Chicken Bonds: A new type of bond that integrates yield models into NFTs

TechFlow Selected TechFlow Selected

Chicken Bonds: A new type of bond that integrates yield models into NFTs

Chicken Bonds, powered by Liquity, is an NFT-based liquidity bootstrapping engine.

Written by: Rxndy444

Translated by: TechFlow

If you've been following the DeFi world this year, you may have noticed a few emerging trends. One narrative centers on innovations in protocol-owned liquidity (POL), while another involves NFT use cases expanding beyond PFPs.

Today we'll discuss a protocol called "Chicken"—vegetarians, don't worry, it's not edible. We're talking about Chicken Bonds, an NFT-based liquidity bootstrapping engine powered by Liquity.

What Are Chicken Bonds?

As the name suggests, CBs are a form of bond. Through the Liquity frontend, users deposit LUSD to create a bond position, which is then represented by a unique NFT.

These bonds have no maturity date and generate yield over time in the form of bLUSD. At any time, bondholders can choose to "join," exchanging their initial LUSD for bLUSD, or they can "exit," terminating the bond and reclaiming their original LUSD deposit while forfeiting their accrued bLUSD.

The primary purpose of CBs: to offer users amplified LUSD yield opportunities while providing Liquity with additional liquidity. On the surface, this seems relatively simple, but there are many interesting aspects to CB strategies, the mechanics of bLUSD, and the NFTs themselves that merit deeper exploration.

Let’s first introduce the system, then explore some strategies for using CBs.

NFT Integration

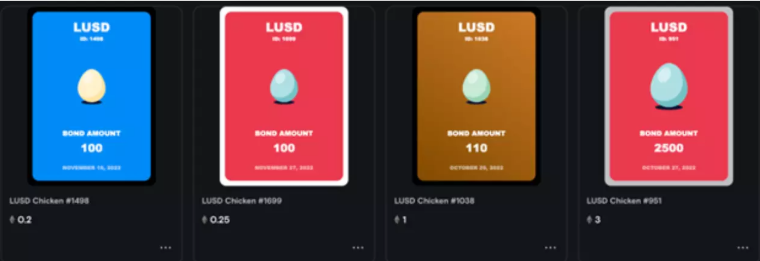

Clearly, the NFTs themselves aren’t the core focus of CBs, but they do deserve attention. They evolve based on bondholder decisions and can be traded on marketplaces like LooksRare and X2Y2.

In this unique design, Liquity’s attention to detail shines—each evolution comes with animations and a rich combination of traits.

These evolutions correspond to bondholder activity. If a bondholder joins, the egg transforms into a mature chicken. If they exit, it becomes a frightened chick.Chickens can also earn badges, shown in the lower corners, obtained through participation in the broader Liquity ecosystem.

Maintaining an open Liquity Trove, staking LQTY tokens, and voting for the LUSD pool on Curve all earn your chicken unique badges. The dynamic nature of these NFTs and their responsiveness to on-chain activity represent a novel approach to NFT integration in DeFi—a significant advancement that other projects will likely emulate in the future.

When selling an Egg NFT, remember that you’re also transferring ownership of the underlying bond, so price listings should reflect this accordingly.

Overall, this is one of the best examples of NFTs serving a legitimate financial purpose without sacrificing flexibility.

Boosted LUSD (bLUSD)

Now that we’ve covered the NFTs, buckle up—we’re diving into technical details. Here’s how bLUSD works, the token that pays out CB yields.

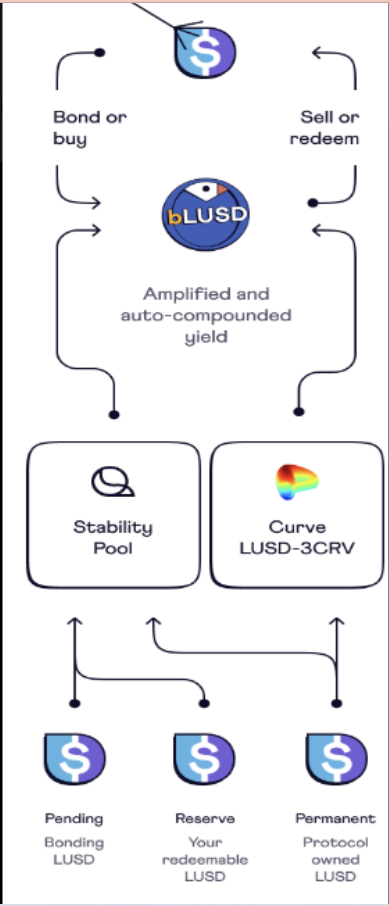

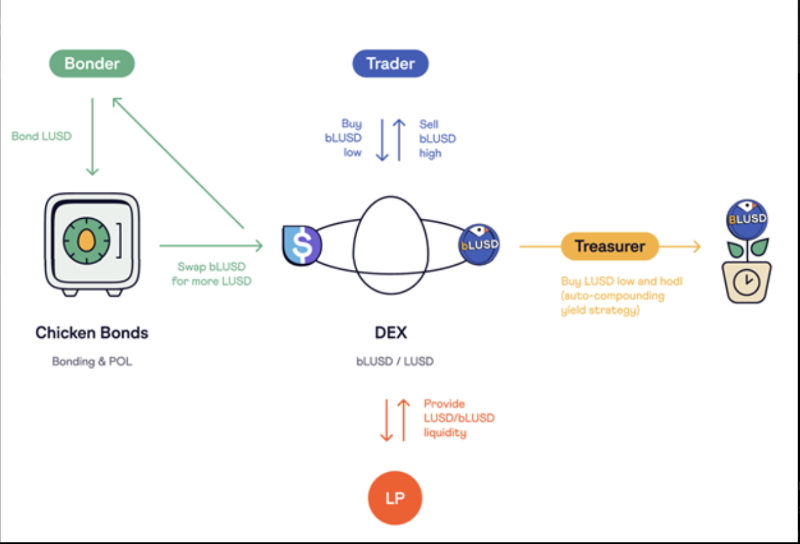

bLUSD (Boosted LUSD) is an ERC-20 token separate from LUSD, backed by reserves within the CB system. These reserves consist of LUSD deposits from bonds, which are then deposited via B.Protocol into Liquity’s LUSD Stability Pool or via Yearn Finance into Curve’s LUSD/3CRV pool. Because bLUSD is supported in this way, it represents a proportional share of the reserves. In other words, a holder redeeming 1% of the current total bLUSD supply would receive 1% of the reserves.

When redeeming bLUSD, holders receive a combination of LUSD and yTokens (Yearn Curve LP tokens). Redemption is only economically viable—and thus likely to be captured by bots—when the market price falls below redemption value. This arbitrage helps maintain a floor value for bLUSD, and due to its enhanced yield potential, the market price should remain above this floor.

Enhanced yield?

Yes, as the name implies, bLUSD typically offers higher yields than standard LUSD deposits in the Stability Pool.

The LUSD held within the CB system is distributed across three buckets:

-

Pending Bucket: LUSD from open bonds (neither joined nor exited) sits here. Yields earned by this LUSD flow into the Reserve Bucket.

-

Reserve Bucket: Contains a portion of LUSD from bonds plus yield accumulated from the other two buckets. This bucket backs the entire bLUSD supply.

-

Perpetual Bucket: Holds another portion of bond-derived LUSD. Yields generated here flow into the Reserve Bucket. The LUSD in this bucket is protocol-owned and not used for redemptions.

Because yields from each bucket feed into the Reserve Bucket, bLUSD gains stronger backing than standard LUSD+Stability Pool returns—thus boosting yield. Returns from both sources (Yearn Curve vault and Stability Pool) are automatically harvested and compounded, maximizing yield potential.

What Does This Mean for Bondholders?

The bucket system is designed to protect the principal of open bonds. Bondholders can exit at any time and reclaim their LUSD principal, providing a solid safety net. Exiting means forfeiting claims to accrued bLUSD yield, which effectively transfers to future joiners. Joining presents an opportunity to capture enhanced yield, prompting bondholders to decide when joining is most optimal.

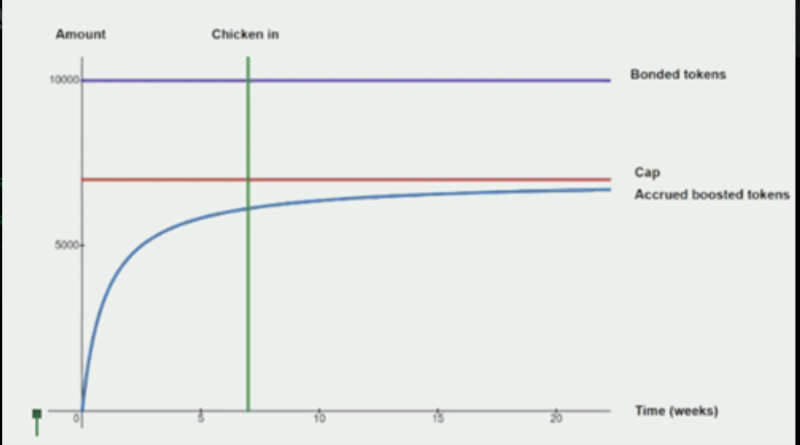

The blue curve below shows the accrual schedule of bLUSD during the bond holding period—initially growing quickly, then slowing as it approaches its cap.

At some point along this curve, the bondholder reaches breakeven—the market value of accrued bLUSD equals their initial principal.

Beyond this point, joining makes sense, but given diminishing returns, further waiting adds little value.

bLUSD Strategies

Given the properties of bLUSD described above, several different strategies can be adopted depending on user goals and risk tolerance. Here are five ways to play bLUSD:

-

Sustained Stablecoin Yields: A relatively simple and passive strategy involving borrowing LUSD via a Liquity Trove (using ETH as collateral), bonding it, and exiting sometime after reaching breakeven. Then, when the market price of bLUSD is significantly above its redemption value, sell bLUSD for LUSD, re-bond to increase principal, and repeat the yield cycle. Main risks include ETH exposure and maintaining the Trove’s collateral ratio if ETH prices drop.

-

Active Trading: A more speculative approach involving actively monitoring bLUSD’s market price, buying when below fair value—ideally near redemption value—and selling when increased demand pushes prices higher. The key risk is timing these trades optimally for profit, though downside risk is limited by bLUSD’s minimum redemption value.

-

Liquidity Provision: Another passive strategy—become an LP for bLUSD. Acquire LUSD via Trove or exchange, bond part of it, enter at some point to receive bLUSD, then deposit both tokens into a Curve pool to earn trading fees. LPs may also keep extra LUSD handy to rebalance the pool during bLUSD sell-offs, capturing additional deposit bonuses from Curve. The CB mechanism reduces impermanent loss risk by allowing POL to shift into the Curve pool to balance prices. Single-sided LPing should also be considered, as it often yields better returns—this involves depositing LUSD only when the LUSD-to-bLUSD ratio in the pool is imbalanced, ensuring a premium. Current pool APR is 4.055%.

-

Redemption Bots: As mentioned earlier, the bLUSD redemption system creates an arbitrage opportunity whenever the market price dips below redemption value. Developers can build bots to monitor and exploit this, purchasing and redeeming bLUSD profitably.

-

Focusing on NFTs: Like most NFTs, CB Jpegs vary in rarity based on their traits, so collectors may be interested in acquiring rare combinations. Users can increase their odds by participating in ecosystem activities and creating multiple bonds to “hunt” for rare attributes.

Use Cases

Chicken Bonds as a POL Bootstrapping Mechanism.

Every DeFi protocol eventually faces the challenge of how to effectively grow liquidity for its token.

Typically, this means offering temporary or declining incentives, usually in the form of native tokens, to attract liquidity providers. While effective in the short term, this can lead to token supply inflation and attract mercenary liquidity.

As demonstrated by Liquity’s own use of Chicken Bonds, enhancing the “amplified yield opportunity” offered by a token can drive protocol-owned LUSD liquidity. As previously explained, LUSD deposits from CBs flow into the perpetual, protocol-owned bucket. The system also enables Liquity to deepen available LUSD liquidity on Curve, as it serves as a yield source for deposited LUSD.

CBs are expected to roll out to other protocols and DAOs starting around Q2 2023, allowing them to integrate the same system and gain liquidity at no cost.

If desired, protocols can deploy additional liquidity to further incentivize their CB systems.

Creating bonds, not redeeming them to boost yields, providing liquidity for boosted tokens, and buying boosted tokens on the open market are all options that make CBs more attractive.

bLUSD as Collateral

By design, bLUSD has a rising floor price due to reserve backing, making it relatively stable. Combined with its yield-bearing nature, this gives it unique potential as collateral.

The idea is: borrowing against bLUSD means no liquidation risk as long as the threshold stays above bLUSD’s redemption price. This allows borrowers to access highly capital-efficient loans—up to 100% LTV based on redemption price—and deploy the borrowed assets into other yield-generating opportunities, such as stablecoin staking. Essentially, this provides leveraged exposure without liquidation risk, since bLUSD’s floor price is hard-backed by the redemption mechanism.

For example, an LUSD holder creates a bond, receiving an Egg NFT representing the bond, which can later be redeemed for bLUSD. They want to borrow another stablecoin for staking, so they use the Egg NFT as collateral, borrowing against the bLUSD redemption (floor) price (currently 1.06 LUSD). The loan could represent a large portion of the bLUSD claim’s value because lenders are protected by the bLUSD floor price in case of default. Borrowers are also protected from liquidation since their collateral’s value is supported by the bLUSD floor.

Metrics

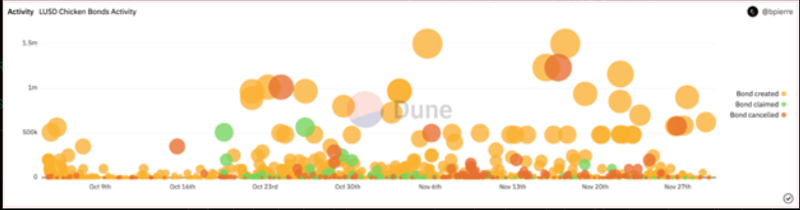

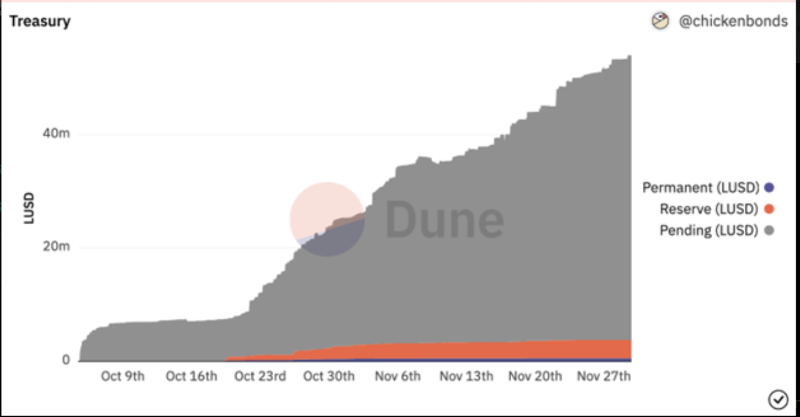

Now let’s look at the numbers behind CBs and see how things have evolved since launch in October. Unless otherwise noted, all figures are in LUSD.

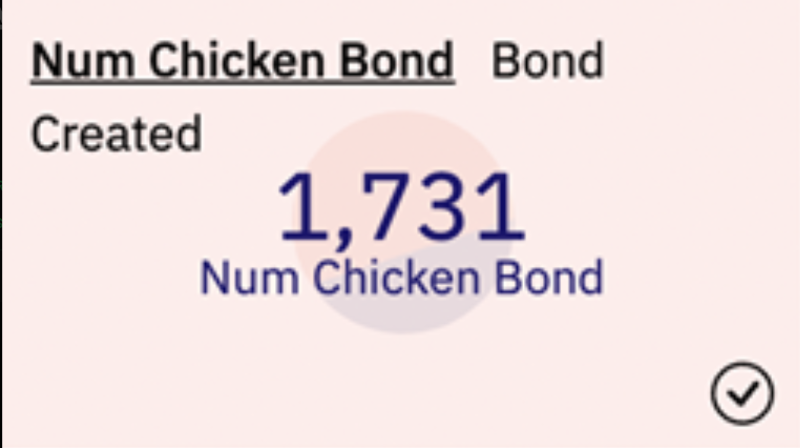

First, volume and user count are substantial—over 1,700 bonds created in just 56 days since launch, totaling over 62 million LUSD.

Below, we can see bond sizes. While there are some large bonds >500k LUSD, most fall at or below 100k LUSD.

This indicates that while larger whales/funds/DAOs are using CBs, the majority of activity is driven by smaller DeFi users—an encouraging sign for adoption and sustainability.

Regarding the buckets, we see that most funds remain in the Pending Bucket, likely because bondholders are still optimizing their entry timing.

The Reserve Bucket is being filled by yield from the Pending Bucket, currently standing at 3.2 million, while the Perpetual Bucket has accumulated a notable 550,000 POL through exits.

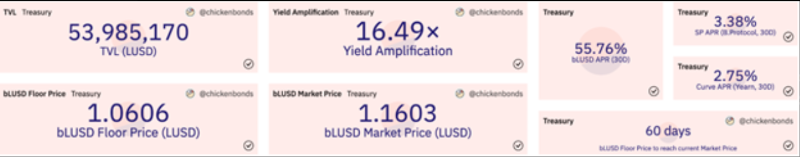

Currently, nearly 53 million LUSD sits in the system, generating substantial treasury yield, driving both market price and bLUSD floor value upward.

At current yield levels, the floor price of $1.0606 is projected to reach the current market price of $1.1603 within 60 days.

The enhanced yield is no joke—investors will find it difficult to match this return level while also benefiting from fully backed reserves.

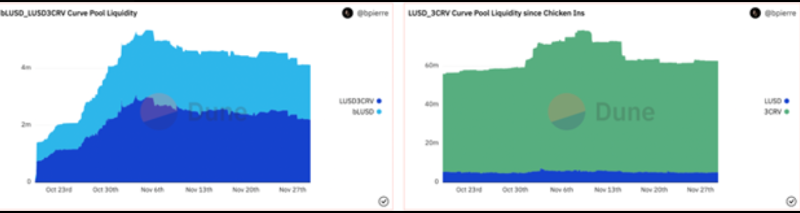

Deepening Curve liquidity is one of Liquity’s main goals with CBs. So far, both the LUSD 3CRV and bLUSD/LUSD pools appear strong. Some growth in the bLUSD/LUSD pool can be attributed to the aforementioned LP strategies and benefits from LUSD 3CRV liquidity.

Conclusion

Liquity’s implementation of Chicken Bonds represents one of the most useful DeFi innovations we’ve seen in recent months, with its multifaceted design offering broad appeal.

Whether you’re an investor seeking high-quality yield, a protocol/DAO bootstrapping liquidity, an LP, an NFT collector, or an arbitrageur, Chicken Bonds and bLUSD offer diverse use cases and strategies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News