Bonds, Stocks, and China: What's Really Happening with the U.S. Economy?

TechFlow Selected TechFlow Selected

Bonds, Stocks, and China: What's Really Happening with the U.S. Economy?

Problems don't suddenly become perfect, and comprehensive tariffs cannot resolve such complexity.

Author: Yuqian Lim

Translation: TechFlow

Fake Headlines and Stock Market Volatility

Earlier this week, stock markets surged on a fake headline claiming that President Trump might suspend new tariffs for 90 days. But just hours later, when the story was revealed to be false, markets quickly reversed course and plunged. The misinformation originated from a Twitter account named Walter Bloomberg (unrelated to Bloomberg News and showing several signs of being individually operated), which appears to have copied or fabricated the headline—possibly with market manipulation in mind; who knows?

The market’s reaction matters because it reveals a deep desire to end tariffs. Investors are so eager for good news that even falsehoods can trigger rallies.

Yet so far, the government has offered no real relief. On Tuesday, hope lifted markets higher—until reality set in with the realization that tariffs were imminent. Markets let out a collective sigh and swiftly dropped.

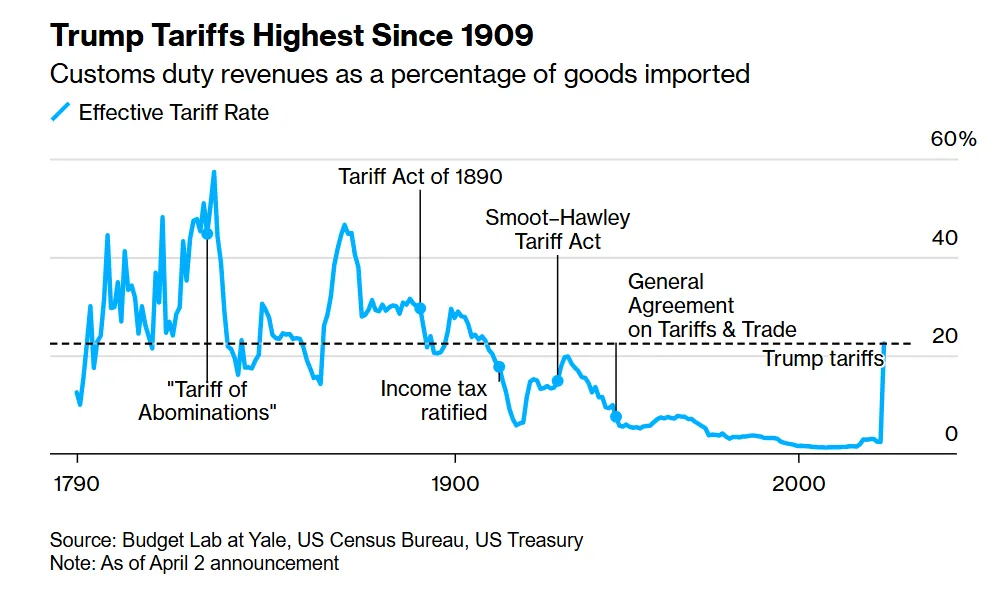

And those tariffs did arrive—the largest tariff hike in U.S. history took effect at 12:01 a.m. on April 9. They are so punitive that they may actually reduce government revenue, as Ernie Tedeschi has noted.

Many questions remain: Why does nostalgia for a factory-driven America of the 1950s obscure today's labor and technological realities? Is the bond market broken? What will Congress do? How will China respond? And what should we do next?

What’s Going On With Bonds?

Let’s start with the bond market.

Bonds are being sold off—even as equities collapse. Right now, the U.S. is perceived globally as a risk, temporarily destabilizing markets. Here are some headlines illustrating how turbulent things have become.

Stocks fell because tariffs threaten real economic activity. Normally, when stocks drop, investors flee to safe-haven assets—thinking: “U.S. Treasuries seem safe. The U.S. is stable. I’ll buy some! Nothing could go wrong!” This buying pushes bond prices up and yields down.

But not this time. Yields are rising, meaning bonds are being sold—not bought. This could signal a new era. Why?

-

China is selling: Foreign governments, including China, may be dumping U.S. debt in retaliation or fear.

-

Forced liquidations: As Matt Levine explains, deleveraging can force the unwinding of positions, triggering forced sales and potentially blowing up hedge funds.

-

Safe haven no more: Investors may be losing faith in the “safe harbor.” If other nations believe the U.S. government might politicize Federal Reserve swap lines—or suspect the White House will keep raising tariffs until the economy breaks—they might think, “Nah, I’ll skip the Treasuries, thanks.”

-

Market sentiment: Perception drives reality. Sentiment matters—it’s a leading indicator of both data and positioning.

This raises a tough question: When and how does this stop? Everything is falling—dollars, oil, bond prices, stocks—while credit spreads soar. Real estate suffers too. All trends are moving in the wrong direction. So who can act?

Can the Fed or Congress Step In?

Maybe the Fed intervenes? But with inflation already high due to tariffs, the Fed cannot easily cut rates. Instead, it opts to hold steady, as San Francisco Fed President Mary Daly stated. The Fed could launch quantitative easing (QE) and buy bonds—but that would worsen inflation.

-

Congress could act—and should. Remember, all these policies are enacted under claims of emergency authority. Congress can halt them anytime. As The Washington Post reported, “Seven Republican senators back a bipartisan bill that would terminate the new tariffs in 60 days unless Congress votes to extend them.” But overriding a potential Trump veto would require two-thirds of the Senate—including 20 Republicans. They don’t seem eager to do so.

-

Hence, some senators—especially those from manufacturing-heavy states—may push for targeted trade deals to shield local businesses. Others, representing agricultural regions hit by retaliatory tariffs, may lobby for exemptions or partial relief. If things worsen, farmers might get bailout programs again—though that would erase any tariff-generated revenue.

-

-

At the state level, governors may negotiate local business partnerships or foreign direct investment deals. For example, a state might offer tax incentives or faster permitting to attract factories, effectively creating mini-trade zones. This could strain relations with the White House but protects local jobs.

-

The core problem lies at the federal level: Ideally, the administration would reverse tariffs. But when policy becomes performance, rational outcomes vanish. According to Politico, as of the morning of April 9, Trump refused to respond to negotiators—even as they “flattered him.” Now he’s even talking about imposing drug tariffs.

The heart of the yield issue: Governments want lower yields to refinance debt cheaply and reduce interest payments. But now, not only is recession looming, yields aren’t falling—creating a perfect stagflation storm: high inflation, low growth, and rising unemployment.

Shifting World Order:

If you’ve read my earlier work, you know I’ve criticized these tariffs—even before the election, when I first interviewed Erica York of the Tax Foundation. The current administration essentially demands that other countries either pay new trade fees or lose access to U.S. markets.

So what is America to the rest of the world? Many assume the U.S. subsidizes others, but the opposite is true—as Ben Hunt has written.

-

The U.S. has long benefited from a global system built on stability and trust. In fact, the rest of the world has been subsidizing American lifestyles. This system, known as Pax Americana, lasted nearly 80 years: the U.S. provided security, open sea lanes, and a stable dollar. In return, other nations allowed the U.S. broad influence over global rules and institutions. This granted America unique privileges—lower borrowing costs and persistent trade deficits (which aren't inherently bad). Global demand for dollars and U.S. debt subsidized the American standard of living.

-

Now, the U.S. is demanding extra fees—unjustified by any reasonable calculation (and based on flawed math, as AEI has pointed out). Other countries are starting to ask: “If the U.S. will nickel-and-dime every cargo ship and submarine, why not build our own trade networks and bypass the hassle?” We’re pushing them away and eroding our greatest advantage: trust.

This is shifting—and reserve currency status may shift too. Previously, the big question was: “Will China replace the dollar?” But that’s overly simplistic. Instead, we may see “currency clubs” emerge—as the IMF once explored: small blocs or bilateral agreements, some using digital clearing systems, others partially pegged—all gradually reducing reliance on the U.S.

Rather than one rival currency replacing the dollar, we may see a patchwork monetary system that collectively diminishes U.S. power. The outcome is the same: automatic demand for U.S. Treasuries declines, markets fragment, and the reflexive “safe haven” appeal weakens.

How Will China Respond?

Many believe the ultimate goal is to weaken China. Treasury Secretary Bessent said delisting Chinese firms from U.S. exchanges is “on the table.” Meanwhile, China retaliated by imposing 50% tariffs on U.S. imports. We are now officially in a trade war.

The yuan has depreciated, as China tries to boost export competitiveness through currency devaluation—a complex strategy with many second-order effects—and possibly prepares for a capital war with the U.S. China is a formidable opponent for several reasons:

-

China depends less on the U.S.: China has diversified its export markets, selling more to Latin America, Africa, and Southeast Asia. The U.S. share of China’s total exports has declined significantly. Some argue, “The U.S. is bankrupting all nations via tariffs, so they can’t afford Chinese goods anyway.” That sounds like reshuffling pieces on another board—but there may be truth to it.

-

China can endure more pain: This is nuanced. During Biden’s final year, U.S. voters were furious over inflation. If tariffs reignite inflation—as they did during Trump’s first term—that could hurt Trump’s approval, despite hopes it strengthens his populist base. (Frankly, today’s “working class” and “Wall Street” are increasingly aligned.)

-

China has superior factories: Unlike the U.S., China embraces automation. Its factories are highly, even fully automated.

-

This doesn’t mention that high-end electronics, batteries, and nearly everything on Amazon still rely on Chinese supply chains. Severing ties would cause massive price hikes. U.S. consumers expect low prices—how would they react to steep increases?

We often assume major trade decisions are made by governments. But remember: tariffs are paid by companies exporting to the U.S., not by nations. Increasingly, multinationals like Apple and Samsung may need to practice a form of “corporate diplomacy” to protect supply chains. They may establish alternative shipping routes and manufacturing hubs outside the U.S., forming quasi-private global networks that could eventually matter more than official Washington-led institutions.

Still, it’s complicated. As Scott Galloway noted, Trump has severely damaged the “American brand”—bad news for U.S. corporations.

The Myth and Reality of Manufacturing Reshoring

One official rationale is “we should just make everything here.” This reflects an obsession with reviving old-school manufacturing. But reality is more complex:

-

Manufacturing is already growing: As Joe Weisenthal points out, thanks to the Inflation Reduction Act (IRA) and CHIPS Act, U.S. manufacturing has boomed over the past four years—without relying on broad tariffs.

-

Nostalgia for a lost era: Officials keep invoking images of 1950s workers screwing phones together. Trump prefers comparing America to the 1870–1913 “golden age,” before income taxes. These nostalgic visions are politically powerful—steel mills and assembly lines symbolize economic strength, especially after WWII, when the U.S. was the sole industrial power. But that world is gone.

-

It won’t solve social problems: Some claim returning to manufacturing will fix deeper issues. But historically, people left manufacturing en masse when given the chance. Not that manufacturing isn’t important—it is!—but the roots of today’s challenges run much deeper.

-

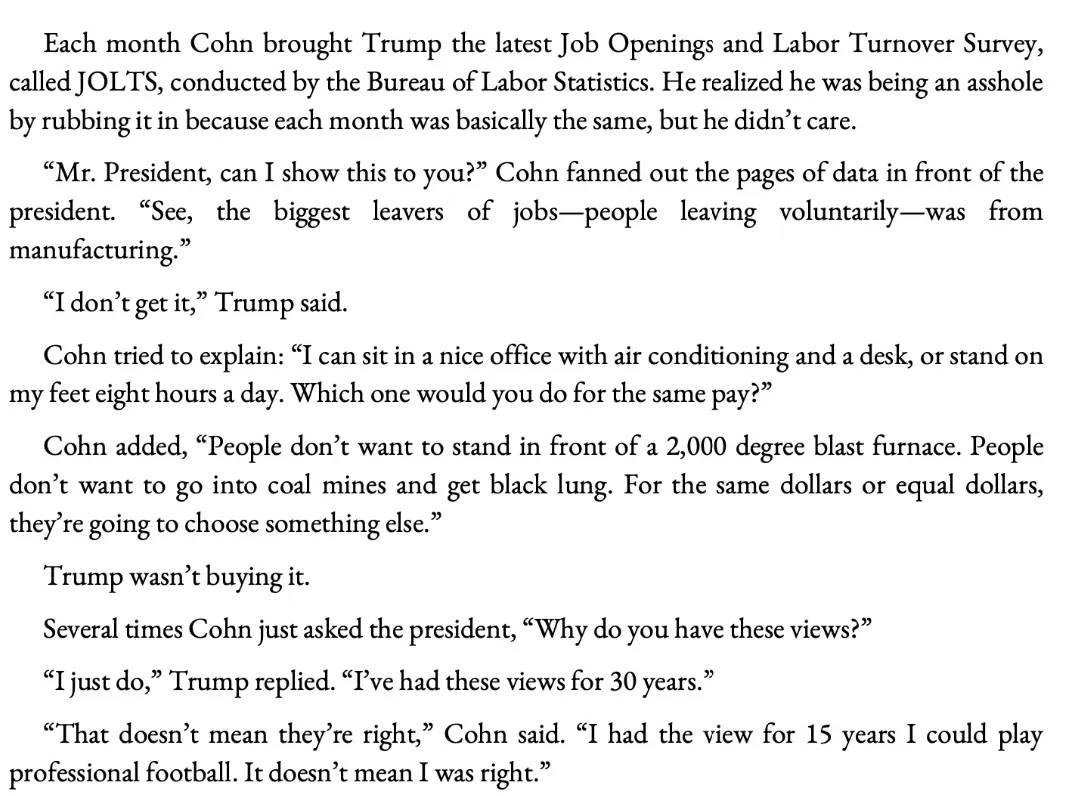

Anecdote: During Trump’s first term, Jordan Schneider shared a moment where Gary Cohn told Trump: People leave manufacturing because the work is hard and monotonous. While we’ve improved conditions with machines, if given a choice, most prefer not to spend their days inserting tiny screws into phones. They’d rather work in aerospace or semiconductor plants—if only the CHIPS Act hadn’t faced threats of cancellation!

-

It’s not just Wall Street worried: David Bahnsen compiled a list showing how tariffs impact Main Street—revealing widespread anxiety. Believing manufacturing revival will cure the “loneliness crisis” or other social ills fundamentally misdiagnoses the real causes: smartphone addiction and housing shortages. When Trump took office, the U.S. was already at full employment.

-

It won’t bring back many jobs: Modern factories need far fewer workers—a point even the government acknowledges. Today’s manufacturing roles require advanced skills, like programming CNC machines, supported by workforce training, faster approvals, and incentives beyond tax cuts. As Alex Tabarrok details, tax breaks alone won’t suffice.

This creates a “lose-lose-lose-lose-lose” scenario.

-

If we reshore production but rely on robots, we lose both cheap foreign labor and mass domestic job creation.

-

Foreign supply chains may shrink (reducing U.S. soft power), yet no wave of new American jobs emerges.

-

Amid uncertainty, manufacturers are cutting spending. Haas Automation has signaled such caution, and Microsoft canceled its $1 billion Ohio data center, costing 1,000 jobs and $150 million annually in local economic output.

-

Trump is trying to repeal the CHIPS Act, adding further uncertainty. If you truly want to boost manufacturing, preserving such policies is essential!

Companies have stopped issuing future guidance, as Sam Ro wrote.

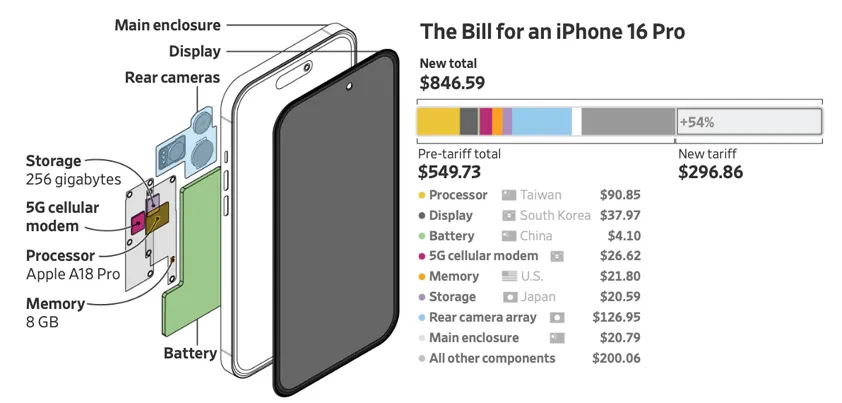

Even if we reshore production—say, making iPhones in the U.S., as Trump suggests—the cost would be astronomical. The Wall Street Journal ran an excellent piece detailing what iPhone production under tariffs would look like. Beyond the massive effort and expense of relocating production, the final product would be prohibitively expensive.

In debates about manufacturing, people focus too much on physical goods and ignore America’s real strength: “financialization.” As Matt Levine writes:

Currently, foreign nations sell goods to the U.S., earn dollars, use some to buy U.S. goods, and invest the rest in U.S. financial assets. Under Trump’s model, they’d have to spend all those dollars on U.S.-made goods instead of stocks and bonds.

This means other countries couldn’t buy U.S. equities or debt—they’d have to purchase American-made products. These goods would need to be so cheap that developing nations could afford them, forcing the U.S. to drastically lower its standard of living to produce exportable, low-cost items.

True, the U.S. runs a goods trade deficit—but a services surplus. Finance, software, media—these are our strengths. If other nations build parallel entertainment, payment, or capital markets, we lose this intangible edge.

Moreover, people overlook that the U.S. cannot produce chocolate, bananas, or raw materials. Some say, “Fine, I don’t eat bananas,” but that ignores global economics. YouTuber MrBeast makes chocolate in the U.S., but cocoa beans come from abroad—America doesn’t grow them. Similarly, even if you don’t eat bananas, small businesses and creators relying on these inputs suffer.

Coffee is another example. I drank two cups while editing this article—beans from Colombia. The U.S. can’t grow them due to climate. So we run a coffee trade deficit—but that’s not bad. Colombia has a comparative advantage. Americans enjoy coffee; Colombians use dollars to buy other goods. Both benefit.

It’s misguided to dream of making socks in America. Our real competitive edge lies in advanced technologies: AI, chips, biotech. If we decouple from or punish foreign partners, we accelerate their efforts to build independent R&D ecosystems. If successful, they’ll depend less on U.S. tech. Then, we won’t just lose shoe factories—we’ll miss the next wave of innovation. That’s the deeper, graver consequence.

Potential Next Steps:

Ray Dalio said: “Everyone should realize—this isn’t about tariffs, it’s about debt. We need to rebalance.” He’s right. We’re discussing a trust ecosystem built over decades. Until recently, the world invested in U.S. Treasuries and accepted U.S. leadership because they believed America would remain a relatively stable hegemon.

But if we keep lashing out unpredictably or treat alliances like subscription fees, that invisible trust evaporates—along with the benefits it brought: low borrowing costs, supply chain stability, and dominant negotiating power. Dalio’s “Overall Big Cycle” has arrived, but solving it by triggering global recessions and weakening industries is clearly suboptimal.

Even if the White House announced next month: “Never mind, no more tariffs!”—the damage is done. The world has seen the risk of U.S. unpredictability. That alone is enough to drive others to build alternatives: strengthen regional trade ties, explore alternative reserve currencies.

How should the U.S. respond?

-

Target real trade abuses:

Focus on verifiable issues: IP theft, forced tech transfer, unfair subsidies. Instead of blanket tariffs, create precise exemptions (e.g., for shrimp farmers) or impose penalties only on proven violations—minimizing collateral damage to U.S. firms.

-

Invest in labor and technology:

Restore the CHIPS Act! Incentives for high-tech manufacturing can encourage domestic wafer fabs without punishing consumers via broad tariffs. Fund vocational training, apprenticeships, and community college programs.

-

Smart industrial policy:

Modernize roads, ports, and broadband to reduce supply chain friction and boost competitiveness. Attract high-value industries—not with tariffs, but with incentives—especially those critical to national security.

-

Revive trade alliances:

Improve USMCA or rejoin a reformed CPTPP under terms protecting domestic interests.

-

Global leadership:

Show consistency, stop erratic social media posts, and honor negotiated commitments.

Hoping for the best—but what comes next? Consider several scenarios:

-

Slow fragmentation: The trade war doesn’t cause a single crash but gradually restructures the global system. Over time, the U.S. becomes one major player among many—not the center.

-

Partial retreat: Facing recession, the government quietly rolls back some tariffs. Markets stabilize slightly, but trust remains low—damage already done.

-

Full crisis and reset: A breaking point—massive Treasury sell-off or supply chain collapse—forces negotiations for a new Bretton Woods. The U.S. may have to surrender some privileges to restore stability.

No scenario returns us fully to the old “normal.” Once reliability or hegemony is questioned, it can’t be simply restored. We may achieve a new balance—but on entirely different terms.

In the meantime, nearshoring may bypass the U.S., allies may ignore our threats, and the “automation plus tariffs” strategy may fail to generate significant manufacturing jobs.

These tariff wars and bond panics aren’t just short-term noise. They could reshape capital flows, supply chains, and global cooperation on crises and conflicts. We may not see one catastrophic moment, but a series of smaller breakdowns—leading to a world where the U.S. is no longer central, and others have already moved on.

Once we destroy the invisible architecture of trust, partial reversals won’t repair it. If we fail to recognize this soon, we may drift through minor crises and temporary alliances—only to realize, ironically, that despite its flaws, the old system was the best deal America ever had.

What Can You Do?

The following is not investment advice—just food for thought.

-

Review your portfolio:

Know your allocation across stocks, bonds, and other assets. Consider international diversification. Understand the holdings within your ETFs or mutual funds. A mix of equities, cash, bonds of varying maturities, and even real estate can help balance risk.

-

Build a cash buffer:

In volatile markets, having several months’ worth of living expenses in cash (or cash equivalents) provides a cushion—preventing forced sales at bad times.

-

High-Yield Savings Accounts (HYSA):

If you're risk-averse, park money in HYSA. These earn interest and allow quick access. Personally, I keep about half my portfolio in such accounts.

-

Avoid panic selling:

Headlines may scare you, but panic selling rarely helps. If you hold a diversified, long-term portfolio, short-term swings are often just noise.

When worrying news hits, don’t let fear dictate decisions. Uncertainty won’t vanish soon—stay calm, clarify your time horizon, and align your portfolio with your risk tolerance. Thank you!

-

Tariff discussions:

I’ve covered tariffs extensively in past newsletters, interviewing Tax Foundation’s Erica York four times and AEI’s Stan Veuger—no one likes tariffs!

-

Impact of foreign investors:

Foreign investors own 18% of U.S. equities—amplifying volatility.

-

Oil and bonds crashing together:

A simultaneous collapse in oil and bonds is unprecedented. Russia is clearly unhappy.

-

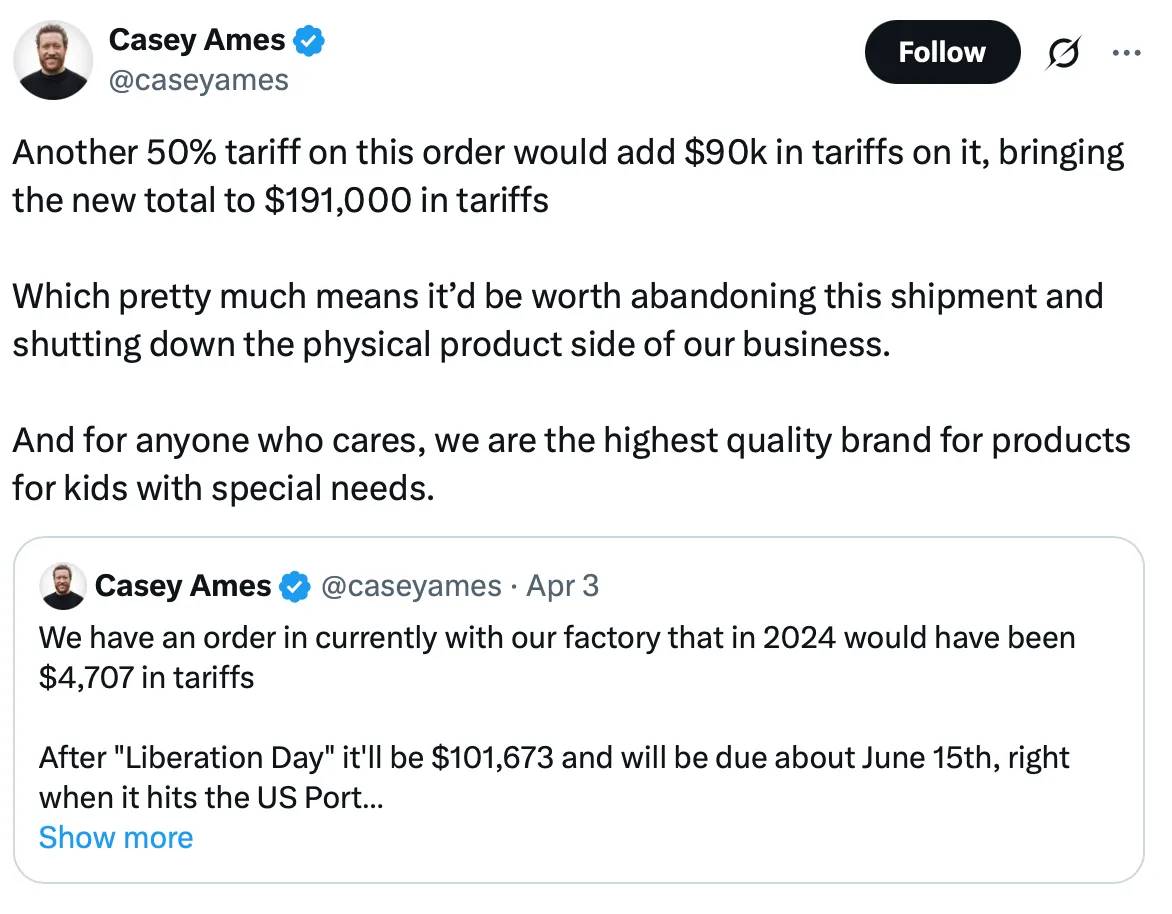

Complexity of manufacturing:

Consider the inputs: processors, displays, cameras, memory, batteries, glass, chips, casings, assembly. It’s incredibly complex. Building such capacity domestically would take years.

-

Labor realities:

We’ve outsourced difficult, low-paid labor to workers abroad—partly due to development ladders. Though harsh, factory jobs may be better than alternatives in emerging economies. Problems won’t vanish overnight. Blanket tariffs won’t solve this complexity—and could worsen it, plunging thousands into extreme poverty.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News