Exploring Crypto, Stocks, and Bonds: A Deep Dive into Leverage Cycles

TechFlow Selected TechFlow Selected

Exploring Crypto, Stocks, and Bonds: A Deep Dive into Leverage Cycles

Cryptocurrencies, stocks, and bonds support each other, with gold and BTC jointly backing U.S. Treasuries as collateral, stablecoins supporting the global adoption of the U.S. dollar, making the losses from deleveraging more socialized.

Author: Zuoye

Cycles originate from leverage. From fast-living, fast-dying meme coins to 80-year technological Kondratiev waves, humanity constantly discovers new forces, beliefs, or organizational methods to generate greater wealth. Let's briefly review our current historical coordinates to understand why the interplay among crypto, stocks, and bonds matters.

Since the end of the 15th century and the Age of Exploration, core capitalist economies have undergone the following transformations:

• Spain and Portugal——physical gold and silver + brutal colonial plantations

• Netherlands——stocks + corporate system (Dutch East India Company)

• Britain——gold standard + colonial trade arbitrage (military rule + institutional design + imperial preference system)

• United States——dollar + U.S. Treasury bonds + military outposts (abandoning direct colonization, controlling strategic points)

It should be noted that later entrants absorb the strengths and weaknesses of predecessors. For example, Britain also adopted corporations and stock systems, while the U.S. still engages in military domination. The emphasis here is on the innovative aspects of each new hegemon. Based on these facts, two key characteristics of classic capitalist trajectories emerge:

• Hegemonic Cope’s Law: Just as animals tend to grow larger through evolution, the scale of core economies keeps increasing (Netherlands->Britain->United States);

• Economic Debt Cycle: Physical assets and commodity production give way to finance; a hallmark of a classic capitalist power is its ability to profit via financial innovation and fundraising;

• Leverage Ultimately Collapses: From Dutch stocks to Wall Street financial derivatives, pressure for returns renders collateral inadequate, debts become unpayable, and new economies replace the old.

The United States has reached the maximum scale of global dominance. What follows will be a prolonged ending phase of "intertwined coexistence."

U.S. debt will eventually become uncontrollable, much like the British Empire after the Boer War. Yet to maintain a dignified exit, financial instruments such as crypto, stocks, and bonds are needed to extend the countdown to debt collapse.

Crypto, stocks, and bonds support one another. Gold and BTC jointly back Treasuries as collateral, stablecoins sustain the global adoption rate of the dollar, making the deleveraging process more socially distributed in terms of losses.

Six Combinations of Crypto, Stocks, and Bonds

All sources of human joy are ultimately illusory.

Growing larger and more complex is a natural law for all financial tools and even biological organisms. When a species reaches its peak, disorderly internal competition follows—ever more elaborate antlers and feathers are responses to increasingly difficult mating challenges.

Tokenomics originated with Bitcoin, creating an on-chain financial system from nothing. With a $2 trillion BTC market cap compared to nearly $40 trillion in U.S. Treasuries, its role is注定 limited to mitigation. Ray Dalio frequently advocating gold as a hedge against the dollar reflects the same logic.

Liquidity from the stock market becomes a new pillar for tokens. Pre-IPO markets open possibilities for tokenization, and tokenized stocks emerge as a new vehicle following digitization. Meanwhile, the DAT (treasury) strategy stands as the central theme for the first half of 2025.

However, while the tokenization of Treasuries is self-evident, issuing bonds based on tokens or tokenizing corporate debt remains experimental, though small-scale implementations have begun.

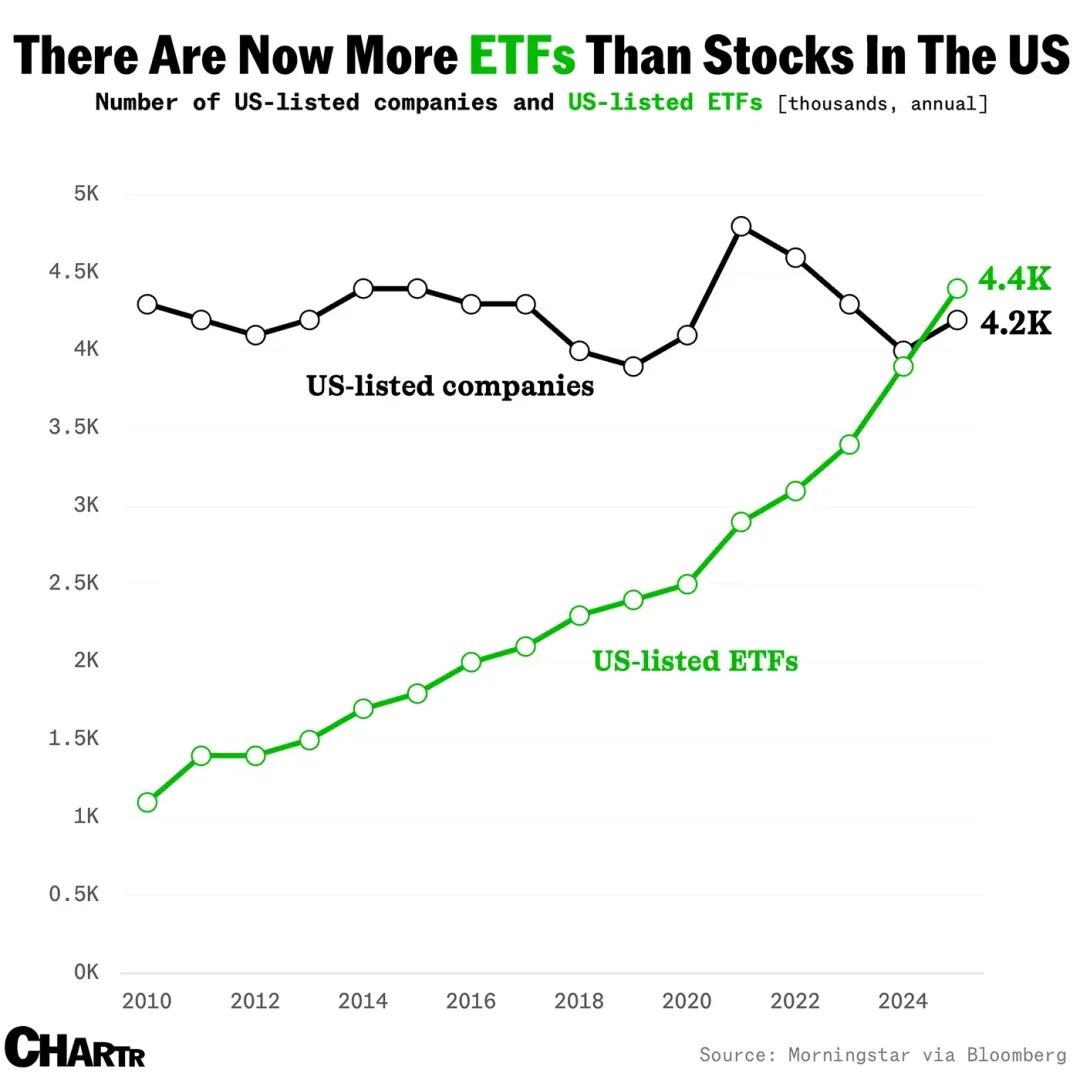

Caption: Growth in ETF count

Source: @MarketCharts

Stablecoins form an independent narrative. Tokenized funds and debts become new synonyms for RWA, while index funds and ETFs anchoring broader crypto-stock-bond concepts begin attracting capital. Will the traditional story of ETFs/index funds absorbing liquidity repeat itself in crypto?

We cannot judge this definitively, but the rise of altcoin DAT and staking-based ETFs signals the official start of a new leverage cycle.

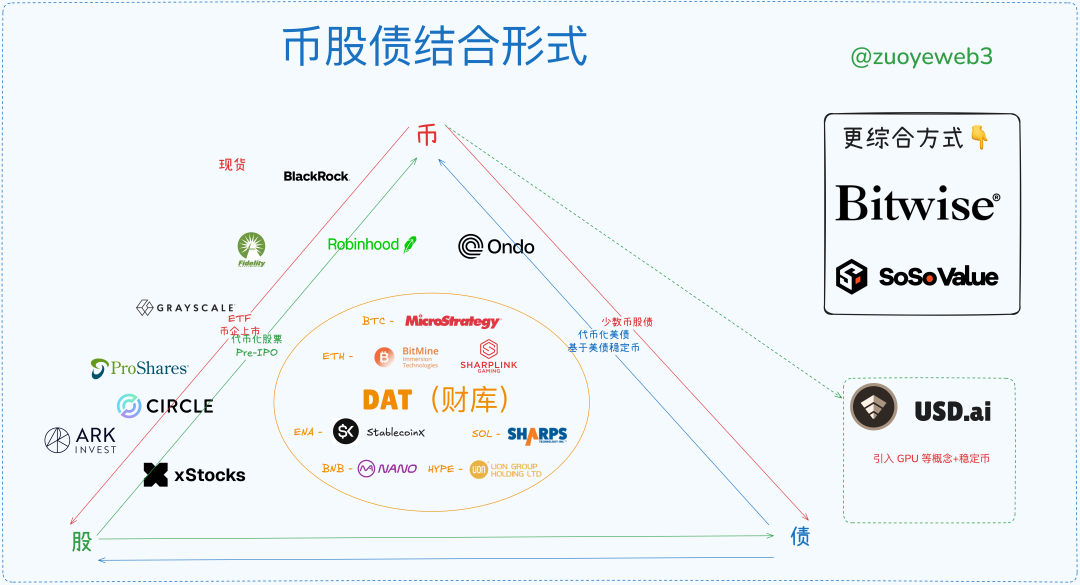

Caption: Forms of crypto-stock-bond integration

Source: @zuoyeweb3

Tokens as collateral are becoming increasingly ineffective in both DeFi and traditional finance. On-chain environments require USDC/USDT/USDS—variants of U.S. Treasuries in form. Off-chain, stablecoins are becoming fashionable. Prior to this, ETFs and RWA have already demonstrated their viability.

In summary, six primary forms of crypto-stock-bond integration have emerged:

• ETFs (futures, spot, staking, general-purpose)

• Crypto-stocks (financial engineering repurposed for on-chain use)

• Crypto-company IPOs (Circle representing a temporary "hard ceiling" for stablecoin trends)

• DAT (MSTR crypto-stock-bond vs. ETH crypto-stock vs. ENA/SOL/BNB/HYPE crypto-only)

• Tokenized U.S. Treasuries and funds (Ondo RWA theme)

• Pre-IPO market tokenization (not yet scaled, dangerous dormant phase, on-chain transformation of traditional finance)

The timing of leverage cycle endings and exits is unpredictable, but we can outline its basic contours.

Theoretically, when altcoin DAT appears, it marks the top of a long cycle. But just as BTC can consolidate near $100,000, if the dollar/Treasuries fully virtualize, the released momentum requires prolonged digestion—measured in decades: from the Boer War to Britain abandoning the gold standard (1931–1902=29 years), and the Bretton Woods system (1973–1944=29 years).

A thousand years is too long; seize the day. At least until the 2026 midterm elections, crypto still has a year of good times ahead.

Caption: Current state of the crypto-stock-bond market

Source: @zuoyeweb3

Analyzing the current market structure, crypto-company IPOs represent the highest-end, most niche segment. Only a tiny fraction of crypto firms can achieve U.S. stock listings, indicating that selling oneself as an asset is the hardest path.

Secondarily, reselling existing quality assets is simpler. BlackRock, for instance, has become the undisputed giant in spot BTC and ETH ETFs. The next battleground will be staking-based and general-purpose ETFs.

Further down, DAT (treasury) strategy companies lead the pack—the only players achieving full rotation across crypto, stocks, and bonds. They issue debt backed by BTC, support stock prices, then reinvest surplus funds into more BTC. This shows market recognition of BTC’s reliability as collateral and acceptance of the Strategy itself as a proxy for BTC’s asset value.

Companies like BitMine and Sharplink in the ETH treasury space achieve at best crypto-stock linkage. They haven’t convinced the market of their ability to issue debt based on their own strength (excluding debt raised purely for buying tokens). The market partially recognizes ETH’s value but not that of ETH treasury companies themselves. An mNAV below 1 (market cap lower than asset holdings) is merely the result.

But once ETH’s value gains broad acceptance, high-leverage competition will produce winners. Only long-tail treasury companies will collapse, while survivors gain representative status over ETH, emerging victorious after levering and delevering cycles.

Tokenized stocks currently lag behind DAT, IPOs, and ETFs in scale, yet hold the greatest application potential. Today’s stocks exist in digital form, stored across servers. Tomorrow’s stocks will circulate directly on-chain—stocks as tokens, tokens as any asset. Robinhood building its own ETH L2, xStocks launching on Ethereum and Solana, SuperState’s Opening Bell helping Galaxy tokenize stocks onto Solana—all signal this shift.

The future battle for tokenized stocks will unfold between Ethereum and Solana. However, this scenario offers the least imagination, emphasizing technical service capabilities. It reflects market validation of blockchain technology, but value capture will flow to $ETH or $SOL.

Tokenized Treasuries and funds show signs of becoming a single-player domain dominated by Ondo, due to分流 between Treasuries and stablecoins. RWA’s future lies in expanding beyond U.S. Treasuries—just as non-dollar stablecoins offer massive long-term market potential, albeit slowly realized.

Finally, Pre-IPO uses two models: raising funds first then purchasing equity, or buying equity first then tokenizing and distributing. xStocks operates in both secondary markets and Pre-IPO, but the core idea is the same: tokenizing incentives for private markets to stimulate public exposure. Note this phrasing—it mirrors the expansion path of stablecoins.

Yet under current legal frameworks, regulatory arbitrage opportunities remain uncertain. Expectations exist, but extensive adaptation is required. Pre-IPO won’t go public quickly. Its core issue is asset pricing power—a fundamentally non-technical matter fiercely guarded by Wall Street’s many distributors.

In contrast, equity distribution and incentive distribution in stock tokenization can be decoupled. “Crypto people care less about rights and more about incentives.” Tax and regulatory issues around equity income are already practiced globally; on-chain implementation isn’t the barrier.

Comparatively, Pre-IPO challenges Wall Street’s pricing authority, whereas stock tokenization amplifies Wall Street’s gains by opening new distribution channels and injecting more liquidity—two entirely different dynamics.

Convergence in Up-Cycles, Crushing in Down-Cycles

The so-called leverage cycle is a self-fulfilling prophecy. Every piece of good news justifies two price surges, continuously fueling higher leverage. But when institutions cross-hold various collaterals, during downturns they prioritize selling lower-tier tokens and fleeing to safer assets. Retail investors, constrained in action, ultimately absorb all losses voluntarily or involuntarily.

When Jack Ma buys ETH, Huaxing Capital acquires BNB, and CMB International launches a Solana tokenized fund, a new era arrives: global economies interconnected via blockchain.

The U.S. represents the limit under Cope’s Law—the lowest-cost, highest-efficiency governance model. Yet it faces an extremely complex web of interdependencies. The new Monroe Doctrine contradicts objective economic laws. The internet can be fragmented, but blockchain remains mysteriously unified—any L2, node, or asset seamlessly integrates within Ethereum.

From a more organic perspective, the fusion of crypto, stocks, and bonds is a process of position swapping between insiders and retail. Similar to how “when Bitcoin rises, altcoins underperform; when Bitcoin falls, alts crash harder,” except this dynamic now extends beyond on-chain ecosystems.

Let’s examine this process:

1. In bull markets, institutions leverage into lower-collateral, high-volatility assets; in bear markets, they sell alt-assets first to preserve high-value holdings;

2. Retail behavior is reversed: during rallies, retail sells BTC/ETH and stablecoins to buy volatile assets. But due to limited capital size, once the market turns, retail must further sell BTC/ETH and stablecoins to maintain leveraged alt positions;

3. Institutions naturally tolerate larger drawdowns. Retail’s high-value assets get sold to them, and retail’s attempts to maintain leverage increase institutional resilience, forcing retail to sell more;

4. The cycle ends with leverage collapse. If retail can no longer sustain leverage, the cycle ends. If institutions collapse causing systemic crisis, retail still bears the brunt—by then, high-value assets have already transferred to other institutions;

5. For institutions, losses are always socialized. For retail, leverage becomes their own noose—and they pay institutions for the privilege. The only hope is exiting before others, a feat nearly as hard as landing on the moon.

Collateral stratification and valuation are superficial. The core is pricing leverage based on expectations of collateral performance.

This explanation still falls short in accounting for why alts always crash harder. A further point: retail desires higher leverage more intensely than issuers. Retail wants every asset pair leveraged at 125x. But in downturns, the market’s real counterparty becomes retail itself. Institutions possess diversified portfolios and sophisticated hedging strategies—costs which retail ultimately bears.

To summarize, crypto-stock-bond integration synchronizes leverage and volatility. Viewing tokens, stocks, and debt through financial engineering, imagine a delta-neutral hybrid stablecoin partially backed by U.S. Treasuries—linking all three forms. Only then does market volatility enable effective hedging, or even greater profits—synchronized upward movement.

ENA/USDe already exhibits partial traits of this. We boldly predict the trajectory of deleveraging: higher leverage attracts more TVL and retail trading, eventually pushing volatility to a critical point. Project operators will prioritize maintaining USDe’s peg, sacrificing ENA’s price. Then DAT company stock prices fall, institutions exit first, and retail gets left holding the bag.

Then comes the terrifying emergence of multiple overlapping leverage cycles: ENA treasury funders sell stocks to protect their value in ETH and BTC treasury firms. Some companies inevitably fail, slowly imploding—first minor alt DATs blow up, then smaller DATs of major coins, until the entire market lives in fear, watching every move of Strategy firms.

Under the crypto-stock-bond model, U.S. equities become the ultimate source of liquidity. Eventually, even they will break under contagion effects. This isn’t alarmist—regulation couldn’t stop the LTCM quant crisis, and now Trump is encouraging everyone to launch tokens. I don’t believe anyone can prevent the massive explosion of crypto-stock-bond linkages.

Global economies, interconnected via blockchain, will implode together.

Then, in reverse motion, every place retaining residual liquidity—on-chain or off-chain, across all six crypto-stock-bond forms—becomes an exit window. Most terrifyingly, there’s no Fed on-chain. The final liquidity provider is absent, leaving the market to fall endlessly into thermal death.

Everything ends. Everything begins.

After a long “period of agony,” retail gradually rebuilds purchasing power for BTC/ETH/stablecoins, delivering sparks to institutions’ new narratives. A fresh cycle restarts—not until financial magic fades and debts clear will real labor value ultimately close the loop.

You might wonder: why not discuss stablecoin cycles?

Because stablecoins are themselves the outward form of the cycle. BTC/gold props up shaky U.S. Treasuries, while stablecoins uphold the dollar’s global adoption rate. Stablecoins cannot form their own cycle—they must couple with deeper underlying assets to generate real yield. Yet stablecoins may bypass Treasuries, increasingly pegged to safer assets like BTC/gold, thereby flattening the leverage curve.

Conclusion

From interpreting classics through myself, to interpreting myself through classics.

On-chain lending hasn't been covered. While DeFi and CeFi convergence is underway, it has little to do with crypto-stock relations. DAT touches on some aspects; future articles will address institutional lending and credit models.

The focus lies in examining structural relationships among crypto, stocks, and bonds, and the new varieties and directions they create. ETFs are maturing, DAT is in fierce competition, stablecoins are expanding at scale—offering the largest on-chain and off-chain opportunities. Crypto-stocks and Pre-IPO have infinite potential but struggle to transform traditional finance through compatibility, lacking self-sustaining internal cycles.

Crypto-stocks and Pre-IPO must resolve equity issues, but cannot do so through equity-focused solutions alone. Economic effects must be created to突破regulatory barriers. Appealing to regulators leads only to bureaucratic entrapment. Stablecoin’s journey illustrates this best—surrounding the city from the countryside works most effectively.

Crypto-company IPOs represent traditional finance’s redemption and pricing of crypto. Going forward, this path will grow increasingly mundane. Those seeking listings should act early—once conceptual advantages are exhausted, quantitative valuation takes over, just like Fintech and manufacturing, where imaginative potential diminishes with each new listing.

Tokenized Treasuries (funds) require long-term positioning, offering little excess return and minimal relevance to retail, highlighting instead technical applications of blockchain.

This article primarily provides a static macro framework, lacking dynamic data, such as Peter Thiel’s allocations and investments across various DAT and ETF vehicles.

Additionally, during leverage unwinding, whales and retail move in opposite directions: whales sell lower-tier assets first, preserving core holdings; retail must sell core assets to maintain leverage on speculative positions. Hence, when Bitcoin rises, alts may not follow, but when Bitcoin falls, alts always crash harder. These dynamics require data for full explanation. For now, limitations prevent this—only a static framework can be established to clarify thinking.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News