, and $CNC.

$CVG holders will also govern the protocol, operate meta-governance, and direct the issuance of $CVG. $CVG can be locked for up to 96 weeks and features a highly unique locking design.

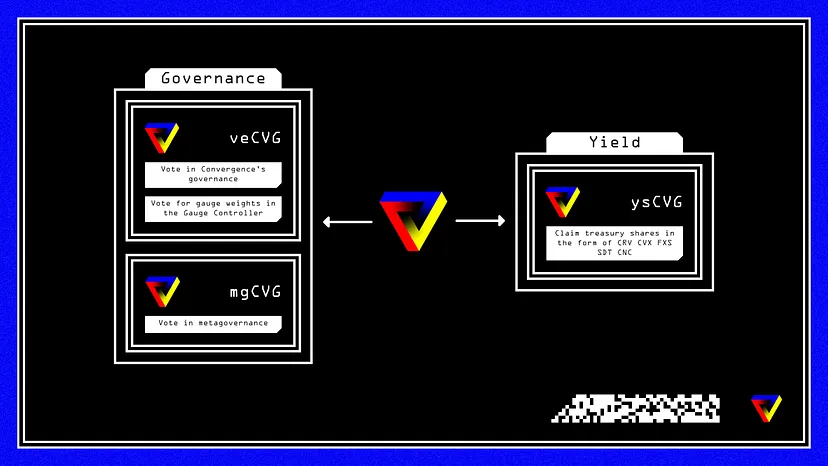

$CVG can be locked as:

• veCVG – for voting and governance;

• mgCVG – for Snapshot-based meta-governance voting;

• ysCVG – for shared revenue rights.

When locking, users can choose the percentage of CVG allocated to veCVG and ysCVG.

Users can allocate their entire CVG amount to either veCVG or ysCVG, or split between both. To obtain mgCVG, CVG must be allocated to veCVG. Locking solely into ysCVG will not generate any mgCVG.

For example, if someone locks 1,000 CVG with a 50/50 split, 500 CVG will count toward veCVG and mgCVG amounts, while 500 CVG will go toward ysCVG.

The calculations for mgCVG and ysCVG are time-weighted but not diluted over time, as balances remain unchanged until the lock expires—enabling passive users to maintain their claims without needing to re-lock repeatedly.

This unique locking design enables users to arbitrage between governance (including bribes) and revenue sharing, represented by veCVG/mgCVG and ysCVG respectively.

Locked positions are also tokenized. veCVG, mgCVG, and ysCVG are non-fungible tokens (NFTs) and are transferable. Creating semi-liquid lock positions via NFTs allows for more flexible trading (tradable on secondary markets) and improves capital efficiency.

Overall, Convergence is not a fork of any existing protocol but is built as an aggregator, thus not relying on a single underlying protocol. $CVG will enable holders to earn yield from aggregated protocols without direct exposure to the underlying assets. However, $CVG will correlate with the performance of the aggregated protocols and tokens, functioning similarly to an index of these protocols.

Additionally, $CVG holders will benefit from treasury-generated yields. Meanwhile, the aggregated protocols—especially projects within the Curve ecosystem—will benefit from an additional layer atop them, reducing sell pressure on native tokens and creating stronger flywheel effects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News