Pendle: How to tokenize the future yields of interest-bearing tokens like Ethereum?

TechFlow Selected TechFlow Selected

Pendle: How to tokenize the future yields of interest-bearing tokens like Ethereum?

In today's market, staking accounts for a relatively small proportion, as there are far too many other opportunities available.

Written by: Louis Cooper

Compiled by: TechFlow

In today's market, staking represents only a small portion of activity because there are so many other opportunities available. But what if I told you that you could earn solid returns by staking liquid assets? Pendle does exactly that—tokenizing your yield.

$PENDLE Token Overview:

- Supports ETH and AVAX.

- Price: $0.05

- Market Cap: $10M (FDV: $11M)

- Founded: 2022

- ATH: $2.5

- ATL: $0.03

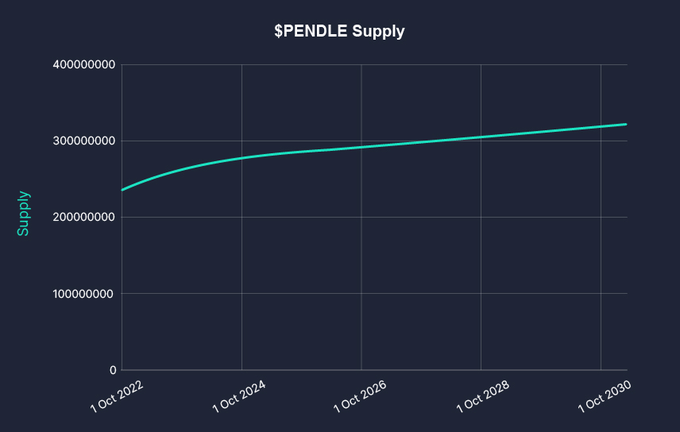

- Max Supply: 230 million

- Holders: 2,200

Appears close to bottom levels:

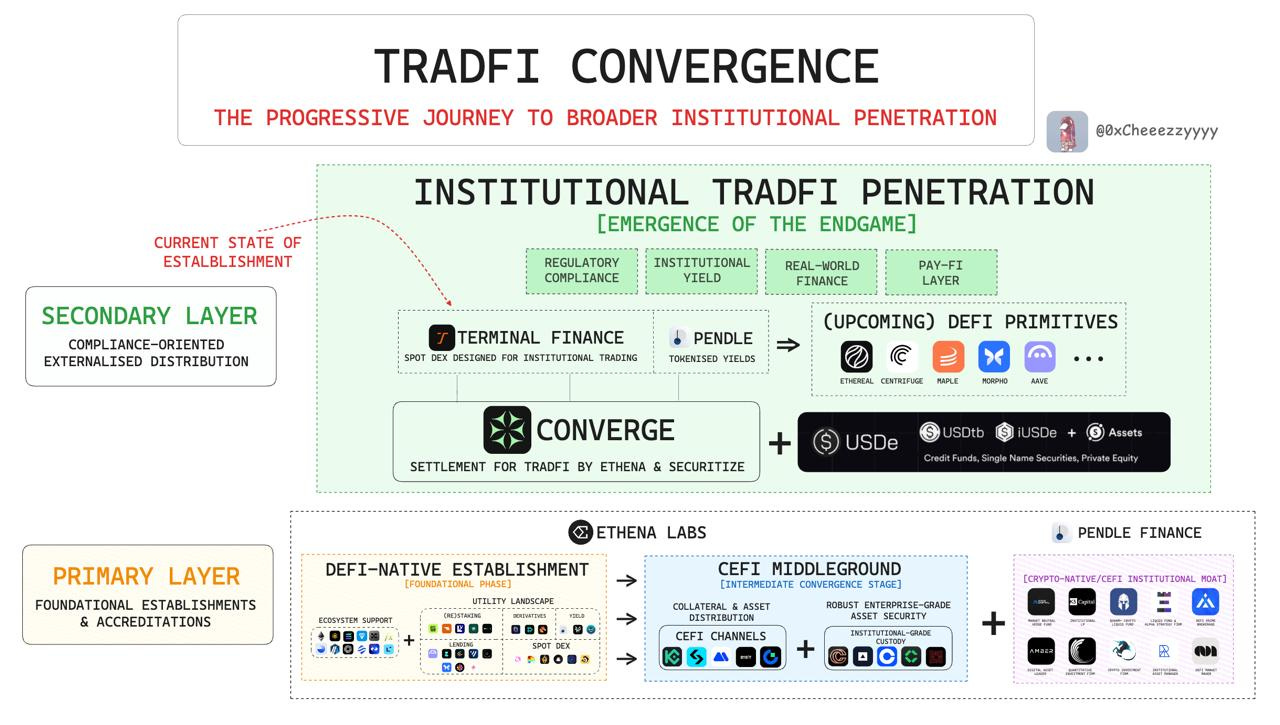

What is Pendle?

$PENDLE is an Ethereum-based protocol that allows users to tokenize and trade the future yield of interest-bearing tokens such as Ethereum. It splits tokens like stETH into two components: principal and yield.

So why do this?

Because tokenizing yield creates several opportunities:

- Going long on assets at a discount.

- Gaining early liquidity.

- Using future yield as leverage without requiring collateral.

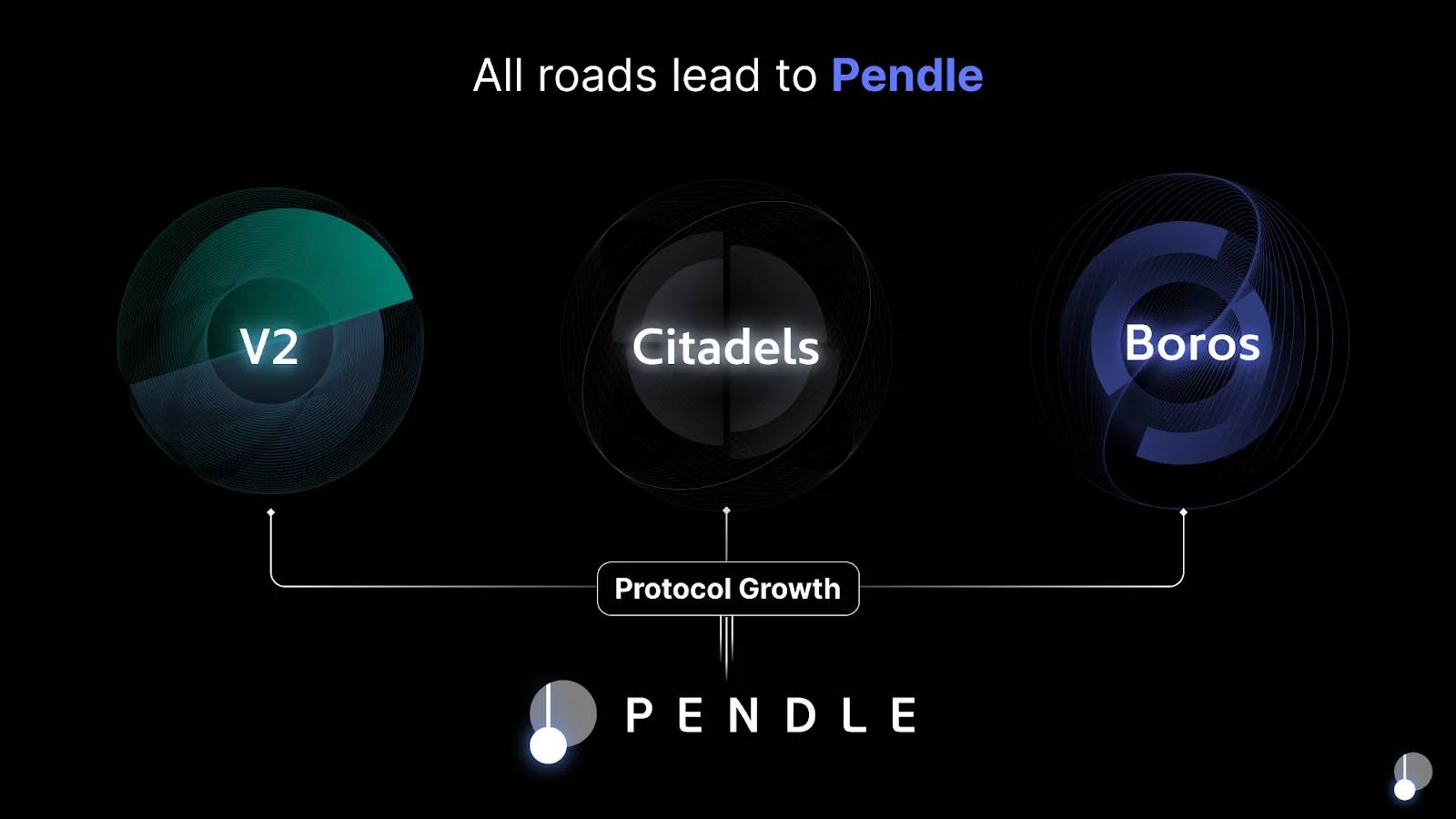

The AMM is currently on version V2 and offers users two experiences: standard and professional versions.

So how does it actually work in practice?

How Does Pendle Split Tokens?

First, tokens are wrapped into an SY token—an EIP-5115 standard token. Everything happens behind the scenes, making it feel just like trading any other token for users.

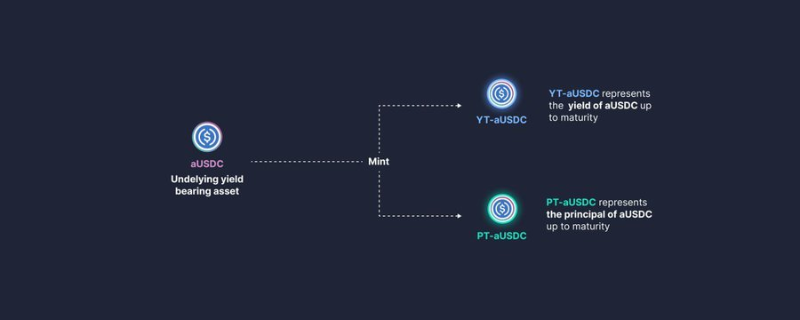

Then, the SY token is split into two parts:

- One Principal Token (PT)

- One Yield Token (YT), representing future yield

Both have one or more maturity dates. When that date is reached:

- The PT becomes fully redeemable for the underlying asset

- The YT stops accruing yield

On Pendle Pro, you can also trade individual tokens (Pro mode is free). This enables strategies based on your outlook for future yield performance:

- Rising yields

- Falling yields

- Stable yields

LP and Fee Sharing

Providing liquidity (LP) with YT and PT tokens adds extra yield to your stake, with nearly zero impermanent loss risk—thanks to both tokens being pegged to the same underlying asset.

For example: stETH PT + stETH YT = stETH

The only IL risk comes from fluctuating demand for PT and YT. At maturity, both assets hold equal value (in ETH price). LP positions can serve as an effective hedge for your PT and YT holdings.

This brings us to the classic question: where do LPs get their yield?

- Fixed-rate yield from PT

- Protocol rewards from the underlying token

- Trading fees

- $PENDLE incentives

Let’s quickly review the V2 AMM.

Pendle’s V2 AMM creates a single pool allowing seamless trading between YT and PT. Due to its design, flash swaps are possible, simplifying user experience.

Of course, the AMM generates fee revenue. The team commits that no fees go to the core team. Instead, 0.1% swap fee per transaction is distributed as follows:

- 20% to LPs

- 80% to $vePENDLE holders

PENDLE Tokenomics

The team's token unlock schedule ends in April 2023, after which emissions will come solely from grants. Weekly distribution: 667,705 (decreasing by 1.1% weekly).

According to their documentation, this equates to a 2% inflation rate.

LPs have clear incentives.

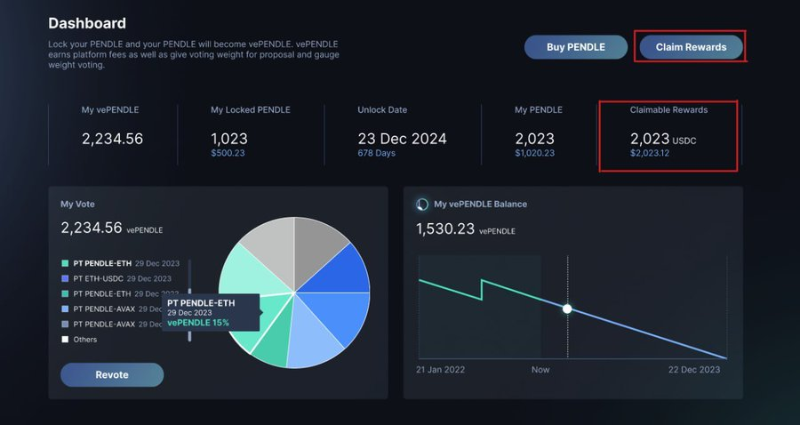

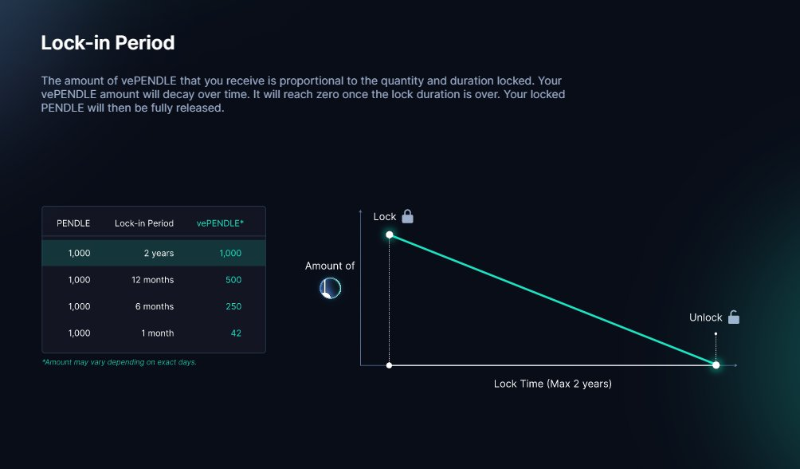

Lock $PENDLE to receive vePENDLE and gain access to:

• Governance rights

• Share of Pendle revenue

• Additional liquidity provider APY bonuses

Personal Thoughts

I recently came across Pendle through the LSD narrative, so I don’t yet have a position. Here I’m doing a quick recap of their strong performance last year—for instance, reaching $100M in TVL.

Pendle is actively embracing the LSD narrative. With the upcoming $ETH Shanghai upgrade, Pendle is well-positioned to benefit.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News