IOSG | Policy Shifts and Market Transformation: Analysis of the U.S. Cryptocurrency Regulatory Framework

TechFlow Selected TechFlow Selected

IOSG | Policy Shifts and Market Transformation: Analysis of the U.S. Cryptocurrency Regulatory Framework

U.S. policy is a major lever shaping market structure and access to capital.

Author | Sam @IOSG

Introduction

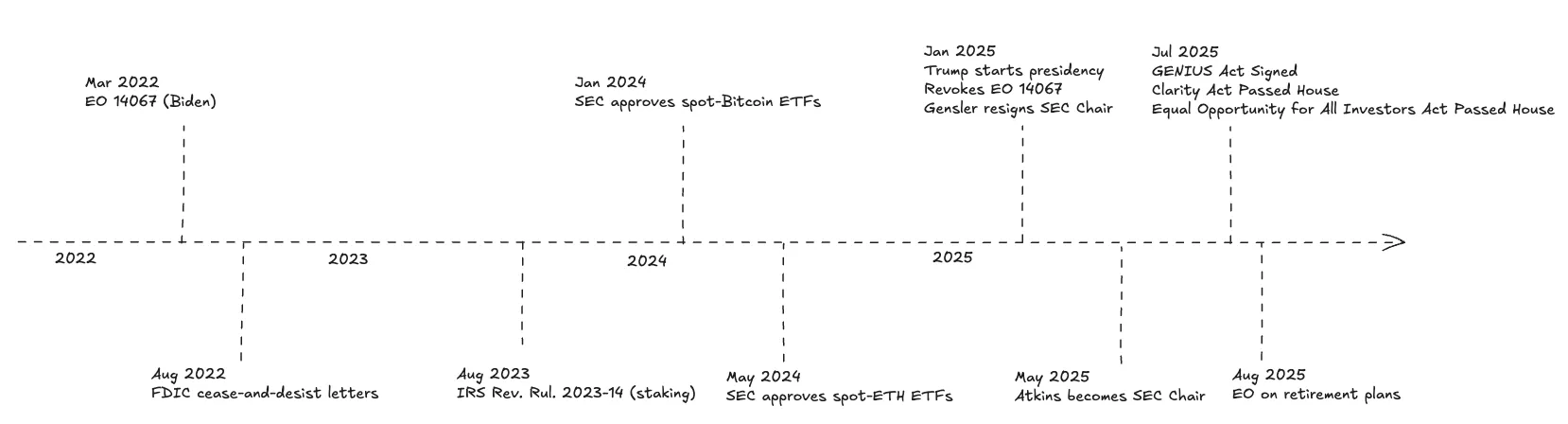

Over the past three years, the United States' stance on cryptocurrency has shifted significantly—from an early posture focused primarily on enforcement and relatively unfriendly regulation toward a more constructive, rules-first regulatory model. This policy shift is not only a key driver behind broader crypto adoption but also a critical catalyst for the industry’s next phase of growth.

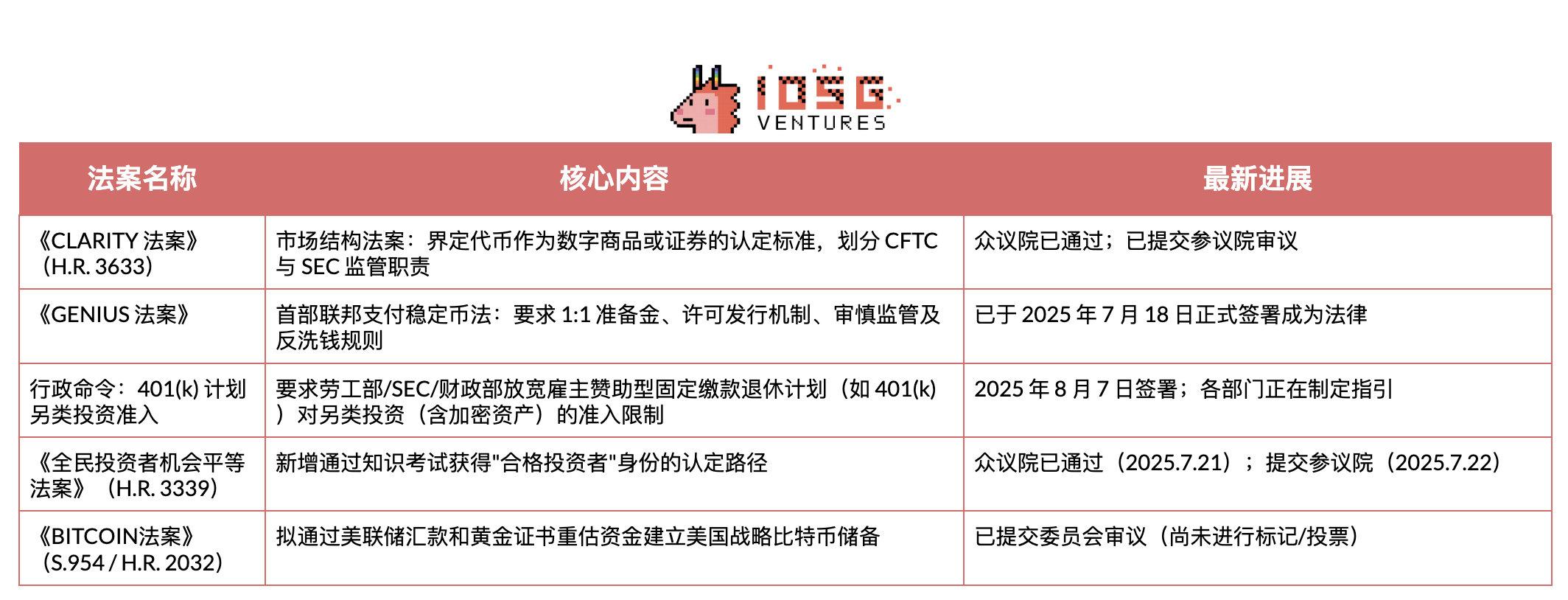

For investors, the following developments are currently most significant: The GENIUS Act has officially taken effect, establishing a foundational regulatory framework for payment stablecoins; the CLARITY Act passed by the House sets clear criteria for determining whether tokens fall under the jurisdiction of the Commodity Futures Trading Commission (CFTC) or the Securities and Exchange Commission (SEC); executive orders are pushing agencies to open 401(k) plans to crypto investments; and a House-passed reform of the qualified investor exam could expand access to private crypto transactions.

CLARITY Act

The CLARITY Act establishes whether a blockchain system receives SEC certification as a "mature system" as the core criterion for classifying digital assets as either "digital commodities" (under CFTC jurisdiction) or securities (under SEC jurisdiction). If a system is certified as mature, its native token may be traded as a digital commodity under CFTC oversight; other on-chain assets retain their existing classification.

What is a "Mature System"?

The Act specifies seven criteria for "maturity":

-

System Value: Market value driven by actual adoption/use, with a fundamentally sound value mechanism

-

Functional Completeness: Transactions, services, consensus mechanisms, and node/validator operations are all in live operation

-

Openness and Interoperability: The system is open-source, with no unilateral exclusivity restrictions on core activities

-

Programmable System: Rules are enforced by transparent code (no discretionary operations)

-

System Governance: No single entity or group can unilaterally modify on-chain rules or control ≥20% of voting power

-

Fairness: No special privileges (only decentralized processes allowed for repairs/maintenance/security operations)

-

Distributed Ownership: Issuer, affiliates, and related parties collectively hold less than 20%

The table below summarizes the key practical differences between digital commodities (CFTC jurisdiction) and securities (SEC jurisdiction). The CLARITY Act largely preserves the current regulatory division but provides a clear pathway for assets to transition from SEC to CFTC oversight—once the underlying blockchain meets the maturity criteria, relevant digital commodities can move into the CFTC regime.

With the legal framework established, the real question lies in how the CLARITY Act impacts specific crypto sectors.

Staking Services

Under the CLARITY Act framework, pure on-chain staking—that is, running validators/sequencers and distributing native rewards—does not require registration with the SEC. This "safe harbor" covers validator/node operation and the distribution of protocol rewards to end users.

However, this exemption does not extend to fundraising via minting or selling new staking derivative tokens. Projects must still timely obtain certification for mature blockchains and remain subject to anti-fraud and disclosure obligations.

Reviewing the MetaMask/Lido/Rocket Pool case: Non-custodial, ministerial-style (i.e., executing only pre-defined protocol rules without autonomous decision-making) reward distribution models align better with the CLARITY Act's safe harbor. In contrast, Kraken-style pooled, custodial, yield-promising models would still be considered securities offerings and face similar regulatory risks if relaunched without reform.

Regarding liquid staking tokens (LSTs): 1:1 vouchers reflecting a user’s staked assets and protocol rewards fall under ministerial end-user distribution. However, models involving strategy selection (e.g., restaking/AVS allocation),叠加 points/additional yields, or issuing asset management tokens/shares that pool and redistribute earnings constitute managed investment schemes. Unless exempt, these remain under SEC jurisdiction.

Decentralized Exchanges (DEXs)

DEXs offering pure on-chain spot trading of native blockchain tokens (e.g., BTC, ETH, governance or utility tokens) are exempt from exchange registration. Operating core DEX smart contracts, order books, matching engines, or AMM factories is not considered an "exchange" activity under the Securities Exchange Act—and thus does not require registration as an exchange or broker-dealer for exempt token spot trading.

Platforms offering derivatives (futures, options, perpetuals), security tokens (on-chain stocks), or real-world asset tokens (e.g., gold) remain fully under SEC or CFTC oversight.

Distributing protocol fees to liquidity providers (LPs) or other users contributing work/assets qualifies as end-user distribution and falls under the CLARITY Act’s DeFi exemption. Note: The Act does not alter the definition of a security. If governance tokens (e.g., UNI) distribute cash or profits solely based on holding, they constitute a profits interest and, under the Howey Test (expectation of profit derived from others’ efforts), are likely classified as securities. In such cases, profit distributions and secondary trading of the tokens fall under SEC jurisdiction.

Decentralized Stablecoins

Collateralized Debt Position (CDP) models (locking collateral to mint USD-pegged tokens) are initially under SEC jurisdiction: tokens acquired through value contribution are treated as investment contracts until the protocol obtains certification as a mature blockchain. Early teams may still raise funds under the CLARITY Act’s initial issuance exemption—up to $50 million over rolling 12 months—but must fulfill crypto-specific disclosure requirements and bear full-cycle anti-fraud liability for four years. Once governance is fully on-chain and no single entity controls ≥20% of voting power or collateral, the protocol can apply for maturity certification. Thereafter, governance tokens and mint/burn mechanisms shift to CFTC digital commodity oversight, no longer subject to SEC securities rules.

Delta-neutral models differ: due to reliance on crypto collateral combined with derivatives exposure and profit distribution mechanisms, they do not qualify for the CLARITY Act’s spot commodity exemption even if the underlying chain matures, nor do they fit within the GENIUS Act’s "licensed payment stablecoin" framework.

Lending

Lending falls under credit, not spot trading, and therefore does not qualify for the CLARITY Act’s spot commodity exemption. Unless relying on exemptions (Regulation D/Regulation S), pooled interest-bearing deposit instruments are considered securities.

Yield Aggregators

Immutable, non-custodial aggregator contracts (where no single party can unilaterally modify them) do not need to register as trading platforms or intermediaries.

However, any governance token or vault share granting future profit rights constitutes an investment contract at issuance. Additionally, complex custodial strategies may trigger multiple registration requirements: if rebalancing or control occurs off-chain or under centralized operators, projects lose DeFi exemption and face compliance obligations as brokers/dealers or exchanges.

ETF Staking

The CLARITY Act provides foundational support: it formally recognizes staking rewards as "end-user distributions" (not securities) and allows native tokens to move under CFTC oversight once the network is certified as "mature." This removes a core securities law barrier to fund-level pass-through of protocol earnings.

However, ETFs must still comply with fund regulations. Two hard constraints exist: First, the Investment Company Act’s liquidity rule (Rule 22e-4) limits "illiquid assets" to 15% of net asset value; any asset that cannot be sold near book value within seven calendar days is deemed illiquid. Native staking positions with unbonding/exit queues typically fall into this category.

Second, for registered open-end ETFs, diversification requirements under the 1940 Investment Company Act apply: the well-known 75/5/10 rule means staking exposure and validator relationships cannot concentrate on a single "issuer" or operator. Practically, this requires multi-validator splitting and precise scale control to ensure no counterparty exceeds 5%/10% across at least 75% of assets (some crypto ETPs avoid this via non-'40 Act structures, but most staking ETFs register under the '40 Act using Cayman subsidiary architectures).

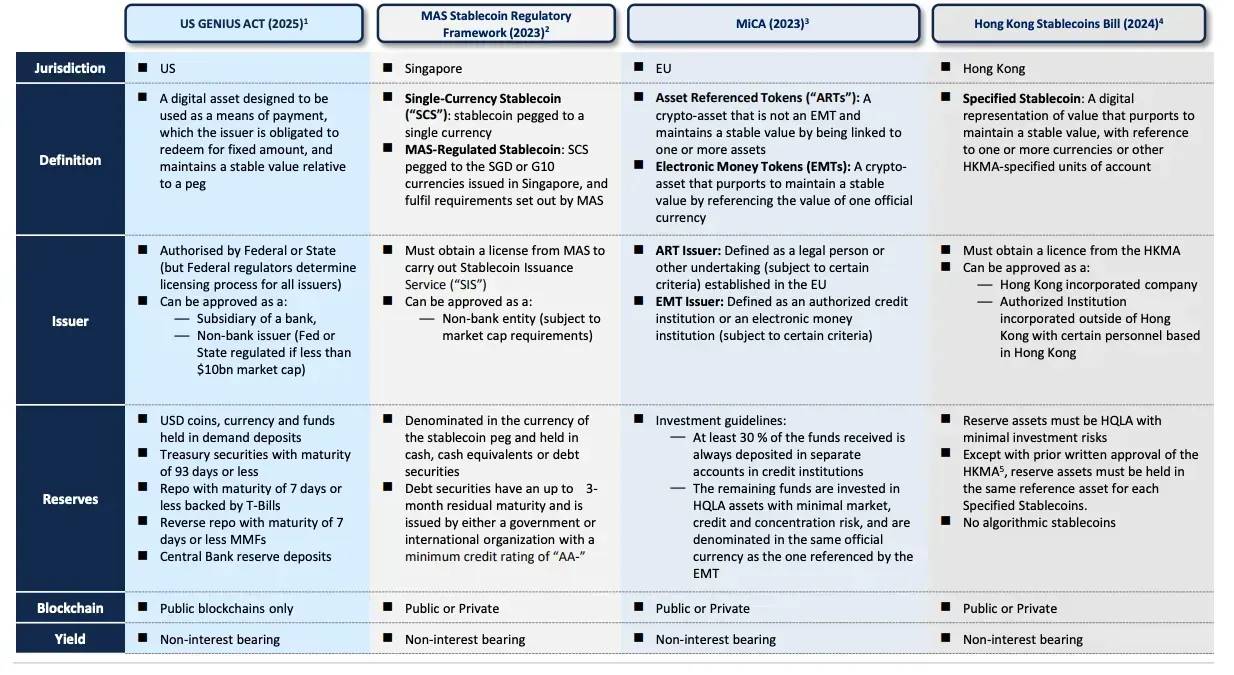

GENIUS Act

In July 2025, the U.S. enacted the GENIUS Act—the first comprehensive federal law regulating stablecoins.

The Act restricts issuance rights to regulated entities and establishes core rules on prudential operations, conduct standards, anti-money laundering, and bankruptcy resolution. Its key准入 threshold: "No person may issue a payment stablecoin in the U.S. unless licensed as a payment stablecoin issuer."

Issuers must maintain 100% reserves composed exclusively of:

-

U.S. dollars or deposits at Federal Reserve banks

-

Short-term U.S. Treasury securities with maturities under 93 days

-

Overnight repurchase agreements backed by Treasuries

Under Section (7)(A), "Payment Stablecoin Activity Restrictions," licensed issuers may only engage in:

-

Issuing payment stablecoins

-

Redeeming payment stablecoins

-

Managing reserve assets (including legally buying, holding, or providing custody)

-

Providing custody for stablecoins, reserves, or private keys as permitted by law

-

Conducting ancillary activities directly supporting the above

This strict list reflects clear regulatory intent: isolating stablecoin operations from high-risk activities to ensure redemption safety. The Act explicitly states, "Payment stablecoin reserve assets may not be pledged, repledged, or reused." This means banks—even when using tokenized versions of their own assets—cannot count them as loan collateral.

With the GENIUS Act clarifying issuance eligibility and reserve rules, multiple industries are shifting from pilots to scalable deployment:

-

Banking: Despite competition with tokenized cash for deposits, banks’ regulatory structure makes them natural issuers. The most likely path involves bank subsidiaries or tightly regulated bank-tech partnerships, starting with enterprise use cases, whitelisted counterparties, and conservative liquidity management—using stablecoin revenue to offset potential deposit loss.

-

Retail: Large merchants view stablecoins as tools to reduce card fees and settlement times. Early adoption will rely on licensed issuers and closed-loop redemption systems, promoted via settlement discounts rather than interest, and integrated directly with ERP and payment systems to improve capital turnover.

-

Card Networks: Visa and Mastercard are adding stablecoins as new settlement rails while retaining authorization, fraud detection, and dispute infrastructure. This enables weekend and near-real-time settlement without merchant front-end changes, shifting profitability toward tokenization, compliance, and dispute management services.

-

Fintech: Payment processors and wallet platforms are launching stablecoin accounts, cross-border payments, and on-chain settlement products built on bank-grade KYC, sanctions screening, and tax reporting. Competitive advantage will center on hiding blockchain complexity, offering reliable fiat on/off ramps, and meeting enterprise procurement and audit needs through operational control systems.

As the U.S. regulatory framework solidifies, similar models are emerging globally (e.g., Hong Kong’s Stablecoin Ordinance), with more stablecoin laws expected to follow.

▲ TBAC Presentation, Digital Money

Other Policy Developments

New Retirement Plan Investment Rules

The August 2025 executive order, "Expanding 401(k) Investor Access to Alternative Assets," aims to broaden investment options in employer-sponsored retirement plans, allowing savers to allocate to digital assets via actively managed investment vehicles.

As the responsible agency, the Department of Labor must reassess ERISA guidance within six months. Expected outcomes include reaffirming neutral, case-by-case prudent investor standards and introducing safe-harbor checklists.

The SEC, though independent, can facilitate access through rulemaking: clarifying qualified custodian standards, improving crypto fund disclosure/marketing rules, and approving retirement-friendly investment products.

Currently, most 401(k) core menus exclude crypto assets; access is mainly through self-directed brokerage windows—participants can buy spot Bitcoin ETFs (some plans include Ethereum ETFs), with a few providers offering limited "crypto windows." Near-term compliant paths will be limited to regulated, ERISA-compatible products: spot BTC/ETH ETFs and professionally managed funds with defined crypto allocations. Since 401(k) committees follow ERISA’s "prudent investor" principle, it is difficult to justify volatile single tokens, self-custody, or staking/DeFi yields for average savers. Most tokens and yield strategies lack standardized NAV accounting, stable liquidity, and clear custodial audit trails, and their legal status remains uncertain—raising risks of SEC/DOL scrutiny and class-action lawsuits if included.

Equal Opportunity for All Investors Act

This bill proposes a new "accredited investor" path via an SEC-administered knowledge exam. The House passed the draft on July 21, 2025; the Senate received it for review on July 22.

Early token presales, crypto venture capital, and most private rounds in the U.S. operate under Regulation D, currently restricted to accredited investors. The knowledge exam route would break wealth/income barriers, enabling knowledgeable but not necessarily wealthy individuals to participate in private crypto financing.

Critics argue that expanding access to opaque, illiquid private markets increases investor risk. The bill’s fate in the Senate hinges on whether the exam and safeguards are sufficiently rigorous. Even if passed, the SEC needs one year to design the exam and 180 days for FINRA rollout—meaning no immediate effect.

The BITCOIN Act

Signed by Senator Cynthia Lummis on March 11, 2025 (S.954), the BITCOIN Act proposes establishing a U.S. Strategic Bitcoin Reserve. It mandates the Treasury to buy 200,000 BTC annually for five years (total 1 million BTC), with a 20-year lock-up period (prohibiting sale, swap, or pledge). After 20 years, sales may occur only to reduce federal debt (limited to 10% of holdings every two years). The Act also requires confiscated BTC to be transferred to the strategic reserve after judicial proceedings.

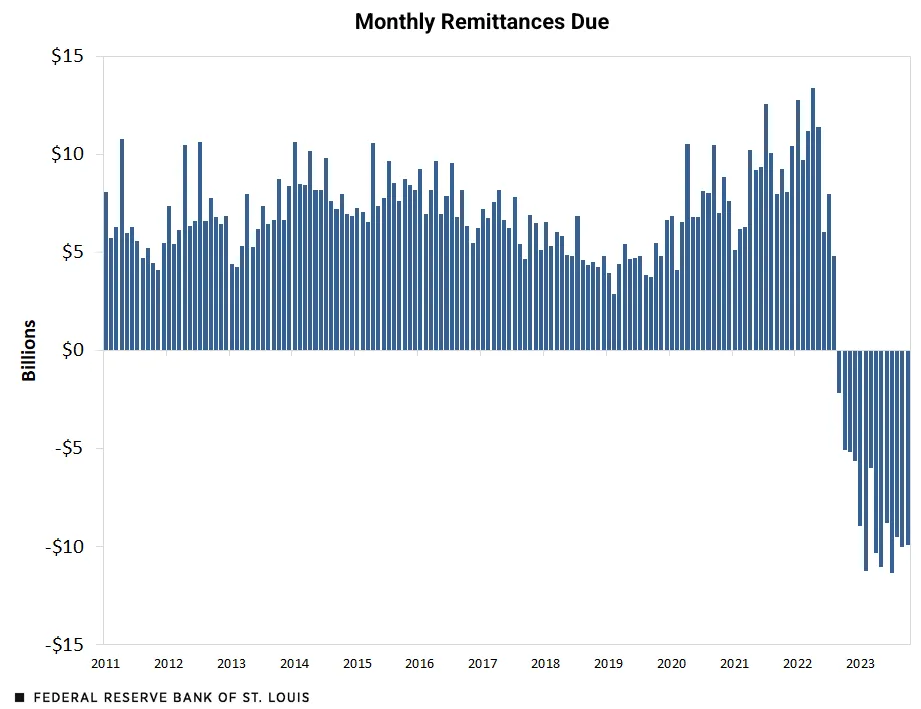

Funding does not rely on new taxes or debt but on: (1) prioritizing the first $6 billion of annual Fed remittances to Treasury (2025–2029) for BTC purchases; (2) revaluing the Fed’s gold certificates from $42.22/oz to market price (~$3,000/oz), with gains directed to the Bitcoin program.

▲ https://www.stlouisfed.org/

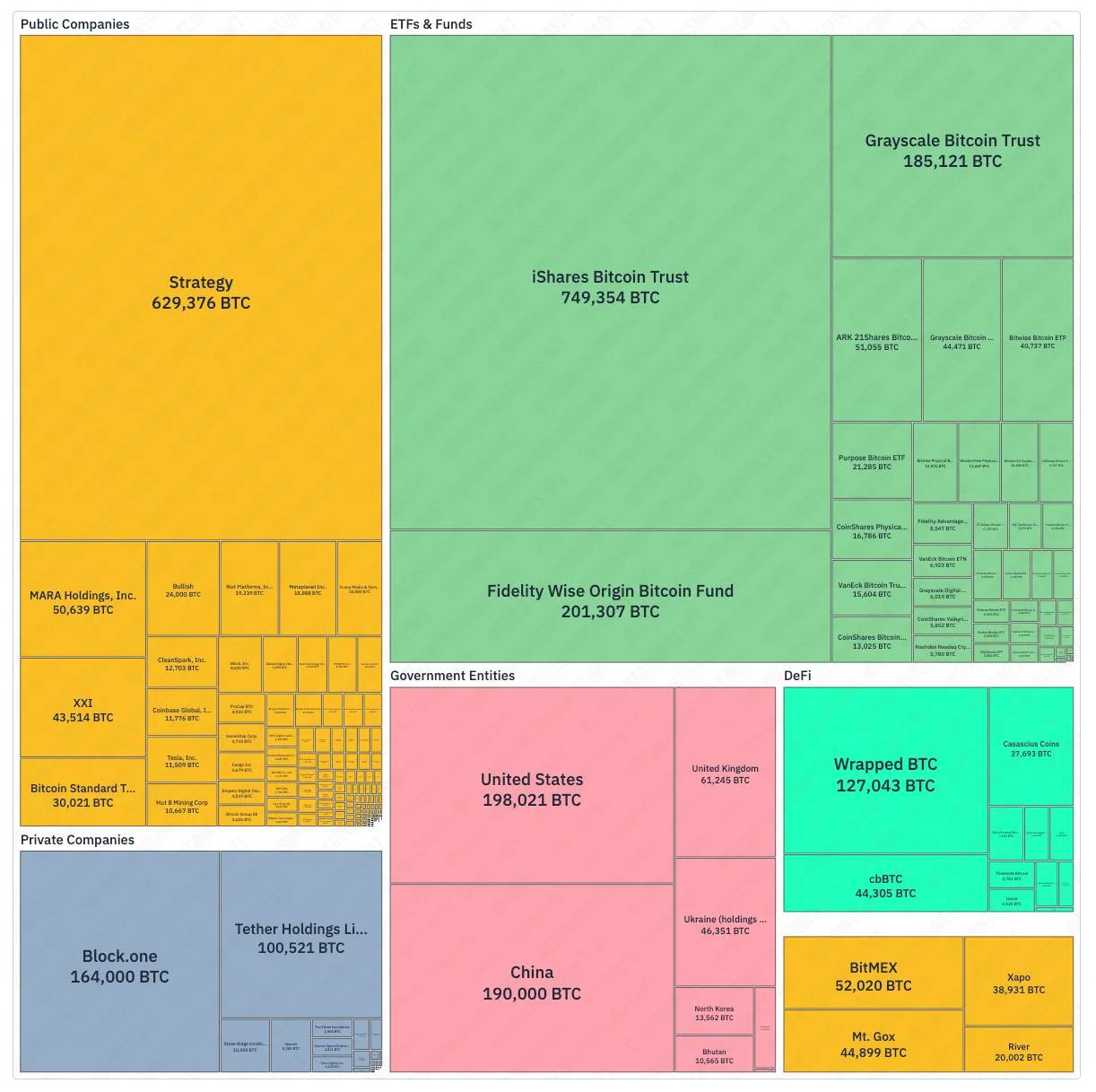

If fully implemented, the U.S. would accumulate 1 million BTC (about 4.8% of the 21 million cap). By comparison, MicroStrategy, currently the largest corporate holder, owns 629,000 BTC (~3%). This reserve would surpass any single ETF and even exceed the total ETF holdings across the industry as tracked by bitcointreasuries.net (~1.63 million BTC).

Elevating Bitcoin to strategic reserve status would grant it unprecedented legitimacy. This official endorsement could shift the stance of institutional investors previously hesitant due to regulatory uncertainty. If the U.S. leads, others may follow. These effects could create powerful price drivers: five years of sustained buying generates real demand, while a 20-year lock-up creates supply shock, potentially triggering global capital reallocation.

▲ bitcointreasuries.net

However, the BITCOIN Act has only been referred to the Senate Banking Committee and has not yet undergone debate or voting. Its progress lags far behind the House-passed CLARITY Act and the already-enacted GENIUS Act. Practically, the bill touches on core issues of Fed independence and budget politics: mandating 1 million BTC purchases locked for 20 years, funded by Fed remittances and gold revaluation. Currently supported mainly by Republicans, such major balance sheet decisions typically require bipartisan agreement to pass the Senate. More critically, directing future Fed remittances to Bitcoin purchases reduces fiscal revenues available for debt reduction, potentially increasing deficit risks.

ETFs

The clearest signal of policy shift is the SEC’s eventual approval of spot crypto ETFs after years of delay. In January 2024, the agency historically approved multiple spot Bitcoin ETPs, immediately launching trading, driving Bitcoin to new highs in March and attracting mainstream capital. By July 2024, spot Ethereum ETFs began trading in the U.S., with major issuers launching funds holding ETH directly.

The SEC has also shown openness beyond Bitcoin and Ethereum: actively reviewing other crypto ETF applications and collaborating with exchanges to establish common listing standards to streamline future approvals. Positive developments have also emerged in staking—recently, the SEC clarified that "protocol staking activities" do not constitute securities offerings under federal law.

U.S. Prediction Market Development

In early October 2024, a federal appeals court allowed prediction market platform Kalshi to launch ahead of elections, significantly boosting participation. The CFTC has since advanced event contract rulemaking and held a 2025 roundtable, potentially leading to further guidance or final rules despite no set timeline.

Polymarket, through its subsidiary QCX LLC (now renamed Polymarket US), obtained CFTC Designated Contract Market status and announced the acquisition of QCEX, stating it would "soon" open access to U.S. users. If integration and approvals proceed smoothly, and if the CFTC ultimately adopts a permissive stance on political contracts, Polymarket could participate in the 2026 U.S. election prediction market. Reports suggest the platform is exploring issuing its own stablecoin to earn Treasury yields on platform reserves, though currently, user returns come mainly from market-making/liquidity incentives rather than real-world yield on idle funds.

Conclusion

U.S. policy remains the primary lever shaping market structure and capital access, thereby exerting decisive influence on Bitcoin prices. The SEC’s January 10, 2024 approval of spot ETFs opened mainstream channels, propelling Bitcoin to record highs in March 2024; Trump’s November 2024 election win brought a favorable policy environment, further pushing prices to new peaks in July–August 2025. Future trends will depend on the pace of regulatory and infrastructural standardization.

Base Case: Continued policy implementation. Regulators enforce the GENIUS Act, the Department of Labor issues ERISA safeguards, and the SEC gradually approves ETFs and staking mechanisms. Access expands via brokerage windows and registered investment advisors (RIAs), while banks and card networks scale stablecoin settlement use.

Optimistic Case: Senate advances market structure legislation,首批 "mature blockchain" certifications are granted without major opposition, and the Department of Labor introduces safe-harbor regimes. Banks widely issue licensed stablecoins, and ETF product menus expand. This would accelerate pension/RIA allocations, deepen liquidity, and drive revaluation of compliant, truly decentralized assets.

Pessimistic Case: Legislative stagnation—all pending bills stall. The SEC delays or rejects staking-related ETF amendments. Bank regulators take a strict approach to GENIUS Act implementation, slowing large-scale issuance; major custodians restrict brokerage window access.

Regardless of scenario, several hard metrics will serve as key indicators: number of licensed stablecoin issuers and settlement volume,首批 maturity certifications and SEC objections, ETF net inflows and percentage of 401(k) plans with brokerage windows, and progress moving bank/card settlement pilots to full production. These metrics will reveal whether the U.S. crypto market is evolving into the regulated financial system—or retreating once again.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News