New Order: Rethinking the Impact of Ethereum's Shapella Upgrade, from Merge to Surge

TechFlow Selected TechFlow Selected

New Order: Rethinking the Impact of Ethereum's Shapella Upgrade, from Merge to Surge

The Shapella upgrade represents a significant step forward in attracting institutional investors, but it is not the end of the journey.

Author: New Order

Compiled by: TechFlow

Introduction

In April 2023, the Ethereum network underwent a significant upgrade known as Shanghai or Capella. Shanghai refers to the execution layer upgrade of Ethereum, while Capella refers to the consensus layer upgrade. These two upgrades are often discussed together and have been collectively termed "Shapella," a term now widely used in the community. A key feature of the upgrade was enabling validators to unstake—either partially withdrawing staking rewards while keeping their original ETH staked, or fully exiting to withdraw their full 32 ETH plus accumulated rewards, effectively ceasing their contribution to network security. However, due to Ethereum’s capacity to process only 16 partial withdrawal requests every 12 seconds, waiting times were expected. Immediately after the upgrade, approximately 1.1 million ETH in rewards became available for withdrawal, raising concerns that stakers might rush to cash out tokens, creating potential selling pressure. Industry entities such as Celsius Network and Kraken, under financial stress and regulatory scrutiny, were also expected to intensify this sell-off through liquidation of their staked ETH. The upgrade also included four Ethereum Improvement Proposals (EIPs) aimed at improving gas efficiency for developers, thereby reducing costs and enhancing user experience.

Post-Shapella Landscape

Despite initial concerns about potential sell-offs following the Shapella upgrade, Ethereum appears to have attracted more investors. According to data from the Ethereum Foundation, one month post-upgrade, around 18.9 million ETH were staked by approximately 588,000 validators, yielding an average return of 5.5%. The total value of staked Ethereum has increased, while the overall supply of ETH has seen a notable decline. Transaction costs on Ethereum reached their highest level in a year, resulting in higher returns for those who stake their ETH.

The ratio of new participants willing to stake has increased since Shapella, reflected in an approximately 8% growth in unique depositors since the upgrade. Investors now seem more willing to stake funds for yield, especially given the ability to withdraw staked ETH. The upgrade did trigger a temporary surge in withdrawals, primarily led by Kraken. Post-Shapella exit queue wait times varied depending on participant volume, with initial estimates suggesting investors might need to wait between 30 to 60 days to access funds. However, influenced by a series of events, one month after the upgrade, withdrawal waiting time dropped to 0 days, while the wait time to join the staking queue extended to 30 days—completely contrary to early predictions.

Current Staking Analysis

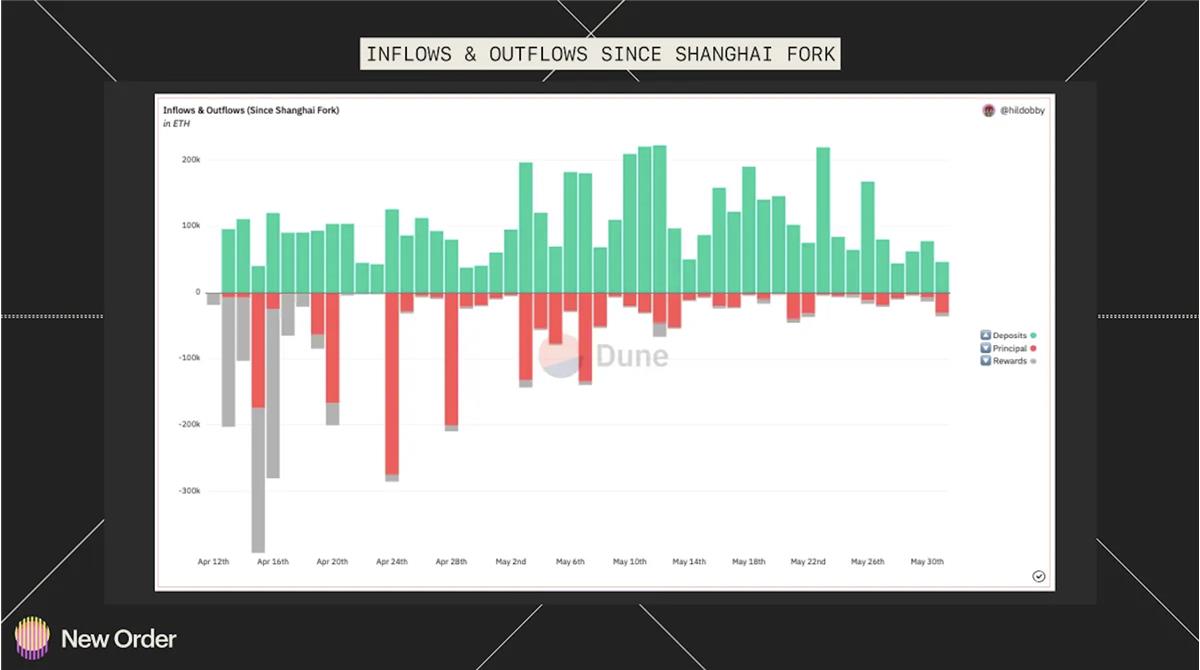

Current Ethereum staking data indicates strong demand for ETH yield, coupled with insufficient numbers of validators attempting to exit via the queue. According to Dune Analytics (as of May 31), the proportion of staked ETH is approximately 18%. Since Shapella occurred on April 12, there has been a net inflow into staking deposits, with roughly 2,263,119 ETH flowing into staking assets. This figure can be calculated using the following formula:

Net Inflow = Deposit Amount - Total Withdrawals - Partial Withdrawals

After excluding reward withdrawals, net inflow of ETH increased by approximately 33%, reaching 3,338,055 ETH. Most reward withdrawals occurred during the first week following the Shapella upgrade. Total deposits have shown an upward trend, while total withdrawals have trended in the opposite direction—contrary to many initial forecasts.

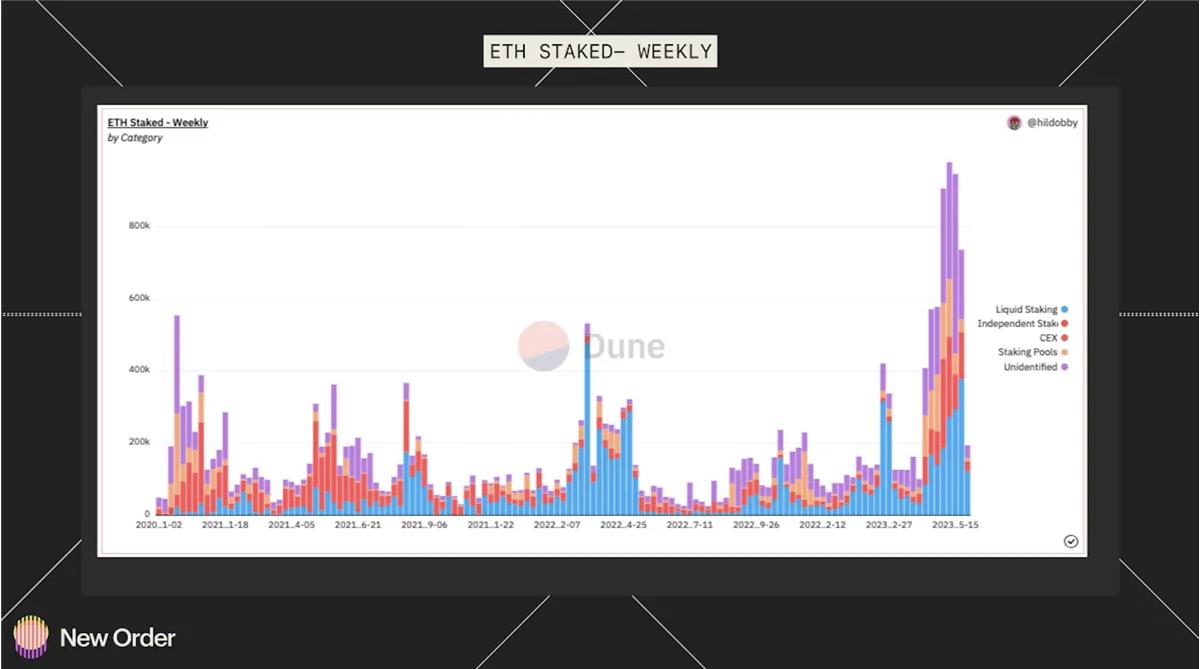

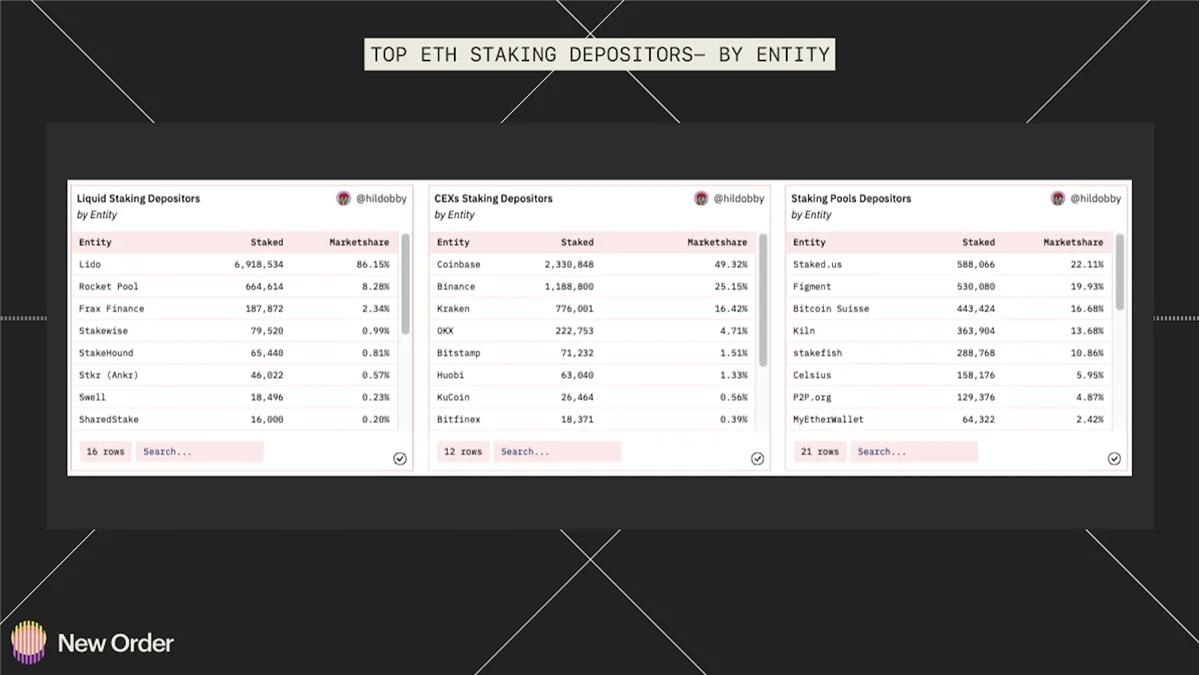

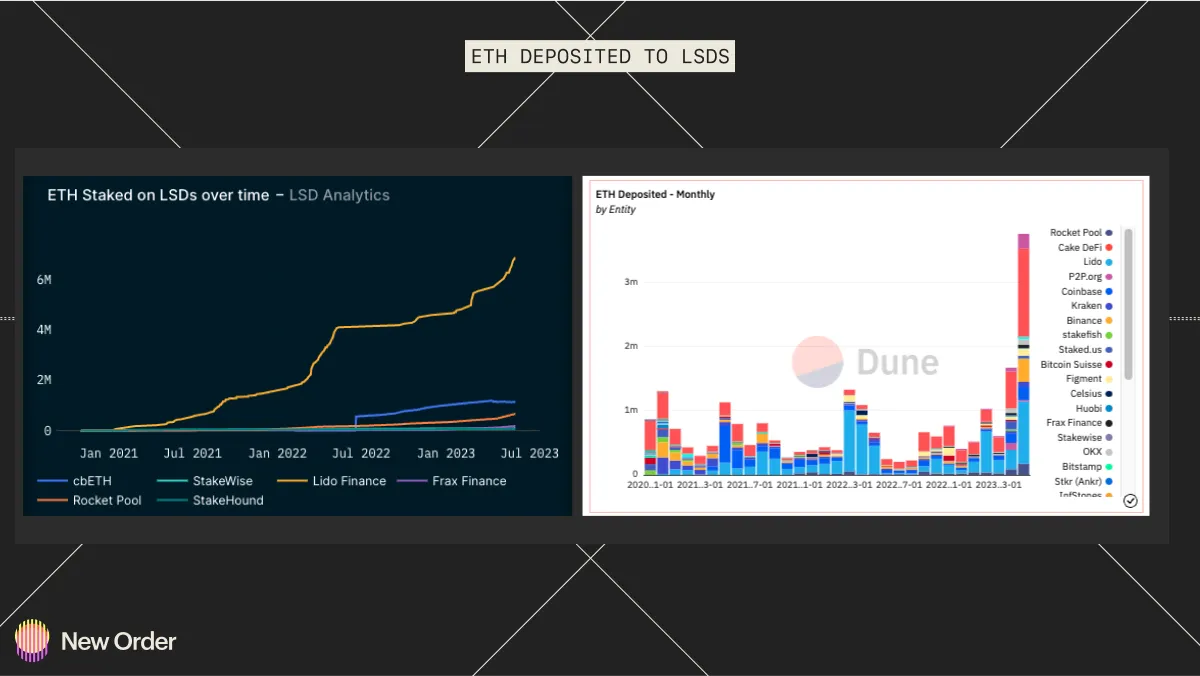

The majority of deposited ETH comes from liquid staking providers such as Lido, followed by unidentified stakers and CEX deposits. Lido continues to hold 31.87% of the total staking market share, maintaining dominant control.

Among the three existing categories, the liquid staking market is highly concentrated under a single protocol, while Coinbase and Binance hold clear advantages in the CEX market. The staking pool category is the most decentralized, with Staked.us, Figment, Kiln, stakefish, and Bitcoin Suisse accounting for approximately 74% of its market share.

Current validator entry and exit queues further reflect strong demand for staking ETH. At the time of writing, 76,349 validators are waiting in the entry queue, compared to only 21 waiting to exit. Exit wait time is just 14 minutes, while new validators face an estimated wait of about 37.5 days.

One of the most debated and important predictions for the second half of this year and into 2024 is the ETH staking ratio.

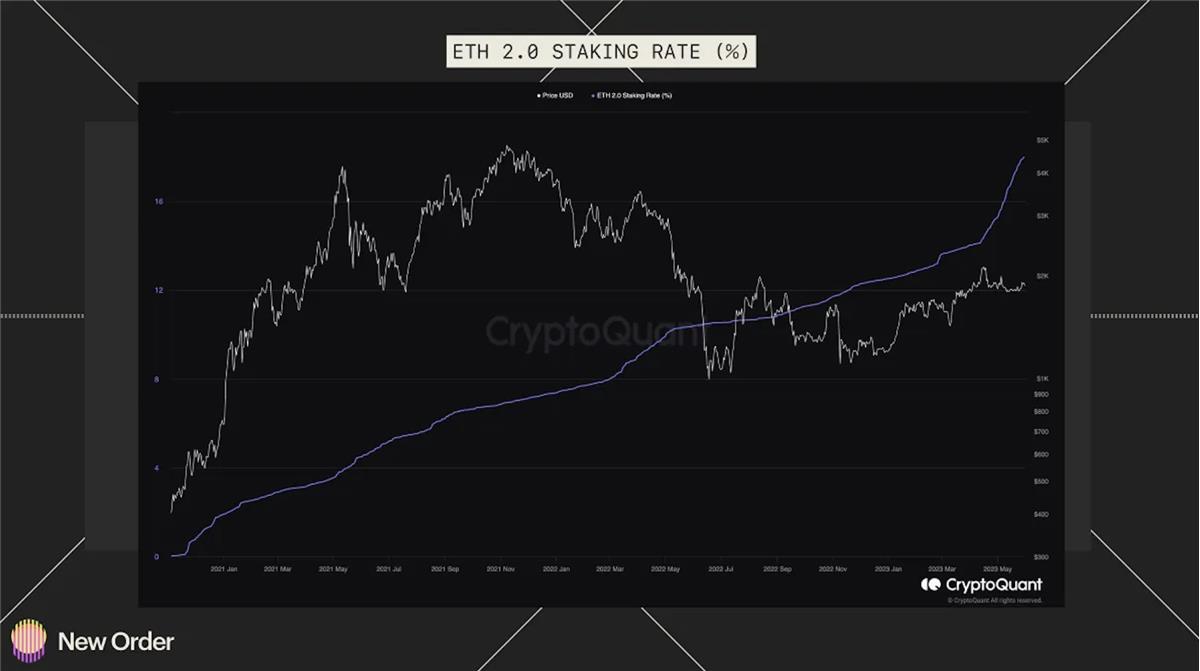

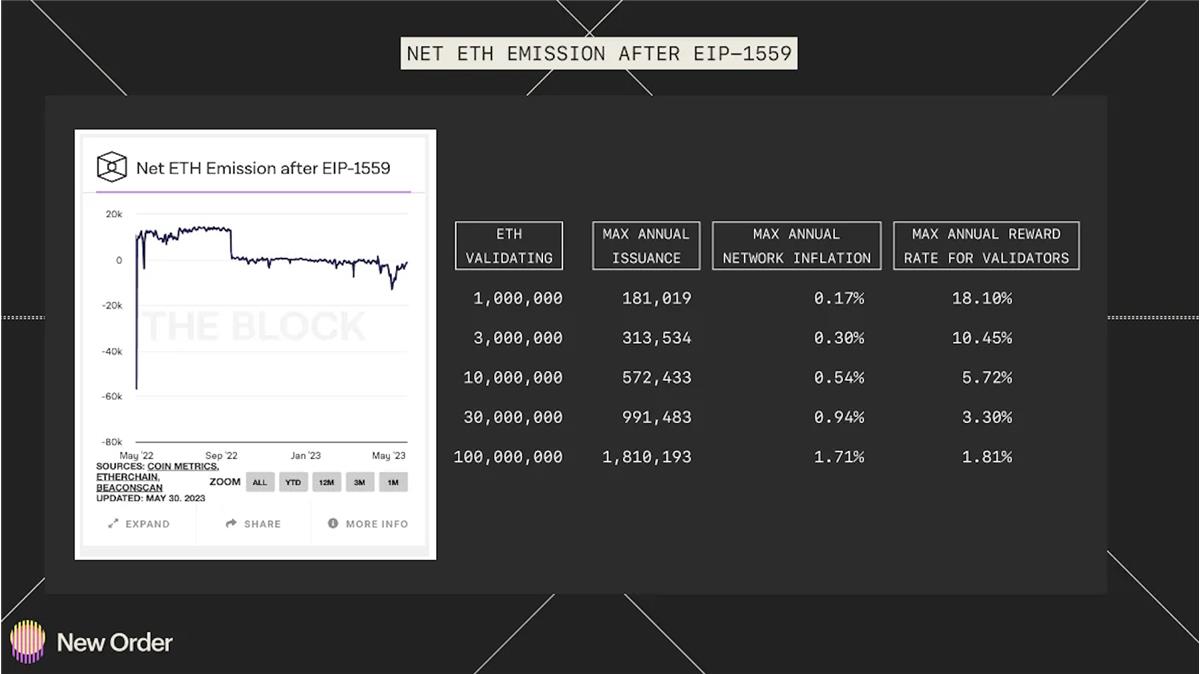

This is because users no longer pay the technical risk premium associated with Ethereum's shift in consensus mechanism and the previous illiquidity prior to Shapella. Some predict this ratio will approach the average of around 60% observed in other major proof-of-stake networks, eventually trending above 90%. This could increase the current number of 730,000 validators to over 2 million. In such a scenario, individual validator yields would likely decrease. Validator rewards consist of three components, each influenced by specific variables such as total staked amount. Ethereum validators earn income from three sources: block rewards, gas tips, and Maximal Extractable Value (MEV) rewards. Block rewards are newly minted ETH generated through PoS. As the staking ratio increases, the network’s annual inflation rate rises, leading to lower per-validator rewards. This trend can be roughly observed in the chart below.

Gas tips refer to additional ETH users can pay validators as an incentive to prioritize their transactions in a block. A typical example is during NFT mints when many users attempt to purchase the same item simultaneously. While there remain reasons to offer gas tips—and this figure may fluctuate due to demand spikes such as meme coin frenzies—the NFT speculation cycle has largely ended, leaving little sustainable justification for expecting this form of income to consistently deliver high validator yields.

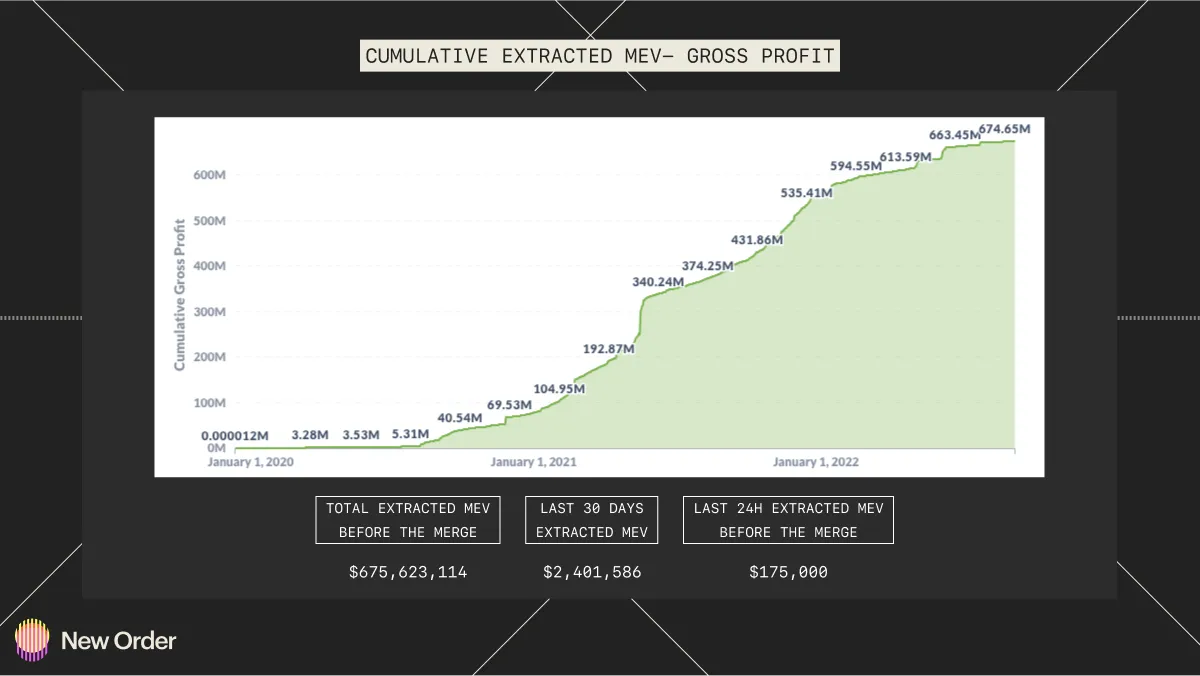

The final variable affecting validator earnings is MEV. Although high MEV profits were possible over the past two years, these earnings have been steadily declining. As more Ethereum transactions gradually migrate to its Rollup ecosystem, the amount of extractable MEV on Ethereum will continue to decrease and become increasingly unsustainable.

Having quantified the sources of ETH yield, it is unlikely that returns will continue to rise in the coming years if staked ETH trends persistently above 60%. Block rewards constitute the primary source of yield, which is likely to trend downward, while the other two categories make up a much smaller proportion of total returns. Despite evidence suggesting that Ethereum yields may decline over time, there is strong evidence that momentum behind Ethereum staking is rapidly increasing.

Interpreting the Numbers

One major reason for the surge in Ethereum staking after Shapella may be the elimination of technical risk and illiquidity premiums. Both The Merge and Shapella were among the most critical events in Ethereum’s history—periods of high uncertainty for investors. Upon successful completion, the risks associated with changing Ethereum’s consensus mechanism were effectively mitigated. Additionally, investors no longer pay an illiquidity premium, as they can now withdraw their ETH at any time. Prior to Shapella, users unable to withdraw ETH had to sell their ETH LSDs on DEXs instead.

The large discrepancy between entry and exit queues post-Shapella may stem from initial fear of staking giving way to confidence. Concerns about mass withdrawals after Shapella—and their absence—may partly be attributed to the queue mechanism. Withdrawals are processed dynamically, meaning they do not occur at fixed intervals. The Shapella update also made Ethereum staking more accessible by removing the requirement for stakers to hold a minimum amount of ETH, thus broadening participation. Recent demand for staking may be driven by institutional and private clients, as noted by the Chief Product Officer of Bitcoin Suisse in commentary on rising demand for staked ETH.

Overall, short-term user behavior regarding Ethereum staking reflects a positive market response. Shapella led to substantial growth in staking via Liquid Staking Derivative (LSD) protocols and tokens such as Lido. After Shapella, the growth in ETH staked through LSDs and across the industry saw the largest monthly deposit volume across all categories.

Looking ahead, Distributed Validator Technologies (DVTs) such as SSV and Obol Network are set to launch their mainnets soon, with Lido, Frax Finance, and many emerging LSD protocols—including Puffer Finance and Swell—planning to use them to decentralize their validator sets. This could act as a catalyst for Ethereum staking and the LSD sector in the coming months and years, enabling new LSDs to be built with lower overhead. Demand for these new LSDs may become a key trend to watch, as newer platforms might offer higher yields than existing ones by introducing token incentives. These new LSDs could decentralize the staking landscape and potentially capture market share from leaders like Lido or Coinbase—an essential development for a thriving Ethereum ecosystem.

What’s Next for Ethereum?

Overall, the impact of the Shapella upgrade on the Ethereum ecosystem has been positive and lays the necessary foundation for future upgrades. With the core upgrades from The Merge and Shapella now complete, the next steps in Ethereum’s general roadmap have become feasible. These include scalability improvements via Rollups and data sharding, followed by significant enhancements in efficiency, decentralization, and censorship resistance.

As outlined in the Ethereum Foundation’s roadmap, these upgrades will take several years to fully implement. Beyond this core path, multiple near-term factors will influence the broader Ethereum ecosystem—namely, restaking and the growing momentum of liquid staking derivatives. Restaking tools like Eigenlayer carry immense potential but also pose significant risks if mismanaged. Combined with increasing centralization in staking services at Lido, Coinbase, and Binance, Ethereum must navigate serious risks as it advances along its roadmap. Failure to address threats from leveraged synthetic staking assets and growing service centralization could undermine the overall decentralization of the Ethereum network. We believe the planned upgrades, along with talent and technology emerging from the staking sector, will successfully mitigate these emerging risk vectors.

What’s Next for the Industry?

As a foundational asset for the industry, the impact of the Shapella upgrade is profound. With staked ETH now withdrawable, staking has become safer, and ETH supply on centralized exchanges (CEXs) is currently draining. Data from Glassnode shows that as of Wednesday, May 31, centralized exchanges held 14.85% of the total Ethereum supply—the lowest level observed since Ethereum’s early days in the summer of 2016—clearly providing upward price momentum. Furthermore, due to the aforementioned staking queues, demand for stETH and other liquid staking derivatives of ETH may increase, leading to higher premiums. We have already observed cases where users, despite Lido/Rocketpool/Frax ETH premiums, are eager to participate in staking to earn rewards immediately. This could further consolidate the market share of leading staking protocols. Meanwhile, adoption of DVTs or improved liquidity flywheels and tokenomics may reshape market distribution within the liquid staking space. New entrants could incentivize users to migrate their staked ETH from dominant players to new platforms by offering substantially attractive rewards and higher APYs. Established protocols like Lido can defend against such challenges by continuously improving their products and maintaining robust security measures. This competition may improve conditions across the sector and drive fees to minimal levels, ultimately benefiting users in the long run.

Finally, as previously mentioned, the Shapella upgrade represents a major step forward in attracting institutional investors—but it is not the end of the journey. Current barriers mainly stem from regulatory uncertainty, particularly hindering large-scale investments by Western institutional investors such as pension funds and insurance companies in the Ethereum ecosystem. However, the Shapella upgrade may stimulate favorable regulatory discussions across the industry, especially as debates around safety evolve. On June 1, Hong Kong's issuance of cryptocurrency exchange licenses further strengthened this potential. The convergence of anticipated capital inflows from the East and the Shapella upgrade brings optimism for a more transparent and regulated future for the industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News