Cycle Trading: Where Is the A-Share Market Headed Next?

TechFlow Selected TechFlow Selected

Cycle Trading: Where Is the A-Share Market Headed Next?

Whether fiscal policy can follow up after the earlier front-loaded monetary easing is the key factor affecting the pace and room for stock market gains recently.

Author: Cycle Capital, Lisa

Since the new policy announcement on "924," China's stock market has experienced an epic surge. Policy support from three financial regulatory bodies and the Central Political Bureau meeting exceeded expectations, significantly boosting market sentiment. Both A-shares and Hong Kong stocks rebounded strongly, leading global markets. However, after the National Day holiday, amid overly optimistic expectations, the market turned downward. Is this rally just a flash in the pan, or has the market already bottomed out? This article attempts to answer this question by analyzing China’s economic fundamentals, policy developments, and overall stock market valuation levels.

1. Fundamentals

Overall, domestic fundamentals remain weak, with some marginal improvements but no clear turning signals yet. Consumption during the National Day holiday improved both year-on-year and month-on-month, but such improvement has not yet reflected in major economic indicators. In the coming quarters, China’s growth may show a mild recovery supported by policy stimulus.

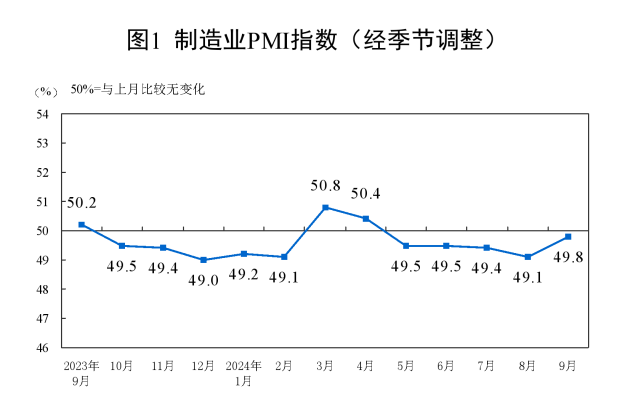

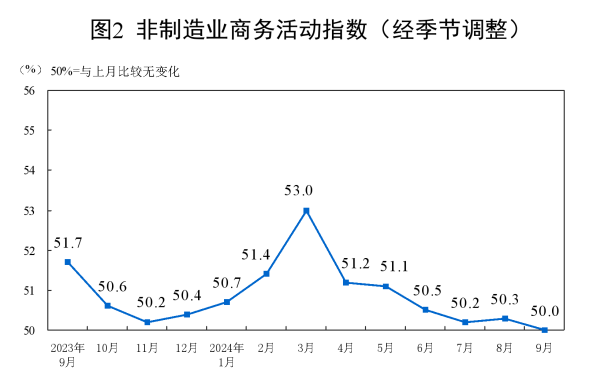

In September, the manufacturing Purchasing Managers’ Index (PMI) was 49.8%, up 0.7 percentage points from the previous month, indicating a recovery in manufacturing activity. The non-manufacturing business activity index stood at 50.0%, down 0.3 percentage points from last month, reflecting a slight decline in non-manufacturing sectors.

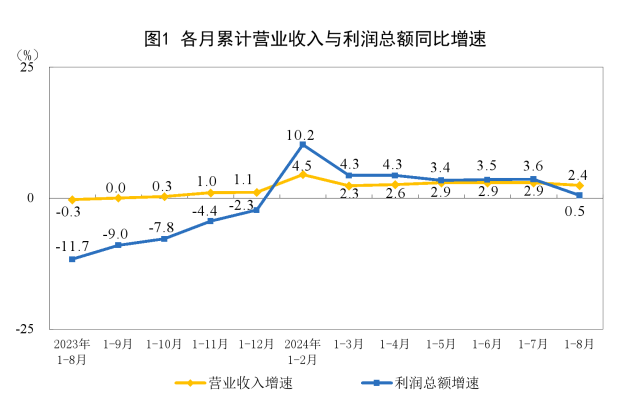

Affected by high base effects from the same period last year and other factors, profits of industrial enterprises above designated size declined 17.8% year-on-year in August.

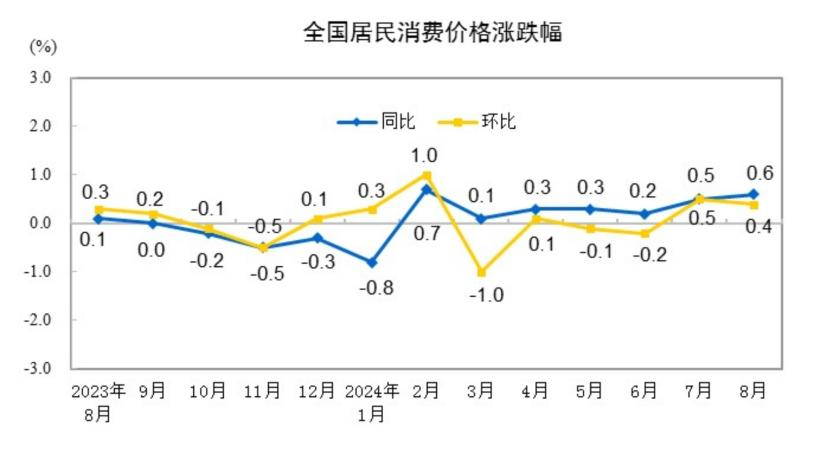

In August 2024, the national consumer price index rose 0.6% year-on-year. Food prices increased by 2.8%, while non-food prices rose 0.2%. Consumer goods prices were up 0.7%, and service prices increased 0.5%. On average from January to August, the national consumer price level rose 0.2% compared to the same period last year.

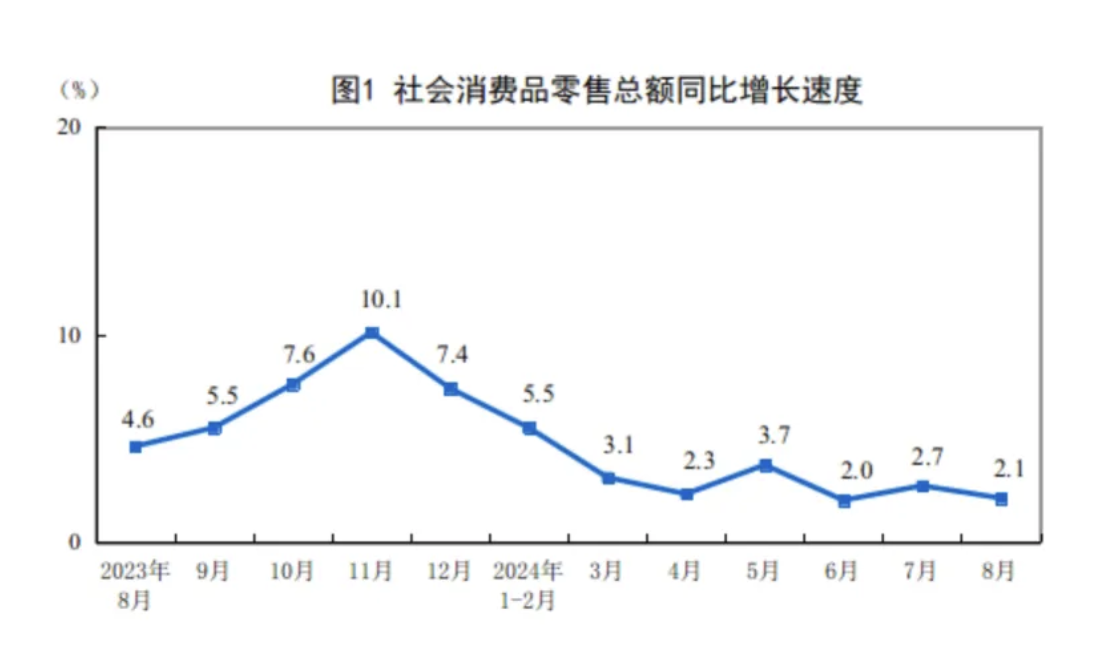

In August, total retail sales of consumer goods reached 3.8726 trillion yuan, up 2.1% year-on-year.

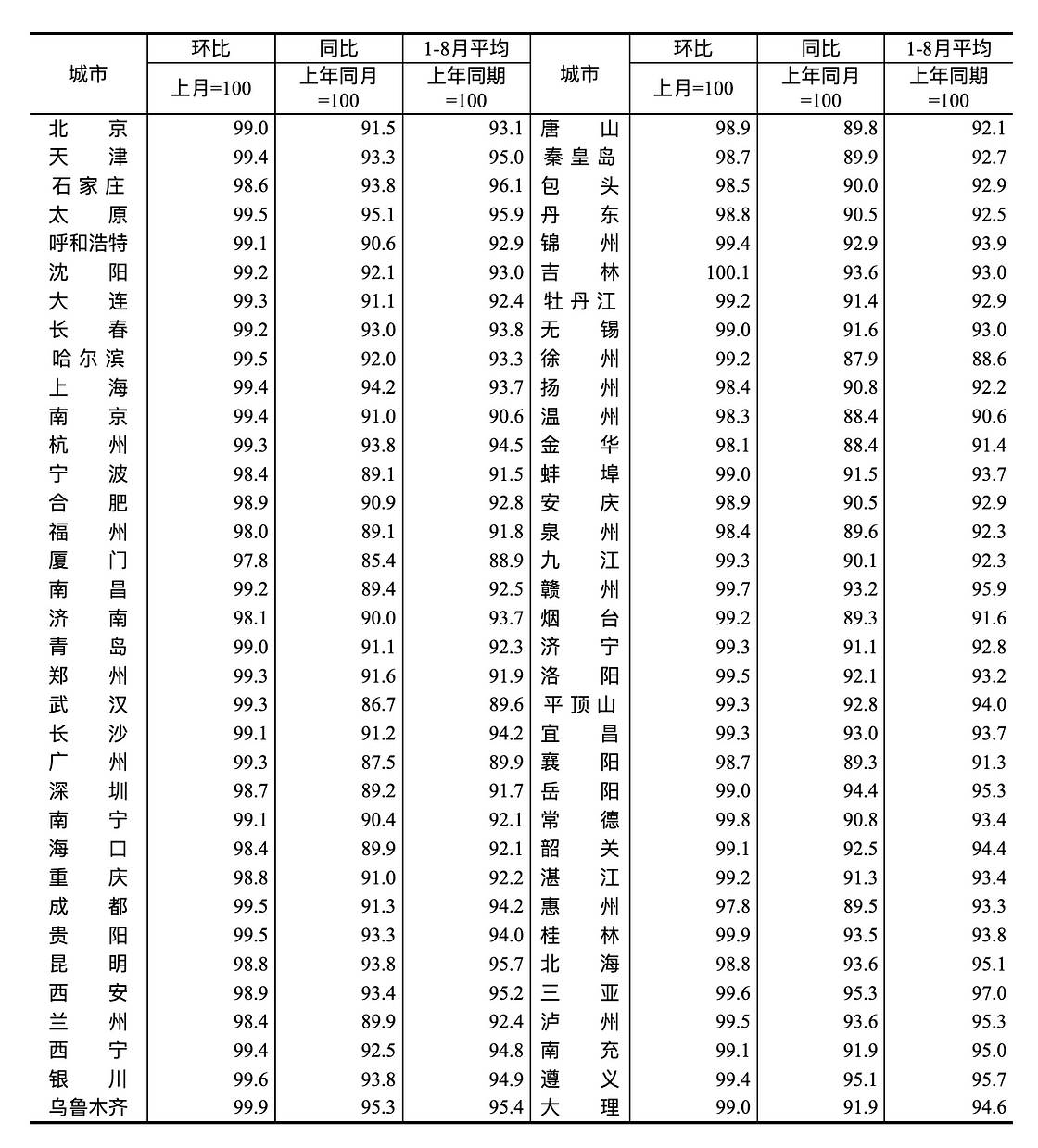

Sales price index for second-hand residential properties in 70 large and medium-sized cities, August 2024

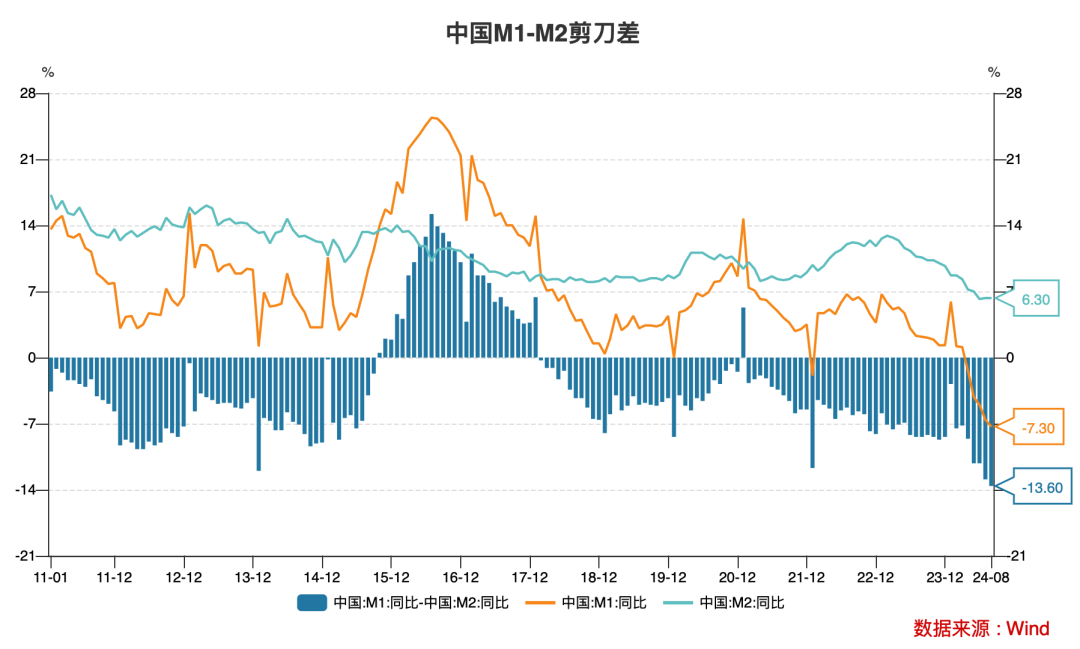

From the perspective of financial leading indicators, overall social financing demand remains relatively weak. Since Q2, both M1 and M2 have slowed year-on-year, widening their gap to historically high levels—indicating insufficient demand, partial financial system liquidity hoarding, and obstructed monetary policy transmission. Short-term economic fundamentals still require further improvement.

2. Policy

Looking back at the past 20 years,阶段性 bottoms in the A-share market are typically accompanied by strong policy signals that exceed investor expectations. Historically, such policy shifts have been a near-necessary condition for market stabilization and rebound. Recently, policy actions have exceeded expectations, and policy signals are clearly emerging.

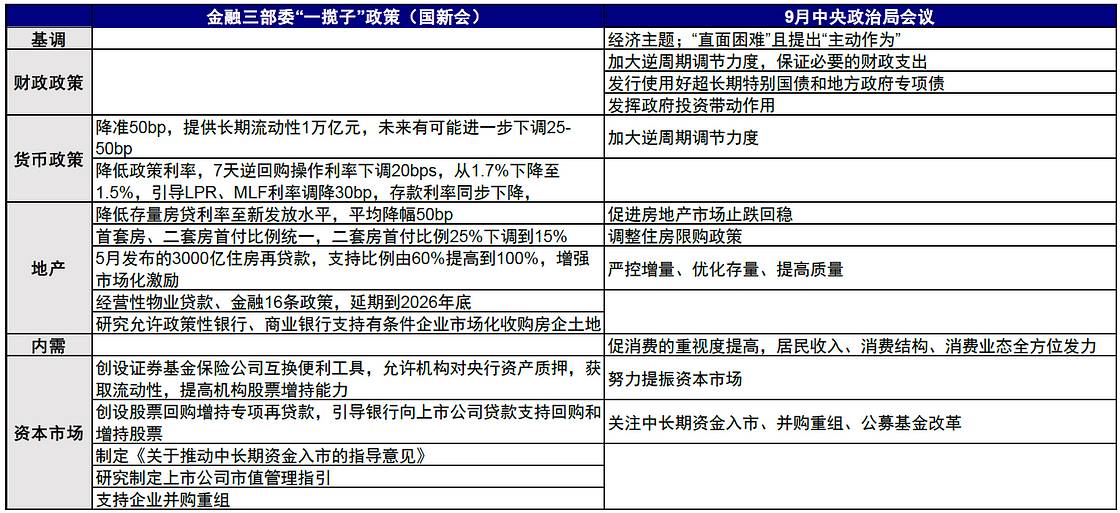

On September 24, 2024, the State Council Information Office held a press conference where PBOC Governor Pan Gongsheng announced the creation of new monetary policy tools to support stable development of the stock market.

The first tool is a swap facility for securities firms, fund companies, and insurance companies. Eligible institutions can use bonds, stock ETFs, and CSI 300 component stocks as collateral to obtain liquidity from the central bank. This measure will significantly enhance institutional capacity to access funds and increase equity holdings. The initial operation scale of this swap facility is 500 billion yuan, with potential for expansion based on future needs.

The second tool is special relending for share buybacks and增持 (increased holdings), guiding banks to provide loans to listed companies and major shareholders to support share repurchases and增持. The initial quota for this buyback instrument is 300 billion yuan, also expandable if needed.

On September 26, 2024, the Central Financial Commission Office and the China Securities Regulatory Commission jointly issued the “Guiding Opinions on Promoting Long-Term Capital Inflows into the Market,” covering measures including: 1) cultivating a capital market ecosystem conducive to long-term investment; 2) vigorously developing equity-oriented public funds and supporting steady growth of private funds; and 3) improving supporting policies for long-term capital inflows—totaling three core areas and eleven key points.

The root of China’s current growth challenge lies in persistent credit contraction and ongoing deleveraging by the private sector, while government credit expansion has failed to effectively offset it. This situation stems primarily from low expected returns on investment—especially due to weak real estate and stock market prices—and financing costs that remain too high. The core of the current policy shift focuses precisely on lowering financing costs (via cuts to multiple interest rates) and improving return expectations (by stabilizing home prices and providing liquidity support to the stock market). These are targeted remedies. Whether they will fully cure the illness—achieving sustained reflation over the medium to long term—depends on follow-up structural fiscal stimulus and actual implementation of policies. Without these, any market recovery could prove fleeting.

On October 8 (Tuesday) at 10:00 AM, the National Development and Reform Commission (NDRC) hosted a State Council press briefing. NDRC Director Zheng Shanjie, along with Vice Directors Liu Sushe, Zhao Chenxin, Li Chunlin, and Zheng Bei, introduced efforts related to “systematically implementing a package of incremental policies, solidly advancing economic structural optimization and sustained positive development trends,” and answered media questions. Bullish sentiment had fully built up during the National Day holiday, with widespread belief that A-shares had bottomed out and reversed course. Morgan Stanley estimated that achieving a rebalancing of the economy from investment to consumption would require policy support of no less than 7 trillion yuan over two years. Market participants held significant expectations for fiscal policy, making this NDRC press conference highly anticipated. However, the event did not deliver the sweeping countercyclical fiscal measures widely expected—this shortfall was the primary reason for the market reversal after the holiday.

3. Valuation

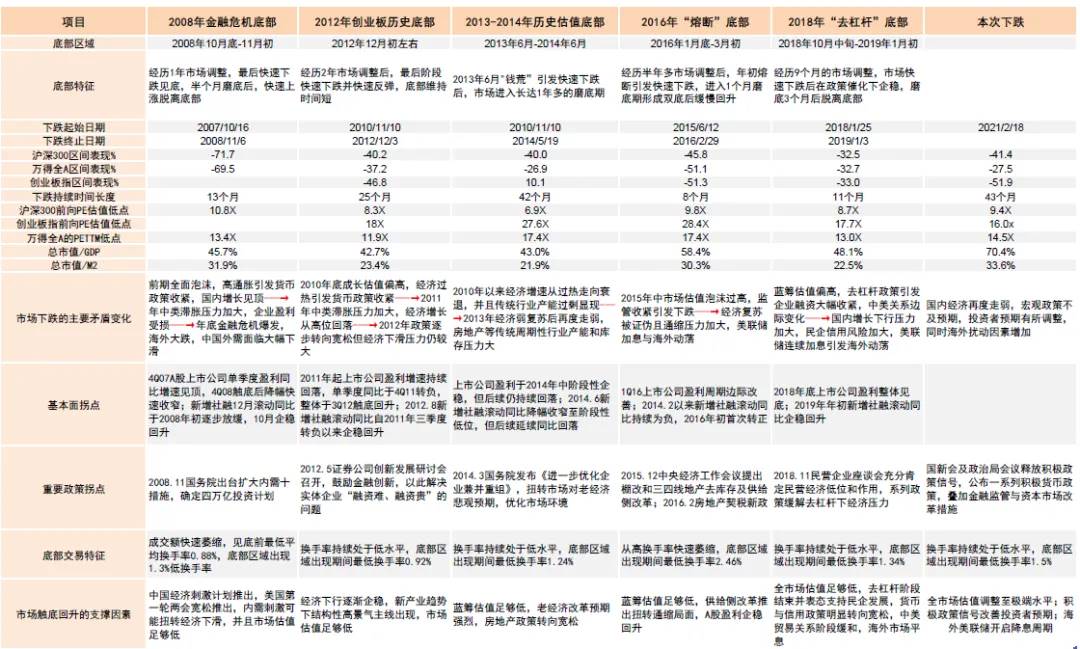

Reviewing historical market bottoms, this round of market movement already exhibits characteristics of a bottom in terms of duration of decline, depth of fall, and valuation levels.

Note: Market data for this downturn as of September 27, 2024. Source: Wind, CICC Research

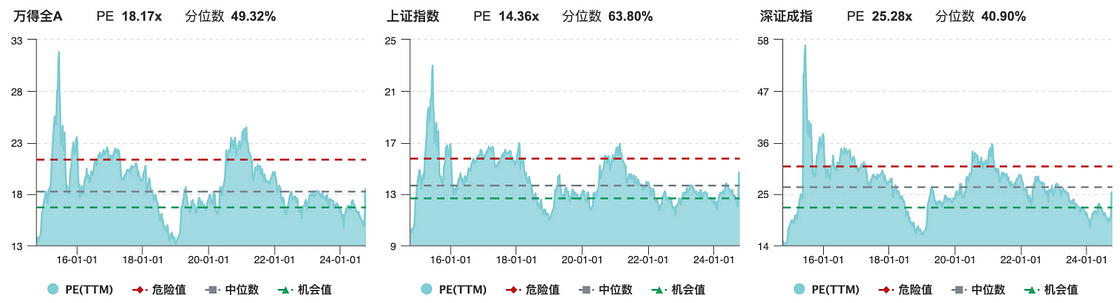

As of October 9, A-share valuations had recovered to around historical median levels.

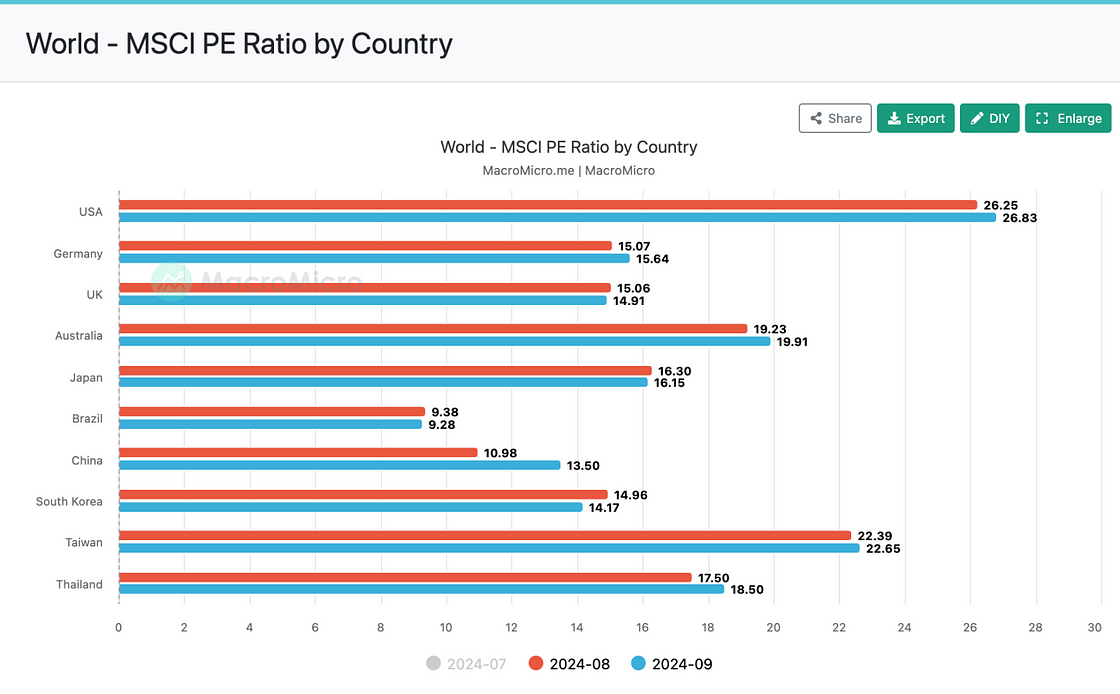

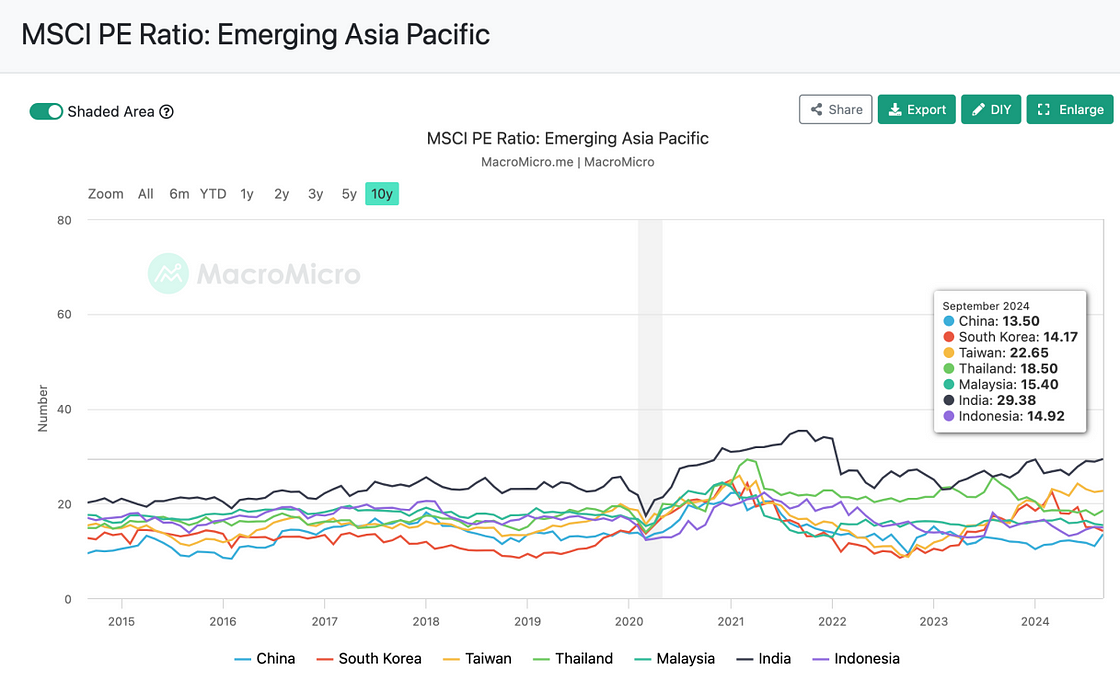

Vertically compared to history, the rebound at the end of September was substantial, reaching the same P/E multiples seen in early 2023 when markets priced in accelerated economic reopening post-pandemic. Horizontally compared to major global markets, China’s valuation relative to emerging markets remains the lowest in the Asia-Pacific region, close to South Korea’s level.

In summary, the key to a sustained market reversal lies in confirmation of medium-term fundamental improvement, which has not yet materialized. The recent short-term rally has been driven largely by expectations and capital flows. Fear of missing out (FOMO) has rapidly inflated sentiment, causing technical indicators like RSI (Relative Strength Index) to become somewhat overextended in the short term. High-volatility markets often experience overreactions, so a pullback following a historically large surge is both technically necessary and logically reasonable. After monetary policy has taken the lead, whether fiscal policy follows through will be the main factor shaping the pace and extent of further stock market gains. Much like the Fed’s art of forward guidance, adding more fuel to an already frenzied market environment would be inappropriate. But as the saying goes, “slow and steady wins the race,” and “a full cup overflows.” What is meant to come will come. From a long-term perspective, I believe the recent dip is a correction rather than the end of a trend. The long-term bottom in A-shares has likely been seen, though the main upward phase has yet to begin.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News