Bankless on Shapella: Why Ethereum’s Upgrade Is Key to Building a Complete Monetary System

TechFlow Selected TechFlow Selected

Bankless on Shapella: Why Ethereum’s Upgrade Is Key to Building a Complete Monetary System

Ethereum has reached a historic moment.

Written by: Jack Inabinet

Compiled by: TechFlow

Lately, we’ve been hearing a lot about the Shapella upgrade.

In reality, it consists of two parts: the Shanghai upgrade on the execution layer and the Capella upgrade on the consensus layer.

Ethereum has reached a historic moment—by enabling withdrawals, ETH holders can now retain liquidity of their staked assets while avoiding complex tax issues and potential regulatory complications. At the same time, this upgrade marks a significant step toward building a crypto-native monetary system. This article explores how Shapella creates new opportunities for the cryptocurrency market and strengthens decentralized network security.

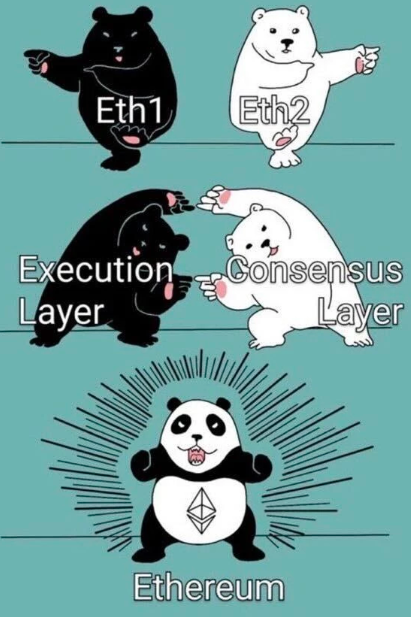

Last September, Ethereum developers implemented the Merge, replacing the original Proof-of-Work (PoW) consensus with the proof-of-stake Beacon Chain, reducing ETH issuance by 88% and cutting energy consumption by 99.95%.

After the Merge, Ethereum’s network security is maintained by stakers rather than miners.

Each staker deposits 32 ETH as collateral on the Beacon Chain to store network data, process transactions, and propose blocks, earning Ether rewards in return for securing the network. However, until now, stakers have been unable to withdraw either the accumulated consensus-layer rewards or their initial 32 ETH stake. That changes today.

With Shapella releasing such a large amount of ETH, Twitter’s crypto discourse is flooded with short-term price predictions. Yet capital flows and their impact on price are only part of the story.

Today, let's explore why you should care about the Shapella upgrade:

Massive De-risking

Staking is undergoing massive de-risking. The era of internet bonds has arrived, and cryptocurrencies will never be the same again.

Solo staking and staking-as-a-service (SaaS) allow crypto participants to earn yield on ETH, but users’ staked assets remain locked—unable to be sold or transferred.

Liquid staking derivatives (LSDs), including Lido’s stETH and Coinbase’s cbETH, were designed to solve this liquidity problem. LSDs now represent over $14.5 billion in total value, allowing ETH holders to earn yield while maintaining liquidity of their staked ETH.

For many Ethereum users, liquid staking derivatives have become the de facto method for liquid staking, accounting for 42% of all ETH liquid staking.

Although LSDs improve liquidity, they are often misunderstood as being pegged 1:1 to ETH like stablecoins. In reality, LSDs can be less liquid than the underlying ETH collateral.

This flaw was clearly exposed during periods of credit contraction. Starting in May 2022, when Three Arrows Capital and Celsius had their stETH positions liquidated, stETH deviated from its peg by up to 6% over the following six weeks, creating a crisis of confidence among LSD holders. Unable to withdraw, these holders had to rely solely on promises of future redeemability to maintain the peg.

Tax Challenges

Liquid staking derivatives also pose significant tax and regulatory challenges for many institutional investors. Take Lido’s stETH—the most widely used LSD, representing 74% of the ETH LSD market—as an example. It is a rebase token, meaning each rebase triggers a taxable event for holders. For tax-sensitive investors, this makes it an unviable option.

While investors may view ETH as a commodity, this classification does not easily extend to many forms of liquid staking.

Many crypto exchanges, decentralized protocols, and SaaS providers pool staking rewards to offer investors consistent yields. This structure imparts securities-like characteristics, which the SEC sought to avoid in its recent settlement with Kraken.

Adding further regulatory confusion, protocols like Lido and RocketPool have previously chosen—and continue—to incentivize liquidity on their LSDs. These incentives arguably reinforce the securities characterization, as maintaining the peg partially depends on ongoing token emissions.

The Solution

Since the launch of the Beacon Chain, SaaS and solo liquid staking solutions have served as viable options for ETH holders seeking to preserve asset liquidity. Now, just two Ethereum Improvement Proposals (EIPs) and one hard fork later, withdrawal functionality changes the game—for both观望 institutions and staunch advocates who insist “not your keys, not your coins.”

As the CTO of a London-based liquid staking firm put it, institutions can finally achieve both control and liquidity of staked assets—without having to argue with tax authorities.

Now, avoiding complex tax burdens and potential SEC scrutiny—while earning risk-free yield at the protocol level and retaining liquidity of staked ETH—is easier than ever. Today’s upgrade not only provides liquidity beyond LSDs but also enables the market to begin redistributing staking power and weakening Lido’s dominant 31% control over the validator set.

Shapella empowers stakers and represents a crucial step toward further decentralizing network security.

Internet Bonds

Ethereum staking has long been compared to fixed-income instruments in traditional finance.

Stakers provide 32 ETH as collateral (principal) and receive rewards (interest). This relationship doesn’t depend on any party’s ability to repay a loan; instead, it’s backed by Ethereum’s future economic activity—specifically, fee revenue. At its core, Ethereum staking is a perpetual instrument with no default risk.

Towards Market Pricing

Another benefit of Shapella is making Ethereum more market-driven.

In traditional finance, loan rates are typically calculated as a spread over the risk-free rate—often represented by U.S. Treasury yields.

The gap between the risk-free rate and borrowing costs reflects the additional risk (especially default risk) of lending to borrowers other than the U.S. government. Treasuries trade daily, and their yields converge to a market-determined interest rate based on supply and demand. Unfortunately, despite having near-zero default risk (akin to U.S. Treasuries), Ethereum staking yields have failed to serve as crypto’s risk-free rate because they haven’t operated at a true market-clearing level.

The network pays out staking yields based on two key factors: the number of validators and transaction fees generated. As validator count increases, fees are distributed across a larger group, lowering expected returns per node—but this is offset by higher ETH issuance subsidies.

Until now, the market could only react to rising attractiveness of staking opportunities: when ETH holders see staking yields becoming more attractive relative to other income sources, more participants join staking. Theoretically, the market responds to attractive staking rewards by increasing validator numbers, thereby eliminating temporary arbitrage opportunities.

Previously, we lacked the ability to respond to declining relative attractiveness—leading to artificially suppressed yields when block space demand was low or compelling alternative investments emerged. Capital reallocation wasn’t an option within staking. With Shapella, that dynamic changes. Stakers can now withdraw their 32 ETH from the Beacon Chain to seek better yields—or exit entirely when the risk-free rate no longer seems attractive.

Due to PoS consensus constraints, necessary withdrawal and exit queue mechanisms limit rapid outflows from staking. Similar mechanisms exist in traditional finance—such as circuit breakers that halt trading under predefined conditions. While not a perfect “market rate,” Shapella brings Ethereum one step closer to becoming the internet bond.

“What is money worth?” is a foundational question in finance, and the risk-free rate is the cornerstone of that system. Shapella transforms Ethereum’s staking yield into something much closer to a market-based risk-free rate.

If ETH is to become a currency, having a native risk-free rate akin to U.S. Treasuries—as a foundation for loan pricing and financial valuation—will greatly aid adoption, especially in attracting financial professionals and institutional investors.

A Historic Moment

Forget about short-term volatility—in the long run, enabling withdrawals provides a major de-risking tool for many crypto market participants who find LSDs fundamentally inadequate.

Regardless of what happens in the immediate term, today marks a pivotal moment in crypto history: since the launch of the Beacon Chain, Ethereum’s Shapella upgrade represents a critical leap toward establishing a crypto-native monetary system.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News