Exploring the zkEVM Ecosystem: Which DeFi Protocols Are Worth Watching?

TechFlow Selected TechFlow Selected

Exploring the zkEVM Ecosystem: Which DeFi Protocols Are Worth Watching?

zkEVM has unleashed a new ecosystem built on the cutting-edge zk execution layer.

Author: Asif Khan

Compiled by: TechFlow

zkEVM has unlocked a new ecosystem built on the cutting-edge zk execution layer. More importantly, we now need to get ahead of the curve by identifying high-quality DeFi dApps即将 launched on this layer. This article highlights several promising native zkEVM protocols that have not yet issued tokens and could become mainstream in the future.

Satori Finance

Order book-based perpetual contracts are set to become a major force on Ethereum L2s. Satori Finance boasts a tightly-knit team unafraid to push boundaries. They’ve secured $10 million in funding. Their key innovation is an off-chain matching engine with on-chain settlement.

Clober

Aligned with the order book thesis, Clober is the only fully on-chain EVM-native order book.

It uses a novel algorithm called "LOBSTER" for efficient order matching, enabling both on-chain order matching and on-chain settlement.

Mantis Swap

Mantis Swap is a novel stablecoin AMM exchange that breaks new ground with its innovative single-sided staking mechanism.

D8X

D8X is launching a cutting-edge perpetual contract engine based on pool-based counterparties. Its core product is a dynamic AMM pricing model designed to ensure:

1. Lowest possible execution prices;

2. Reduced risk for AMM LPs;

3. Enhanced funding rate profiles for LPs.

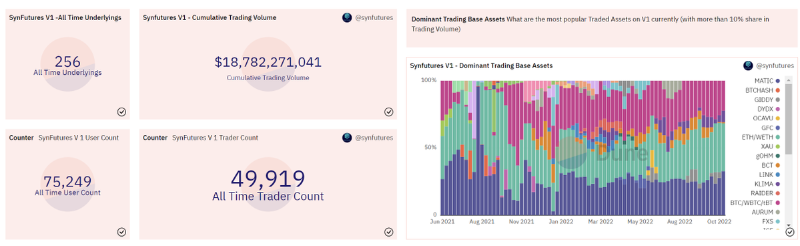

Syn Futures

Syn Futures is another Polygon-native perpetual contract platform. Its v1 achieved nearly $19 billion in notional trading volume. The team has raised $14 million and will soon launch v2, introducing NFT leveraged trading.

Timeswap Labs

Timeswap Labs may be one of the smartest DeFi protocols in the space. Imagine a liquidity lending market that operates entirely on-chain without relying on oracles—well, you don’t need to imagine anymore, because Timeswap Labs is already here. It can also serve as a foundational building block for options products.

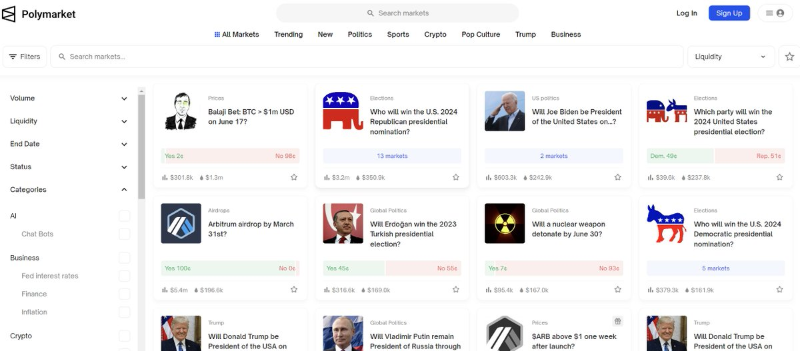

Polymarket

Polymarket has recently gained significant traction within the community. Centered around topics like the Arbitrum airdrop and Balaji predictions, it has captured widespread attention. In my view, Polymarket could become one of the largest dApps in the sector in the coming months.

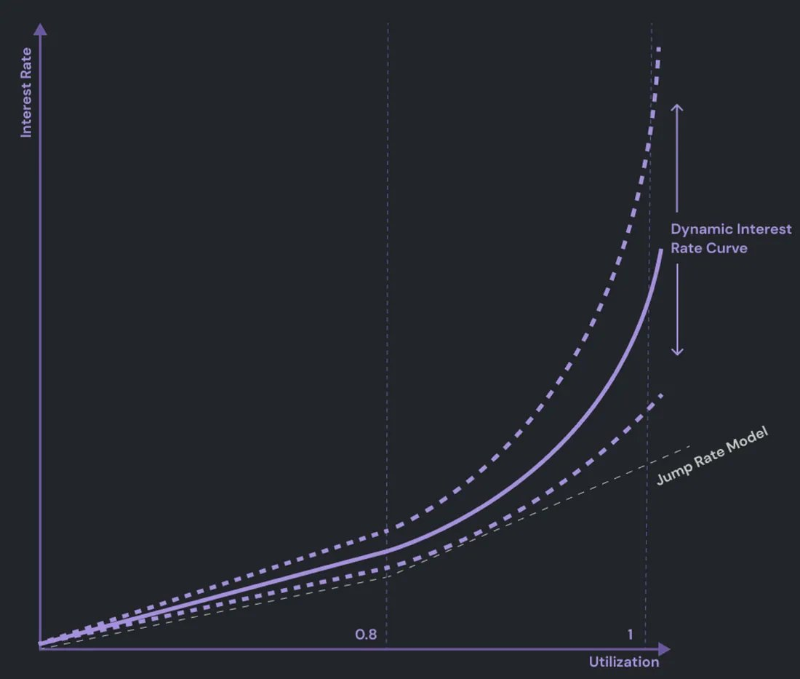

0Vix

0Vix is advancing on-chain lending to the next stage using native zk powered by PolygonID. But its main killer feature is its dynamic interest rate curve. I’m confident they’ll emerge as leaders in the zkEVM lending market.

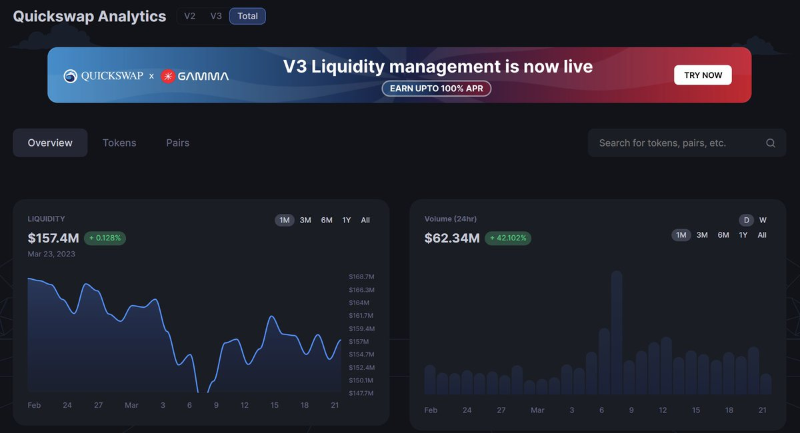

Quickswap

Quickswap, the OG native protocol on Polygon, has been growing rapidly over the past six months:

- Quickswap v3 daily trading volume > $50 million;

- Integration with Quickswap LP Gamma;

- QuickPerps—this DEX has maintained consistent liquidity for two years, ensuring strong liquidity for perpetual contracts.

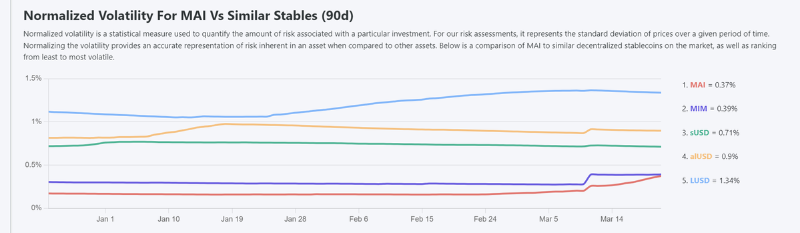

QiDao

QiDao is the OG stablecoin protocol on Polygon, launching at an incredible pace while maintaining the most stable peg in the decentralized stablecoin space.

Many teams aspire to become cross-chain stablecoins, but Mai has already achieved this goal, making its future prospects highly promising.

A new era of zk L2s has arrived, and we must pay close attention. This space has achieved unprecedented levels of liquidity, making it fertile ground for innovative DeFi applications.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News