How will changes in token supply affect the token price?

TechFlow Selected TechFlow Selected

How will changes in token supply affect the token price?

Does token supply affect price? If so, how much?

Author: Tascha Lab

Compiled by: TechFlow

TLDR:

-

Token supply is negatively correlated with price changes—on average, a 10% increase in supply leads to approximately a 5% drop in token price.

-

The impact of supply reduction on price is five times stronger than that of supply expansion.

-

Supply changes have a greater price impact during bear markets.

-

The effect is the same regardless of whether the token has a maximum supply cap.

1. Does token supply affect price?

2. If so, how significant is the impact?

The following data comes from the top 1,000 tokens by market capitalization over the past three years—and it may surprise you.

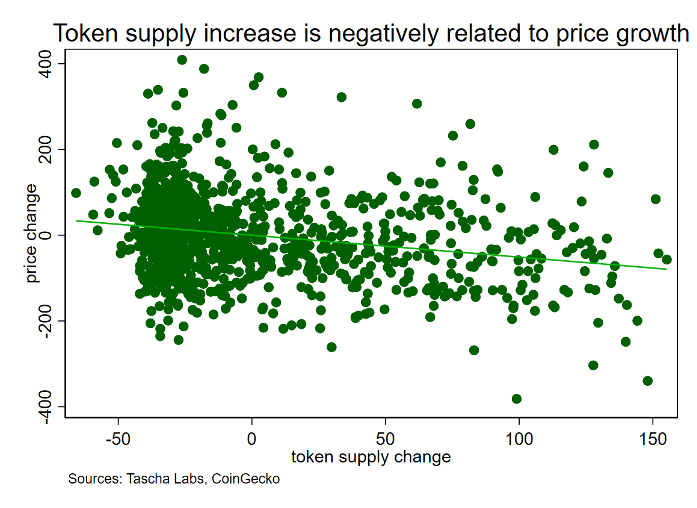

The answer to the first question is yes. All else being equal, supply growth → price decline.

The answer to the second question is: roughly half the rate of supply growth.

Data from the top 718 tokens by market cap between 2020 and 2022 (excluding tokens with less than two years of history) shows that: a 10% increase in total token supply correlates with an average 5.1% decline in price.

In other words, increasing token supply can raise the market cap ceiling for a token (since market cap = total supply × price, and only about half of the supply increase is offset by price decline).

Think about this—it theoretically shouldn’t happen.

If market cap represents the valuation of the entire project, then splitting value across 1,000 or 1 million tokens should not change the total market cap. Or in other words, the number of tokens shouldn’t matter for the overall value of the project—right?

In stock markets, there’s a well-known related phenomenon: "the stock split premium"—when a company splits its shares, its market cap often increases despite theoretically having no impact.

Why does this happen?

One reason applicable to both tokens and stocks is: lower prices reduce entry barriers for buyers → increased demand → broader holder base → higher liquidity → price appreciation.

But clearly, this effect is stronger in crypto than in equities. Why?

Because projects often use new tokens for airdrops and rewards to directly incentivize or attract new users—directly increasing holders without relying on secondary markets.

This creates unusual implications for a project’s token strategy.

For example, when a project issues 10% more tokens, it could give half to existing holders—as staking rewards—so they don’t suffer much (expected 5% price drop, but receive 5% in new tokens)—and allocate the other half to potential new users to incentivize adoption.

This could be a viable way to boost adoption and market cap without harming relationships with existing holders. Note that this likely only works for healthy projects—with stable holder bases and real products people want to use.

There are many other nuances regarding the relationship between token supply and price:

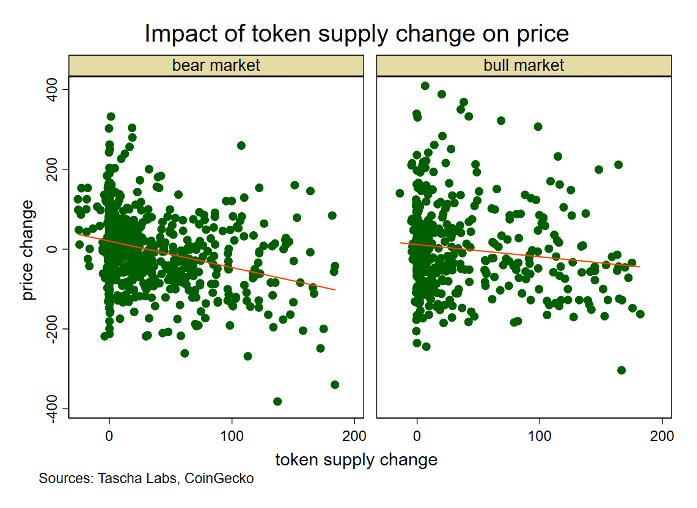

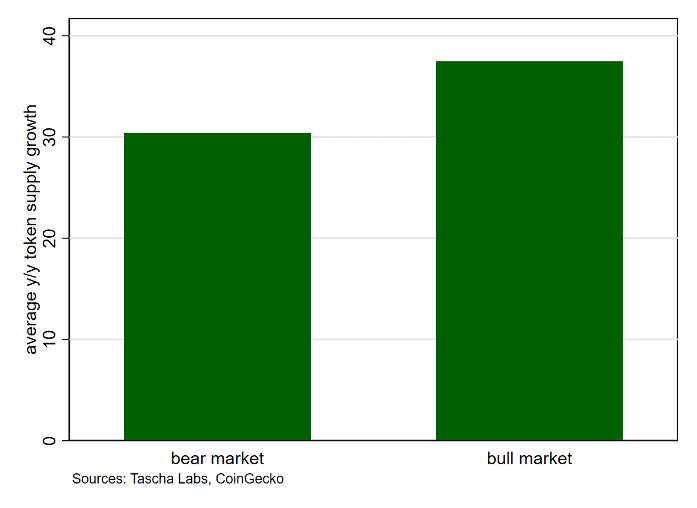

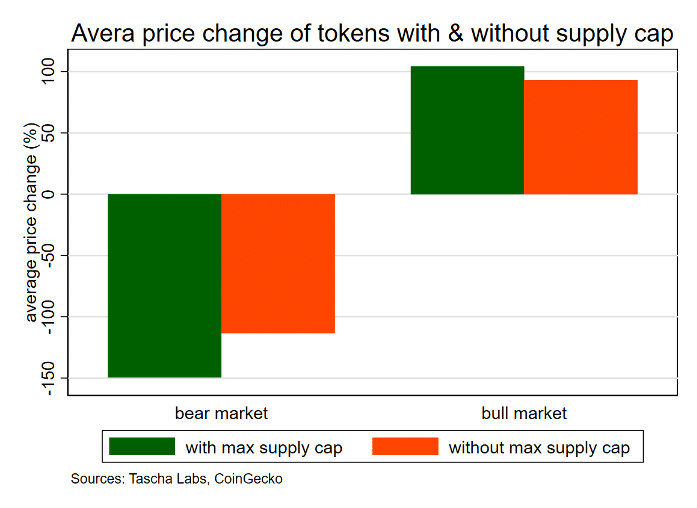

Does Market Condition (Bull vs Bear) Matter?

Yes, it matters significantly.

During bull markets, supply expansion has a smaller impact on price. The reason is intuitive—higher demand in bull markets helps offset the supply effect.

In bear markets, a 10% supply increase leads to an average 7% price decline.

Project teams are clearly aware of this—the overall token supply growth this year has declined across the board. Average annual supply growth is down 7 percentage points compared to last year.

Still, the average supply growth rate in 2022 was 30% (median at 10%). Whether this is high or low depends on your perspective.

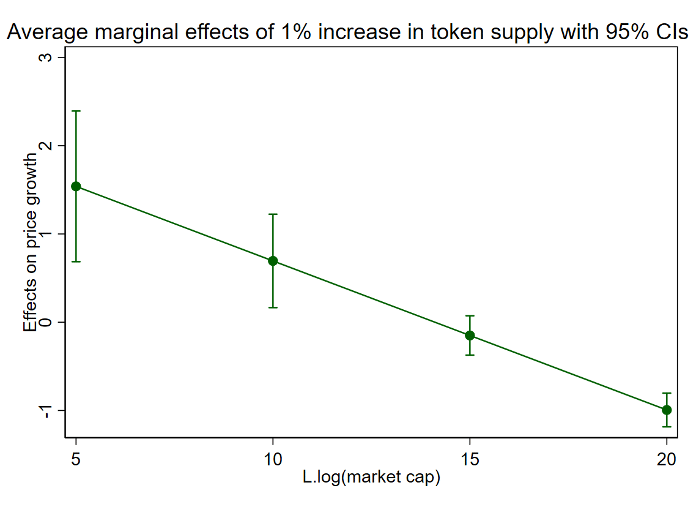

Does Token Size Matter?

Yes, it does.

The negative relationship between supply growth and price appears to apply mainly to more mature tokens or those with larger market caps.

For small-cap tokens (market cap < $1.5M), increasing supply can actually lead to higher price growth.

Why?

As mentioned earlier, increasing supply and getting tokens into more hands helps boost liquidity and secondary market trading demand, which in turn supports price growth.

For small-cap tokens, this effect seems to dominate. But once your market cap exceeds several million dollars, it becomes less pronounced.

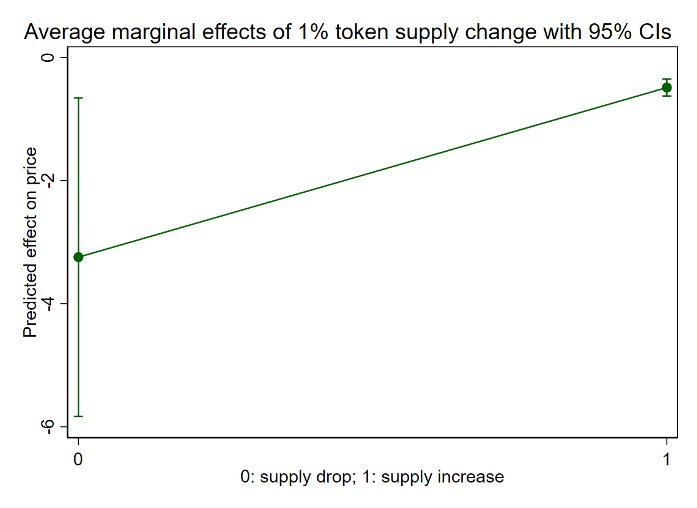

Does It Matter If Supply Change Is Positive or Negative?

Yes, it matters significantly.

Supply contraction impacts price more strongly than supply expansion—much more so. A 10% reduction in token supply → 32% price increase. Meanwhile, a 10% supply increase → 4.9% price decline.

Not certain of the exact reasoning, but one guess is that crypto investors favor supply reduction—the narrative around token burns and buybacks itself generates additional demand and reflexively amplifies price effects.

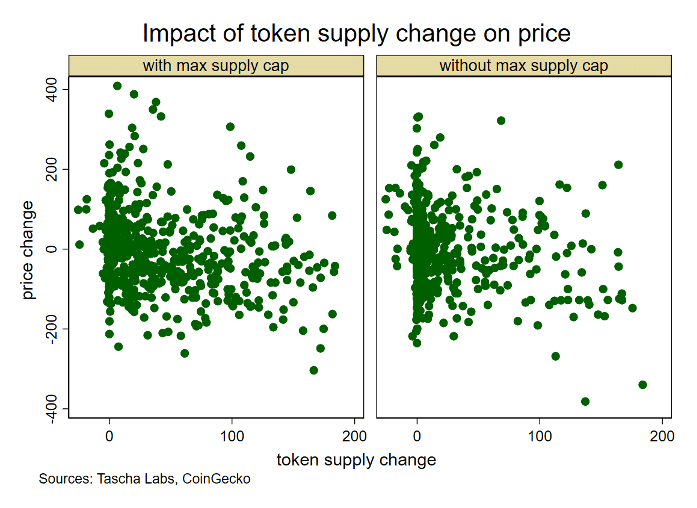

Does Having a Maximum Supply Cap Matter?

Not really.

The relationship between supply growth and price remains unchanged regardless of whether a token has a finite supply cap in the future.

Ironically, tokens with hard supply caps tend to fall more on average during bear markets compared to those without such caps. This difference is statistically significant.

Some possible reasons I believe:

1. Tokens with hard supply caps may disproportionately attract more speculative holders.

Originating from Bitcoin's 21 million cap, limited supply has become a crypto meme. Many crypto investment gurus and influencers list it as a non-negotiable factor in their token-buying checklist. Speculators care more about these checklists than actual project fundamentals.

But speculators aren’t real users. Their holdings are more volatile than those who actively use the product. Attracting more speculative holders brings higher price volatility.

2. It may reflect poor consideration in the project’s tokenomics design.

Fixed supply caps come with many limitations, making them suboptimal for most projects.

Yet they are simple and appealing to investors. Any project team, regardless of whether they’ve thought through how supply should evolve, can at least set a fixed cap without needing to explain their rationale.

As a result, in past cycles, tokens with fixed caps have actually seen higher supply growth than those without—suggesting that a fixed cap superficially serves as a convenient cover for sloppy supply management.

To be clear, this is a complex issue depending on many factors: project stage, goals, business model, product, etc.

Yes, supply affects price—but it’s only one piece of the tokenomics puzzle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News