Goldman Sachs forecasts: global stock markets expected to deliver an 11% return over the next 12 months

TechFlow Selected TechFlow Selected

Goldman Sachs forecasts: global stock markets expected to deliver an 11% return over the next 12 months

Although last year's stock market rally pushed valuations to historical highs, corporate earnings and economic growth worldwide are expected to continue supporting equity markets.

Author: Goldman Sachs

Translation: TechFlow

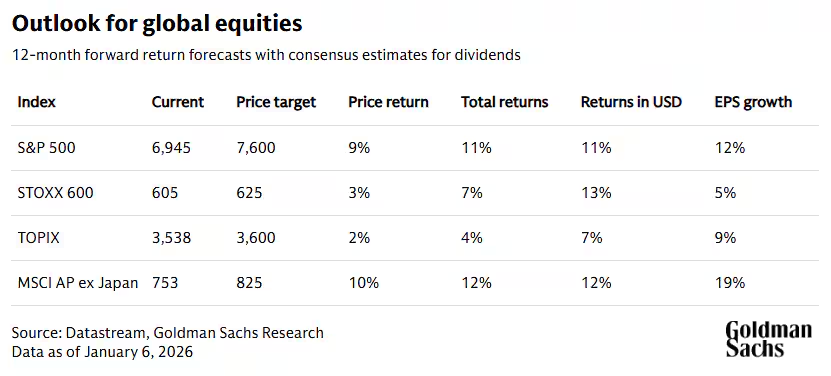

- Following last year's strong growth, Goldman Sachs Research forecasts global equities to continue rising in 2026, with expected returns of 11% over the next 12 months (including dividends, in USD).

- Although last year’s market rally has pushed valuations to historical highs, corporate earnings and economic growth worldwide are expected to continue supporting equity markets.

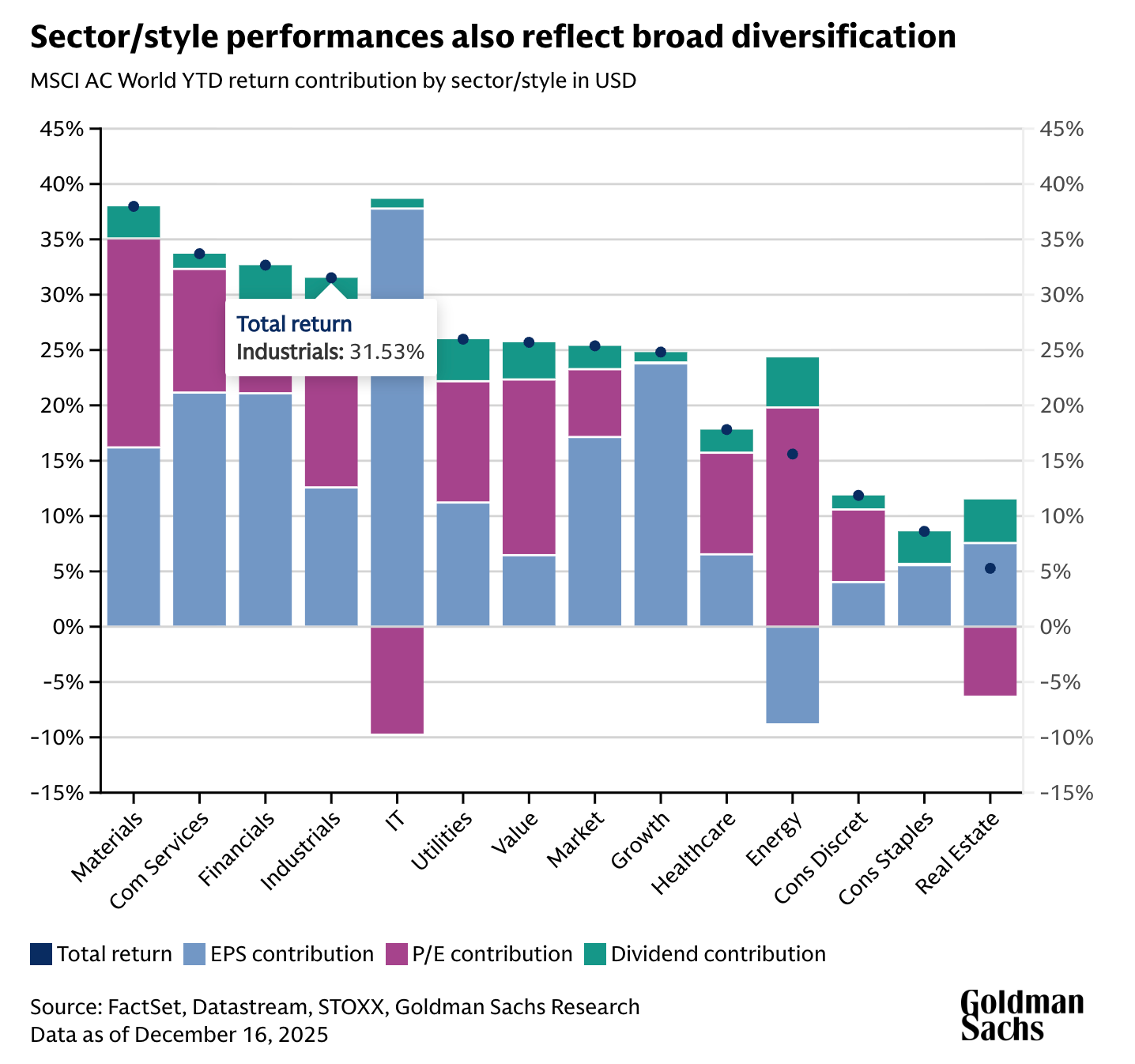

- Last year, investors benefited significantly from cross-regional diversification—a trend that may persist. Diversifying across investment styles and sectors is also expected to further enhance returns.

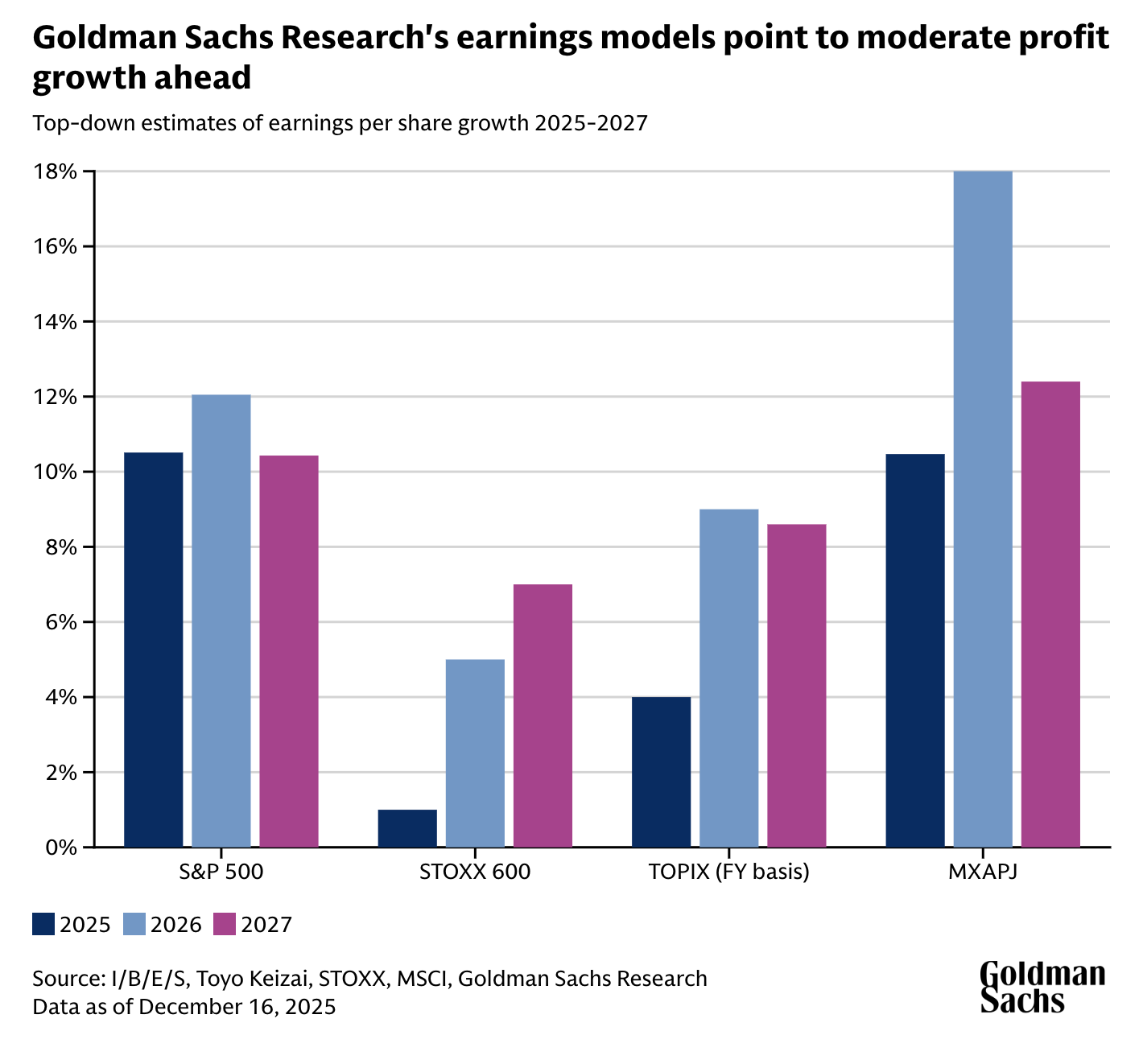

According to Goldman Sachs Research, the global bull market is likely to continue this year, driven by improving corporate earnings and ongoing economic expansion. However, the pace of equity gains is expected to be more moderate compared to the strong performance seen in 2025. The global economy is projected to maintain expansion across regions in 2026, with the US Federal Reserve anticipated to continue a modestly accommodative monetary policy.

"In the current macro environment, a significant equity correction or bear market would be unusual in the absence of a recession, even with elevated valuations," wrote Peter Oppenheimer, Chief Global Equity Strategist at Goldman Sachs Research, in his report titled *Global Equity Strategy 2026 Outlook: Tech Tonic—a Broadening Bull Market*.

Diversification was a core theme emphasized by Goldman Sachs Research last year. In 2025, investors were rewarded for geographic diversification for the first time in many years. Analysts expect this trend to continue into 2026 and expand to include diversification across investment factors such as growth and value, as well as across industries. (Investment factors refer to asset characteristics—such as size, value, or momentum—that typically influence risk and return.)

What Is the Outlook for Global Equities in 2026?

Despite strong equity performance in 2025—outperforming both commodities and bonds—the rally was not without volatility. Equities started the year weakly, with the S&P 500 experiencing nearly a 20% correction between mid-February and April before rebounding.

Peter Oppenheimer noted that the strong global equity rally has left valuations at historical highs across all major regions, including the US, Japan, Europe, and emerging markets.

"As a result, we believe returns in 2026 will be more likely driven by fundamental earnings growth rather than further valuation expansion," Oppenheimer said. Based on Goldman Sachs analysts’ forecasts as of January 6, 2026, global equity prices (market-cap weighted by region) are expected to rise 9% over the next 12 months, delivering an 11% total return in USD (including dividends). "The majority of returns will come from earnings-driven growth," he added.

In addition, according to another Goldman Sachs forecast, commodity indices are also expected to rise this year, with precious metals gains offsetting declines in energy prices—a trend similar to what was observed in 2025.

Oppenheimer’s team also examined the typical progression of a market cycle: the despair phase triggered by equity declines during a bear market; a brief hope phase during initial recovery; a longer growth phase fueled by earnings improvements; and finally, an optimism phase marked by rising investor confidence and, eventually, complacency.

Their analysis suggests that equities are currently in the optimistic phase of the cycle that began after the 2020 pandemic-related bear market. "This late-cycle optimism phase is typically accompanied by rising valuations, suggesting some upside risk to our base-case outlook," Oppenheimer’s team wrote.

Should Investors Diversify Their Equity Portfolios in 2026?

In 2025, geographic diversification delivered substantial benefits to investors—an uncommon occurrence. US equities underperformed other major markets, something not seen in nearly 15 years. Due to a weakening dollar, European, Chinese, and Asian equity returns were nearly double the total return of the S&P 500.

US equity returns were primarily driven by earnings growth, particularly within large technology companies. Outside the US, however, the balance between earnings improvement and valuation expansion was more evenly distributed. Last year, the growth-adjusted valuation gap between US and global markets narrowed.

"Even though absolute valuations in the US remain high, we expect these growth-adjusted valuation ratios to continue converging in 2026," Oppenheimer’s team wrote.

Oppenheimer noted that diversification is still likely to offer better risk-adjusted returns in 2026. He advised investors to seek broad geographic opportunities, including increased exposure to emerging markets. Investors should also balance portfolios between growth and value stocks and pay attention to sector allocation. Additionally, lower stock correlations could create favorable conditions for stock-picking.

"With declining stock correlations potentially remaining low, we are placing greater emphasis on generating alpha," wrote Peter Oppenheimer, Chief Global Equity Strategist at Goldman Sachs Research. Alpha measures the performance of an asset relative to a broader market index.

Oppenheimer added that non-tech sectors could perform strongly this year, and investors may benefit from stocks that gain from tech companies' capital expenditures. Furthermore, as new AI capabilities are gradually realized, market attention may increasingly shift to companies outside the tech sector that stand to benefit from AI advancements.

Are AI Stocks in a Bubble?

Overall, market enthusiasm for artificial intelligence "remains high," Goldman Sachs analysts noted. However, this does not necessarily indicate a bubble in AI. "The technology sector’s dominance in the market was not triggered by the rise of AI," Oppenheimer wrote. "This trend began after the financial crisis and has been supported by its superior earnings growth."

Despite the surge in large tech stocks, current valuation levels have not reached the extreme levels seen during previous bubbles. For example, comparing the valuation gap between the five largest companies in the S&P 500 and the other 495 shows that the disparity is far smaller than during prior cycles, such as the peak of the 2000 dot-com bubble.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News