Made less from crypto trading in a year than my mom did from investing in A-shares

TechFlow Selected TechFlow Selected

Made less from crypto trading in a year than my mom did from investing in A-shares

This year, the crypto market has almost lost to all other capital markets.

Author: Lüdong Xiaogong

This has been a year when "everything is rising," yet the crypto market is widely recognized as one of the hardest years to make money.

Compared to previous years, 2025 resembles a rare "bountiful year." The U.S. Nasdaq index hits new highs, core A-share assets rebound, gold breaks historical records, and commodities rally collectively—almost every market is up.

Yet in crypto, despite Bitcoin reaching a historic high of $120,000, many still complain it's been the "hardest year to profit." A friend remarked about family investment strategies this year: "In terms of returns, my mom's A-share trading outperformed my crypto trading by far."

A-shares: A Once-in-a-Decade Bull Run

"This year, both my own and my family’s A-share accounts have achieved a 100% win rate," said Professor Cai, who has researched and taught A-share markets for over two decades at a university in Hangzhou, speaking to BlockBeats.

"The overall market trend is strong; most investors are profitable. Compared to previous years, making money in the stock market has become significantly easier. As long as you don’t chase peaks or buy delisted stocks, almost any purchase yields profit—it’s just a matter of how much."

If Professor Cai’s insight reflects "a veteran’s intuition," his students’ data is even more convincing: "Among the students I communicate with frequently, many have made substantial gains. Some who traded over twenty stocks still maintained a 100% win rate."

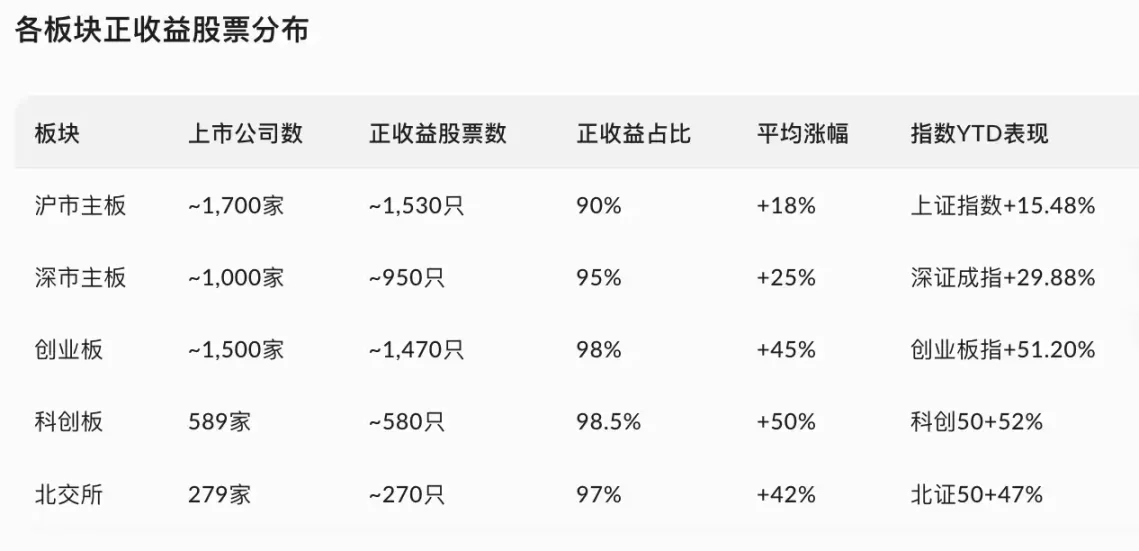

Data confirms this broad-based rally.

In the first three quarters of this year, according to China’s most widely used industry classification standard (the Shenwan Level-1 classification), 28 out of 31 sectors posted gains—over 90%. Wind数据显示 shows that more than 80% of individual stocks rose in value, with as many as 448 doubling in price.

"A notable feature of this year’s A-share market is rising volume alongside rising prices—not only did prices perform well, but trading volumes were also huge, especially in Q3, with multiple consecutive trading days exceeding RMB 2 trillion in turnover," said Zhuochen, a long-time A-share trader, summarizing for BlockBeats.

Compared to the main board, growth-oriented boards like ChiNext and STAR Market showed even stronger momentum.

"AI led the gains this year, so related indices such as the ChiNext Index and CSI 500 saw annual gains exceeding 50%," Zhuochen said.

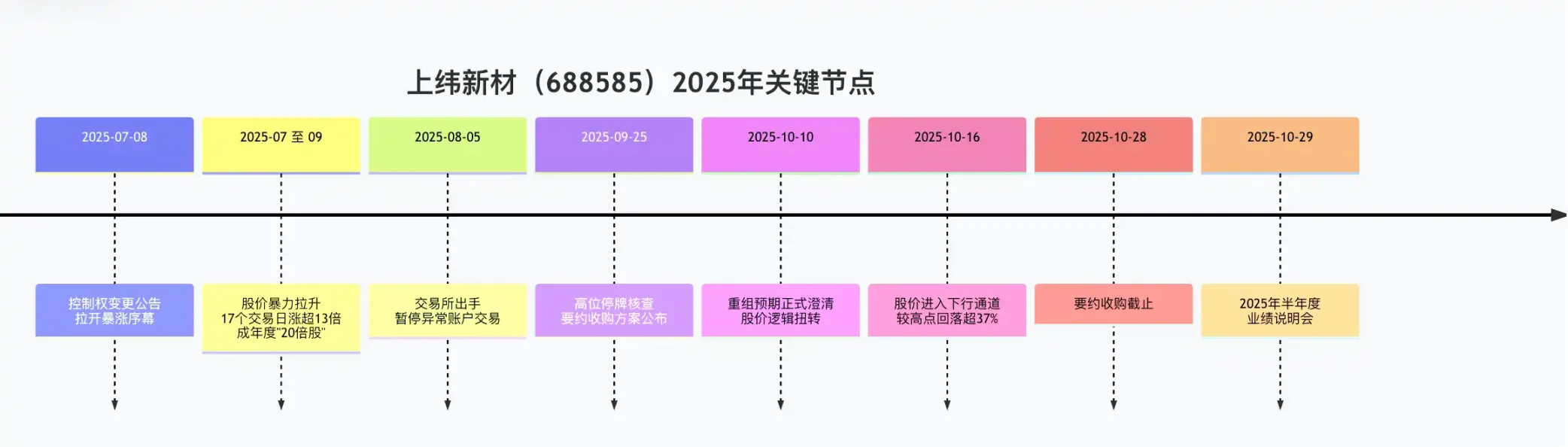

A representative example is "SWANCOR New Materials," the first "20-bagger" stock in the A-share market this year.

"It was originally a chemical company listed on the STAR Market. The surge began after an announcement that its controlling shareholder had changed to Zhiyuan Hengyue, a firm closely linked to Zhiyuan Robotics, placing it directly within the AI sector."

TechFlow Note: Zhiyuan Robotics is a star player in the "embodied intelligence" space, co-founded by Peng Zhihui (aka Zhihui Jun), a former Huawei "prodigy," and Deng Taihua, a former Huawei vice president.

This news ignited market imagination. Headlines like "Zhiyuan Robotics backdoor listing" and "China’s version of NVIDIA" flooded social media. Despite repeated clarifications from the company denying any short-term asset restructuring plans, investor sentiment remained red-hot.

In just 17 trading sessions, the share price soared from single digits, gaining over 13-fold. As of September 25, SWANCOR New Materials had gained over 2030% year-to-date, becoming the first "20-bagger" in the A-share market in 2025.

Professor Cai sees nothing abnormal about this year’s explosive rally.

"Markets rise after prolonged declines. Historically, the A-share market experiences a bull cycle roughly every ten years. Last year marked the shift from bear to bull, and this year is the main upward phase of that bull market," he explained.

The 2005 bull run saw the Shanghai Composite climb from 998 in 2004 to 6,124 in 2007; the 2015 bull market rose from 1,849 in 2013 to 5,178 in 2015. These cycles are roughly a decade apart—and another decade has passed.

"Moreover, nearly all overseas markets have performed exceptionally well this year," Professor Cai added. "From Japan, Germany, the UK, India, the US, to Canada, major markets have hit record highs."

Hong Kong Stocks: Even Elephants Can Turn

Before looking at U.S. stocks, consider Hong Kong equities.

As of writing, the Hang Seng Index has gained nearly 29% year-to-date, briefly surpassing 26,000 in September—the highest level in four years.

Tech giants have once again led the rally. Internet heavyweights including Alibaba, Tencent, Meituan, and Xiaomi drove the Hang Seng Tech Index higher.

They say "an elephant can't turn quickly," but this year has proven otherwise.

Many were initially skeptical about Alibaba’s rebound. After years of steep declines, it had become synonymous with the struggles of Chinese internet stocks.

But since the beginning of the year, Alibaba Cloud has posted double-digit growth for two consecutive quarters, with Q2 revenue up 26%—a three-year high—while its AI business has maintained triple-digit growth for eight straight quarters. On the stock front, Alibaba’s shares doubled this year, making it one of the brightest large-cap performers.

Tencent hasn’t lagged behind. In Q2 2025, Tencent’s domestic gaming revenue grew 24% year-on-year, while ad revenue jumped 20% thanks to AI-driven algorithm optimization. Starting in 2024, Tencent ramped up share buybacks to HK$112 billion—the largest in a decade. Its stock rose over 50% this year, reclaiming a HK$6 trillion market cap—nearly tripling in value over three years.

Beyond blue chips, the most notable highlight in Hong Kong this year has been the profitability of IPO subscriptions.

"Making money from one IPO subscription this year equals half a year of trading profits," Arez told BlockBeats.

The numbers speak for themselves.

In the first three quarters of 2025, 68 new stocks listed in Hong Kong. Of these, 48 rose on their debut, 4 were flat, and only 16 fell below offering price—a mere 24% failure rate, the lowest since 2017.

In the second half alone, only 3 out of 24 IPOs in July–September priced below offer, with visible profitability. Correspondingly, average first-day returns surged to 28%—nearly triple last year’s figure.

"The profitability of Hong Kong IPOs started showing signs in late 2024—for instance, MG Ping surged 70% on its first day, marking the start of a small spring rally. This year, it turned into a full-blown boom,"

Arez previously shared with BlockBeats that due to poor conditions in the crypto airdrop farming scene, his team established a dedicated Hong Kong IPO subscription group.

"We’ve successfully subscribed to Brukoi, Mixue, Auntie Shang, Ningwang, Enlivio Bio, and other highly profitable IPOs. It’s been very easy to earn over RMB 100,000 this year. For example, Enlivio Bio alone brought RMB 10,000 per lot. With some banks and brokers offering up to 10x leverage, capital efficiency has been extremely high," Arez said.

"Also, the A+H IPO model became very common this year, making operations quite stable." Several leading A-share companies, including CATL and Hengrui Medicine, launched Hong Kong listings. Since A-shares already have established valuations, H-share offerings often come with discounts—this "valuation cushion" greatly reduced IPO risks.

"Profit from CATL’s IPO felt like free money," Arez joked with BlockBeats. "Everyone knew there’d be a discount in Hong Kong, but no one expected it to be this sweet."

As profits became evident, Hong Kong IPO investing took on a near-"nationwide" trend. Compared to last year, activity has visibly intensified—oversubscription ratios moved from hundreds of times to thousands. "At the extreme, Daxing Ke Gong was oversubscribed nearly 8,000 times."

Statistics show that in the first three quarters of 2025, 68 new stocks listed in Hong Kong, with 98% receiving oversubscriptions. 86% were oversubscribed more than 20 times—double the rate from the same period last year. Fifteen stocks saw demand exceed 1,000 times, nearly a quarter of all IPOs.

Daxing Ke Gong led with a public offering subscription ratio of 7,558x, earning the title of "Subscription King"; Brukoi and Yinuo Medicine followed with 5,999x and 5,341x respectively. Against this backdrop, Hong Kong IPOs have effectively become a new form of "risk-free wealth management."

Gold: Everyone Is Seeking Certainty

On the other end of capital flows: gold’s meteoric rise.

Starting the year at $2,590 per ounce, gold dipped to a yearly low on January 3, then climbed steadily, repeatedly setting new records. It now trades stably around $4,100—an over 58% gain.

The S&P Global Gold Mining Index surged 129%, outperforming all other S&P sector indices. Silver prices also rocketed to multi-decade highs, up over 70% year-to-date.

This precious metals bull run isn’t driven solely by risk aversion. U.S. government shutdown risks, continuous central bank buying, and fears over soaring sovereign debt—all macro narratives point in one direction: money is seeking safer havens.

"For gold mining stocks, this has been an incredible year. They’re sitting on so much cash they don’t know what to do with it," Zhuochen lamented during the interview.

Zijin Mining, the largest gold-related company by market cap in the A-share market, exemplifies this boom.

By Q3, the company reported revenue of RMB 254.2 billion and net profit of RMB 37.86 billion. Combining its A-share and H-share valuations, Zijin’s total market cap has exceeded RMB 1 trillion.

Source: Zijin Mining Q3 Report

In late August, Zijin made a bold move, acquiring 84% of Anhui Jinsha Molybdenum for a massive sum, securing control of Shapinggou, the world’s second-largest molybdenum mine, with an annual capacity of 10 million tons.

This deal gives China direct access to one-third of global molybdenum resources.

Almost simultaneously, Zijin’s subsidiary "Zijin Gold International" debuted on the Hong Kong Stock Exchange on September 30, doubling on its first day—becoming the second-largest IPO of the year.

Not only A-shares: among U.S. stocks, gold miners were also the top performers this year.

Data shows Newmont rose 137%, Barrick 118%, and Agnico Eagle 116%. In contrast, Nvidia, a star in the U.S. AI sector, rose 40%; Oracle 72%; Alphabet 30%; Microsoft 25%.

While U.S. gold stocks stood out, they don’t fully represent the breadth of U.S. market gains.

The Revival of Meme Stocks in the U.S.

By late October, all three major U.S. indices had gained over 20% this year. The S&P 500 hit a record closing high of 6,753.72 on October 8. Nvidia’s market cap surpassed $4 trillion, while Microsoft, Meta, and Apple all reached new highs.

Beyond mainstream stocks, Matt, who frequents Reddit communities like "WallStreetBets" and "StocksToBuyToday," witnessed the resurgence of meme stocks and shared several standout examples with BlockBeats.

"If I had to pick the biggest meme stock on Nasdaq over the past three months, it’s OpenDoor—very similar to GameStop back in the day. Up 245% in July, 141% in August, 79% in September, the share price jumped from $0.5 to a peak of $10.87—a 2,000% gain," Matt said, his tone clearly excited.

Interestingly, this instant real estate trading company has been unprofitable since inception. Its stock plunged from a 2021 high of $35.80 to just $0.50 by June 2025 and even received a Nasdaq delisting warning.

"The turning point came when a well-known investor mentioned on social media that OpenDoor had potential to become a 100-bagger, attracting a group of retail investors on Reddit called 'Open Army,' who drove the stock’s rocket-like ascent. They elevated OpenDoor to meme stock status and even succeeded in forcing a board reshuffle."

Another meme stock Matt recently participated in was Beyond Meat, the former "leader in lab-grown meat," whose shares surged 1,100% in just days. "Same story—years of losses, heavily shorted by institutions, with short interest as high as 80%. But the more institutions doubted it, the more retail investors loved it—that’s the power of the crowd."

Interestingly, one of the best-performing U.S. stock sectors this year remains tied to crypto—but not cryptocurrencies themselves.

Compared to the stellar performance of "Bitcoin概念股," Bitcoin itself looks lackluster—even though it hit new highs this year, its annual gain was only about 15%.

Crypto’s Stall

No asset can rise indefinitely.

After multiple narrative cycles, the crypto market has become a "market without a clear theme."

While traditional capital markets found new growth logic in AI, energy, and manufacturing, crypto remains trapped in self-referential loops.

Declining trading volume tells the clearest story. In Q3 2025, spot trading volume across global centralized crypto exchanges dropped 32% year-on-year. Retail sentiment is worn thin, market makers less active, market depth shrinking.

On-chain funds are quiet, token prices flatline, project teams silent. On social media, even complaints about failing exchanges have dwindled.

Crypto participants, once fueled by get-rich-quick myths, have become "self-exploiting subjects." Monitoring screens 24/7 because "opportunities wait for no one"; frantically farming airdrops, chasing memecoins, jumping on trends because "if you don’t hustle, you’ll be left behind"; blaming themselves for losses ("I wasn’t smart enough"), never satisfied with profits ("not enough yet").

Three quarters into 2025, effort stopped yielding results—burnout was inevitable.

"Those who were going to leave have left; those who remain don’t want to bet anymore," Arez’s pessimism about crypto seems to reflect many. "In 2024, I still monitored the blockchain daily. This year, I don’t even feel like opening the exchange app."

The crypto market truly underperformed this year. But its loss was an inevitable outcome within the cycle.

When macro conditions gave traditional assets clear upside logic, when tighter regulations raised speculation costs, and when exhausted narratives failed to attract new capital—crypto’s downturn was almost predestined.

But this doesn’t mean the crypto story is over.

"If you believe in China’s national trajectory, dollar-cost average the CSI 300; if you believe in China’s tech breakthroughs, invest in CSI 500; if you believe in America’s future, buy the S&P 500; if you believe in human technological revolution, go for the Nasdaq. If you believe humanity is doomed, invest in gold." This quote has recently gone viral on Twitter.

Each asset represents a belief. And perhaps crypto’s belief simply needs new time and new people to rewrite it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News