The trillion-dollar stock token market is accelerating its buildup, and the next bull market’s capital breakthrough may already be emerging.

TechFlow Selected TechFlow Selected

The trillion-dollar stock token market is accelerating its buildup, and the next bull market’s capital breakthrough may already be emerging.

This article systematically reviews the current status and prospects of stock tokens from multiple dimensions, including their advantages and issuance mechanisms, the current state and performance data of the stock token market, representative issuers of stock tokens, associated risks and opportunities, and future trend outlooks.

Author: Hotcoin Research

Introduction

Since 2025, tokenized U.S. equities have exhibited exponential growth. Major trading platforms have launched dedicated sections and listed equity tokens issued by entities such as Ondo and xStocks. Notably, recent on-chain trading volumes for U.S. equity and precious metals tokens have repeatedly hit new highs, signaling a transition of equity tokens from crypto-native fringe innovation to a mainstream investment gateway. Tokenized on-chain assets of tech giants—including Tesla, Nvidia, Apple, and Circle—are sparking cross-border investment enthusiasm among global users.

This report systematically examines the current state and future outlook of equity tokens across multiple dimensions: their advantages and issuance mechanisms; market status and performance metrics; representative issuers; associated risks and opportunities; and forward-looking trends. By analyzing the specific models and distinctions among key issuers—including Ondo, xStocks, Securitize, and Robinhood—we uncover how equity tokens are reshaping participation logic and infrastructure within securities markets. As capital continues flowing into on-chain securitized assets, equity tokens are evolving into a bridging market connecting traditional finance and Web3—potentially serving as a critical catalyst for the next bull market.

I. Advantages and Mechanisms of Equity Tokens

The core design principle of equity tokens is mapping real or anticipated equity assets onto blockchains and enabling free circulation in standardized token form.

Advantages of Equity Tokens

As a fusion product of traditional financial assets and blockchain technology, equity tokens offer multiple potential advantages:

- Global Accessibility: Through crypto wallets and open networks, users worldwide can access tokenized U.S. equities and ETFs without opening brokerage accounts—significantly lowering cross-border investment barriers.

- Fractional Investment: Users may purchase arbitrarily small amounts, enabling more flexible asset allocation—ideal for young retail investors and those in emerging markets.

- 24/7 Trading: Unlike traditional stock exchanges bound by fixed trading hours, tokenized equities support round-the-clock trading—enhancing market efficiency and risk management capabilities.

- Faster Settlement: On-chain transactions enable real-time settlement (T+0), reducing counterparty risk and intermediary costs.

- Programmability: Smart contracts can automate dividend distribution, governance weight assignment, and trade restrictions—unlocking new possibilities for financial product design.

- DeFi Ecosystem Integration: Tokenized equities can serve as collateral in DeFi protocols or participate in portfolio strategies—expanding functionality within on-chain financial systems.

These advantages are increasingly attracting both traditional financial institutions and crypto-native users—accelerating the evolution of equity tokens from “alternative tools” toward foundational “infrastructure.”

Issuance Mechanisms of Equity Tokens

The core design principle of equity tokens is mapping real or anticipated equity assets onto blockchains and enabling free circulation in standardized token form. Current mainstream token mechanisms fall into three categories:

(1) Real-Asset-Backed Mapping

Regulated entities hold actual shares or ETFs and issue an equivalent number of tokens—commonly adopted by xStocks, Ondo, and WisdomTree. These tokens typically feature off-chain custodial structures and fully compliant pathways, with a strict 1:1 token-to-equity ratio. Some support redemption in USDC at net asset value (NAV) or on-chain conversion back into traditional brokerage accounts.

- Shareholder Rights: Holders generally enjoy economic rights—including price appreciation and dividend distributions—but lack voting or corporate governance rights unless implemented via on-chain registration frameworks like Superstate’s, which confer legal shareholder status.

- Custodial Structure: Shares are held by independent third-party brokers or trusts (e.g., Backed Assets Jersey, Prime Trust) to ensure asset segregation and redemption capacity.

- Regulatory Compliance: Adheres to securities issuance regulations (e.g., Reg D, Reg A+, MiCA) and falls under supervision by regulators such as the U.S. SEC, EU ESMA, or national financial authorities—currently the most regulatorily certain model.

(2) SPV-Based Mapping

Examples include PreStocks, which uses Special Purpose Vehicles (SPVs) to hold private company equity (e.g., OpenAI, SpaceX) and issues tokens representing expected economic exposure. Investors hold no voting rights or legal shareholder status and cannot redeem tokens. Such products follow ambiguous regulatory paths, often restricting participation to non-U.S. investors—and carry relatively high legal risk.

- Shareholder Rights: Token holders possess no direct rights over underlying companies—economic returns depend solely on SPV exits (e.g., IPO or acquisition).

- Custodial Structure: Assets are managed by project-operated SPVs lacking independent custodians—resulting in limited structural transparency.

- Regulatory Compliance: Typically unregistered contract-based assets—neither registered as securities nor funds—and legally unenforceable in most jurisdictions.

(3) Synthetic Tokens

Lacking real underlying assets, these tokens track reference stock prices solely via oracles—exemplified by the now-defunct Mirror Protocol. They reflect only price movements, grant no voting or dividend rights, and are widely viewed as unregistered derivatives facing significant regulatory pressure—largely abandoned by mainstream institutions.

- Shareholder Rights: No equity ownership or cash flow entitlements—investors bear pure price speculation risk.

- Custodial Structure: No off-chain assets exist—no custody required—operation relies entirely on on-chain mechanisms.

- Regulatory Compliance: Legally akin to CFDs or synthetic futures—classified as illegal securities or banned products across most jurisdictions.

Overall, real-asset-backed tokens demonstrate the strongest regulatory adaptability and market sustainability—making them the fastest-growing mainstream format today. Their issuance typically requires integrated off-chain custodians, restricted investor eligibility, and NAV-based redemption mechanisms—increasingly becoming the standard paradigm for “on-chain mirroring” of traditional equity assets.

II. Current Status and Performance of Equity Tokens

Beginning in 2025, amid favorable macro conditions and technological maturity, the equity token market entered an explosive growth phase. Major institutions and trading platforms have aggressively joined the race: Kraken Exchange partnered with Swiss-compliant entity Backed Finance to launch its xStocks equity token service in May 2025—offering dozens of U.S. equities and ETF tokens, including S&P 500 constituents. Robinhood’s brokerage platform introduced 24/7 equity token trading in June 2025 using Arbitrum—a Layer-2 network built on Ethereum—providing European users with round-the-clock access to U.S. stocks, ETFs, and even tokenized private company equity. Robinhood also announced plans to develop its own blockchain to enable native custody and settlement for equity tokens. Ondo launched a series of large-cap tech equity tokens via Ondo Global Markets across Solana, Ethereum, and BNB Chain. JPMorgan and BlackRock are piloting on-chain fund products and ETF share tokenization—including JPMorgan’s MONY Fund and BlackRock’s BUIDL Fund. With diverse participants entering the space, the equity token market experienced exponential growth in 2025—propelling equity tokens from experimental periphery to mainstream prominence.

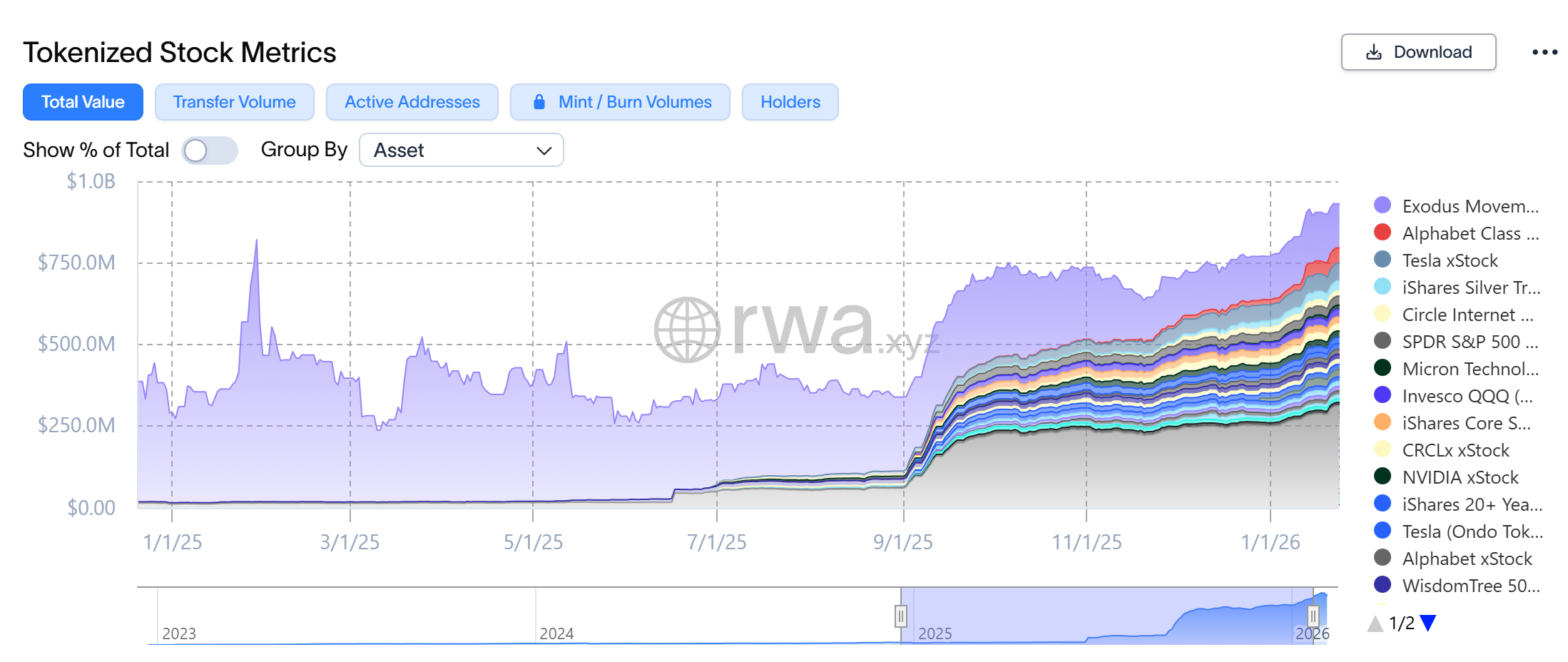

As of early February 2026, the total on-chain market capitalization of equity tokens stands at approximately $930 million—representing a multi-fold increase year-on-year: According to TokenTerminal and RWA data, equity token market cap stood at just ~$32 million at the start of 2025—growing nearly 25-fold within one year, demonstrating remarkable explosive power.

Source: https://app.rwa.xyz/stocks

Beyond total market cap, on-chain trading activity has surged dramatically. Monthly on-chain transfer volume for equity tokens averages ~$2.4 billion. The total number of unique addresses holding equity tokens currently stands at ~298,000. Across exchanges, these tokens are widely listed on Binance, Kraken, Bybit, Hotcoin, Bitget, Gate, and Jupiter DEX—forming a hybrid centralized + decentralized trading ecosystem.

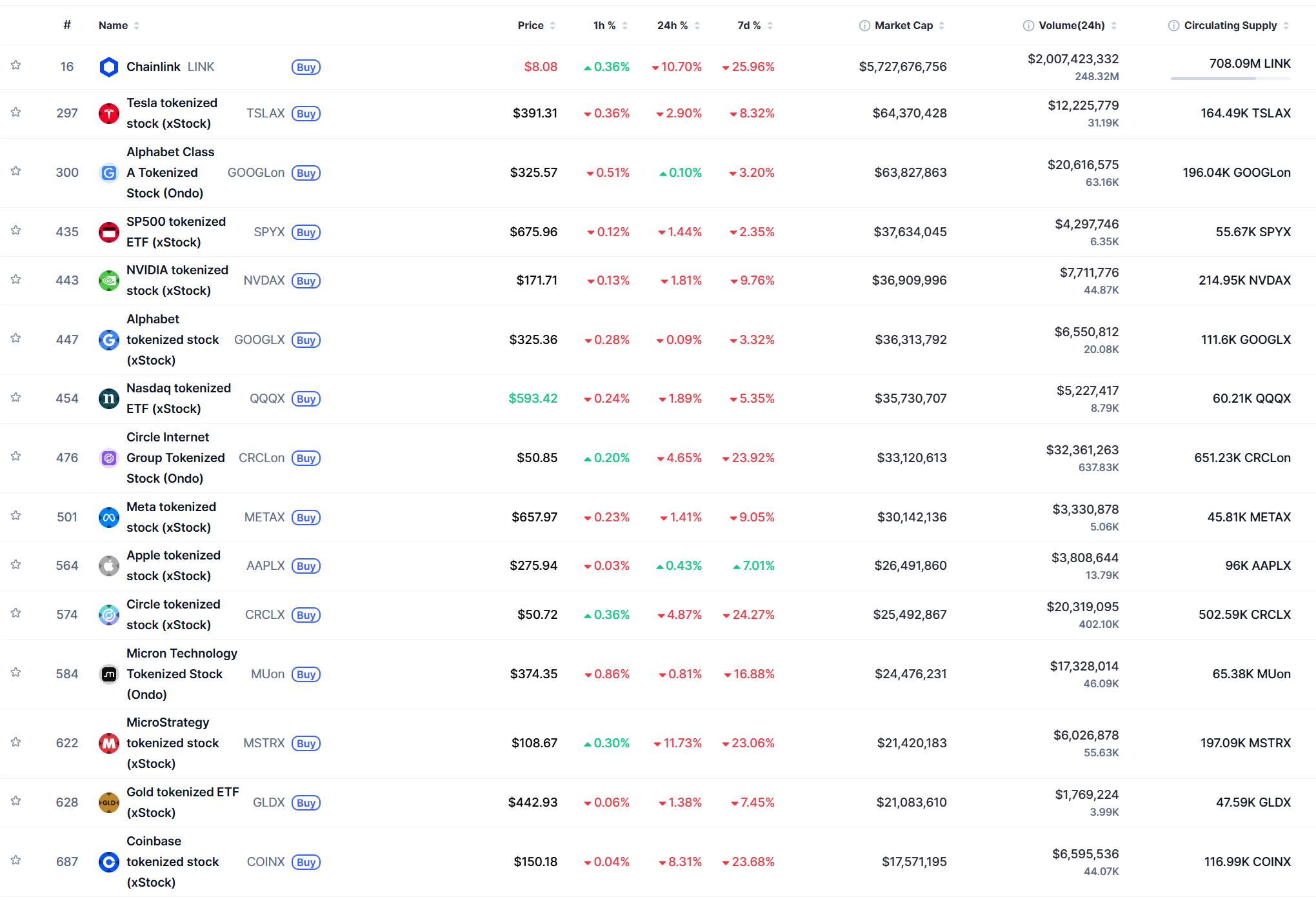

Per CoinMarketCap’s Tokenized Stock category data, equity tokens collectively exhibit strong capital attention and trading activity. Tech giants—including Apple, Tesla, Nvidia, and Meta—dominate the sector, with steadily rising TVL and trading volumes. Average daily trading volume over the past 30 days consistently exceeds the $1 million threshold. Market-wide premium/discount phenomena persist—for instance, some tokens trade at ±1%–2% deviations relative to their underlying stock prices.

Source: https://coinmarketcap.com/view/tokenized-stock/

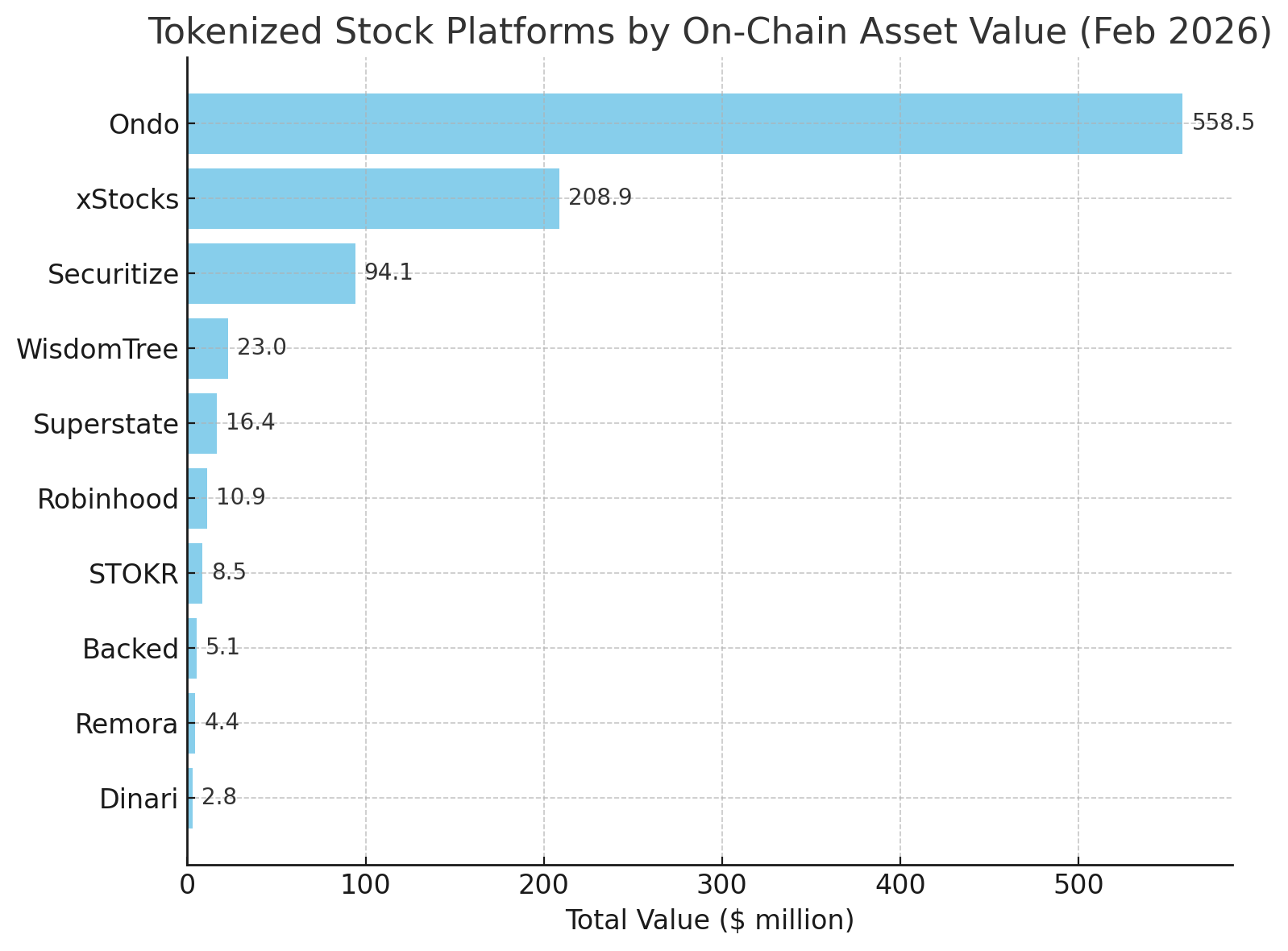

III. Representative Equity Token Issuers

By market share, as of early February 2026, the ranking of on-chain tokenized equity value across platforms is as follows: Ondo Finance leads decisively, commanding a 59.5% market share—nearly six-tenths of the entire market—with on-chain asset value totaling ~$559 million. Second is xStocks, with a market cap of ~$209 million (22.4% share). xStocks offers ~74 U.S. equity and ETF tokens—and ranks among the highest-engagement channels for retail investors. Third is Securitize, holding ~10% share ($94.1 million), primarily driven by a few large equity token projects like Exodus. Following are WisdomTree (2.5%), Superstate Opening Bell (1.8%), and Robinhood-related tokens (~1.2%). This concentration reveals that the market is highly consolidated among a few leading platforms—the top two collectively account for over 80% of market share—highlighting investor preference for trusted, licensed institutions while newer entrants continue scaling efforts.

Source: https://app.rwa.xyz/stocks

- Ondo Finance: A decentralized finance (DeFi) startup founded in 2021, initially focused on bringing traditional fixed-income assets on-chain. In 2023, Ondo launched three tokenized fund products: OUSG (short-term U.S. Treasury fund), OSTB (investment-grade corporate bond fund), and OHYG (high-yield bond fund)—all tracking ETFs managed by BlackRock and PIMCO. These tokens are offered exclusively to KYC-verified qualified investors on chains like Ethereum and redeemable daily in USDC. Ondo relies on partner custodians (e.g., Prime Trust) to hold underlying ETF shares. In 2025, Ondo expanded into equity tokens via its subsidiary “Ondo Global Markets,” issuing tokenized versions of major tech stocks—including Alphabet, Microsoft, Apple, and Tesla—across Solana, Ethereum, and BNB Chain. As of early 2026, Ondo-managed equity/securities token value totals ~$559 million—the industry leader. Ondo’s model emphasizes high compliance + on-chain funds: each token is backed by robust legal structure and real assets—requiring higher entry thresholds but accommodating larger capital pools. Regulatory-wise, Ondo adopts Regulation D private placement—open only to Qualified Purchasers. Currently, Ondo tokens trade primarily on its proprietary portal and secondary-market DeFi protocols—demonstrating strong liquidity.

- xStocks: Launched in 2025 by Kraken—the globally renowned crypto exchange—xStocks provides tokenized equity and ETF trading services powered by Backed Finance, a Swiss firm acquired by Kraken. xStocks features strict 1:1 backing—holding actual underlying stocks/ETFs via regulated custodians and minting equivalent SPL tokens on Solana. On Kraken’s platform, these tokens append “x” to stock tickers (e.g., AAPLx, TSLAx), covering over 70 assets—including Amazon, Apple, and S&P 500 ETFs. xStocks permits non-U.S. users to invest from as little as $1 and supports 24/5 trading. For dividends, xStocks employs automatic reinvestment—token balances increase proportionally upon dividend payouts rather than distributing cash. Legally, xStocks token holders are not considered shareholders; tokens function more like exchange notes. Kraken ensures compliance via a Jersey-registered entity—restricting service availability outside the U.S., Canada, and UK. Since launch, xStocks’ trading volume and asset scale have grown rapidly. As of early 2026, xStocks’ on-chain market cap stands at ~$209 million—ranking second industry-wide with a 22% share. Kraken announced in late 2025 that xStocks will expand to Ethereum to enhance composability. xStocks exemplifies how major exchanges are actively embracing tokenization—leveraging brand credibility and operational excellence to resolve user trust barriers around equity token access.

- Securitize: Founded in 2017, Securitize is a leading U.S.-based digital securities issuance platform specializing in blockchain-based securities registration and trading solutions for enterprises. Holding SEC and FINRA licenses—including transfer agent and broker-dealer registrations—Securitize adheres strictly to compliant issuance practices. A landmark case was its 2021 assistance to Exodus Wallet in completing a Reg A+ equity token offering: Exodus raised ~$75 million in tokenized company shares registered on Algorand. Investors subscribed via Securitize’s investment portal, with Securitize acting as official transfer agent managing the shareholder register. Today, Exodus token EXOD trades on ATS platforms—with on-chain data indicating a ~$94 million market cap. Beyond Exodus, Securitize has tokenized assets for multiple private companies and funds—including KKR healthcare fund shares and global equity portfolios. Securitize’s model combines full compliance + private markets—helping unlisted companies raise capital or provide employee equity liquidity—primarily targeting qualified/institutional investors.

- WisdomTree: A prominent U.S. asset manager renowned for its ETF offerings, WisdomTree has extended operations into on-chain funds through platforms like WisdomTree Prime and WisdomTree Connect—launching tokenized money market funds, equity portfolios, and bond funds. WisdomTree has issued 13 SEC-registered tokenized funds. Investors can purchase these fund tokens via WisdomTree’s mobile app—mirroring traditional ETF buying workflows—except that share records reside on blockchain. WisdomTree tokens are deployed across Ethereum, Solana, and other chains. Holding asset management and brokerage licenses across the U.S. and Europe, WisdomTree represents traditional asset managers’ foray into tokenization—issuing products that seamlessly bridge conventional funds and blockchain, delivering 7×24 fund trading and holding experiences.

- Superstate Opening Bell: Launched in May 2025 by Superstate—a company founded in 2023 by Compound protocol creator Robert Leshner—Opening Bell is a regulated on-chain securities issuance platform enabling public companies to convert SEC-registered shares directly into on-chain form. Its distinguishing feature lies in partnering directly with issuers so that on-chain tokens constitute part of the company’s statutory capital—not third-party issued instruments. Superstate itself is a registered transfer agent and FINRA member—authorized to maintain and update shareholder registers on-chain post-issuer approval. To date, Opening Bell has launched three equity tokens—Forward, Galaxy, and others—with a combined market cap of ~$16.4 million. Though modest in scale, its model is highly compliant: Superstate’s registered transfer agency status ensures on-chain shareholders hold identical rights to traditional shareholders—achieving “tokens-as-shares.” This grants holders full shareholder rights—including participation in corporate actions via on-chain mechanisms.

- Robinhood: A well-known U.S. zero-commission stock trading platform, Robinhood launched equity token trading services for European users in 2025 via its Robinhood Wallet and Robinhood Crypto entity. Its equity tokens are issued on Arbitrum Nova—supporting 24/5 trading across 2,000+ assets—including U.S. listed stocks, ETFs, and tokenized private equity. Robinhood does not issue tokens directly but integrates multiple issuer-provided assets—and leverages its proprietary chain for trade matching and custody. Services are primarily available to European users; U.S. investors cannot access them directly. Regulatory-wise, Robinhood’s equity token trading lacks formal SEC approval—managed instead by Robinhood Europe and Robinhood Crypto under applicable EU crypto asset regulations. On-chain data shows Robinhood-related tokens (tracked via Arbitrum Nova addresses) hold ~$10.9 million TVL—with rapid user growth making it one of the most active retail gateways. Its tokens do not confer voting rights or direct shareholder status—but anchor pricing to underlying stocks—providing convenient market access.

- PreStocks: A platform specializing in tokenizing pre-IPO private company equity, PreStocks holds minority secondary-market stakes in prominent unlisted firms—including OpenAI, SpaceX, Anthropic, and Neuralink—via SPV structures, then issues corresponding tokens on Solana. PreStocks explicitly states no official partnerships with these companies—its tokens represent purely economic entitlements, conferring no voting rights, shareholder status, or dividend entitlements. Purchasers acquire rights to future SPV proceeds (e.g., IPO monetization or equity sales). PreStocks holds no U.S. securities broker-dealer license and is unregistered with the SEC—services are open only to non-U.S. users.

- Additionally, Coinbase has signaled intent to seek SEC approval for tokenized stock trading—potentially introducing this capability via its Broker-Dealer subsidiary to compete directly with Kraken and Robinhood. Dinari secured the first-ever tokenized stock brokerage license—launching dShares token products and planning a dedicated L1 chain. These distinct participants collectively enrich the equity token ecosystem.

IV. Risks and Opportunities of Equity Tokens

Equity tokens currently face a dual landscape of coexisting risks and opportunities. Only through effective risk mitigation can their full potential be unlocked—driving this innovation toward maturity.

Key Risks

- Regulatory and Policy Risk: As equity tokens straddle traditional securities and crypto domains, regulatory uncertainty remains the foremost risk. Jurisdictions differ significantly in classifying equity tokens—potentially treating them as securities, derivatives, or even illegal offerings. Tightened regulation could force suspension of related services—as previously seen with Binance and FTX’s equity token offerings. Even compliant tokens must navigate varying national securities laws—posing cross-border rollout barriers. For example, the U.S. has yet to formally approve public equity token trading for retail investors; EU MiCA regulations remain under observation. Policy shifts may restrict platform access or trigger token delistings.

- Legal Rights and Investor Protection: Many equity tokens do not confer genuine shareholder status—especially synthetic or gray-market tokens—leaving investors without enforceable rights. In disputes or issuer defaults, token holders may lack direct legal recourse. This is especially acute in bankruptcy scenarios: if custodial entities fail, can token holders reclaim assets? Precedents remain scarce. Moreover, absent voting rights, token investors cannot influence corporate governance—potentially harming interests during pivotal events (e.g., mergers, privatizations).

- Liquidity and Premium/Discount Risk: Despite rising market cap, overall equity token liquidity remains low versus traditional equity markets. Some tokens exhibit minimal daily volume and wide bid-ask spreads—leading to persistent premiums or discounts. When redemption mechanisms falter, token prices may decouple significantly from underlying asset values. For example, a private company token might trade far below its latest funding valuation—causing paper losses. Simultaneously, large holders dumping tokens in thin markets may trigger flash crashes—risking liquidity collapse.

- Technical and Security Risk: Equity token contracts operate on blockchains—exposing them to smart contract vulnerabilities and hacker attacks. Compromised contracts could result in mass token theft or unauthorized transfers—disrupting underlying asset linkages. For synthetic tokens, oracle price feeds are mission-critical; oracle failures or manipulation could cause severe price deviations—triggering cascading liquidations. Additionally, blockchain network stability impacts trading experience—Solana’s past outages disrupted token trading and caused user losses. While most equity tokens deploy on mature chains with audited contracts, technical risks remain non-negligible—requiring sustained security investment.

- Counterparty and Credit Risk: When purchasing equity tokens, users implicitly assume credit risk of issuers or custodians. Compliant tokens fare better—typically backed by independent trusts—but gray-market models leave users as mere creditors to counterparties. If issuers abscond or misappropriate assets, users suffer losses. Even with custody, complex legal structures pose challenges: e.g., opaque SPVs make monitoring SPV managers difficult. These counterparty risks require mitigation via audits, notarization, etc.—otherwise, trust incidents could severely damage market confidence.

Potential Opportunities

- Cross-Border Investment and Financial Inclusion: Equity tokens promise to reconfigure cross-border investment channels. Traditionally, investors face hurdles—account setup, FX controls, market access—hindering foreign equity investment. Equity tokens transcend geographical constraints: anyone with internet access and a crypto wallet can buy overseas equity tokens 24/7. This particularly benefits emerging-market investors—offering new pathways to global capital markets. For instance, an individual in a country lacking developed securities markets can invest in Apple or Tesla via equity tokens. This advances financial inclusion and global wealth allocation. Long-term, equity tokens may evolve into a shared global market—dramatically lowering barriers and costs for cross-border securities investment.

- Enhanced Market Efficiency and Liquidity: Tokenization’s 24/7 trading and real-time settlement hold transformative potential for market efficiency. Investors escape exchange-hour limitations—responding flexibly to news or events (e.g., earnings reports, macro data). Instant settlement eliminates T+2 counterparty default risk—releasing capital efficiency. Broker clearing pressures ease—users rebalance positions instantly. Such efficiency may attract traditional equity trading onto-chain. Furthermore, fractional investing brings new capital into markets—boosting overall liquidity. Especially for illiquid or high-priced stocks, tokenization unlocks fresh investor cohorts. Institutionally, banks and funds already accept tokenized securities as collateral—accelerating asset turnover. Overall, equity tokens promise more efficient, interconnected, and continuous securities markets.

- Innovative Financial Products and Services: Equity tokens enable Lego-like composability with DeFi—sparking novel financial services. Existing use cases include: pledging equity tokens as collateral in lending protocols to borrow stablecoins; providing liquidity on DEXs to earn fees; or combining with options contracts to create new derivative strategies. Future developments may include index tokens or actively managed tokenized portfolios—delivering on-chain ETF and portfolio management functions. Equity tokens could also enter payment/settlement contexts—e.g., representing receivables in supply-chain finance or enabling direct stock-token swaps in M&A—reducing intermediary costs. These applications are impractical or costly in legacy systems—but feasible on blockchain. Equity tokens thus provide fertile ground for financial innovation—expanding the boundaries of securities.

- Opportunities for Traditional Financial Institutions: For brokers and exchanges, equity tokens represent both challenge and opportunity. Leading institutions are investing proactively: JPMorgan and Morgan Stanley established tokenized asset divisions; Nasdaq announced plans for digital asset custody/trading. By adapting to this trend, incumbents can leverage brand equity and client bases to capture market share. For example, Fidelity launched a digital asset platform enabling qualified clients to purchase tokenized securities. Some traditional brokers consider partnering with issuers like Dinari—providing custody and market-making services. As regulations clarify, traditional institutions will likely enter en masse—accelerating market maturity and unlocking new revenue streams. For multinational financial groups, this is a strategic avenue to extend business reach and connect global markets.

- Catalyzing Capital Market Reform: The rise of equity tokens compels traditional capital markets to reconsider reform. Pain points abound—lengthy settlement cycles, limited trading hours, high cross-border fees. Tokenization offers a viable alternative—prompting existing exchanges and intermediaries to cut costs and extend hours to stay competitive. Some exchanges are exploring T+0 settlement and 24-hour trading. Tokenization also drives legal framework updates—including recognition of electronic equity registries and smart-contract-enforced rights. These changes benefit the broader capital market—aligning it with digital-era demands. Macroscopically, full securities digitization would enable regulators to monitor transactions in real time—enhancing market stability and risk prevention.

V. Future Outlook for Equity Tokens

Based on current development trajectories and industry consensus, we project the following trends for equity tokens:

- Massive Potential for Tokenized Securities Market: The World Economic Forum forecasts that ~10% of global securities will be tokenized within the next decade. As the largest securities asset class, equities harbor trillion-dollar tokenization potential—projected to reach several trillion dollars in market size by 2030. Cross-border equity investment and private equity markets stand to gain significantly—expanding participant bases and unlocking previously inaccessible liquidity. This will foster a nascent global, 24/7 capital market—enabling more efficient capital allocation.

- Accelerated Transformation of Traditional Brokers and Exchanges: As noted, equity tokens are disrupting traditional broker and exchange business models—forcing adaptation. Incumbents may either proactively launch digital asset segments offering tokenized equity trading—or optimize existing processes (lowering fees, enhancing services) to retain customers. We’ve already seen emerging brokers like Robinhood leverage tokenization for 24-hour trading; Nasdaq and LSE are researching blockchain-based settlement. Future scenarios include major exchanges launching dedicated equity token trading boards—or migrating SME listings to blockchain to reduce IPO costs. Brokers may evolve into digital asset brokers—selling both traditional and tokenized equities—delivering one-stop services. Equity tokens thus act as a “reverse-engineered reform” for traditional intermediaries—whose ability to transform will determine their fate in the new competitive landscape.

- Gradual Refinement of Regulatory Frameworks: Regulators globally are closely monitoring tokenized securities. Clear regulatory frameworks are expected within the coming years—providing guidance for market participants. For example, the U.S. may introduce a Digital Securities Act—integrating tokenized equities into existing securities law with tailored flexibility; the EU may refine STO rules under MiCA; Asian financial hubs like Hong Kong and Singapore are already publishing guidance. The SEC may gradually expand licensing and investor protection rules after observing pilot outcomes. Regulatory clarity will eliminate uncertainties—drawing conservative institutional capital and further expanding the market.

- Strengthened Mapping of Real Shareholder Rights: Currently, many equity tokens lack voting rights—but this may change. As Superstate’s model proves viable, more companies or intermediaries may adopt direct shareholder rights mapping—using blockchain for shareholder registry management and online voting. This empowers token holders with rightful entitlements—and improves corporate governance efficiency. For example, AGM voting could be automated via on-chain tokens—ensuring transparent, tamper-proof vote tallying. Dividend distribution could be programmable—delivered promptly and directly to token holders. These enhancements narrow the gap between tokens and real shares—ultimately achieving “same share, same rights, same benefits.”

- Synergistic Development with Real-World Assets (RWAs): Beyond equities, tokenization of bonds, funds, and real estate is accelerating. Future tokenized securities ecosystems will integrate diverse assets—equity tokens alongside bond tokens, commodity tokens, etc. These tokens can be combined, staked, and traded across unified wallets and DeFi protocols—creating synergies. For instance, investors could pledge treasury token collateral to borrow stablecoins for equity token purchases—enabling leveraged investment in traditional assets; or use smart contracts to automatically rebalance equity/bond token allocations—forming dynamic tokenized portfolios. This connects fragmented markets—enabling seamless global capital flow on-chain—and improving resource allocation efficiency.

Conclusion

In summary, equity tokens—standing at the frontier of financial innovation—are transitioning from inception to takeoff. They hold transformative potential to reshape how we engage with equity markets—making investment more open, efficient, and global. Today’s equity token market still exhibits “wild-west” characteristics—such as volatile valuations and uneven project quality. Going forward, institutional participation and regulatory maturation will drive market standardization—manifesting in uniform disclosure standards, industry self-regulatory bodies, and third-party rating agencies. Market infrastructure will strengthen—professional market makers will provide liquidity; insurance products will cover token asset loss risks. Investors will receive services and safeguards comparable to traditional securities investing—further attracting institutional capital and creating virtuous cycles—unlocking a multi-trillion-dollar on-chain equity trading market. By 2030, the equity token market may be as commonplace as electronic trading was in 2010.

About Us

As the core research arm of Hotcoin Exchange, Hotcoin Research transforms professional analysis into your practical edge. Our flagship publications—“Weekly Insights” and “Deep Research Reports”—decipher market dynamics. Through our exclusive column “Hotcoin Select” (powered by AI + expert curation), we identify high-potential assets—reducing your trial-and-error costs. Each week, our researchers host live sessions on Hotcoin Live—breaking down hot topics and forecasting trends. We believe that empathetic companionship and expert guidance empower more investors to navigate market cycles—and seize Web3’s value opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News