Convex Protocol Contract-Level Revenue Breakdown

TechFlow Selected TechFlow Selected

Convex Protocol Contract-Level Revenue Breakdown

Can Convex's high yields continue? And if so, for how long?

Author: Alan

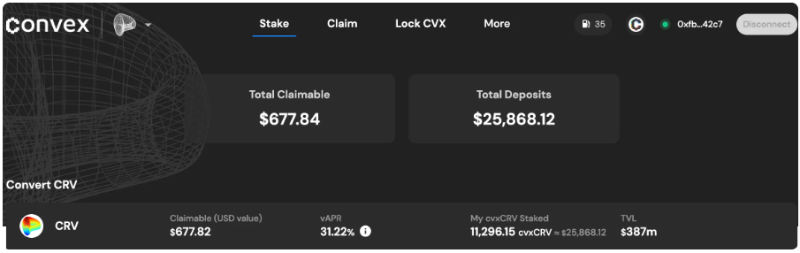

Convex Finance

Over the past few months, I've allocated some funds into DeFi yield farming and have been tracking and analyzing several relatively stable projects. Convex is one of the protocols I'm particularly bullish on. It has operated stably for a year since deployment, with a TVL as high as $400M (staking CRV), making it a leading protocol in DeFi. Its annualized yield has consistently remained above 30%. But can this high yield be sustained? And for how long? This article dives deep into the contract level to answer these questions.

Before understanding Convex's yield, it’s essential to first understand Curve, because Convex is built upon Curve’s incentive mechanism. Let’s briefly review this.

Curve’s Reward Sources

1. Fee income generated from trading activity in liquidity pools

2. CRV rewards earned by depositing LP tokens into gauges

3. Locking CRV to obtain veCRV grants trading fee revenue and governance rights on the platform, and boosts liquidity mining rewards by up to 2.5x.

The above are the direct yield sources for users participating in Curve, forming the foundation of the Curve ecosystem. Providing liquidity requires corresponding tokens. Here we focus on CRV: holding CRV allows users to lock it into veCRV to earn fees and gain governance rights, while also boosting liquidity mining yields by up to 2.5x—but this requires a 4-year lock-up period.

Convex leverages this feature by issuing cvxCRV, which is 1:1 pegged to CRV. If you stake CRV directly, you must lock it; but if you convert it to cvxCRV and let Convex stake on your behalf, you can always swap cvxCRV back to CRV via the cvxCRV/crv liquidity pool. Theoretically, this is a 1:1 conversion, though there may be minor slippage. Meanwhile, Convex locks the CRV to maximize yield.

Convex’s Yield Sources

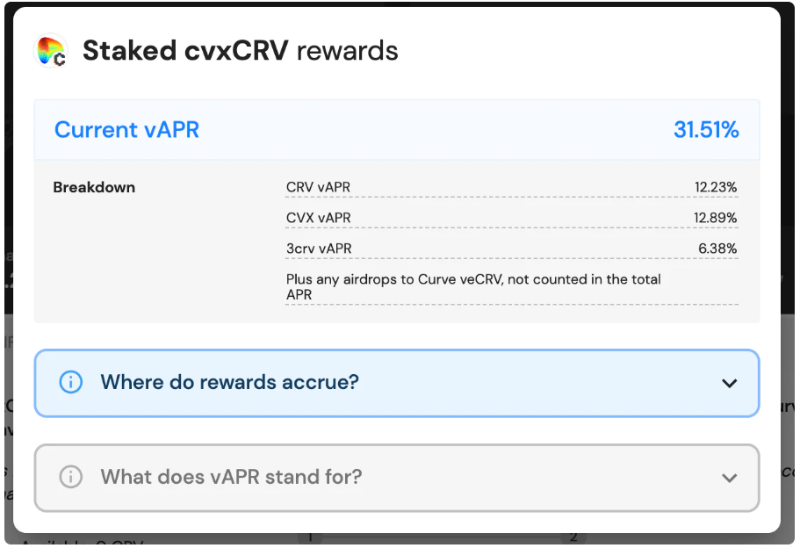

Convex yield sources

1. 12.23% CRV: Rewards obtained by Convex locking CRV on Curve to boost LP rewards; Convex distributes 10% of this to users

2. 6.38% 3CRV: Transaction fee rewards received by Convex on Curve, distributed in 3CRV form

3. Airdrops to veCRV holders

4. 12.89% CVX: Emissions from Convex’s native token inflation, governed by an economic model detailed below

1. CRV Rewards

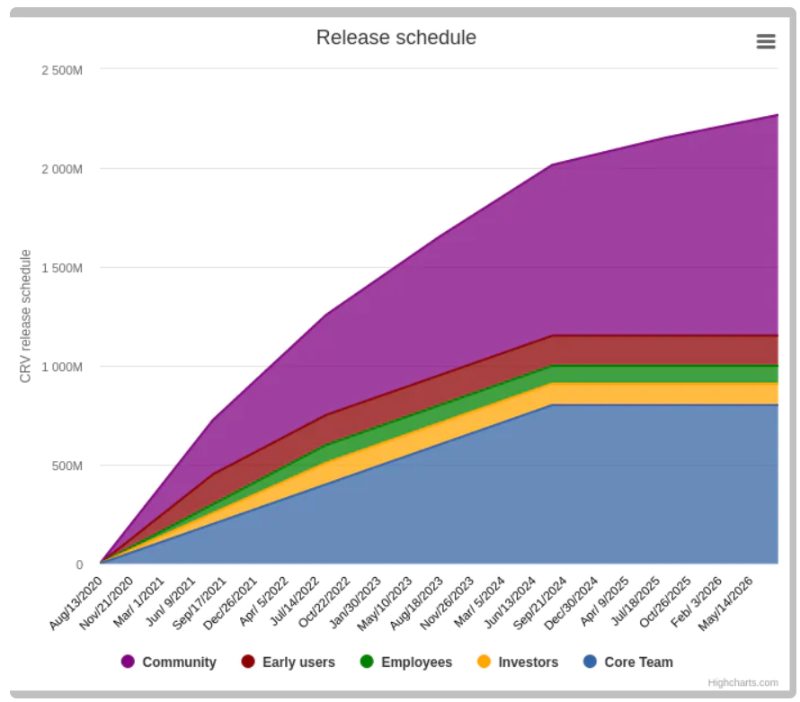

This reward comes from Convex locking CRV on Curve to boost LP incentives. Convex allocates 10% of these rewards to users. On Curve, locking CRV enables boosted rewards for liquidity provision—beyond base trading fees, users earn additional CRV. This CRV emission program began in November 2020 and runs until June 2026. Currently, around 600,000 CRV are emitted daily, with a reduction expected in August 2022 to ~500,000 per day, followed by another drop to ~300,000 per day in August 2024.

Detailed plan: https://dao.curve.fi/inflation

2. 3CRV Rewards

The 3CRV reward is straightforward—it comes from Curve’s transaction fee distribution. As platform activity grows, this yield will only increase.

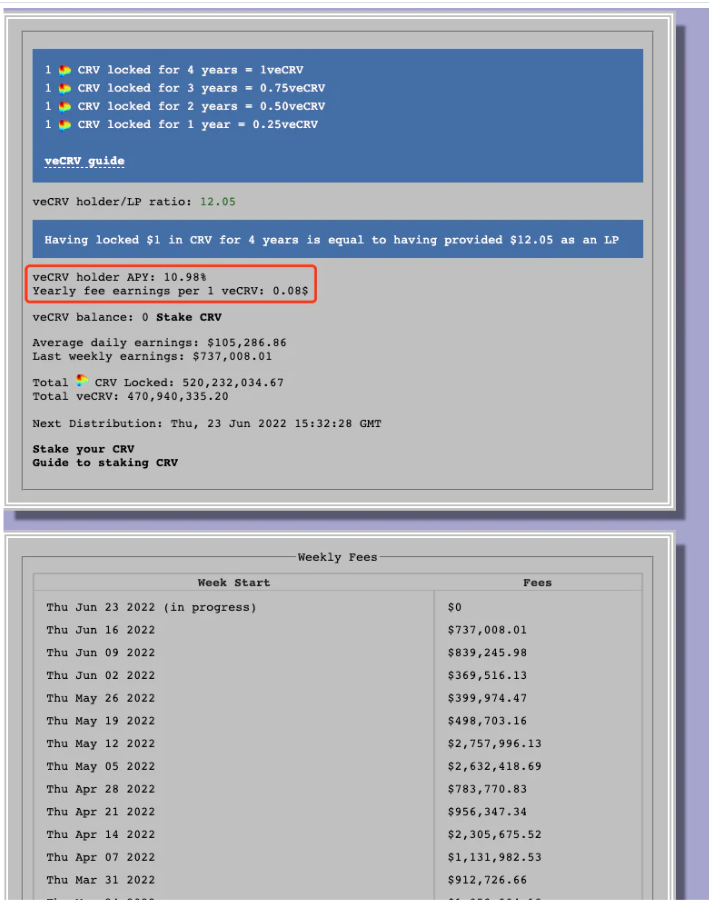

Below is their weekly fee report and the current annualized yield for veCRV holders. Convex holds and locks veCRV on our behalf, claims rewards weekly, and distributes them to cvxCRV holders. Notably, Convex owns about 51% of total veCRV, but the total supply of cvxCRV is smaller, so under current conditions, Convex’s 3CRV yield is approximately 1.26 times the weekly veCRV yield.

Worth noting: recent market volatility has increased on-chain activity, pushing 3CRV yields well above 10%, even nearing 20%. Since 3CRV is effectively a stablecoin, this yield is particularly robust.

Total veCRV: 469,480,707

Convex-held veCRV: 235,955,754

Total cvxCRV: 187,098,030

Website: https://curve.fi/usecrv

3. CVX Rewards

CVX is Convex’s native token, with its own economic model.

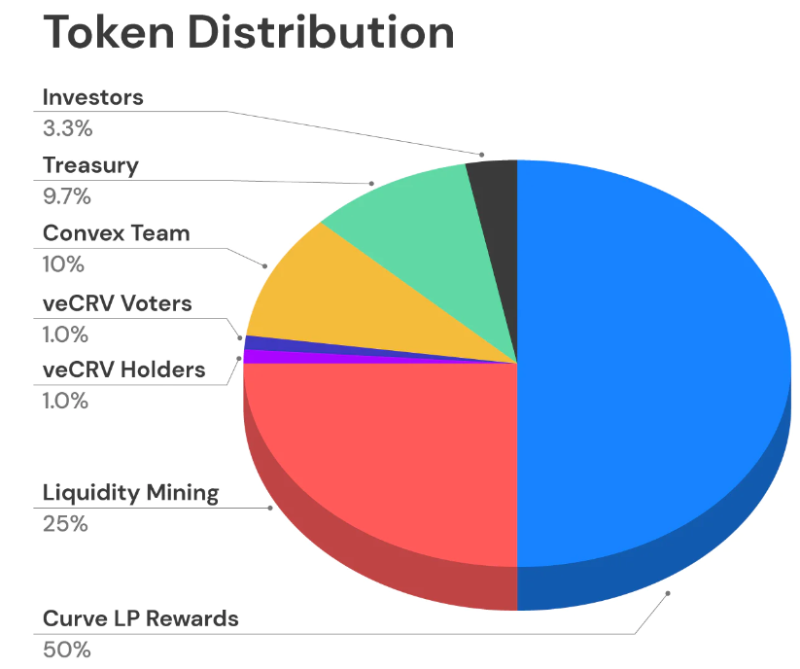

CVX economic model

Max supply: 100M

50% allocated to Curve LP rewards (for users staking CRV on Convex)

25% allocated to liquidity providers

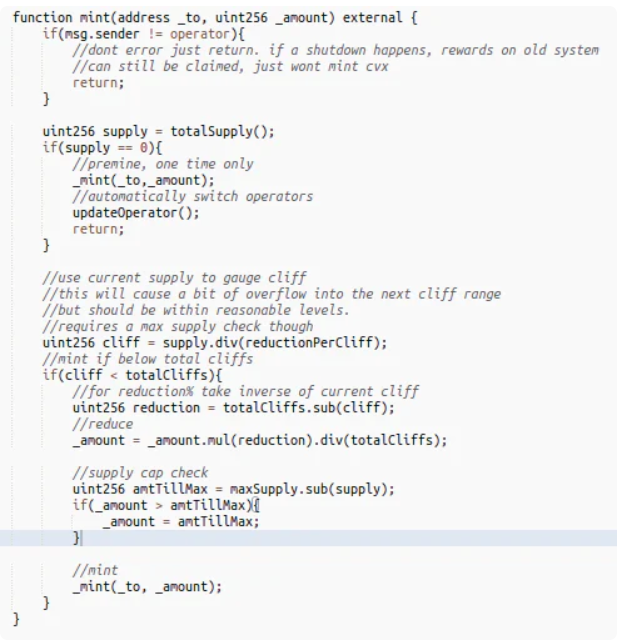

We’ll now examine the emission schedule directly from the contract code.

Mint function source code

Contract address: https://etherscan.io/address/0x4e3fbd56cd56c3e72c1403e103b45db9da5b9d2b/advanced#code

This mint function governs CVX emissions. The max supply is 100M, with key constants:

totalSupply = 89,617,290 x 1e18 (out of 100M total, 89.6M currently issued)

totalCliffs = 1000

reductionPerCliff = 100,000 x 1e18 (100K)

From the code:

uint256 cliff = totalSupply.div(reductionPerCliff);

//for reduction% take inverse of current cliff

uint256 reduction = totalCliffs.sub(cliff);

//reduce

_amount = _amount.mul(reduction).div(totalCliffs);

In other words, each reward amount is multiplied by a decay factor:

ratio = (totalCliffs - totalSupply / reductionPerCliff) / totalCliffs

Plugging in current numbers, the ratio is approximately 0.104. This means for every 1 CRV reward earned, users receive 0.104 CVX. If CRV APR is 10%, then CVX APR would be ~5.97%. Currently, around 50,000 CVX are minted daily. Assuming stable relative prices between CVX and CRV, the daily yield decreases by ~0.05%, or ~0.1% every two days, and ~1% every 20 days. If CVX price falls relative to CRV, the effective yield drops further; otherwise, it may slightly rise. However, in a prolonged bear market, outperformance is difficult.

Update on June 23:

totalSupply = 91,647,591 x 1e18 (91.6M issued)

totalCliffs = 1000

reductionPerCliff = 100,000 x 1e18 (100K)

Latest ratio = 0.0835 → for every 1 CRV reward, users get 0.0835 CVX

Current CRV vAPR = 11.02%

CVX vAPR = 11.02 * 0.0835 * (CVX Price / CRV Price) = 5.495%

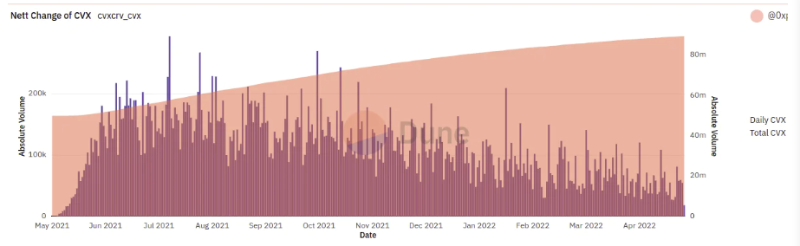

Daily CVX emissions

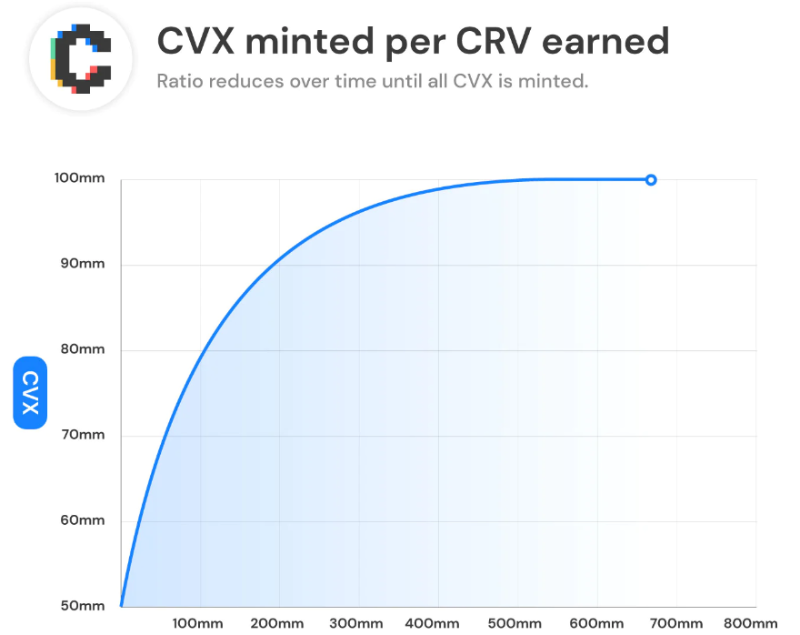

This results in the smooth emission curve shown below:

CVX emission curve

Summary

To summarize, we’ve analyzed Convex’s three yield components: CRV, 3CRV, and CVX. The 3CRV yield, driven by trading volume, is stable and sustainable. CRV rewards will decline slightly in August 2022 and again in August 2024, but remain viable until then. The fastest-declining component is likely CVX yield, decreasing by ~0.1% every two days. At the current ~10% yield level, it could deplete in roughly 200 days. For those considering entering Convex, I hope this analysis helps inform your decision.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News