Numbers Behind the DeFi Yield Market: Pendle TVL Surges 10x, Convex Lockup Value Grows 17.5%

TechFlow Selected TechFlow Selected

Numbers Behind the DeFi Yield Market: Pendle TVL Surges 10x, Convex Lockup Value Grows 17.5%

Pendle performed exceptionally in the first half of 2024, emerging as a leader in its overall category.

Author: OurNetwork

Compiled by: TechFlow

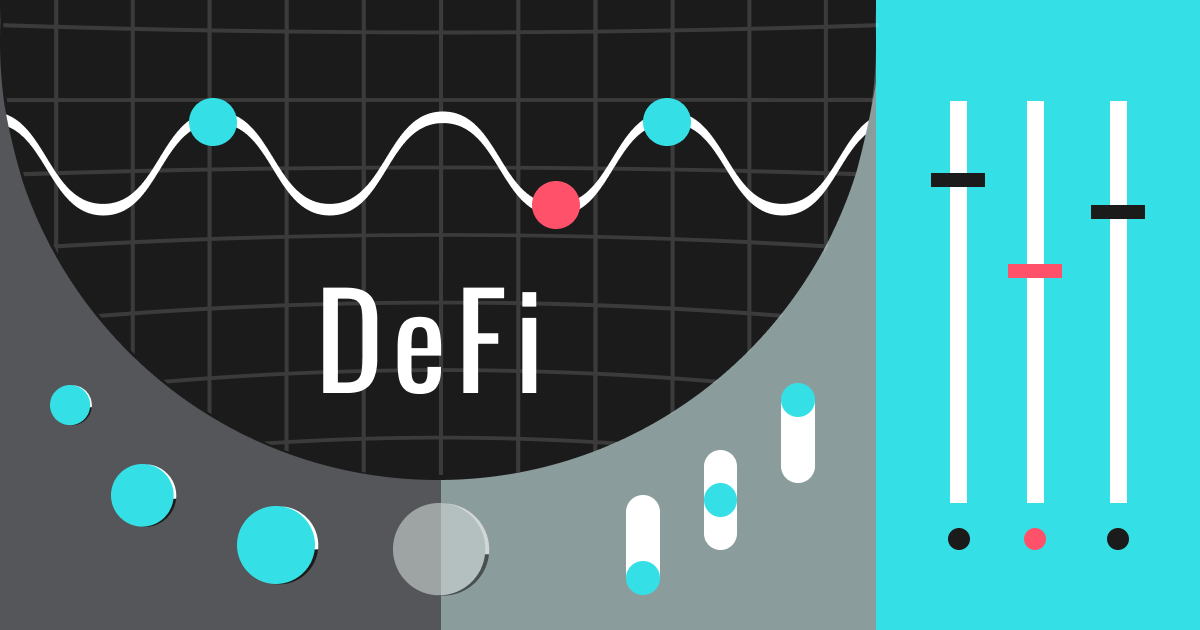

Today we will discuss "yield" protocols—a category of DeFi protocols coined by DeFiLlama. While the term is somewhat ambiguous, we currently lack a better alternative, so we’ll use it for now. In DeFiLlama’s yield category, there are over 500 protocols, collectively holding $7.95 billion in TVL—down 74% from November 2021, but still impressive for a nascent decentralized financial system.

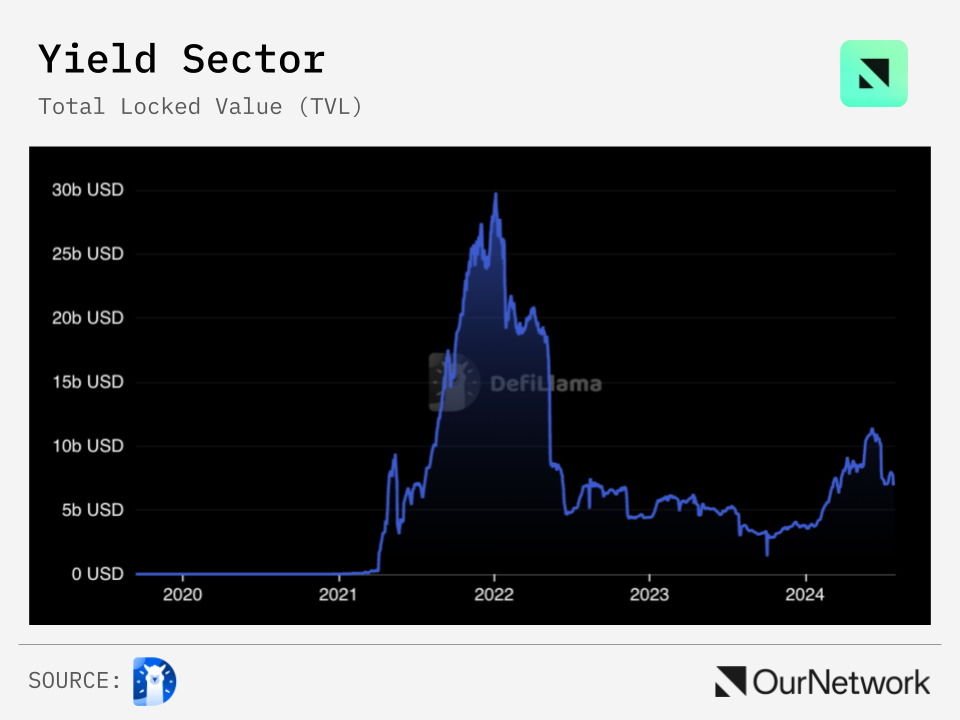

Despite shifting markets and competition between traditional players and new entrants for on-chain capital, several clear winners have emerged. The fixed-rate lending protocol Pendle stood out in the first half of 2024, leading the entire category with TVL growing from $300 million to $3.5 billion—an increase of 10x—even as the overall DeFi market contracted. The PENDLE token has also tripled in value year-to-date. The protocol now accounts for 44% of the yield category's TVL and is on track to generate $22.6 million in annualized fees. Altogether, this is an outstanding achievement, and I look forward to seeing more on-chain research explaining how they pulled it off.

Friendly reminder: These DeFi yields are accessible to anyone in the world with a wallet and internet connection! I encourage you to try some on-chain protocols to earn yield for yourself. Now, let’s dive deeper into this category.

DeFi Yield

Convex, Stake DAO, Tranchess, Pendle, Aura

① Convex

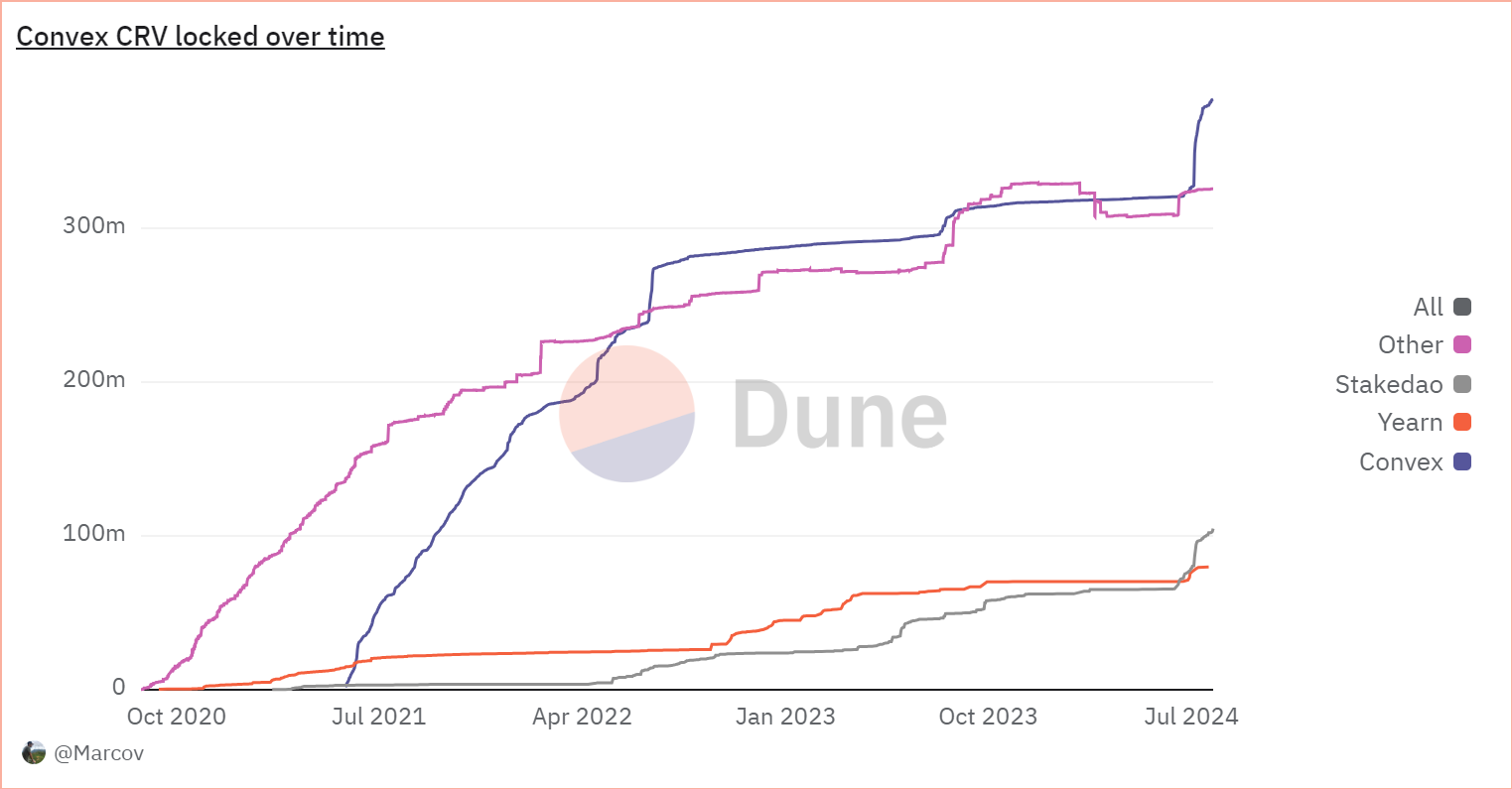

Convex-locked CRV reached 385 million in July (+17.5%)

-

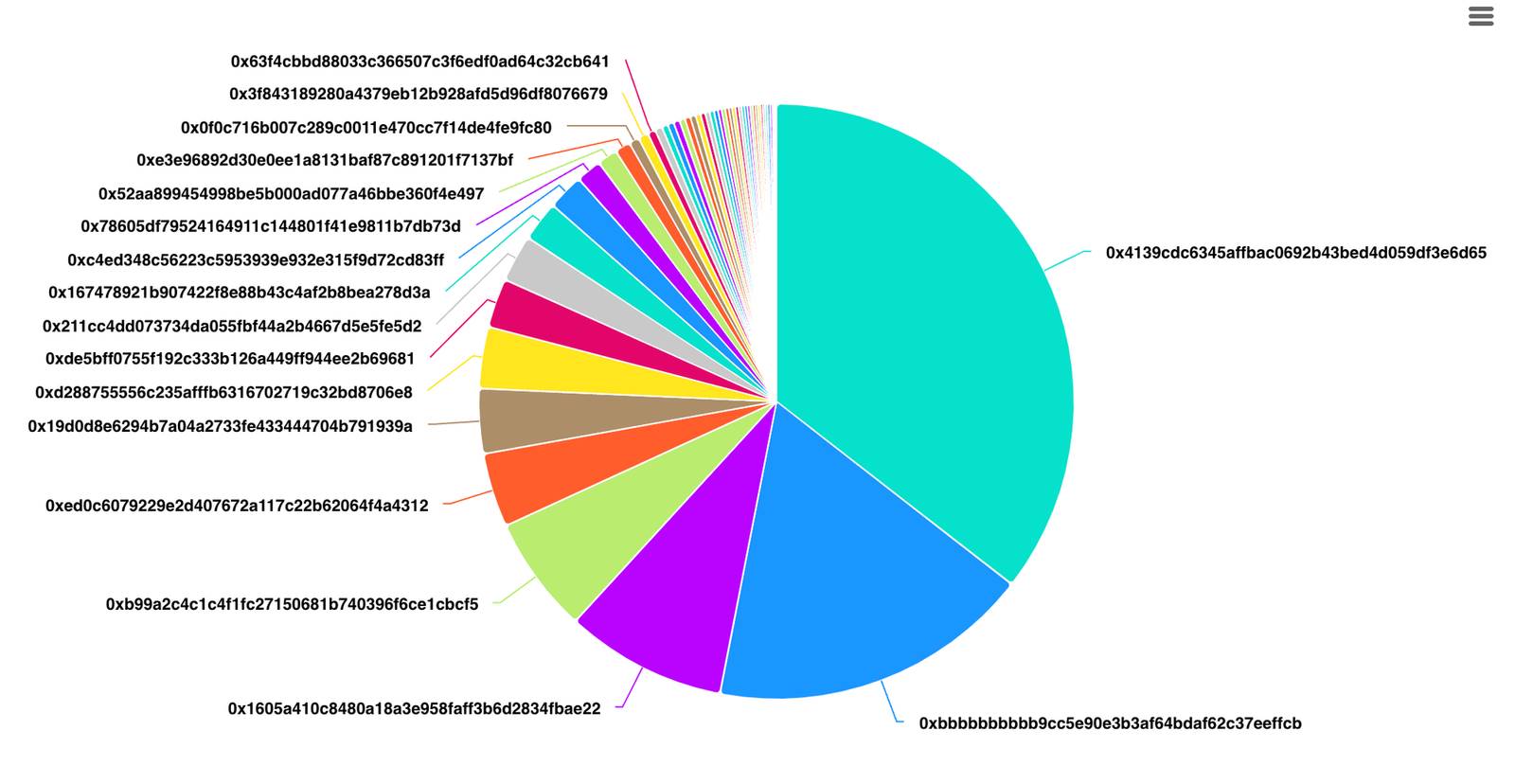

Convex enables liquidity providers on Curve.fi to earn boosted CRV and liquidity mining rewards without locking up CRV. Conversely, it offers CRV lockers trading fees and enhanced CRV share, improving capital efficiency. Recently, due to large-scale liquidations of CRV that drove down its price, the total amount of CRV locked via Convex surged within a month to over 384 million (+17.5%). As shown in the chart below, Convex remains the largest entity locking CRV.

-

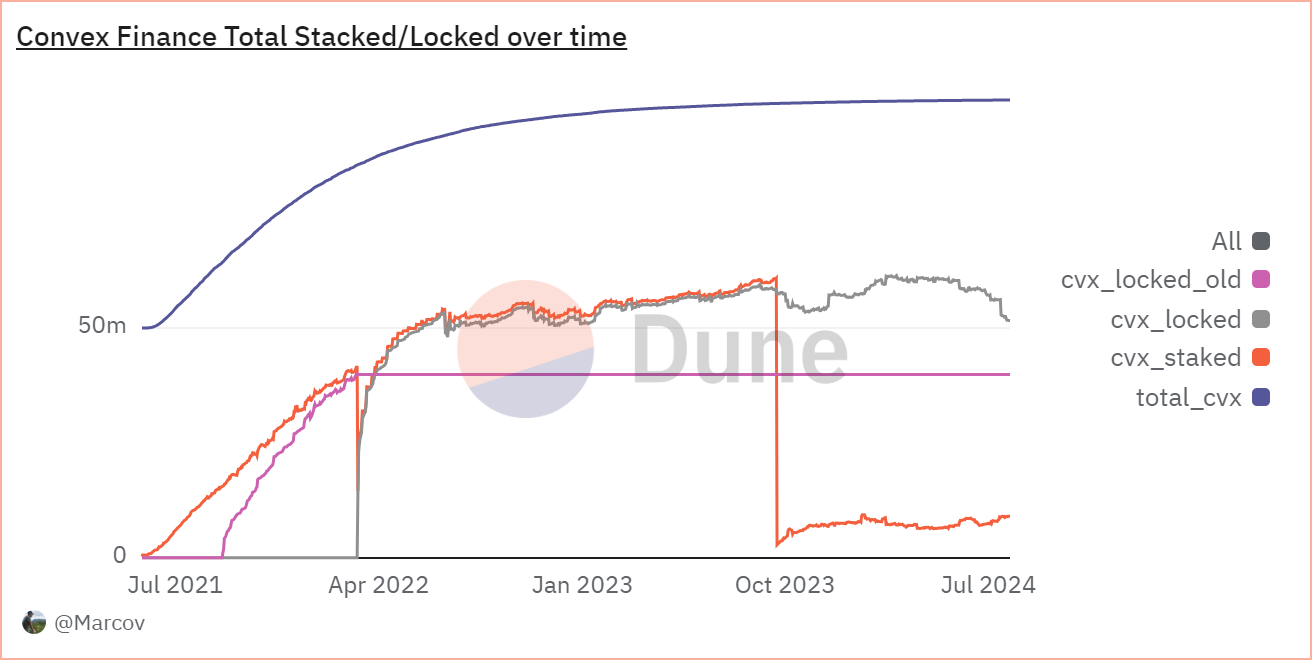

Users can access Convex-locked CRV by locking CVX, earning protocol revenue (currently 0.05%) and bribes (currently around 15%). You can also stake CVX to earn a 5.25% yield. In July, we observed a slight decline in locked CVX and a slight increase in staked CVX.

-

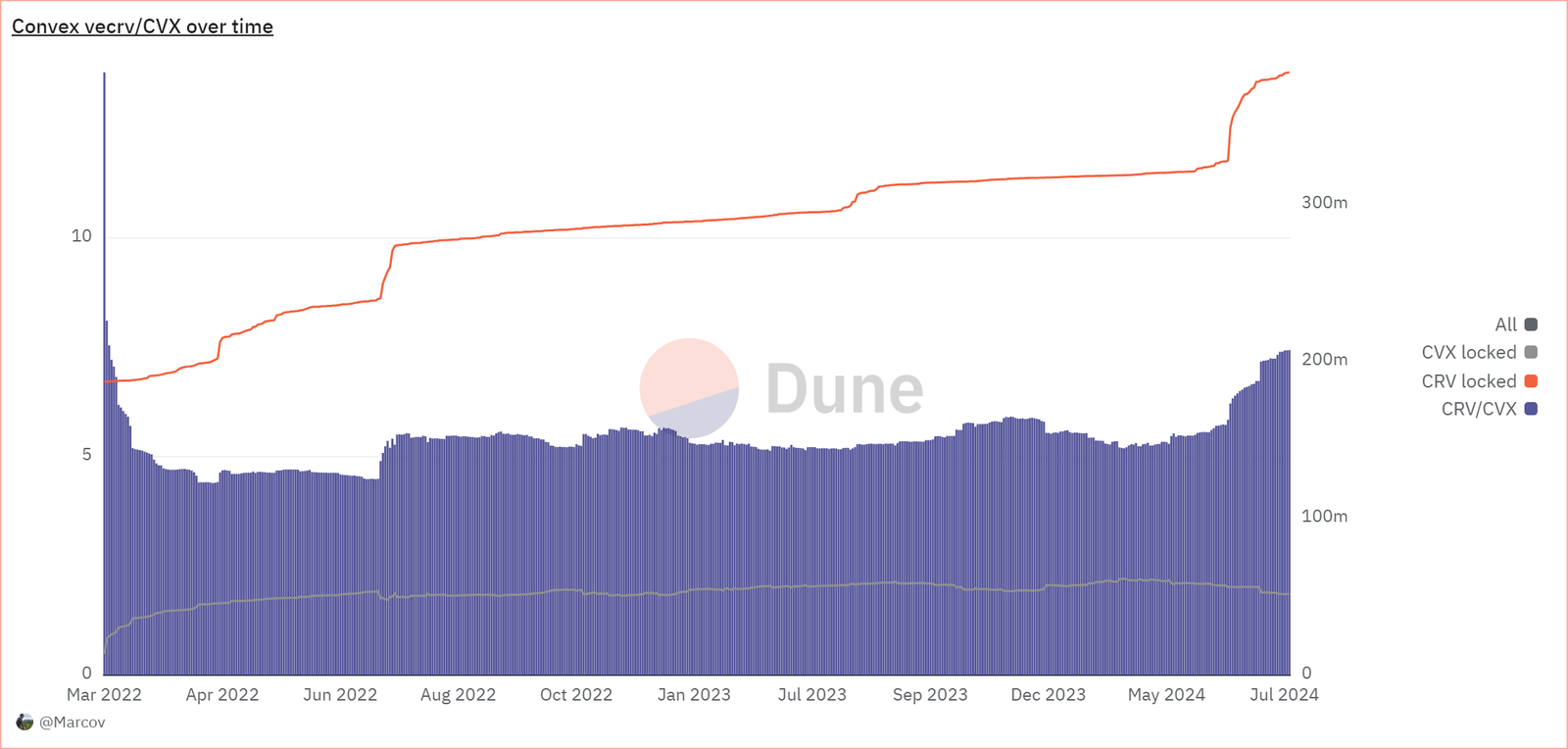

Dividing the total locked CVX by the amount of Convex-locked CRV gives the number of CRV tokens per locked CVX. Due to increased locked CRV and slightly reduced locked CVX, this ratio rose to 7.43. This means that locking 1 CVX token grants access to 7.43 locked CRV.

② Stake DAO

Stake DAO locks over 100 million CRV

-

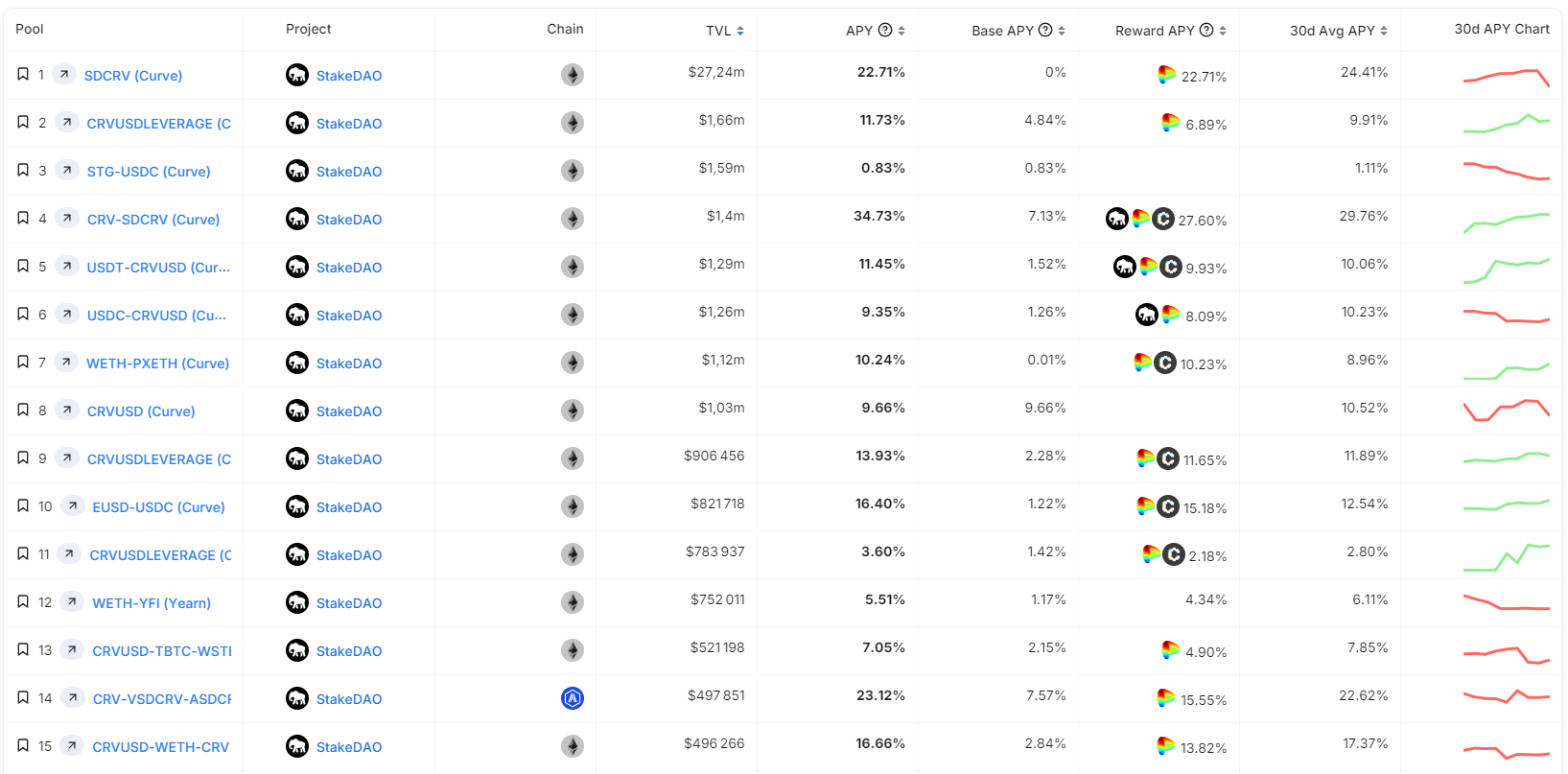

Stake DAO is the go-to platform for generating yield on your crypto assets. On Stake DAO, you gain access to yield opportunities across multiple protocols such as Curve (decentralized exchange and lending), Pendle, PancakeSwap, Yearn, Balancer, and F(x). It allows users to provide liquidity, lend, and leverage across multiple chains while receiving better rewards than using these protocols directly.

-

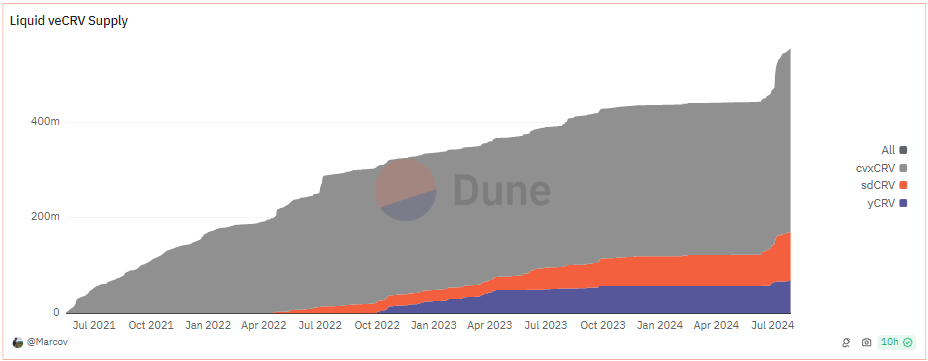

This superior yield stems from Stake DAO’s share in governance tokens of underlying protocols, which boosts rewards when providing liquidity. For example, on Curve, Stake DAO has just reached the milestone of locking 100 million CRV—the second-largest holder after Convex.

-

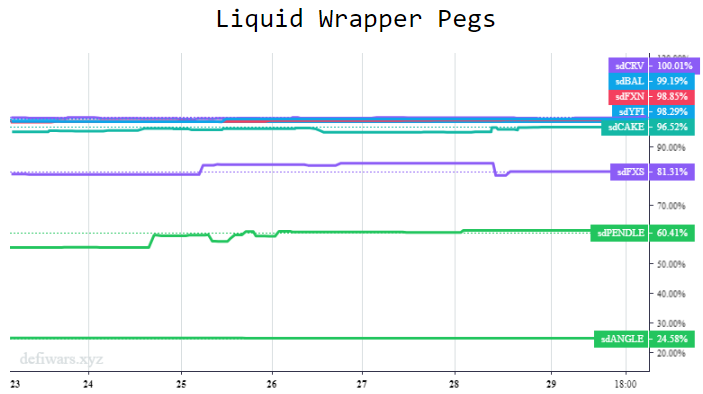

Beyond Curve integration, Stake DAO collaborates with over a dozen protocols. Its success is closely tied to superior peg maintenance and broader utility of liquid restaking derivatives.

-

Trade-level Alpha: Finally, Stake DAO recently launched OnlyBoost, a product that simplifies decision-making by helping users find optimal yields for specific pools, allocating deposits across different "boosters" (e.g., Convex and Stake DAO) to maximize returns. In this transaction, a user deposited $560,000 into the crvUSD lending pool. Funds were split: $303,000 through Convex and $257,000 through Stake DAO, allowing the pool to maintain 2.5x boosting and optimal yield.

③ Tranchess

Anthony Loya | Website | Dashboard

Tranchess unlocked 101.58 million CHESS tokens, worth approximately $14.08 million

-

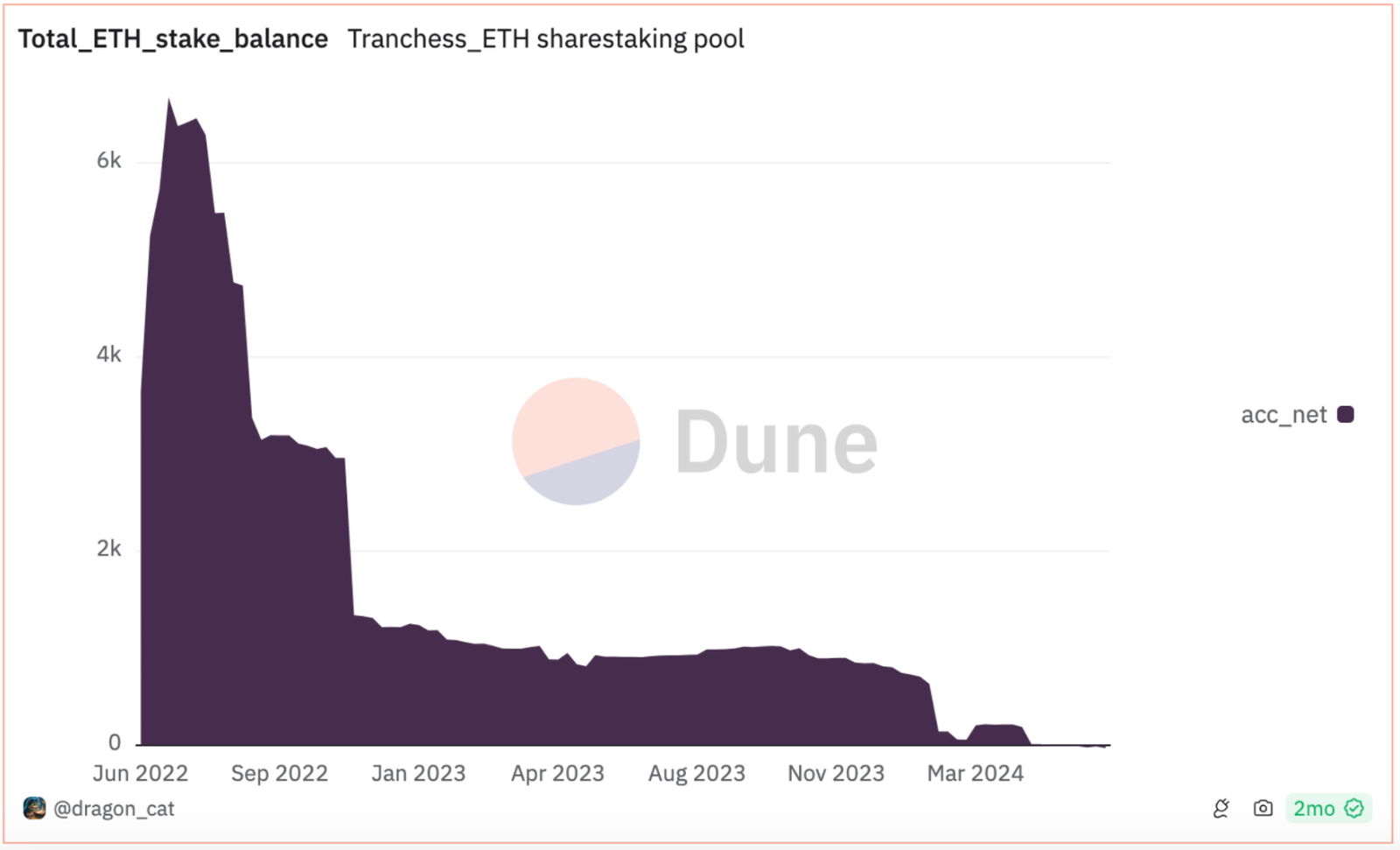

Tranchess is a DeFi protocol offering enhanced-yield products via QUEEN, BISHOP, ROOK, and CHESS tokens, supporting diversified risk profiles across assets like BTC, ETH, and BNB. CHESS is the governance token, while veCHESS represents locked CHESS tokens, conferring voting rights and rewards. Tranchess V2 introduced instant swaps and an expanded rebate pool, enhancing asset allocation flexibility.

-

During this period, asset prices fluctuated significantly, peaking at $0.1954 in December 2023 before declining and partially recovering to $0.1399 in July 2024. Trading volume showed notable spikes, especially on July 11, 2023, and November 11, 2023, indicating strong market activity. Liquidity remained relatively stagnant, gradually decreasing from $1.03 million in July 2023 to $253,600 in July 2024. Major unlock events in recent months coincided with sharp price drops and low trading volumes, such as on April 6, 2024, and June 2, 2024. Overall, the market exhibited dynamic behavior with signs of recovery emerging in mid-July 2024.

-

The volume of CHESS token unlocks was substantial—approximately 101.58 million—and staking amounts also declined according to DefiLlama data. From March 28, 2024, staked value dropped from $12.29 million to $6.35 million by July 30, 2024. Several factors contributed to the decline in protocol staking. First, the introduction of liquid restaking tokens (LRTs) and new staking models intensified competition within DeFi.

-

Trade-level Alpha: Entering June, many six-figure stakes appeared among Tranchess stakers, suggesting the protocol still attracts certain participants. For instance, one user account staked $331,700.55 worth of eQUEEN on June 3, 2024.

④ Pendle

Dan Anthony | Website | Dashboard

Pendle leads the "yield" category with $3.5 billion in TVL

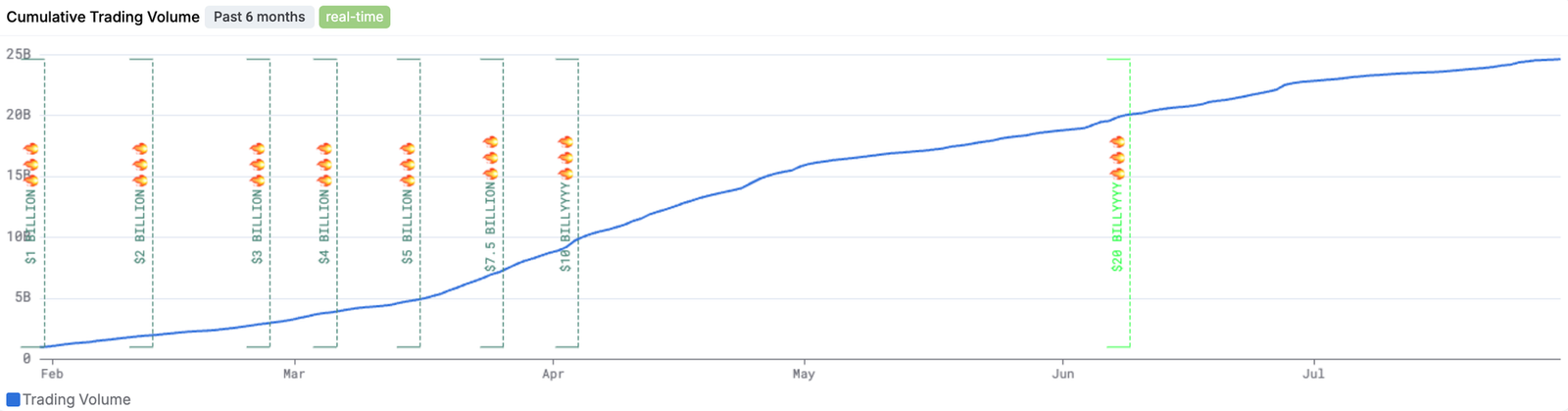

Pendle is a protocol that splits yield-bearing tokens into Principal Tokens (PT) and Yield Tokens (YT), recording over $24.5 billion in trading volume since January and achieving a monthly growth rate of 96%.

-

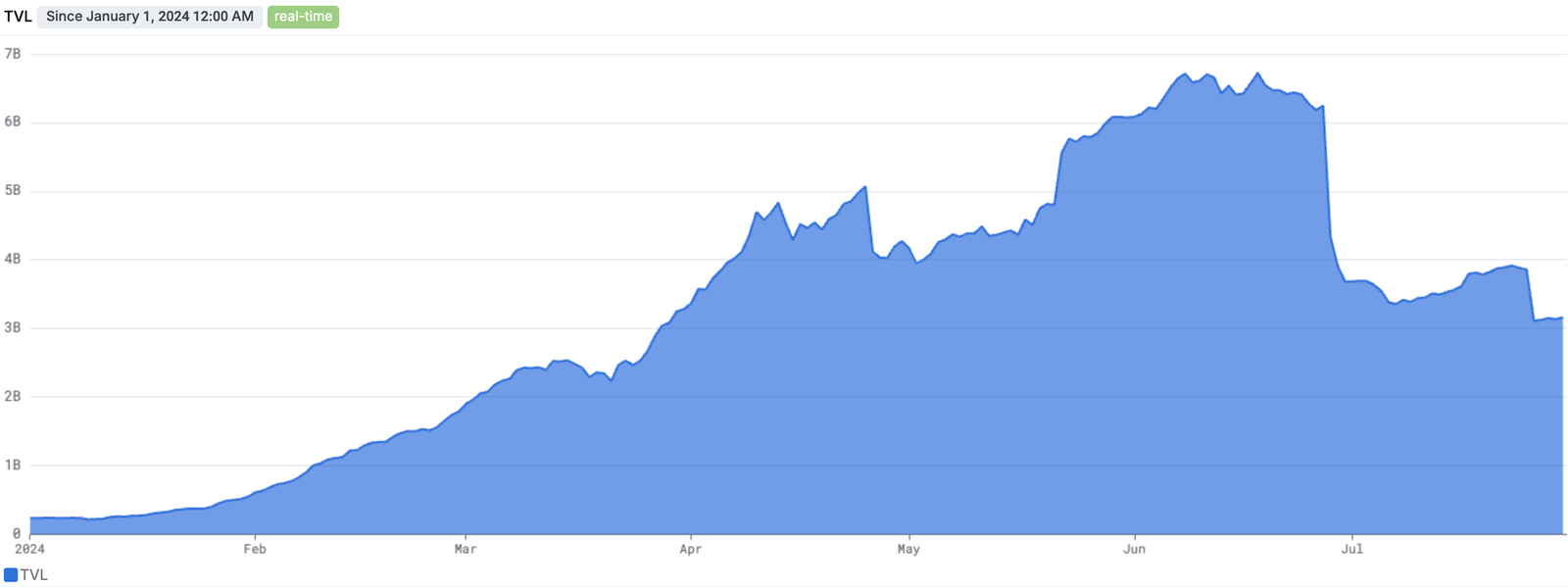

Pendle’s current TVL stands at $3 billion, having previously peaked at $6.7 billion. The decline resulted from pools maturing and settling at the end of June, during which Pendle resolved over $3 billion in yield.

-

Pendle currently holds about 40% of Ethena’s sUSDe TVL ($600 million), making us the largest sUSDe holder to date.

-

Trade-level Alpha: Justin Sun, founder of Tron, purchased PT-eETH and PT-pufETH to secure fixed income. This link shows Justin Sun’s dashboard on Pendle. Transactions were executed in multiple trades.

⑤ Aura

Owen Fernau | Website | Dashboard

Aura captures 70% of Balancer’s vote-locked BAL (veBAL) tokens

-

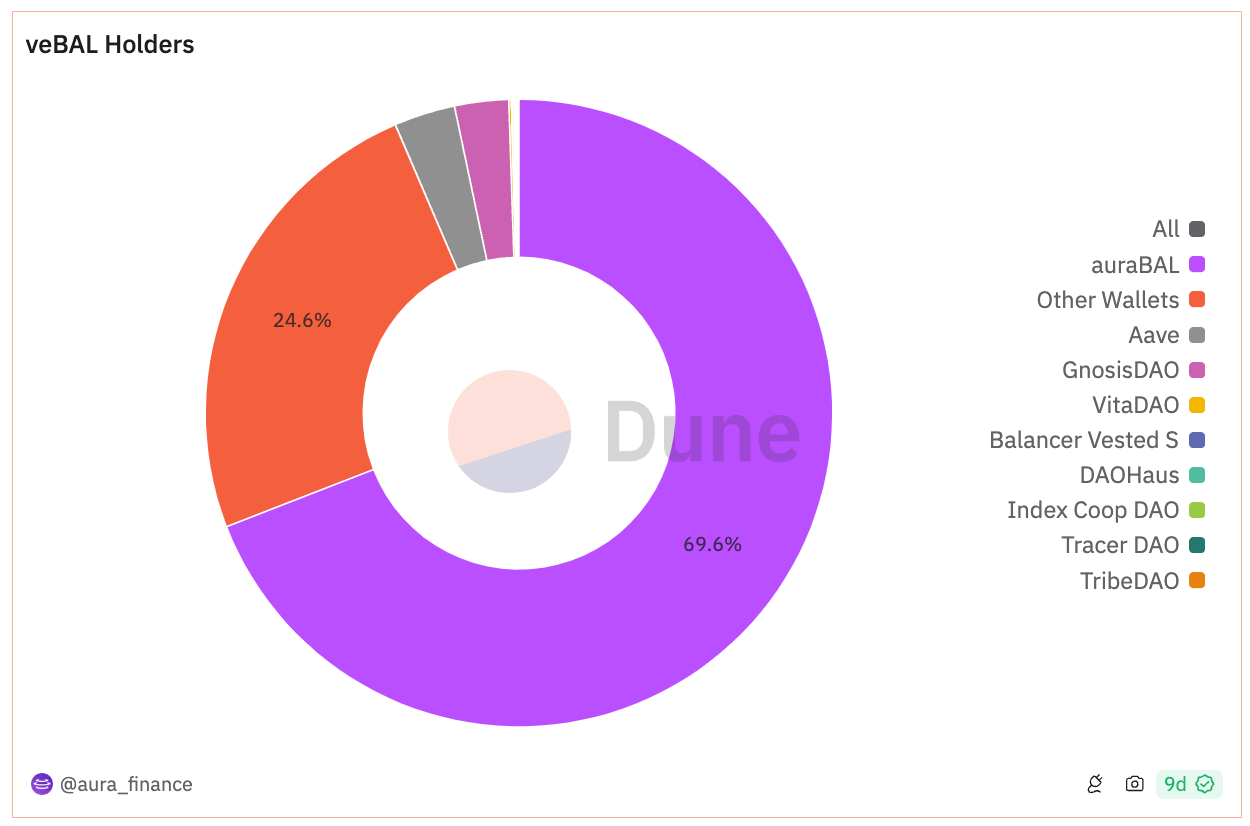

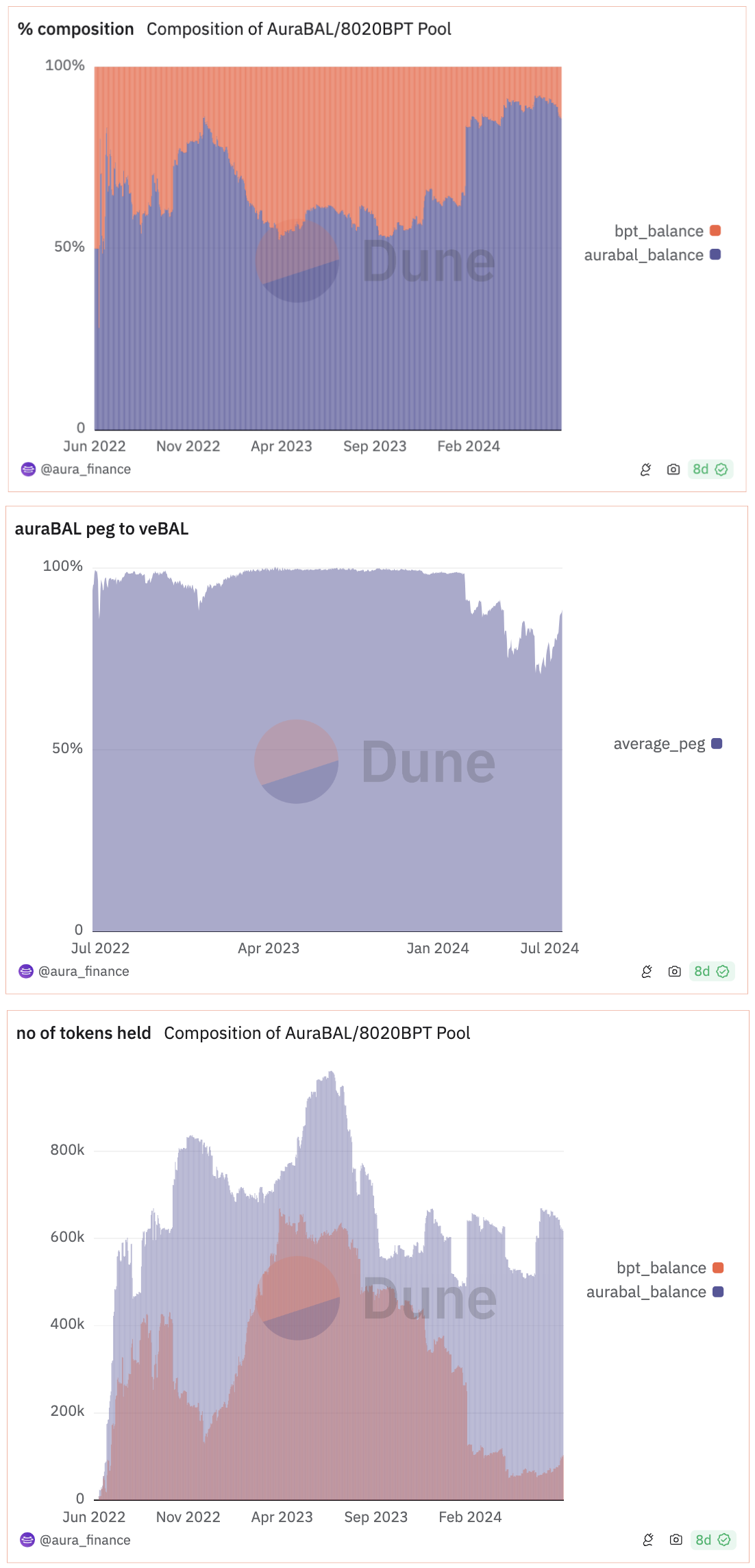

Aura Finance is a protocol with over $400 million in TVL, built atop the decentralized exchange Balancer, which itself has over $800 million in TVL. Aura interfaces with three key entities: BAL stakers, Balancer liquidity providers (LPs), and AURA holders—all of whom can earn yield from the protocol. Aura attracts 70% of all vote-locked BAL (veBAL), the token granting users voting power and fee earnings on the Balancer platform. Users receive these benefits via auraBAL, which earns additional yield from Aura when staked or used for liquidity provision.

Dune Analytics - @aura_finance

-

The peg between auraBAL, Aura’s version of veBAL, and the 80/20 BAL/ETH Balancer LP token (which is used to mint veBAL) has deviated from the ideal 1:1 ratio. The proportion of auraBAL relative to the two tokens reached as high as 90% in June. The ideal peg ratio is 50:50.

Dune Analytics - @aura_finance

-

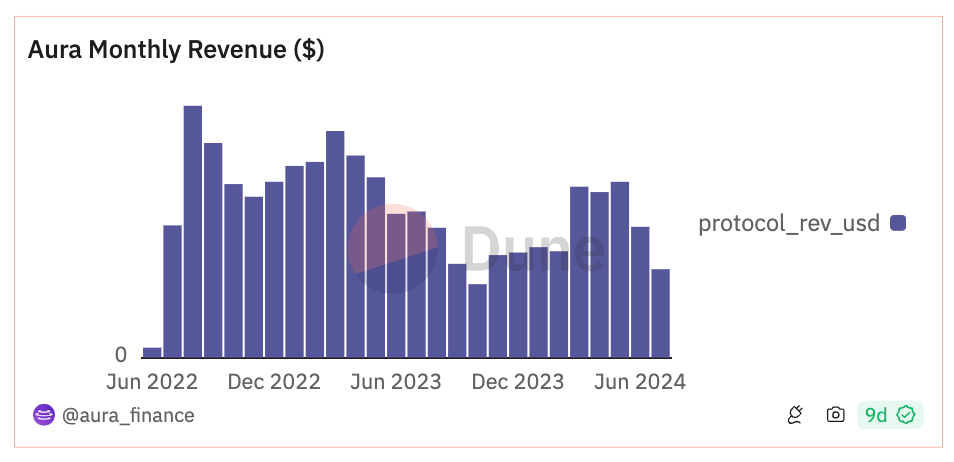

Since the protocol’s launch in July 2022, Aura has generated over $250,000 in revenue nearly every month, with only one exception. In August 2022, the protocol hit a record high of $8.35 million in revenue.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News