Timeswap, an on-chain lending protocol: fixed term, fixed yield, and LTV that varies according to market demand

TechFlow Selected TechFlow Selected

Timeswap, an on-chain lending protocol: fixed term, fixed yield, and LTV that varies according to market demand

Timeswap is not the best DeFi money market, but it is the leader.

Written by: grace

Translated by: TechFlow

Those who have followed Timeswap for a while already know how it differs from AAVE, but I’d still like to explain it for newcomers.

-

AAVE is a continuous, variable-yield product. This means you can borrow or lend without an expiration date—think of your savings account.

-

Timeswap, on the other hand, is a fixed-term, fixed-yield product—like a fixed deposit (FD).

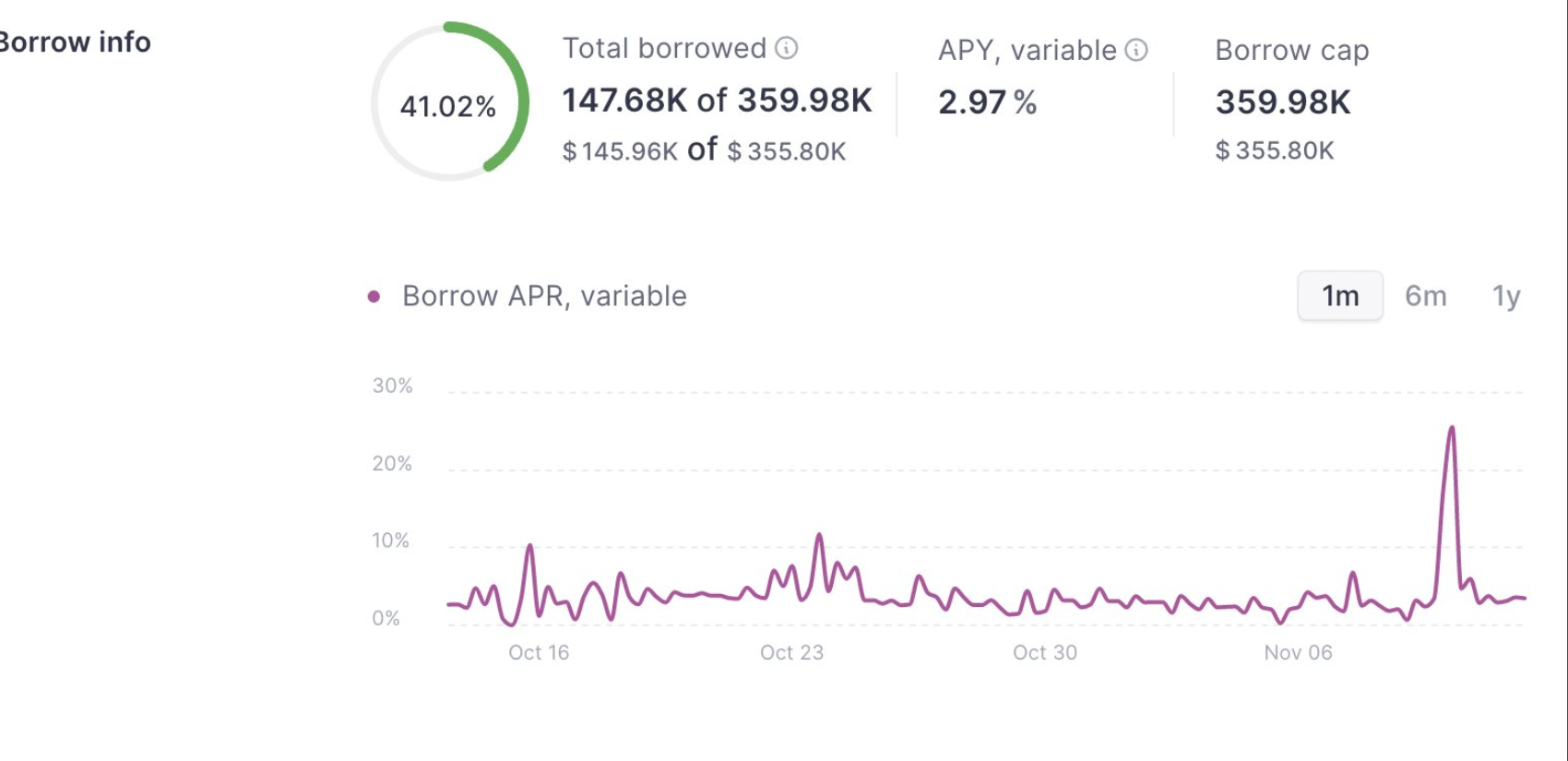

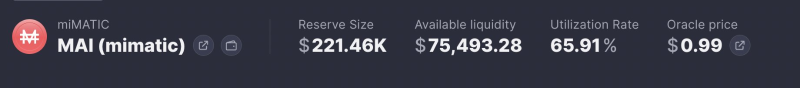

AAVE has MAI, a decentralized stablecoin designed by Qi Dao that can be used for borrowing, and so does Timeswap. MAI can be borrowed on AAVE at 3%, but since the rate isn't fixed, it may change based on utilization (borrowed / total supply).

Higher utilization equals higher interest, and vice versa.

The fundamental reason lending exists is leverage—the ability to buy without actually selling anything. Therefore, while using leverage, it's also important to consider collateral, i.e., asset locking. In more advanced terms, this is known as LTV (Loan-to-Value ratio).

Simply put, a 75% LTV means: pledge $100, borrow $75. A higher LTV means higher leverage, and vice versa.

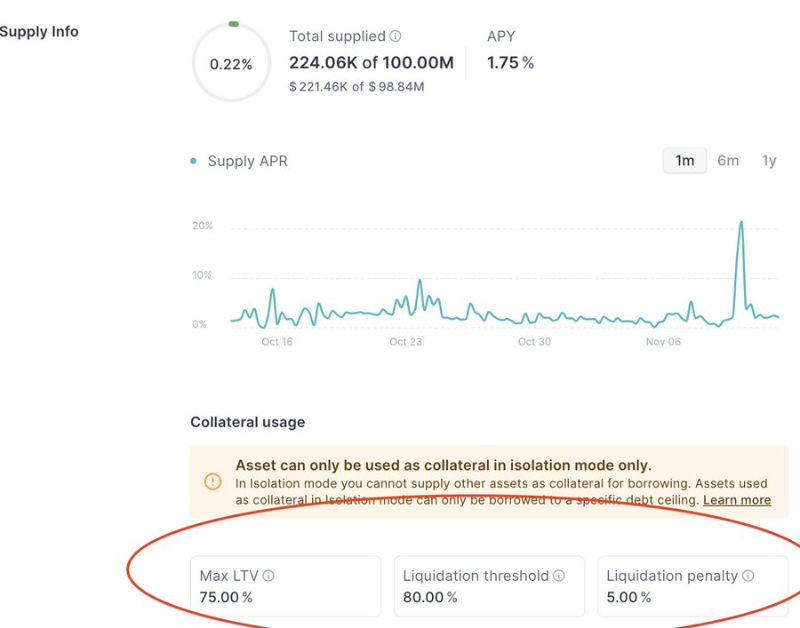

AAVE has a 75% LTV for MAI—deposit any asset worth $100 (ETH/USDC), receive $75 worth of MAI.

Before diving deeper into Timeswap, it’s important to understand liquidations.

First, every loan on AAVE must be over-collateralized ($100 collateral for $75 debt), because these products do not verify borrowers' creditworthiness, making over-collateralization essential.

Following this logic, if a volatile collateral drops below $100 in value, the platform issuing the $75 loan must protect lenders against borrower default.

Therefore, AAVE’s design includes a liquidation mechanism: if a borrower’s collateral falls below a certain threshold—the liquidation threshold—the position will be liquidated.

If the $100 collateral drops to or below $80, it will be sold to protect the lender’s $75 deposit.

Back to Timeswap: loans are non-liquidatable—regardless of how much the collateral value drops, it won’t be sold, meaning there are no liquidation thresholds or penalties.

What makes Timeswap unique is that borrowers can either repay before the loan matures or default.

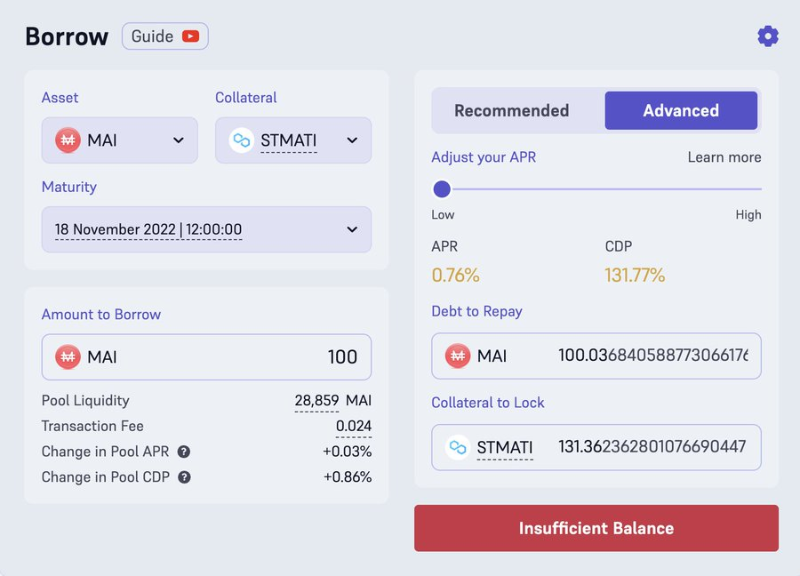

On Timeswap, you can borrow MAI at less than 1% APR with a 132% CDP: $100 worth of MAI can be borrowed using $132 worth of collateral, such as stMATIC.

Roughly speaking, Timeswap’s LTV (loan-to-value) is 75% (100/132), same as AAVE. The best part? Timeswap’s LTV adjusts dynamically based on borrowing demand.

Think about it: Timeswap borrowers can borrow as much MAI as they want on Polygon at the lowest possible rates, without worrying about their collateral losing value in a market downturn.

More importantly, the CDP/LTV adjusts according to market forces (supply and demand), unlike other DeFi money markets.

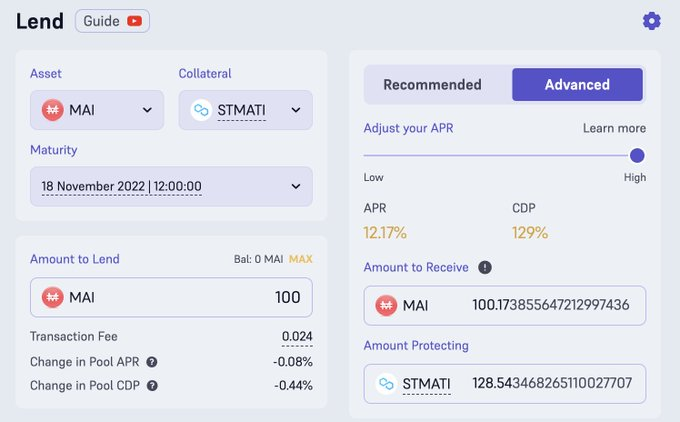

In theory, a sound system benefits all participants—in this case, both lenders and borrowers.

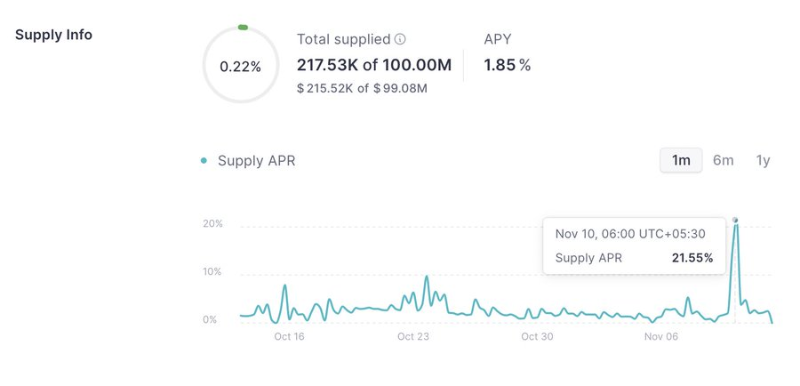

Lending is one of the best ways to earn real yield in DeFi, which is why it's widely adopted by users.

Although current lending positions on Timeswap will expire in 6 days, it currently offers sweet, organic double-digit yields on MAI—one of the best yields available.

Timeswap may not be the best DeFi money market, but it is a leader. I believe there’s nothing more secure than exchanging tokens with time-bound constraints.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News