A casino economy where no one is happy: American youth are losing faith in the future

TechFlow Selected TechFlow Selected

A casino economy where no one is happy: American youth are losing faith in the future

Why do we feel deep sadness?

Author: KYLA SCANLON

Translated by: TechFlow

Good morning from Washington D.C.! This article is a bit long, so it might get truncated in your inbox. If you're looking for an affordable holiday gift for loved ones (or anyone), and want to support local bookstores, "In This Economy?" is a great choice!

I’ve recently been on the road again for work, visiting Michigan, Kentucky, and D.C. While going through security, I noticed a woman ahead of me coughing with her mouth wide open like a baby. I stared at her—first surprised by her apparent carelessness, then struck by deep fear.

Most people are kind. But living in society means confronting others’ divergent internal norms. Some people cough with their mouths wide open—that’s just reality. I have a theory: perhaps they don’t feel responsible for collective comfort, possibly due to a lack of belonging in public spaces. This is a form of social drift, increasingly visible in public areas (like staring 90 degrees down at phones and walking into walls, or blocking major pedestrian pathways).

But I think there’s much in common between these open-mouth coughers and the ongoing economic malaise we’re witnessing. If you’ve lost trust in surrounding systems, why follow collective norms? Hard work doesn’t seem to pay off—so why not take a gamble? Institutions lie! But that YouTuber making thumbnails won’t lie—his image shows a gaping mouth pointing at a bowl of pasta, asking “big questions.” We no longer trust each other. As Jordan Schwartz, student chair of the Harvard Public Opinion Project, put it:

“Gen Z is on a path that may threaten American democracy and the future stability of society. This is a five-alarm crisis, and immediate action is required if we hope to restore young people’s confidence in politics, America, and one another.”

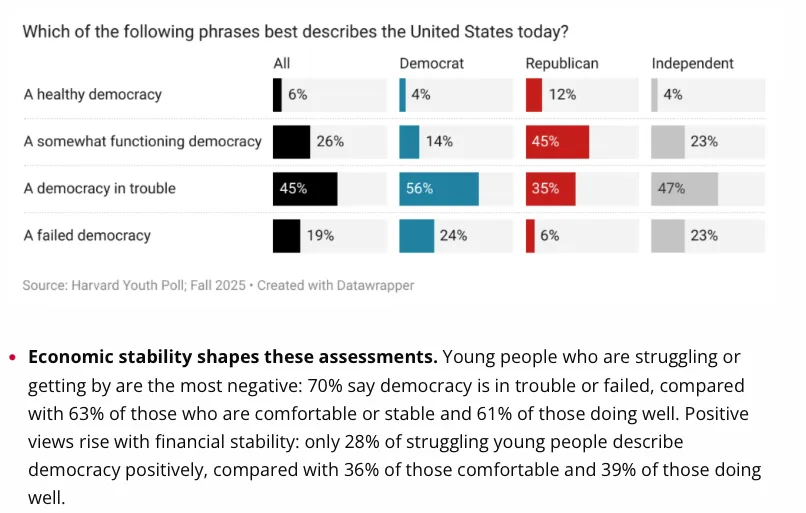

His project—the Harvard Youth Poll—surveyed over 2,000 Americans aged 18 to 29 about trust, politics, and artificial intelligence. When asked whether they believe the U.S. is a healthy democracy, respondents showed clear partisan divides—but anxiety was evident across the board.

Trust among groups is also collapsing. Only 35% of young Americans believe those with differing views want the country to move in a positive direction. Fifty percent see mainstream media as a threat. And only 30% believe they will be better off economically than their parents.

So from this survey, three concerning issues emerge:

-

Concern about democracy

-

Concern about the economy

-

Concern about one another

I believe you can’t truly understand the economy without understanding how we talk about it. Here we face a compound effect: (1) post-pandemic adjustment; (2) smartphone-driven “micro-solipsism”; and (3) younger generations witnessing objectively toxic behavior in politics being rewarded. People (understandably) are experiencing a form of “cognitive drift,” some even calling it “medieval peasant brain,” tied to the internet’s relentless information flood (e.g., putting potatoes in socks to “detox”).

We’re trapped in a compound crisis—economic deterioration and cognitive overload interacting in a recursive trap, each worsening the other and destroying the resources needed to break free.

-

Economic stress (such as Baumol’s cost disease, housing issues, weak labor markets) impairs our ability to think clearly, making us more vulnerable to scams, poor decisions, and exploitative markets, which in turn deepen economic stress.

-

Economic stress + information overload erodes trust in institutions.

-

Loss of trust makes coordination impossible, problems unsolved, and unresolved issues deepen the crisis.

Right now, we’re trying to understand the economy against a backdrop where social and cognitive conditions are changing faster than traditional economic indicators. This is the context of the “vibecession.”

Note: Given that Paul Krugman and Scott Alexander have recently revisited this concept, it’s worth re-examining what “vibecession” meant in the past and how it has evolved today.

Vibecession: Past and Present

I first coined the term “vibecession” (Vibecession) in July 2022. At the time, inflation was falling (but still painfully high), the labor market was recovering, and the economy was growing. AI hadn’t yet captured all attention, there were no tariff wars, and major infrastructure investments were underway. By the numbers, everything seemed to be improving.

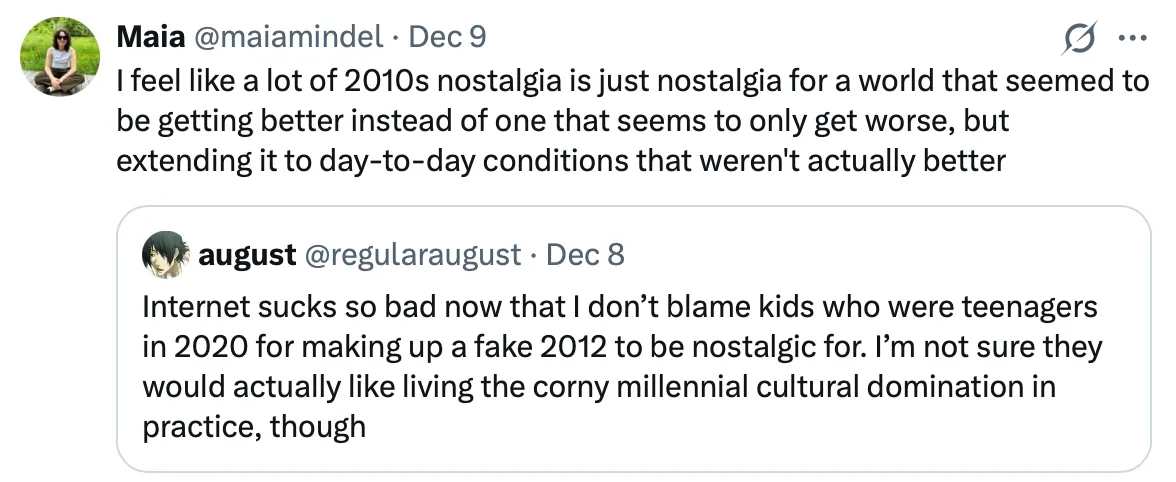

While the 2000s and 2010s had many problems (many indeed!), people’s moods hadn’t fully collapsed. Now, TikTok even has a nostalgic trend (nostalgiacore), where teens fabricate a fantasy of “2012”—dreaming of infinity scarves, third-wave coffee shops, and an Instagram that used to share photos of daisies in fields, rather than today’s hyper-competitive algorithmic battleground.

There was still a glimmer of hope (the core of Obama’s campaign!), and people held “better” expectations for the internet’s future. Though the internet already had issues, it wasn’t yet monetizing outrage as it does now.

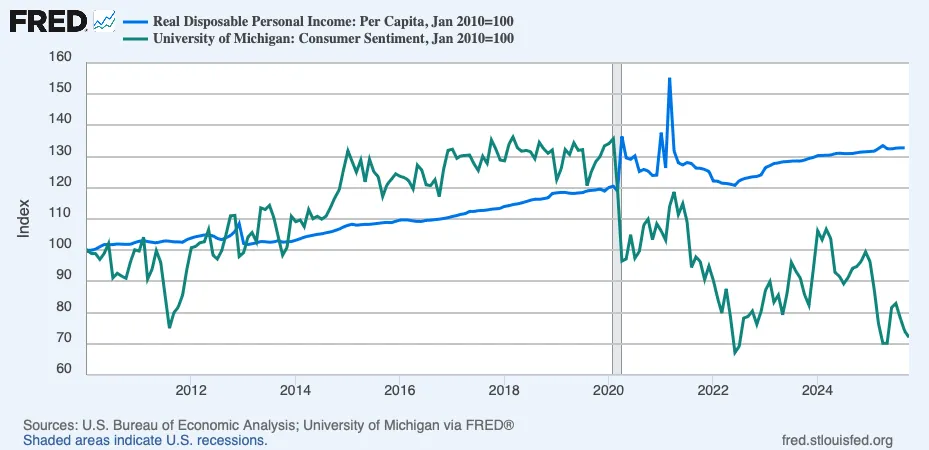

Some claim “the entire past decade has been a vibecession,” but sentiment data doesn’t support this. In fact, the emotional break is sharp and sudden.

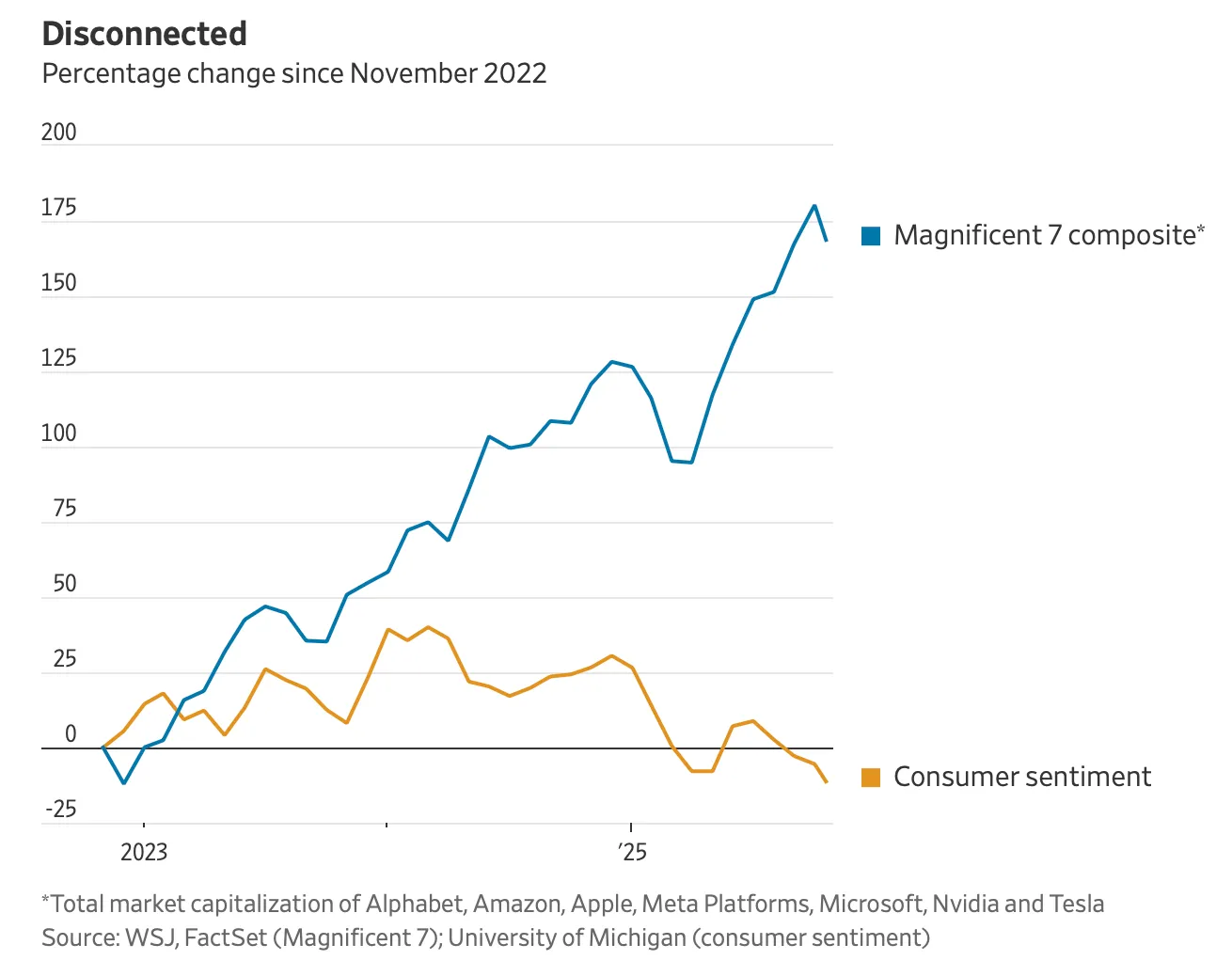

The chart below roughly shows when the “vibecession” began, illustrating the divergence between sentiment and economic data. After the pandemic shock, real disposable income recovered and continued growing, returning to its normal trend. Yet public sentiment never recovered. It slid into recession-like (or worse) territory and stayed there, even as economic fundamentals stabilized.

I think part of the reason lies in cumulative effects. The chaos from the pandemic hasn’t ended—prices remain volatile, stores are understaffed, teachers and students are exhausted, public information systems have collapsed, institutions appear fragile. Daily life friction accumulates in countless small ways. Pandemic-era home price surges never reversed. As the Fed raised rates, mortgages “locked” people in place. Rent skyrocketed, and the path to adulthood—moving out, renting, saving, buying—has broken for many. If you didn’t buy before 2020, you likely never will.

But as Dan Davies wrote, “vibecession” (Vibecession) may not have a specific trigger. “Mood is like a supercooled liquid, waiting for a random shock to trigger phase change.” And the pandemic was that shock.

The vibecession came early. Now, economic data and people’s emotions align—or at least match more closely than before. We now face low hiring, persistent inflation, and extremely odd trade policies. When the National Bureau of Economic Research (NBER) defines a recession, it looks at three aspects:

-

Depth: How severe is the economic decline?

-

Diffusion: How widespread is the pain?

-

Duration: How long has this lasted?

If we look at the decline in consumer sentiment, it (roughly) fits the definition of a recession—it’s long-lasting, widespread, and sentiment levels approach historical lows. Schwab’s Kevin Gordon calls it “vibepression”—extremely low mood, while GDP is propped up by AI-related investment. Can an economy booming from AI data centers make ordinary people happy? Clearly not!

But why do we feel this deep sense of gloom?

Part One: Economic Deterioration

A few weeks ago, Michael Green published an article claiming “$140,000 is the new poverty line,” arguing that almost no one can now afford the cost of participating in society. The piece sparked heated debate online. Then Tyler Cowen, Jeremy Horpedahl, and others pushed back. Yet, as John Burn Murdoch wrote, the reaction itself was fascinating.

Most strongly agreed with the article’s sentiment (many rebuttals were met with “who cares if the data is accurate—the vibe is right!”). The article was republished by outlets like More Perfect Union and The Free Press. Both left and right readers said: “Yes, this is why everything feels so bad. This is poverty. My economic pain is finally validated by data. What a relief.”

Being “seen” in analysis brings relief. In his series on “vibecession” (Vibecession), Paul Krugman pointed out three key concepts poorly captured by traditional economic data:

-

Economic participation: Can you afford to participate in society?

-

Security: Are you one bad tooth away from bankruptcy?

-

Fairness: Are you being cheated?

People need to feel they can afford homes, children, or cars, that a medical bill won’t bankrupt them, and that others aren’t cheating them. And answers to these questions are becoming harder to find.

On the first point—the Fed cut rates yesterday, sparking controversy and division. Their dual mandate—price stability and maximum employment—is under increasing strain. Inflation hasn’t fallen to the 2% target (bond markets are deeply concerned). The labor market is weakening, and inequality is rising.

There is very real economic pain—participating in society is harder. Young people once voted for Trump to improve the economy, but now they’re turning against him. According to Yale’s Fall 2025 Youth Poll, 18- to 29-year-olds express strong dissatisfaction with President Trump’s handling of the economy.

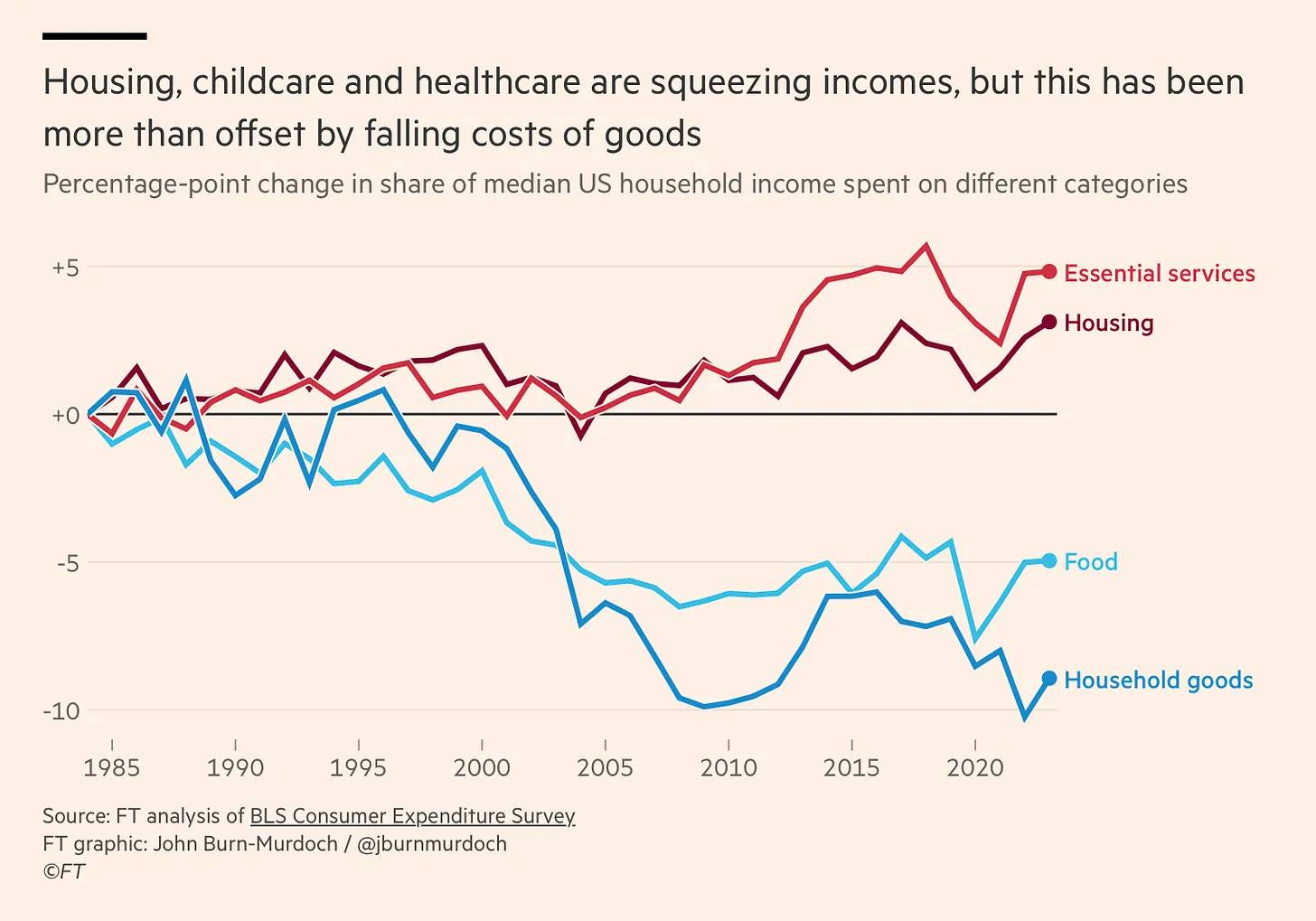

John Burn Murdoch points out we’re facing “Baumol’s Cost Disease.”

The same productivity gains driving down prices of tradable goods cause costs of face-to-face services to balloon rapidly. Sectors like healthcare and education, requiring intensive human labor, must raise wages to attract workers who might otherwise choose higher-paying jobs in more productive industries—even though productivity growth in these sectors is slow (or nonexistent). As a result, even if people consume the exact same mix of goods and services, they find themselves spending more and more on essential services as national living standards rise.

Prosperity may actually make life more expensive.

Source: Financial Times. Paul Starr in The American Prospect documented the collapse of cultural affordability under Baumol’s Cost Disease, noting that “public elementary and secondary schools, public libraries, low-tuition land-grant colleges, and 20th-century mass media—including free broadcast radio and television” were once free or heavily subsidized. Now, support for arts and education is being cut.

In reality, this means core elements of middle-class life—housing, healthcare, childcare, education, eldercare—all fall within Baumol sectors. Their costs rise faster than wages. Even if you “do everything right,” you may still feel financially underwater.

In the 20th century, we partly solved Baumol’s cost problem by socializing or heavily subsidizing these areas—public schools, libraries, low-tuition state universities, public hospitals. Through policy, we made these expensive, low-productivity sectors cheaper. Yet now, at precisely the worst moment, we’re privatizing (or dismantling, bureaucratizing) these sectors. We’re shifting costs once shared socially onto households. Is it any wonder the middle class feels strained?

Of course, things get even more complex. AI will make non-Baumol sectors hyper-efficient. Software development, data analysis, and anything computer-related will become abundant and cheap, meaning the productivity gap between scalable and non-scalable sectors will grow into a massive chasm.

Second issue—the government shut down this year over healthcare. The average health insurance premium for a family of four is $27,000 annually. Premiums are expected to rise 10%-20% next year. Many are one bad tooth away from bankruptcy.

Third issue—we’re rapidly moving toward a quid-pro-quo economic model. America, once a beacon of democracy, is now trading land with Russia, demanding tourists’ five years of social media history, threatening the independence of independent agencies like the Fed, and ignoring antitrust laws to enable media control. When you read such news and see such headlines, your mood naturally plummets.

Thus, for many—especially young people trying to build lives—economic fundamentals have indeed worsened. But economic stress alone can’t fully explain this deep anxiety. That’s when cognitive factors come into play.

Part Two: Cognitive Overload

These issues aren’t new, right? For years, America has been sliding toward a tougher equilibrium. People have long experienced high housing costs, tight job markets, and Baumol’s cost disease. But the difference now is that these pressures are landing on a public already cognitively and socially overwhelmed.

For most of human history, literacy was scarce, but attention was abundant. Outside of work, people were mostly in what we’d now call “boredom.” Today, it’s the opposite—literacy is declining, attention is commodified, and cognitive load is completely overloaded. Jean Twenge wrote in The New York Times an article titled “The Screen That Ate Your Child’s Education,” stating:

In a study published in October in The Journal of Adolescence, I found that countries where students use electronic devices more for entertainment during school hours show significantly greater declines in standardized math, reading, and science test scores compared to countries with less usage.

And Brady Brickner-Wood wrote in “The Curious Notoriety of Performative Reading”:

Americans spend 40% less time on leisure reading than two decades ago, and 40% of fourth graders lack basic reading comprehension... Meanwhile, colleges are partnering with companies like OpenAI to integrate chatbots into student curricula, while humanities departments are being continuously cut.

If you trust no information source, you won’t trust economic data. We conducted a massive experiment—giving people unlimited access to millions of things that could destabilize them—and the answer is, no, it really doesn’t work. It’s like boiling the whole population into a single egg.

The loss of education and deep reading triggers cascading effects: weak foundational skills, declining media literacy, and, more importantly, the collapse of trust. David Bauder’s research on teen news consumption shows that “about half of surveyed teens believe journalists give special treatment to advertisers and fabricate details like quotes.”

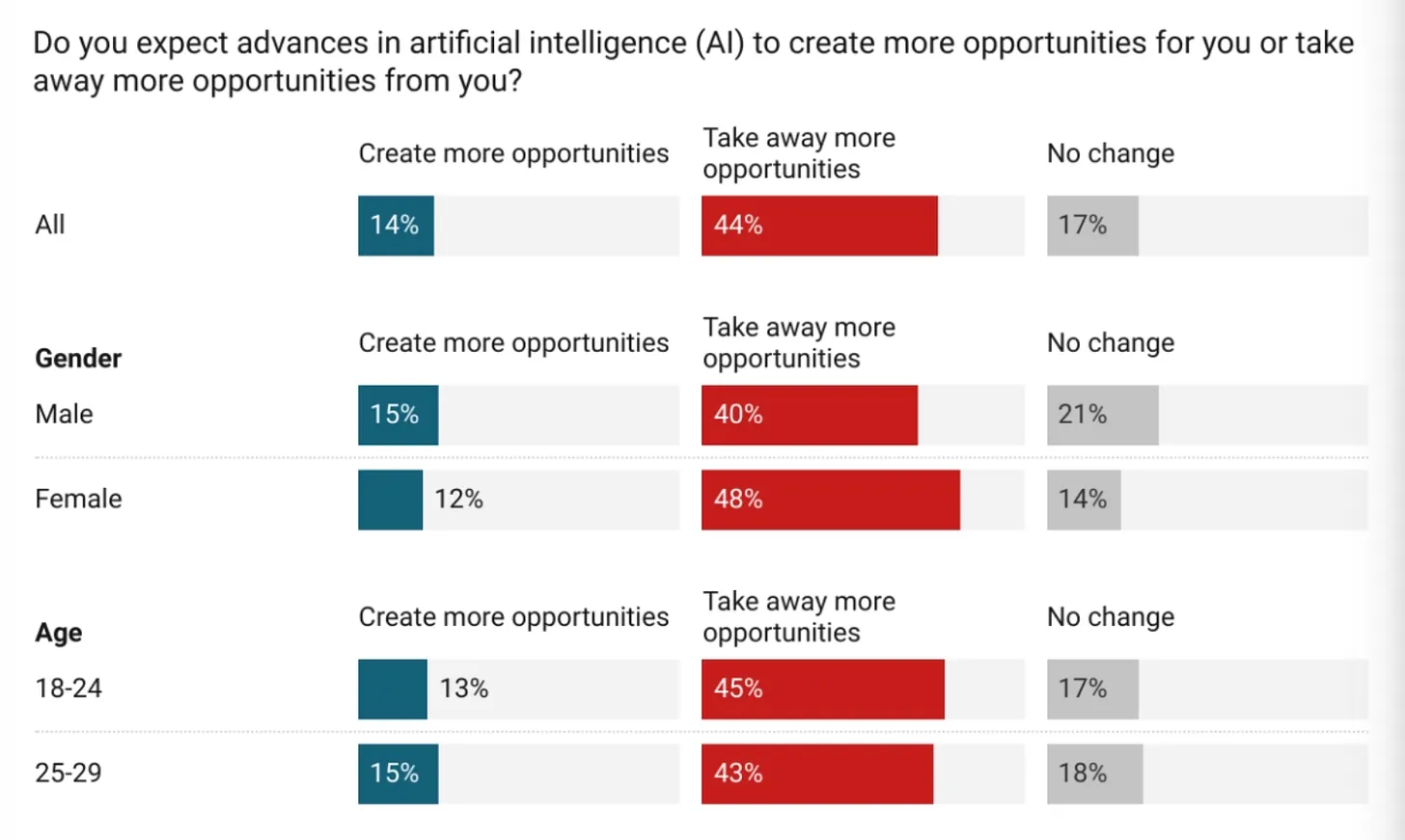

AI only makes this more complex. Greg Ip’s Wall Street Journal article, “The Most Joyless Tech Revolution Ever: AI Is Making Us Rich and Unhappy,” captures it perfectly. Nearly two-thirds of people feel uneasy about AI, and only 40% trust the AI industry to do the right thing. We have all this technology, yet we don’t trust each other and feel awful.

Source: Greg Ip, WSJ

So when we talk about negative sentiment, there’s indeed a “computerized” quality to it.

We’re collectively plagued by the Bullshit Asymmetry Principle: debunking a lie is ten times harder than creating one. This enables marketing and product strategies like “ragebait”—and is also a great way to raise massive venture capital?

Misinformation has become an effective wealth accumulation tool: if you lie to enough people and make them angry at you, Twitter pays you handsomely. Foreign actors are also using this “printing press”—which logically makes sense—and polluting American politics in ways that should arguably be illegal?

Many are also “skimming” at every level, cheating to gain advantage—what Krugman called the “scam” problem. Every adult senses their attention slipping away, their thinking flattening, their world filled with noise, no neutrality, and no institution truly existing to protect them. Bro, your brain is being sold—and as attention dissipates, so do cognitive capacity, depth, and certainty.

Confidence, optimism, and long-term thinking require “mental space.” If the information environment is chaotic, the emotional environment becomes chaotic too. And if attention is the infrastructure of democracy, that infrastructure is already badly damaged.

We’re seeing the consequences of outsourcing human learning to screens. Now, we may witness what happens when we outsource humanity itself to AI. When you can’t trust any information source, you can’t trust economic data. When attention is fragmented and thinking flattened, people become more vulnerable to the next stage: extraction.

Part Three: Extractive Economy

As the cognitive world unravels, maintenance of the physical world isn’t faring much better. The friction between decaying physical domains (bridges, schools, labor markets) and hyper-optimized digital domains (large language models, algorithms, ad tech) is becoming increasingly obvious.

In this newsletter, I’m quite harsh on artificial intelligence (AI)—to be clear, I believe AI is a tool that can drive significant scientific breakthroughs—but AI itself is creating a full downward spiral. In a documentary, Demis Hassabis’s discussion of AI is crucial, and as Linus Torvalds said in a recent interview:

I strongly believe in AI’s potential, but I don’t like what’s around AI. I think the market and marketing are sick. This will lead to a crash.

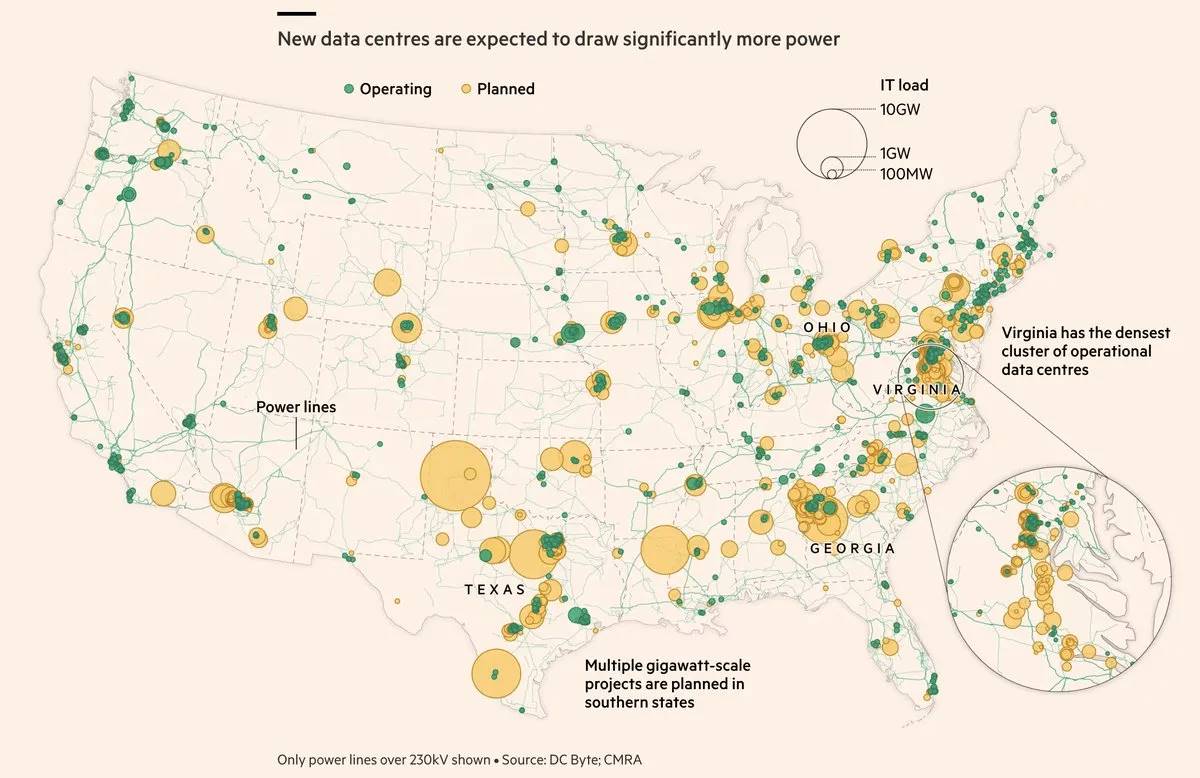

Today, people become billionaires by expanding data centers, driving up electricity costs and blackout risks. These centers occupy vast physical space, yet their impact is nearly invisible to ordinary people—except for rising power bills.

The AI race is an energy race, not a computing race. As the Financial Times wrote:

In the competition among global superpowers, AI could be slowed by decades due to outdated grid infrastructure and insufficient power capacity.

Source: Financial Times

The Financial Times also reported that OpenAI’s partners have taken on $100 billion in debt to build AI computing capacity. This is concerning because debt is where problems turn dangerous. The dot-com bubble was mainly an equity crash, meaning no complex web of debt relationships. But once debt enters the picture, things quickly become very messy.

The U.S. also decided to sell some top-tier Nvidia chips to China in exchange for soybeans and a 25% kickback. As the U.S. Department of Justice stated:

The nation controlling these chips will control AI; the nation controlling AI will control the future.

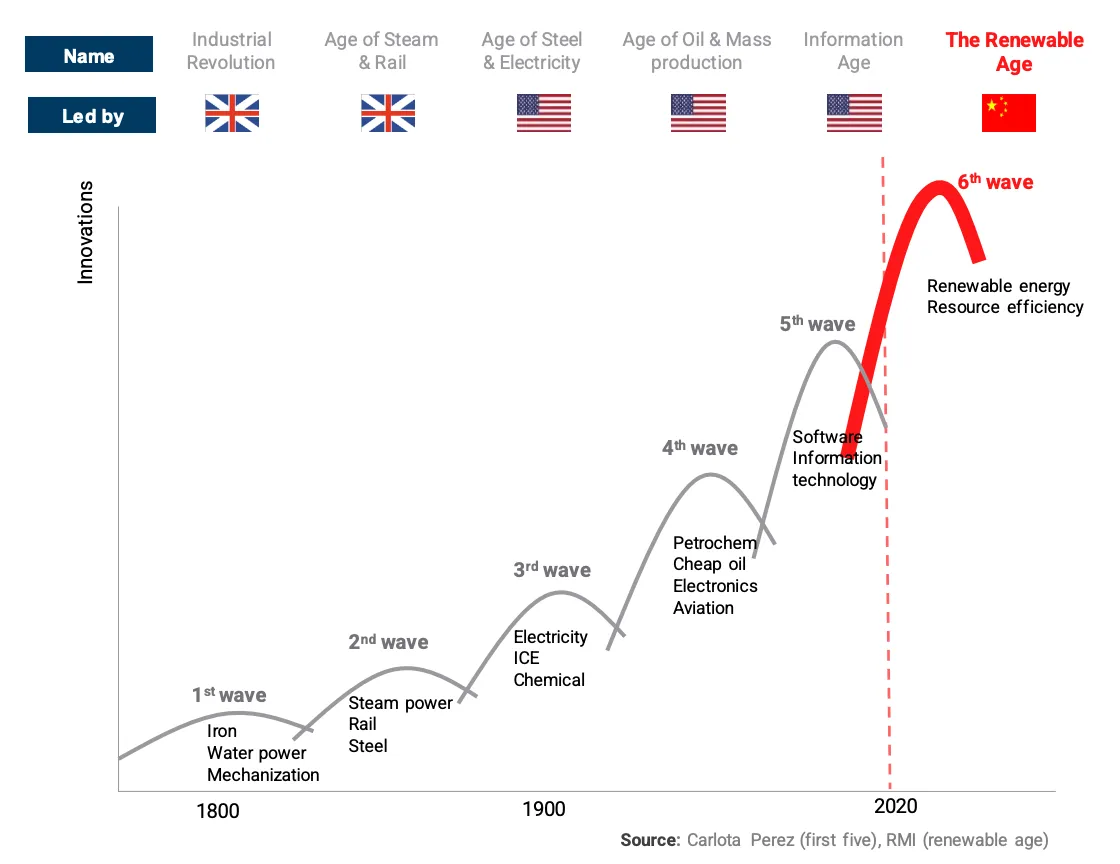

So, you know, that’s fine. The Financial Times reports the U.S. is losing the AI race, “with many American companies, including Airbnb, becoming loyal users of ‘fast and cheap’ Qwen.” They pose the question: “Can the West catch up with China?”

The chart below is critical—when we talk about the future, we often assume the U.S. is the leading global superpower, but China is investing in the key ingredient for AI success: energy. The U.S. is doing the opposite.

Source: Phenomenal World

Barclays estimates that over half of U.S. GDP growth by 2025 will come from AI-related investment. People realize we’re betting the economy on something that doesn’t promise much—like “hey :) this thing will take your job :) now it can do art too :) might make some people very rich, but your electricity bill (which is already changing voter attitudes) will rise. And China might win. Also, suicide violates terms of service.”

Virtually all young people are deeply worried AI will take their jobs. MIT’s “Iceberg Index” estimates about 12% of U.S. wages come from jobs AI can already do more cheaply, but only 2% of jobs are currently automated. The capability exists—it just hasn’t fully launched.

How can you trust a system that seems indifferent to your future?

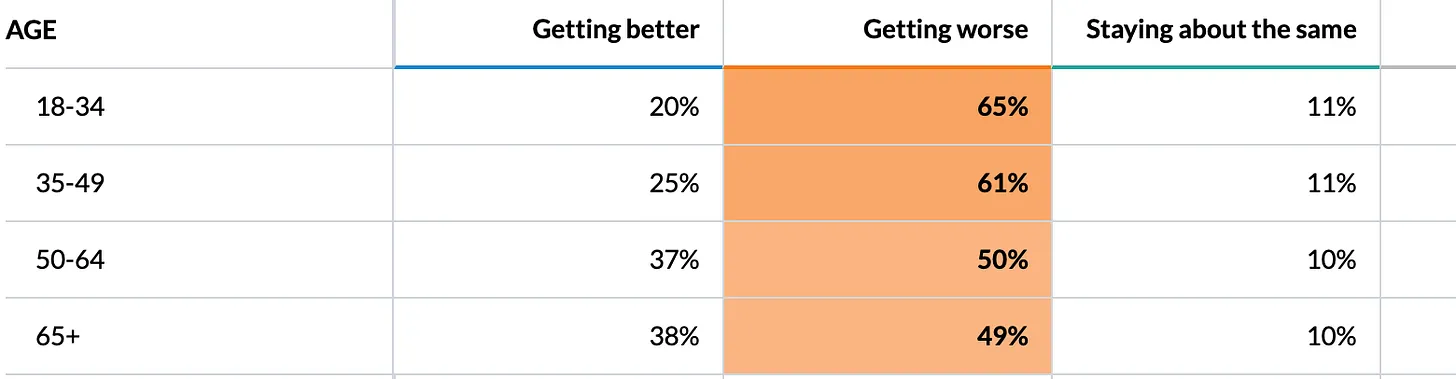

Source: Harvard Youth Opinion Poll. This might partly explain why nearly 40% of Americans over 50 believe the economy is “getting better,” while most Americans aged 18–49 believe it’s “getting worse.” These are two entirely different economic worlds. Older generations are largely insulated from AI and housing shocks, while younger people face these threats head-on.

Source: Civiqs

Adam Millsap wrote an interesting piece on “Total Boomer Luxury Communism.” This concept refers to older generations “hoarding opportunity and resources, while young people struggle to buy homes and support generous Social Security and Medicare benefits expected by the wealthiest boomers.” This intergenerational tension will only intensify with longevity-enhancing medical technologies and resource scarcity.

So what should people do? AI is taking jobs, policy is increasingly designed around the elderly, everything feels uncertain. How do we move forward?

Gamble?

Tarek Mansour, co-CEO of Kalshi, recently said: “Our long-term vision is to financialize everything and turn any disagreement into a tradable asset.”

Financialize everything??? Every disagreement, every uncertainty, every future outcome—turned into a bet??? This is the extreme extension of Marx’s “commodity fetishism.” When every interaction becomes a transaction, every opinion a tradable asset, building solidarity becomes incredibly difficult.

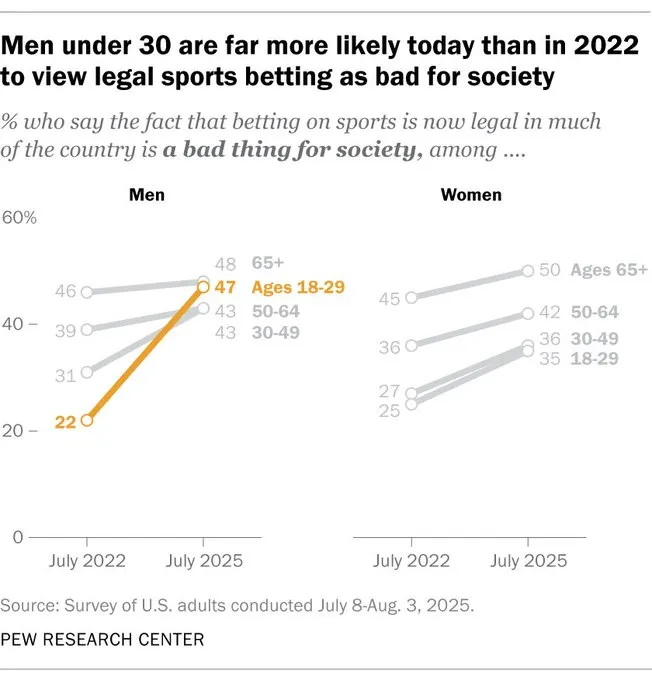

Gambling has become one of the few activities offering immediate rewards, even life-changing outcomes. Living near a casino increases the likelihood of becoming a problem gambler. And when you live inside your phone, the casino comes directly to you—I’ll let you imagine the rest. But the truth is, nobody actually wants this life. As shown below, this is what’s truly depressing about the “casino economy”—nobody wants it.

Attention is monetized, engagement is optimized, risk is financialized—everything feels like a scam. As Whitney Curry Wimbish wrote in The American Prospect and Emily Stewart noted in Business Insider, layers of middlemen extract value with almost no real regulation or protection. Some might say: “Well, clearly the market has expressed its preference, and that preference is for people to spin the roulette wheel.” But I don’t know how to respond.

When the labor market tightens, upward mobility stalls, wealth concentrates at the top and becomes harder to reach, gambling appears a rational response. In this structure, people lose a sense of purpose and meaning (save us, Viktor Frankl), and that’s exactly when problems begin.

Reduced cognitive bandwidth + ubiquitous extraction systems = rational economic paranoia. People feel cheated because they often are. When traditional paths become unpredictable, people turn to “narrative ladders”—online communities, aesthetic categories, etc. These become ways to make sense of uncertainty. The debate over the “$140,000 poverty line” erupted in this context. Reactions are about identity and experience, about whether one’s worldview is understood by others. These reactions aren’t all rational—but they exist.

When values diverge and common ground erodes, collective solutions become structurally impossible. Even with broad consensus—nobody truly wants the “casino economy”—we still can’t coordinate to stop it, because we can’t agree on what “stopping it” should look like or who should have the power to do so.

For the past 70 years, America operated on a simple contract: deliver growth, and people would tolerate everything else. But this year, after 40 weeks on the road, the most consistent feedback I’ve heard from people of all ages, regions, and income levels is that life’s basic trajectory no longer makes sense. These are scattered anecdotes, but they’re what people stop to tell me most—what worries them. They worry not just about finances, but about the entire future.

Part Four: Trust

We’re in a complex crisis: economic stress reduces cognitive bandwidth, reduced bandwidth fuels extraction, and extraction worsens economic stress. Stress and overload jointly erode trust, loss of trust blocks collaboration, failed collaboration leaves problems unsolved, and unsolved problems deepen the crisis.

This isn’t a problem solvable by a single policy lever. When the trap exists at the intersection of housing, AI regulation, and media literacy, you can’t fix it by just “fixing housing” or “regulating AI” or “improving media literacy.” Economic deterioration and cognitive collapse reinforce each other, destroying the institutional capacity and social trust needed to solve them.

It sounds terrible! But breaking this cycle doesn’t require solving everything at once. We need to identify the most actionable levers and recognize that improving one area weakens the trap elsewhere.

Directly reduce economic stress—make Baumol sectors (like education, healthcare) affordable again (I know, too simple, right?). If people have more breathing room economically, their cognitive bandwidth increases. We all know this. More bandwidth means less vulnerability to extraction and fraud. Less vulnerability means better decision-making, which means less economic stress.

Directly regulate extraction—ban or strictly limit business models that profit from confusion and cognitive overload. Kalshi wants to financialize everything? We can say “no”! Ban prediction markets on elections. It’s all about incentives. We can regulate physical casinos—we can absolutely regulate digital ones.

Make AI’s benefits visible—currently, people’s experience of AI is “your electricity bill goes up, and eventually it takes your job.” If AI is to drive growth, that growth must translate into tangible benefits for ordinary people—like lower healthcare costs via diagnostic tools, cheaper goods, and more free time.

None of this is easy, or even imaginable. But there’s hope. You don’t need to solve everything at once. It requires economic affordability (heard the “affordability tour” just started), state capacity, some friction, and understanding “humanity” in a technological world. Plus one seemingly simple but daunting task—eradicate crony capitalism and build some shared sense of reality. Mid-flight across the country, the internet went out, hours after that person coughing into thin air. I was frantically typing, doing various “very important work,” like writing this newsletter. We were all typing in the dark, sending emails, busy on Slack. When the internet dropped, we opened the plane windows. Outside was one of the most beautiful sunsets I’ve ever seen. There’s something to reflect on there.

Finally, I love this quote from a recent interview with Kahlil Joseph:

“There’s a famous story about Jimi Hendrix mixing his music for transistor radios because that’s what soldiers listened on, so he tailored his work for FM radio. He didn’t imagine someone listening on a thousand-dollar sound system. That always struck me—meeting people where they are.”

Thank you.

Notes:

-

The University of Michigan Survey of Consumers switched from random-digit dialing to online surveys in mid-2024.

-

Netflix and Paramount are vying for Warner Brothers. According to the Wall Street Journal (WSJ), “David Ellison assured Trump administration officials that if he acquired Warner, he would overhaul CNN, a frequent target of criticism by President Trump.”

-

Reflections on internet impacts are gaining traction. Róisín Lanigan wrote an article titled “The Next Status Symbol is an Offline Childhood,” a title that speaks for itself. More similar pieces are emerging, like P.E. Moskowitz’s “The Internet is Destroying Our Memory and History,” exploring the trade-offs of internet life.

-

Cracks are appearing in financial markets. Applied Digital struggled selling bonds, having to offer a 10% yield to attract buyers. They provide data center services to CoreWeave, which in turn serves Nvidia and OpenAI.

-

Kalshi faces nationwide class-action lawsuits, with plaintiffs accusing it of operating an “illegal sports betting platform.” The suit claims Kalshi “deceives” customers into believing they’re betting against other consumers, when in fact they’re betting against the house (Kalshi). Additionally, a Nevada court ruled Kalshi isn’t exempt from state gambling regulations, posing a major challenge to its business model. A Bloomberg analysis shows Kalshi’s fees are so high that users would often be better off using FanDuel directly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News