Learning from History: A Review and Outlook on the Evolution of Blockchain Sectors

TechFlow Selected TechFlow Selected

Learning from History: A Review and Outlook on the Evolution of Blockchain Sectors

When innovation in token business models, product maturity, and application narrative innovation converge, we will迎来 the next major cycle opportunity.

By | Frank Fan @Arcane Labs

Don @Arcane Labs

Edited by | Charles @Arcane Labs

Innovation and development in any field are built upon the foundations and challenges left by predecessors. This article analyzes the evolutionary patterns of blockchain industry sectors by reviewing three major cycles the industry has undergone, examining observed phenomena and details. It further forecasts the likely stages and popular sectors in the next cycle.

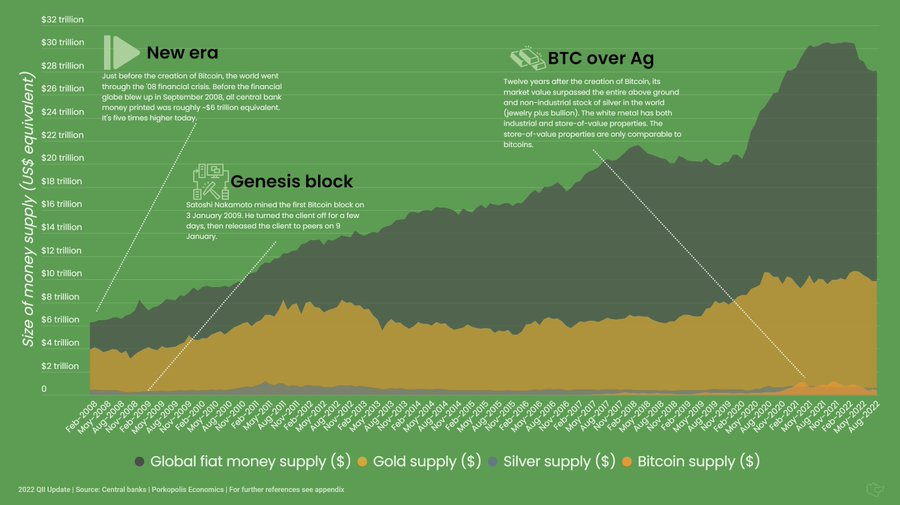

The term "blockchain" has now existed for 13 years since the publication of the Bitcoin whitepaper in 2009. What began as an obscure term has evolved into a widely recognized industry, spawning countless ecosystems and sub-sectors. Through multiple bull and bear market cycles, the industry has grown from nothing, enabling early participants focused on various niches to rise with the tide and reap substantial wealth. Looking back at recent sectoral shifts within the industry, we can clearly identify underlying patterns.

Firstly, it is well known that the blockchain industry exhibits particularly pronounced cyclical behavior. During bull markets, the industry thrives and continuously generates bubbles. In bear markets, however, activity becomes extremely sluggish and quickly clears out. Historically, these cycles have aligned closely with Bitcoin's halving events—marked by waves of capital rushing in and later exiting at losses—establishing a rough four-year bull-bear cycle pattern.

Beyond Bitcoin’s halving—a constant narrative across cycles—each cycle also features unique industry transformations that drive its progression.

For instance, the three cycles we've experienced so far:

The first was the value discovery of decentralized commodity money led by Bitcoin;

The second marked the shift from simple decentralized currency to decentralized smart contract platforms;

The third saw users increasingly engaging in on-chain behaviors and discovering value in decentralized foundational applications.

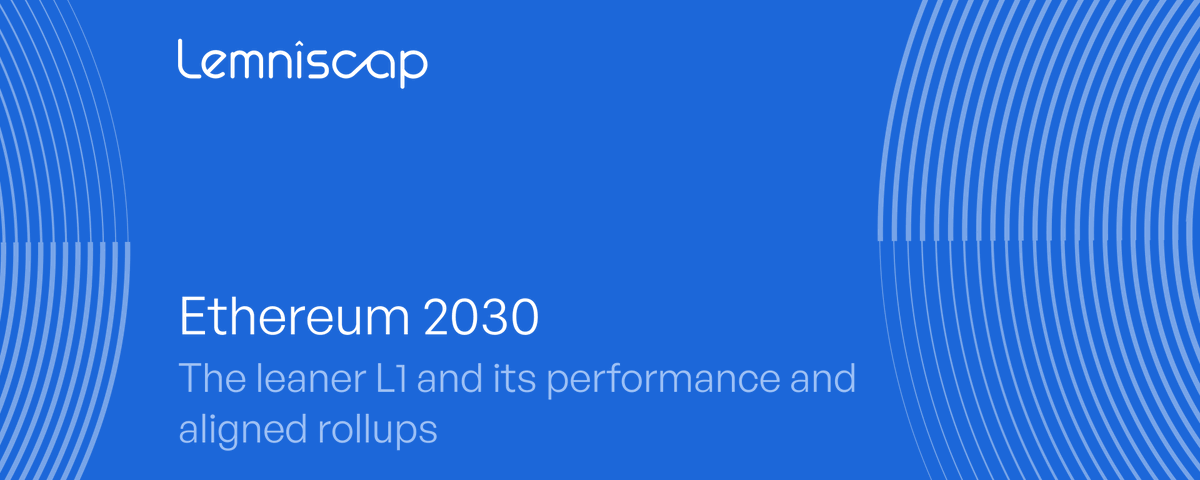

Figure 1: Size of money supply

#1 The First Three Cycles in the Blockchain Industry

1.1 Decentralized Commodity Money Enlightenment Phase (2010–2013)

Looking back, during the first crypto cycle, Bitcoin—the pioneer of the entire industry—began entering public awareness due to its anonymity, decentralization, and fixed supply scarcity. Its narrative as a borderless transfer tool and "digital gold" gradually gained recognition among more people. The saying “Bitcoin is gold, Litecoin is silver” perfectly captured this early stage of decentralized commodity money.

This phase was also driven by the loss of trust in traditional finance following the 2008 financial crisis. Early participants in the cryptocurrency market were predominantly hardcore tech enthusiasts. Compared to today, where capital is deeply involved in crypto, early adopters held much stronger ideological convictions about decentralization.

This period was essentially an enlightenment phase for decentralized ideology.

1.2 Emergence of Smart Contract Platforms (2014–2017)

The second crypto cycle was primarily defined by the era of Initial Coin Offerings (ICOs) and the value discovery of blockchain smart contract platforms represented by Ethereum. From its inception to when its fundraising potential was first recognized, Ethereum was followed by numerous so-called "Ethereum killers," such as prominent projects like EOS, Tron, and ADA. This period was characterized by the broad concept of "blockchain" dominating discourse—a wild west era where only native coins of select blockchain smart contract platforms achieved consensus value. Very few applications existed on these platforms, and their tokens rarely held recognized value; users typically immediately swapped application tokens for the platform's native coin. On-chain activity remained minimal, with most users still focused on trading tokens via centralized exchanges. Finding the "killer DApp" was a recurring theme mentioned at nearly every blockchain conference.

This phase marked the true beginning of blockchain as a concept stepping onto the historical stage—an embryonic stage of growth.

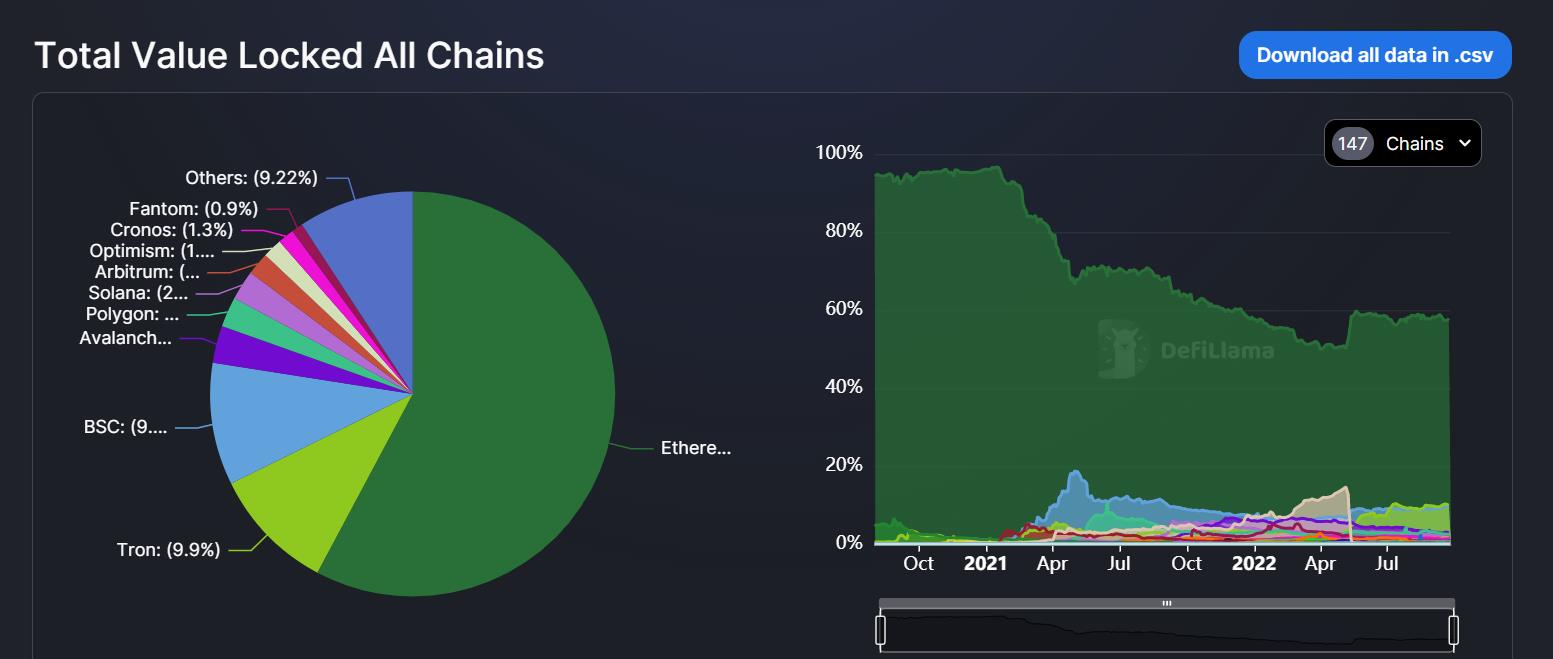

Figure 2: Total Value Locked All Chains

1.3 Foundational Stage of DApp Applications (2018–2021)

The third crypto cycle, the most recent one, brought the most noticeable change: on-chain ecosystems and user activities became visibly more vibrant. A clear indicator was how many traders, when encountering an unfamiliar token, no longer asked which centralized exchange listed it, but instead requested the token’s on-chain contract address. Something commonplace today was unimaginable in the previous cycle.

This shift was enabled by the maturation of decentralized foundational applications during this cycle. Starting with the DeFi Summer, two key innovations—Automated Market Makers (AMM) and liquidity mining—ushered in an era of DeFi prosperity on-chain. As everyone remembers, throughout 2021, DeFi, NFTs, GameFi, and other on-chain applications took turns driving the bull market. Additionally, meme coin manias sparked by Doge and Shiba Inu, along with wealth effects from airdrops like those of Dydx and ENS, significantly boosted on-chain activity.

By this stage, DeFi infrastructure had been largely established, with leading products emerging in trading, lending, and other areas. DAOs remained in an early ideological phase, with immature products. NFTs sat between DeFi and DAOs, having successfully pioneered the PFP (profile picture) avatar model, yet requiring broader use cases for further development. This summarizes the current state of what were once called the three pillars of blockchain applications.

Currently, on-chain applications in this cycle have hit a bottleneck. Most subsequent developments involve minor innovations or patchwork built upon existing models, resulting in significant homogenization. Toward the end of this crypto cycle, market speculation shifted toward grander narratives like Metaverse and Web3—classic signs of stagnation in product-level innovation. Of course, we’re still in the early days of the blockchain industry. If compared to human development, we're more like adolescents—still laying foundations while beginning to explore specialized paths.

This phase laid solid groundwork for future diversified DApp applications. It was also during this cycle that discussing "sectors" or "tracks" began to carry real meaning.

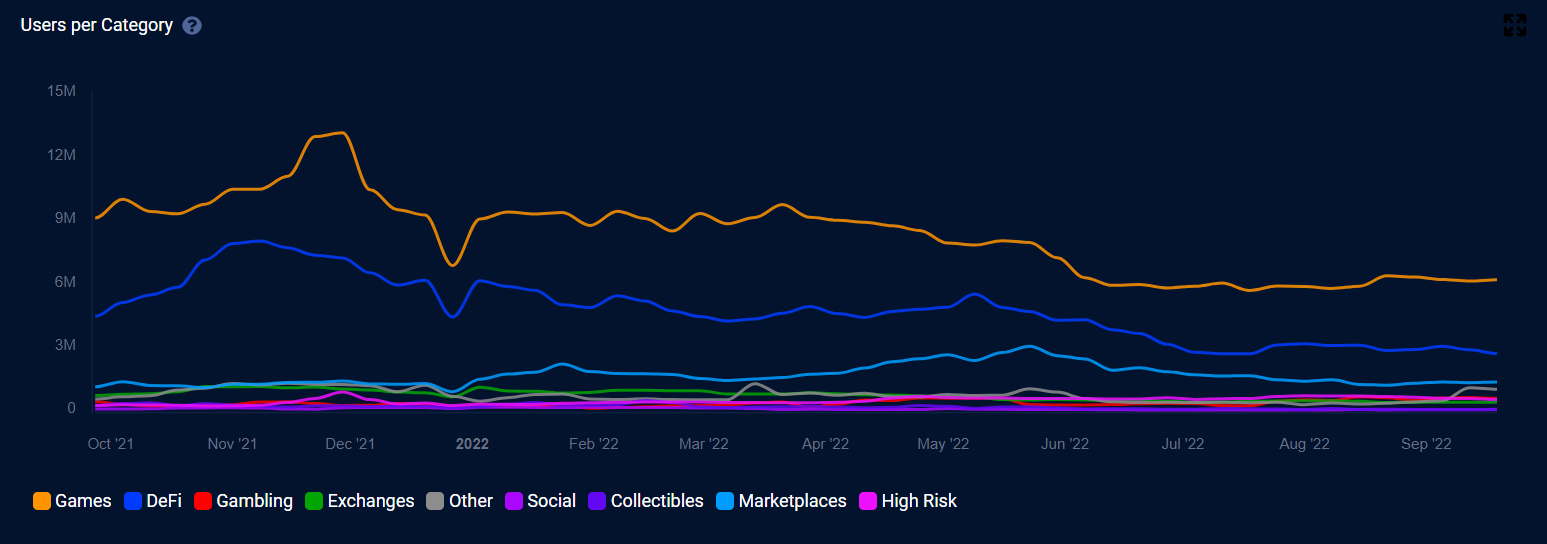

Figure 3: Dapp Users per Category

#2 Early Stage of Full-Scale Blockchain Application Adoption

The next cycle will mark the initial phase of comprehensive value discovery through widespread blockchain application adoption.

The full-scale development of applications will make the blockchain industry more mainstream. Only continuous mainstream adoption can bring exponential user growth. Against the backdrop of global macroeconomic downturn and fading internet population dividends, the rising popularity of Web3—the new synonym for the blockchain industry—has attracted unprecedented attention from both new and traditional investors. Moreover, with established public chains, newly emerged capital-intensive Layer 1 platforms, and narratives around Ethereum’s Merge, Rollups, and Danksharding, technological maturity combined with capital inflows signals growing potential for large-scale blockchain applications in the near future.

To advance further toward mainstream adoption, progress must be made in three key areas:

a. Scalable blockchain底层 technologies and platforms capable of supporting complex applications

b. Regulatory frameworks and compliance policies better suited to the crypto industry to attract mainstream capital

c. Lowering entry barriers and improving user experience of onboarding products to onboard more mainstream users

Of course, Rome wasn’t built in a day. Reviewing past cycles, the explosion of industry narratives has always evolved spirally across several dimensions.

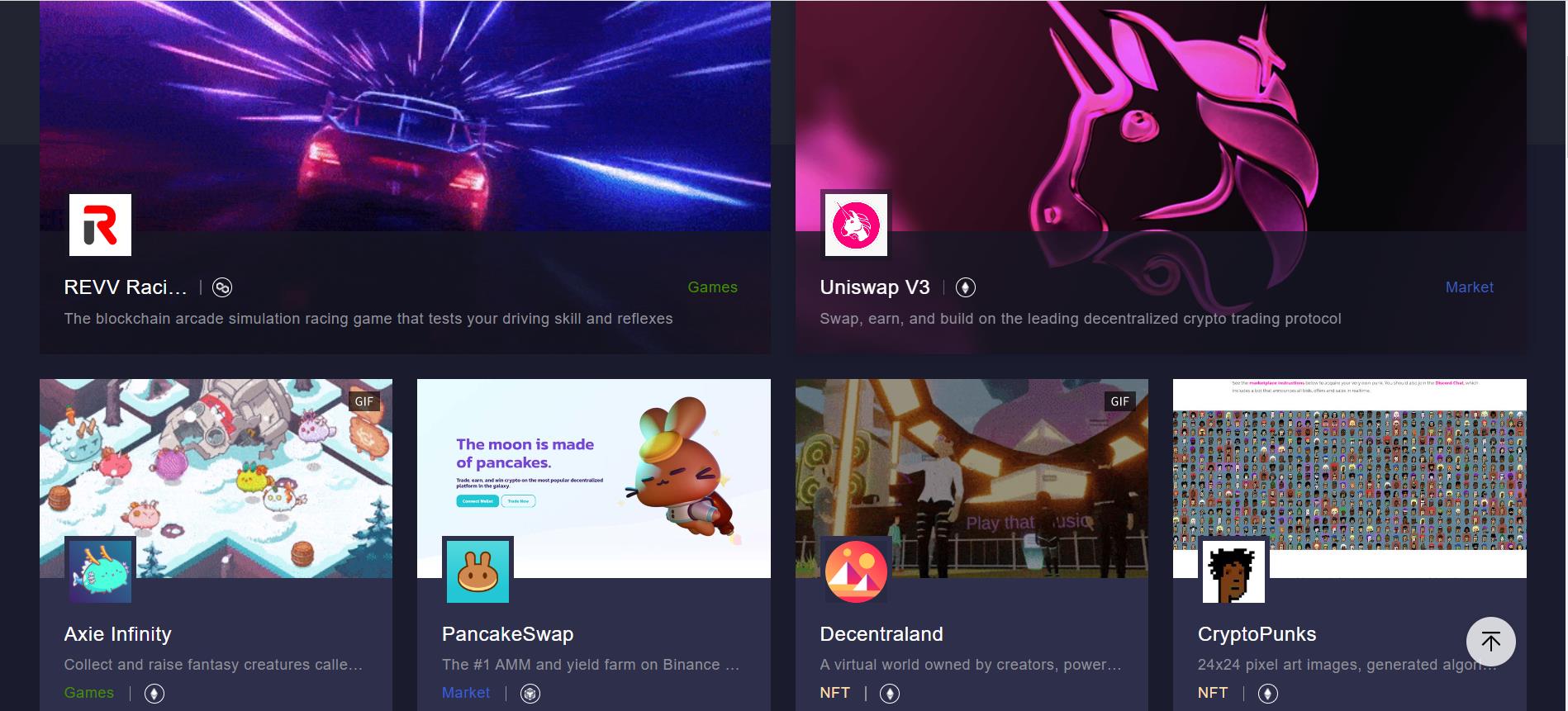

2.1 Products and Concepts

Breakthrough products are prerequisites for sectoral booms. Rapid data growth from a product itself tells the best story. For example, Uniswap and Compound for DeFi rapidly increased on-chain TVL by an order of magnitude; Axie Infinity for GameFi briefly surpassed top Web2 mobile games like Honor of Kings in revenue; Sandbox and Decentraland for Metaverse; CryptoPunks and Bored Ape Yacht Club for NFTs. Conversely, many sectors haven’t taken off simply because they lack breakout products validated by the market. That said, during bull markets, abundant liquidity allows even immature concepts to be hyped cyclically. Such speculation helps draw more developers into building, eventually filtering out superior products through natural selection.

Moreover, truly paradigm-shifting products appear only once per cycle: Bitcoin in the first, Ethereum in the second, and Uniswap in the current cycle.

Figure 4: dapponline.io

2.2 Applications and Infrastructure

Application development and infrastructure advancement must co-evolve and reinforce each other. App growth depends on robust底层 infrastructure and continuously optimized middleware services. Meanwhile, infrastructure thrives based on the success of applications built atop it. For instance, the rapid growth of DeFi and its demand for fund security cemented Ethereum’s position as the top public chain, while fueling explosive growth for tools like ChainLink and The Graph. Similarly, GameFi applications perform better on newer chains like BSC, Avalanche, and Solana, which offer lower fees and faster transaction speeds. Current applications mostly handle relatively simple logic. I believe the next cycle will spawn more sophisticated applications and corresponding infrastructure to support them.

2.3 Issuance and Circulation

The core difference between Web3 and Web2 lies in Tokens—the fundamental distinction between assets and information. Token issuance, circulation, and economic design are unavoidable considerations for every Web3 entrepreneur. Over the years, methods of token issuance and circulation have continuously evolved. Initially, tokens were mined via POW/POS consensus mechanisms. Later came ICOs and IEOs for fundraising. More recently, DeFi introduced liquidity mining, GameFi introduced play-to-earn mechanics, and IDOs on launchpads along with airdrops have become popular distribution methods. With increasing venture capital involvement, token issuance now resembles traditional startup financing—multiple funding rounds followed by IPO-like launches—indicating a diversification of issuance models.

On the circulation side, trading evolved from fragmented OTC (over-the-counter) models to centralized exchange order-matching systems, and now to decentralized exchanges (DEXs). Today, two dominant models have emerged: centralized limit-order books and decentralized AMMs.

Whether this represents the final form of token issuance and circulation remains unknown. However, as issuance and circulation represent two fundamental attributes of any asset, changes in these mechanisms consistently trigger massive industry shifts and generate enormous wealth effects. We hope to continue seeing innovation in this dimension in the next cycle.

Figure 5: PoW & PoS

The preliminary value discovery of fully applied blockchain also hints at several possible trends: In the next cycle, industry dynamics will become more complex, and many previously assumed "rules" may be broken. Many investors relying solely on on-chain data analysis ("cutting the boat to find the sword") in secondary markets may already feel this shift. Additionally, the time required for innovation and maturation in products and technology may be longer than before. Therefore, we advise industry participants to prepare mentally and financially for long-term building efforts.

#3 Predictions on Upcoming Hot Sectors

3.1 Rollup and Other Scaling Solutions

In blockchain scalability, numerous technical approaches and teams continue active development. Efforts have progressed from modifying consensus algorithms, to L1 sharding, to today’s layered L1/L2/L3 architectures. Among these, Rollup has become the dominant approach. In late 2020, Vitalik Buterin published “An Ethereum roadmap towards a rollup-centric future,” reaffirming Rollup’s strategic importance during the 2022 ETH Shanghai Summit. Technologies like Danksharding are specifically designed to enhance Rollup capabilities. Currently, Rollups fall into two main types: Optimistic Rollup and ZK Rollup.

Optimistic Rollups offer easier EVM compatibility and support general-purpose smart contracts, though withdrawal times are longer. Representative projects like Arbitrum and Optimism have developed strong ecosystems with many deployed applications. Their withdrawal mechanism has also created opportunities for third-party cross-chain bridges.

Zero-Knowledge Proof (ZKP) technology has become a highly sought-after investment area in the primary market. Technically, ZK is a verification method allowing a prover to convince a verifier of a statement’s truth without revealing any additional information. Originally used for privacy, ZK is now increasingly applied to scaling.

ZK Rollups offer much faster withdrawals than Optimistic Rollups, but currently struggle with EVM compatibility and general-purpose contract support. Leading projects like ZkSync and StarkWare remain in development phases.

Performance-wise, ZK Rollups slightly outperform Optimistic Rollups, but the latter are easier for developers to migrate to. Vitalik has publicly stated he favors Optimistic Rollups in the short term but is more bullish on ZK Rollups long-term.

Regardless of the scaling method, the ultimate goal remains providing better experiences for users and developers to foster thriving ecosystems. The scaling race is far from over—which is why I define the next cycle merely as the initial phase of full-scale blockchain application adoption. We expect next-generation scaling solutions led by Rollups to maintain a diversified landscape, which in turn supports a richer variety of applications and ecosystems.

Notably, new scaling architectures may give rise to novel native applications, especially in derivatives and gaming. Examples include dedicated chains like Arbitrum Nova.

Figure 6: Arbitrum Nova

3.2 DID (Decentralized Identity)

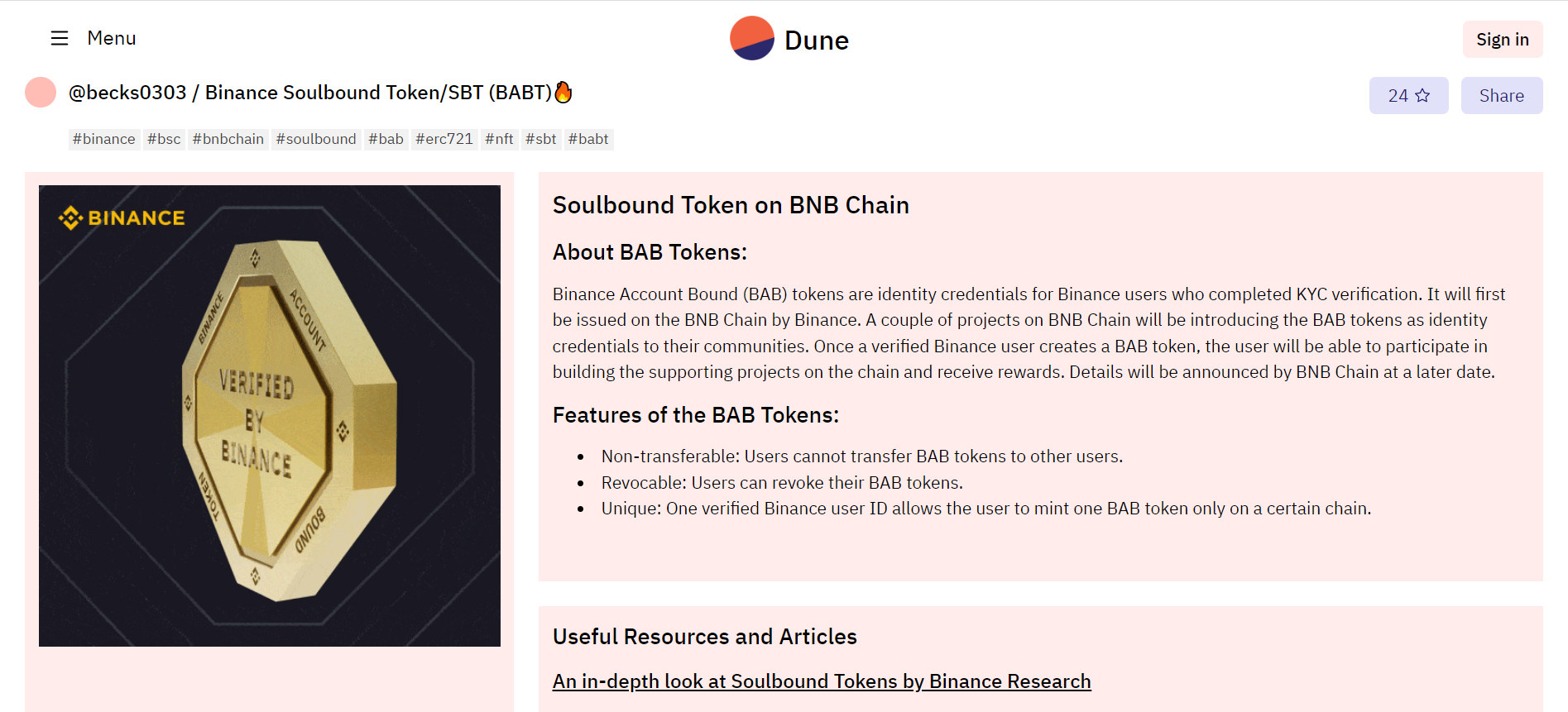

DID, or decentralized digital identity, is not a new concept. However, Vitalik Buterin’s recent proposal of SBT (Soulbound Tokens) and Binance’s launch of its own “Soulbound Token” BAB have reignited market interest in DID.

Without reiterating its technical features, from narrative and practical perspectives, a mature and widely adopted DID product could become essential infrastructure for bringing the industry into the mainstream.

DID could unlock innovative possibilities in decentralized social networks, on-chain KYC, credit systems, collateral-free lending, and regulatory compliance.

Simply porting Web2-style KYC solutions directly into Web3 won't work. Projects must focus on integrating user on-chain interaction data organically. Success will come from addressing specific needs to capture users effectively.

Figure 7: Binance Soulbound Token/SBT (BABT)

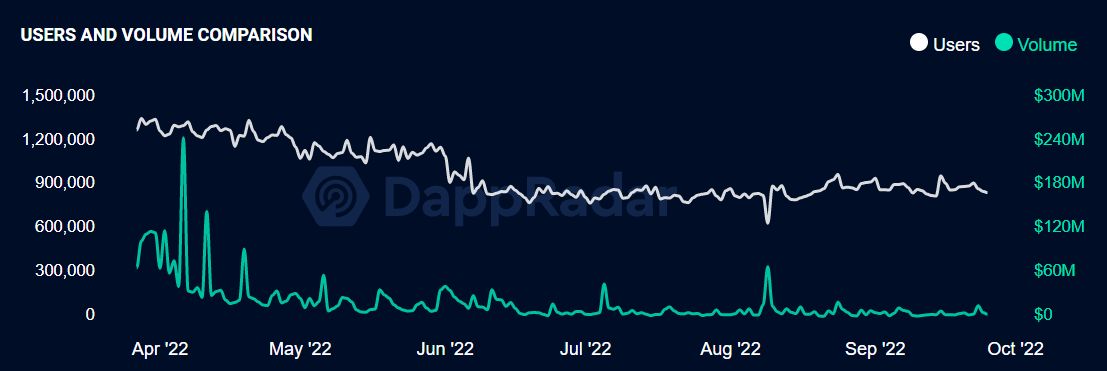

GameFi was exceptionally hot in the second half of last year. But the boom didn’t last. Amid retail frenzy, blockchain games became the final leg of the bull run. Today, game investments have become one of the most controversial areas for institutional investors. Looking back, we now understand that GameFi 1.0 was essentially DeFi mining disguised as games—or even Ponzi schemes. The gaming layer lowered the entry barrier: unlike DeFi, many users joined through guilds (akin to mining pools), simply depositing funds with managers. However, conflicts of interest between agents and investors harmed many GameFi participants.

From a pure gaming perspective, fun is paramount. Beyond visuals, compelling gameplay, engaging mechanics, or immersive storylines are needed to captivate players—drawing on principles from game theory and psychology.

None of last year’s blockchain games were truly fun. They relied solely on high-income farming incentives to attract players. By the peak of the hype, participants competed only on whose returns would deplete slower. Once token prices collapsed and yields dropped, players had no reason to stay engaged.

Figure 8: GameFi Users and Volume Comparison

This isn’t just a project-specific issue—it reflects a deeper divide between Web2 and Web3 user expectations and experiences. Web3 users seek high financial returns, while Web2 users prioritize entertainment. These groups aren’t mutually exclusive: many Web3 users love games, and many Web2 users want to earn money. These needs cannot be satisfied by slapping a token onto a beautifully designed game. Instead, tailored strategies targeting different user types must be developed and integrated thoughtfully.

Returning to our original vision, the value of blockchain gaming lies in solving ownership of in-game assets—putting control directly in players’ hands—and enabling token-based governance to prevent unilateral decisions by developers. These benefits matter only after a game gains player acceptance. Given current Web2 users' limited familiarity with blockchain, full "blockchain transformation" of games may be premature. Hence, incentives are critical for native Web3 games. Thus, last year’s incentive-driven model represented an inevitable extreme phase in early development.

The next stage may focus on shaping game assets—specifically NFTs. NFTs align most naturally with gaming attributes and possess strong consumer characteristics, unlike GameFi 1.0, where NFTs served merely as mining "machines" or access keys. As blockchain games improve in gameplay and NFT protocols evolve, NFT liquidity will increase. Games centered around NFT value may define the next wave of blockchain gaming.

Token incentives will persist, but economic models will stabilize and play a less dominant role.

#Conclusion

After a decade of ups and downs, the crypto industry has evolved from ideological foundations to technical underpinnings and finally to application development. We believe we are standing at the dawn of a full-scale blockchain application explosion. Beyond frequently discussed sectors like Rollup, DID, and GameFi, promising projects will emerge in DeFi derivatives, NFT liquidity, decentralized middleware, cross-chain protocols, blockchain security, mobile blockchain apps, and DAOs. Tokens, as the industry’s unique incentive mechanism, represent a distinctive business model. Regardless of economic design, they inherently exhibit financial cyclicity. When innovation in token-based business models converges with maturing products and novel application narratives, we will welcome the next major cycle of opportunity.

References:

1. https://twitter.com/DocumentingBTC/status/1574421976298332160

2. https://DeFillama.com/chains

3. https://dappradar.com/industry-overview

4. https://dapponline.io/dapp

5. https://twitter.com/viv_three/status/1574003545283891200

6. https://dappradar.com/topic/games

7. https://twitter.com/BMANLead/status/1520488056599457792

8. https://nova.arbitrum.io/

9. https://dune.com/becks0303/binance-soulbound-token

🔗 Original link: (or click “Read Original”)

https://mirror.xyz/arcanelabs.eth/-vTsz36fsRqjiVgIR4BPvEVZ8wyexU36M8LjzIDrtlo

📙 Author:

Frank Fan, Partner at Arcane Fund, Founder of Arcane Labs, former senior executive at Huobi and Microsoft, alumnus of Tsinghua University and Columbia University, dedicated to exploring new business models and technological revolutions, promoting the widespread adoption of Web3.0, focusing on investment, incubation, strategy, and management. Twitter: @MetaLouis66

Don, Researcher at Arcane Labs, five years of hands-on crypto investing experience, firmly believes blockchain will transform the world, dedicated to identifying early-stage projects and discovering the next generation of paradigm-shifting products. Twitter: @AtomWxw

📬 Contact email: labs@arcanegroup.io

🔗 Browse more articles:

Mirror: mirror.xyz/arcanelabs.eth

Twitter: twitter.com/Arcane_Labs_

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News