DID: The Quest for Credit and Permissionlessness

TechFlow Selected TechFlow Selected

DID: The Quest for Credit and Permissionlessness

The credit system is the cornerstone of a frictionless society, offering everyone the possibility of equal dignity and happiness.

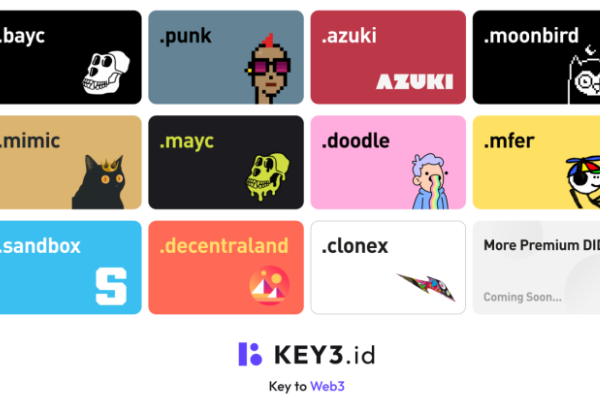

In last week's article End-to-End: Decentralized Pathways Built by DID and On-Chain Data, R3PO pointed out that on-chain data functions as a "sinking" data infrastructure. It must be integrated into products such as SocialFi, GameFi, and wallets together with decentralized identifiers (DID) as a functional suite. The article particularly analyzed the significance of domain names like ENS for personal identity in the Web 3.0 era.

According to R3PO, there remains a lack of observation regarding application directions for on-chain data. While blockchain represents a breakthrough over traditional systems through comprehensive data openness, this does not imply equal "data access rights." Limited by capital and technical skills, data-driven products have commercialized along paths that exclude most users, creating new forms of inequality.

This de facto inequality leads to evaluation and control of the majority by a minority. Meanwhile, personal data is scattered across different public chains, DApps, and platforms. Individuals cannot truly exercise rights to create, read, update, or delete their own data. Combined with constantly changing addresses and domain names, personal identities in the on-chain world are becoming increasingly fluid and fragmented.

From the perspective of genuinely empowering individuals, R3PO argues that we must start from unified data sources and personal identity, returning data ownership and access rights to users, thereby building a decentralized social system based on credit.

A credit system is the cornerstone of frictionless societal operation, offering every individual the possibility of equal dignity and happiness.

Web3 Personal Identity: Verifying Asset Ownership

Personal identity is a prerequisite for the mass adoption of future Web3 products, and data accumulation provides a decentralized verification pathway for identity construction.

Take Bitcoin as an example: its underlying data structure is essentially a variant of Merkle Trees formed by combining hash pointers with binary trees. Data itself serves as the ledger, and the ledger records all on-chain activities. From the genesis block to miners competing for bookkeeping rights via hash collisions, to transaction information (Tx) between individuals—this data constitutes the blockchain itself.

However, R3PO believes that while this data stacking enables decentralization, it also creates another persistent issue—the anxiety of identity disconnection. Public-private key-based account systems actually lack effective mechanisms binding individuals to the chain. Once recovery phrases or private keys are lost, proving one’s identity or ownership of assets becomes impossible forever.

To solve identity disconnection, wallet solutions and on-chain data analysis attempt to address the problem from two angles. After eliminating all impossible answers, only one truth remains.

Specifically, wallet solutions provide containers for identity. Boosted by approaches like MPC (Multi-Party Computation) and account abstraction, social recovery links personal identity with interpersonal relationships. On-chain data analysis, using AI and behavioral modeling, directly infers connections between on-chain addresses and real-world entities—for instance, after the FTX hack, although the hacker’s identity remained unknown, tools like Nansen tracked their behavior in real time.

Yet the problem remains unsolved. Wallet solutions fail to address interactions between individuals, especially among strangers or in public domains. Only when more personal data is accumulated through DID, SBT, and SocialFi can identity receive genuine data-backed validation.

Like Twitter’s blue checkmark verification system, centralized review ensures identities aren’t impersonated. In a decentralized society, only sufficient data volume can achieve effective identity attestation.

The biggest limitation of on-chain data analysis lies in its effectiveness primarily targeting whales and institutional addresses, failing to identify the vast number of retail individuals. At best, it can reverse-engineer account behaviors and assign labels—for example, OKLink has collected 200 million entity tags, and Nansen tracks major CEX cold wallets in crypto circles.

But labels are not identity. Multidimensional labels may constitute aspects of a person, yet personal identity is a unique “on-chain asset” and carrier of social capital. As per SBT theory, its non-transferability stems from being “unique”—individuals cannot sell themselves, only their various assets such as labor and time.

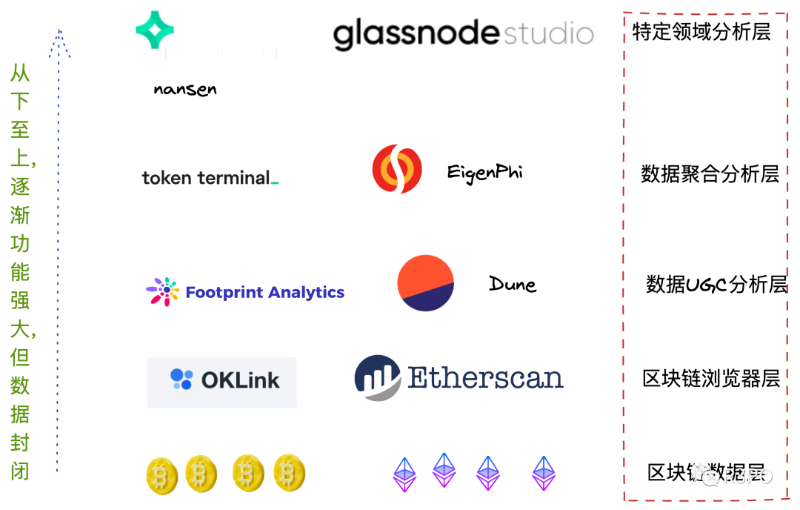

Caption: Blockchain Data Layers Image Source: R3PO

R3PO believes that, as shown above, at the foundational level of blockchain data hierarchy, the architecture, storage, and flow of raw data reside on public chains and are equally accessible to anyone. Alice’s address can be tracked in real-time by Bob, but without Bob revealing his own address, reverse tracking is impossible.

Starting from the browser layer, however, asymmetry emerges in data storage and access, leading to personal identities being exploited without individuals sharing in the profits. For example, Nansen charges high subscription fees without revenue-sharing with the addresses it analyzes, turning individual users into “digital labor” for data platforms.

Platforms like Dune and Footprint allow users to create data products and grant open query access, yet they struggle to monetize sustainably. They gain users but lose profitability—high user stickiness cannot be converted into revenue. Just as governance tokens like UNI fail to capture protocol value, token economics largely fails here too.

From this perspective, current blockchain data products generate new problems. Their profit models rely on informational asymmetry created by excluding the majority—an approach clearly incompatible with what users need in the Web 3.0 era. The breakthrough lies in integrating with identity attributes like DID and SBT, returning personal data to individuals, thus activating the profit flywheel of data products.

For example, SocialFi token economic models universally emphasize data portability—no social protocol should be able to seize data or profits from individuals.

Equal DID Is the Only Path to Eliminate Data Access Inequality

R3PO argues that inequalities generated at the data access level cannot serve as the foundation for future Web 3.0. First, we must acknowledge that decentralization implies equality—a concept rarely emphasized in prior discussions around privacy and freedom. This unequal access right has not been widely recognized in terms of value.

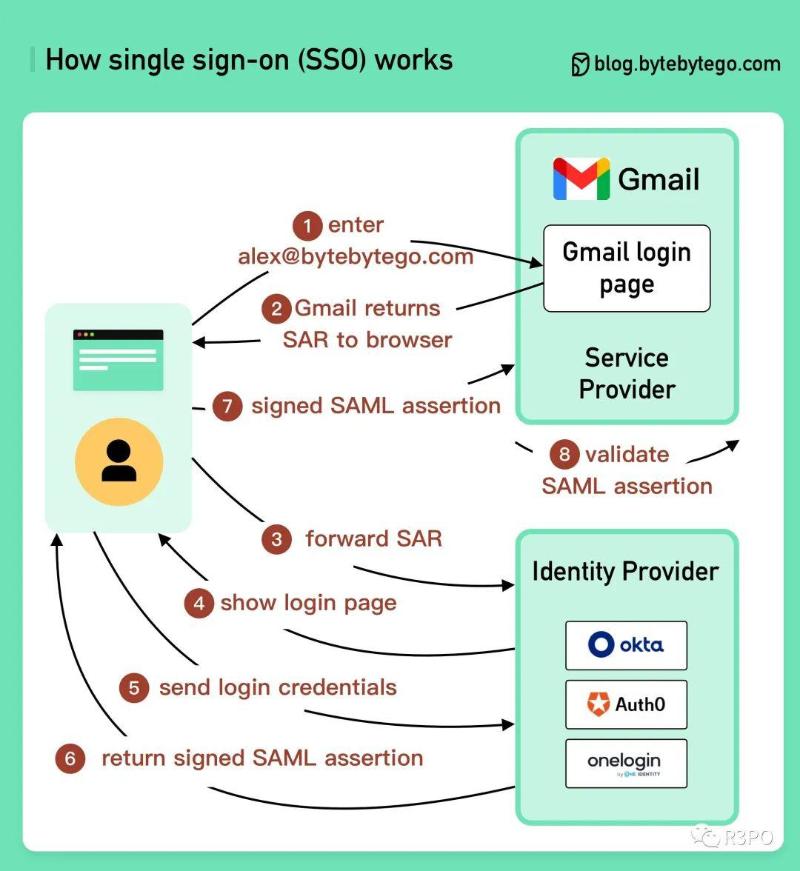

The flow of personal identity in Web 2 follows: centralized verification → account distribution → cross-product account recognition → account binding. Within this process, centralized verification at the origin and mutual recognition between accounts represent critical flaws, signifying that individuals never truly control their own data.

Taking traditional credit products as an example, their core consists of risk control and credit rating—controlling losses and achieving expected returns, respectively.

Here, the biggest issue remains that individuals must unilaterally disclose personal data to obtain financial support—a long-standing concern regarding data and privacy security. Moreover, businesses cannot publicly share acquired data due to competitive pressures, resulting in a zero-sum game where both individual privacy and corporate transparency lose.

Longstanding difficulties in obtaining loans for small and micro enterprises reflect risk-avoidance behavior by commercial banks. Without the ability to individually verify true business conditions, banks preserve profits by halting lending—leading to operational struggles for companies and potentially triggering economic crises in severe cases.

Caption: SSO Diagram Image Source: bytebytego.com

Web 3.0 offers an alternative possibility. Once a credit system built on personal data is established, uncollateralized lending becomes merely a basic function. Market liquidity will be priced on credit, enabling new risk-control models that could transform today’s DeFi landscape. Currently, DeFi heavily relies on USD stablecoins, centralized lending, and market makers—centralized institutions that undermine its decentralization claims.

R3PO believes current DeFi is largely experimental, serving as early-stage validation rather than a viable component of a future DeSoc (decentralized society)'s credit economy.

The path toward a credit society is gradually clarifying—increasing practicality of DID/SBT products serves as proof. However, current DID/SBT offerings remain confined within functional modules. Beyond that, the deeper issue persists: inequality. Whether between Asia and Europe/America, the Global North and South, or North America and Latin America, endless conflicts reveal how existing societal inequalities threaten to permeate our future.

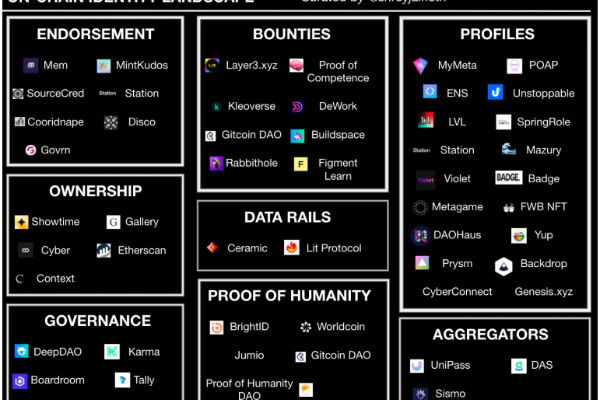

In the previous article, R3PO discussed development directions and carrier products of major DID solutions, which won't be repeated here. What needs highlighting are the issues present in current DID/SBT development:

Severe centralization, especially in KYC (Know Your Customer), reflecting strong Web 2.0 path dependency and mental inertia;

Unequal access to identity—underdeveloped regions may sell personal information at extremely low prices, contradicting the original intent of privacy protection;

These two issues often overlap. Taking initiators of DID/SBT products as examples, they are mostly Western projects engaging in product dumping onto the Global South:

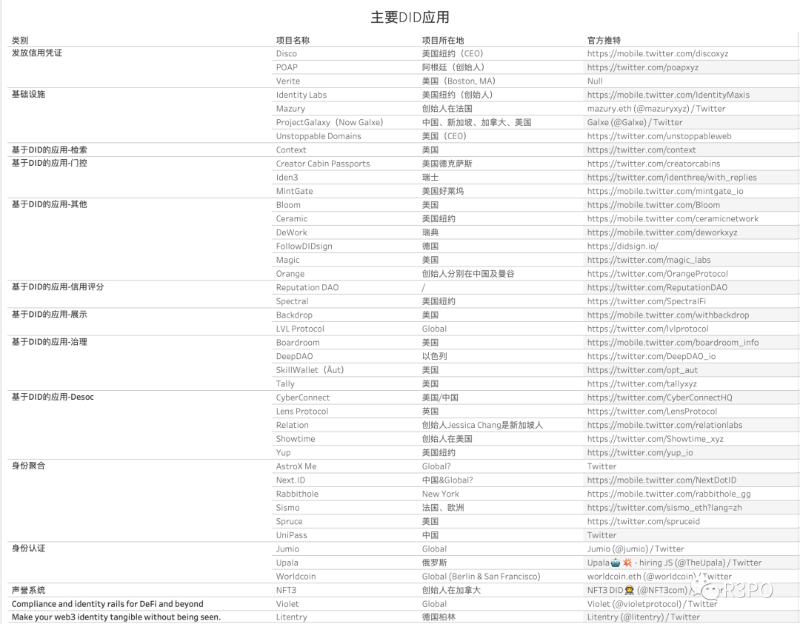

Caption: Major DID Products Image Source: R3PO

Take Southeast Asia as an example—it rivals Western counterparts in GameFi, producing globally influential products like Axie Infinity, YGG, and Coin98. Yet in the DID/SBT space, it shows clear weakness. Only Orange, Galxe, and Relation have meaningful ties to Southeast Asia, while most other products originate from the West. In terms of probability of success, the disparity in scale is stark.

In sharp contrast to the scarcity of local projects, the cheap personal identities of Southeast Asian users are repeatedly abused across multiple products. This de facto inequality is widespread. If Web 3.0 itself fails to ensure equitable access to on-chain identity, credit and loans will continue flowing to whales and institutions, just as in traditional finance.

At the beginning of 2022, the explosive popularity of WorldCoin brought attention to the vision of establishing on-chain identities for billions globally. Its ambition was to scan every individual onto the chain, breaking free from existing centralized verification constraints and creating a utopia of free-flowing information, identity, and assets.

It adopted a sales model where each collector purchases an Orb iris-scanning device to verify personal information, earning $10–200 per day. User numbers quickly grew into the millions. However, this very collection of personal information constitutes information exploitation. Compared to users in the West, those in Southeast Asia and Africa are more willing to trade their biometric data for rewards or tokens.

Front-end real-name identification combined with on-chain anonymity is inevitably a wrong turn toward a decentralized credit society. After WorldCoin, other so-called DID/SBT products like Galxe and Binance’s BAB still conduct KYC operations. While Europe and the U.S. enforce GDPR compliance, Southeast Asian markets impose fewer restrictions, leading to actual inequities in personal data collection.

Genuine DID/SBT products do require large volumes of user data to identify individuals—just like WorldCoin, Galxe, and BAB—but such identifiers must emerge through long-term decentralized construction. Just as DeFi evolved, centrally-built products cannot meet the demands of future decentralized societies.

Inequality has long existed in Web 2.0, but these shackles should not carry over into Web 3.0. At minimum, promising everyone equal access rights serves as a long-term driving force for industry advancement.

Conclusion

Will privacy still be protectable if on-chain data and DID lead to full public exposure of personal identity?

Under prevailing logic, on-chain data cannot be revoked. Regardless of truth, accuracy, morality, or legality, any information confirmed on-chain becomes permanently unforgotten. Possessing someone’s secrets also remains a tried-and-true tactic for online harassment in real life.

For current DID/SBT products, behavioral data will persist eternally on-chain. One’s DeFi financial history will be aggregated and scored. Individuals can access any data without permission—but so can others.

Currently, ZK technology may offer a solution: personal information can be recorded without requiring others to know its specific content, allowing verification of authenticity and creditworthiness. Ultimately, scoring and attestation exist to differentiate individuals. To curb invasive curiosity while ensuring efficient operation of a decentralized society, more technological pathways must strike balance between privacy and efficiency.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News