When will the A-share bull market return, and when will the crypto bull market start?

TechFlow Selected TechFlow Selected

When will the A-share bull market return, and when will the crypto bull market start?

Everyone's all in on A-shares, who still cares about the crypto market?

Author: Viee, Core Contributor at Biteye

Editor: Crush, Core Contributor at Biteye

Today the market opened low and closed down 6 points, cooling off the recent stock market frenzy.

Just how crazy has the stock market been? Everyone’s already seen it firsthand.

The Shanghai Composite Index experienced a miraculous rally of over 600 points in just 9 sessions before the holiday break.

After the break, all three major indices opened sharply higher with gains exceeding 10%.

Daily trading volume surged past 3.45 trillion yuan, setting a new historical record.

Foreign capital rushed in, joining the buying spree.

The Hang Seng Index has gained 35.5% year-to-date, leading global equity markets.

Some Hong Kong stocks soared as much as 730%, rivaling meme coins in crypto!

Crypto markets have naturally caught some of this momentum too:

USDT, the largest stablecoin in crypto, was sold off into a discount,

becoming a "hot potato" investors were eager to convert back into fiat currency.

Little did we expect the headline linking A-shares and crypto would be — A-shares draining liquidity from crypto.

01 Current State of A-Share Market: A Surge of Enthusiasm

On the first trading day after the holiday, the A-share market exploded. All three major indices surged. Trading volume exceeded 1 trillion yuan within just 20 minutes of opening. The market rose more than 10% at the open, with over 5,000 stocks climbing, nearly 1,000 hitting their daily trading limits, and securities firms soaring across the board...

This dramatic surge not only stirred investor excitement but also sparked widespread discussion about future market trends. How did the long-struggling A-share market suddenly become so strong?

Not long ago, weak economic data and lackluster market confidence had left the A-share market in a slump. But now, bolstered by strong policy support and recovering market sentiment, the market has responded vigorously.

So, what signals suggest a bull market may be emerging in A-shares?

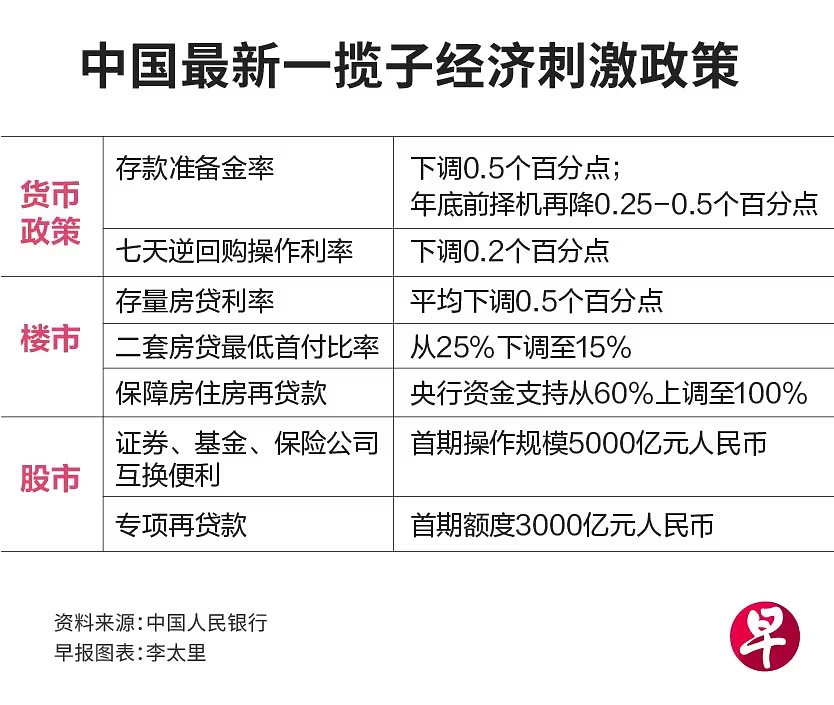

Unprecedented Policy Support: On September 24, the central bank and regulators jointly announced a comprehensive package of easing measures, signaling strong intent to support the market. Governor Pan Gongsheng's bold statement—"another 500 billion after the first 500 billion"—gave the market a powerful shot in the arm.

Record-Breaking Trading Volume: On October 8, trading volume reached an all-time high of 3.45 trillion yuan, clearly indicating heightened market activity. High volume is typically a key signal of an impending bull market, reflecting optimistic investor expectations.

Influx of Foreign Capital: Since the policy announcement, Chinese概念股 have broadly risen, and multiple foreign institutions have voiced bullish views on China's stock market, injecting fresh momentum into the market.

Valuations Still Low: Overall valuations in the A-share market remain relatively low. For example, the ChiNext Index sits below the 8th percentile of its historical valuation range, offering attractive opportunities for medium- to long-term positioning.

Securities Firms Working Overtime: New investor account openings are surging. Data shows that net bank-to-broker transfers spiked to 7.04 on September 27—the highest level in three and a half years. Brokerages even reopened services during the National Day holiday to meet demand.

02 Current State of Crypto Market: Undercurrents Stirring

While the A-share market burns hot, the crypto market appears somewhat sluggish. Bitcoin climbed to a two-month high of $66,500 on September 27, then drifted lower, falling to around $60,000 by early October.

Is the crypto market brewing new opportunities? When will the bull market begin? Watch these key signals:

Macroeconomic and Policy Developments

Recently, the Federal Reserve cut interest rates by 50 basis points. This monetary easing has led to increased liquidity, driving broad gains in crypto markets. Loose monetary policy is generally favorable for speculative assets like cryptocurrencies, contributing to positive market outlook. Additionally, improving U.S. employment data has further boosted expectations for rising Bitcoin prices.

Sustained Inflow of New Capital

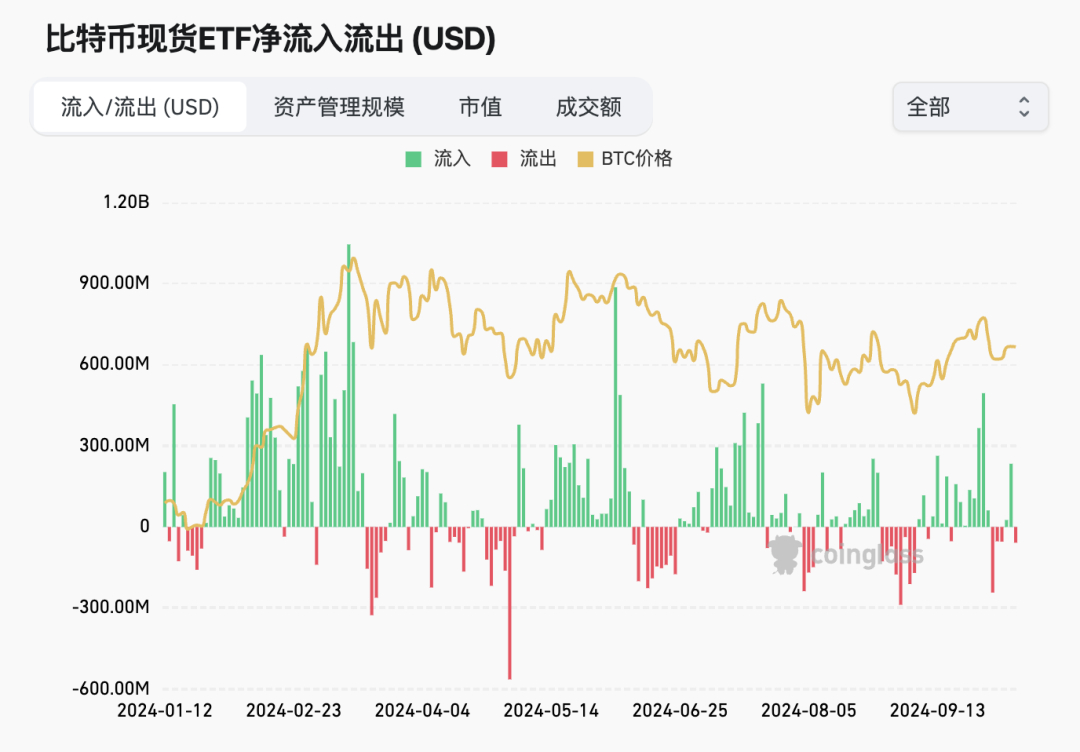

Capital inflows are one of the most important indicators of a potential bull run in crypto.

ETFs

Net inflows into spot Bitcoin ETFs have a significant impact on price. Sustained net inflows indicate growing demand for Bitcoin, which often translates into price stability or upward momentum.

Conversely, large-scale net outflows could pressure prices downward, usually signaling weakening investor confidence and potentially leading to prolonged price declines. Thus, ETF fund flows serve as a crucial barometer for gauging market sentiment.

In the past month, spot Bitcoin ETFs saw net outflows on only six days, and the outflow amounts were smaller compared to earlier periods. Currently, after a phase of price consolidation and decline, confidence among external investors is gradually returning.

Data source: Coinglass

Stablecoins

Stablecoin market cap reflects the entry of new capital into the crypto ecosystem. When users buy stablecoins with fiat, that money enters the market, pushing up stablecoin supply. Monitoring changes in stablecoin supply helps track overall capital flows.

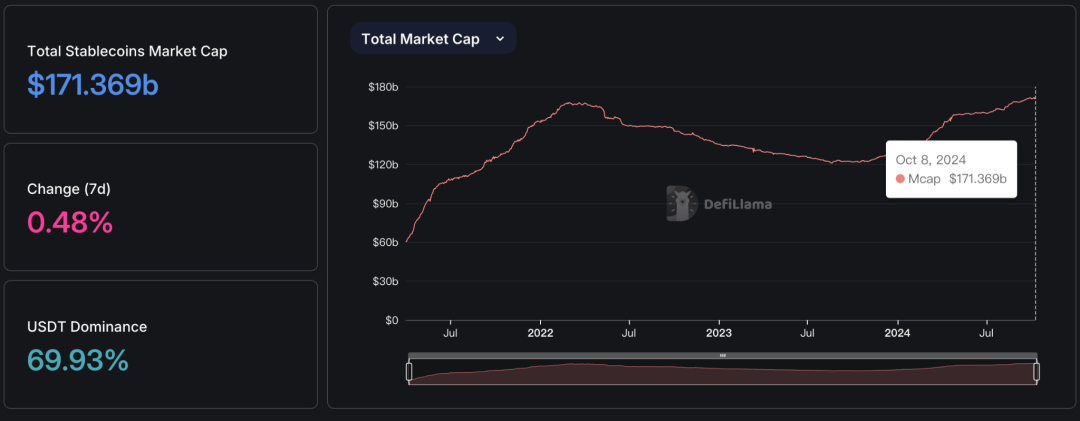

As shown below, total stablecoin market cap surged to $168 billion in August, surpassing the previous high of $167 billion set in March 2022—setting a new all-time record. It continues to climb, reaching $171.3 billion on October 8.

Data source: Defillama

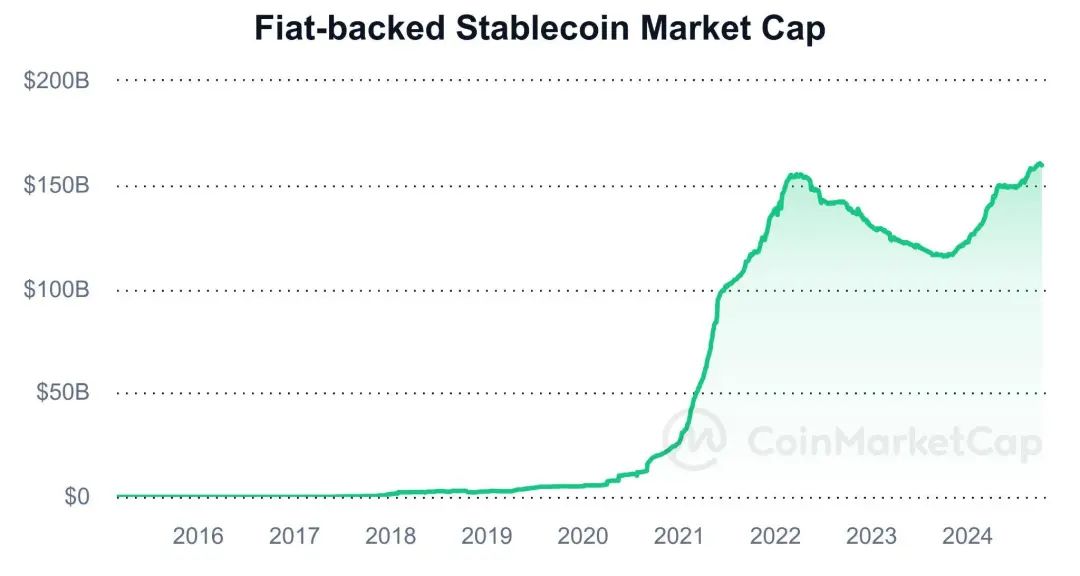

The total market cap of fiat-backed stablecoins has also hit a new record and continues to grow. This metric includes only fiat-collateralized stablecoins, excluding algorithmic stablecoins reliant on complex mechanisms. See chart below:

Data source: CoinMarketCap

Notably, Tether (USDT) remains dominant with a market cap of nearly $119.6 billion, accounting for almost 70% of the total stablecoin market. USD Coin (USDC) follows closely behind with steady growth, now valued at approximately $35.3 billion. As market confidence returns, demand for both stablecoins is expected to rise. Below is a chart showing USDT's market cap trend.

Data source: CoinMarketCap

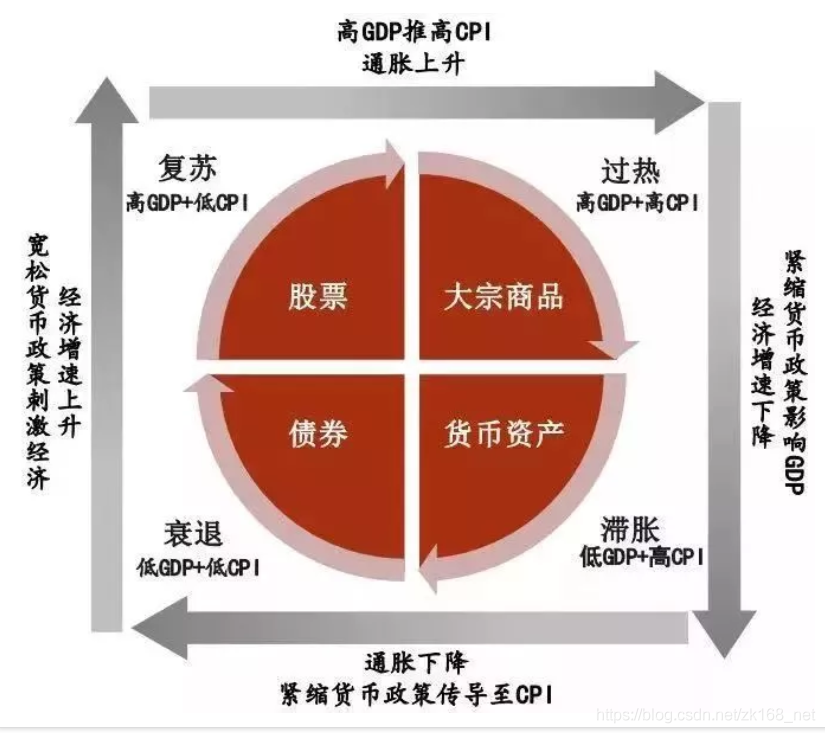

Markets Clock Cycle (Merrill Lynch Investment Clock)

The Merrill Lynch Investment Clock is a key framework for analyzing the relationship between economic cycles and asset performance, dividing the cycle into four phases: recession, recovery, overheating, and stagflation.

-

Recession:

Characteristics: Slow or stagnant economic growth, low inflation.

Investment strategy: Bonds perform best as falling interest rates make fixed-income assets attractive.

-

Recovery:

Characteristics: Economy begins to rebound, growth accelerates, inflation remains low.

Investment strategy: Stocks become the top choice as corporate earnings improve and market confidence strengthens.

-

Overheating:

Characteristics: Strong economic growth continues, but inflation rises.

Investment strategy: Equities still hold value, while commodities shine. Investors may face risks from rising interest rates.

-

Stagflation:

Characteristics: Economic growth lags potential, yet inflation remains high.

Investment strategy: Holding cash becomes optimal, as other assets underperform.

Cryptocurrencies, as risk assets, tend to attract capital during the recovery and overheating phases of the investment clock. During recovery, market confidence rebounds and capital flows increase; high-risk assets like crypto gain favor, often pushing prices up. In the overheating phase, despite strong growth, rising inflation increases demand for assets like Bitcoin, potentially triggering rapid price appreciation.

Therefore, Bitcoin bull markets are more likely during these two phases. On September 18, the Fed announced a 0.5% rate cut, marking the start of a new easing cycle in the U.S. According to the Markets Clock, we are currently transitioning from recession to recovery—a sign that a bull market may be near.

Beyond this, Bloomberg data shows the correlation coefficient between cryptocurrencies and the MSCI World Equity Index is nearing 0.6—one of the highest levels in the past two years. This suggests increasing alignment between the two markets: when equities perform well, crypto tends to follow.

On-Chain Data Indicators

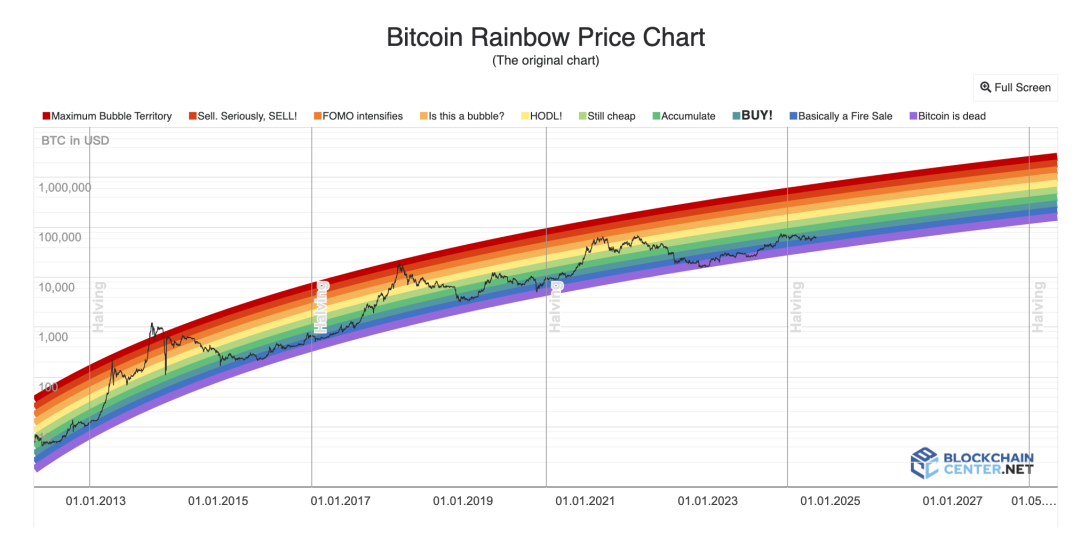

Bitcoin Rainbow Chart Indicator

The Rainbow Chart is a long-term valuation tool for Bitcoin, using logarithmic growth curves to project potential future price directions. Warmer colors (yellow, orange, red) at the top indicate overheated markets—good times to sell. Cooler colors (green, blue) suggest subdued market sentiment—better times to buy. The Rainbow Chart can help identify early signs of a bull market.

The chart features 10 color bands. As of today, October 8, BTC is within the green "Buy" zone, indicating moderate market热度. If BTC ever moves into the yellow, orange, or red bands, it would signal increasing market excitement and clearer signs of a bull run.

For more analysis on on-chain indicators, see Biteye’s recent article: "Is a Market Reversal Coming? Reviewing 7 Bitcoin Bottom-Fishing Indicators"

03 Conclusion

In the past half-month, capital has flooded into Chinese equities. Going all-in on A-shares is no longer a joke in financial circles.

In contrast, although the current crypto market lacks momentum, taking a longer view, Bitcoin remains the top-performing asset this year. According to Goldman Sachs’ latest data on October 8, Bitcoin has gained over 40% in 2024, outperforming major stock indices, fixed-income securities, gold, and oil.

When will the crypto bull market arrive? Look not only at sentiment, but also at evidence.

By monitoring these positive signals—and with global economic recovery and supportive policies unfolding—we believe a crypto bull market is just around the corner!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News