20 Days, 4 Statements, 3 Bills, 2 Executive Orders: Which Crypto Sectors Benefit from U.S. Policy?

TechFlow Selected TechFlow Selected

20 Days, 4 Statements, 3 Bills, 2 Executive Orders: Which Crypto Sectors Benefit from U.S. Policy?

What opportunities remain in this round of the crypto market.

Author: BUBBLE

"The White House is preparing to issue an executive order to penalize banks that discriminate against crypto companies"—this news has been circulating widely on social media recently. Anyone who has been in the cryptocurrency industry for more than two years would rub their eyes in disbelief, exclaiming, "It feels like a different era."

Yet it was only a little over a year ago, in March 2023, when Operation Choke Point 2.0 was fully implemented. The Biden administration issued a joint statement through institutions such as the Federal Reserve, FDIC, and OCC, classifying cryptocurrency operations as "high-risk," requiring banks to strictly assess risk exposure from crypto clients. Regulatory bodies exerted informal pressure to shut down core operations at crypto-friendly banks like Signature Bank and Silvergate Bank, while restricting new customer access. Builders of payment and trading platforms felt this deeply—publicly traded crypto firms like Coinbase were caught in the middle, forced to spend hundreds of millions establishing independent banking relationships. Small and medium-sized crypto startups, unable to meet KYC/AML requirements, largely moved offshore.

In contrast, policy shifts over the past month have rapidly redefined nearly all types of crypto assets, including stablecoins, DeFi, ETFs, LSTs, and more. Traditional financial institutions are accelerating their entry into the space, and the rise of coin-stock companies has created a strong sense of disconnection. But beyond signaling a starting gun for institutional players, what opportunities can we find within these legislative moves?

Four Statements, Three Bills, Two Executive Orders

Before diving into analysis, let’s review key actions taken by the U.S. government and regulators between July and August. Though appearing fragmented and dense, they collectively form America's emerging crypto regulatory blueprint:

July 18: Trump Signs the GENIUS Act

This bill establishes the first federal-level stablecoin regulatory framework, including:

-

Requiring payment stablecoins to be 100% backed by liquid assets such as U.S. dollars or short-term Treasury securities, with monthly disclosures.

-

Mandating that stablecoin issuers obtain either a “federally qualified issuer” or “state-qualified issuer” license.

-

Prohibiting issuers from paying interest to holders and prioritizing stablecoin holder protection in bankruptcy proceedings.

-

Explicitly defining payment stablecoins as neither securities nor commodities.

July 17: House Passes the CLARITY Act

The bill aims to define the market structure for digital assets, specifically:

-

Clearly allocating jurisdiction between CFTC (regulating digital commodities) and SEC (regulating restricted digital assets).

-

Allowing projects to transition from securities to digital commodities after temporary registration once the network matures, providing safe harbor for decentralized participants like developers and validators. The CLARITY Act creates an exemption under Section 4(a)(8) of the Securities Act for digital commodity issuance, allowing up to $50 million in fundraising every 12 months, using a “mature blockchain system” test to determine whether the network operates independently of any individual or team.

July 17: House Passes Anti-CBDC Surveillance State Act

The House passed this bill banning the Federal Reserve from issuing a central bank digital currency (CBDC) to the public and prohibiting federal agencies from researching or developing CBDCs. Representative Tom Emmer explained that CBDCs could become "tools of government surveillance." This legislation codifies the president’s executive order banning CBDC development into law to protect citizen privacy and freedom.

July 29: SEC Approves Spot Bitcoin and Ethereum ETFs with In-Kind Creation/Redemption

The commission approved crypto exchange-traded products that allow shares to be created and redeemed using crypto assets rather than cash, granting Bitcoin and Ethereum treatment similar to commodities like gold.

July 30: White House Releases 166-Page “Working Group Report on Digital Assets Markets” (PWG Report)

The White House Working Group on Digital Assets released a 166-page report outlining a comprehensive crypto policy framework, including:

-

Emphasizing the creation of a digital asset classification system to distinguish among security tokens, commodity tokens, and commercial/consumer tokens.

-

Calling on Congress to grant CFTC authority over spot markets for non-security digital assets based on the CLARITY Act and embracing DeFi technology.

-

Recommending that SEC and CFTC use exemptions, safe harbors, and regulatory sandboxes to quickly approve crypto asset issuance and trading.

-

Suggesting restarting crypto innovation within the banking sector, allowing banks to custody stablecoins and clarifying procedures for accessing Federal Reserve accounts.

July 31 – August 1: SEC’s “Project Crypto” and CFTC’s “Crypto Sprint” Initiatives

In a speech at the U.S. Securities and Exchange Commission, Atkins launched “Project Crypto,” aiming to modernize securities rules to bring U.S. capital markets on-chain. The SEC will develop clear rules for crypto asset issuance, custody, and trading, and use interpretive guidance and exemptions to ensure existing regulations do not hinder innovation during the rulemaking process. Key elements include:

-

Guiding crypto issuance back to the U.S. by establishing clear standards to classify digital commodities, stablecoins, collectibles, and other categories.

-

Updating custody rules to affirm individuals’ rights to self-custody digital wallets and permit registered intermediaries to offer crypto custodial services.

-

Promoting “super apps” enabling broker-dealers to trade both securities and non-security crypto assets on a single platform, offering staking, lending, and other services.

-

Modernizing rules to create space for decentralized finance (DeFi) and on-chain software systems, clearly distinguishing pure software publishers from intermediary services, and exploring innovative exemptions to allow new business models to enter the market under lighter compliance burdens.

On August 1, the Commodity Futures Trading Commission (CFTC) officially launched its “Crypto Sprint” regulatory initiative, aligning with Project Crypto. Four days later, on August 5, it further proposed bringing spot crypto assets onto CFTC-registered futures exchanges (DCMs) for compliant trading—meaning platforms like Coinbase or on-chain derivatives protocols could gain legal operating licenses by registering as DCMs.

August 5: SEC Division of Corporation Finance Statement on Liquid Staking

The SEC’s Division of Corporation Finance released a statement analyzing liquid staking activities, concluding that liquid staking itself does not involve securities transactions, and that staking receipt tokens are not securities. Their value represents ownership of the staked crypto asset, not reliance on third-party entrepreneurial or managerial efforts. The statement clarifies that liquid staking does not constitute an investment contract, giving DeFi staking services clearer compliance room.

August 5: Draft Executive Order Against “Operation Choke Point 2.0”

This order targets discrimination against crypto companies and conservative individuals, threatening penalties for banks that sever client relationships for political reasons, including fines and consent orders or other disciplinary actions. Reports indicate the executive order also directs regulators to investigate whether any financial institutions violated the Equal Credit Opportunity Act, antitrust laws, or consumer financial protection laws.

August 7: Trump Signs Executive Order on 401(k) Retirement Investment

The order proposes allowing 401(k) retirement funds to invest in alternative assets such as private equity, real estate, and cryptocurrencies. This move could represent a major breakthrough for an industry seeking access to the roughly $12.5 trillion retirement market.

The Super App Era of On-Chain Everything: Which Crypto Sectors Will Benefit from Policy Tailwinds?

With this, the U.S. has effectively established a compliance architecture for the crypto sector. The Trump administration used the stablecoin bill and anti-CBDC bill to cement the foundational status of stablecoins—pegged to U.S. debt and linked to global liquidity—enabling stablecoins to expand confidently across all crypto domains. The CLARITY Act clarified jurisdictional boundaries between the SEC and CFTC. Then, within just one week—from July 29 to August 5—four key statements emerged, all closely tied to on-chain developments: enabling in-kind redemption for BTC and ETH ETFs, recognizing liquid staking receipts—all aimed at first connecting “old money” to the blockchain, then expanding traditional financial systems on-chain via “DeFi yields.” The two recent executive orders directly inject capital from “banks” and “pension funds” into the crypto ecosystem. This coordinated series of actions marks the first true “policy-driven bull market” in crypto history.

When Atkins introduced Project Crypto, he highlighted a key concept: the “Super App.” This refers to the horizontal integration of product and service offerings. In his vision, a single app in the future could provide full-spectrum financial services. Atkins stated: “Broker-dealers with alternative trading systems should be able to offer trading in non-security crypto assets, crypto securities, and traditional securities, along with crypto staking and lending services—all without needing licenses from over 50 states or multiple federal agencies.”

When discussing the top contenders for this year’s most promising Super Apps, traditional brokerage Robinhood and early “compliant” exchange Coinbase stand out. While Robinhood acquired Bitstamp this year, launched tokenized equities, and partnered with Aave to bring them on-chain (enabling both platform-based and on-chain trading), Coinbase has deepened integration between its Base chain ecosystem and its exchange, upgrading the Base Wallet into a unified app combining social features and off-chain application layers. Yet under the Super App paradigm, RWA sectors are where the real explosion lies.

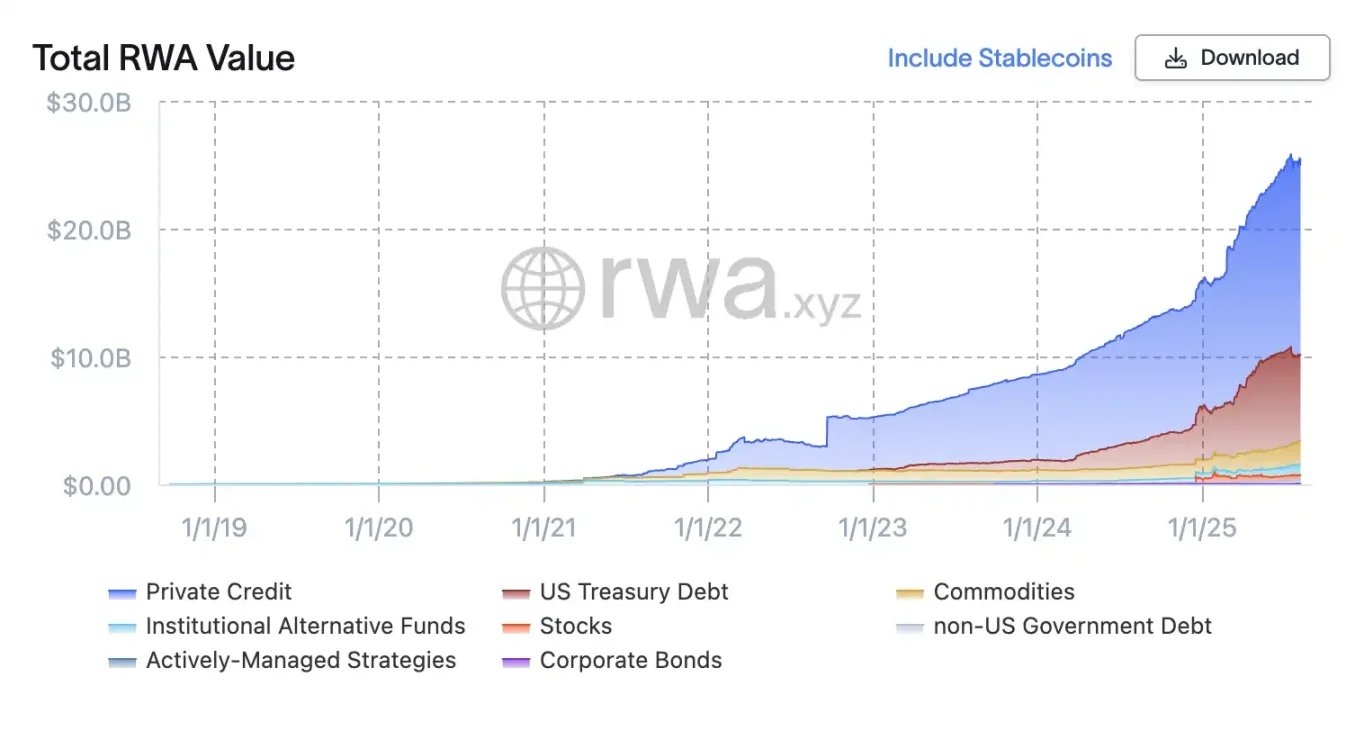

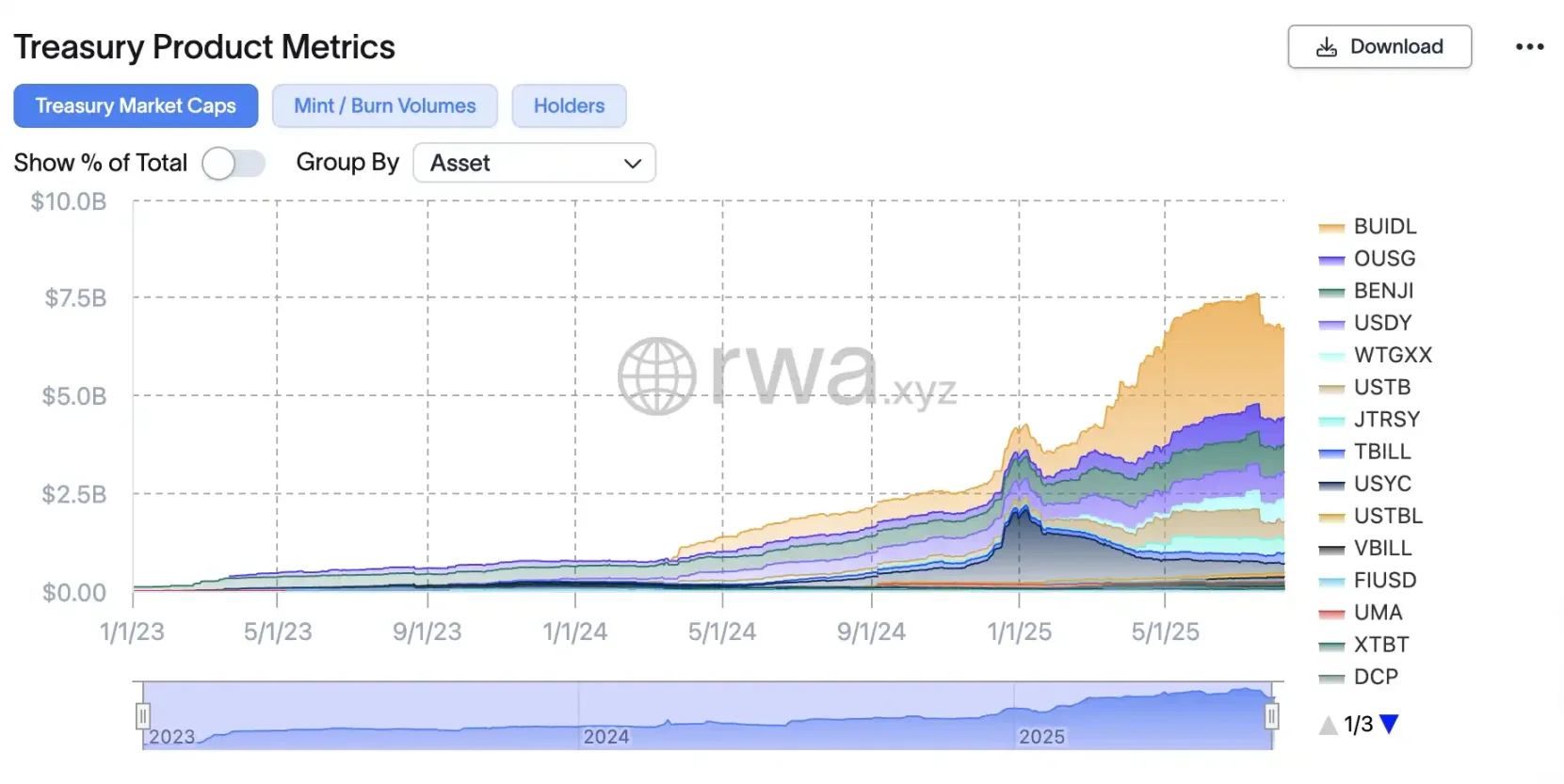

After policy encouragement to bring traditional assets on-chain, on-chain U.S. bonds, tokenized stocks, and Treasury bills will gradually follow compliant paths. According to data from RWA.xyz, the global RWA market grew from around $5 billion in 2022 to approximately $24 billion by June 2025. Rather than calling this RWA, it might be better termed FinTech—its goal being to make financial services more efficient through institutional and technological improvements. From REITs born in the 1960s, E-gold, to ETFs, and through countless failed and successful experiments like colored BTC and algorithmic stablecoins, these innovations evolved into today’s RWA.

Now recognized within the policy framework, RWA gains the strongest possible endorsement, and its market potential is enormous. Boston Consulting Group estimates that 10% of global GDP—about $16 trillion—could be tokenized by 2030, while Standard Chartered forecasts tokenized assets reaching $30 trillion by 2034. Tokenization opens exciting new doors for institutions by reducing costs, streamlining underwriting, and increasing capital liquidity. It also helps boost returns for investors willing to take on more risk.

The Nature of Stablecoins: On-Chain Treasuries

When discussing RWA in crypto, U.S. dollar assets—especially U.S. currency and Treasury bonds—remain central. This is the result of nearly 80 years of economic history. Since the Bretton Woods system of 1944, the U.S. dollar has become the pillar of global finance. Central banks hold most of their reserves in dollar-denominated assets, with about 58% of official foreign exchange reserves held in dollars—mostly invested in U.S. Treasuries. The U.S. Treasury market is the world’s largest bond market, with about $28.8 trillion in outstanding debt and unmatched liquidity. Foreign governments and investors alone hold around $9 trillion of this debt.

Few assets in history match the depth, stability, and credit quality of U.S. Treasuries. High-grade government bonds serve as the cornerstone of institutional portfolios, used to safely park capital and as collateral for other investments. The crypto world leverages these same fundamentals. As stablecoins have become crypto’s dominant “on-ramp,” the relationship between the two has deepened more than ever.

While crypto may not have fulfilled Satoshi Nakamoto’s original vision of creating an “alternative to the dollar system,” it has instead become a more efficient infrastructure built upon the dollar. Paradoxically, this very dependence may be why the U.S. government now fully accepts its existence—and indeed, may need it more than ever before.

With recent additions of Saudi Arabia, UAE, Egypt, Iran, and Ethiopia, the BRICS bloc reached a combined GDP of $29.8 trillion in 2024, surpassing the U.S. GDP of $29.2 trillion—making the U.S. no longer the world’s largest economic bloc by GDP. Over the past two decades, BRICS economies have grown significantly faster than G7 nations.

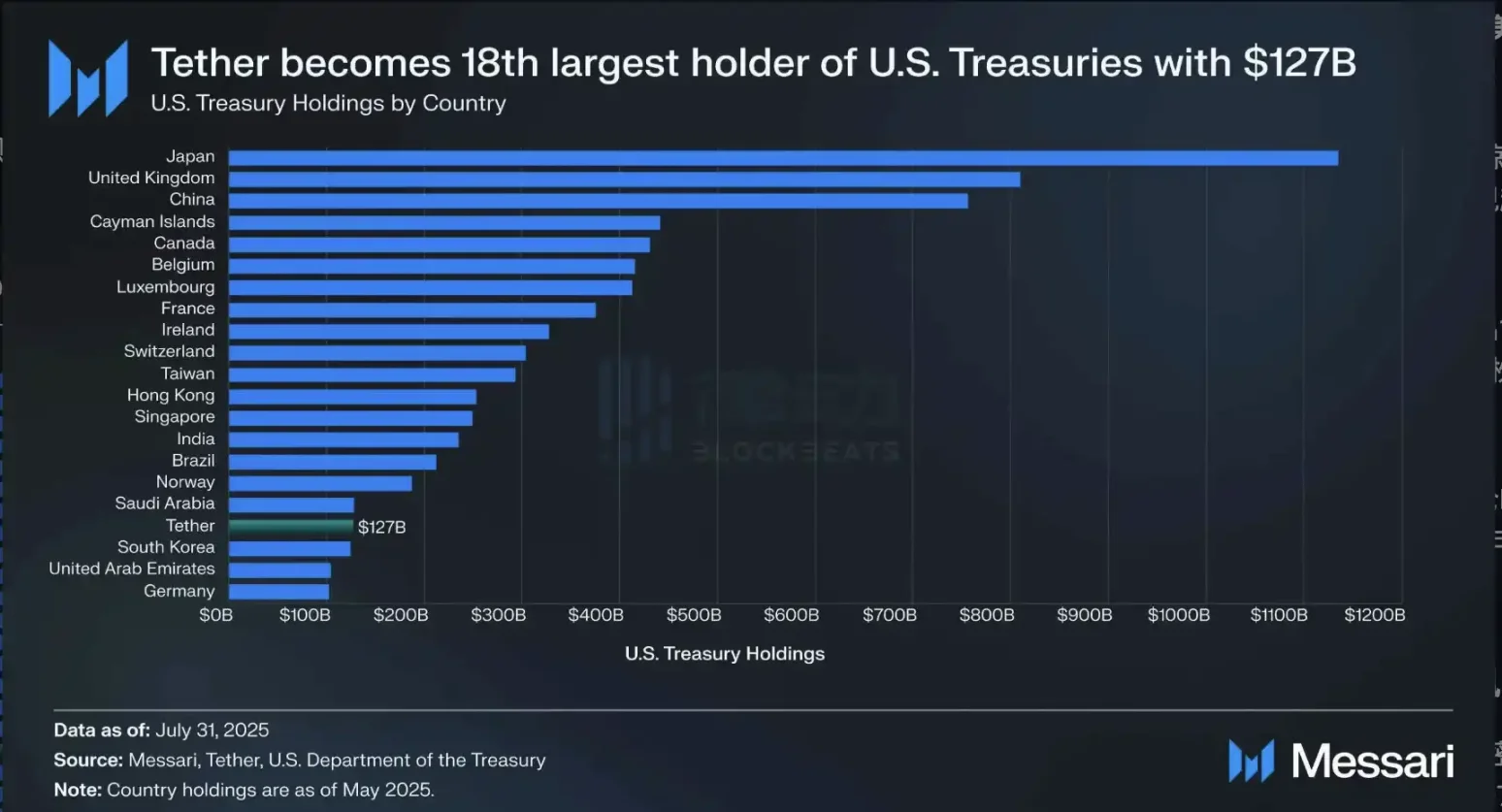

As of May 15, 2025, Tether holds more U.S. Treasuries than South Korea, source: Messari

Closely related stablecoins occupy a unique position in the global financial landscape—they are the most liquid, efficient, and user-friendly packaging of short-term U.S. Treasuries, effectively addressing two obstacles related to de-dollarization: maintaining the dollar’s dominance in global transactions while ensuring sustained demand for U.S. debt.

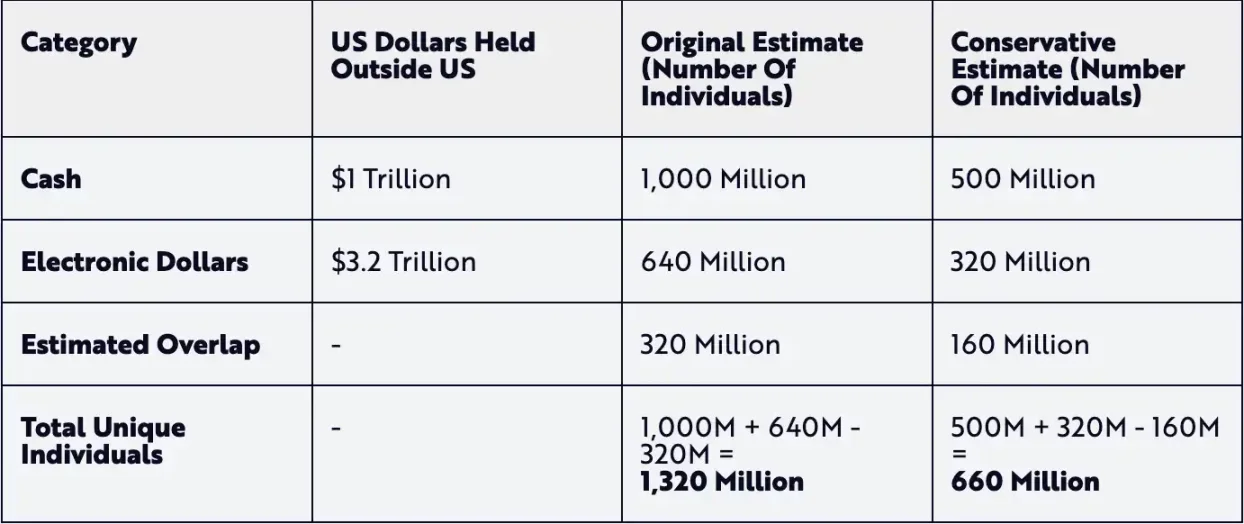

U.S. dollar holders as of December 31, 2024: Stablecoin users reached 15–30% of the total accumulated over centuries of traditional dollar development within just five years, source: Ark Investment

Dollar-pegged stablecoins like USDC and USDT provide traders with stable transactional currencies, backed by the same bank deposits and short-term Treasuries relied upon by traditional institutions. While the Treasury income from such instruments doesn’t accrue directly to end users, more on-chain financial products are integrating U.S. Treasury concepts. Currently, there are two primary methods to build tokenized Treasuries on-chain: yield-bearing mechanisms and rebasing mechanisms.

For example, yield tokens like Ondo’s USDY and Circle’s USYC accumulate underlying yield through various pricing mechanisms. Under this model, USDY’s price will be higher six months from now due to accrued yield. In contrast, rebasing tokens like BlackRock’s BUIDL, Franklin Templeton’s BENJI, or Ondo’s OUSG maintain dollar parity by distributing newly minted tokens as yield at predefined intervals.

Whether “yield-bearing stablecoins” or “tokenized Treasuries,” much like fund portfolios in TradeFi, on-chain financial products now treat on-chain U.S. Treasuries as a stable-yield component. They have become alternatives to high-risk DeFi, allowing crypto investors to earn steady annual yields of 4–5% with minimal risk.

The Easiest Way to Make Money: On-Chain Lending

Traditional lending is one of the most profitable segments in the financial system. According to research by Magistral Consulting, the global credit market reached $11.3 trillion in 2024 and is projected to reach $12.2 trillion in 2025. In contrast, the entire crypto lending market remains under $30 billion—but offers typical yields of 9–10%, far exceeding traditional finance. If regulatory constraints are lifted, massive growth potential will be unlocked.

In March 2023, a research team led by Giulio Cornelli at the University of Zurich published a paper in the Journal of Banking & Finance on the importance of large tech company lending. The study found that clear FinTech regulatory frameworks can double new lending activity (one study showed a 103% increase in FinTech lending volume under clear regulation). The same logic applies to crypto lending: clear policy brings capital.

Credit market size, source: magistral consulting

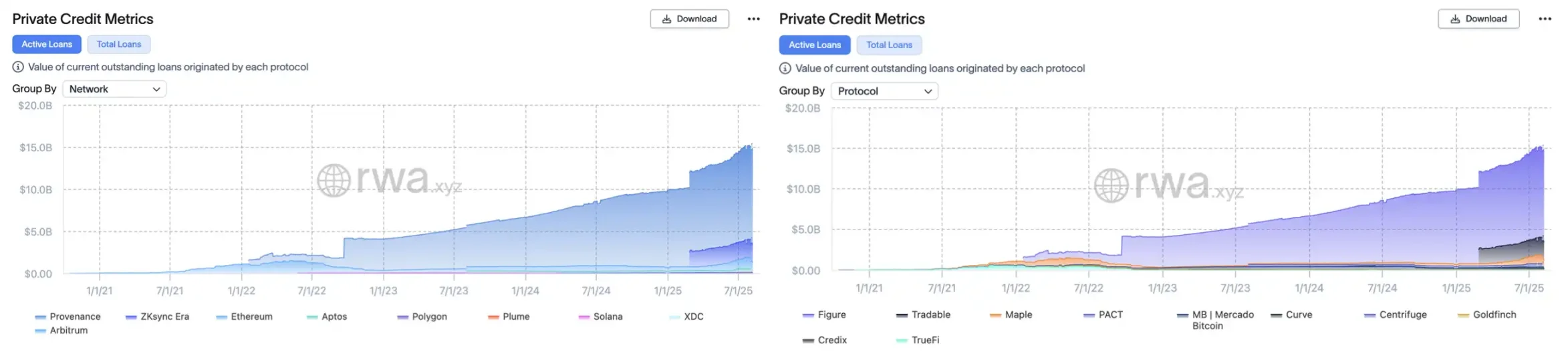

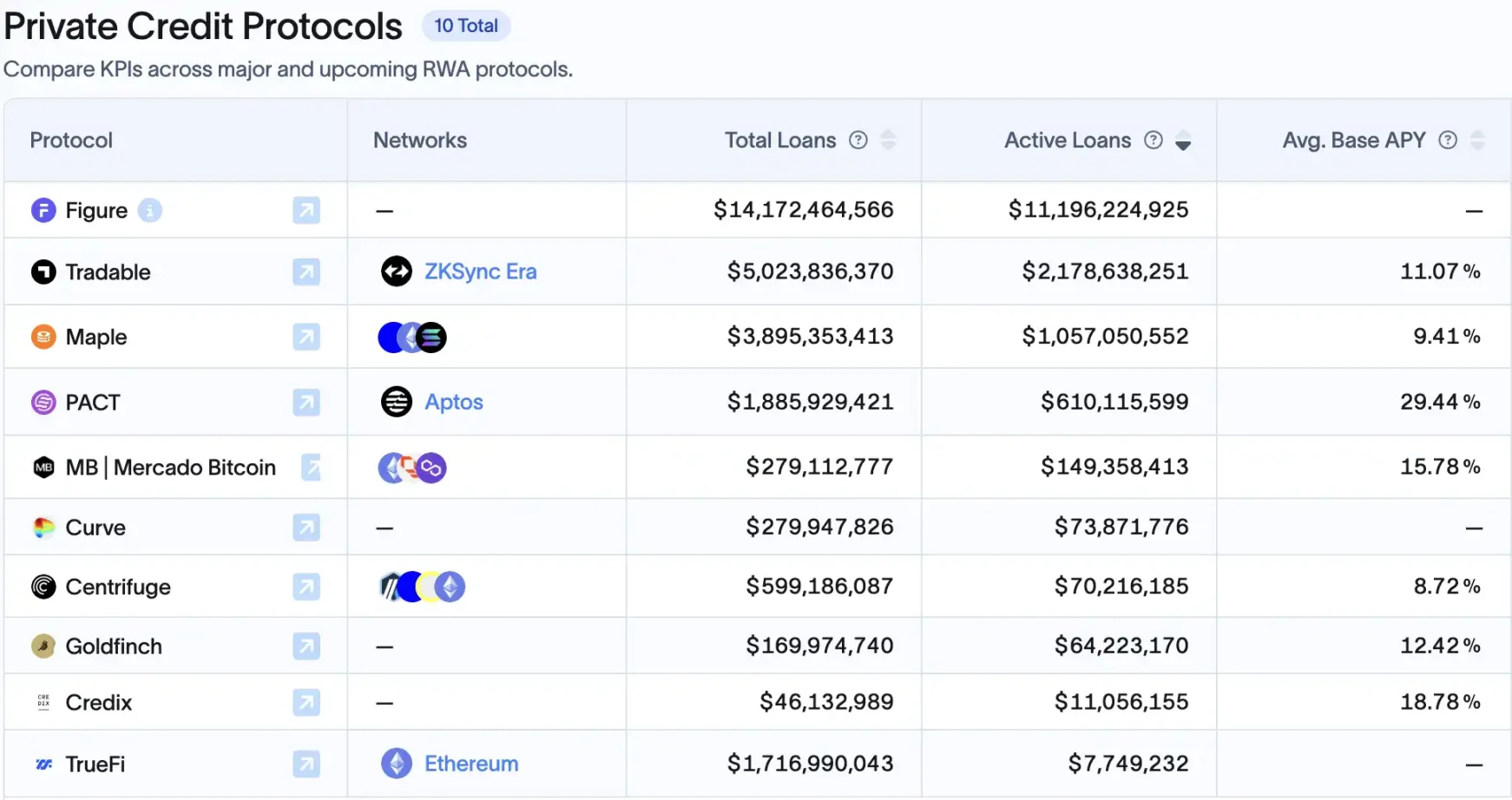

Therefore, during this period of increasing RWA tokenization, one of the biggest beneficiaries post-compliance may be the on-chain lending sector. Currently, due to the lack of a “government credit scoring” big data system available in traditional finance, crypto can only rely on “collateralized assets,” using DeFi to enter secondary debt markets to diversify risk. As a result, private credit assets currently account for about 60% of on-chain RWA, totaling around $14 billion.

Behind this wave is deep involvement by traditional institutions. Leading the pack is Figure, which recently discussed going public. Its Cosmos-based blockchain Provenance, designed specifically for asset securitization and loan finance, had hosted about $11 billion in private credit assets as of August 10, 2025, capturing 75% of the sector. Its founder, Mike Cagney, former CEO of SoFi and a serial entrepreneur in lending, has brought seamless expertise to blockchain lending, building an end-to-end platform covering loan origination, tokenization, and secondary trading.

In second place is Tradable, which partnered with asset manager Janus Henderson ($330 billion AUM), tokenizing $1.7 billion in private credit on Zksync early this year (making Zksync the second-largest “lending chain”). Third is Ethereum, the “world computer,” though its market share in this sector is only one-tenth that of Provenance.

Left: “Lending Chain” market cap; Right: Lending project market cap, source: RWAxyz

Native DeFi platforms are also entering the RWA lending market. For example, Maple Finance has facilitated over $3.3 billion in loans, with about $777 million currently active, some backed by real-world receivables. MakerDAO has begun allocating to real-world assets like Treasuries and commercial loans, while platforms like Goldfinch and TrueFi have long been active in this space.

All of this was previously suppressed under hostile regulation. Now, with “policy warming,” this sector may finally be activated.

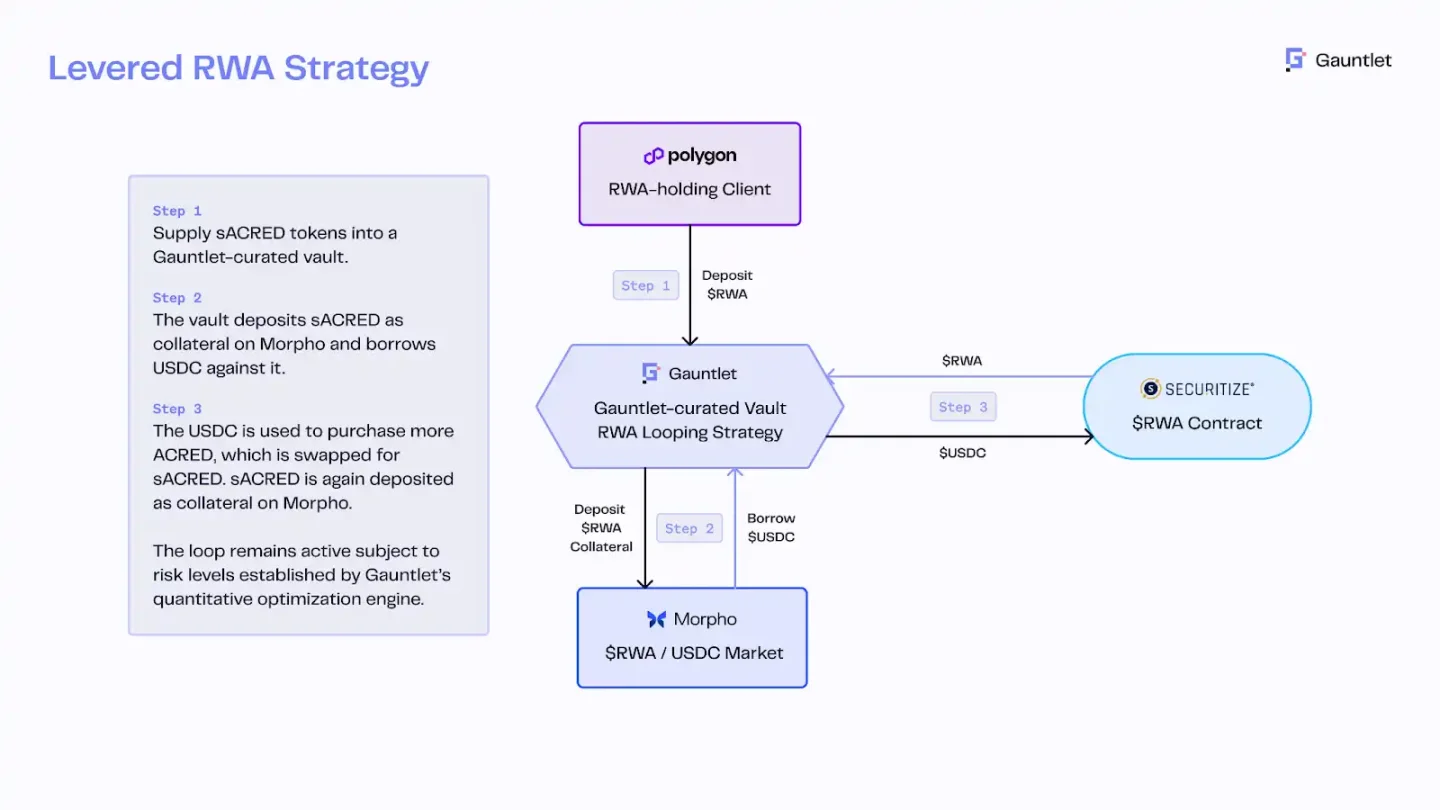

For example, Apollo launched a tokenized version of its flagship credit fund ACRED, allowing investors to mint sACRED tokens via Securitize to represent their shares. These tokens can then be used on DeFi platforms (like Morpho on Polygon) for arbitrage lending. Using RedStone price oracles and Gauntlet risk engines, sACRED is pledged to borrow stablecoins, then leveraged to repurchase ACRED, boosting the base 5–11% yield to a 16% annualized return. This innovation merges institutional credit funds with DeFi leverage.

sACRED circular lending structure, source: Redstone

In the longer term, 401(k) reforms will indirectly benefit on-chain lending. Wintermute OTC trader Jake Ostrovskis noted the impact cannot be underestimated: “Even a 2% allocation to Bitcoin and Ethereum would equal 1.5 times the total ETF inflows to date, while a 3% allocation would more than double overall market inflows. Crucially, these buyers are mostly price-insensitive—they focus on meeting allocation benchmarks, not tactical trading.” The yield demands of traditional pensions could spark interest in stable, high-yield DeFi products. For instance, tokenized assets based on real estate debt, small business loans, or private credit pools, if properly packaged for compliance, could become new options for pension funds.

Top 10 on-chain lending projects by current market share, source: RWAxyz

With clear regulations, institutional-grade “DeFi credit funds” could rapidly scale. After all, most major institutions (Apollo, BlackRock, JPMorgan) already view tokenization as a key tool to enhance market liquidity and returns. Beyond 2025, as more assets—real estate, trade finance, even mortgages—are tokenized and brought on-chain, on-chain lending could evolve into a multi-trillion-dollar market.

Transforming the 5×6.5-Hour “American Value” into a 7×24 “On-Chain U.S. Stock Market” for the World

The U.S. stock market is one of the world’s largest capital markets. As of mid-2025, its total market cap stands at approximately $50–55 trillion, accounting for 40–45% of global equity value. Yet this vast “American value” has long been tradable only during a narrow window—five days a week, about 6.5 hours per day—clearly limited by geography and time. Today, this is changing: on-chain stocks now allow global investors to participate in U.S. markets 7×24.

On-chain U.S. stocks refer to digitizing shares of U.S.-listed companies into blockchain tokens, priced to track real stocks and backed by actual shares or derivatives. The biggest advantage is unrestricted trading time: traditional U.S. exchanges operate about 6.5 hours daily on weekdays, while blockchain-based stock tokens enable round-the-clock trading. Currently, stock tokenization is advancing in three directions: third-party compliant issuance with multi-platform access, licensed brokers issuing and operating closed-loop on-chain trading, and CFD (Contract for Difference) models.

Today’s market already hosts various stock tokenization projects—from Republic’s “Pre-IPO” mirror tokens, to Hyperliquid’s shortable Ventuals, to Robinhood’s xStocks (a collaboration with multiple institutions) shaking both TradFi and crypto circles, MyStonk offering dividend payouts, and StableStock, soon to launch a dual-track model combining broker and on-chain tokens integrated with DeFi.

This trend is driven by rapidly clarifying regulations and the entry of traditional giants. Nasdaq has proposed creating a digital asset version of ATS (Alternative Trading Systems), allowing tokenized securities and commodity tokens to list and trade together, enhancing market liquidity and efficiency. SEC Commissioner Paul Atkins likened on-chaining traditional securities to the digital revolution in music: just as digital music disrupted the music industry, on-chain securities could transform issuance, custody, and trading, reshaping capital markets. However, this sector remains early-stage. Compared to other RWA sectors worth billions, the stock tokenization space has greater upside—current on-chain stock market cap is under $400 million, with monthly trading volume around $300 million.

The main hurdles include incomplete compliance pathways, complex institutional regulations, and friction in onboarding. But for most users, the primary challenge is insufficient liquidity. Tech investor Di Zheng noted that high OTC costs separate U.S. stock players from on-chain users: “You pay several basis points in OTC fees. If you use a Singapore-licensed exchange like Coinbase, add another ~1% fee plus 9% consumption tax. So crypto money and traditional brokerage money exist in separate systems, never interfacing—like fighting on two battlefields.”

Thus, on-chain U.S. stocks today resemble teachers educating “Degens” on stock basics while simultaneously shouting “open 7×24” to traditional brokerage users. In an interview with Zhibupoliyan, StableStock founder ZiXI categorized on-chain stock users into three groups and analyzed why on-chain stocks are “needed” in each scenario:

Beginner users: Mainly located in countries with strict capital controls—China, Indonesia, Vietnam, Philippines, Nigeria. They hold stablecoins but face restrictions preventing overseas bank accounts and access to traditional U.S. stocks.

Professional users: Hold both stablecoins and overseas bank accounts. But traditional brokers offer low leverage—e.g., Tiger only allows 2.5x. On-chain, with higher LTV (loan-to-value) ratios, users achieve high leverage—e.g., 90% LTV enables 9x leverage.

High-net-worth users: Long-term holders of U.S. stocks, earning interest, dividends, or capital gains via margin in traditional accounts. Once tokenized, their stocks can be used as LP, lent out, or operated cross-chain on-chain.

From Robinhood’s announcement to Coinbase submitting a pilot application to the SEC, becoming one of the first licensed institutions to launch “on-chain U.S. stocks,” combined with the SEC’s favorable statement on liquid staking, it’s foreseeable that as the policy bull market progresses, on-chain U.S. stocks will gradually integrate into DeFi, building deeper liquidity pools. The “American value” once confined to 5×6.5-hour trading is accelerating toward a global, timezone-free, on-chain equity market. This not only vastly expands the asset universe for crypto investors but also introduces 24/7 liquidity to traditional stock markets, marking Wall Street’s advance into the “Super-App Era” of on-chain capital markets.

Legitimizing Staked Assets: The Rise of DeFi

Among the biggest winners from this regulatory shift are undoubtedly DeFi derivative protocols. The SEC’s clarification on liquid staking has paved the way—arguably the most significant positive development for “Crypto Native” users. Previously, the SEC viewed centralized staking services with hostility, forcing exchanges to delist staking products and raising concerns over whether Lido’s stETH or Rocket Pool’s rETH constituted unregistered securities. However, in August 2025, the SEC’s Division of Corporation Finance declared: “If the underlying asset is not a security, then the LST is not a security either.” This clear policy signal is hailed as a watershed moment for staking legitimacy.

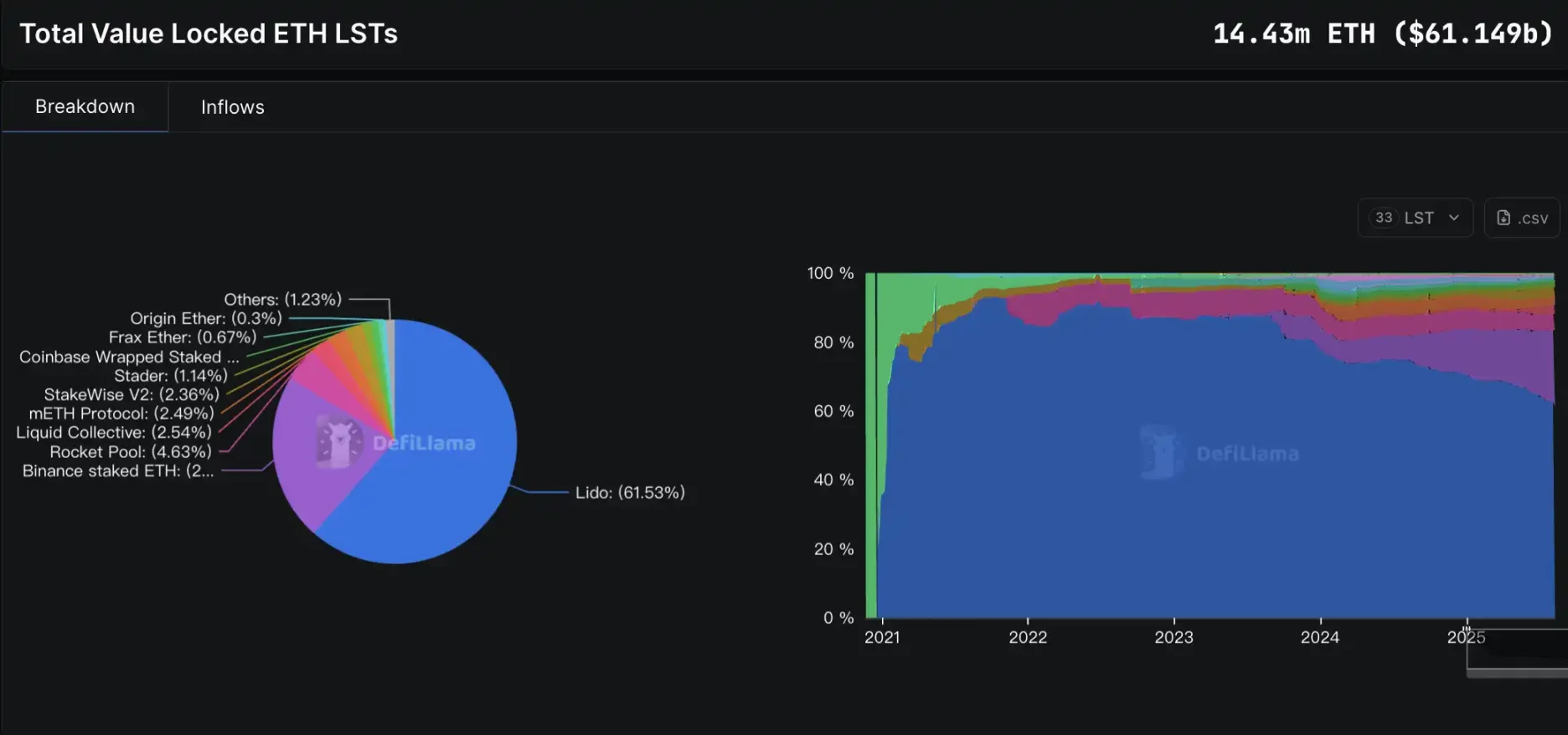

This benefits not only staking itself but activates an entire DeFi ecosystem built on staking—from LST-backed lending, yield aggregation, restaking mechanisms, to staking-based yield derivatives. More importantly, clear U.S. regulation means institutions can now legally participate in staking and related products. ETH’s locked amount in liquid staking is now around 14.4 million, with accelerating growth. According to Defillama, LST TVL surged from $20 billion in April 2025 to $61 billion by August 2025, returning to historical highs.

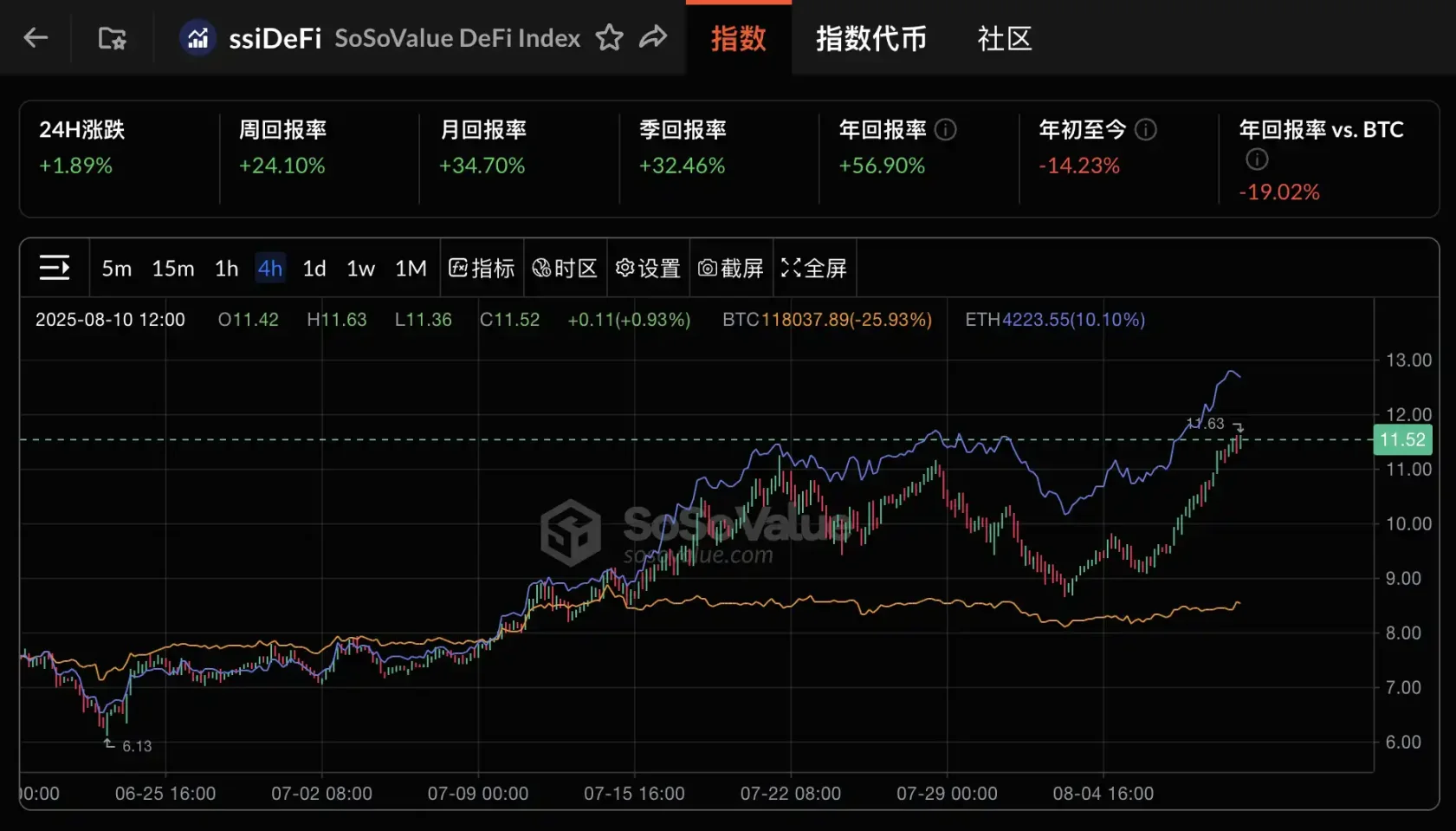

SosoValue DeFi Index outperformed even the strong ETH recently, source: SosoValue

At some point, these DeFi protocols appear to have reached a consensus, beginning deep collaborations. They not only connect institutional resources but also coordinate yield structures, gradually forming systematic “yield flywheels.”

For example, dEthena and Aave’s new integration allows users to gain leveraged exposure to sUSDe yields while holding USDe for better overall liquidity (no cooldown period). Within a week, the Liquid Leverage product attracted over $1.5 billion in inflows. Pendle splits yield-bearing assets into principal (PT) and yield (YT), creating a “yield trading market.” Users can buy YT with small capital for high returns; PT locks in fixed yield, suitable for conservative investors. PT is used as collateral on platforms like Aave and Morpho, forming infrastructure for a yield capital market. With Pendle’s new “Project Boros” partnering with Ethena, the market expands to perpetual funding rates, allowing institutions to hedge Binance contract rate risks on-chain.

DeFi user JaceHoiX noted: “Ethena, Pendle, and Aave are forming the iron triangle of bubble TVL.” Now, a user can start with $1, mint USDe → mint PT → deposit PT → borrow USDT → mint USDe again, looping to turn $1 into $10 of deposits. Meanwhile, this $10 is counted in the TVL of all three protocols—turning $1 into $30 of reported TVL across the three platforms.

Many institutions have already entered this space in recent years—JP Morgan’s lending platform Kinexys, BlackRock, Cantor Fitzgerald, Franklin Templeton, etc. Regulatory clarity will accelerate DeFi protocols’ integration with TradFi, extending the narrative of turning $1 into $30—“selling apples in the village”—into a longer, sustainable story.

American Public Chains and the World Computer

U.S.-based public chains are gaining policy tailwinds. The July-passed CLARITY Act introduced the “mature blockchain system” standard, allowing crypto projects to transition from securities to digital commodities once networks mature in decentralization. This means highly decentralized public chains and their tokens, following compliant paths, could gain commodity status and fall under CFTC—not SEC—jurisdiction.

KOL @Rocky_Bitcoin believes America’s financial advantages are shifting into crypto: “With clear division between CFTC and SEC, the U.S. wants not just high trading volume in the next bull run, but to become a hub for project incubation.” This is great news for U.S.-based chains like Solana, Base, Sui, and Sei. If these chains natively embed compliance logic, they could become primary networks for the next USDC or ETF.

For example, asset manager VanEck has applied for a Solana spot ETF, arguing SOL functions similarly to Bitcoin and Ethereum and should thus be treated as a commodity. Coinbase listed a CFTC-regulated Solana futures contract in February 2025, accelerating institutional participation in SOL and paving the way for a future SOL spot ETF. These moves signal that under the new regulatory approach, certain “American public chains” are gaining commodity-like status and legitimacy, serving as key bridges for traditional capital to enter the blockchain, allowing legacy institutions to confidently migrate value onto public chains.

Meanwhile, the crypto world’s “world computer,” Ethereum, also benefits clearly from the policy shift. New rules restricting “insider trading and quick pump-and-dump schemes” favor established, fundamentally sound coins with robust liquidity. As the most decentralized blockchain with the largest developer community and one of the few that has never gone down, Ethereum already handles the vast majority of stablecoin and DeFi transaction volume.

Now, U.S. regulators broadly accept Ethereum’s non-security status. In August 2025, the SEC stated that if the underlying asset (e.g., ETH) is not a security, then its liquid staking derivatives are also not securities. Combined with prior SEC approval of Bitcoin and Ethereum spot ETFs, this indirectly confirms Ethereum’s status as a commodity.

With regulatory backing, institutional investors can boldly engage with the Ethereum ecosystem—whether issuing on-chain Treasuries, stocks, or other RWA assets, or using Ethereum as a settlement layer to connect with TradFi. It’s foreseeable that while “American public chains” compete in compliant expansion, Ethereum—the “world computer”—will remain the backbone of global on-chain finance. Not just due to first-mover advantage and network effects, but because this wave of policy tailwinds has opened new doors for deep integration with traditional finance.

Has Policy Really Created a Bull Market?

Whether it’s the stablecoin bill establishing compliant status for dollar-pegged assets, or “Project Crypto” outlining a blueprint for on-chain capital markets, this top-down policy shift has indeed granted the crypto industry unprecedented institutional space. But historical experience shows that regulatory friendliness does not mean unlimited openness. Standards, thresholds, and enforcement details during the policy trial period will still directly determine the survival and trajectory of each sector.

From RWA and on-chain lending to staking derivatives and on-chain U.S. stocks, nearly every sector can find its place in the new framework. But their real test may be whether they can maintain crypto-native efficiency and innovation while achieving compliance. Whether the global influence of U.S. capital markets can truly merge with blockchain’s decentralization will depend on the long-term interplay among regulators, traditional finance, and the crypto industry. The policy wind has shifted—now, how to pace forward and manage risks will determine how far this “policy bull market” can go.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News