The new competitive landscape in Ethereum's staking market after the Shapella upgrade

TechFlow Selected TechFlow Selected

The new competitive landscape in Ethereum's staking market after the Shapella upgrade

Following Ethereum's transition to PoS in September last year, two major protocol upgrades are scheduled this year: Shapella and Cancun.

Author: Jiawei@IOSG

Abstract

-

Shapella has released liquidity, and withdrawal pressure has eased in the short term; long-term outlook remains positive for staking rates;

-

The Ethereum staking market will exhibit a dynamic competitive landscape driven by events, price competition, and differentiation in target customers;

-

DVT will enhance the robustness and stability of Ethereum's validator set;

-

Influx of institutional investors will help diversify Ethereum’s validator set;

-

Despite being an established sector, the staking landscape may still face disruptions from key developments, revealing potential investment opportunities.

Introduction

Following Ethereum’s transition to PoS in September last year, two major protocol upgrades have taken place this year: Shapella and Cancun. The former enables validator withdrawals, closing the loop on Ethereum staking; the latter introduces Data Blobs as an early step toward data sharding.

It has now been over a month since the successful implementation of Shapella. With the activation of withdrawals, notable shifts have emerged in the market. This article presents observations from the primary market, offering insights into the Ethereum staking landscape and exploring associated investment opportunities.

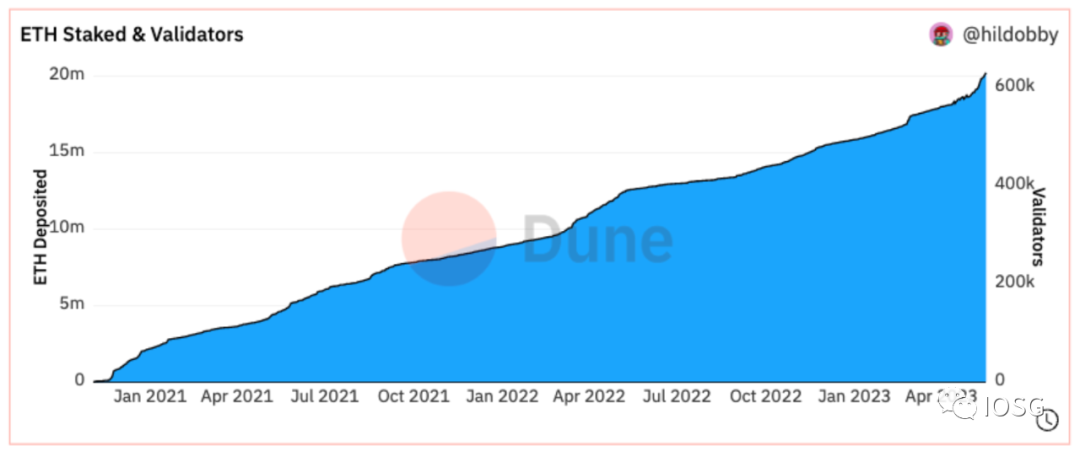

Source: Dune Analytics@hildobby

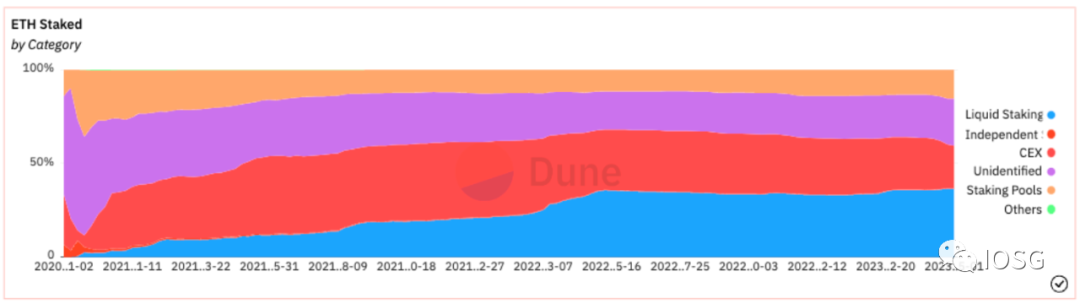

A quick overview of the current market: Since the Beacon Chain staking activation in December 2020, Ethereum staking has grown steadily. At the time of writing, there are over 600,000 validators and approximately 20 million ETH staked (worth over $36 billion at current prices), with a network staking rate approaching 17%.

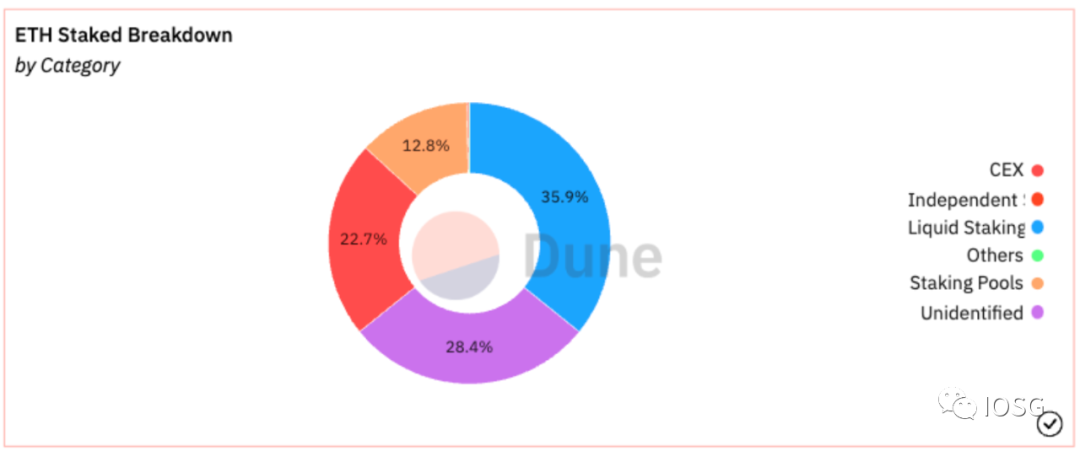

Source: Dune Analytics@hildobby

Currently, liquid staking accounts for 35.9% of all staking categories, with Lido alone capturing 31% of the entire staking market share. Despite large withdrawals by centralized exchanges like Kraken and Coinbase, CEXs still hold 22.7% of the market share.

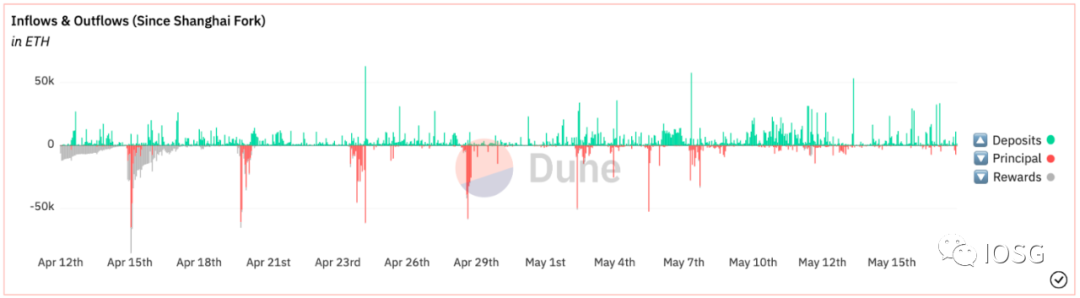

Source: Dune Analytics@hildobby

With Shapella activating the exit mechanism for staked ETH, downward market pressure was inevitable. As shown in the chart above, ETH outflows clearly exceeded inflows immediately after Shapella. However, withdrawal pressure has since subsided, and net ETH inflows have now surpassed 1 million ETH—consistent with pre-Shapella market expectations. Given this release of liquidity, I believe Ethereum staking remains an attractive asset management vehicle in the medium to long term, and I remain optimistic about continued growth in the staking rate.

Post-Shapella — The Ethereum Staking Market Will Enter a Dynamic Competitive Phase

Lido currently dominates the staking market, primarily due to its first-mover advantage and the moat built around network effects. However, I do not believe Lido represents the final state for liquid staking—or even the broader staking sector. Shapella marks a turning point and sets the foundation for other staking protocols to compete with Lido.

This section discusses competition dynamics through three lenses: event-driven shifts, price wars, and customer differentiation.

Event-Driven Shifts

Source: Dune Analytics@hildobby

Certain direct or indirect external events may shift the staking market landscape.

For example, custodial staking services offered by centralized exchanges once held over 40% market share in 2021. However, with the rise of liquid staking, their share has been squeezed, accelerating recently. Two factors may explain this:

1. Following FTX’s collapse in November last year, user trust in centralized, custodial solutions declined.

2. In February this year, under regulatory pressure from the SEC, Kraken announced it would cease offering staking services to U.S. customers, triggering withdrawals and increasing concerns among users about staking providers within specific jurisdictions.

Source: Nansen

After Shapella, early stakers were able to withdraw and migrate to alternative staking services—the top three entities in the withdrawal queue being centralized exchanges reflects this trend.

Price War

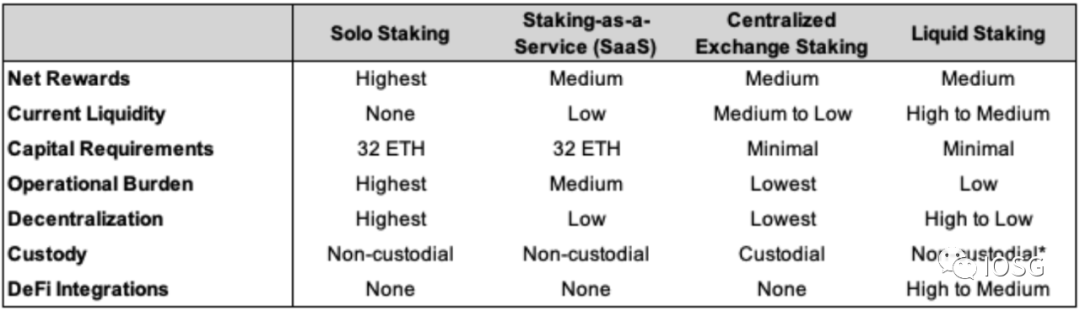

In a liquid and free market, traditional business logic applies. Given the high degree of homogeneity in the staking market, competitive advantages naturally manifest in pricing. Users can now withdraw from existing staking services and freely choose alternatives, intensifying competition among providers.

Source: GSR

For instance, SaaS platforms mainly serve institutional clients, while solo staking poses high barriers for retail users—leaving the latter two as the primary choices. Centralized exchanges typically charge higher service fees and lack transparency. Liquid staking, by contrast, offers superior liquidity. As noted, stETH functions almost like hard currency across most mainstream DeFi applications and can even be directly swapped for ETH without waiting in withdrawal queues. Users thus weigh different staking options carefully.

Within liquid staking, Puffer offers lower entry barriers for node operators and lower fees compared to competitors like Lido and Rocket Pool. Puffer charges stakers only 2.5%, which is one-fourth and one-sixth of Lido’s and Rocket Pool’s fees respectively. Assuming similar rewards across protocols (currently around 5%, with little variation), fee structures become a key factor in user choice.

Additionally, the degree of LST integration across DeFi protocols matters—it represents embedded "Lego yields."

Source: ultrasound.money

On yield composition, Ethereum staking returns consist of consensus-layer and execution-layer rewards. The former decreases as more validators join. The latter is variable, composed of tips and MEV, closely tied to Ethereum network activity. Total yield from a staking service depends on how much of these rewards the provider shares with users—for example, stakefish shares 80% of execution-layer rewards with users.

To stay competitive, node operators may maximize sharing of execution-layer rewards to boost APR and attract users. Restaking, discussed later, is another method to increase APR.

Source: Messari

On the supply side, Rocket Pool launched its Atlas upgrade alongside Shapella—reducing the required stake from 16 ETH to just 8 ETH per validator, further lowering the barrier for node operators (running two 8-ETH minipools yields over 18% more rewards than one 16-ETH minipool). The chart above shows Atlas triggered measurable growth for Rocket Pool.

Target Customer Differentiation

Unlike Lido and Rocket Pool, which primarily target crypto-native users (B2C), Alluvial partnered with staking providers such as Coinbase and Figment to launch an enterprise-grade liquid staking solution (B2B).

Post-Shapella, with clearer exit pathways for staked ETH, traditional financial institutions may grow interested in liquid staking. Ethereum liquid staking as an asset allocation strategy offers exposure to industry beta via ETH, ~5% annual staking yield, and additional DeFi yield from LSTs. With restaking, cumulative returns could exceed 15%.

However, traditional institutions require counterparty risk assessments and must complete KYC/AML compliance procedures. Current crypto-native liquid staking protocols like Lido cannot meet these needs—they are permissionless at the user level, perform no asset screening, and pool deposits together, making them highly sensitive to institutional standards.

One solution is enterprise-focused liquid staking like Alluvial; another involves third-party partners providing non-LST liquidity solutions.

Beyond staking itself, Ethereum’s validator set forms the foundational trust layer for its ecosystem. The influx of institutional investors helps diversify the validator set, strengthen game-theoretic resilience, and improve overall network stability.

DVT Will Enhance the Robustness and Stability of Ethereum’s Validator Set

Source: Vitalik Buterin

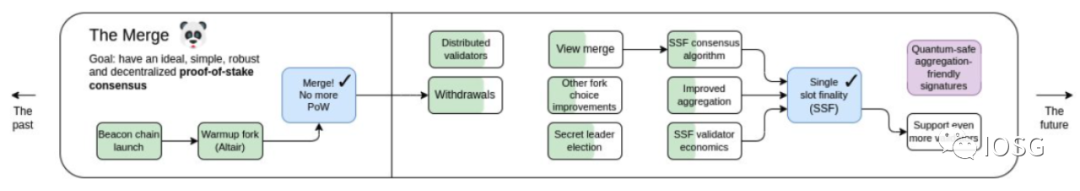

After The Merge, Ethereum’s roadmap includes two major updates: enabling withdrawals of staked ETH in Shapella, and incorporating EIP-4844 in Cancun to provide more data space for Rollups. Compared to these, DVT (Distributed Validator Technology) has less visible impact on users but is crucial for infrastructure resilience and stability.

Prior to DVT, a single node typically ran one validator. During validator operation, network failures or configuration errors could lead to inactivity or slashing, resulting in lost rewards. DVT allows a cluster of nodes to jointly operate a single validator (many-to-one). For example, if at least 5 out of 7 nodes are active, validation proceeds—eliminating single points of failure.

Source: rated.network

From a data perspective, Rated evaluates staking providers based on Proposal Effectiveness, Attestation Effectiveness, and Slashing Record. Overall Ethereum validator effectiveness stands at ~96.9%, below ideal levels.

Since becoming a Node Operator for Lido requires DAO governance approval, while Rocket Pool is permissionless, the nearly 2% difference in ratings may stem from inconsistent operator quality.

Recently, Lido has begun integrating with DVT providers such as Obol Network and SSV Network. Lido’s V2 Staking Router also includes a DVT module featuring Obol’s distributed validator clusters and SSV nodes.

DVT is poised to become an industry standard in staking infrastructure, though most end users will remain unaware of its presence.

Source: clientdiversity.org

Besides DVT, diversity in consensus and execution layer clients is equally important.

Conclusion

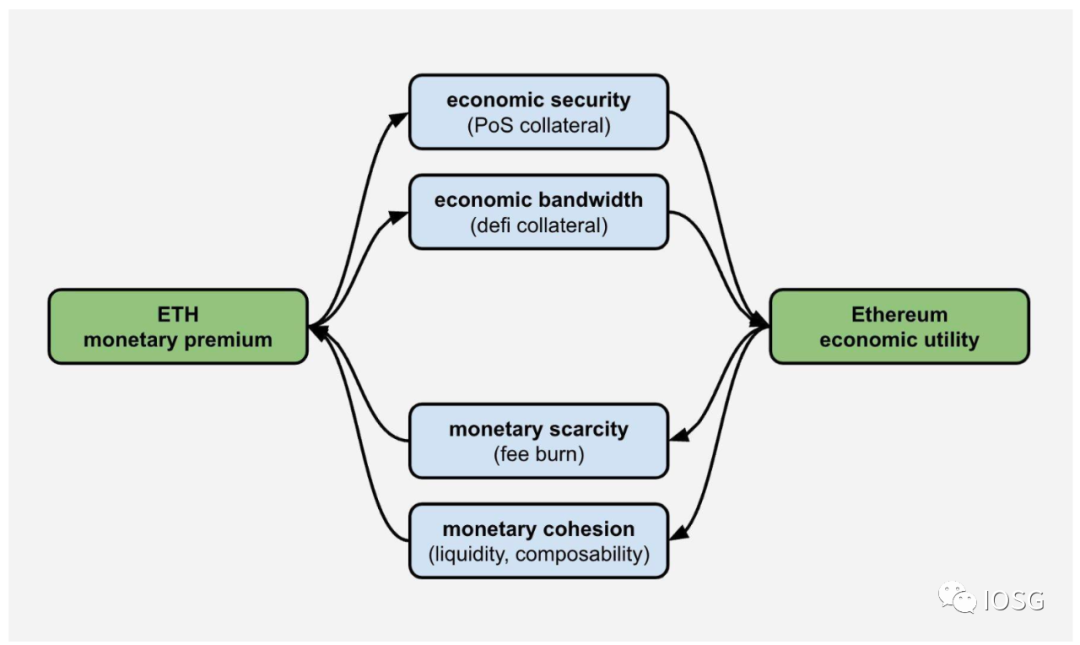

Source: David Hoffman

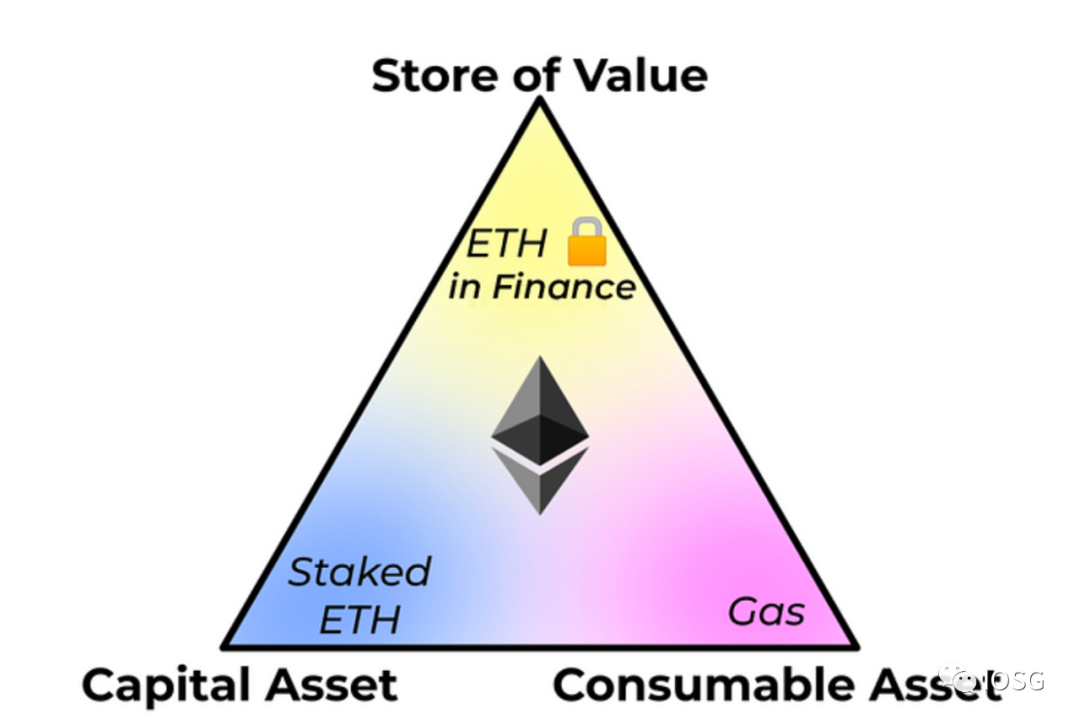

In 1997, Robert Greer proposed three asset classes:

1. Capital assets: Assets that generate value/cash flow, such as stocks and bonds;

2. Convertible/Consumable assets: Assets that can be consumed, burned, or transformed, such as oil and coffee;

3. Store-of-value assets: Assets whose value persists across time/space, scarce, such as gold and Bitcoin.

David Hoffman pointed out in 2019 that Ethereum can function as all three: staked ETH as capital assets, gas as consumable assets, and ETH locked in DeFi as store-of-value assets.

Source: Jon Charbonneau

In February this year, Jon provided a more detailed breakdown:

1. Staked or restaked ETH, including liquid staking tokens like stETH, representing value-generating/cash-flowing assets—capital assets;

2. Gas costs on Layer 1 and Layer 2, and DA costs of Layer 2 posted to Layer 1, which are consumed and burned—consumable assets;

3. Reserve assets in DAO treasuries, collateral in CeFi/DeFi, and uses in NFT trading, MEV denomination, token pairs, etc., serving as units of account and mediums of exchange, preserving value across time/space—store-of-value assets.

Source: Justin Drake

From 2019 to 2023, as the Ethereum ecosystem flourished, ETH’s utility has continuously expanded—evident in its role as an NFT denomination unit, Layer 2 gas token, MEV, LSTs and LST-based derivatives, and even through restaking, extending economic security to middleware and recycling value back to stakers.

Post-Shapella, major protocol-level changes to Ethereum staking have paused temporarily, with future developments likely focusing on application-level innovations. Though the staking sector is well-established, significant shifts driven by key events may still disrupt the current landscape, unveiling hidden investment opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News